Содержание

- 2. What’s the Big Idea? Earlier chapters on capital budgeting focused on the appropriate size and timing

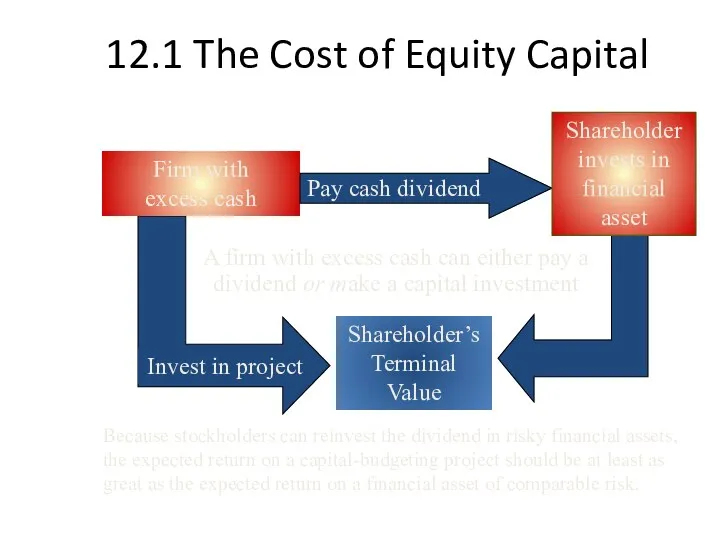

- 3. 12.1 The Cost of Equity Capital Firm with excess cash Shareholder’s Terminal Value Shareholder invests in

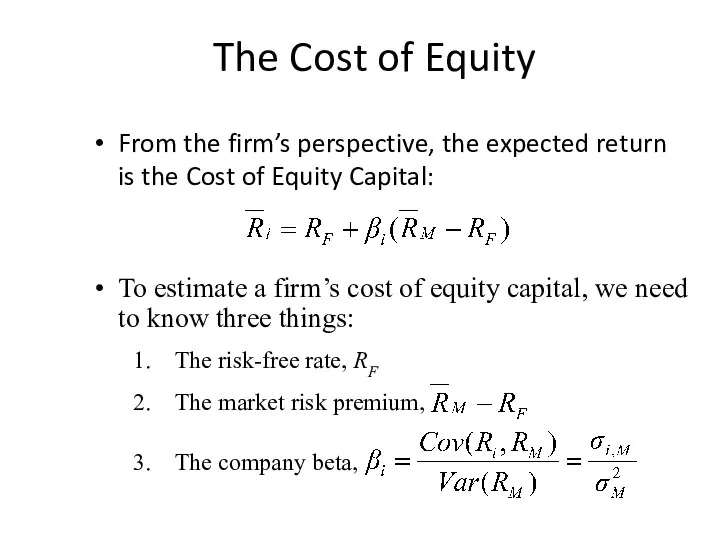

- 4. The Cost of Equity From the firm’s perspective, the expected return is the Cost of Equity

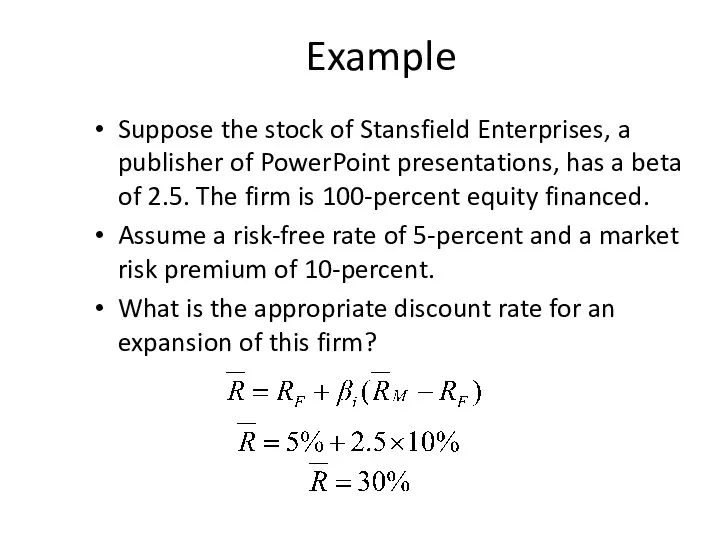

- 5. Example Suppose the stock of Stansfield Enterprises, a publisher of PowerPoint presentations, has a beta of

