- Главная

- Менеджмент

- Internal control and deontology - Chapter 9 External audit

Содержание

- 2. 1. Types of audits Financial audit (external audit) Of interest to a wider group: Not only

- 3. Link between internal and external control ? the better the ICS, the more assurance there is

- 4. 2. What is an external audit? Legally obliged for large companies – an external auditor has

- 5. 2. What is an external audit? The (registered) accountant has to perform control activities to gather

- 6. 2.1 Standards regarding the execution of the audit assignment The auditor should perform all necessary control

- 7. 2.1 Standards regarding the execution of the audit assignment All evidence found should be kept in

- 8. 2.2. Standards regarding the audit opinion/report 4 types of audit opinions possible: Unqualified Opinion (clean opinion):

- 9. 2.2. Standards regarding the audit opinion/report Qualified Opinion: In situations when a company’s financial records have

- 11. Скачать презентацию

Слайд 2

1. Types of audits

Financial audit (external audit)

Of interest to a wider

1. Types of audits

Financial audit (external audit)

Of interest to a wider

group:

Not only the individual company/organisation

Also of interest to employees, customers, suppliers, banks, creditors, government, etc.

Assessing the level of internal control is a step in the external audit process

Operational audit

Assessing the efficiency and effectiveness of processes, working methods, departments, ….

Compliance audit

Are the rules (internal, external, legal, …) rules being followed?

Example: Valipac / Fost Plus / Bebat audit

Not only the individual company/organisation

Also of interest to employees, customers, suppliers, banks, creditors, government, etc.

Assessing the level of internal control is a step in the external audit process

Operational audit

Assessing the efficiency and effectiveness of processes, working methods, departments, ….

Compliance audit

Are the rules (internal, external, legal, …) rules being followed?

Example: Valipac / Fost Plus / Bebat audit

Internal control and deontology: Chapter 9

Слайд 3

Link between internal and external control

? the better the ICS, the

? the better the ICS, the

more assurance there is for the external auditor that the financial statements are correct

? the less the external auditor has to investigate/check/test…

Differences?

Independency

Knowledge

Working method

? the less the external auditor has to investigate/check/test…

Differences?

Independency

Knowledge

Working method

Internal control and deontology: Chapter 9

Слайд 4

2. What is an external audit?

Legally obliged for large companies –

2. What is an external audit?

Legally obliged for large companies –

an external auditor has to check whether the FS meet the conditions below and thus can be approved by the auditor:

Reasonable

existance

Completeness

Ownership

valuation

Classification

Timeliness

correctness (mathematicaly)

disclosure

Reasonable

existance

Completeness

Ownership

valuation

Classification

Timeliness

correctness (mathematicaly)

disclosure

Internal control and deontology: Chapter 9

Слайд 5

2. What is an external audit?

The (registered) accountant has to perform

2. What is an external audit?

The (registered) accountant has to perform

control activities to gather evidence for his statement. Herefore he has to follow the GAAS (Generally Accepted Auditing Standards).

The standards indicate the procedure(s) that have to be followed by the auditor to be able to deliver a high quality audit statement.

Standards on the quality and objectiveness of the auditor (see also chapter 10)

Standards regarding the execution of the audit assignment

Standards regarding the audit opinion

The standards indicate the procedure(s) that have to be followed by the auditor to be able to deliver a high quality audit statement.

Standards on the quality and objectiveness of the auditor (see also chapter 10)

Standards regarding the execution of the audit assignment

Standards regarding the audit opinion

Internal control and deontology: Chapter 9

Слайд 6

2.1 Standards regarding the execution of the audit assignment

The auditor should

The auditor should

perform all necessary control activities to obtain reasonable assurance regarding the absence of material errors/misrepresentations in the financial statements.

Control activities can be: observation, recalculation, reconciliation of documents/postings, external confirmations, etc…

The auditor should make an audit program before starting the audit assignment. The audit program lists the control activities to be performed, the timeframes that will be used and the auditor(s) responsible for the control activity.

Control activities can be: observation, recalculation, reconciliation of documents/postings, external confirmations, etc…

The auditor should make an audit program before starting the audit assignment. The audit program lists the control activities to be performed, the timeframes that will be used and the auditor(s) responsible for the control activity.

Internal control and deontology: Chapter 9

Слайд 7

2.1 Standards regarding the execution of the audit assignment

All evidence found

All evidence found

should be kept in the so called working papers. The working papers consist of 2 parts:

Permanent file: containing all the information on the company that does not change frequently (charter/rules of the company, procedures, contact data, organization charts, large contracts, …)

Actual working papers: containing all data regarding one FS (of one particular year) – data is organized based on the balance sheet and P&L

Permanent file: containing all the information on the company that does not change frequently (charter/rules of the company, procedures, contact data, organization charts, large contracts, …)

Actual working papers: containing all data regarding one FS (of one particular year) – data is organized based on the balance sheet and P&L

Internal control and deontology: Chapter 9

Слайд 8

2.2. Standards regarding the audit opinion/report

4 types of audit opinions possible:

Unqualified

4 types of audit opinions possible:

Unqualified

Opinion (clean opinion):

The auditor determines that each of the financial records provided by the company is free of any misrepresentations.

