Содержание

- 2. Royal Dutch Shell Introduction History SWOT Analysis Competitor Analysis Strategic Alternatives Future Outlook Recommendations

- 3. Introduction Vision To engage efficiently, responsibly and profitably in in its products To participate in the

- 4. Oil and Gas Exploration and Development Product Diversity Petrochemicals Oil Products LNG (Liquefied Natural Gas) Renewable

- 5. Business Operations 140 locations with 108,000 employees Explores and produces in 39 countries Over 45,000 service

- 6. History Shell Transport and Trading Company London, UK in 1897 First Bulk Tanker, the “Murex” Royal

- 7. Early Twentieth Century Global Expansion WW I British and Allies’ largest fuel supplier Provided 80% of

- 8. Great Depression Cut labor and costs Cartel agreement failed WWII Lost 87 ships Lost Access to

- 9. 1950s through 1970s Alliance with Middle East Gulf Oil Royal Dutch Shell and Ferrari Partnership Shell

- 10. 1980s and 1990s Largest producer of petrochemicals and leading supplier of agrochemicals Expansion through acquisitions and

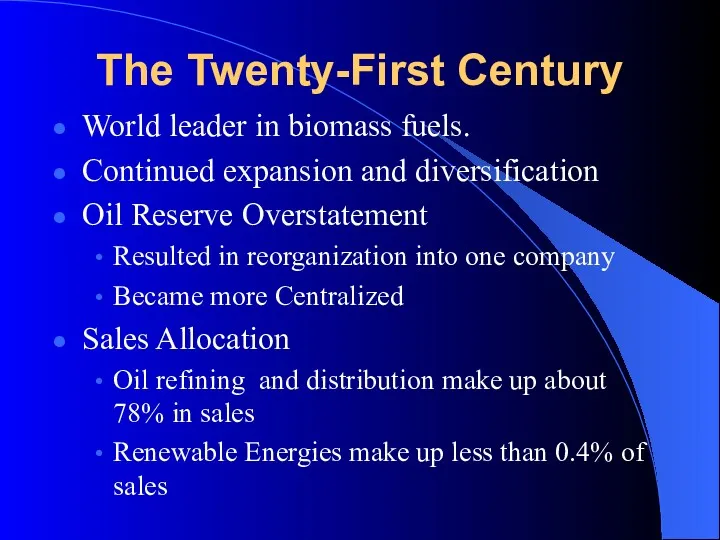

- 11. The Twenty-First Century World leader in biomass fuels. Continued expansion and diversification Oil Reserve Overstatement Resulted

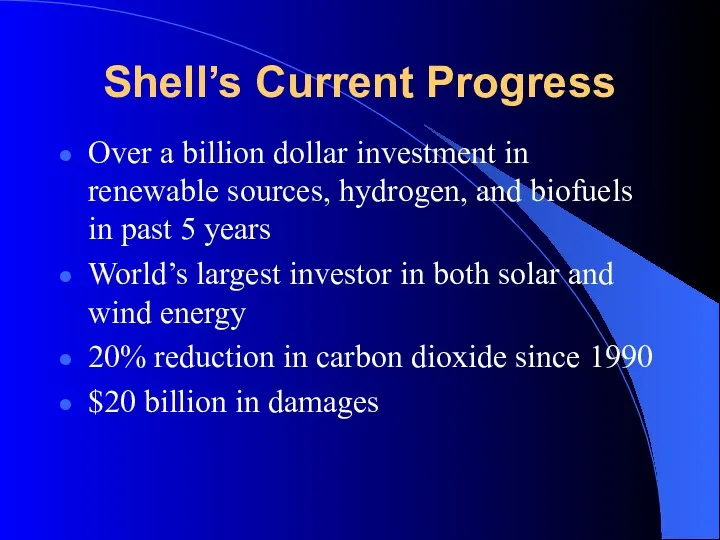

- 12. Shell’s Current Progress Over a billion dollar investment in renewable sources, hydrogen, and biofuels in past

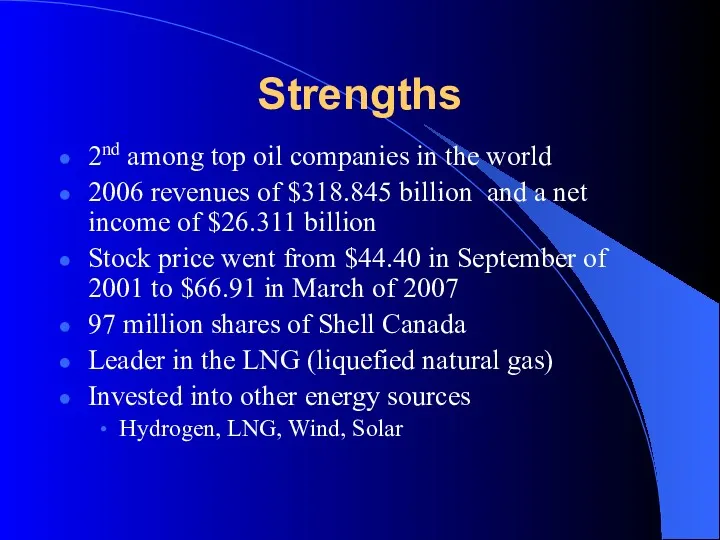

- 13. Strengths 2nd among top oil companies in the world 2006 revenues of $318.845 billion and a