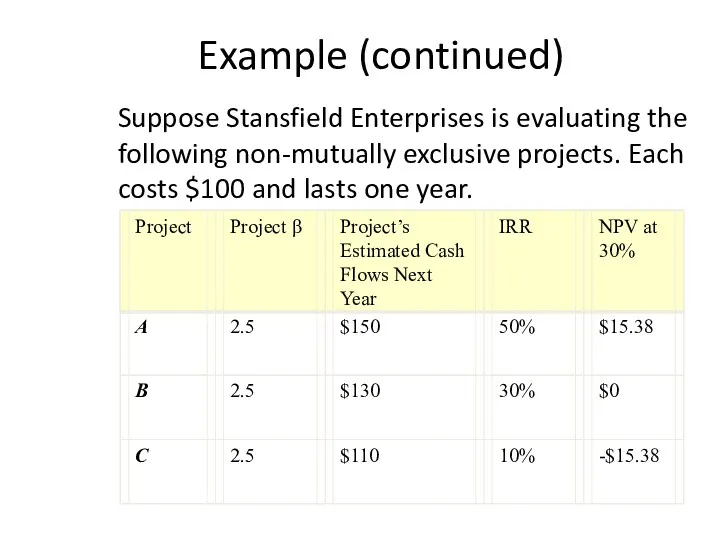

- 6. Example (continued) Suppose Stansfield Enterprises is evaluating the following non-mutually exclusive projects. Each costs $100 and

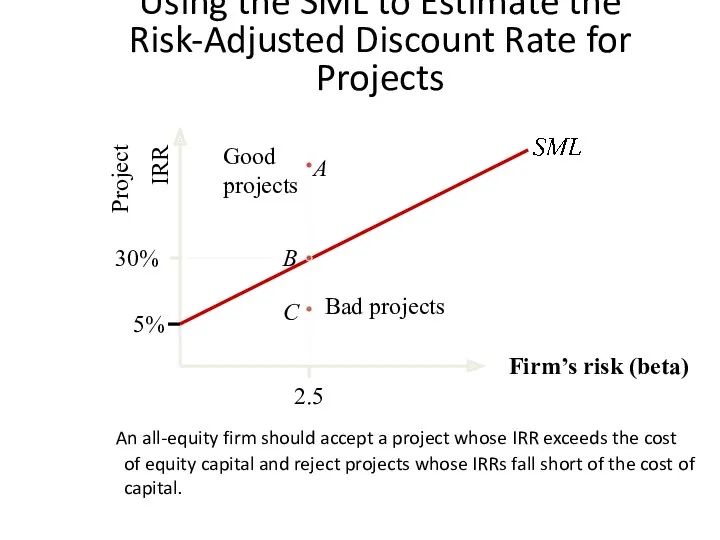

- 7. Using the SML to Estimate the Risk-Adjusted Discount Rate for Projects An all-equity firm should accept

- 8. 12.2 Estimation of Beta: Measuring Market Risk Market Portfolio - Portfolio of all assets in the

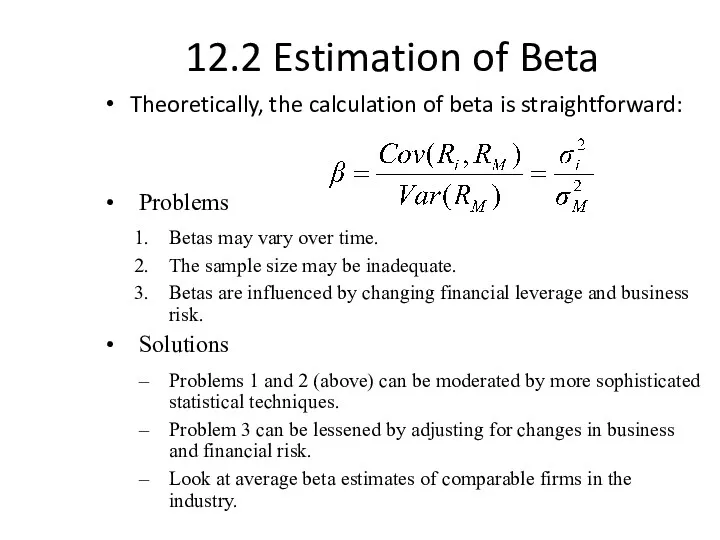

- 9. 12.2 Estimation of Beta Theoretically, the calculation of beta is straightforward: Problems Betas may vary over

