Содержание

- 2. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Preview Partial equilibrium analysis of tariffs: supply, demand,

- 3. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Types of Tariffs A specific tariff is levied

- 4. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Supply, Demand, and Trade in a Single Industry

- 5. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Supply, Demand, and Trade in a Single Industry

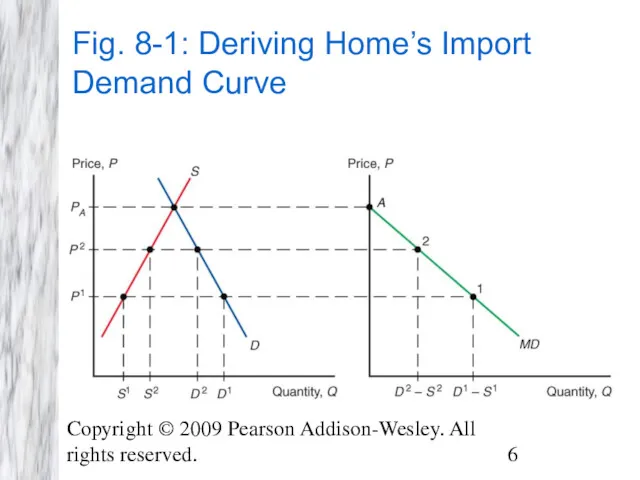

- 6. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Fig. 8-1: Deriving Home’s Import Demand Curve

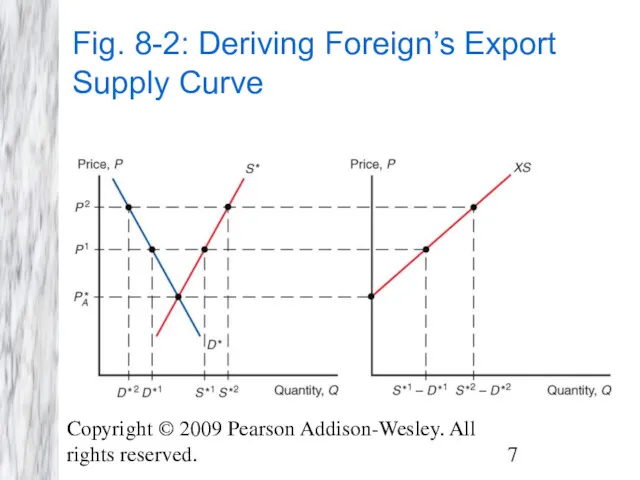

- 7. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Fig. 8-2: Deriving Foreign’s Export Supply Curve

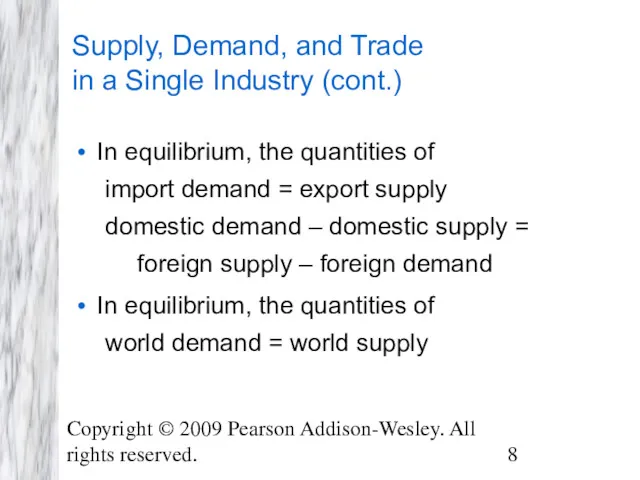

- 8. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Supply, Demand, and Trade in a Single Industry

