Содержание

- 2. Supply, Demand, and Government Policies In a free, unregulated market system, market forces establish equilibrium prices

- 3. CONTROLS ON PRICES Are usually enacted when policymakers believe the market price is unfair to buyers

- 4. CONTROLS ON PRICES Price Ceiling A legal maximum on the price at which a good can

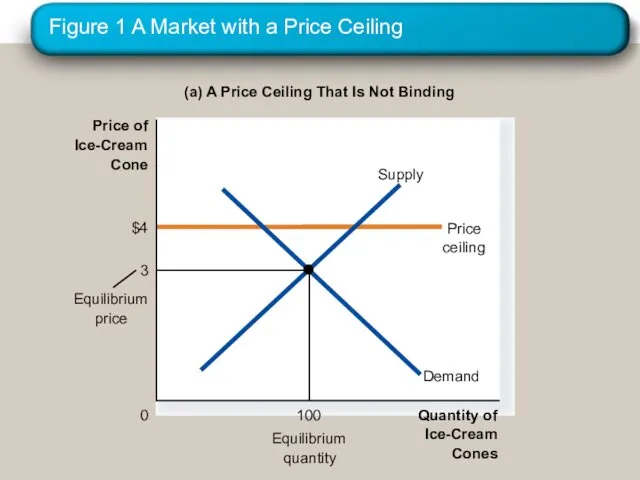

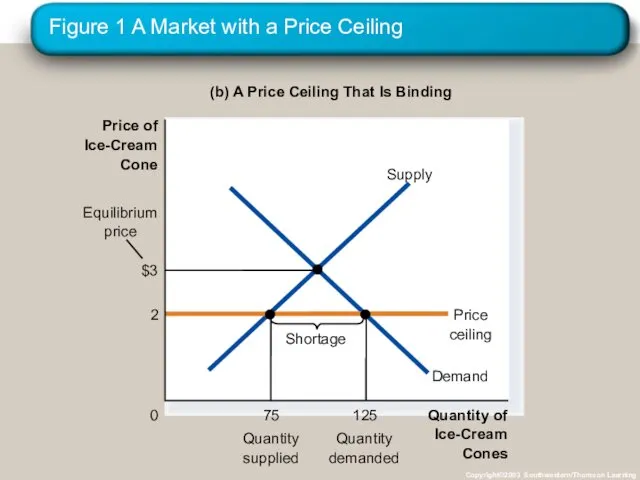

- 5. How Price Ceilings Affect Market Outcomes Two outcomes are possible when the government imposes a price

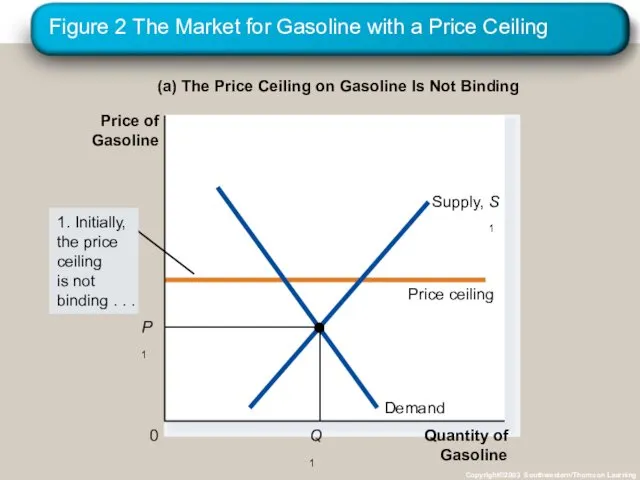

- 6. Figure 1 A Market with a Price Ceiling (a) A Price Ceiling That Is Not Binding

- 7. Figure 1 A Market with a Price Ceiling Copyright©2003 Southwestern/Thomson Learning (b) A Price Ceiling That

