Слайд 2

European Union Energy Policy:

Topic 1. Main and additional priorities of

the European Union energy policy

Topic 2. Fuel and energy balance of the EU

Topic 3. Liberalization of EU gas and energy markets

Topic 4. EU energy diplomacy and external actions

Topic 5. The EU-Russia energy dialog

Слайд 3

Topic 1. Main and additional priorities of the European Union energy

policy

Introduction

Milestones of EU energy policy

Evolution of European energy policy

Legislation

Слайд 4

Energy is the irreplaceable part of almost every aspect of modern

life from industry to transportation, heating and electricity, it is at the heart of human

development and economic growth.

Слайд 5

Energy is a fundamental factor in the construction of European Union

project. The deep interaction and cooperation among the founding members of the Union crystallized around energy considerations.

The European Coal and Steel Community (ECSC) Treaty and Euratom Treaty did not only establish the roots of European Community but also ensured regular supply of coal and coordination in nuclear energy.

Слайд 6

Nevertheless, despite energy’s importance in our daily lives, despite the fact

that EU project “took off” with the integration in economic domain and despite potential beneficial effects of integration in terms of external energy policy and action against climate change, European Energy Policy displayed an unsuccessful example of integration.

Слайд 7

The EU’s energy dependence (import dependence) ? ? ?

Energy is

the significant item on the agenda of European decision makers

Слайд 8

The issue gets further complicated with the inclusion of worries about

global warming, hazardous effects of certain energy types on health and environmental damages due to energy production, transportation and consumption, which overall require not only secure access to energy but also access to clean and efficient energy.

Слайд 9

With these challenges on the background, until recently, climate change and

energy efficiency had started to outweigh the agenda of internal and international efforts of the European Union concerning the creation of an energy policy.

Слайд 10

Although some of the policies are still up to the individual

choices of each Member State in line with their national preferences, global interdependence requires energy policy to offer a European dimension.

Слайд 11

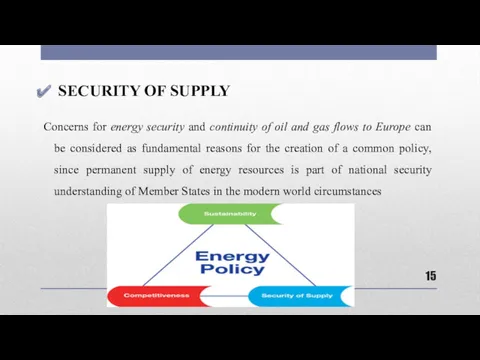

The milestones of EU energy policy:

SUSTAINABILITY

COMPETITIVENESS

SECURITY

OF SUPPLY

Слайд 12

Major European documents constituting these milestones of European energy policy:

Green Paper of 2006

The Commission's communication “An Energy Policy for Europe” of 2007

Слайд 13

SUSTAINABILITY

linked to climate change

80% of greenhouse gas (GHG) emission in the

Union is caused by energy related activities

Слайд 14

COMPETITIVENESS

aims at liberalization of energy market ?

at the

opening of energy markets for the benefit of EU citizens in line with latest energy technologies and investments in clean energy production

Слайд 15

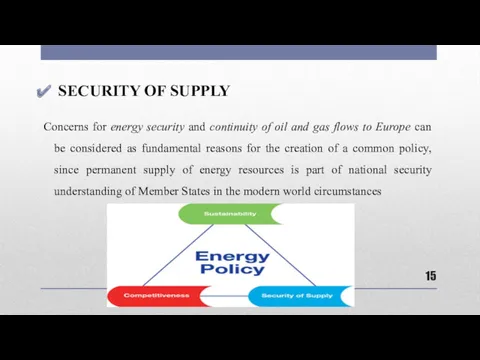

SECURITY OF SUPPLY

Concerns for energy security and continuity of oil and

gas flows to Europe can be considered as fundamental reasons for the creation of a common policy, since permanent supply of energy resources is part of national security understanding of Member States in the modern world circumstances

Слайд 16

SECURITY OF SUPPLY

In 2030, it is expected that reliance on

imports of gas and oil will rise to 84% and 93% as opposed to 57% and 82% in 2007, respectively.

Слайд 17

SECURITY OF SUPPLY

When such a level of dependency is combined with

uncertainty about the willingness and capacity of oil and gas exporters to invest more and increase production to meet the increasing global demand, threat of supply disruptions emerge as one of the major challenges of the century.