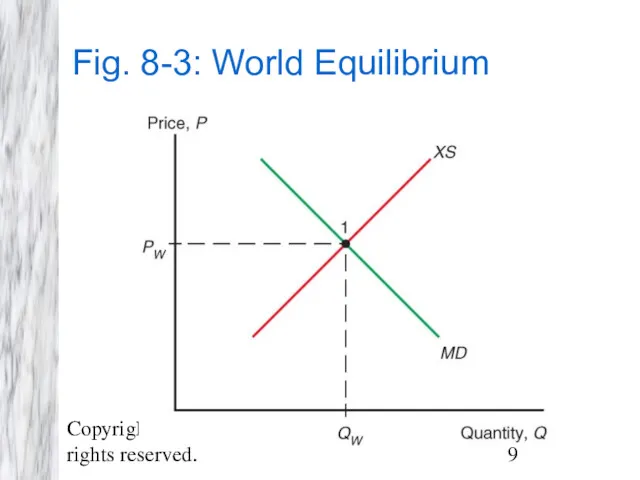

- 9. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Fig. 8-3: World Equilibrium

- 10. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. The Effects of a Tariff A tariff can

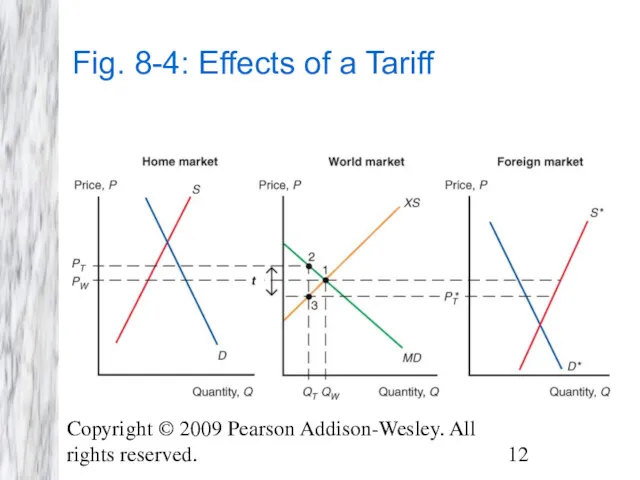

- 11. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. The Effects of a Tariff (cont.) Thus, a

- 12. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Fig. 8-4: Effects of a Tariff

- 13. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. The Effects of a Tariff (cont.) Because the

- 14. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. The Effects of a Tariff (cont.) The quantity

- 15. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. The Effects of a Tariff in a Small

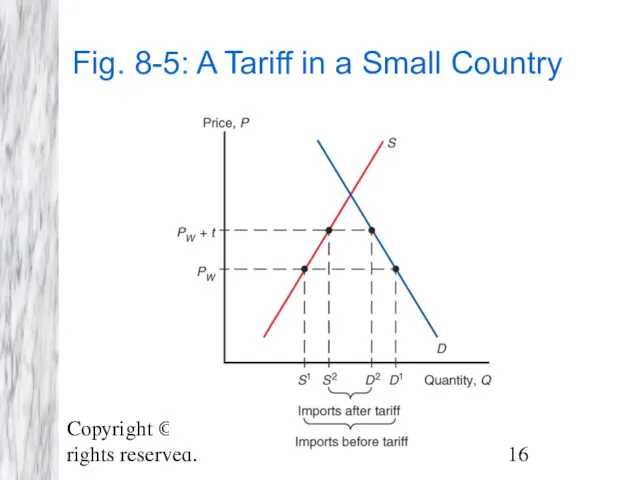

- 16. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Fig. 8-5: A Tariff in a Small Country

- 17. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Effective Rate of Protection The effective rate of

- 18. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Effective Rate of Protection (cont.) For example, suppose

- 19. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Effective Rate of Protection (cont.) The effective rate

- 20. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Costs and Benefits of Tariffs A tariff raises

