Содержание

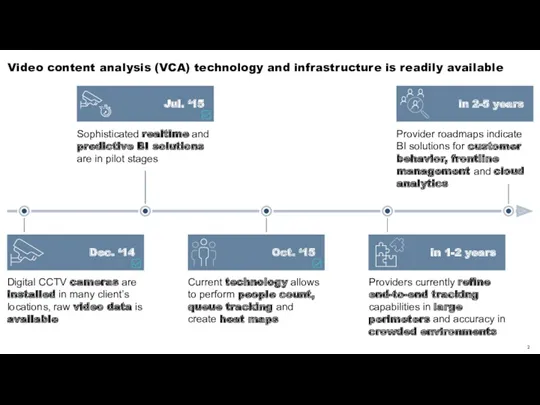

- 2. Video content analysis (VCA) technology and infrastructure is readily available Provider roadmaps indicate BI solutions for

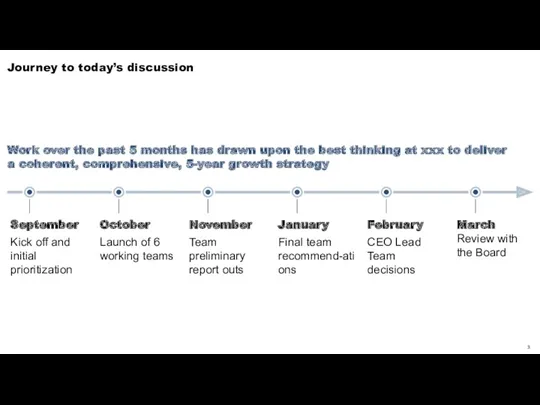

- 3. Journey to today’s discussion Work over the past 5 months has drawn upon the best thinking

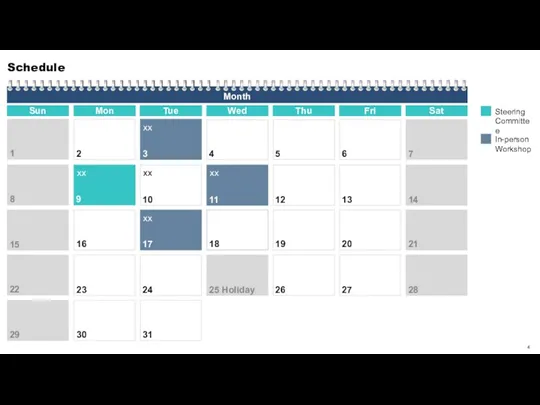

- 4. Schedule

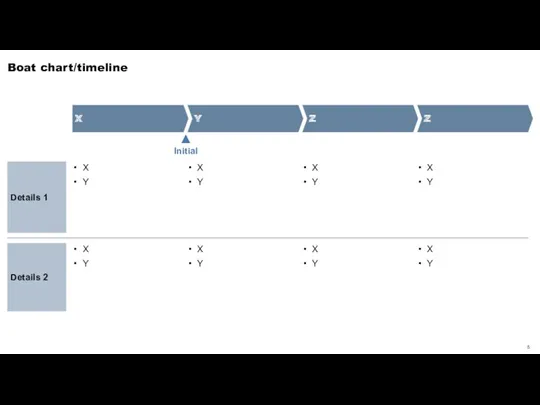

- 5. Boat chart/timeline Initial Details 1 Details 2 X Y X Y X Y X Y X

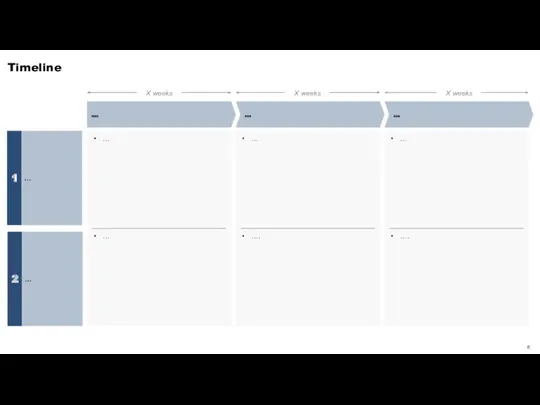

- 6. Timeline X weeks X weeks X weeks … … … … …. ….

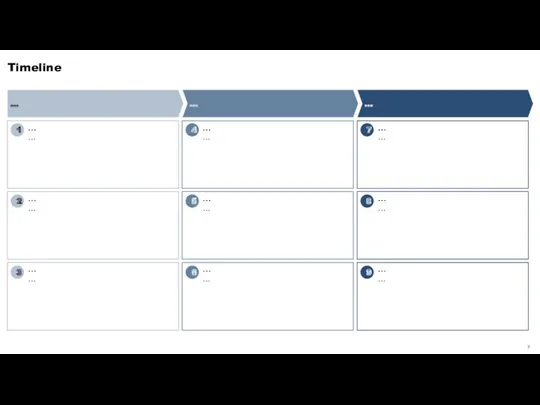

- 7. Timeline … … … … … … 1 4 7 … … … … … …

- 8. Stage gate timeline Timing Q4 2009 Q1 to Q4, FY10 FY11 to FY12/14 FY12/14 onwards Stage

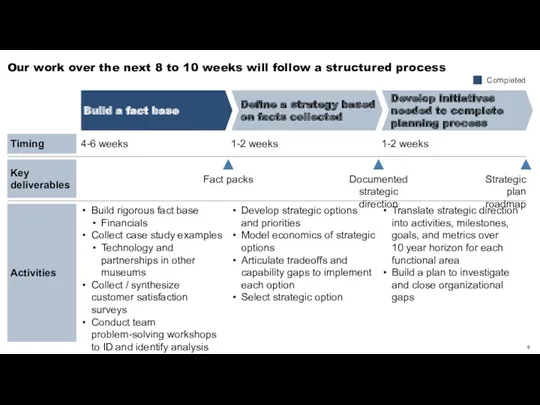

- 9. Our work over the next 8 to 10 weeks will follow a structured process Timing 4-6