Слайд 18

DEVELOPMENT OF EU ENERGY POLICIES OVER TIME

Слайд 19

EVOLUTION OF EUROPEAN ENERGY UNION

In the evolution of the EU itself,

policies concerning energy and energy security remained at the back plan. Left to national discretion of Member States, decisions and policies concerning energy security was initially excluded from the EU level integration of European countries.

Слайд 20

European energy policy initiated as a need to be capable of

responding to international energy supply crises:

the Suez crisis in 1956

the Six Day war between Egypt and Israel in 1967

Arab oil embargo in 1973

oil crisis following Iranian revolution in 1979

Слайд 21

International Energy Supply Crises ? two major concerns:

1). political instability in

producer countries and regional tensions will lead to a disruption in oil supply

2). the threat that exporter countries can purposefully use oil and natural gas as a weapon in their foreign relations

Слайд 22

THE RESPONSE TO SUCH CRISES:

Oil Stock Directive, 1968

An amendment

to the directive of 1968, accepted in 1972 - 72/425/EEC

The establishment of International Energy Agency (IEA), 1973

Two more directives - 73/238/EEC and 77/706/EEC

Слайд 23

The end of Cold War ?

the end of ideological, political

and economic divisions between eastern and western Europe ?

in December 1991 political decision for EUROPEAN ENERGY CHARTER was signed.

Слайд 24

EUROPEAN ENERGY CHARTER, 1991:

competition

free transit

taxation

transparency

conditions on

environment and sovereignty

Слайд 25

Between 1990 and 2000 – THREE Green Papers on ENERGY =

BASELINES

for a COMMON policy of the EU

Слайд 26

1994 – the Green Paper “For A European Union Energy Policy”

to establish an internal market

to increase the EU’s role in the energy sector

to harmonize national and community level of energy policies

Слайд 27

1996 – the Green Paper “Energy for the Future: Renewable

Sources of Energy”

incorporation of renewable energy sources into the future Community strategy on energy

offered concrete strategies in the specific issue of renewable resources

mobilization of national and Community instruments for the development of these resources in order to increase the percentage of renewable energy in the EU’s energy mix

Слайд 28

!!! 2000 – the Green Paper “Towards a European Strategy for

the Security of Energy Supply”

environmental concerns and repeated the interdependence between the Member States which required a Community dimension in the strategies dealing with energy related challenges

the Union’s increasing import dependence

focused on the security of supply

offered a detailed study concerning EU’s energy mixture

Слайд 29

2005 – the Green Paper “Green Paper on Energy Efficiency or

Doing More with Less”

The Commission suggested the establishment of energy efficiency Action Plan which would be a multi-level initiative combining national, regional, community and international levels. From buildings to tyres and clean vehicles, the paper examined several measures especially in industrial and transportation sectors, which could contribute to energy efficiency.

Слайд 30

Russia – Ukraine crises (2006) ?

Member States understood the importance

of community level actions in the sphere of energy policy

Слайд 31

2006 – the Green Paper “A European Strategy for Sustainable, Competitive

and Secure Energy”

competitiveness and the creation of an internal market (common European market)

diversification of energy mix

solidarity between member states

sustainable development as a response to climate change

innovation and technology for the increase of energy efficiency and diversity through renewable resources

an integrated external policy

Слайд 32

“An Energy Policy for Europe” introduced

“20/20 Package” (2007):

reducing GHG

emission by 20%

improving energy efficiency by 20%

achieving a 20% share of renewable energy

a 10% share of biofuels by 2020

Слайд 33

2008 - An EU Energy Security and Solidarity Action Plan

infrastructure needs

the diversification of energy supplies

external energy relations

oil and gas stocks and crisis response mechanisms

energy efficiency

- making the best use of the EU’s indigenous energy resources

Слайд 34

The Kyoto Protocol

The Kyoto Protocol (1997) is an international agreement which

is intended to lower the greenhouse gas emissions of the industrialized world by 2012. Ideally, the end result of the Kyoto Protocol should be a reduction of these emissions to below 1990 levels. The agreement also addresses the issue of the developing world, which is rapidly industrializing and therefore producing a large volume of greenhouse gases.