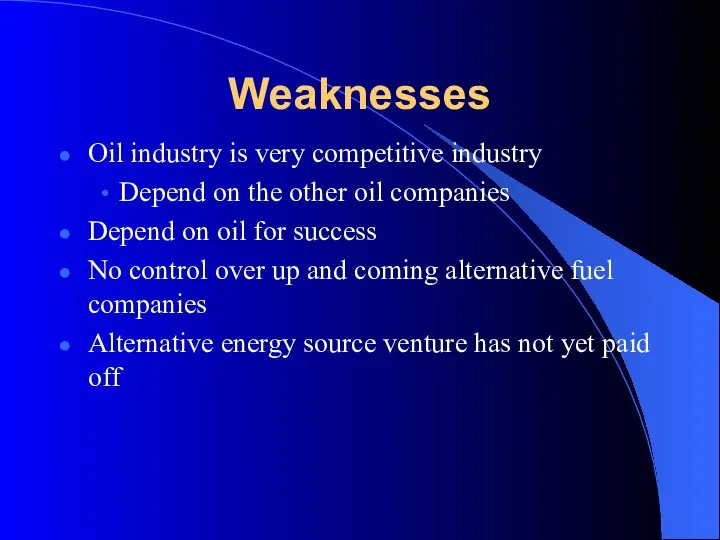

- 14. Weaknesses Oil industry is very competitive industry Depend on the other oil companies Depend on oil

- 15. Opportunities LNG becomes the main source of energy Between 2005 and 2010, the demand for LNG

- 16. Threats Competition ExxonMobil, BP, Chevron, ConocoPhillips Nigeria’s deepwater's World’s eighth largest oil exporter and fifth largest

- 17. What is competition in oil industry? Tough Growing fast Quality of the product Service provided Activities

- 18. Royal Dutch competitors are… Exxon Mobil BP ( British Petroleum) Chevron Corp.

- 19. Exxon Mobil Number 1 Irving, Texas 40, 000 gas and service stations Reserves of 13.6 billion

- 20. BP (British Petroleum) - # 3 Founded as Anglo Persian Oil Company London, UK 18.3 billion

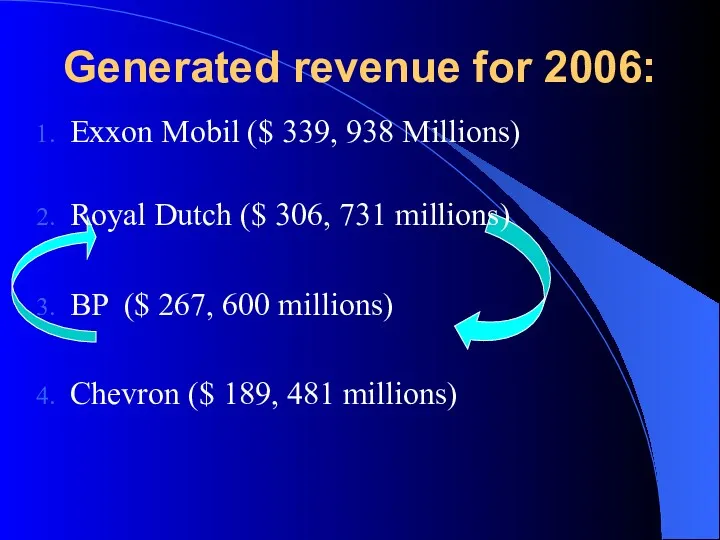

- 21. Generated revenue for 2006: Exxon Mobil ($ 339, 938 Millions) Royal Dutch ($ 306, 731 millions)

- 22. Chevron Corporation Merger of Texaco Inc. and Chevron San Ramon, California 11.6 billion barrels of OE

- 23. Strategic Alternatives Electricity sources: Solar energy Wind energy Objective: environmentally friendly and cost efficient! Vehicle fuel

- 24. Solar power Solar power is the technology of obtaining usable energy from the light of the

- 25. Wind power Like old fashioned windmills, today’s wind machines use blades to collect the wind’s kinetic

