Содержание

- 2. About Coach Founded in 1941 in New York Distributes products primarily through company stores in North

- 3. Can Coach Continue to Grow? Highly successful growth 2000-2011 Sales +11% CAGR Net income increased 55x

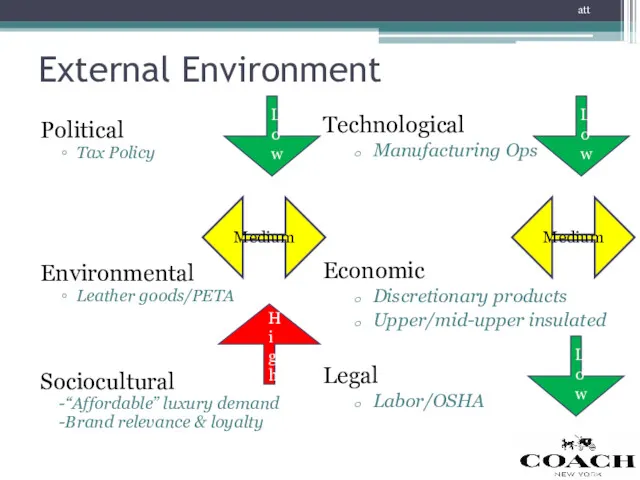

- 4. External Environment Political Tax Policy Environmental Leather goods/PETA Sociocultural -“Affordable” luxury demand -Brand relevance & loyalty

- 5. “Affordable” Luxury Driving Forces Design & brand reputation Lead fashion/style trends Brand loyalty, exclusivity Quality Sturdy,

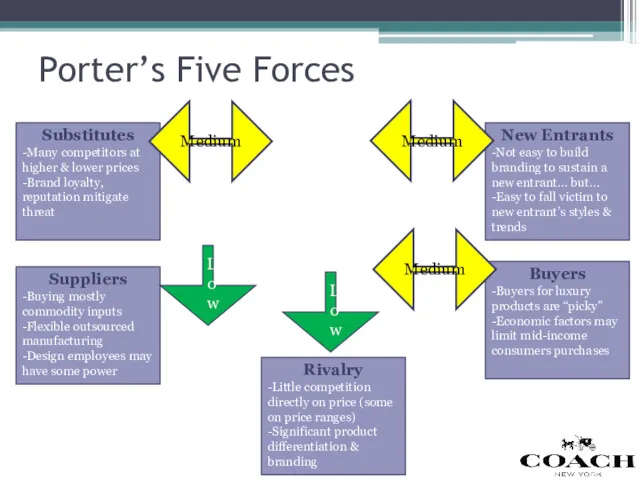

- 6. Porter’s Five Forces Substitutes -Many competitors at higher & lower prices -Brand loyalty, reputation mitigate threat

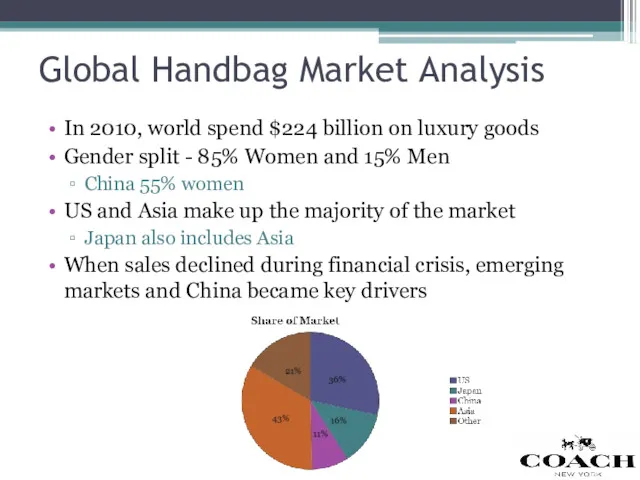

- 7. Global Handbag Market Analysis In 2010, world spend $224 billion on luxury goods Gender split -

- 8. Key Competitors Competitors around the globe Sales dependent on diffusion lines Coach seen as high end