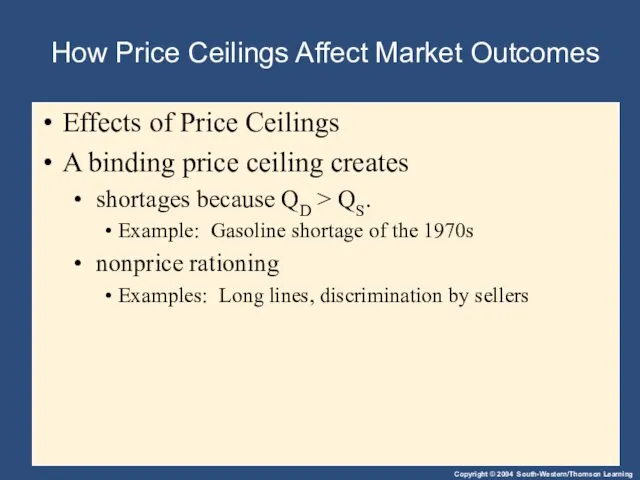

- 8. How Price Ceilings Affect Market Outcomes Effects of Price Ceilings A binding price ceiling creates shortages

- 9. In 1973, OPEC raised the price of crude oil in world markets. Crude oil is the

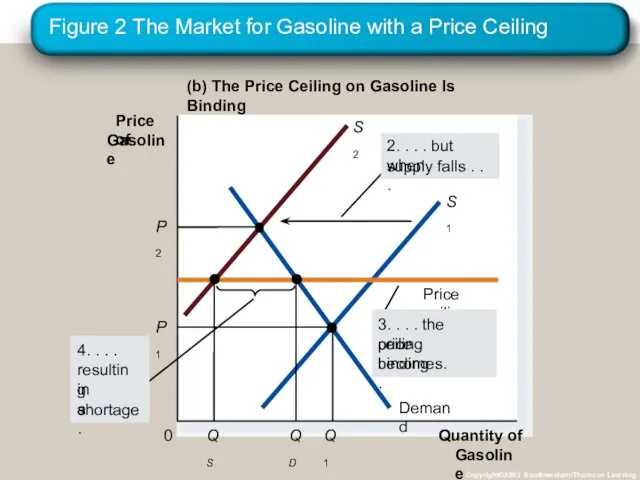

- 10. Figure 2 The Market for Gasoline with a Price Ceiling Copyright©2003 Southwestern/Thomson Learning (a) The Price

- 11. Figure 2 The Market for Gasoline with a Price Ceiling Copyright©2003 Southwestern/Thomson Learning (b) The Price

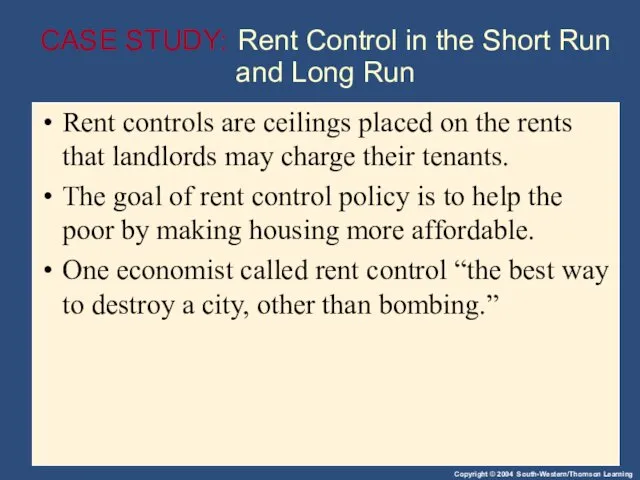

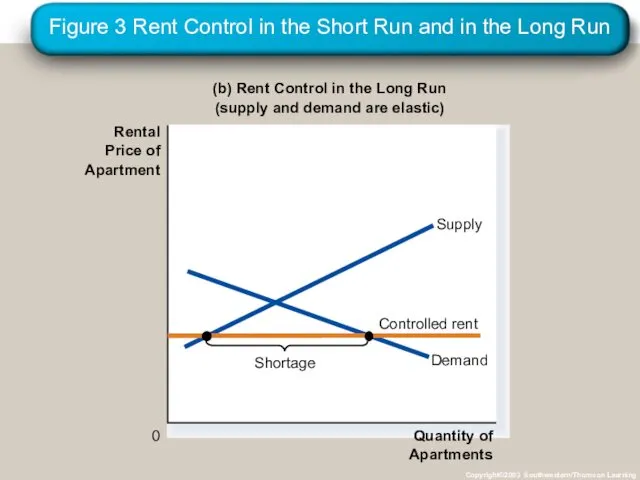

- 12. CASE STUDY: Rent Control in the Short Run and Long Run Rent controls are ceilings placed