- 10. Stability of Beta Most analysts argue that betas are generally stable for firms remaining in the

- 11. Using an Industry Beta It is frequently argued that one can better estimate a firm’s beta

- 12. 12.3 Determinants of Beta Business Risk Cyclicity of Revenues Operating Leverage Financial Risk Financial Leverage

- 13. Cyclicality of Revenues Highly cyclical stocks have high betas. Empirical evidence suggests that retailers and automotive

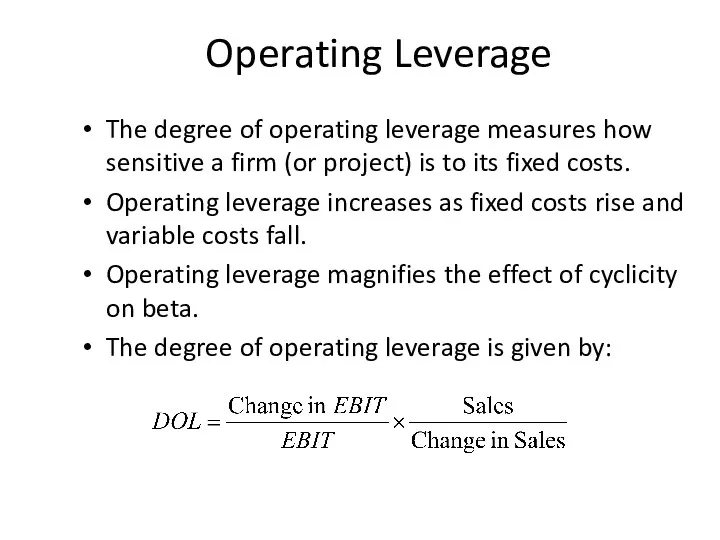

- 14. Operating Leverage The degree of operating leverage measures how sensitive a firm (or project) is to

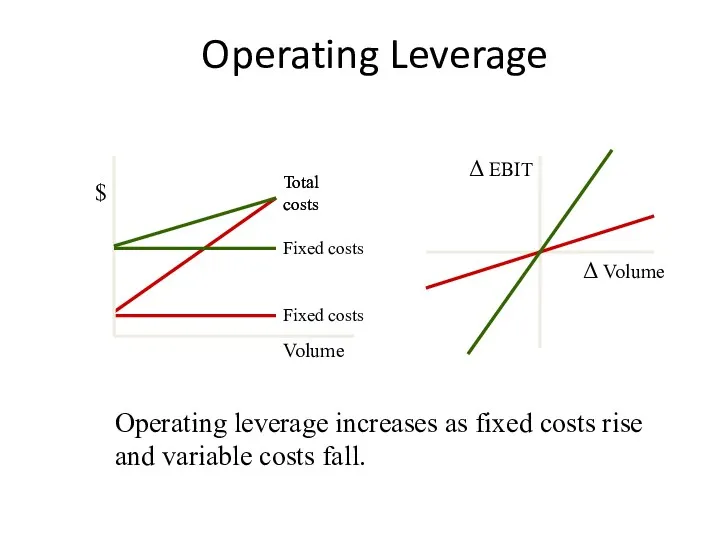

- 15. Operating Leverage Volume $ Fixed costs Total costs Δ EBIT Δ Volume Operating leverage increases as