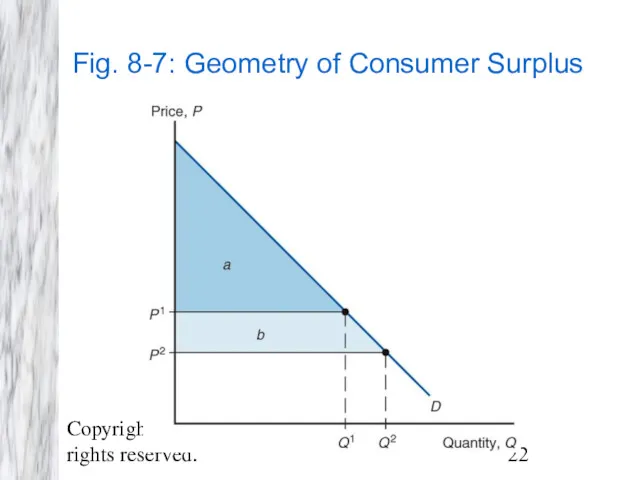

- 21. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Consumer Surplus Consumer surplus measures the amount that

- 22. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Fig. 8-7: Geometry of Consumer Surplus

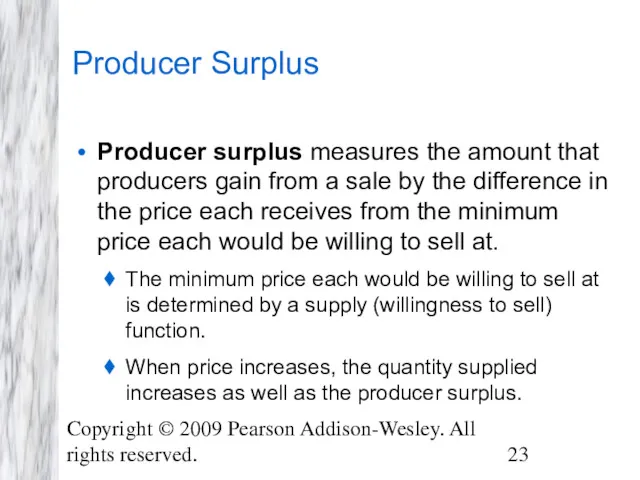

- 23. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Producer Surplus Producer surplus measures the amount that

- 24. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Fig. 8-8: Geometry of Producer Surplus

- 25. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Costs and Benefits of Tariffs A tariff raises

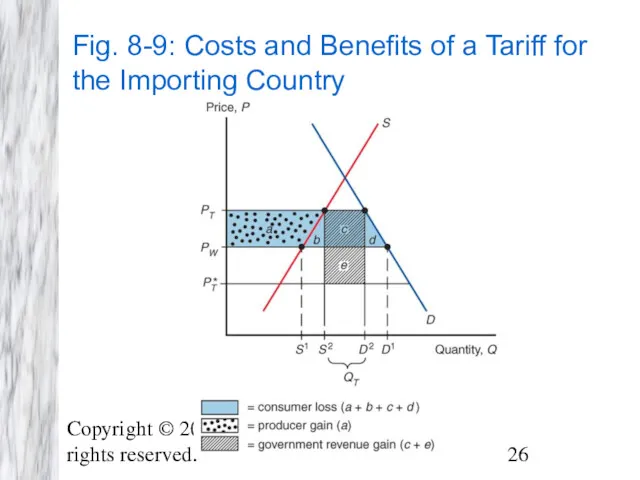

- 26. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Fig. 8-9: Costs and Benefits of a Tariff

- 27. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Costs and Benefits of Tariffs (cont.) For a

- 28. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Costs and Benefits of Tariffs (cont.) Government revenue

- 29. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Costs and Benefits of Tariffs (cont.) If the

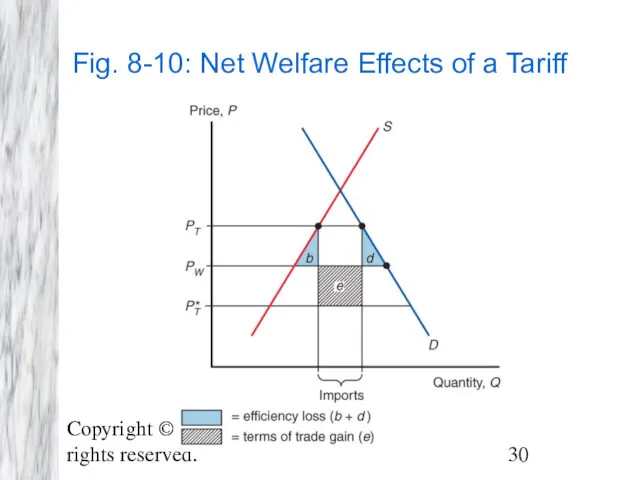

- 30. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Fig. 8-10: Net Welfare Effects of a Tariff