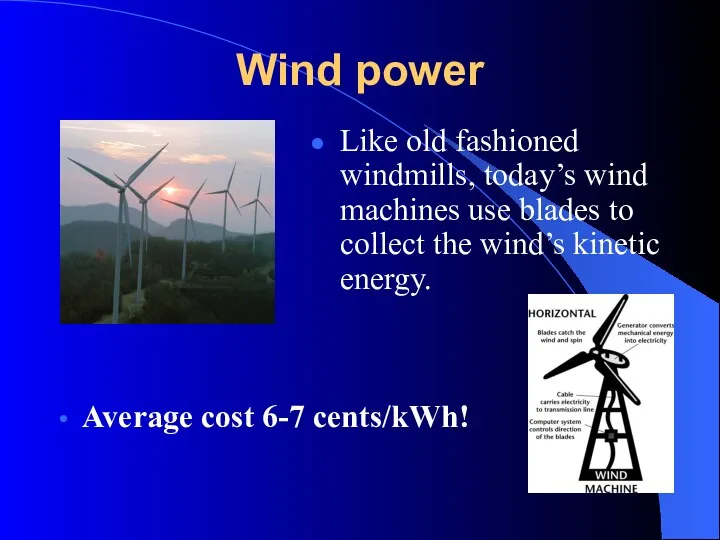

- 26. Biofuels Biofuel is any fuel that is derived from biomass — recently living organisms or their

- 27. Hydrogen fuel cell Using electricity, it is easy to split water molecules to create pure hydrogen

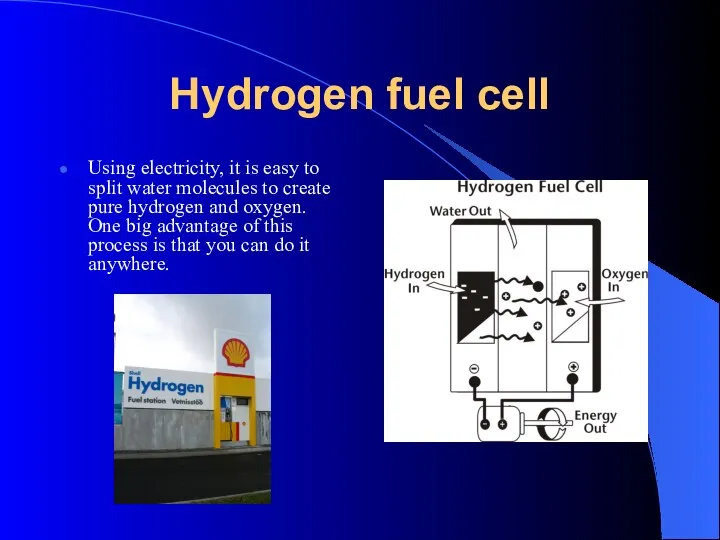

- 28. Future Outlook Rise in global energy needs Oil, gas, and coal will continue to meet the

- 29. New cheaper, more efficient technologies Increased demand for LNG Result in Shell having higher profits due

- 30. Recommendations Invest more money into R&D for alternative fuels Buying land rights in certain areas, or

- 31. Recommendations Continue to operate the way they are Second largest oil company Leader in LNG Already

- 33. Скачать презентацию

История развития экологии как науки

История развития экологии как науки Призентация приложения к программе Доброморье

Призентация приложения к программе Доброморье Повышение эффективности ТЭУ

Повышение эффективности ТЭУ I wish a had a magic vacuum cleaner, instead of my old broom!

I wish a had a magic vacuum cleaner, instead of my old broom! Приложение 1 к уроку по теме Озёра. Презентация. часть 3

Приложение 1 к уроку по теме Озёра. Презентация. часть 3 Интегративный подход к организации развивающих центров активности детей

Интегративный подход к организации развивающих центров активности детей Интерактивная игра Своя игра. ОРКСЭ. Основы православной культуры.

Интерактивная игра Своя игра. ОРКСЭ. Основы православной культуры. Ливонская война

Ливонская война Концептуальные аспекты управления инновациями

Концептуальные аспекты управления инновациями История русской вышивки. Вышивка крестом

История русской вышивки. Вышивка крестом Геодезическое обеспечение геологоразведочных работ

Геодезическое обеспечение геологоразведочных работ Консультация для родителей второклассников.

Консультация для родителей второклассников. Поздравления с 8 марта

Поздравления с 8 марта Исследовательская работа: Прекрасные и опасные комнатные растения

Исследовательская работа: Прекрасные и опасные комнатные растения Усилители СВЧ

Усилители СВЧ SWOT-анализ

SWOT-анализ Западно-Сибирская низменность

Западно-Сибирская низменность Политическая карта мира

Политическая карта мира Педагогическая академия последипломного образования

Педагогическая академия последипломного образования Презентация кружка Уроки здоровья

Презентация кружка Уроки здоровья Многолучевые и сканирующие антенны. (Лекция 14)

Многолучевые и сканирующие антенны. (Лекция 14) Голландское искусство XVII в

Голландское искусство XVII в правила пожарной безопасности

правила пожарной безопасности Кислородные соединения углерода Диск

Кислородные соединения углерода Диск Метрологическое оборудование от калибратора до лаборатории

Метрологическое оборудование от калибратора до лаборатории Отморожения. Классификация

Отморожения. Классификация Последние дни земной жизни Господа нашего Иисуса Христа. Вход Господень в Иерусалим

Последние дни земной жизни Господа нашего Иисуса Христа. Вход Господень в Иерусалим Принтерлермен жұмыс істеу

Принтерлермен жұмыс істеу