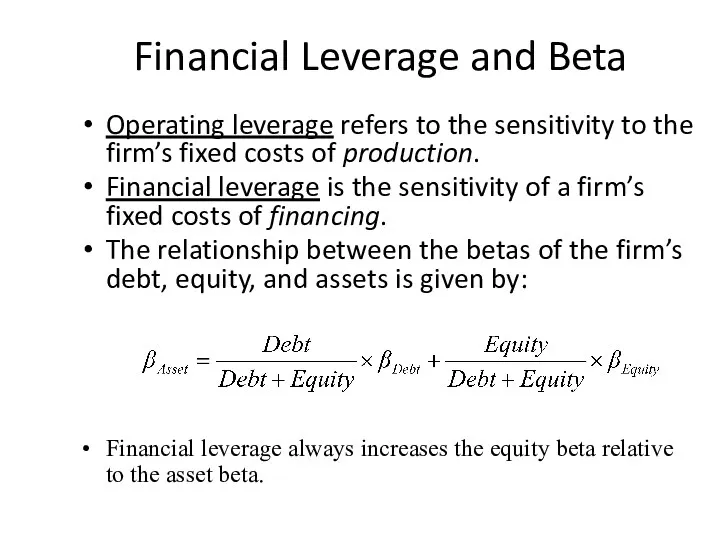

- 16. Financial Leverage and Beta Operating leverage refers to the sensitivity to the firm’s fixed costs of

- 17. Financial Leverage and Beta: Example Consider Grand Sport, Inc., which is currently all-equity and has a

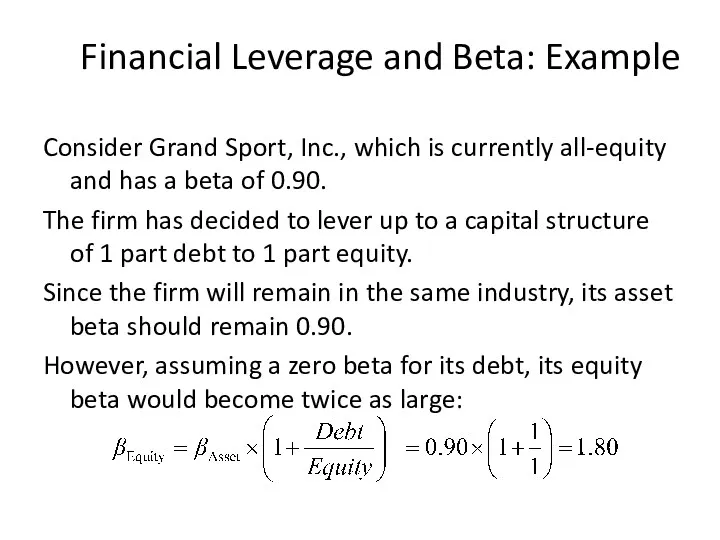

- 18. 12.4 Extensions of the Basic Model The Firm versus the Project The Cost of Capital with

- 19. The Firm versus the Project Any project’s cost of capital depends on the use to which

- 20. Capital Budgeting & Project Risk A firm that uses one discount rate for all projects may

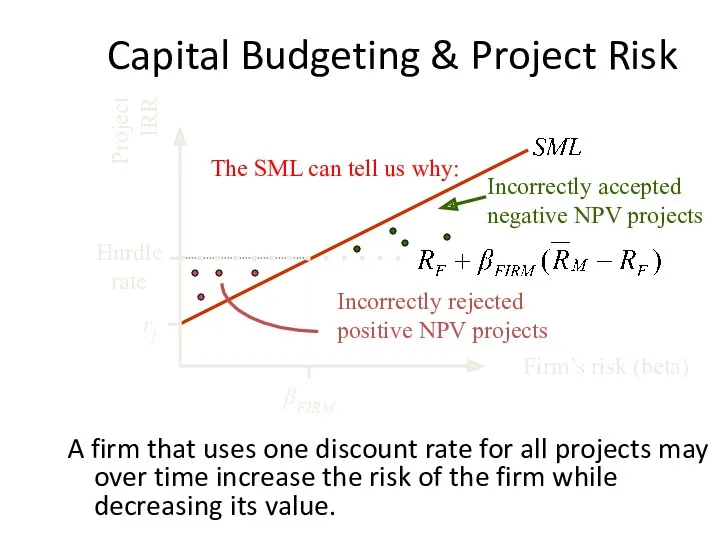

- 21. Capital Budgeting & Project Risk Suppose the Conglomerate Company has a cost of capital, based on