- 31. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Export Subsidy An export subsidy can also be

- 32. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Export Subsidy (cont.) An export subsidy raises the

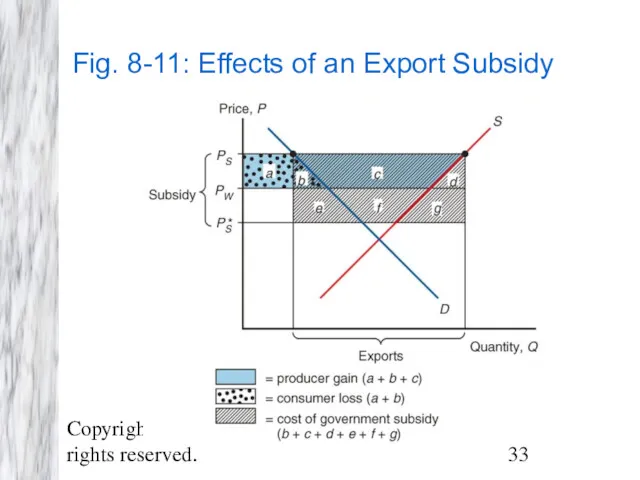

- 33. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Fig. 8-11: Effects of an Export Subsidy

- 34. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Export Subsidy (cont.) An export subsidy unambiguously produces

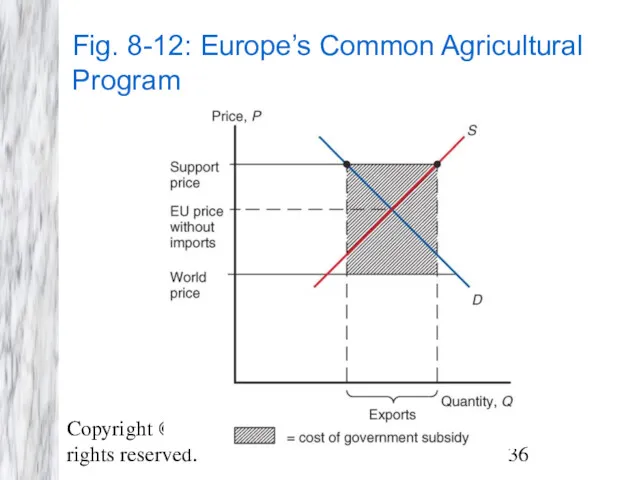

- 35. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Export Subsidy in Europe The European Union’s Common

- 36. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Fig. 8-12: Europe’s Common Agricultural Program

- 37. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Import Quota An import quota is a restriction

- 38. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Import Quota (cont.) When a quota instead of

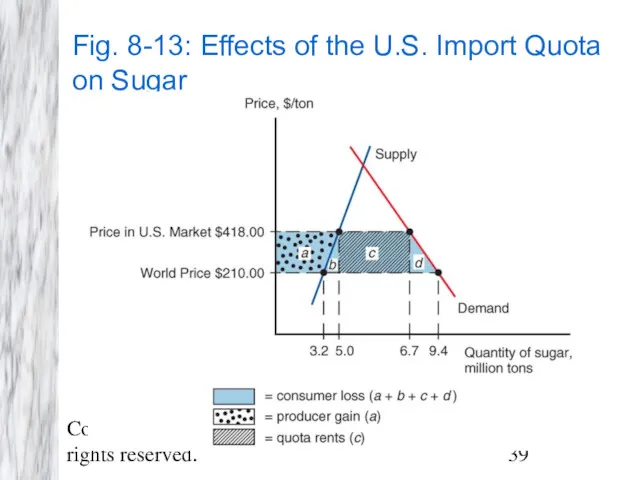

- 39. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Fig. 8-13: Effects of the U.S. Import Quota

