Содержание

- 2. Chapter Topics Benefits of and requirements for segmenting the business market Potential bases for segmenting the

- 3. Knowing the Customer is Not Enough! Once we know the customer, we need to understand what

- 4. Selecting well-defined groups of potentially profitable customers High-Growth Companies Succeed By: Focusing marketing resources on acquiring,

- 5. Business Sector The business market consists of 3 broad sectors: Commercial Enterprises Institutions Government Each sector

- 6. Keys to Success The marketer who… Recognizes various profitable segments Develops competitive products or services Develops

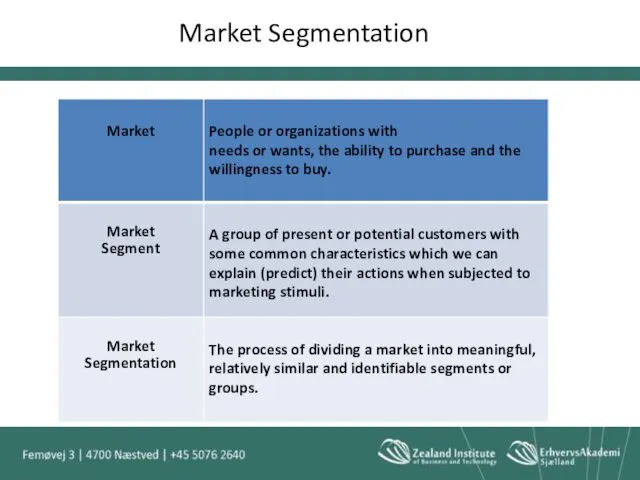

- 7. What Is A Market? A market is… (1) People or organizations who (2) need & want

- 8. Market Segmentation

- 9. Business Market Often in the business market, segments that appear strong (that is, they produce a

- 10. What key criteria best define a unique market segment? Measurability Accessibility Substantiality Responsiveness

- 11. 1. Measurability The degree to which information on particular buyer characteristics exists or can be obtained.

- 12. 2. Accessibility The degree to which the firm can effectively focus its marketing efforts on chosen

- 13. 3. Substantiality The degree to which the segments are large or profitable enough to be worth

- 14. 4. Responsiveness The degree to which segments respond differently to different marketing mix elements such as

- 15. Art of Segmentation Segmentation involves identifying groups of customers or business groups that are… Large enough

- 16. Marketer’s Dilemma Marketing strategists spend too much attention on “What is..” vs. “What could be…” By

- 17. Undershot customers - Existing solutions fail to meet their needs, resulting in: a purchase of new

- 18. Often, marketers focus too much on Undershot and not enough on Overshot or Non-Consuming customers. Consequently,

- 19. Selective Segmentation Benefits Attunes marketer to unique needs of customer segments Focuses product development efforts, develops

- 20. Consumer vs. Business Profiling Consumer-goods marketers are interested in meaningful profiles of individuals concerning: Demographics Lifestyle

