Содержание

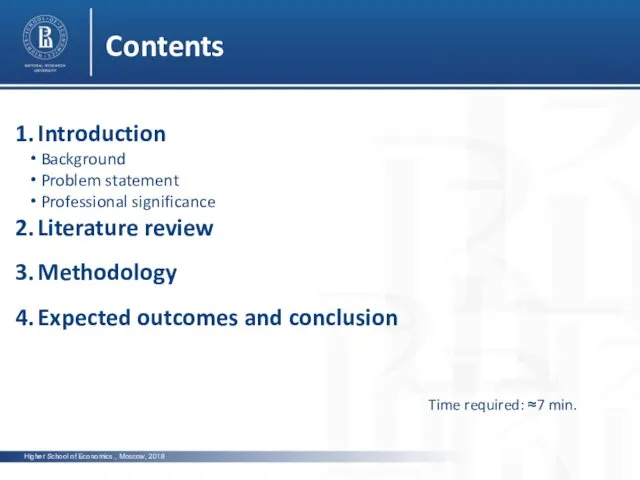

- 2. Higher School of Economics , Moscow, 2018 Contents photo photo photo Introduction Background Problem statement Professional

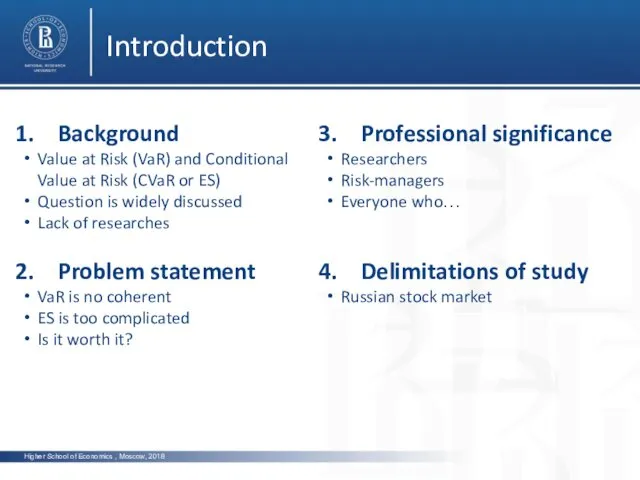

- 3. Higher School of Economics , Moscow, 2018 Introduction photo photo Background Value at Risk (VaR) and

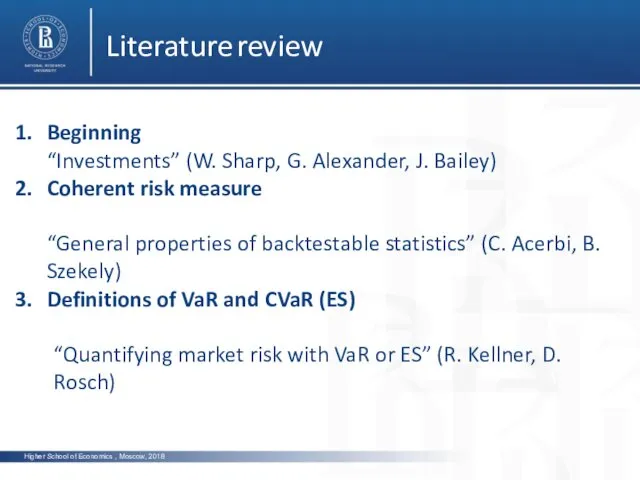

- 4. Higher School of Economics , Moscow, 2018 Literature review photo photo Beginning “Investments” (W. Sharp, G.

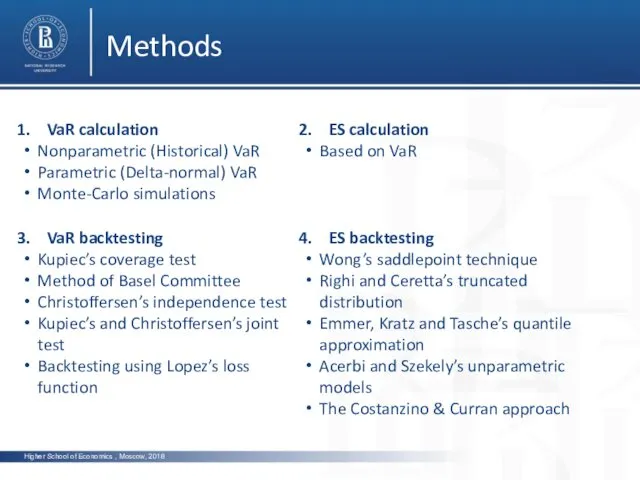

- 5. Higher School of Economics , Moscow, 2018 Methods VaR calculation Nonparametric (Historical) VaR Parametric (Delta-normal) VaR

- 6. Higher School of Economics , Moscow, 2018 Expected outcomes VaR or ES?