Слайд 35

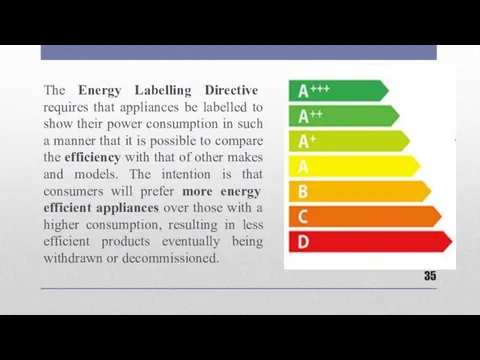

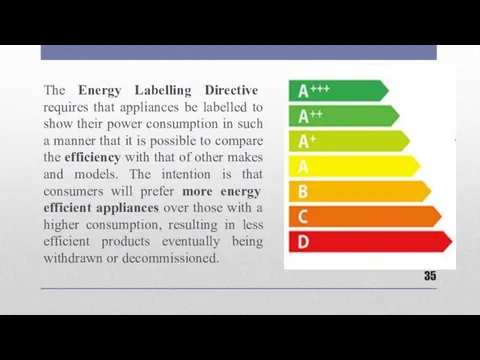

The Energy Labelling Directive requires that appliances be labelled to show

their power consumption in such a manner that it is possible to compare the efficiency with that of other makes and models. The intention is that consumers will prefer more energy efficient appliances over those with a higher consumption, resulting in less efficient products eventually being withdrawn or decommissioned.

Слайд 36

EUROPEAN EMISSIONS STANDARDS

Each of the standards Euro 1 to Euro 6

(the latest) represent a total amount of exhaust gas emissions from a car. They measure four main groups of emission – carbon monoxide, hydrocarbons, nitrous oxide and particulate matter.

Слайд 37

INTELLIGENT ENERGY EUROPE

Intelligent Energy – Europe (IEE) offered a helping hand

to organisations willing to improve energy sustainability. Launched in 2003 by the European Commission, the programme was part of a broad push to create an energy-intelligent future.

Слайд 38

2011 - A Roadmap for Moving to a Competitive, Low-Carbon Economy

in 2050:

- reducing emissions by 80% relative to what they were in 1990 by 2050 = this is what Europe needs to do in order to make sure that global warming does not go beyond two degrees centigrade (2°C is usually seen as the upper temperature limit to avoid dangerous global warming).

Слайд 39

The latest decisions in this matter have come from the European

Council of October 2014. That is to aim at reducing carbon emissions by 40% by 2030.

Now, we have the following objectives:

for 2020, a reduction of 20% relative to 1990

we have an objective for 2050, a reduction by 80% and

we have an intermediate objective for 2030, a reduction by 40%.

Слайд 40

Today the main goal is to establish ENERGY UNION!

In 2015, the

Framework Strategy for Energy Union is launched as one of the European Commission's 10 Priorities.

Слайд 41

Topic 2. Fuel and energy balance of the EU

Слайд 42

The energy balance remains subject to the national level, not common

European

?

A plurality of energy models

Слайд 43

Oil:

Malta, Cyprus,

Nuclear energy:

France, Sweden, Belgium

Coal:

Poland, the Czech Republic, Bulgaria

Gas:

the

UK, the Netherlands, Italy

Слайд 44

The energy available in the European Union comes from energy produced

in the EU and from energy imported from third countries. In 2015, the EU produced around 46 % of its own energy, while 54 % was imported.

Слайд 45

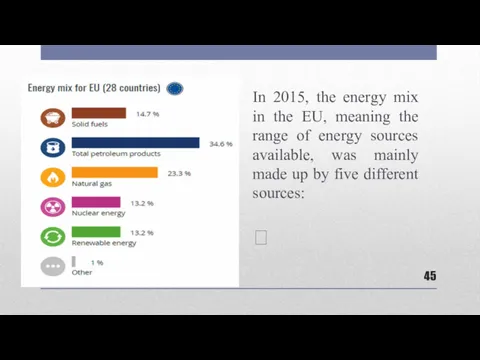

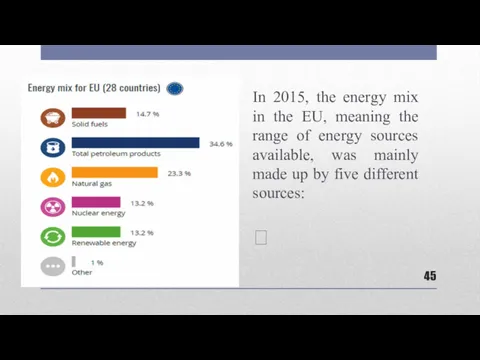

In 2015, the energy mix in the EU, meaning the range

of energy sources available, was mainly made up by five different sources:

?

