Содержание

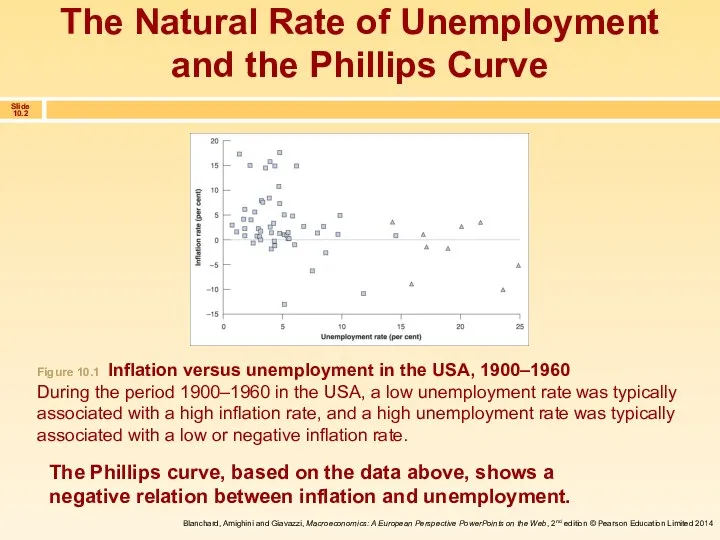

- 2. The Natural Rate of Unemployment and the Phillips Curve The Phillips curve, based on the data

- 3. 10.1 Inflation, Expected Inflation and Unemployment The above equation is the aggregate supply relation derived in

- 4. The appendix to this chapter shows how to go from the equation above to the relation

- 5. According to this equation: An increase in the expected inflation, πe, leads to an increase in

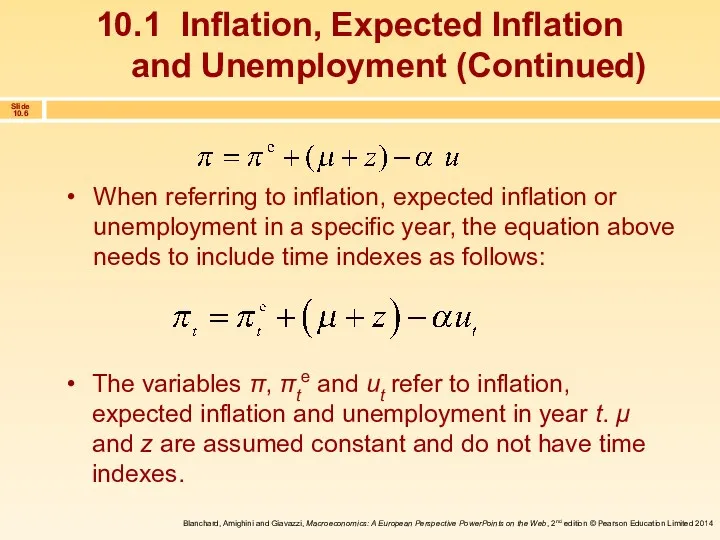

- 6. When referring to inflation, expected inflation or unemployment in a specific year, the equation above needs

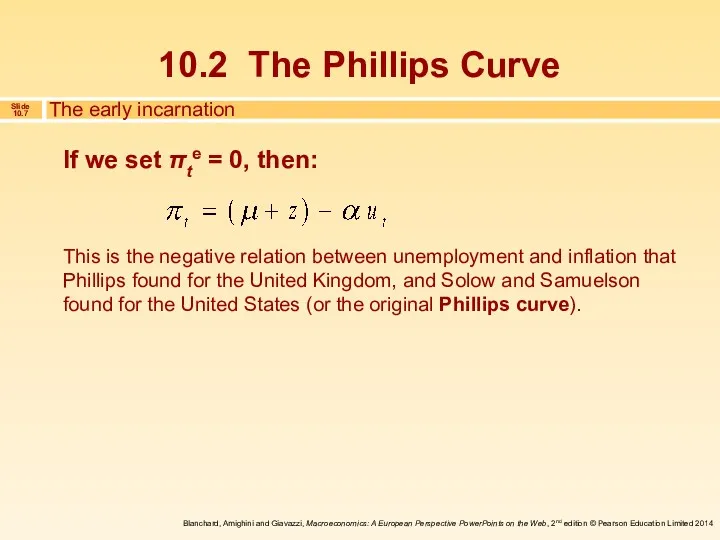

- 7. If we set πte = 0, then: This is the negative relation between unemployment and inflation