- 40. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Voluntary Export Restraint A voluntary export restraint works

- 41. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Local Content Requirement A local content requirement is

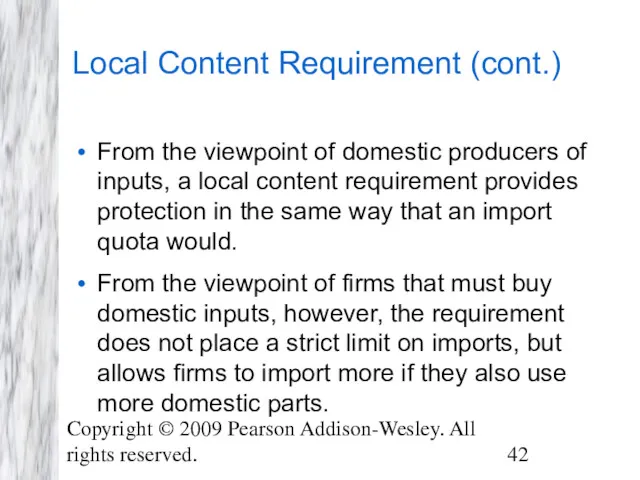

- 42. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Local Content Requirement (cont.) From the viewpoint of

- 43. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Local Content Requirement (cont.) Local content requirement provides

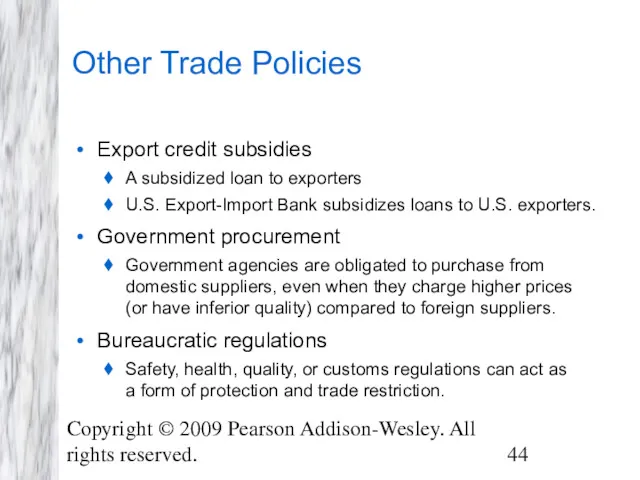

- 44. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Other Trade Policies Export credit subsidies A subsidized

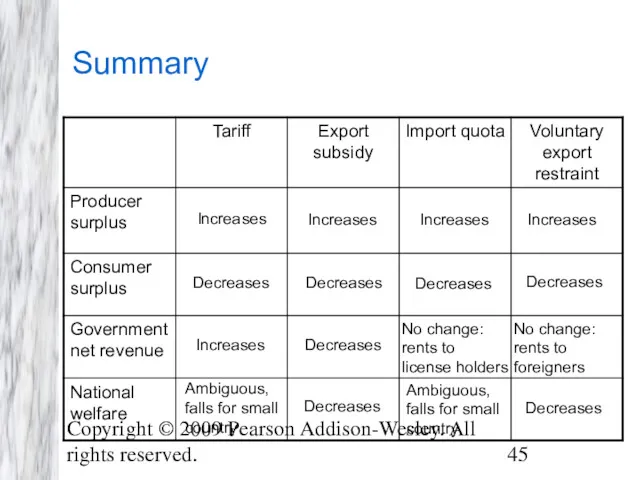

- 45. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Summary Increases Increases Increases Increases No change: rents

- 46. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Summary (cont.) A tariff decreases the world price

- 47. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Summary (cont.) The welfare effect of a tariff,

