Содержание

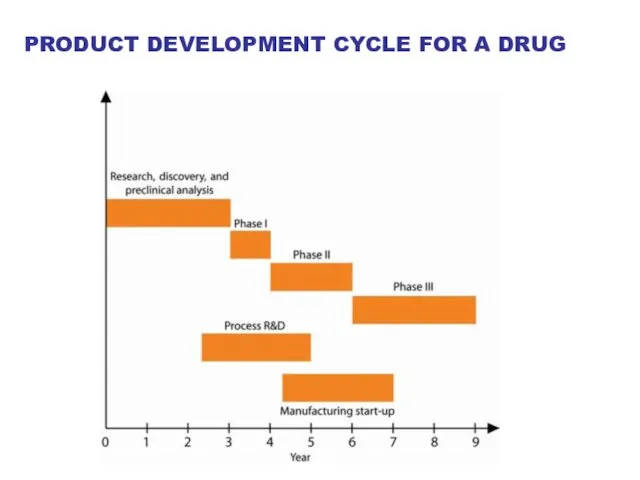

- 2. PRODUCT DEVELOPMENT CYCLE FOR A DRUG

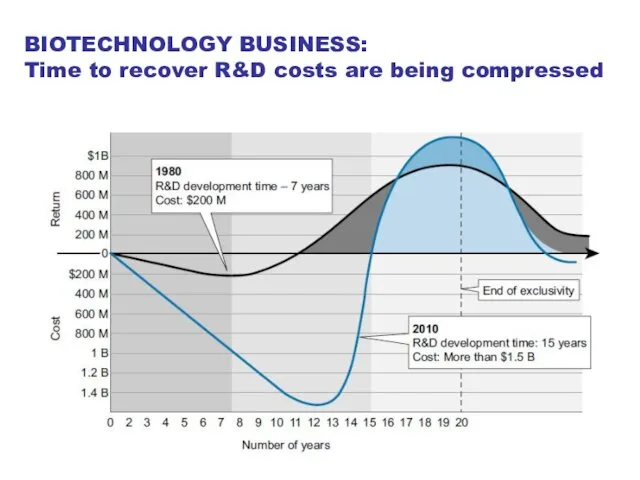

- 3. BIOTECHNOLOGY BUSINESS: Time to recover R&D costs are being compressed

- 4. THE VALUE OF THE BIOTECH COMPANY’S ASSET varies with market and geographic region

- 5. THE SAN FRANCISCO BAY AREA a major biotechnology claster

- 6. THE BOSTON/CAMBRIDGE a world-top biotechnology claster

- 7. BioBAT AT BROOKLING ARMY TERMINAL a biotechnology incubator

- 8. SILICON VALLEY

- 9. MEDICON VALLEY

- 10. Abundance of high quality, adequately funded academic research Ready resource of seasoned and experienced biotechnology entrepreneurs