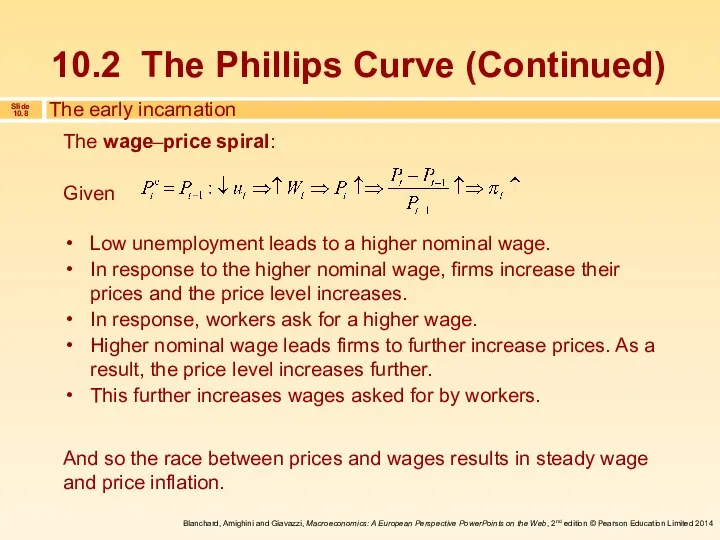

- 8. The wage–price spiral: Given Low unemployment leads to a higher nominal wage. In response to the

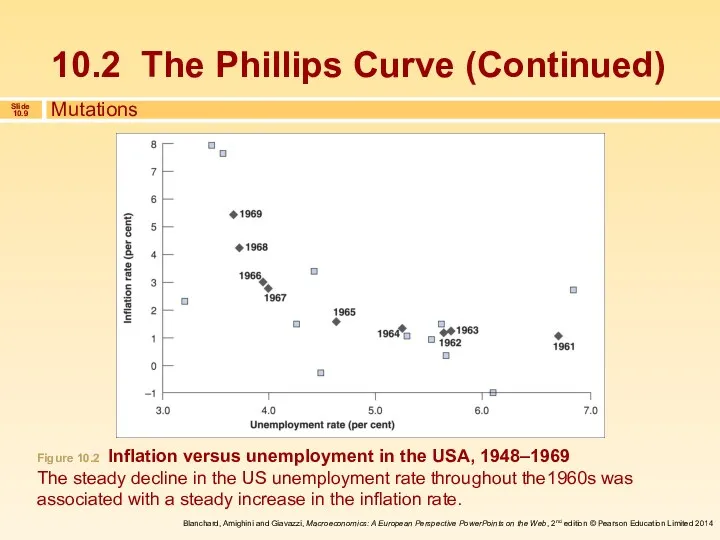

- 9. Mutations Figure 10.2 Inflation versus unemployment in the USA, 1948–1969 The steady decline in the US

