Содержание

- 2. Topic 8. Normative analysis of tariff and non-tariff instruments of international trade policy Lecture 11 Traditional

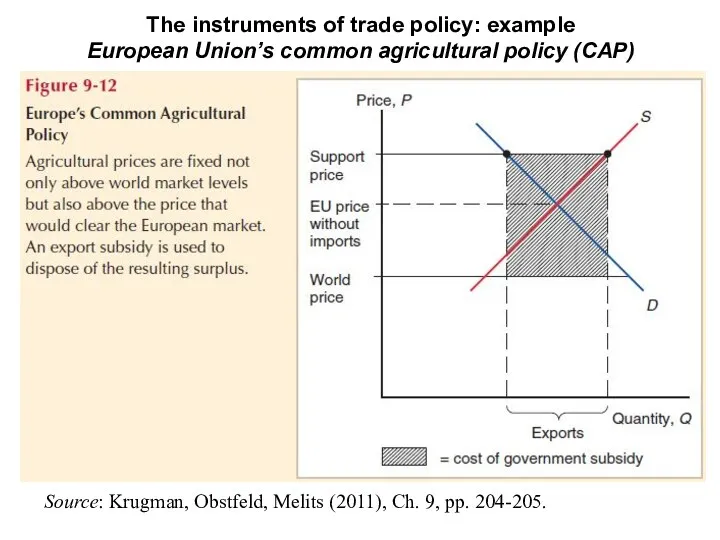

- 3. The instruments of trade policy: example European Union’s common agricultural policy (CAP) Source: Krugman, Obstfeld, Melits

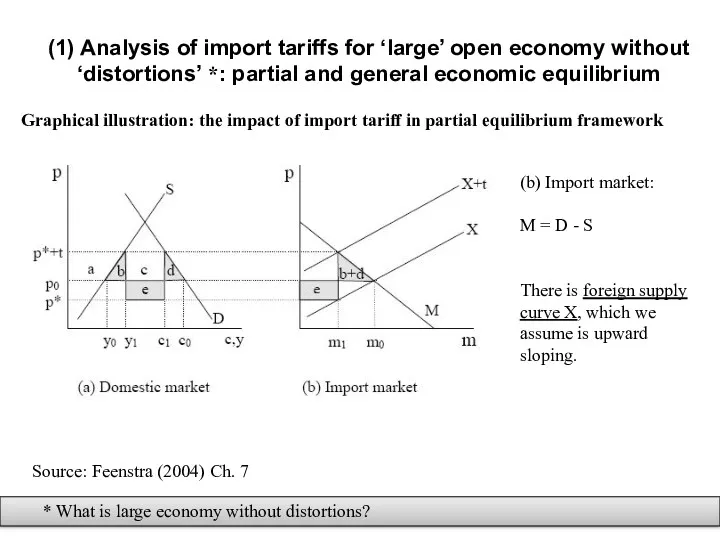

- 4. (1) Analysis of import tariffs for ‘large’ open economy without ‘distortions’ *: partial and general economic

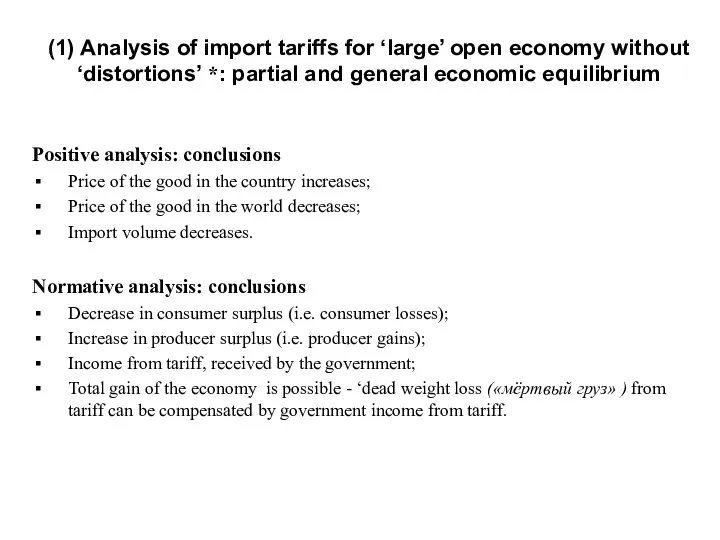

- 5. (1) Analysis of import tariffs for ‘large’ open economy without ‘distortions’ *: partial and general economic