- 10. Schedule

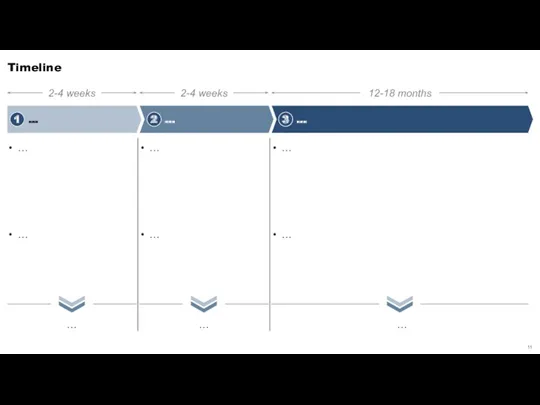

- 11. Timeline 1 2 3 2-4 weeks 2-4 weeks 12-18 months … … … … … …

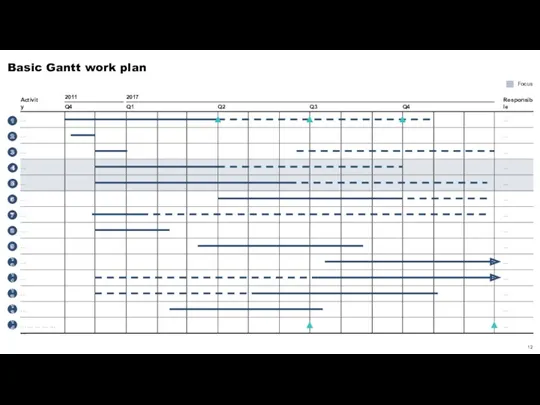

- 12. Basic Gantt work plan 4 5 2011 2017 Q4 Q1 Q2 Q3 Q4 … … …

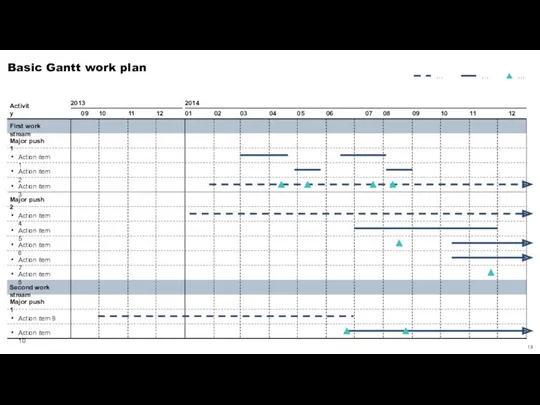

- 13. Basic Gantt work plan 2013 2014 09 10 11 12 01 02 03 04 05 06

- 14. Приложение: шаблоны и примеры слайдов Шаблоны слайдов с планом работ Шаблоны слайдов с процессом Шаблоны слайдов

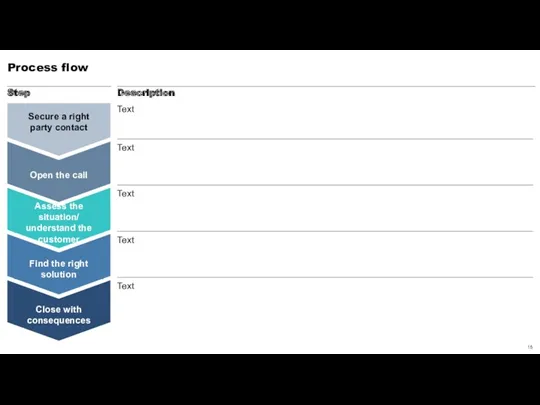

- 15. Process flow Text Text Text Text Text

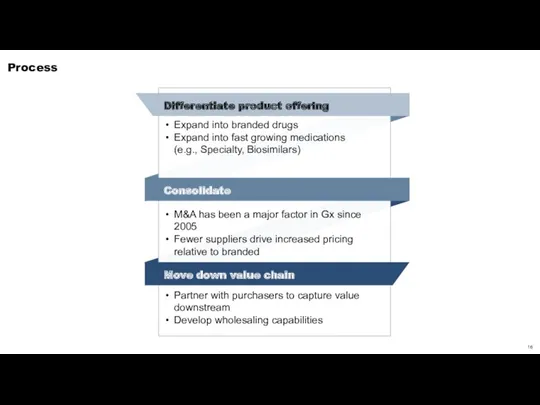

- 16. Process Differentiate product offering Consolidate Move down value chain Expand into branded drugs Expand into fast

- 17. Circular process … … … … A. … B. … C. … D. … …

- 18. Circular process … … … … … … E. … F. … A. … B. …

- 19. Process A. … B. … C. … D. … E. … F. … … … …

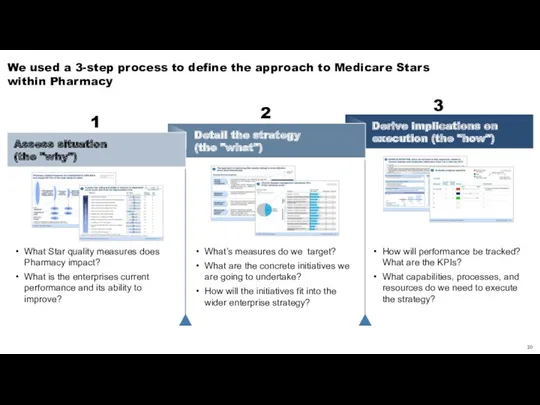

- 20. We used a 3-step process to define the approach to Medicare Stars within Pharmacy Assess situation