- 48. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Additional Chapter Art

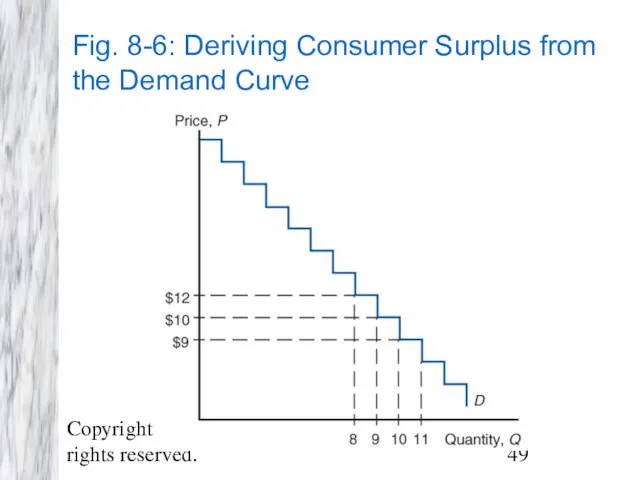

- 49. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Fig. 8-6: Deriving Consumer Surplus from the Demand

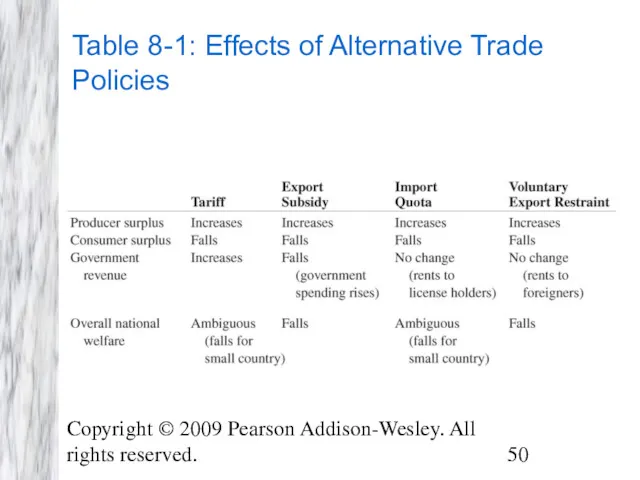

- 50. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Table 8-1: Effects of Alternative Trade Policies

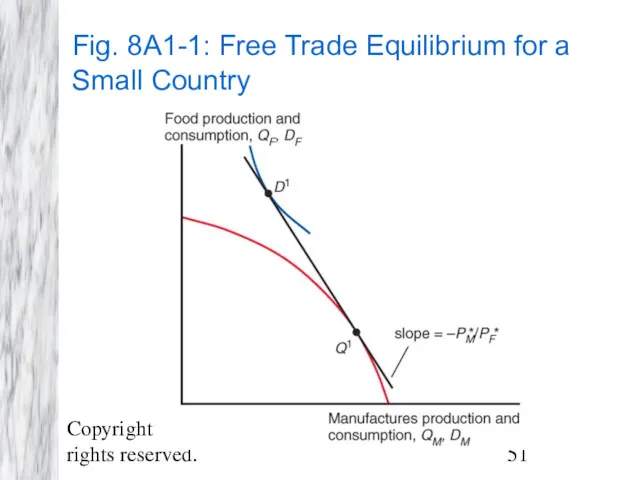

- 51. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Fig. 8A1-1: Free Trade Equilibrium for a Small

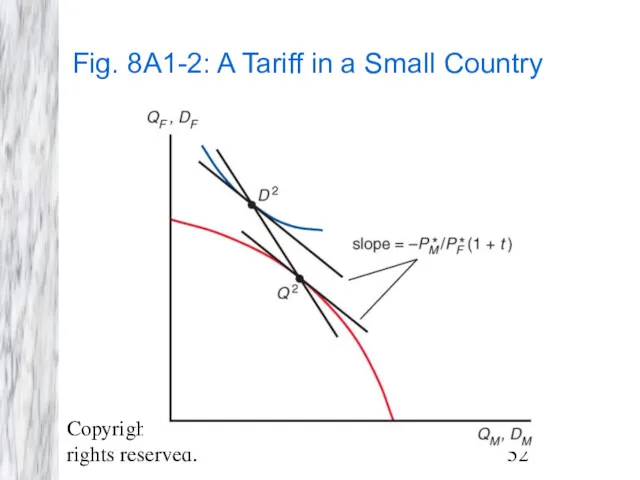

- 52. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Fig. 8A1-2: A Tariff in a Small Country