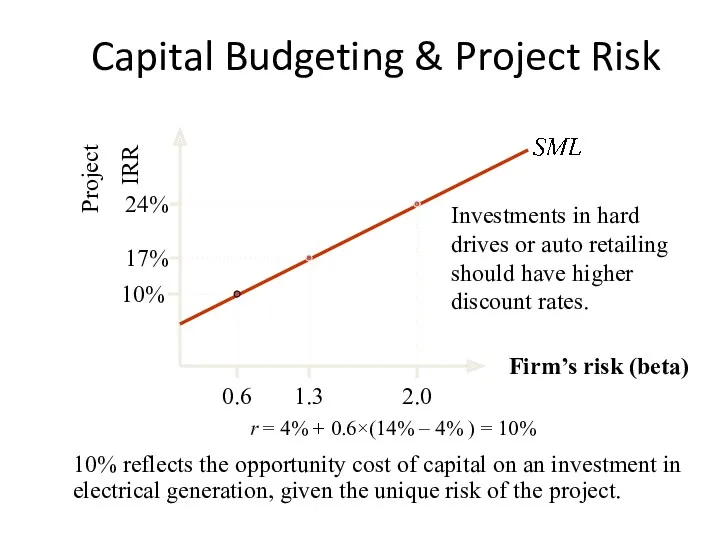

- 22. Capital Budgeting & Project Risk Project IRR Firm’s risk (beta) r = 4% + 0.6×(14% –

- 23. The Cost of Capital with Debt The Weighted Average Cost of Capital is given by: It

- 24. 12.5 Estimating Bombardier’s Cost of Capital We aim at estimating Bombardier’s cost of capital, as of

- 25. 12.5 Estimating Bombardier’s Cost of Capital Bombardier’s beta is 0.79; the (current) risk-free rate is 4.07%,

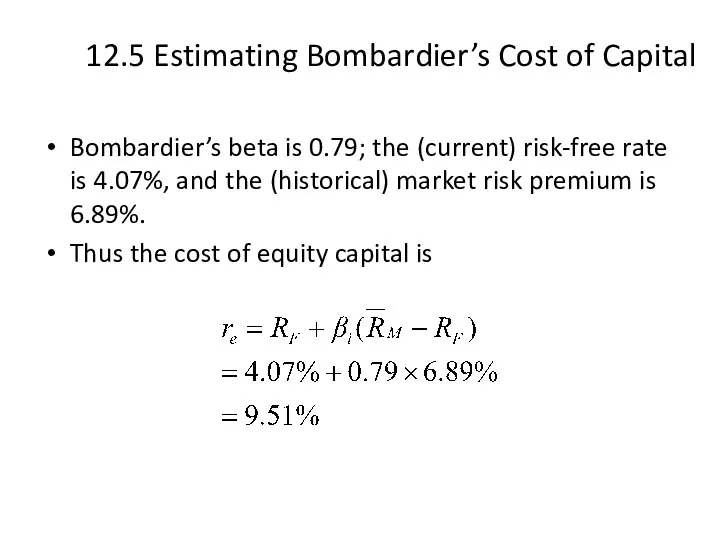

- 26. 12.5 Estimating Bombardier’s Cost of Capital The yield on the company’s 6.6% 29 Nov 04 bond

- 27. 12.5 Estimating Bombardier’s Cost of Capital To calculate the cost of capital, we need to estimate