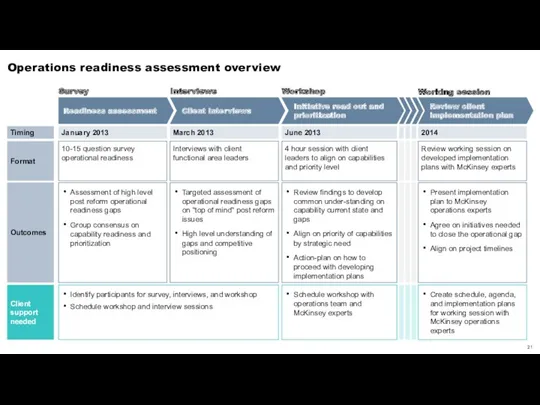

- 21. Operations readiness assessment overview Working session Survey Interviews Workshop Timing Format Outcomes Readiness assessment January 2013

- 22. Приложение: шаблоны и примеры слайдов Шаблоны слайдов с планом работ Шаблоны слайдов с процессом Шаблоны слайдов

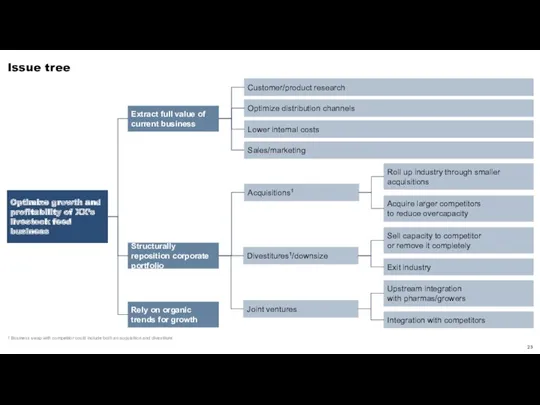

- 23. Issue tree Optimize growth and profitability of XX’s livestock feed business Customer/product research Lower internal costs

- 24. Structure/Solution tree How can we convince the IOC to choose our city for the 2024 Olympics?

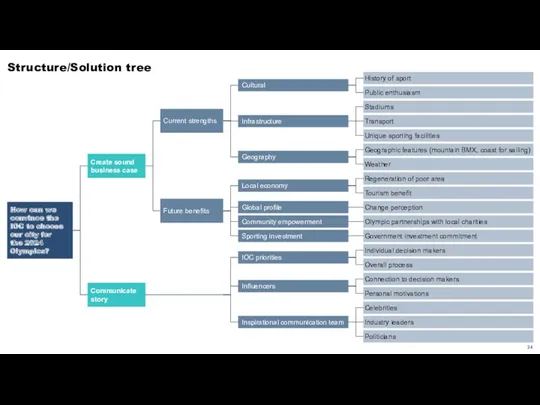

- 25. Text Text Structure/Solution tree Text Text Text Text Text Text Text Heading Text Text Text Text

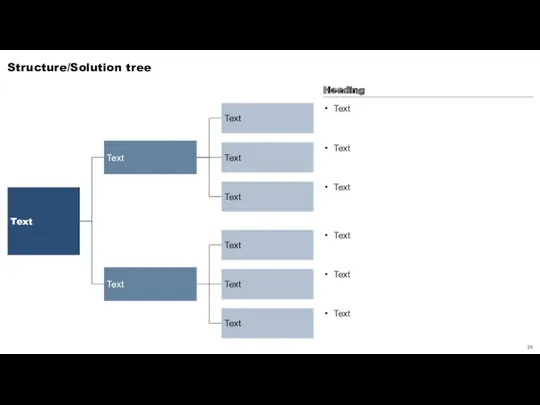

- 26. Structure/Solution tree Text Text Text Text Text Text Text Text Text Text

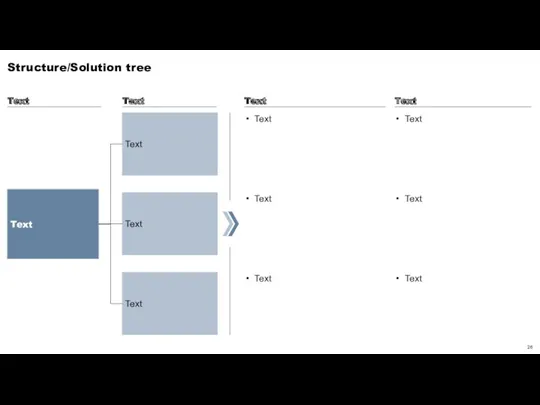

- 27. Structure/Solution tree Text Text Text Text Text Text Text Text Text Text Text Text Text Text

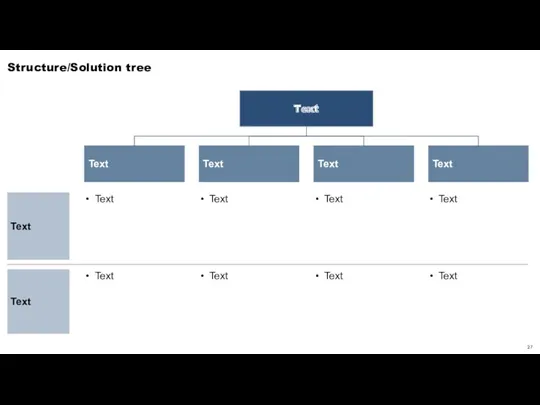

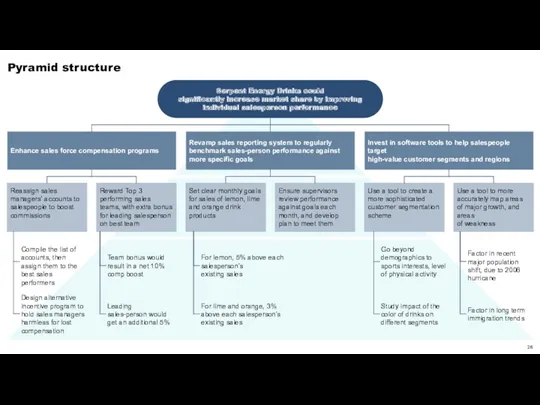

- 28. Pyramid structure Enhance sales force compensation programs Invest in software tools to help salespeople target high-value

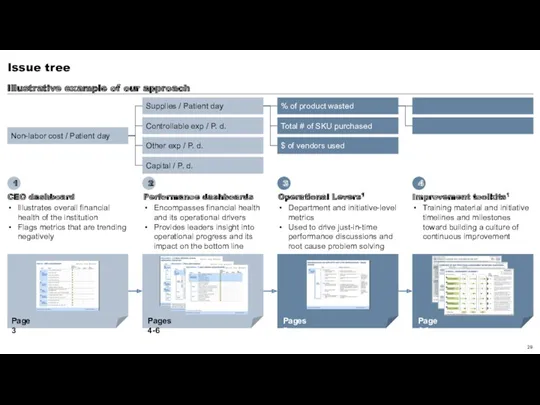

- 29. Issue tree Non-labor cost / Patient day Supplies / Patient day Controllable exp / P. d.