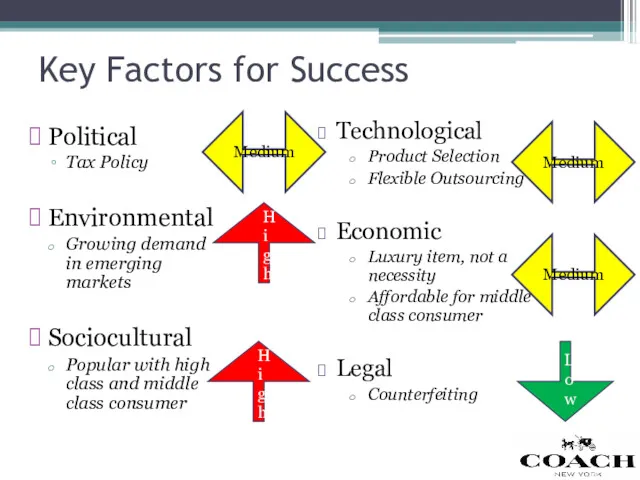

- 9. Key Factors for Success Political Tax Policy Environmental Growing demand in emerging markets Sociocultural Popular with

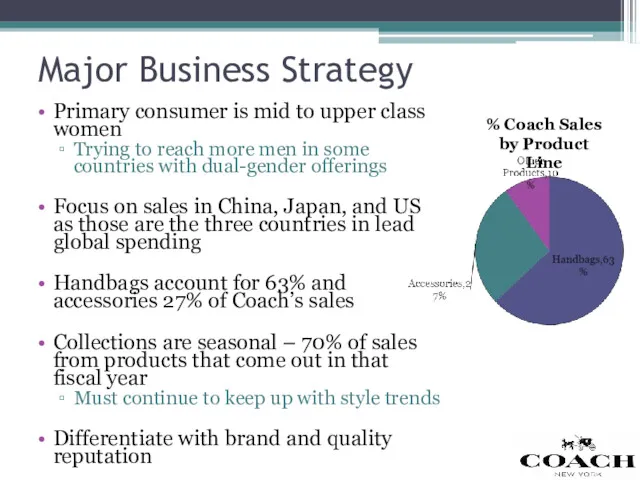

- 10. Major Business Strategy Primary consumer is mid to upper class women Trying to reach more men

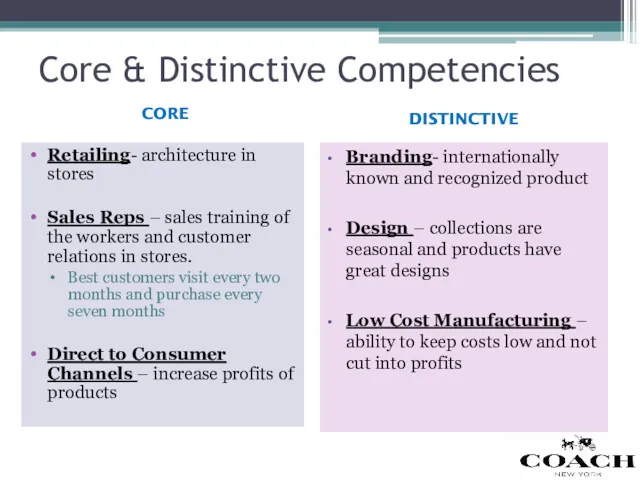

- 11. Core & Distinctive Competencies Retailing- architecture in stores Sales Reps – sales training of the workers

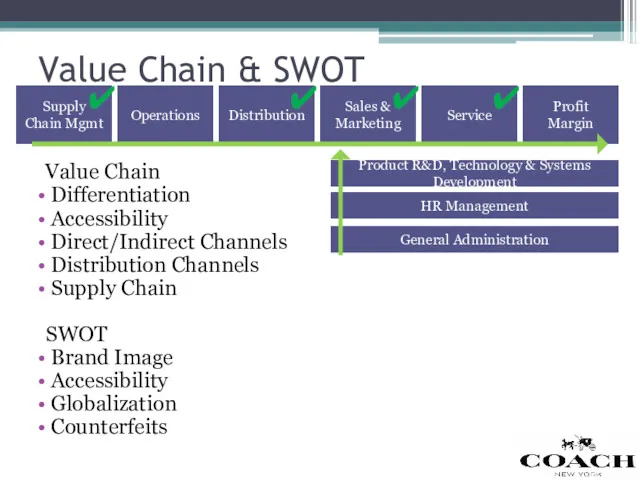

- 12. Value Chain & SWOT Value Chain Differentiation Accessibility Direct/Indirect Channels Distribution Channels Supply Chain SWOT Brand