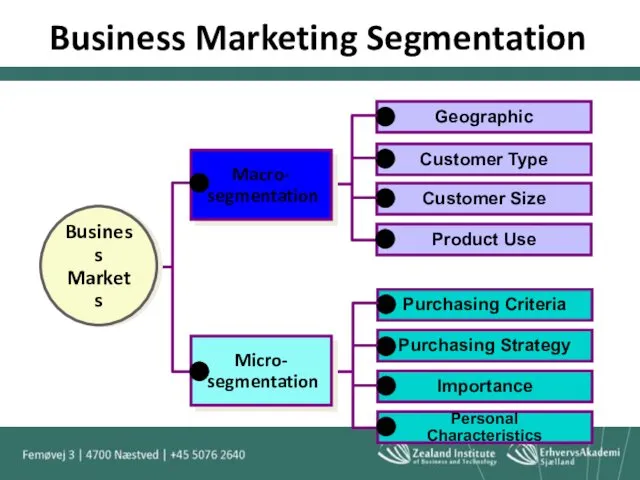

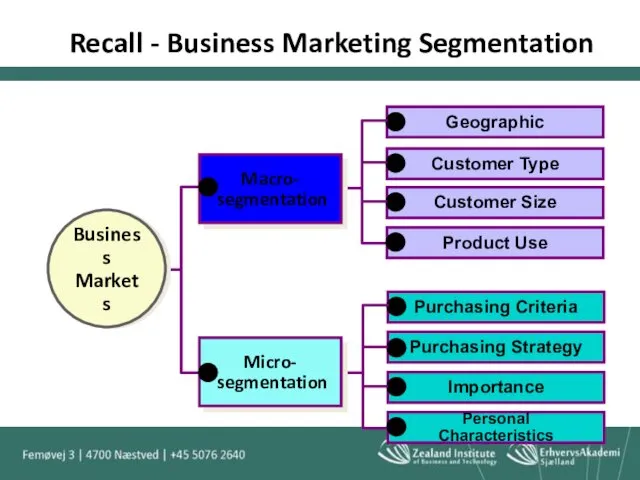

- 21. Business Marketing Segmentation

- 22. Macro-Level Bases To find viable macro-segments, it is useful to partition buying organizations into smaller groups

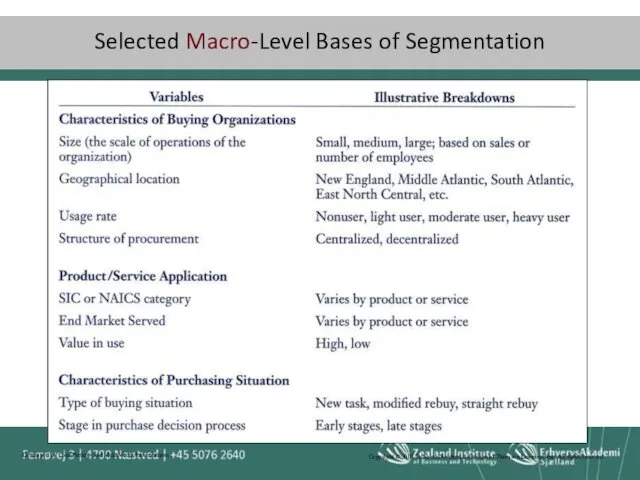

- 23. Copyright © 2007 by South-Western, a division of Thomson Learning, Inc. All rights reserved. Developed by

- 24. Product/Service Applications: Because a specific industrial good can be used in different applications, the market can

- 25. Classifying Commercial Enterprises NAICS organizes business activity into economic sectors and identifies groups of business firms

- 26. Segmentation: Value in Use Value in use is a product’s economic value to the user relative

- 27. Purchasing Situation Segmentation of purchasing situation has an enormous affect on marketing strategy. New task buy

- 28. Characteristics of Buying Organization The structure of the procurement function offers challenges and opportunities to marketers.

- 29. Centralized Purchasing Forces specialization upon buyers and they usually meet the challenge Allows for better coordination

- 30. Decentralized Purchasing Local autonomy helps support local businesses—makes buying organization a good neighbor and citizen to

- 31. Types of Buyers First-Time Prospects: customers who see a need but have not purchased Novices: First-time

- 32. Micro-Level Bases Once macro-segments are identified, the next step is to divide each macro-segment into smaller

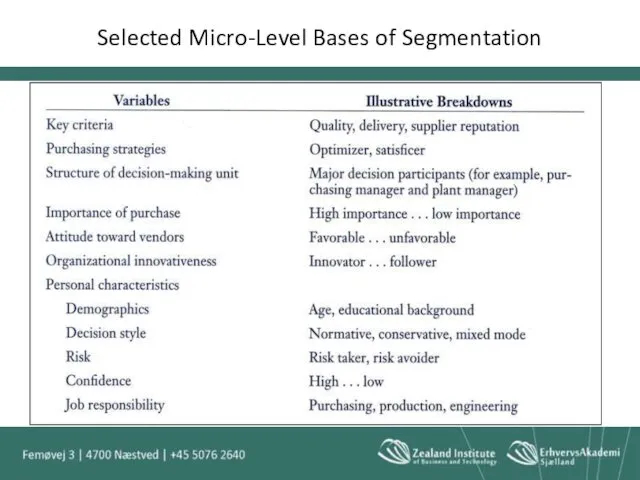

- 33. Recall - Business Marketing Segmentation

- 34. Selected Micro-Level Bases of Segmentation

- 35. Key Criteria Most business buyers value: Quality Delivery Service Supplier’s Reputation Price (all other things being