- 30. Приложение: шаблоны и примеры слайдов Шаблоны слайдов с планом работ Шаблоны слайдов с процессом Шаблоны слайдов

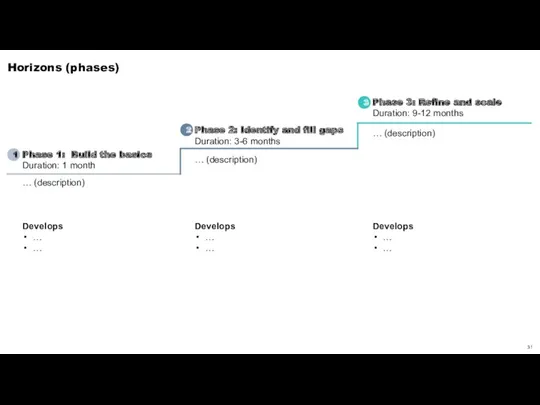

- 31. Horizons (phases) Phase 1: Build the basics Duration: 1 month Phase 3: Refine and scale Duration:

- 32. Improving contract management systems would enable operational savings across the enterprise Purchase order based system for

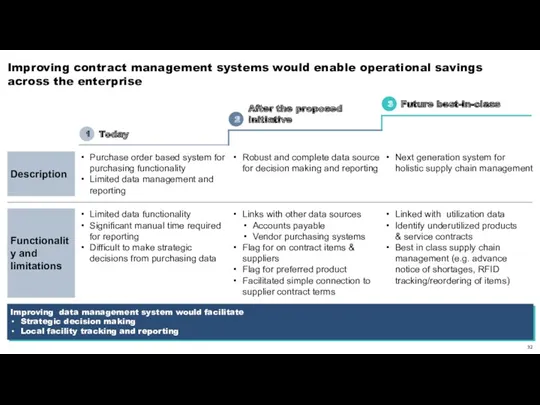

- 33. Приложение: шаблоны и примеры слайдов Шаблоны слайдов с планом работ Шаблоны слайдов с процессом Шаблоны слайдов

- 34. From-to template Standalone, off the rack products One size fits all approach Narrow cost, opportunistic sales

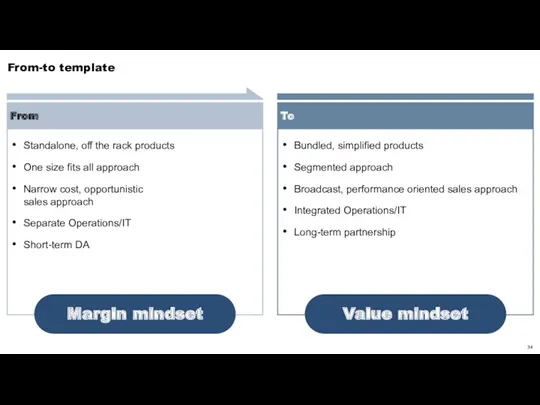

- 35. From-to template Standalone, off the rack products One size fits all approach Narrow cost, opportunistic sales

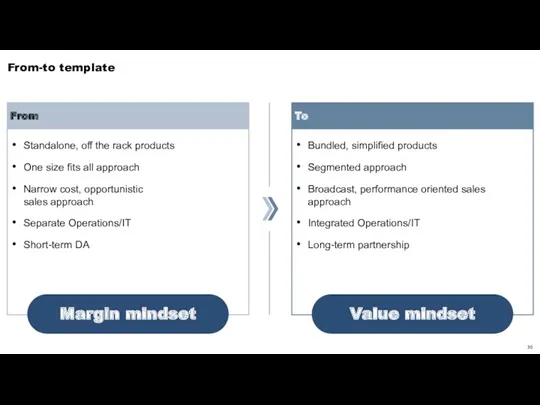

- 36. From-to template Title Title

- 37. From-to template … … … … … From … To … … … … … …

- 38. From-to template Title Current state Behavior changes Future state icon icon icon icon icon … …

- 39. Situation-Complication-resolution template Resolution Complication Situation Text Text Text

- 40. From-to template … … … … … … … …

- 41. Приложение: шаблоны и примеры слайдов Шаблоны слайдов с планом работ Шаблоны слайдов с процессом Шаблоны слайдов

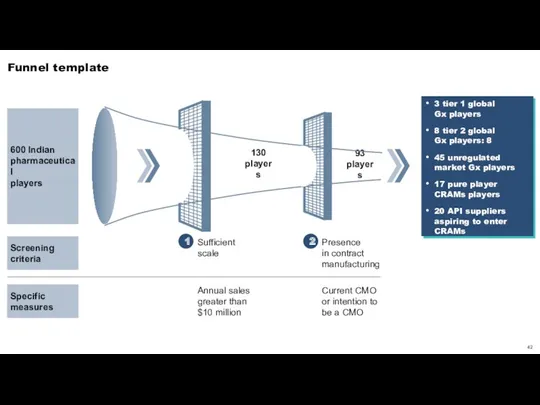

- 42. Funnel template Screening criteria 2 1 600 Indian pharmaceutical players 93 players 130 players 3 tier