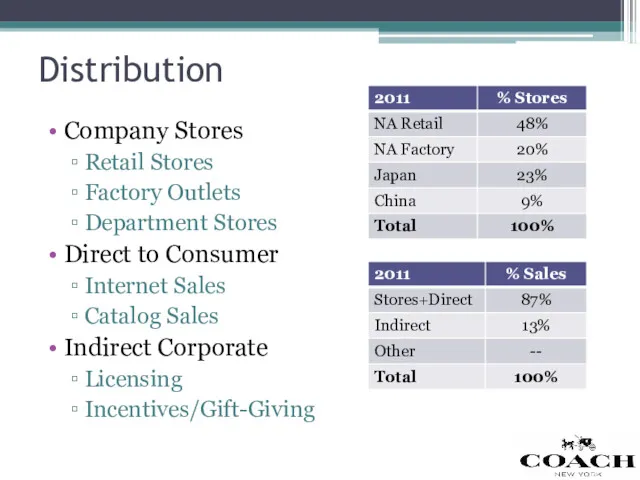

- 13. Distribution Company Stores Retail Stores Factory Outlets Department Stores Direct to Consumer Internet Sales Catalog Sales

- 14. International Presence Coach seeks to become a Global Lifestyle brand Growth initiatives Store expansion in US,

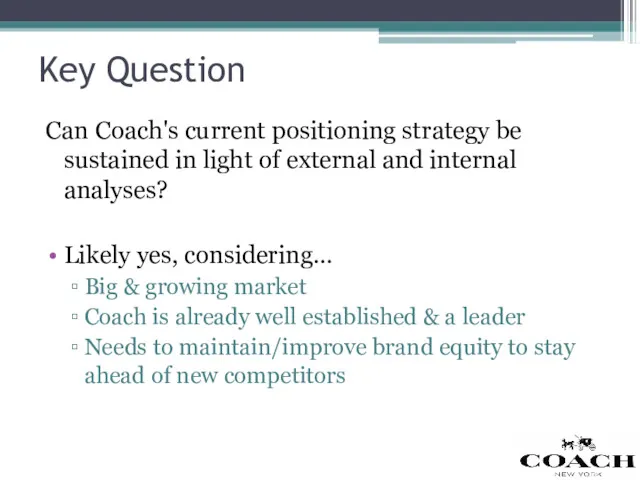

- 15. Key Question Can Coach's current positioning strategy be sustained in light of external and internal analyses?

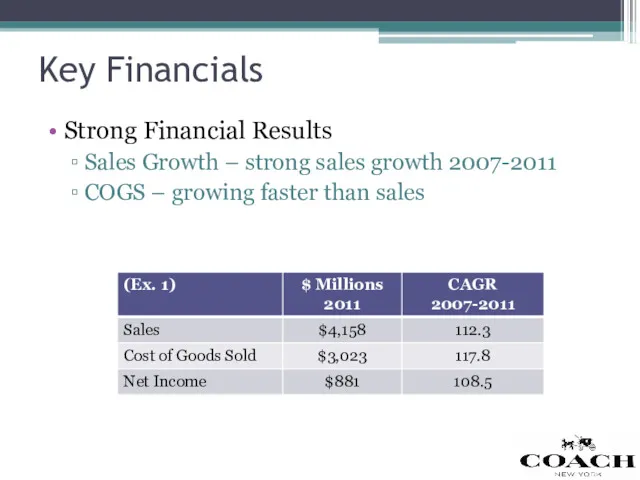

- 16. Key Financials Strong Financial Results Sales Growth – strong sales growth 2007-2011 COGS – growing faster

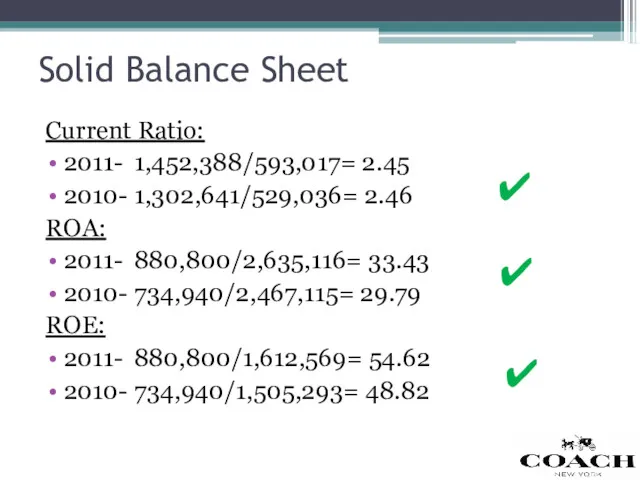

- 17. Solid Balance Sheet Current Ratio: 2011- 1,452,388/593,017= 2.45 2010- 1,302,641/529,036= 2.46 ROA: 2011- 880,800/2,635,116= 33.43 2010-