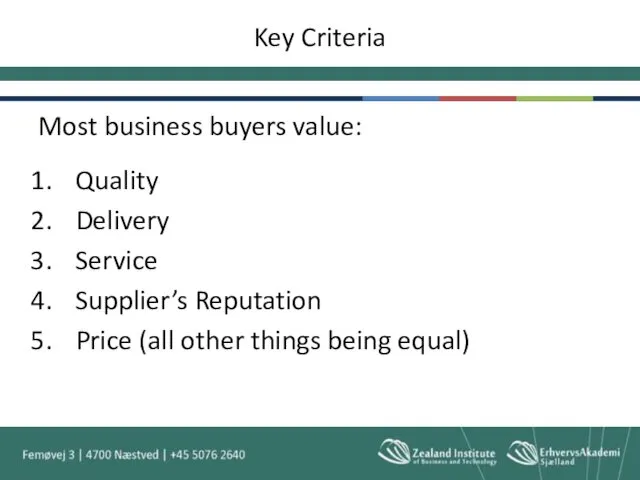

- 36. Price vs. Service Often there are tradeoffs between buyers with respect to Price vs. Service One

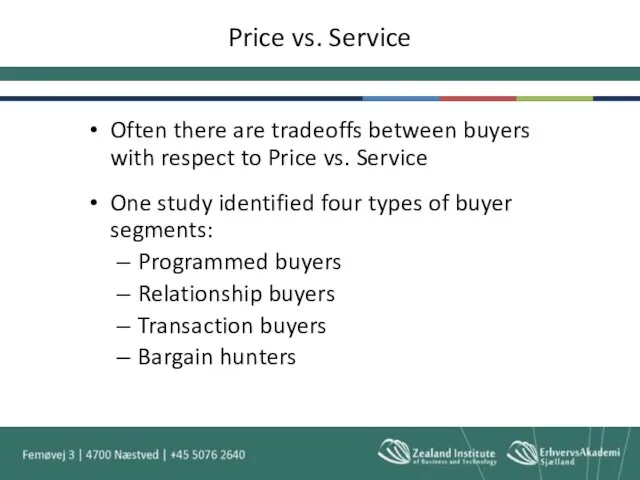

- 37. Types of Buyers Programmed Buyers - Neither price or service sensitive. They buy routine products according

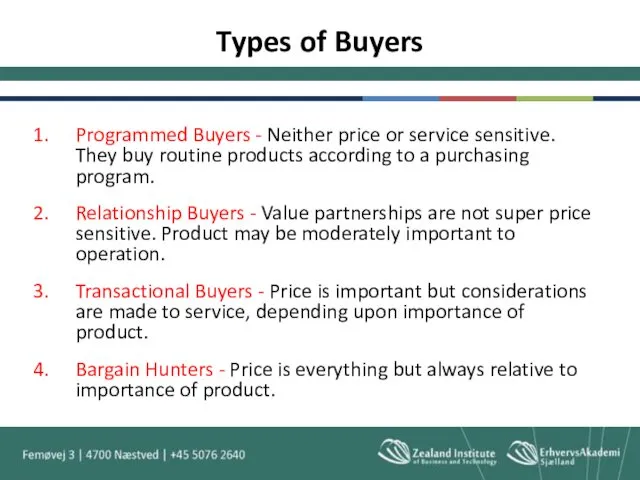

- 38. Value Based Strategies Many customers seek sellers who are able to offer innovative solutions to help

- 39. 1. Innovation-Focused Customers Committed to being the first in the market with new products and technologies

- 40. 2. Customers in Fast-Growing Markets Constantly under pressure from competitors in fast-growth markets Seek suppliers who

- 41. 3. Customers in Highly Competitive Markets Have mature products in highly competitive markets Look for suppliers

- 42. Purchasing Strategies Micro-segments can be classified according to their purchasing strategies: Some buyers have several suppliers

- 43. Structure of the Decision Making Unit Whoever makes the buying decisions often dictates how to market

- 44. Other Meaningful Micro-Segments Importance of purchase – Appropriate when product is applied in various ways by