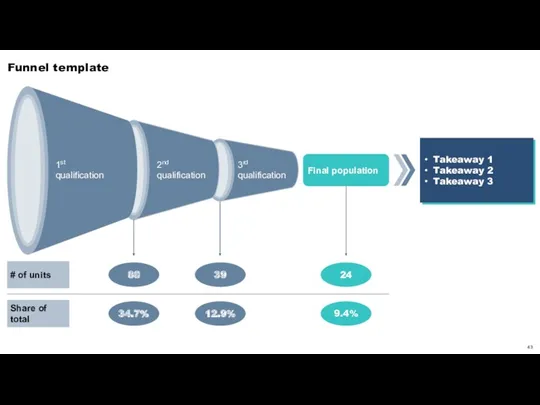

- 43. Funnel template 88 39 24 2nd qualification 3rd qualification 1st qualification 34.7% 12.9% 9.4% Final population

- 44. Funnel template ... … ... … ... … ... …

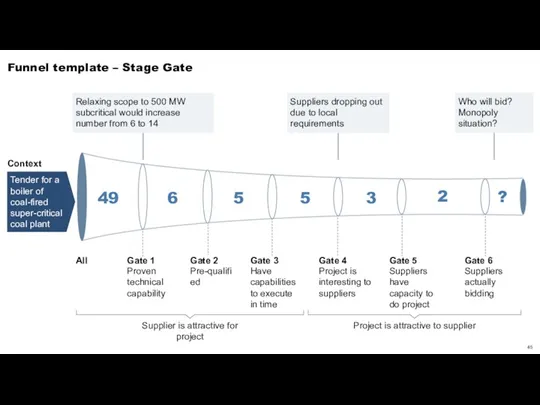

- 45. Funnel template – Stage Gate Proven technical capability Pre-qualified Have capabilities to execute in time Project

- 46. Funnel template Policies accepted Offers/week Customer visits/week Customer contacts/week Top 25% of all salesmen Ø all

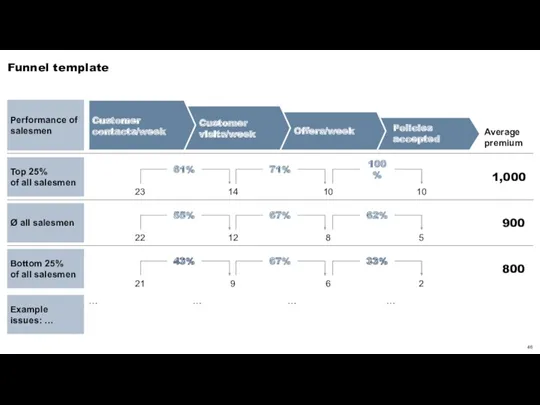

- 47. Приложение: шаблоны и примеры слайдов Шаблоны слайдов с планом работ Шаблоны слайдов с процессом Шаблоны слайдов

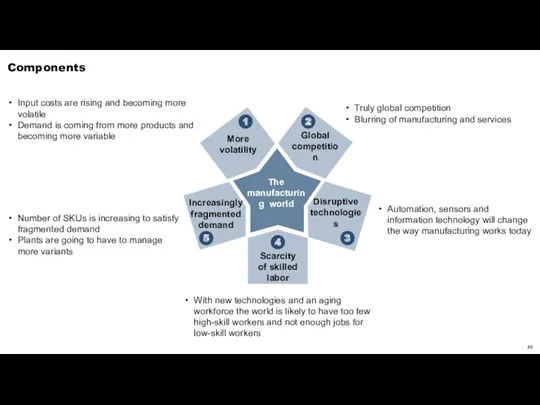

- 48. Components Input costs are rising and becoming more volatile Demand is coming from more products and

- 49. Components "PSM alignment with business strategy and support of it" "The way PSM professionals think, feel,

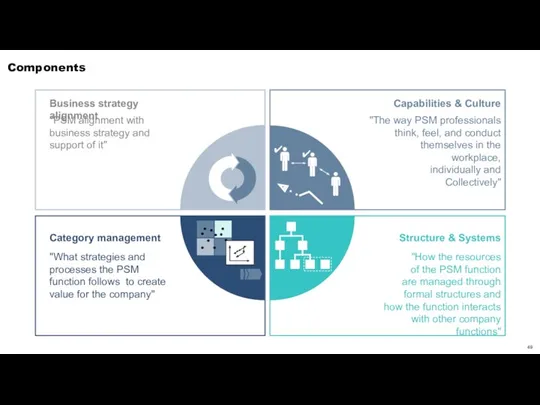

- 50. Components … … … … … … … … … … … … …

- 51. Components … … … … … … …

- 52. Components … 2 Element 1 Element 5 Element 3 Element 4 Element Brand Promise 6 Element

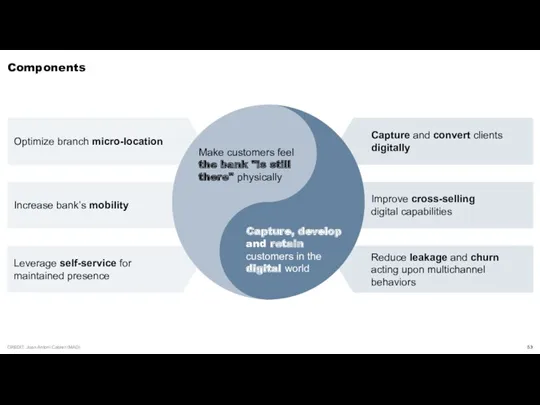

- 53. Components Optimize branch micro-location Increase bank’s mobility Leverage self-service for maintained presence Make customers feel the