Слайд 46

WHAT DOES THE EU PRODUCE?

Nuclear energy (29 % of total EU

energy production) was the largest contributing source to energy production in the EU in 2015. Renewable energy (27 %) was the second largest source, followed by solid fuels (19 %), natural gas (14 %) and crude oil (10 %).

Слайд 47

However, the production of energy is very different from one Member

State to another. The significance of nuclear energy is particularly high in France (83 % of total national energy production), Belgium (65 %) and Slovakia (63 %). Renewable energy is the main source of energy produced in a number of Member States, with over 90 % (of the energy produced within the country) in Malta, Latvia, Portugal, Cyprus and Lithuania. Solid fuels have the highest importance in Poland (80 %), Estonia (76 %) and Greece (68 %), while natural gas is the main source of energy produced in the Netherlands (82 %). Crude oil is the major source of energy produced in Denmark (49 %) and the United Kingdom (39 %).

Слайд 48

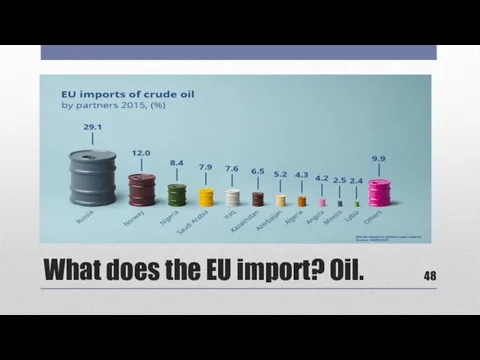

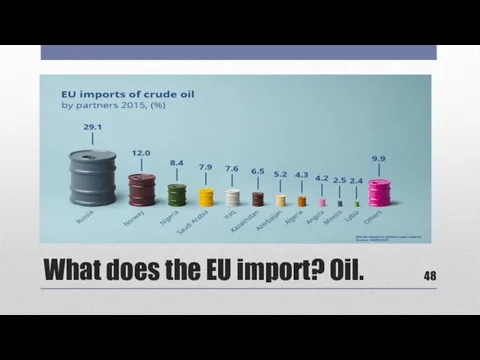

What does the EU import? Oil.

Слайд 49

What does the EU import? Coal.

Слайд 50

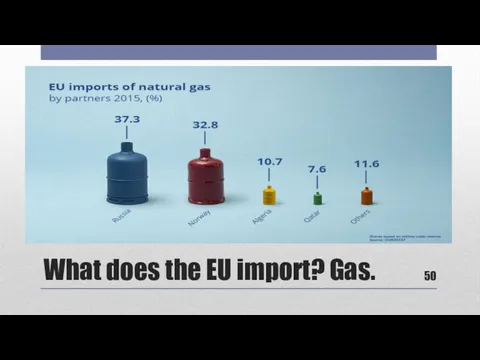

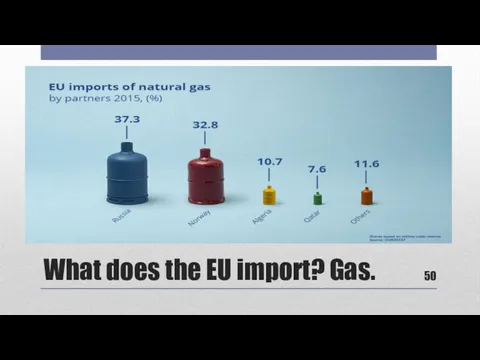

What does the EU import? Gas.

Слайд 51

How dependent is the EU from energy produced outside the EU?

In

the EU in 2015, the dependency rate was equal to 54 %, which means that more than half of the EU’s energy needs were met by net imports. This rate ranges from over 90 % in Malta, Luxembourg and Cyprus, to below 20 % in Estonia, Denmark and Romania. The dependency rate on energy imports has increased since 2000, when it was just 47 %.