- 6. (1) Analysis of import tariffs for ‘large’ open economy without ‘distortions’: partial and general economic equilibrium

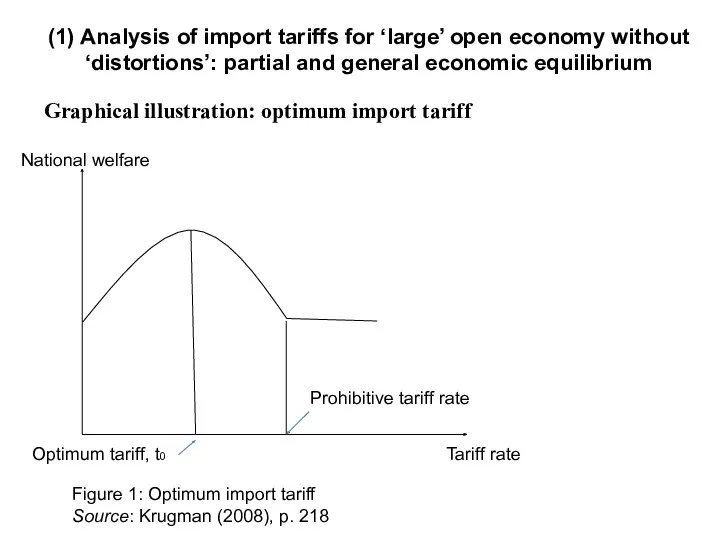

- 7. Optimum tariff For a large economy, there is an optimum tariff to at which the marginal

- 8. Graphical illustration: optimum import tariff (1) Analysis of import tariffs for ‘large’ open economy without ‘distortions’:

- 9. Formulation of the general equilibrium model for large open economy Exogenous parameters of the model Production

- 10. Formulation of the general equilibrium model for large open economy (2) Endogenous parameters of the model

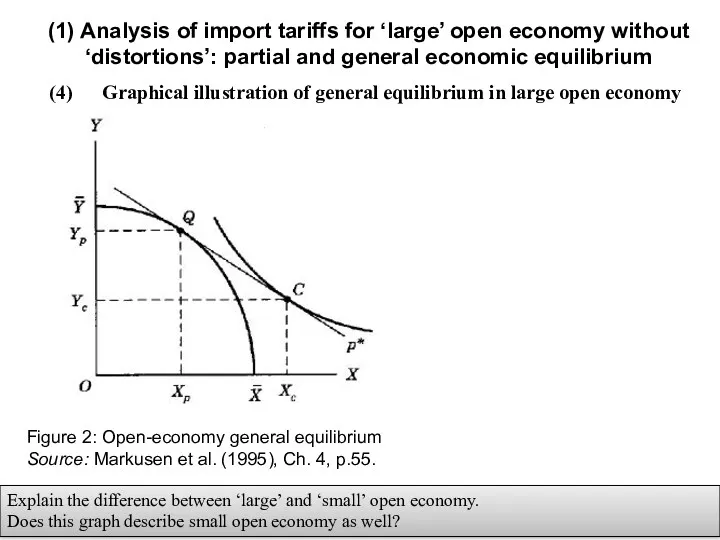

- 11. (4) Graphical illustration of general equilibrium in large open economy (1) Analysis of import tariffs for

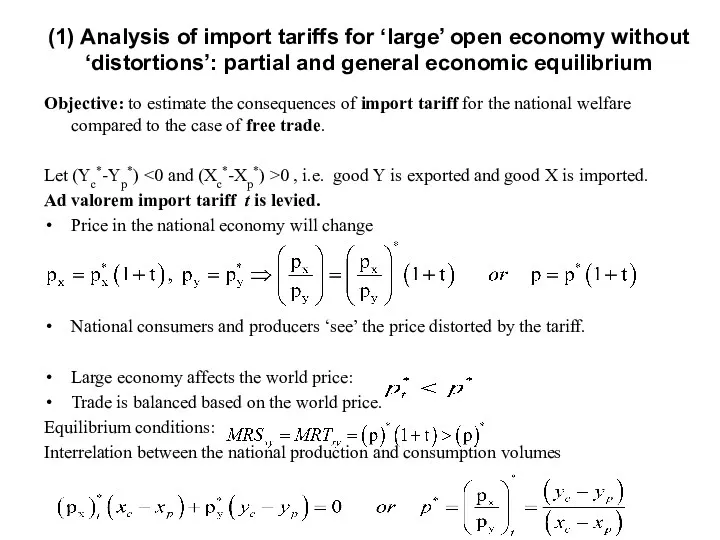

- 12. Objective: to estimate the consequences of import tariff for the national welfare compared to the case