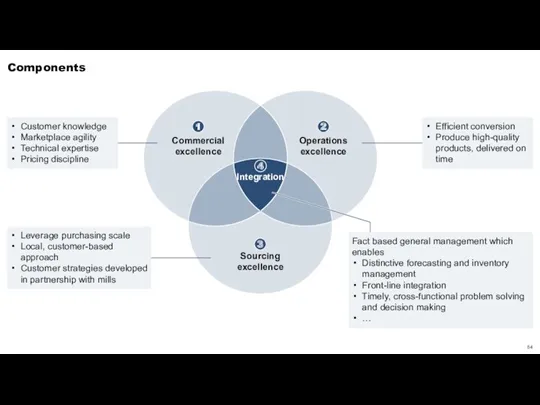

- 54. Components 1 Commercial excellence 2 Operations excellence 3 Sourcing excellence 4 Integration Customer knowledge Marketplace agility

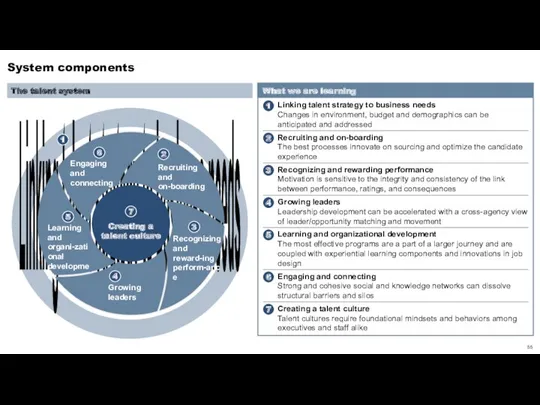

- 55. System components What we are learning Linking talent strategy to business needs Changes in environment, budget

- 56. Components Element 1 Element 2 Element 3 … … … … … …

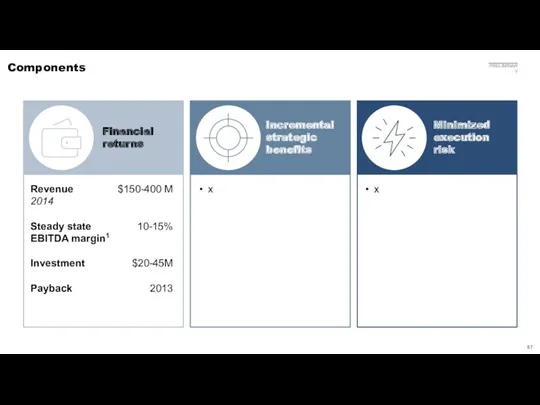

- 57. Incremental strategic benefits x Minimized execution risk x Revenue 2014 Steady state EBITDA margin1 Investment Payback

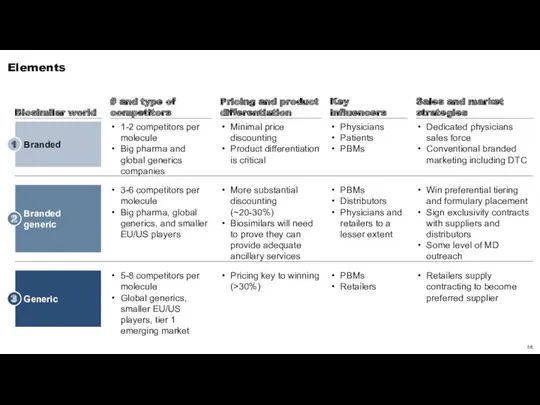

- 58. Elements Branded 1 Dedicated physicians sales force Conventional branded marketing including DTC 1-2 competitors per molecule

- 59. Приложение: шаблоны и примеры слайдов Шаблоны слайдов с планом работ Шаблоны слайдов с процессом Шаблоны слайдов

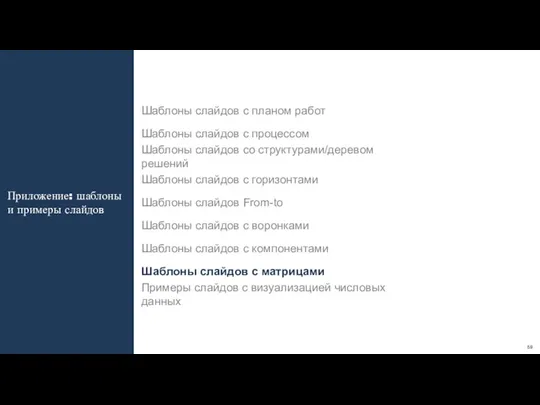

- 60. ME/CP++ opportunity : Tier 3 regional payor Time to market (Alabama) Long term Near term Sample

- 61. Four high priority initiatives have been selected for the pilot Bubble size = estimated impact HIGH

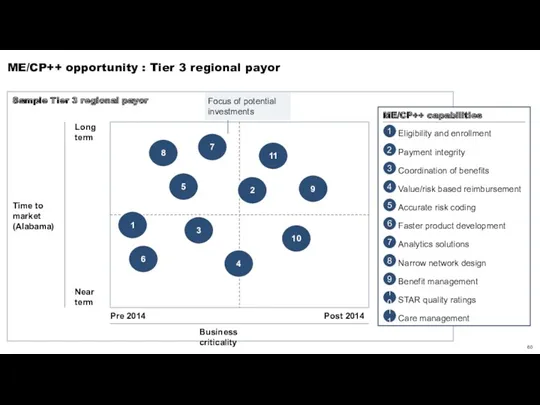

- 62. A responsibility assignment matrix will help to drive an aligned and efficient sourcing process Responsible Accountable

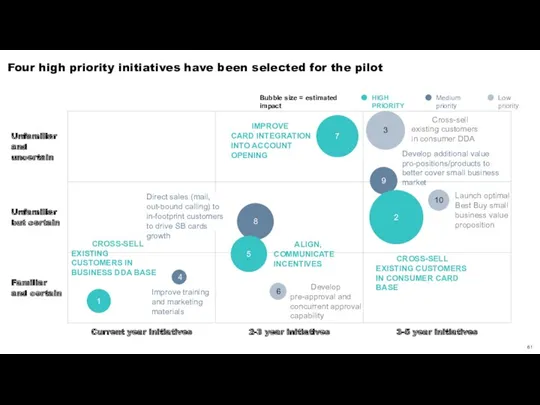

- 63. Приложение: шаблоны и примеры слайдов Шаблоны слайдов с планом работ Шаблоны слайдов с процессом Шаблоны слайдов