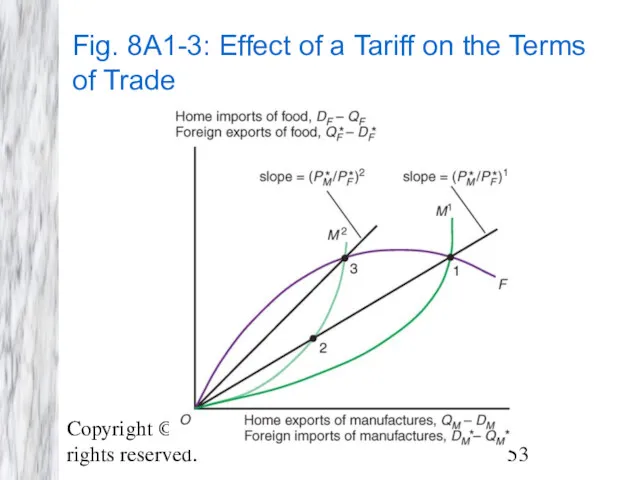

- 53. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Fig. 8A1-3: Effect of a Tariff on the

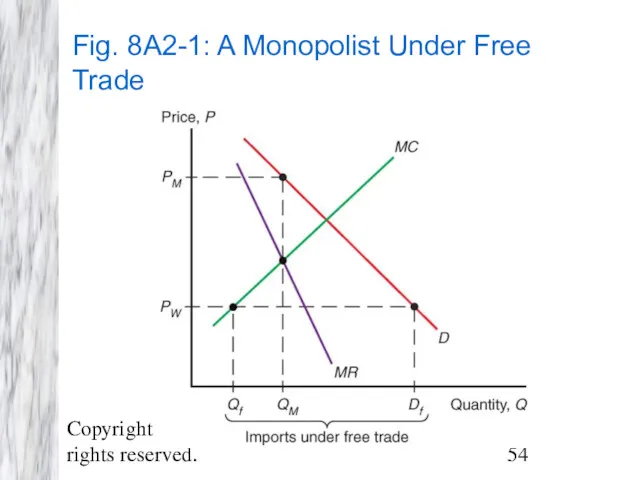

- 54. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Fig. 8A2-1: A Monopolist Under Free Trade

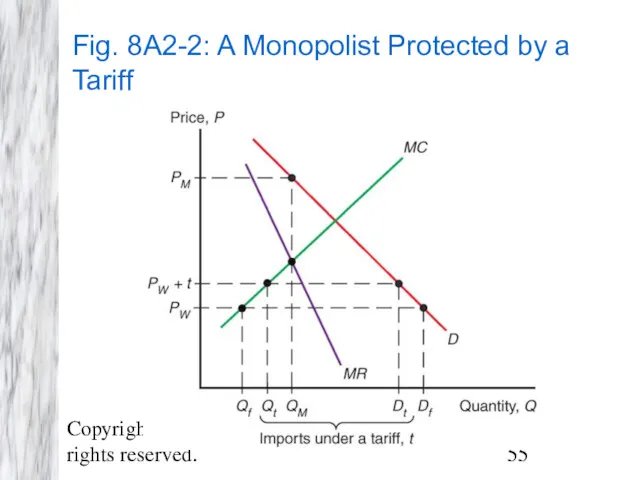

- 55. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Fig. 8A2-2: A Monopolist Protected by a Tariff