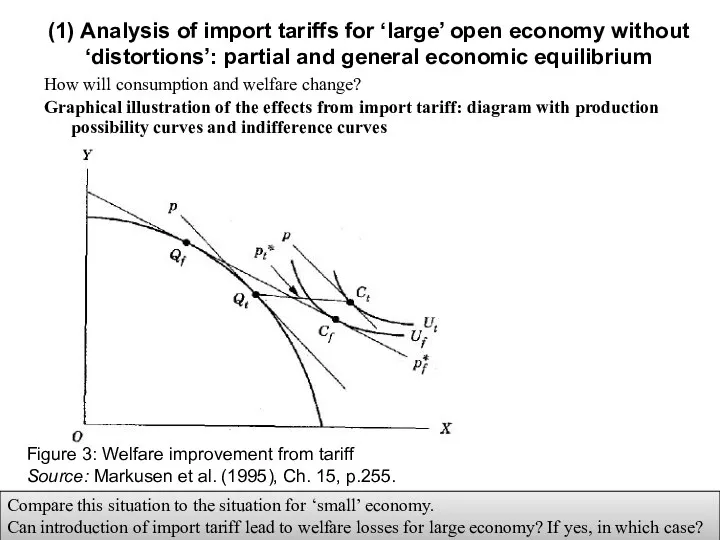

- 13. How will consumption and welfare change? Graphical illustration of the effects from import tariff: diagram with

- 14. Consequences of import tariff Resources move from sector Y (exporting sector) to sector X protected by

- 15. (2) Equivalence of import tariff and export tax Import tariff is equivalent to export tax if

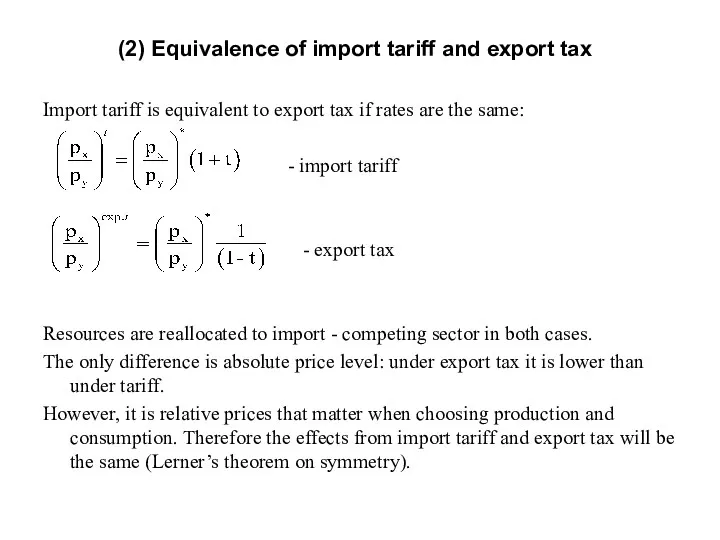

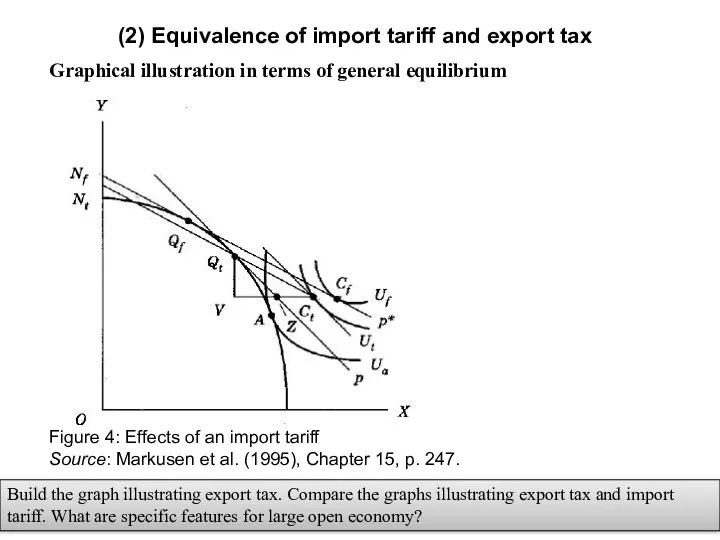

- 16. (2) Equivalence of import tariff and export tax Graphical illustration in terms of general equilibrium Build