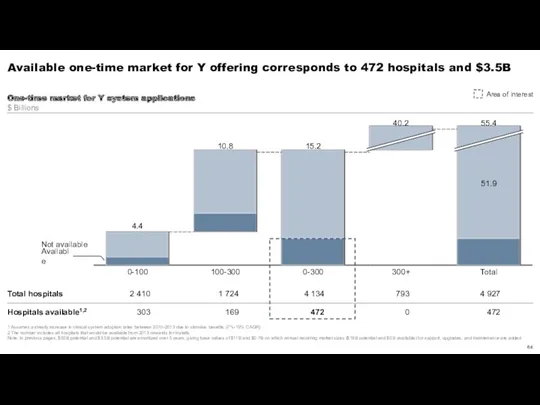

- 64. Available one-time market for Y offering corresponds to 472 hospitals and $3.5B 0-300 0-100 51.9 100-300

- 65. Spending on health care exceeded expected levels by $572 billion in 2009 – 23% of total

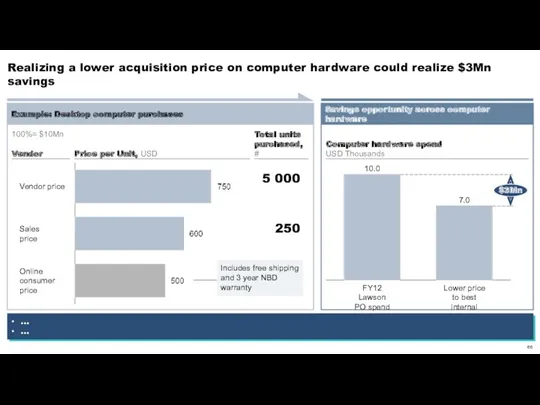

- 66. Realizing a lower acquisition price on computer hardware could realize $3Mn savings Example: Desktop computer purchases

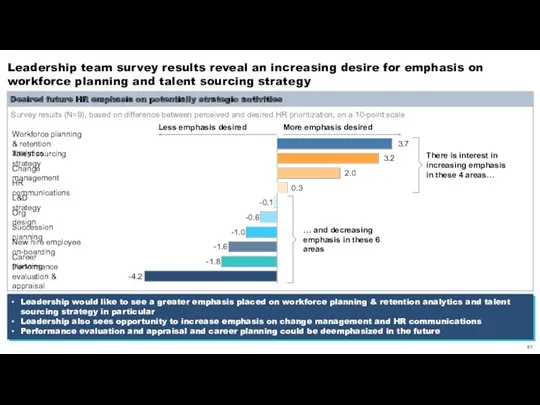

- 67. Leadership team survey results reveal an increasing desire for emphasis on workforce planning and talent sourcing

- 68. Bank ABC performs near or above the top quartile bank in portfolio balance and account growth

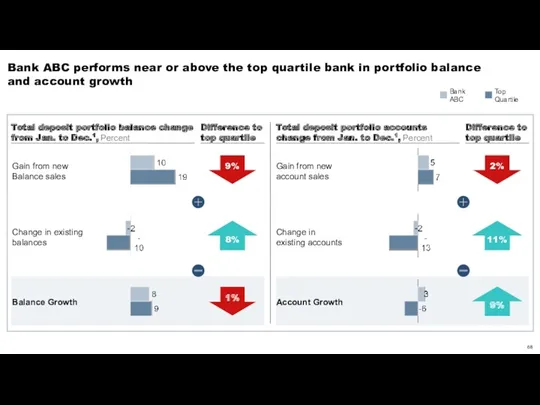

- 69. Physicians are drawn to rewards, and have interests that can be part of a rewards value

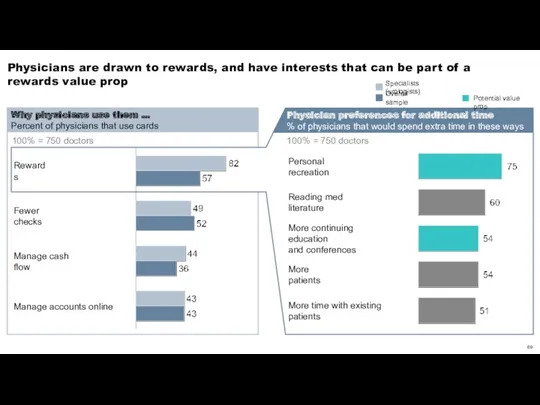

- 70. The top management team focuses on cross-selling Scorecard: 15 key measures tracked by top management Homeowner-customers

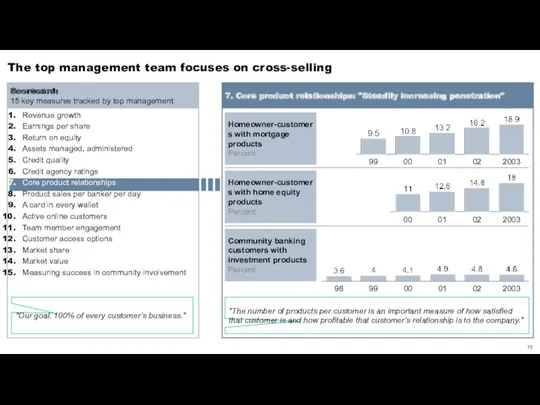

- 71. Pilot targets and KPIs … … 4 10.0 min 150% 3 200% 5 30 customers 40

- 72. We can gain up to 80 basis points of margin by addressing five cost levers Reduce