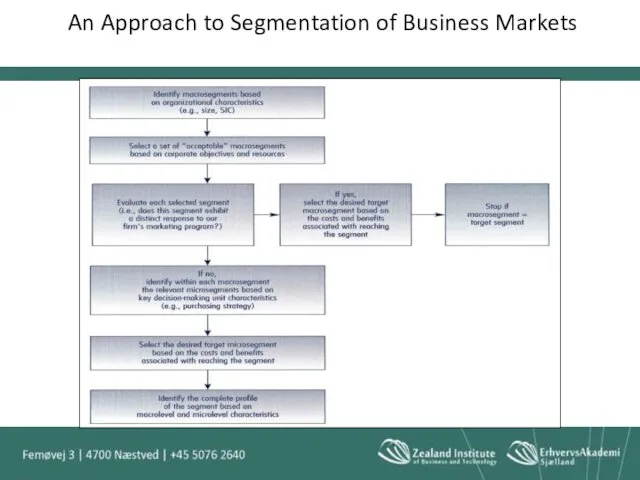

- 45. An Approach to Segmentation of Business Markets

- 46. Choosing Market Segments As you can see, there are numerous steps to choosing market segments. We

- 47. Segmentation Model Identify key characteristics (macro-segments) based on organizational characteristics (e.g.: size, NAICS) Consider the buying

- 48. Segmentation Model 3. Select set of acceptable macro-segments based on corporate objectives and resources. 4 Evaluate

- 49. Segmentation Model If a particular macro-segment is not the right market, then do a micro-segment analysis

- 50. Utilizing Segmentation Management can utilize segmentation in different ways. Companies can categorize their present business customers

- 51. Account-Based-Marketing (ABM) ABM is an approach that treats an individual account as a market. Done right,

- 52. A well-developed segmentation plan will fail unless the following issues are addressed: How should the sales

- 53. Segmentation Summary Managing the implementation of segmentation is a difficult task at best. It means the

- 54. Estimating Demand Estimating demand within selected markets is vital to marketing management! Forecasting demand represents probable

- 55. Relationship between Potential Demand and the Forecast

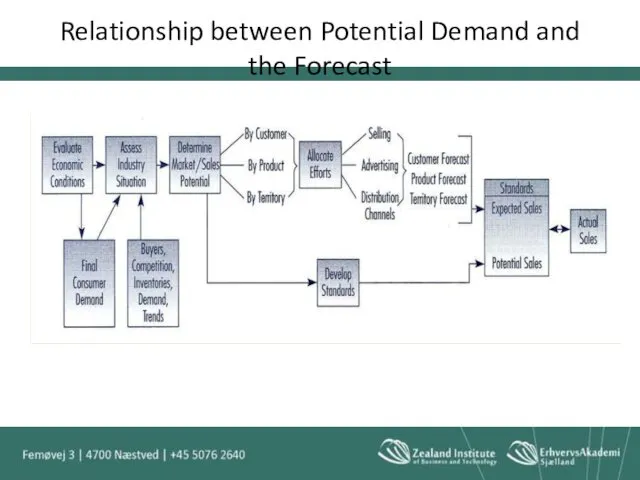

- 56. Before anyone can formulate a business plan, they need to formulate a marketing plan. Before they

- 57. Affected Stakeholders Demand analysis (or lack thereof) affects three broad stakeholder groups: Engineering Design and Implementation

- 58. Where are the customers? Where should sales outlets be located? How many are outlets are required

- 59. Application of Demand The application of demand rests in the planning and control of marketing strategy

- 60. Estimates of Probable Demand Estimates of probable demand should only be made after a firm has

- 61. Supply Chain Links Sales forecasts are critical to a smooth operation throughout the supply chain. Timely

- 62. Sales Forecast Data Sales Forecast Data is used to: Distribute inventory within the supply chain Manage

- 63. Methods of Forecasting Demand Qualitative Executive Judgment Sales Force Composite Delphi Method Quantitative Time Series Regression

- 64. Qualitative Method: Executive Judgment Executive Judgment: This method is very popular because it is: Easy to

- 65. Executive Judgment: Benefits Executive judgments are often used in conjunction with quantitative approaches to forecasting Tend