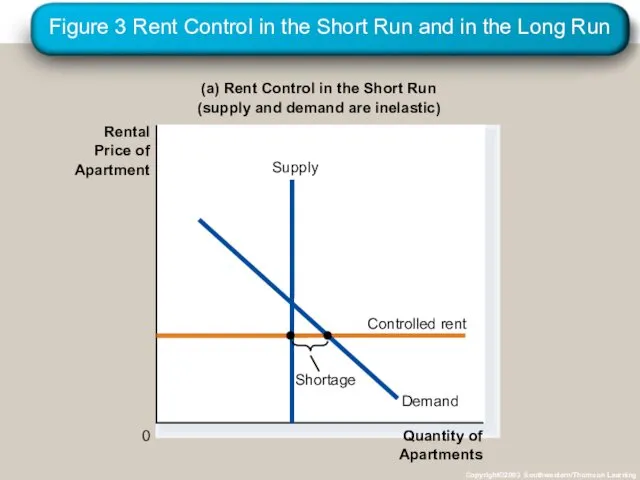

- 13. Figure 3 Rent Control in the Short Run and in the Long Run Copyright©2003 Southwestern/Thomson Learning

- 14. Figure 3 Rent Control in the Short Run and in the Long Run Copyright©2003 Southwestern/Thomson Learning

- 15. How Price Floors Affect Market Outcomes When the government imposes a price floor, two outcomes are

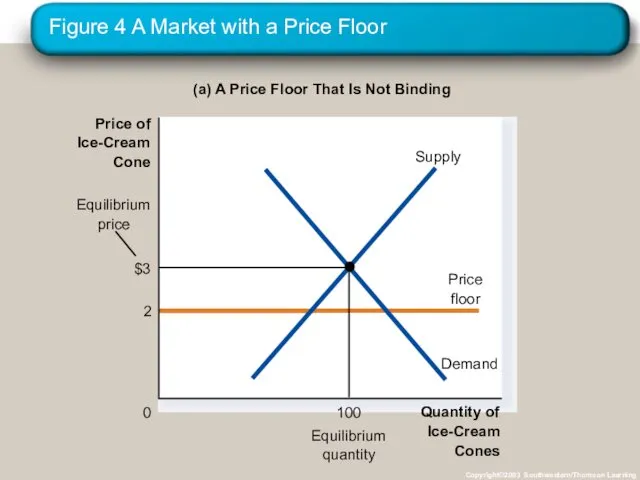

- 16. Figure 4 A Market with a Price Floor Copyright©2003 Southwestern/Thomson Learning (a) A Price Floor That

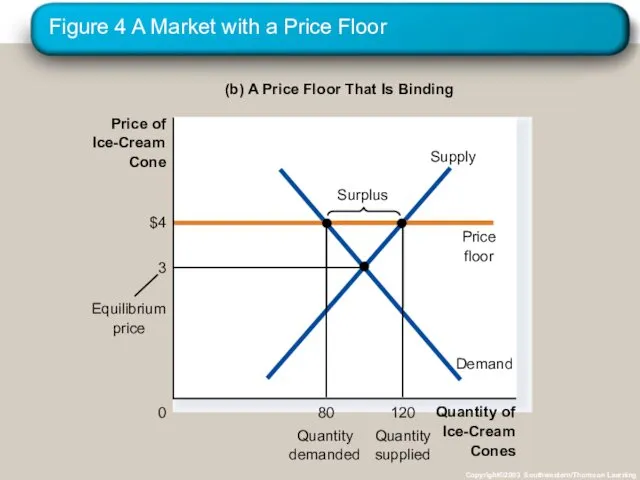

- 17. Figure 4 A Market with a Price Floor Copyright©2003 Southwestern/Thomson Learning (b) A Price Floor That

- 18. How Price Floors Affect Market Outcomes A price floor prevents supply and demand from moving toward

- 19. How Price Floors Affect Market Outcomes A binding price floor causes . . . a surplus

- 20. The Minimum Wage An important example of a price floor is the minimum wage. Minimum wage