- 17. (3) Import tariff as a sub-optimal instrument of international trade policy Import tariff and production subsidy

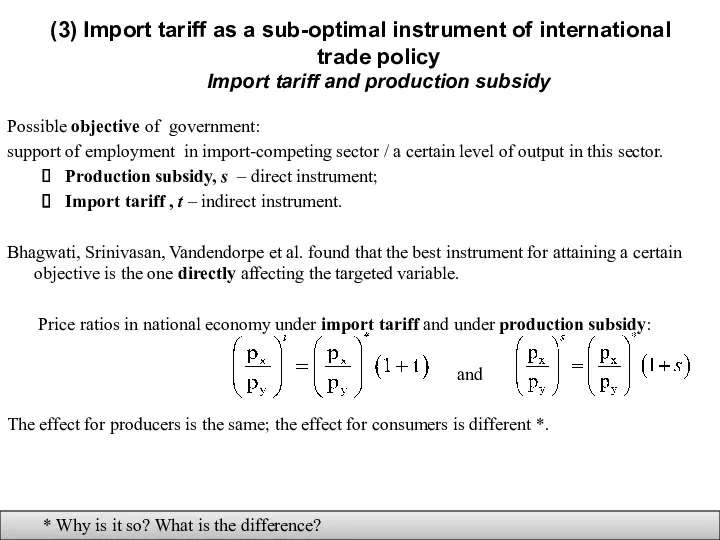

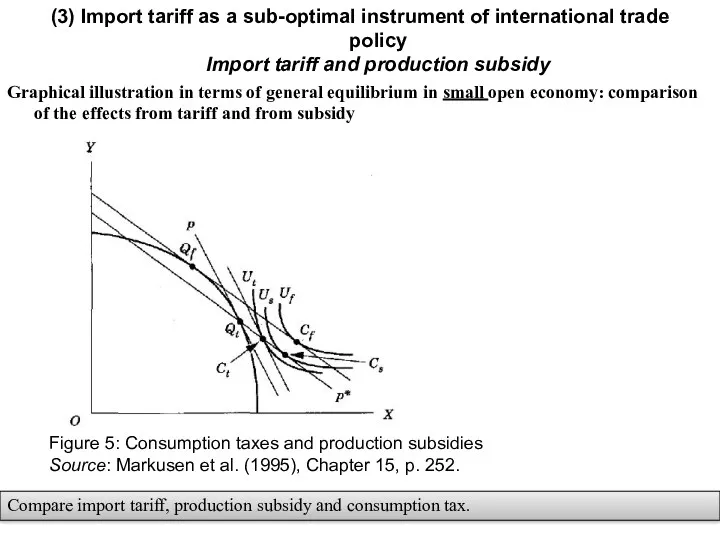

- 18. Graphical illustration in terms of general equilibrium in small open economy: comparison of the effects from

- 19. Objective: to estimate the consequences of production subsidy for the national welfare compared to the case

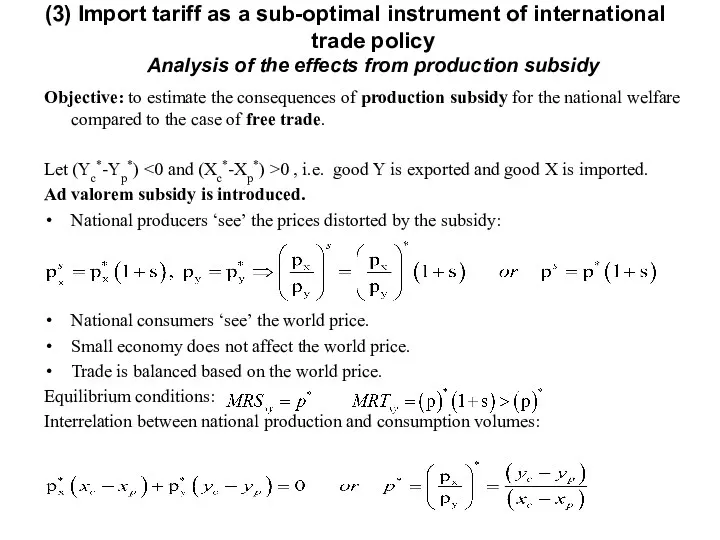

- 20. Import tariff as a measure aimed at decreasing the existing distortions Example. Small economy. Good Y