- 66. Executive Judgment: Limitations Does not offer systematic analysis of cause & effect relationships No formula for

- 67. Qualitative Method: Sales Force Composite Rationale is that the sales force knows their customers, markets and

- 68. Sales Force Composite: Benefits More successful if the dyadic (buyer/seller) relationship is close Inexpensive Facilitates salespeople

- 69. Sales Force Composite: Limitations Limitations are similar to the executive judgment approach Not a systematic analysis

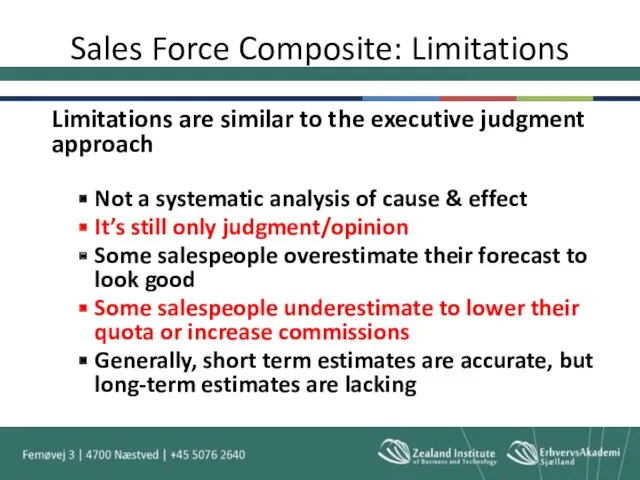

- 70. Qualitative Method: Delphi Method It starts with a moderator (analyst) who attains a forecast opinion from

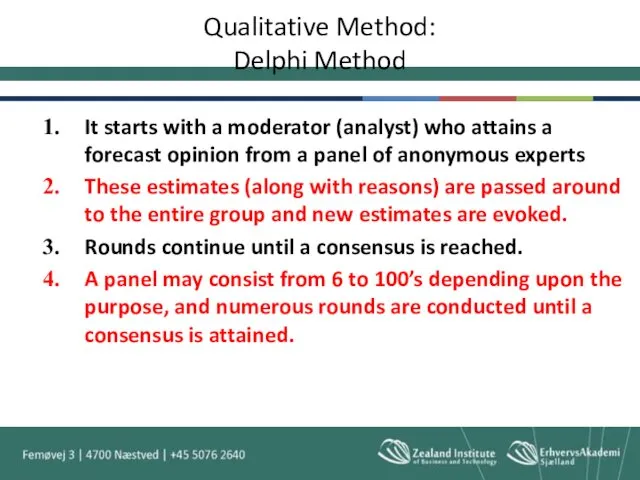

- 71. Delphi Method It is generally applied to long term forecasting of demand. It’s good for new

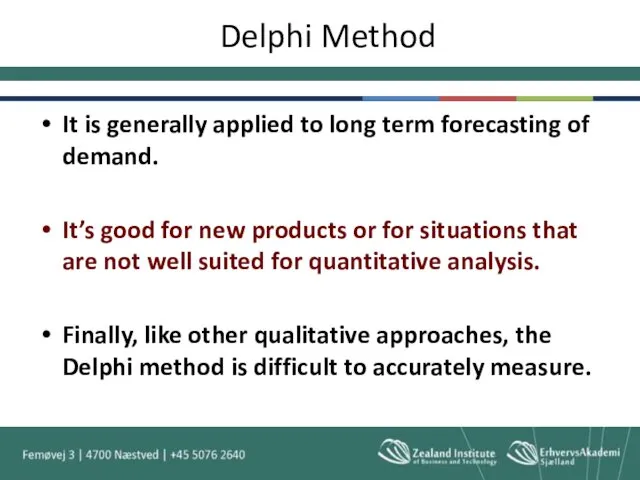

- 72. Typically, qualitative estimates are merged with quantitative ones. Summary of Qualitative Forecasting Techniques Copyright © 2007