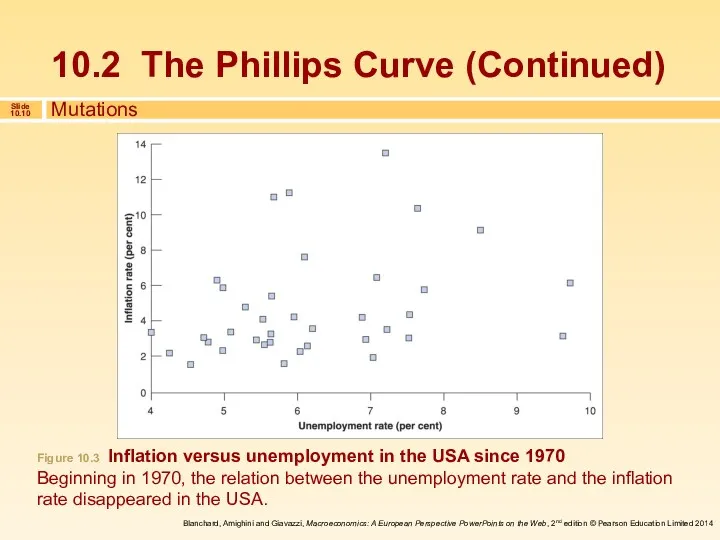

- 10. Mutations Figure 10.3 Inflation versus unemployment in the USA since 1970 Beginning in 1970, the relation

- 11. The negative relation between unemployment and inflation held throughout the 1960s, but it vanished after that

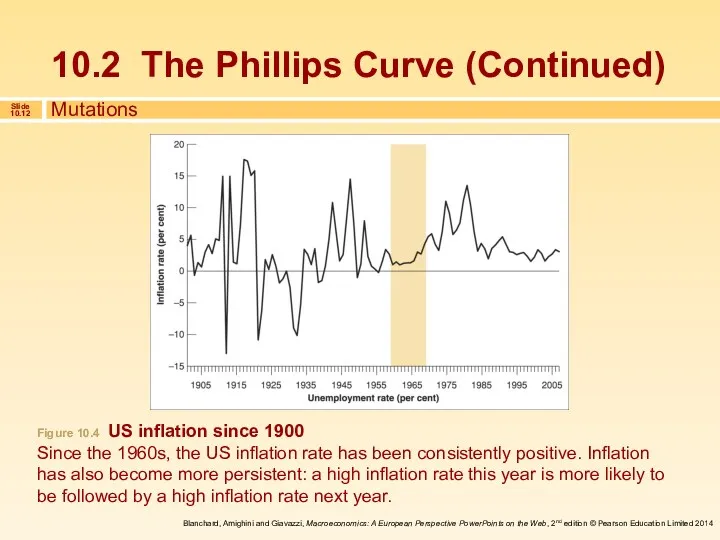

- 12. Mutations Figure 10.4 US inflation since 1900 Since the 1960s, the US inflation rate has been

- 13. Suppose expectations of inflation are formed according to The parameter θ captures the effect of last

- 14. We can think of what happened in the 1970s as an increase in the value of

- 15. When θ equals zero, we get the original Phillips curve, a relation between the inflation rate

- 16. When θ = 1, the unemployment rate affects not the inflation rate, but the change in

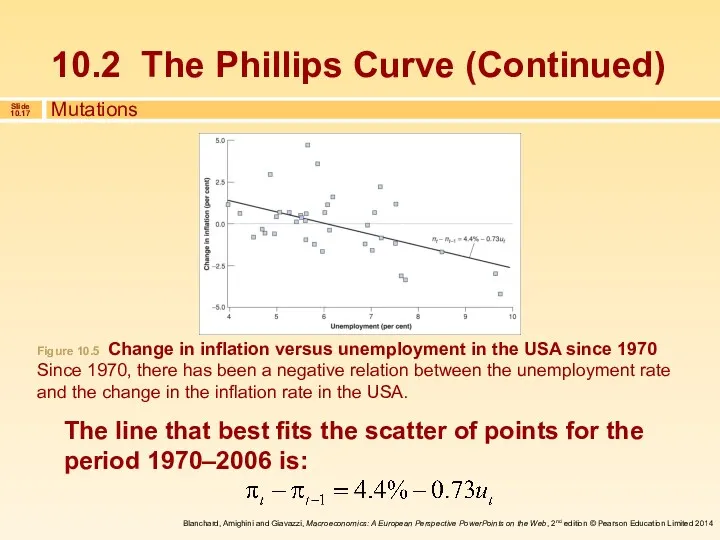

- 17. The line that best fits the scatter of points for the period 1970–2006 is: Mutations Figure