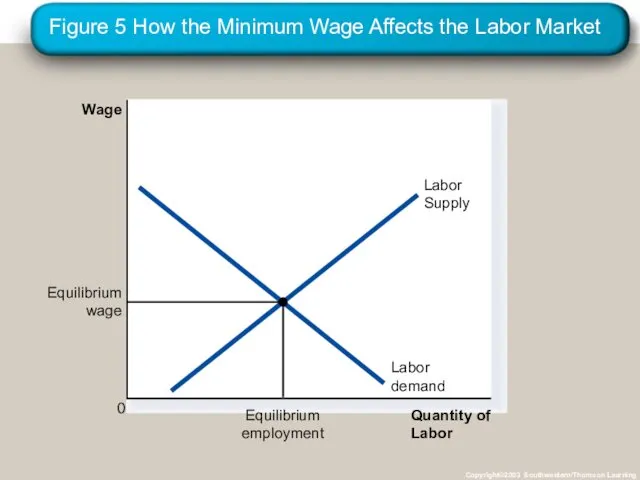

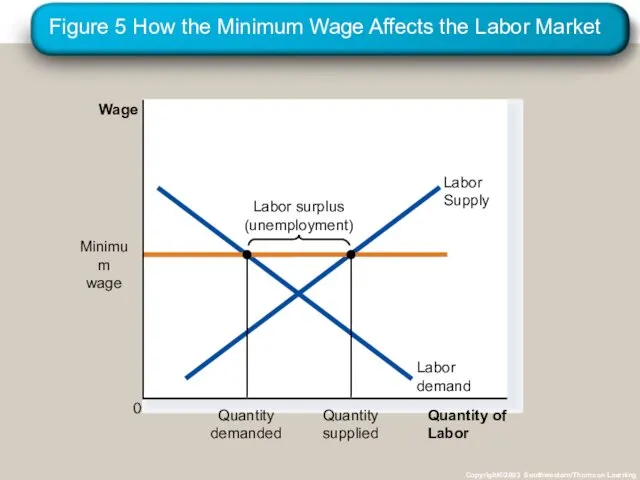

- 21. Figure 5 How the Minimum Wage Affects the Labor Market Copyright©2003 Southwestern/Thomson Learning Quantity of Labor

- 22. Figure 5 How the Minimum Wage Affects the Labor Market Copyright©2003 Southwestern/Thomson Learning Quantity of Labor

- 23. TAXES Governments levy taxes to raise revenue for public projects.

- 24. How Taxes on Buyers (and Sellers) Affect Market Outcomes Taxes discourage market activity. When a good

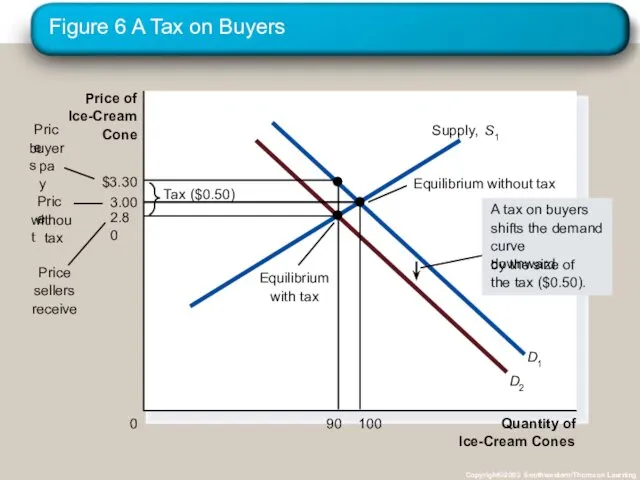

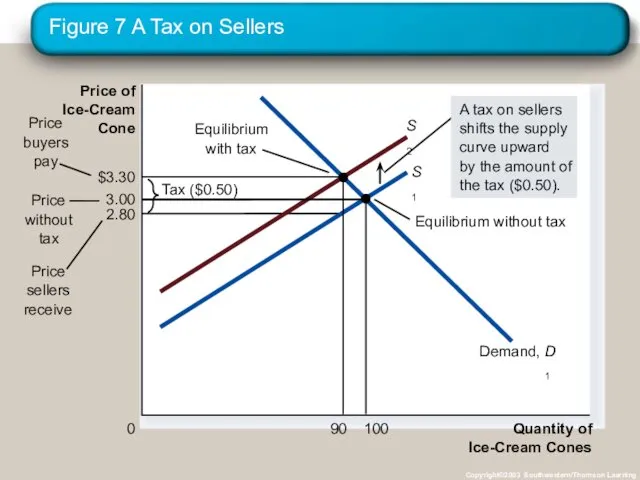

- 25. Elasticity and Tax Incidence Tax incidence is the manner in which the burden of a tax