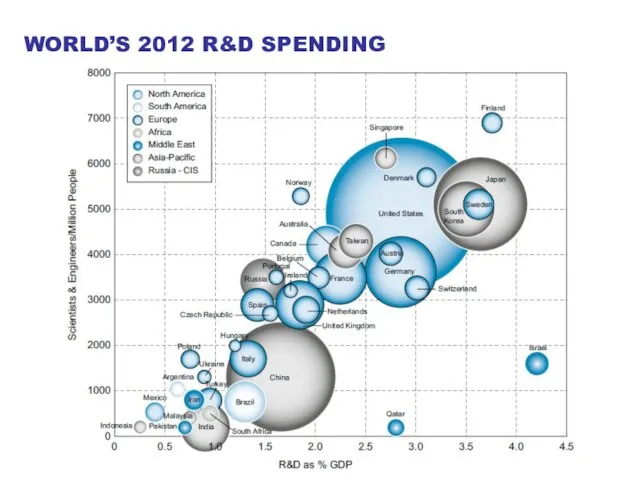

- 11. WORLD’S 2012 R&D SPENDING

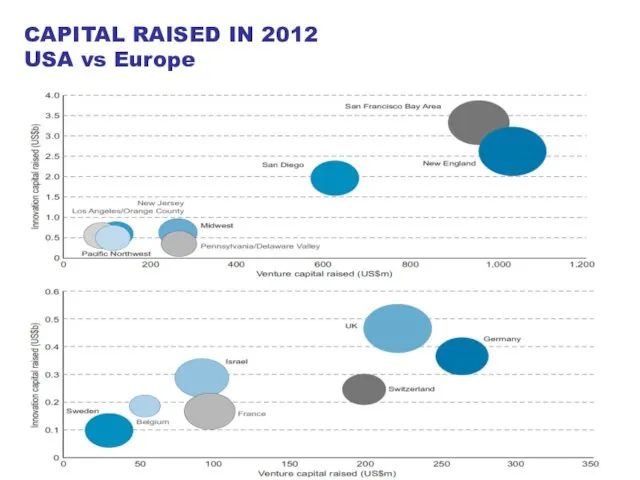

- 12. CAPITAL RAISED IN 2012 USA vs Europe

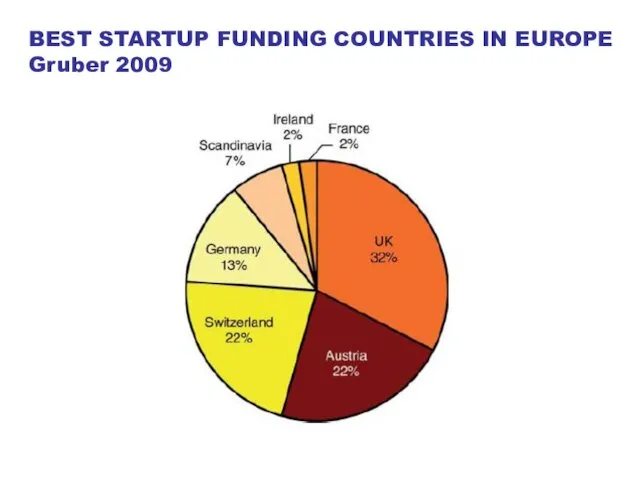

- 13. BEST STARTUP FUNDING COUNTRIES IN EUROPE Gruber 2009

- 14. STARTUP FUNDING SOURCES Personal capital (Fools), Friends and Family (FFF) Government grants and financing programs Angel

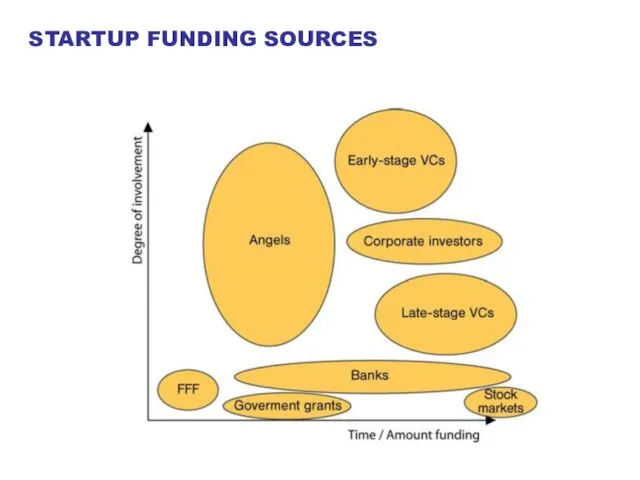

- 15. STARTUP FUNDING SOURCES

- 16. PERSONAL CAPITAL ~5-20% of the company assets relatively small, varies: 500 USD (Rob Swanson + Herb

- 17. FFF relatively small, varies, up to tens of thousands USD, sometimes up to hundreds of thousands

- 18. GOVERNMENT GRANTS AND FINANCING PROGRAMS relatively large (up to several millions USD), non-dilutive hard to get

- 19. https://www.sbir.gov/ https://www.helmholtz.de/transfer/technologietransfer/transferinstrumente/helmholtz_enterprise/ GOVERNMENT GRANTS AND FINANCING PROGRAMS

- 20. ANGEL INVESTORS USD 20-250 K, relatively easy to get

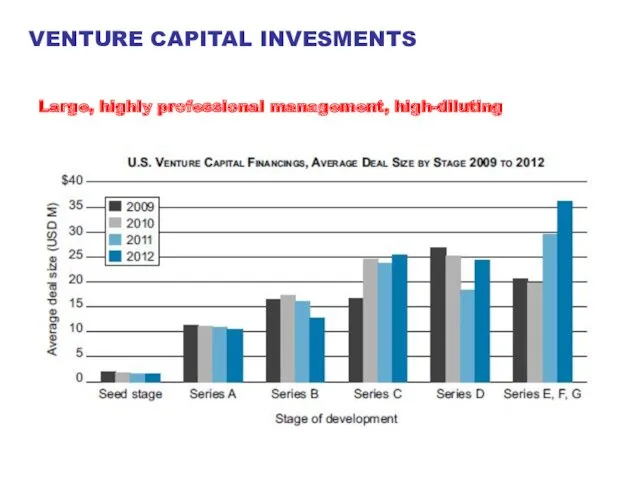

- 21. VENTURE CAPITAL INVESMENTS Large, highly professional management, high-diluting