- 18. The original Phillips curve is: The modified Phillips curve, or the expectations-augmented Phillips curve or the

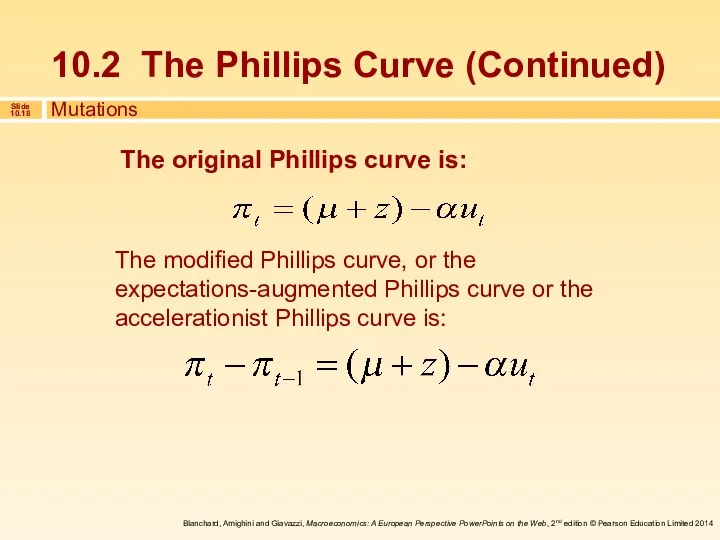

- 19. Friedman and Phelps questioned the trade-off between unemployment and inflation. They argued that the unemployment rate

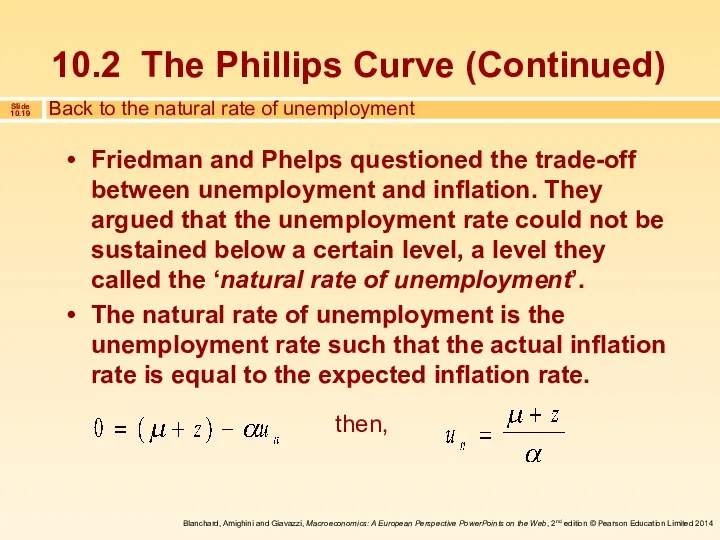

- 20. This is an important relation because it gives another way of thinking about the Phillips curve