- 26. Elasticity and Tax Incidence Tax incidence is the study of who bears the burden of a

- 27. Figure 6 A Tax on Buyers Copyright©2003 Southwestern/Thomson Learning Quantity of Ice-Cream Cones 0 Price of

- 28. Elasticity and Tax Incidence What was the impact of tax? Taxes discourage market activity. When a

- 29. Figure 7 A Tax on Sellers Copyright©2003 Southwestern/Thomson Learning Quantity of Ice-Cream Cones 0 Price of

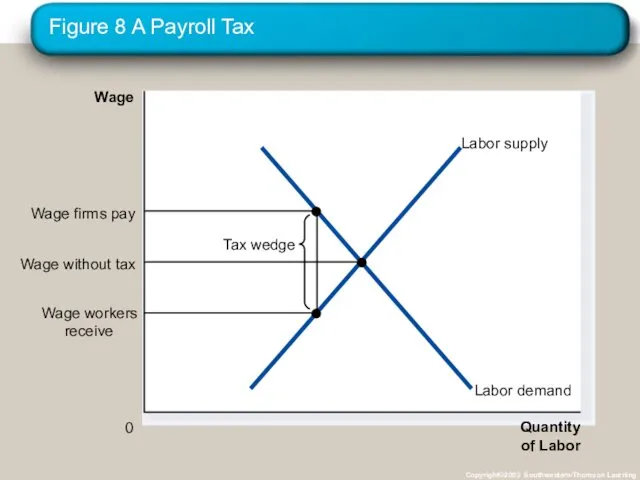

- 30. Figure 8 A Payroll Tax Copyright©2003 Southwestern/Thomson Learning Quantity of Labor 0 Wage

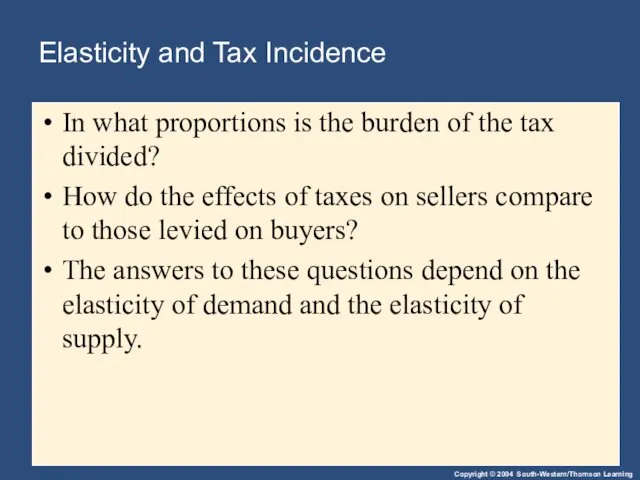

- 31. Elasticity and Tax Incidence In what proportions is the burden of the tax divided? How do