- 7. Higher School of Economics , Moscow, 2018 Conclusion photo photo photo Contribution to the line of

- 9. Скачать презентацию

портфолио педагога-психолога

портфолио педагога-психолога Технологии публичных выступлений

Технологии публичных выступлений Наши домашние помощники: бытовая техника

Наши домашние помощники: бытовая техника Гражданская авиатехника

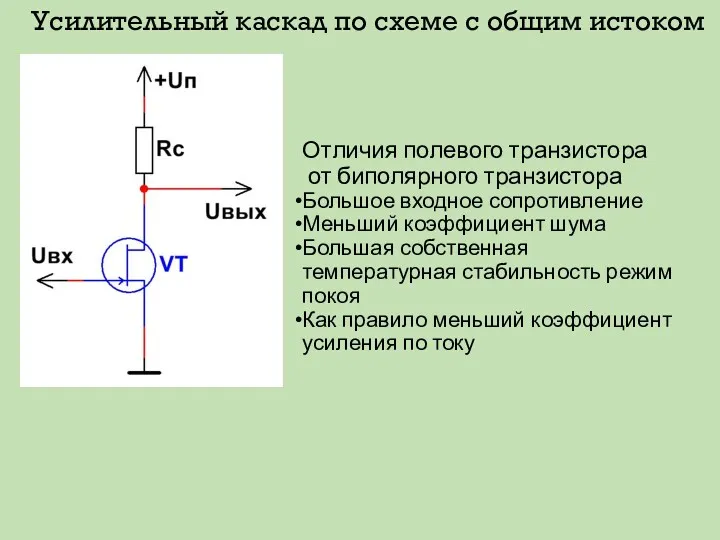

Гражданская авиатехника Электронные устройства мехатронных и робототехнических систем

Электронные устройства мехатронных и робототехнических систем Формирование связной речи у дошкольников старшего возраста с ОНР.

Формирование связной речи у дошкольников старшего возраста с ОНР. Архитектура, как вид искусства

Архитектура, как вид искусства Презентация Неделя начальной школы

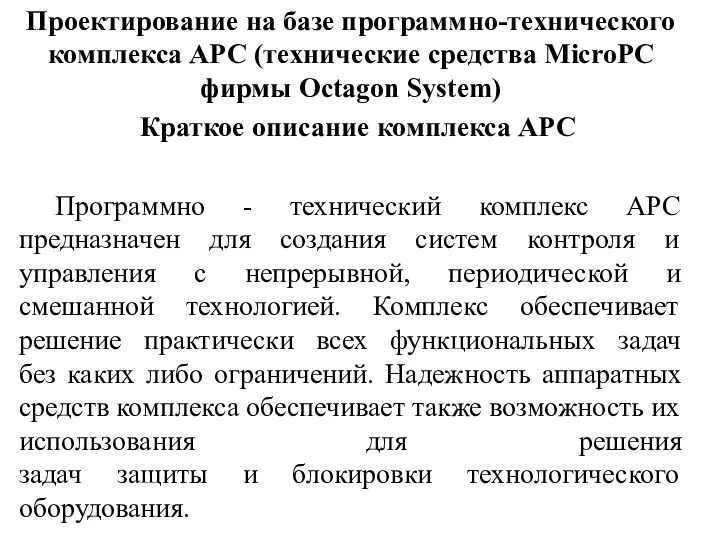

Презентация Неделя начальной школы Проектирование на базе программно-технического комплекса АРС

Проектирование на базе программно-технического комплекса АРС Эксклюзивная немецкая парфюмерия LR health & beauty systems

Эксклюзивная немецкая парфюмерия LR health & beauty systems Вирок. Соловки. Микола Куліш

Вирок. Соловки. Микола Куліш 20231110_matematicheskiy_kvn_5-6

20231110_matematicheskiy_kvn_5-6 География машиностроения

География машиностроения Антропогенез

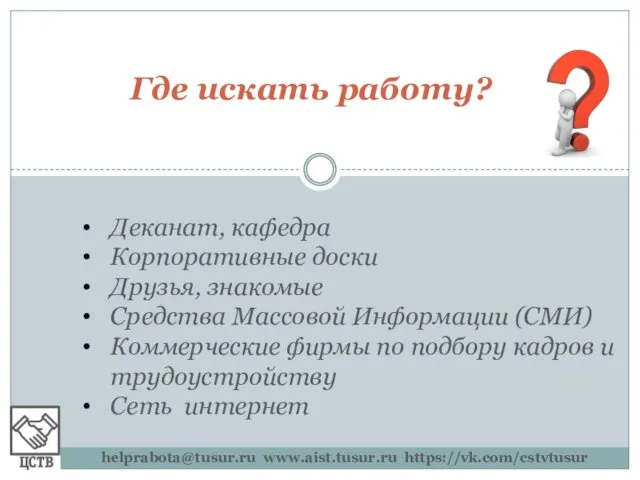

Антропогенез Где искать работу. Профориентационное занятие

Где искать работу. Профориентационное занятие Язык и речь. Язык и его единицы

Язык и речь. Язык и его единицы Хвала рукам, что пахнут хлебом

Хвала рукам, что пахнут хлебом Интерстициальные болезни легких (ИБЛ)

Интерстициальные болезни легких (ИБЛ) Основы эпидемиологии инфекционных болезней

Основы эпидемиологии инфекционных болезней Кинезиология. Развивающая программа

Кинезиология. Развивающая программа Юбилей деда

Юбилей деда Прибыль и рентабельность

Прибыль и рентабельность Задачи экологического содержания на уроках математики

Задачи экологического содержания на уроках математики Презентация кабинета

Презентация кабинета Начало ВОВ

Начало ВОВ Технология изготовления металлического мангала

Технология изготовления металлического мангала Методика обучения и воспитания в области дошкольного образования

Методика обучения и воспитания в области дошкольного образования Мультфильмы вчера, мультфильмы сегодня, мультфильмы завтра

Мультфильмы вчера, мультфильмы сегодня, мультфильмы завтра