“Fat" client(additional software is installed) . Bankers install on a client

computer a special program that creates a user-friendly interface and provides remote access to the customer's bank account. As a rule, "fat" clients can connect to the credit institution as a modem or via the Internet.

" Thin" clients(no software is installed). The system operates in the on-line via the Internet, access to their information the client receives the right on the bank's website. " Thin " clients are more mobile they are not tied to a particular PC and can actually gain access to a bank account anywhere in the world.

Types of clients.

IT’S INTERESTING! Market research showed that RUSSIAN BANKS prefer to work with “thin” clients, and Belarusian banks are working mainly with "thick" clients.

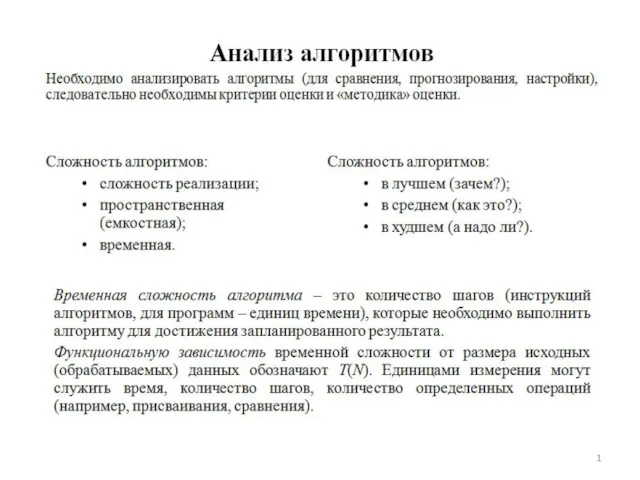

Анализ алгоритмов

Анализ алгоритмов Урок по созданию диаграмм в Excel для финансовых отчетов

Урок по созданию диаграмм в Excel для финансовых отчетов Интернет-этикет сетикет или по-другому нетикет

Интернет-этикет сетикет или по-другому нетикет Как вести себя в Интернете? Безопасность в сети Интернет

Как вести себя в Интернете? Безопасность в сети Интернет Алгоритм и исполнители

Алгоритм и исполнители Общие сведения о языке программирования Паскаль. Начала программирования. Информатика. 8 класс

Общие сведения о языке программирования Паскаль. Начала программирования. Информатика. 8 класс Электронные таблицы. MS Excel

Электронные таблицы. MS Excel Контент-анализ как количественный метод исследования текстов

Контент-анализ как количественный метод исследования текстов Лекция 2016.3. Построение конфигурации. Дерево конфигурации

Лекция 2016.3. Построение конфигурации. Дерево конфигурации Форматирование текста в текстовом редакторе MS Word

Форматирование текста в текстовом редакторе MS Word Приложения по информатике

Приложения по информатике Обратное распространение ошибки. Практика

Обратное распространение ошибки. Практика Цикл с параметром

Цикл с параметром Назначение и возможности табличного процессора MS Excel

Назначение и возможности табличного процессора MS Excel Носії інформації

Носії інформації Виртуальные машины и их операционные системы

Виртуальные машины и их операционные системы Протоколы IPTV

Протоколы IPTV Создание веб-страниц в WORD. Проектирование веб-сайта

Создание веб-страниц в WORD. Проектирование веб-сайта История развития ООП. Базовые понятия ООП: объект, его свойства и методы, класс, интерфейс

История развития ООП. Базовые понятия ООП: объект, его свойства и методы, класс, интерфейс Запись чисел в различных системах счисления

Запись чисел в различных системах счисления Создание структуры базы данных. Семинар 3. Лекция 1. Первое знакомство с базами данных

Создание структуры базы данных. Семинар 3. Лекция 1. Первое знакомство с базами данных Организация ввода и вывода данных. Начала программирования

Организация ввода и вывода данных. Начала программирования Рецензия - отзыв, разбор и оценка

Рецензия - отзыв, разбор и оценка Суммирование элементов массива, вычисления следа матрицы, суммирование двух массивов

Суммирование элементов массива, вычисления следа матрицы, суммирование двух массивов Современные системы автоматизации

Современные системы автоматизации Проектирование информационной системы учета услуг по монтажу и ремонту электрооборудования

Проектирование информационной системы учета услуг по монтажу и ремонту электрооборудования SOFiSTiK: Расчет монолитных железобетонных плит с учетом физической нелинейности 21.05.2013

SOFiSTiK: Расчет монолитных железобетонных плит с учетом физической нелинейности 21.05.2013 Лекция 8. Форматы графических файлов. Формат JPEG

Лекция 8. Форматы графических файлов. Формат JPEG