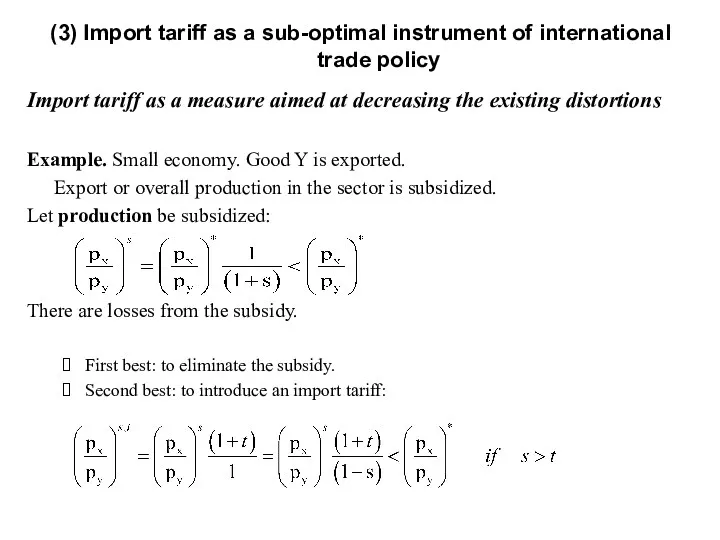

- 21. How will consumption and welfare change? Graphical illustration of consequences of import tariff when there is

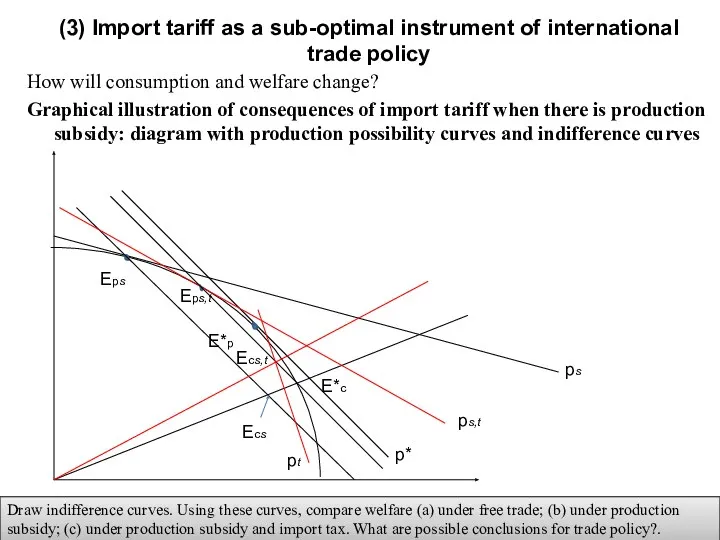

- 22. Consequences of import tariff (for X) when there is production subsidy (for Y): Resources move from

- 23. Reasoning behind protectionism Initially an industry should be protected so that afterwards it would develop independently.

- 24. Source: А.Ю. Кнобель. Межотраслевые различия импортного тарифа в России // Журнал Новой экономической ассоциации, № 11,

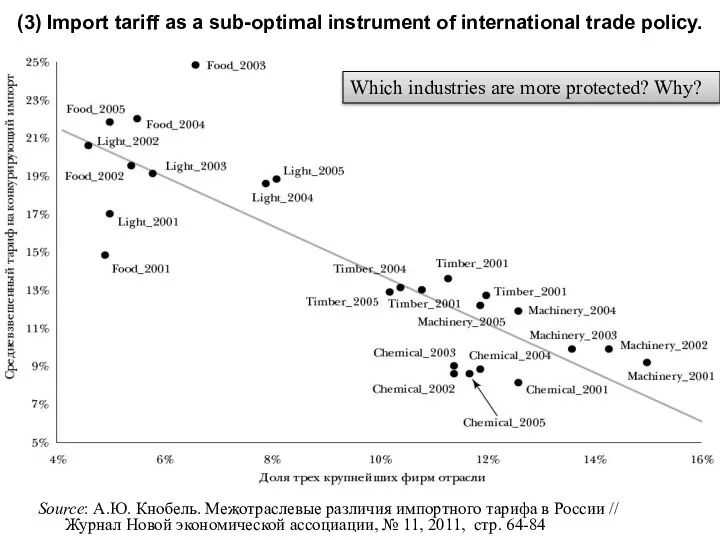

- 25. Exercise sessions 7 and 8 (2) Think about topics for reports during exercise sessions; work on

- 27. Скачать презентацию

Основы предпринимательства (рекламный шаг).