- 18. Share Price Trends 2009-2011 In 2009, Coach acquired Image X group Provided greater control over the

- 19. Causes of SG&A Expense Increases SG&A up $700 milion from 2007-2011 Wholesale distribution in international markets

- 20. Differentiation Recommendation Maintain a Broad Differentiation Strategy Provide both tangible and intangible features in products Continue

- 21. Marketing Recommendation (Broad Differentiation - Marketing Emphasis) Invest in non-traditional marketing – such as publicity &

- 22. Constant Innovation Recommendation (Broad Differentiation – Product Emphasis) Stress Constant Innovation Consider carefully expand non-handbag leather

- 23. Blue Ocean Recommendation Blue Ocean Strategy Offer a fully customizable line of products Gives customer opportunity

- 24. Sub-brand Recommendation Consider launching an up-market sub-brand at higher prices to compete against traditional players now

- 25. International Recommendations Accelerate growth in Asia Focus on growing male segment Male specific stores 25% market

- 27. Скачать презентацию

Испания, остров Майорка

Испания, остров Майорка ПРЕЗЕНТАЦИЯ дистрибьюторской компании ИП ПЕТИН К. П

ПРЕЗЕНТАЦИЯ дистрибьюторской компании ИП ПЕТИН К. П History of Asven Kahveciniz Food products LTD

History of Asven Kahveciniz Food products LTD Online shopping behavior of customers

Online shopping behavior of customers Спілкування менеджера з клієнтом

Спілкування менеджера з клієнтом SMM стратегия (название бренда/продукта)

SMM стратегия (название бренда/продукта) Анализ рынка

Анализ рынка Коммуникационная политика. Реклама в системе маркетинговых коммуникаций

Коммуникационная политика. Реклама в системе маркетинговых коммуникаций Типология гостей

Типология гостей Сдача помещений в аренду

Сдача помещений в аренду Системный курс-практикум Маркетинг PRO. Модуль 15. Реклама и медиапланирование

Системный курс-практикум Маркетинг PRO. Модуль 15. Реклама и медиапланирование Key elements of brand Amazon Kindle

Key elements of brand Amazon Kindle Орифлейм компаниясының мүмкіндіктері

Орифлейм компаниясының мүмкіндіктері Управление инновационным проектом

Управление инновационным проектом Методы управления инновациями

Методы управления инновациями Дорожные сервисы

Дорожные сервисы ТОВ Ромни-Кондитер

ТОВ Ромни-Кондитер 97% природная алоэ-забота о коже и волосах. Компания ВИТЭКС

97% природная алоэ-забота о коже и волосах. Компания ВИТЭКС Моя микрозелень. Вертикальные фермы

Моя микрозелень. Вертикальные фермы Эффективная презентация компании и ее предложений. Занятие 3

Эффективная презентация компании и ее предложений. Занятие 3 5 постулатов посадочной страницы

5 постулатов посадочной страницы Создание и продвижение бренда (на примере кондитерской фабрики Россия филиал, в г. Самара ООО Нестле Россия)

Создание и продвижение бренда (на примере кондитерской фабрики Россия филиал, в г. Самара ООО Нестле Россия) Маркетинговая деятельность как условие конкурентоспособности оптовой организации на рынке лекарственных препаратов

Маркетинговая деятельность как условие конкурентоспособности оптовой организации на рынке лекарственных препаратов Dspm. Фундаментальные основы продаж

Dspm. Фундаментальные основы продаж Создание туристского продукта. Маркетинг сельских территорий

Создание туристского продукта. Маркетинг сельских территорий Маркетинг в образовательной организации: актуальные проблемы реализации в современных условиях модернизации образования

Маркетинг в образовательной организации: актуальные проблемы реализации в современных условиях модернизации образования Холудексан

Холудексан AZIMUT Hotel Sochi – Ваш незабываемый отдых в Сочи

AZIMUT Hotel Sochi – Ваш незабываемый отдых в Сочи