Слайд 52

GAS. ADVANTAGES:

much lower emissions

there is no need to maintain

a reservoir for crude oil or storage for coal

the efficiency of the transformation is high

Слайд 53

The drawback of gas is the difficulty in transporting, high cost

of transportation!

Слайд 54

The largest importers of Russian gas in the European Union are

Germany and Italy, accounting together for almost half of the EU gas imports from Russia. Other larger Russian gas importers (over 5 billion cubic meter per year) in the European Union are France, Hungary, Czech Republic, Poland, Austria and Slovakia.

Слайд 55

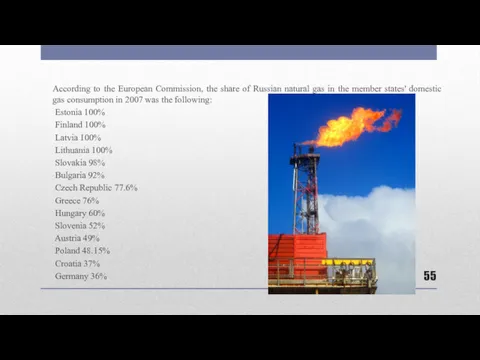

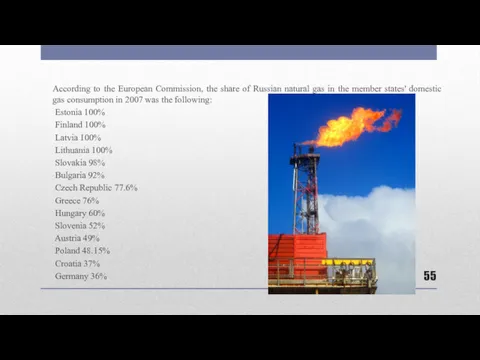

According to the European Commission, the share of Russian natural gas

in the member states' domestic gas consumption in 2007 was the following:

Estonia 100%

Finland 100%

Latvia 100%

Lithuania 100%

Slovakia 98%

Bulgaria 92%

Czech Republic 77.6%

Greece 76%

Hungary 60%

Slovenia 52%

Austria 49%

Poland 48.15%

Croatia 37%

Germany 36%

Слайд 56

Oil. Advantages.

Oil is a mix of hydrocarbons that are liquid

under atmospheric conditions. Therefore, the fact that they are liquid allows for easier treatment of it, easier transportation, easier containment in tanks, and it is one of the greatest advantages of oil.

Слайд 57

Based on data from OPEC at the beginning of 2013 the

highest proved oil reserves oil deposits are in

Venezuela (20% of global reserves),

Saudi Arabia (18% of global reserves),

Canada (13% of global reserves), and

Iran (9%).

Слайд 58

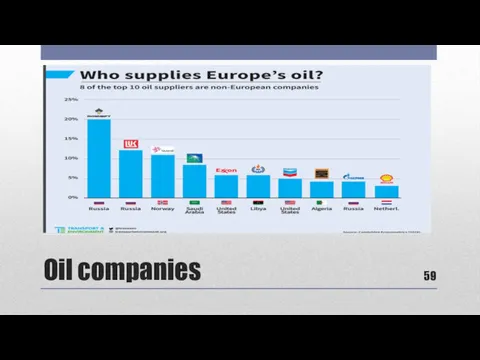

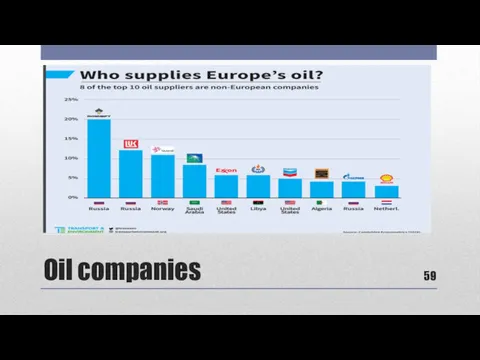

European dependence on oil imports has grown from 76% in 2000

to over 88% in 2014. The EU spends some €215 bn on oil imports, over 5 times as much as gas imports (€40 bn). Russia is the biggest supplier: dependence on Russia has grown from 22% in 2001 to 30% in 2015.

Слайд 59

Слайд 60

More than 40% of the oil was exported from Middle Eastern

countries such as Algeria, Iraq, Libya, and Angola, former Soviet states such as Azerbaijan and Kazakhstan, and Nigeria and Angola in Africa. Russia itself was the source of 30% of Europe’s crude imports.