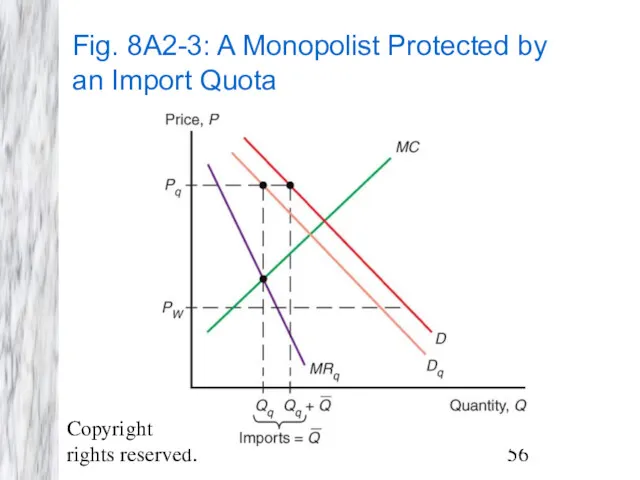

- 56. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Fig. 8A2-3: A Monopolist Protected by an Import

- 58. Скачать презентацию

Товар и деньги. (8 класс)

Товар и деньги. (8 класс) Жер нарығы

Жер нарығы Инфраструктурный комплекс

Инфраструктурный комплекс Предмет экономики. Общественное производство

Предмет экономики. Общественное производство Основополагающие принципы налогообложения

Основополагающие принципы налогообложения Роль государства в экономике

Роль государства в экономике Моделирование роста и развития городов. (Тема 4)

Моделирование роста и развития городов. (Тема 4) Показатели оценки эффективности деятельности высших должностных лиц субъектов РФ

Показатели оценки эффективности деятельности высших должностных лиц субъектов РФ Экономическое чудо Эрхарда в Германии

Экономическое чудо Эрхарда в Германии Мотивация персонала

Мотивация персонала Технические средства наноэлектроники. Нанолитография. (Тема 3.13.2)

Технические средства наноэлектроники. Нанолитография. (Тема 3.13.2) Фирма в экономике отраслевых рынков

Фирма в экономике отраслевых рынков Мәңгілік ел жалпыұлттық идеясының құндылықтары

Мәңгілік ел жалпыұлттық идеясының құндылықтары Особенности экономических воззрений в докапиталистических обществах

Особенности экономических воззрений в докапиталистических обществах Методология экономической науки. Этическая проблематика и экономическая наука

Методология экономической науки. Этическая проблематика и экономическая наука Основные проблемы экономики

Основные проблемы экономики Доклад главы администрации МО Беломорский муниципальный район за 2018 год

Доклад главы администрации МО Беломорский муниципальный район за 2018 год Экономическая концентрация

Экономическая концентрация Бәсекелестік, ерекшелігі және табиғаты. Нарықтық экономикада бәсекелестік механизмінің пайда болуы

Бәсекелестік, ерекшелігі және табиғаты. Нарықтық экономикада бәсекелестік механизмінің пайда болуы Экономика как наука и хозяйство

Экономика как наука и хозяйство Оценка эффективности инноваций

Оценка эффективности инноваций Уровень глобальной конкуренции стран Латинской Америки и Карибского бассейна. Бразилия, Чили, Аргентина, Мексика

Уровень глобальной конкуренции стран Латинской Америки и Карибского бассейна. Бразилия, Чили, Аргентина, Мексика Стратегии социального развития России в 21 веке

Стратегии социального развития России в 21 веке Постсоветское пространство: Центральная Азия

Постсоветское пространство: Центральная Азия Особая экономическая зона промышленно-производственного типа Липецк

Особая экономическая зона промышленно-производственного типа Липецк Нарықтық экономика жағдайында компанияның ішкі аудитін ұйымдастыру

Нарықтық экономика жағдайында компанияның ішкі аудитін ұйымдастыру Международное движение капиталов

Международное движение капиталов Климат и бедность. Экономические оценки России

Климат и бедность. Экономические оценки России