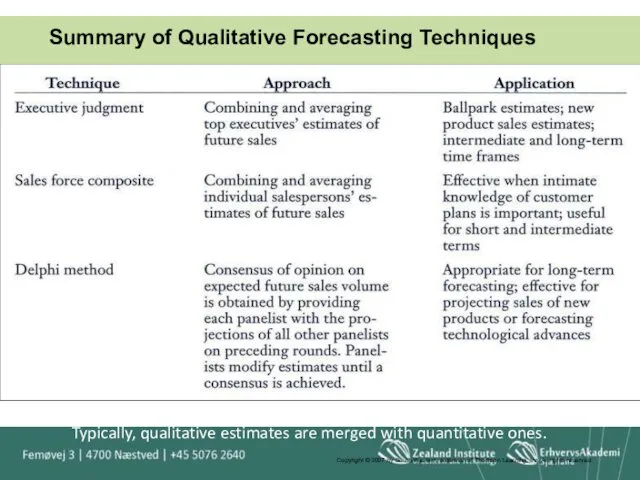

- 73. Quantitative Methods: Time Series Time Series uses historical data Rationale is that the past patterns will

- 74. Uses factors that are identified as affecting past sales Y = a + bX Linear Regression

- 75. Regression Analysis Much historical data is needed Some will come from accounting data Other data can

- 76. Regression Analysis: Limitations Although regression analysis is fairly accurate, there are some limitations, thus the need

- 77. Research suggests that strategists should choose a forecast method that is based on the market’s “underlying

- 78. Using CPFR to Estimate Demand CPFR: Collaborative Planning Forecasting & Replenishment involves deriving and sharing information

- 79. Result of CPFR Result: Often, the forecast of demand is very accurate! Partners can map this

- 81. Скачать презентацию

Project: Global Social Media Plan // September Topic: Tiguan Easy Open Subline: Featuring the Hands-Free Easy Open Trunk system

Project: Global Social Media Plan // September Topic: Tiguan Easy Open Subline: Featuring the Hands-Free Easy Open Trunk system CRM-система в CRM-маркетинге

CRM-система в CRM-маркетинге Яндекс. Директ за 27 минут. Быстро, дешево, эффективно

Яндекс. Директ за 27 минут. Быстро, дешево, эффективно Позиционирование товара на рынке

Позиционирование товара на рынке Маркетинговый план. Шаблон

Маркетинговый план. Шаблон Работа с возражениями

Работа с возражениями Абсент. Конно-спортивный развлекательный клуб

Абсент. Конно-спортивный развлекательный клуб Galilee Export. Fresh agricultural products from Israel’s

Galilee Export. Fresh agricultural products from Israel’s Политический маркетинг

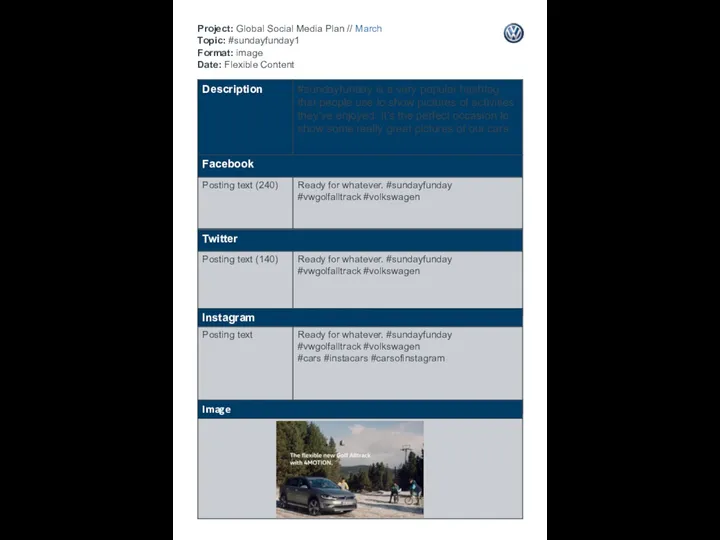

Политический маркетинг Project: Global Social Media Plan // March Topic: #sundayfunday1 Format: image Date: Flexible Content

Project: Global Social Media Plan // March Topic: #sundayfunday1 Format: image Date: Flexible Content Управление продвижением

Управление продвижением Пергамент для выпечки, ТМ Мелочи Жизни

Пергамент для выпечки, ТМ Мелочи Жизни Let us do your

Let us do your Реализация стартаппроекта. Основы ораторского мастерства (Питчинга)

