Содержание

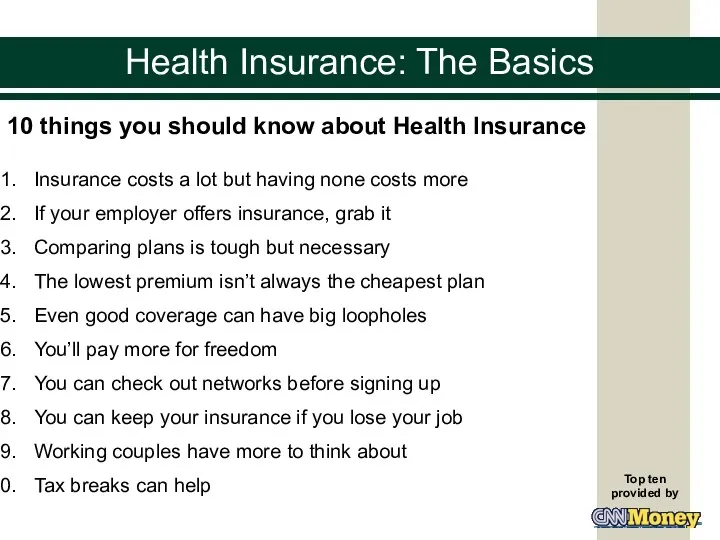

- 2. Health Insurance: The Basics 10 things you should know about Health Insurance Insurance costs a lot

- 3. Health Insurance: The Basics At some point in your life you will probably need expensive medical

- 4. Health Insurance: The Basics It is important that you understand health insurance in order to protect

- 5. Health Insurance: The Basics Law of Large Numbers Health insurance companies, as with other types of

- 6. Health Insurance: The Basics Two Basic Plans: Group Plans and Individual Plans Group Plans A group

- 7. Health Insurance: The Basics Group Plans (continued) Advantages: Generally less expensive Everyone who belongs to the

- 8. Health Insurance: The Basics Individual Plans People who are self-employed, or whose company does not offer

- 9. Matching a Health Plan to your Needs Group Plans Does your employer or group offer a

- 10. Group Plans Evaluate your medical needs List the people in your household and what their medical

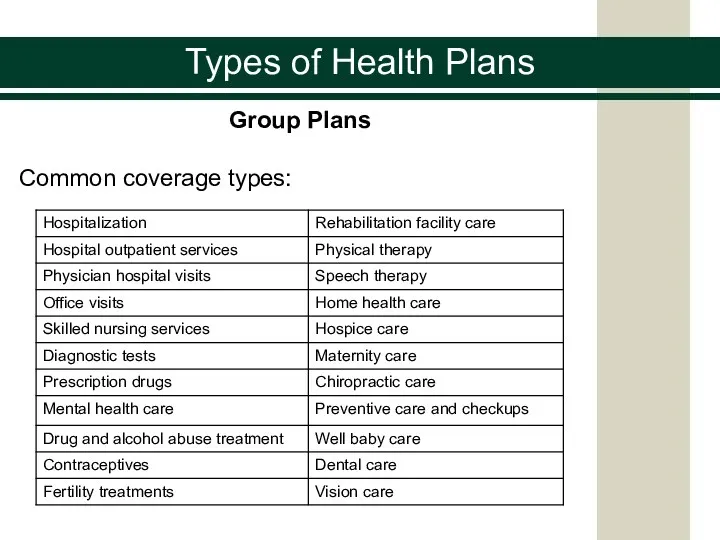

- 11. Types of Health Plans Group Plans Common coverage types:

- 12. Individual Plans You can customize your plan to match your personal needs Your state department of

- 13. Individual Plans Underwriting Factors: Age Health Occupation Habits Lifestyle The higher the risk factors that an

- 14. Health Insurance: The Basics The Bottom Line Young people who are relatively healthy often do not

- 15. Healthcare Problems in the United States The United States provides the highest quality health care in

- 16. Healthcare Problems in the United States Rising Healthcare Costs Factors accounting for the increase Rising hospital

- 17. Healthcare Problems in the United States Rising Healthcare Costs Factors accounting for the increase (continued) Cost