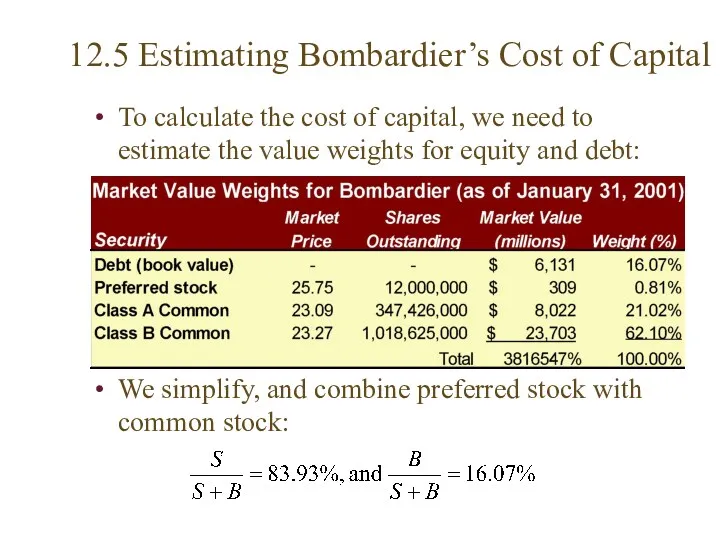

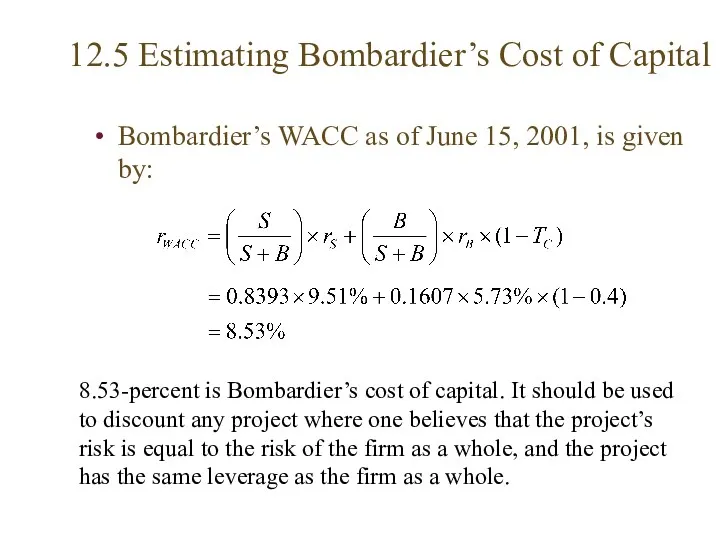

- 28. 12.5 Estimating Bombardier’s Cost of Capital Bombardier’s WACC as of June 15, 2001, is given by:

- 29. 12.6 Reducing the Cost of Capital What is Liquidity? Liquidity, Expected Returns, and the Cost of

- 30. What is Liquidity? The idea that the expected return on a stock and the firm’s cost

- 31. Liquidity, Expected Returns, and the Cost of Capital The cost of trading an illiquid stock reduces

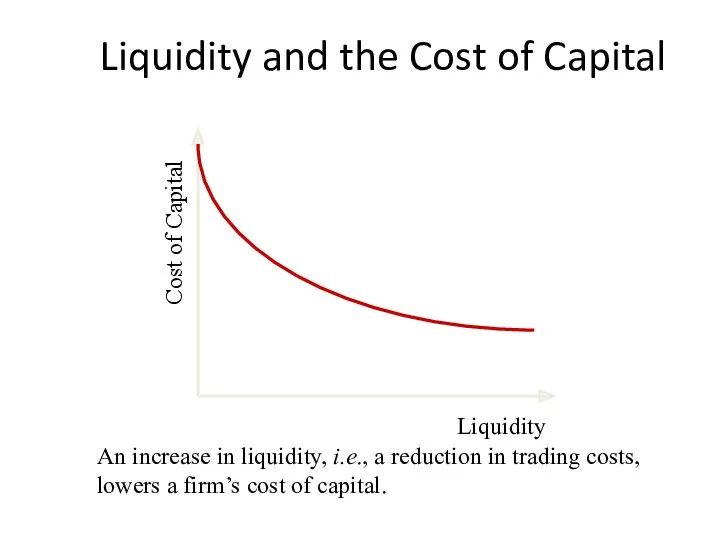

- 32. Liquidity and the Cost of Capital Cost of Capital Liquidity An increase in liquidity, i.e., a

- 33. Liquidity and Adverse Selection There are a number of factors that determine the liquidity of a

- 34. What the Corporation Can Do The corporation has an incentive to lower trading costs since this

- 35. What the Corporation Can Do Companies can also facilitate stock purchases through the Internet. Direct stock

- 37. Скачать презентацию

Основы управления, планирования, экономики и финансирования здравоохранения. Всемирная организация здравоохранения

Основы управления, планирования, экономики и финансирования здравоохранения. Всемирная организация здравоохранения Глобальные проблемы человечества