Реализация стартаппроекта. Основы ораторского мастерства (Питчинга) Трансляція формотворчих методів кубізму в рекламі сучасних брендів

Трансляція формотворчих методів кубізму в рекламі сучасних брендів Строительная компания ПаритетСтрой

Строительная компания ПаритетСтрой MercuryMedia. Лучшее PR-агентство

MercuryMedia. Лучшее PR-агентство Батончики Нэчурал Баланс

Батончики Нэчурал Баланс Спецпроект Леди Весна

Спецпроект Леди Весна Выставочные стенды

Выставочные стенды Реклама - це засіб змусити людей мати потребу в тому, про що вони раніше не чули

Реклама - це засіб змусити людей мати потребу в тому, про що вони раніше не чули Eurokraski. Направления, самые ходовые схемы окраски, объекты

Eurokraski. Направления, самые ходовые схемы окраски, объекты ВКР: Стимулирование продажи товаров на розничных предприятиях торговли

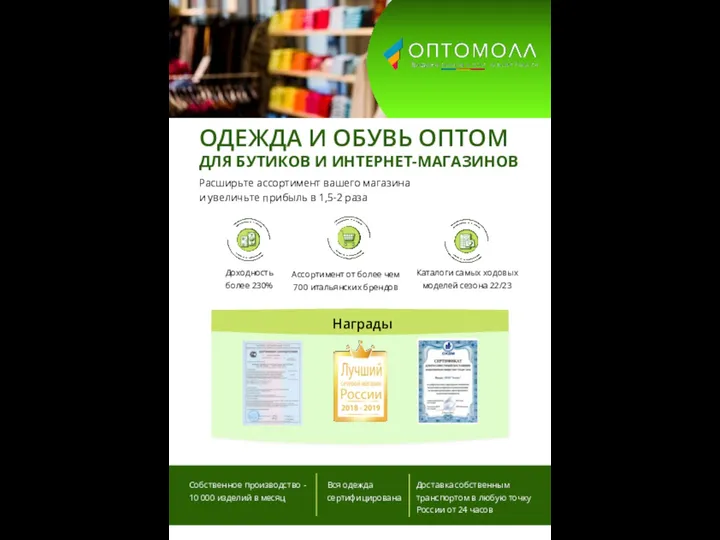

ВКР: Стимулирование продажи товаров на розничных предприятиях торговли Одежда и обувь оптом для бутиков и интернет - магазинов

Одежда и обувь оптом для бутиков и интернет - магазинов Жизненный цикл товара

Жизненный цикл товара Почему у тебя 100% получится заработать со мной

Почему у тебя 100% получится заработать со мной Маркетплейс локального туризма и активностей

Маркетплейс локального туризма и активностей ТЗ на двери и шторки. Корректировки

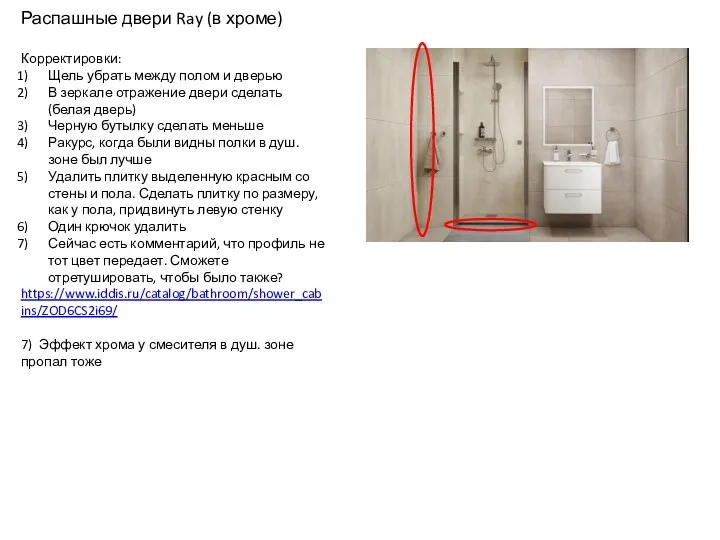

ТЗ на двери и шторки. Корректировки