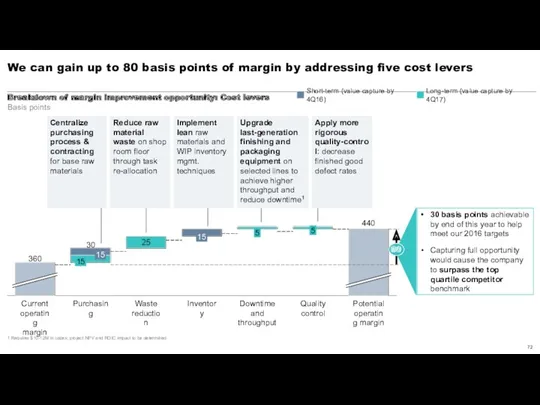

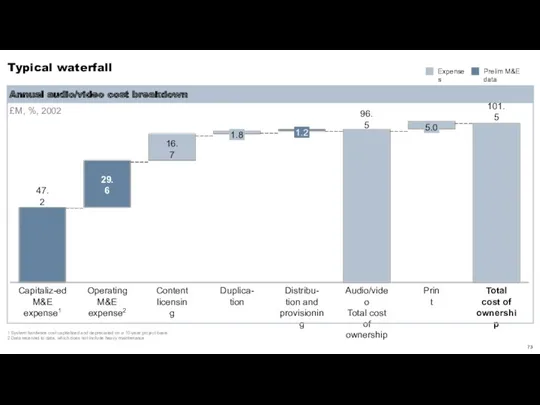

- 73. Typical waterfall £M, %, 2002 Annual audio/video cost breakdown Capitaliz-ed M&E expense1 1.8 Content licensing Audio/video

- 74. Typical waterfall 4-7 … Segmentation, Sales productivity and delivery … 1-2 ~1 … … 1-4 2

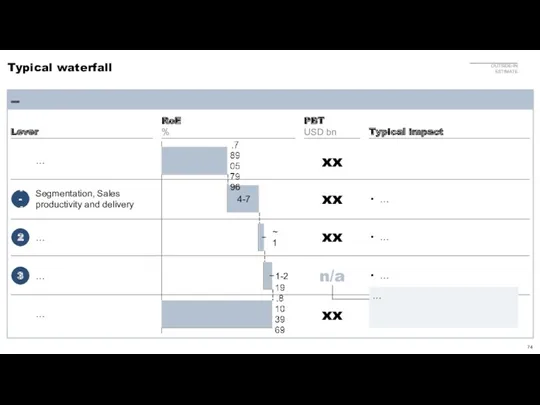

- 75. Chart with implications 2011 12 12 15 2013 18 +22% p.a. Series 3 Series 1 Series

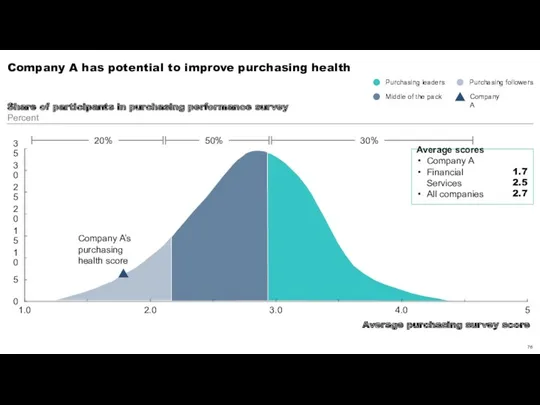

- 76. Company A has potential to improve purchasing health 25 35 0 5 10 20 30 15

- 78. Скачать презентацию

Компьютер и его части

Компьютер и его части HTTP протокол передачи гипертекста

HTTP протокол передачи гипертекста Правила по обеспечению информационной безопасности на рабочем месте

Правила по обеспечению информационной безопасности на рабочем месте ABC-Pascal. Структура программы. Переменные и присваивание. Ввод-вывод

ABC-Pascal. Структура программы. Переменные и присваивание. Ввод-вывод Электронная подпись: теория и практика использования. Тема 1.3.2

Электронная подпись: теория и практика использования. Тема 1.3.2 Проектирование АСУ ТП . Принципы проектирования

Проектирование АСУ ТП . Принципы проектирования Методическая разработка урока по теме Компьютерные вирусы. Антивирусные программы

Методическая разработка урока по теме Компьютерные вирусы. Антивирусные программы Методы научного моделирования

Методы научного моделирования Оборудование для наших клиентов

Оборудование для наших клиентов Урок по информатике в 5 классе по теме Кодирование информации

Урок по информатике в 5 классе по теме Кодирование информации Электронная тетрадь по информатике

Электронная тетрадь по информатике Текстові і графічні обʼєкти на слайдах. Урок 30

Текстові і графічні обʼєкти на слайдах. Урок 30 Модели данных. Примеры МИС. Стандарты. Шкалы измерения параметров. Этапы проектирования БД

Модели данных. Примеры МИС. Стандарты. Шкалы измерения параметров. Этапы проектирования БД Особенности объектной модели Java. (Лекция 5)

Особенности объектной модели Java. (Лекция 5) Training Module Overview

Training Module Overview ЗАДАНИЯ для интер доски к уроку ОБЪЕКТ

ЗАДАНИЯ для интер доски к уроку ОБЪЕКТ Системи програмного та слідкуючого керування рухом

Системи програмного та слідкуючого керування рухом Основы Java. Язык и платформа

Основы Java. Язык и платформа Машнное обучение. Практический пример. Подготовка данных. Применение алгоритмов ML

Машнное обучение. Практический пример. Подготовка данных. Применение алгоритмов ML Презентация из опыта работы Компьютерные игры для детей дошкольного возраста

Презентация из опыта работы Компьютерные игры для детей дошкольного возраста Устройства ввода и вывода информации

Устройства ввода и вывода информации Контент. Контент-план

Контент. Контент-план Моделирование сетей в ГИС. Примеры поиска оптимальных маршрутов

Моделирование сетей в ГИС. Примеры поиска оптимальных маршрутов Интернет желілері

Интернет желілері Основы поисковой оптимизации (теория и практика)

Основы поисковой оптимизации (теория и практика) История журналистики

История журналистики Introduction to database management systems

Introduction to database management systems Pascal.Тип данных - записи.

Pascal.Тип данных - записи.