Глобальные проблемы человечества Глобальные проблемы человечества

Глобальные проблемы человечества Экономическая динамика

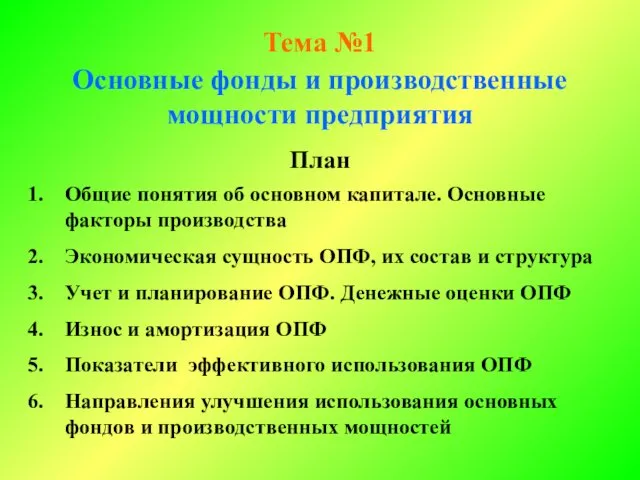

Экономическая динамика Основные фонды и производственные мощности предприятия

Основные фонды и производственные мощности предприятия Методы расчета валового внутреннего продукта

Методы расчета валового внутреннего продукта ЕГЭ по Обществознанию.Экономика

ЕГЭ по Обществознанию.Экономика Меркосур. Руководящие органы. Развитие интеграции

Меркосур. Руководящие органы. Развитие интеграции Альтернативні джерела енергії

Альтернативні джерела енергії Макроэкономика. Система национальных счетов

Макроэкономика. Система национальных счетов Три кити економіки Єгипту

Три кити економіки Єгипту О реализации мер по обеспечению доступа негосударственных организаций к предоставлению услуг в социальной сфере

О реализации мер по обеспечению доступа негосударственных организаций к предоставлению услуг в социальной сфере Предпринимательский всеобуч

Предпринимательский всеобуч Моделирование социально-экономических процессов в экономике

Моделирование социально-экономических процессов в экономике Формирование политики доходов населения в Монако

Формирование политики доходов населения в Монако Модель основанная на не кооперативной стратегии. Модель Курно

Модель основанная на не кооперативной стратегии. Модель Курно Влияние кризиса 2014-2015 на экономику РФ

Влияние кризиса 2014-2015 на экономику РФ Унікальність економічної системи Китаю

Унікальність економічної системи Китаю Цели устойчивого развития в Беларуси

Цели устойчивого развития в Беларуси DeltaSecurity. System to check contractors for reliability to provide economical security of the company

DeltaSecurity. System to check contractors for reliability to provide economical security of the company Стратегии социально-экономического развития макрорегионов РФ

Стратегии социально-экономического развития макрорегионов РФ Глобальные проблемы современности

Глобальные проблемы современности Экономика - искусство ведения хозяйства

Экономика - искусство ведения хозяйства Инфляция: сущность, причины, измерение

Инфляция: сущность, причины, измерение Постоянные и переменные затраты

Постоянные и переменные затраты Теоретические основы оценки финансовой устойчивости предприятия

Теоретические основы оценки финансовой устойчивости предприятия Структура советского общества

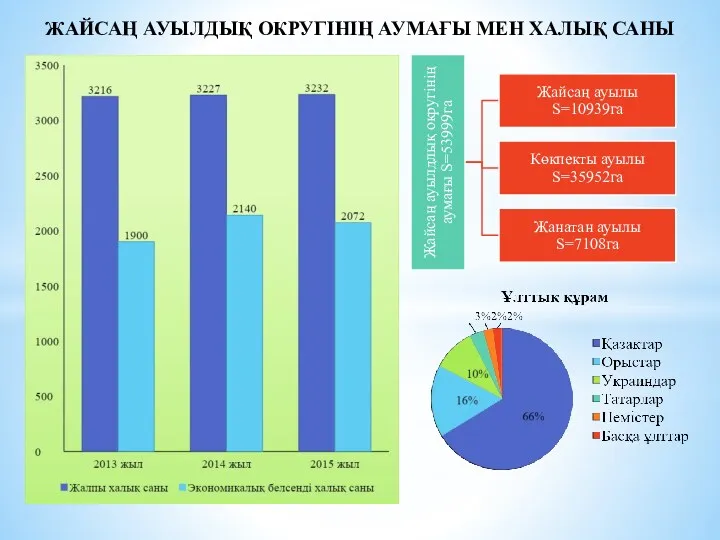

Структура советского общества Саны экономикалық белсенді халық

Саны экономикалық белсенді халық