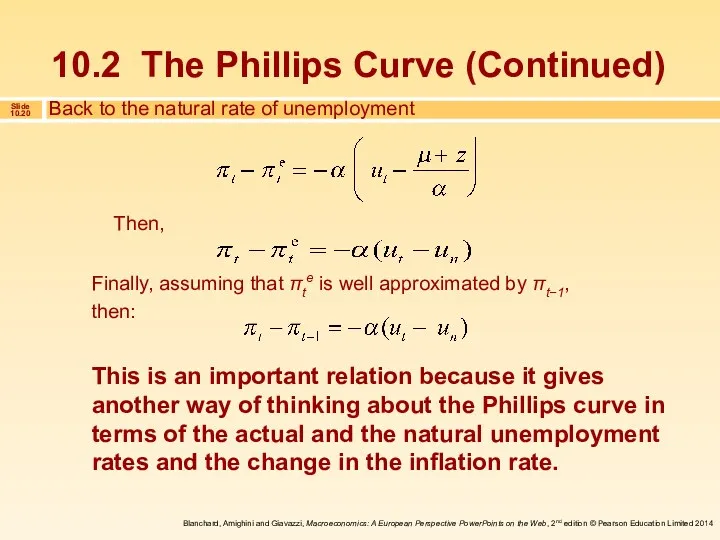

- 21. The equation above is an important relation for two reasons: It gives us another way of

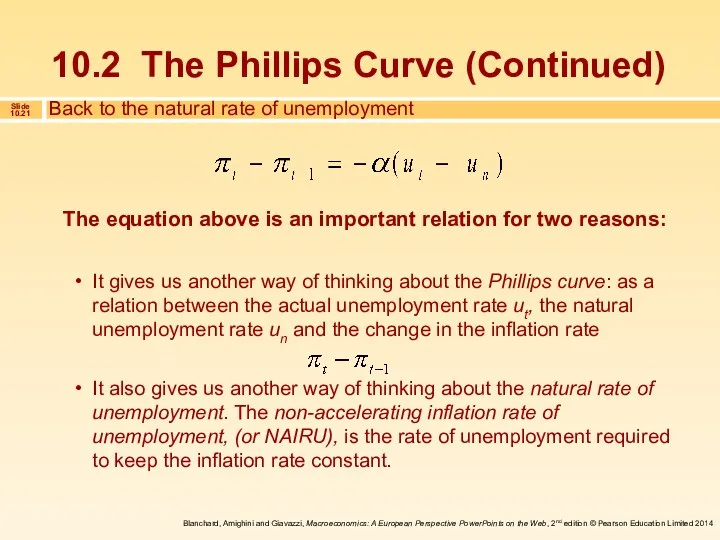

- 22. Let’s summarize what we have learned so far: When the unemployment rate exceeds the natural rate

- 23. The factors that affect the natural rate of unemployment above differ across countries. Therefore, there is

- 24. In the equation above, the terms μ and z may not be constant but, in fact,

- 25. What explains European unemployment? Labour market rigidities: A generous system of unemployment insurance A high degree

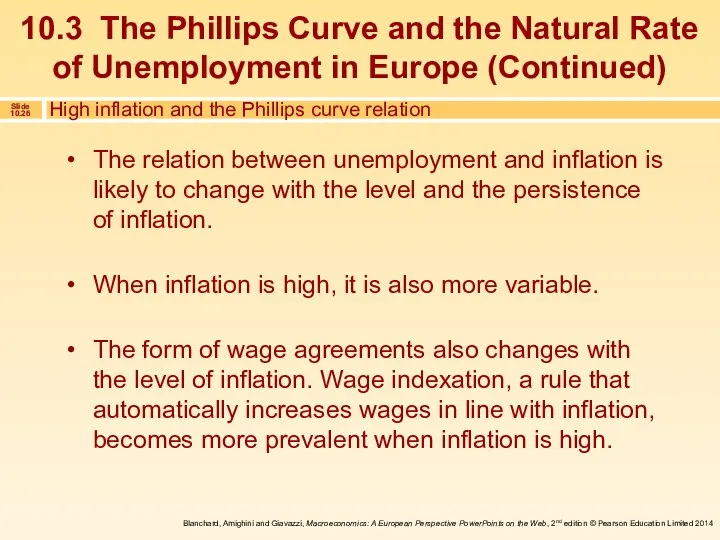

- 26. The relation between unemployment and inflation is likely to change with the level and the persistence