- 22. CORPORATE PARTNERSHIP

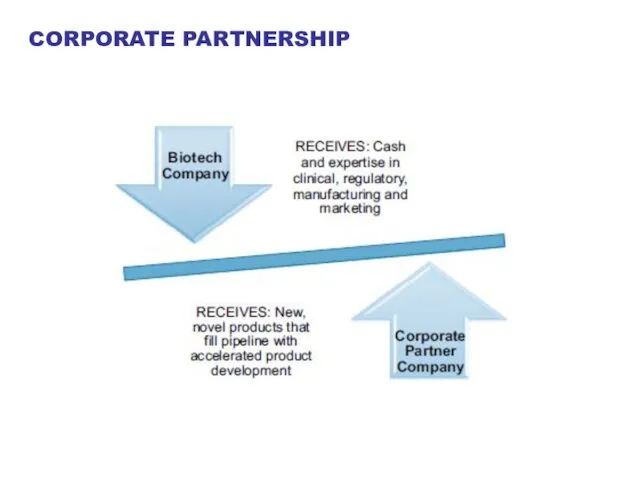

- 23. IPO, ACQUISITIONS, SELLS

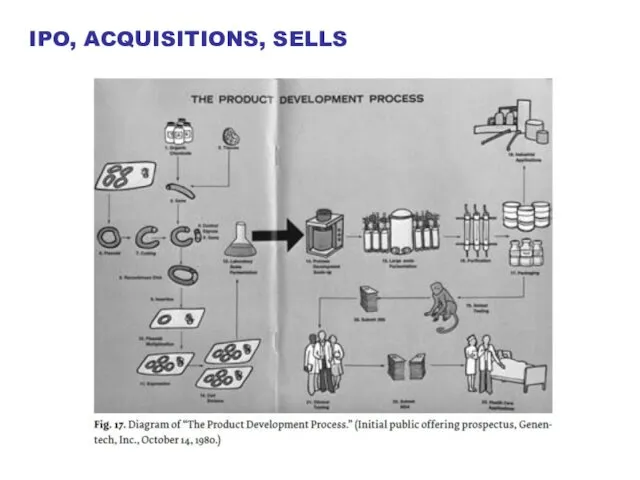

- 25. Скачать презентацию

Організація ремонту пральної машини

Організація ремонту пральної машини Бизнес-проект. Организационный план. Организационно-правовая форма. Организационная структура. Персонал. Деловое расписание

Бизнес-проект. Организационный план. Организационно-правовая форма. Организационная структура. Персонал. Деловое расписание Бизнес идея по созданию своего интернет-магазина

Бизнес идея по созданию своего интернет-магазина Особенности формирования внешний и внутренний среды бизнеса

Особенности формирования внешний и внутренний среды бизнеса Морской единорог

Морской единорог Rest-life. Комплексное цифровое решение для ресторанного бизнеса

Rest-life. Комплексное цифровое решение для ресторанного бизнеса Разработка бизнес-плана развития предприятия ООО СТС

Разработка бизнес-плана развития предприятия ООО СТС Бизнес-идея, бизнес- модель, бизнес-план

Бизнес-идея, бизнес- модель, бизнес-план Стартапы. Прибыльность и ее причины

Стартапы. Прибыльность и ее причины Raketa это онлайн-платформа для управления корпоративными поездками

Raketa это онлайн-платформа для управления корпоративными поездками Жеке кәсіпкерлік

Жеке кәсіпкерлік Ұлттық мейрамханаларды дамытудың перспективалық бағыттары

Ұлттық мейрамханаларды дамытудың перспективалық бағыттары Предмет и задачи государственного регулирования бизнеса

Предмет и задачи государственного регулирования бизнеса Трехдневный марафон Начни работать риэлтором прямо сейчас

Трехдневный марафон Начни работать риэлтором прямо сейчас ООО Ависта Сервис

ООО Ависта Сервис Қонақ үйдегі 12 орынды кафенің салқын цехының жұмысын ұйымдастыру

Қонақ үйдегі 12 орынды кафенің салқын цехының жұмысын ұйымдастыру Создание внеконкурентного предложения

Создание внеконкурентного предложения Бизнес-игра Construction Team

Бизнес-игра Construction Team Мой любимый бренд

Мой любимый бренд Гүл дүкенін ашу

Гүл дүкенін ашу Review for Midterm2

Review for Midterm2 Развитие туризма и рекреации в Семёновском городском округе Нижегородской области

Развитие туризма и рекреации в Семёновском городском округе Нижегородской области Проект генерального плана изменений в землепользовании и застройке территории города

Проект генерального плана изменений в землепользовании и застройке территории города Бизнес-план создания и организации деятельности ногтевой студии Beaunail

Бизнес-план создания и организации деятельности ногтевой студии Beaunail Промышленный туризм

Промышленный туризм Бизнес-концепция: Продажа минималистичной одежды

Бизнес-концепция: Продажа минималистичной одежды Қазақстан Республикасы агроөнеркәсіптік кешеніндегі мемлекеттік қолдаудың негізгі құралдары

Қазақстан Республикасы агроөнеркәсіптік кешеніндегі мемлекеттік қолдаудың негізгі құралдары Umbro компаниясы

Umbro компаниясы