Основы предпринимательства (рекламный шаг). Трудоустройство и занятость населения в России

Трудоустройство и занятость населения в России Производительность труда

Производительность труда Финансовая устойчивость предприятия: основные определения, порядок проведения анализа. (тема 12)

Финансовая устойчивость предприятия: основные определения, порядок проведения анализа. (тема 12) Экономическая теория как наука

Экономическая теория как наука Влияние инфляции на семейную экономику

Влияние инфляции на семейную экономику Международные экономические организации

Международные экономические организации Современные методы экономического анализа деятельности организации

Современные методы экономического анализа деятельности организации Глобальный экономический кризис 2008 -2010 годов. Современное состояние конъюнктуры мирового рынка

Глобальный экономический кризис 2008 -2010 годов. Современное состояние конъюнктуры мирового рынка Макроэкономическое равновесие

Макроэкономическое равновесие Развитие Дальнего Востока в первой половине XXI века

Развитие Дальнего Востока в первой половине XXI века Методы экономического анализа

Методы экономического анализа История экономической мысли. Маржинализм, становление и развитие. (Лекция 9)

История экономической мысли. Маржинализм, становление и развитие. (Лекция 9) Основа успеха российского капиталиста

Основа успеха российского капиталиста Экономическая теория контрактов. Тема 3

Экономическая теория контрактов. Тема 3 Рынок монополистической конкуренции

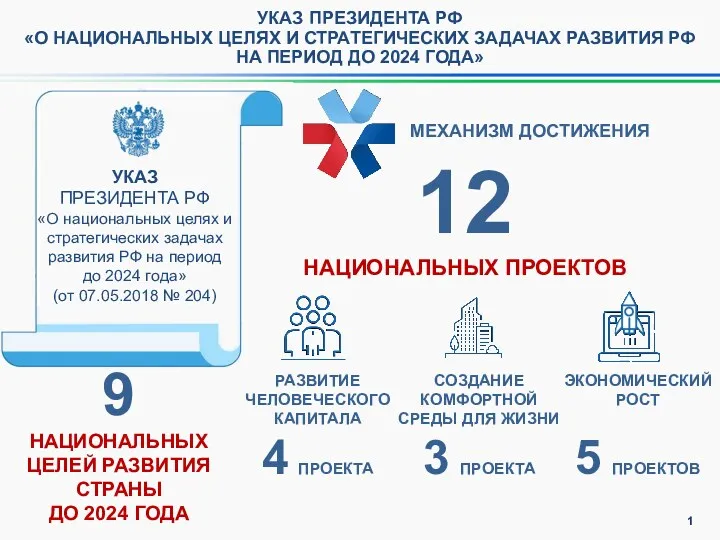

Рынок монополистической конкуренции Указ президента рф о национальных целях и стратегических задачах развития РФ на период до 2024 года

Указ президента рф о национальных целях и стратегических задачах развития РФ на период до 2024 года Сущность и основные понятия внешнеэкономических связей и внешнеэкономической деятельности. (Тема 1)

Сущность и основные понятия внешнеэкономических связей и внешнеэкономической деятельности. (Тема 1) Особенности социальноэкономического развития мировой экономики в 1950-1990-е гг

Особенности социальноэкономического развития мировой экономики в 1950-1990-е гг План з праці

План з праці Медициналық қызметтер нарығындағы бәсекелестің типтері

Медициналық қызметтер нарығындағы бәсекелестің типтері Экономия воды

Экономия воды Қазақстан Республикасының Президенті – Елбасы Н.Ә. Назарбаевтың

Қазақстан Республикасының Президенті – Елбасы Н.Ә. Назарбаевтың Macroeconomics. GDP /Business Cycle. Unemployment

Macroeconomics. GDP /Business Cycle. Unemployment Международные экономические организации

Международные экономические организации Организация стран экспортёров нефти (ОПЕК)

Организация стран экспортёров нефти (ОПЕК) Микроэкономика. Фирма. Методы исследования микроэкономических явлений и процессов

Микроэкономика. Фирма. Методы исследования микроэкономических явлений и процессов Международное движение финансовых и производственных ресурсов

Международное движение финансовых и производственных ресурсов