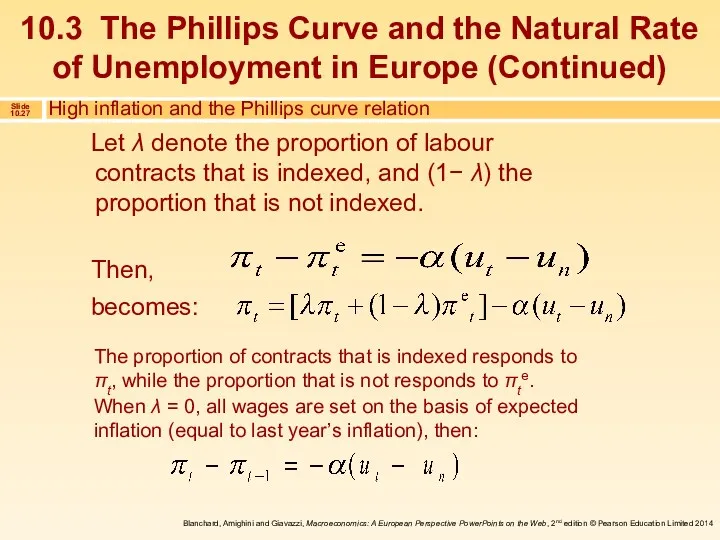

- 27. Let λ denote the proportion of labour contracts that is indexed, and (1− λ) the proportion

- 29. Скачать презентацию

Внешние эффекты (экстерналии)

Внешние эффекты (экстерналии) Обоснование ресурсов. Производственные мощности. Капитальные затраты. Затраты на сырье и материалы

Обоснование ресурсов. Производственные мощности. Капитальные затраты. Затраты на сырье и материалы Экономика және оның қоғам өміріндегі орны

Экономика және оның қоғам өміріндегі орны Демография – наука о народонаселении

Демография – наука о народонаселении Правовое и организационное обеспечение экономической безопасности

Правовое и организационное обеспечение экономической безопасности Экономический рост и развитие

Экономический рост и развитие Презентация Упражнения по теме спрос и предложение

Презентация Упражнения по теме спрос и предложение Статистические показатели, используемые в государственном регулировании

Статистические показатели, используемые в государственном регулировании Типи країн та показники їх економічного рівня

Типи країн та показники їх економічного рівня Предмет и метод экономической теории. (Тема 1)

Предмет и метод экономической теории. (Тема 1) Государственные и муниципальные унитарные предприятия. Производственные кооперативы. Объединения предприятий. Малый бизнес

Государственные и муниципальные унитарные предприятия. Производственные кооперативы. Объединения предприятий. Малый бизнес Историческое развитие человечества. Формационный подход

Историческое развитие человечества. Формационный подход Тема 9_Открытая экономика при несовершенной мобильности капитала

Тема 9_Открытая экономика при несовершенной мобильности капитала Понятие, источники, элементы и показатели предпринимательского дохода

Понятие, источники, элементы и показатели предпринимательского дохода Главная цель экономического развития региона Ленинградской области

Главная цель экономического развития региона Ленинградской области Занятие 29. Экономический рост

Занятие 29. Экономический рост Международные валютно-кредитные и финансовые организации и их регулирующая роль в мировом хозяйстве

Международные валютно-кредитные и финансовые организации и их регулирующая роль в мировом хозяйстве Занятие по Экономическому практикуму

Занятие по Экономическому практикуму Рынок инноваций

Рынок инноваций Развитие промышленности в Краснодарском крае

Развитие промышленности в Краснодарском крае Преступления в сфере экономической деятельности. Тема 21

Преступления в сфере экономической деятельности. Тема 21 Сукупний попит та сукупна пропозиція: макроекономічна рівновага. (Тема 5)

Сукупний попит та сукупна пропозиція: макроекономічна рівновага. (Тема 5) Технологічна політика ТНК

Технологічна політика ТНК Анализ технологических укладов

Анализ технологических укладов Территория опережающего социально-экономического развития

Территория опережающего социально-экономического развития Риск и неопределенность

Риск и неопределенность Экономика семьи

Экономика семьи Экономика: наука и хозяйство

Экономика: наука и хозяйство