In addition, an unqualified opinion indicates that the financial records have been maintained in accordance with the standards known as Generally Accepted Accounting Principles (GAAP). This is the best type of report a business can receive.

Typically, an unqualified report consists of a title that includes the word “independent.” This is done to illustrate that it was prepared by an unbiased third party. The title is followed by the main body. Made up of three paragraphs, the main body highlights the responsibilities of the auditor, the purpose of the audit and the auditor’s findings. The auditor signs and dates the document, including his address.

The auditor determines that each of the financial records provided by the company is free of any misrepresentations.

In addition, an unqualified opinion indicates that the financial records have been maintained in accordance with the standards known as Generally Accepted Accounting Principles (GAAP). This is the best type of report a business can receive.

Typically, an unqualified report consists of a title that includes the word “independent.” This is done to illustrate that it was prepared by an unbiased third party. The title is followed by the main body. Made up of three paragraphs, the main body highlights the responsibilities of the auditor, the purpose of the audit and the auditor’s findings. The auditor signs and dates the document, including his address.

Internal control and deontology: Chapter 9

Слайд 9

2.2. Standards regarding the audit opinion/report

Qualified Opinion:

In situations when a company’s

Qualified Opinion:

In situations when a company’s

financial records have not been maintained in accordance with GAAP but no misrepresentations are identified, an auditor will issue a qualified opinion. The writing of a qualified opinion is extremely similar to that of an unqualified opinion. A qualified opinion, however, will include an additional paragraph that highlights the reason why the audit report is not unqualified.

Internal control and deontology: Chapter 9

- Предыдущая

Число і цифра 1. Написання цифри 1Следующая -

BEC Poland General introduction

Основные виды централизованных структур управления. Достоинства и недостатки

Основные виды централизованных структур управления. Достоинства и недостатки Методы страт планирования

Методы страт планирования Планирование проектов

Планирование проектов Менеджер проекта: координатор, лидер или начальник

Менеджер проекта: координатор, лидер или начальник Контроль и принятие управленческих решений в системе стратегического контроллинга

Контроль и принятие управленческих решений в системе стратегического контроллинга Управление развитием организации

Управление развитием организации Ростелеком - крупнейший в России интегрированный провайдер цифровых услуг

Ростелеком - крупнейший в России интегрированный провайдер цифровых услуг Процессы поддержки и предоставления ИТ-сервисов. (Лекция 3)

Процессы поддержки и предоставления ИТ-сервисов. (Лекция 3) Управление конфликтами в организации

Управление конфликтами в организации Методологические основы прогнозирования

Методологические основы прогнозирования Управление персоналом

Управление персоналом Opti-Corrugated, эффективное планирование и управление гофрокартонным производством ООО Опти-Софт

Opti-Corrugated, эффективное планирование и управление гофрокартонным производством ООО Опти-Софт Стандарты обслуживания КЦ

Стандарты обслуживания КЦ Логистика складирования. Определение места расположения распределительного склада на обслуживаемой территории

Логистика складирования. Определение места расположения распределительного склада на обслуживаемой территории Планирование и развитие деловой карьеры. Высвобождение работников

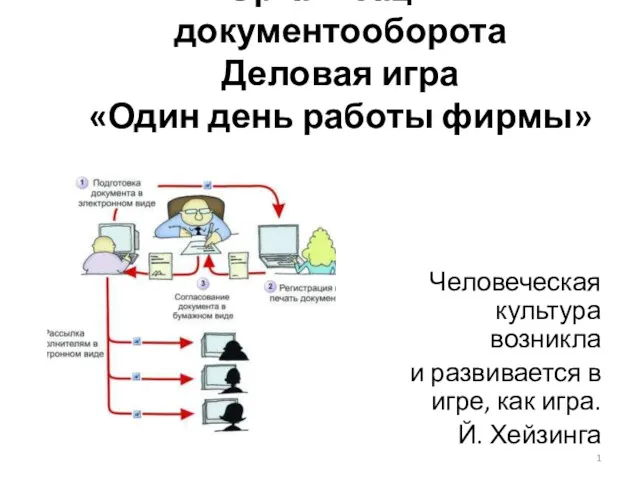

Планирование и развитие деловой карьеры. Высвобождение работников Организация документооборота. Деловая игра Один день работы фирмы

Организация документооборота. Деловая игра Один день работы фирмы Аудит персонала

Аудит персонала Стратегия мотивации персонала

Стратегия мотивации персонала Что такое организация. Ее цели и миссия

Что такое организация. Ее цели и миссия Функциональная модель структуры организации

Функциональная модель структуры организации Актуальные требования к персоналу гостиниц и иных средств размещений

Актуальные требования к персоналу гостиниц и иных средств размещений Регламентация и нормирование труда

Регламентация и нормирование труда Netflix culture. Freedom & responsibility

Netflix culture. Freedom & responsibility Повышение удовлетворенности потребителей гостиничных услуг

Повышение удовлетворенности потребителей гостиничных услуг Индустрия красоты

Индустрия красоты Мотивация труда, как элемент и функция управления персоналом

Мотивация труда, как элемент и функция управления персоналом Бережливое управление. Потери. Виды потерь

Бережливое управление. Потери. Виды потерь Самсунг. Антикризисное управление

Самсунг. Антикризисное управление