- 18. Healthcare Problems in the United States Large Number of Uninsured Persons An estimated 15 percent of

- 20. Скачать презентацию

АФО нервной системы и органов чувств ребенка. НПР детей раннего детского возраста

АФО нервной системы и органов чувств ребенка. НПР детей раннего детского возраста Развитие медицины в Древнем Египте

Развитие медицины в Древнем Египте Pelvic аnatomy

Pelvic аnatomy Лимфомы. Лимфогранулематоз

Лимфомы. Лимфогранулематоз Нарушение сна и бодрствования

Нарушение сна и бодрствования Профилактика туберкулеза. Диспансерное наблюдение, группы учета. Вакцинация БЦЖ и ее осложнения

Профилактика туберкулеза. Диспансерное наблюдение, группы учета. Вакцинация БЦЖ и ее осложнения Гиперкинезы. Некоторые виды гиперкинезов

Гиперкинезы. Некоторые виды гиперкинезов История развития сестринского дела

История развития сестринского дела Микроорганизмы, возбудители антропозоонозных инфекций

Микроорганизмы, возбудители антропозоонозных инфекций Понятия о ВИЧ-инфекции и СПИДе

Понятия о ВИЧ-инфекции и СПИДе Анемиялар

Анемиялар Паращитовидные железы

Паращитовидные железы Акупунктура. Акупунктураны медицинада қолдану. Биологиялық активті үктелер

Акупунктура. Акупунктураны медицинада қолдану. Биологиялық активті үктелер Желтушный синдром. Вирусный и токсический гепатит

Желтушный синдром. Вирусный и токсический гепатит Кариес и его профилактика

Кариес и его профилактика Клиника дифференцированных олигофрении

Клиника дифференцированных олигофрении ҚР 2016-2020 ж.арналған Денсаулық мемлекеттік бағдарламасы

ҚР 2016-2020 ж.арналған Денсаулық мемлекеттік бағдарламасы Ранняя помощь детям с ОВЗ

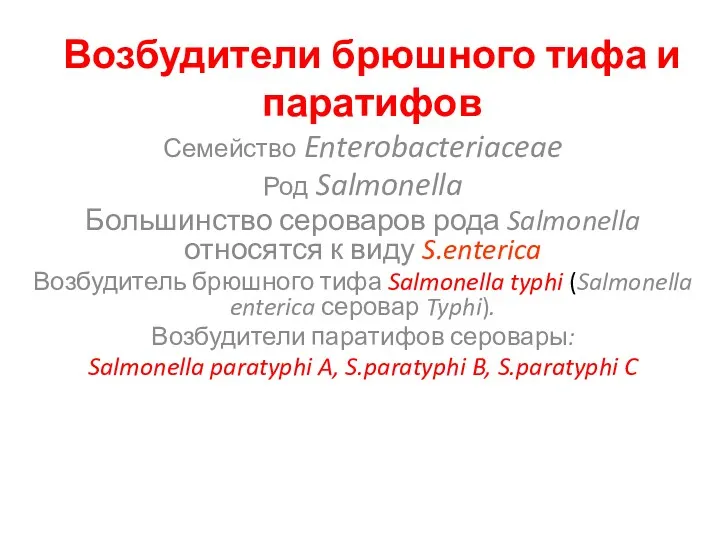

Ранняя помощь детям с ОВЗ Возбудители брюшного тифа и паратифов

Возбудители брюшного тифа и паратифов Патология слюнных желез

Патология слюнных желез Реабилитация пациентов при инфекционных и паразитарных заболеваниях

Реабилитация пациентов при инфекционных и паразитарных заболеваниях Трихофития

Трихофития Профессия Ветеринар

Профессия Ветеринар Угрожающее неотложное состояние у детей

Угрожающее неотложное состояние у детей Неходжкинские лимфомы у ВИЧ-инфицированных больных

Неходжкинские лимфомы у ВИЧ-инфицированных больных Ревматоидный артрит

Ревматоидный артрит Анемиялардың патоморфологиясы

Анемиялардың патоморфологиясы Определение арт-терапии

Определение арт-терапии