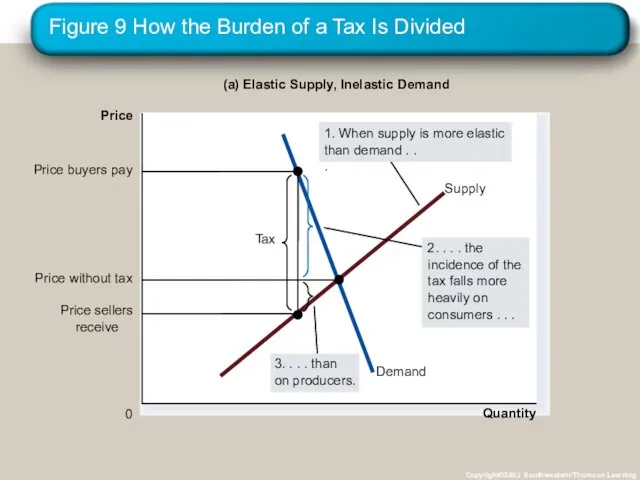

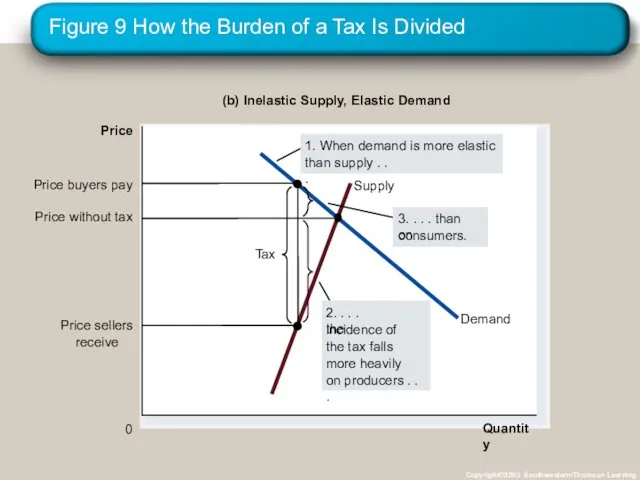

- 32. Figure 9 How the Burden of a Tax Is Divided Copyright©2003 Southwestern/Thomson Learning Quantity 0 Price

- 33. Figure 9 How the Burden of a Tax Is Divided Copyright©2003 Southwestern/Thomson Learning Quantity 0 Price

- 34. So, how is the burden of the tax divided? The burden of a tax falls more

- 35. Summary Price controls include price ceilings and price floors. A price ceiling is a legal maximum

- 36. Summary Taxes are used to raise revenue for public purposes. When the government levies a tax

- 38. Скачать презентацию

Рынок и его правовое регулирование

Рынок и его правовое регулирование Основы квалиметрии

Основы квалиметрии Научно-техническая революция

Научно-техническая революция Transport infrastructure development performance

Transport infrastructure development performance Устойчивое развитие Сахалинской области

Устойчивое развитие Сахалинской области Экономика и государство. Регулирующая роль государства в рыночной экономике

Экономика и государство. Регулирующая роль государства в рыночной экономике Економічна розвідка як фактор у конкурентній боротьбі

Економічна розвідка як фактор у конкурентній боротьбі Производственная структура организации

Производственная структура организации Интеграционные союзы

Интеграционные союзы Право Европейского Союза

Право Европейского Союза Экономико-правовой аспект снижения себестоимости строительно-монтажных работ строительной организации

Экономико-правовой аспект снижения себестоимости строительно-монтажных работ строительной организации Производственные фонды сельского хозяйства

Производственные фонды сельского хозяйства Экономика. Искусство ведения хозяйства

Экономика. Искусство ведения хозяйства Экономический анализ ответственности за неумышленное причинение ущерба: расширения базового подхода

Экономический анализ ответственности за неумышленное причинение ущерба: расширения базового подхода PEST-анализ

PEST-анализ Comparative analysis of the budgets of the two countries: the UK and Russia

Comparative analysis of the budgets of the two countries: the UK and Russia Индикаторы финансового рынка

Индикаторы финансового рынка Returning of Nokia to the global market of the mobile industry

Returning of Nokia to the global market of the mobile industry Побудова та використання нейронних мереж у прогнозуванні показників соціально-економічного розвитку регіону

Побудова та використання нейронних мереж у прогнозуванні показників соціально-економічного розвитку регіону Публичное и непубличное акционерные общества

Публичное и непубличное акционерные общества Теория абсолютных преимуществ

Теория абсолютных преимуществ Презентация методической разработки раздела образовательной программы по экономике

Презентация методической разработки раздела образовательной программы по экономике Фирмы в экономике. Logo

Фирмы в экономике. Logo Глобальные проблемы и их влияние на мировую экономику

Глобальные проблемы и их влияние на мировую экономику Счета доходов

Счета доходов Общественный сектор экономики: масштабы, роль и значение для динамики развития социально-ориентированной рыночной экономики

Общественный сектор экономики: масштабы, роль и значение для динамики развития социально-ориентированной рыночной экономики Экономические результаты хозяйственной деятельности предприятий

Экономические результаты хозяйственной деятельности предприятий Персонал, производительность труда и оплата труда в энергетике

Персонал, производительность труда и оплата труда в энергетике