Just two of the top 10 oil suppliers to the EU were European – Shell and Statoil – whose combined crude market share was 12%. In total 88% of Europe’s crude was imported.

Слайд 61

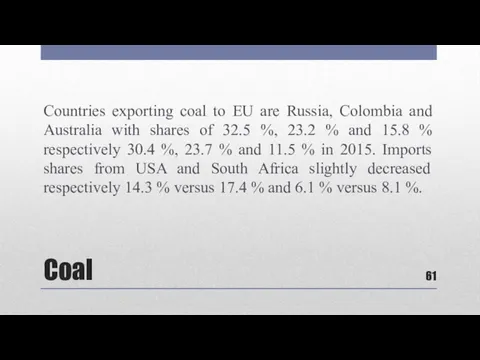

Coal

Countries exporting coal to EU are Russia, Colombia and Australia

with shares of 32.5 %, 23.2 % and 15.8 % respectively 30.4 %, 23.7 % and 11.5 % in 2015. Imports shares from USA and South Africa slightly decreased respectively 14.3 % versus 17.4 % and 6.1 % versus 8.1 %.

Слайд 62

Coal

Coal, as the largest artificial contributor to carbon dioxide emissions,

has been attacked for its detrimental effects on health. Coal has been linked to acid rain, smog pollution, respiratory diseases, mining accidents, reduced agricultural yields and climate change.

Proponents of coal downplay these claims and instead advocate the low cost of using coal for energy. Many European countries, such as Italy, have turned to coal as natural gas and oil prices rose.

Слайд 63

Nuclear energy

potentially very cheap

the lowest carbon emissions

Nuclear

power plants generate almost 30% of the electricity produced in the EU. There are 130 nuclear reactors in operation in 14 EU countries. Each EU country decides alone whether to include nuclear power in its energy mix or not.

Слайд 64

Nuclear safety

The EU promotes the highest safety standards for all types

of civilian nuclear activity, including power generation, research, and medical use. In response to the 2011 Fukushima nuclear accident, a series of stress tests were carried out in 2011 and 2012 to measure the ability of EU nuclear installations to withstand natural disasters.

Слайд 65

Radioactive waste and decommissioning

Radioactive waste results from nuclear activities such as

electricity generation, medicine, and research. The EU's Directive for the Management of Radioactive Waste and Spent Fuel sets out rules for safely disposing of used radioactive materials.

The shutting down and decommissioning of a nuclear power plant at the end of its lifecycle is a long and expensive process. The 'Waste Directive' also requires the creation of EU member states plans for financing the safe disposal of radioactive waste during decommissioning.

Слайд 66

Nuclear energy

France is the one country that has the most

of its electricity from nuclear power. It has a dependency of approximately 75% of total electricity produced from nuclear power.

But not many people realize that even Belgium, Slovakia and Hungary have levels of dependency on nuclear energy that are of the order of 50%. And then we have Sweden that has a dependency of above 40%.

Слайд 67

Nuclear energy

Russian nuclear reactors in the EU are in Bulgaria

(2), Czech Republic (6), Finland (2), Hungary (4) and Slovakia (4, with two more being built). Hungary has an agreement for two more to be built, and Finland is planning one with Russian equity.

Слайд 68

Renewable energy

The use of renewable energy has many potential benefits,

including a reduction in greenhouse gas emissions, the diversification of energy supplies and a reduced dependency on fossil fuel markets (in particular, oil and gas).

Слайд 69

Renewable energy

The share of renewable energy in energy consumption increased

continuously between 2004 and 2015, from 8.5 % to 16.7 %, approaching the Europe 2020 target of 20 % by 2020.

Слайд 70

Renewable energy

The share of renewable energy in the Member States

was highest in Sweden (53.9 % of energy consumption) followed by Finland (39.3 %) and Latvia (37.6 %). This share was lowest in Luxembourg and Malta (both 5.0 %), the Netherlands (5.8 %) and Belgium (7.9 %).

Слайд 71

Renewable energy

This positive development has been prompted by the legally

binding (обладающий обязательным характером) targets for increasing the share of energy from renewable sources enacted by Directive 2009/28/EC on the promotion of the use of energy from renewable sources.

Слайд 72

Renewable energy in the EU

Слайд 73

Topic 3. Liberalization of EU gas and energy markets

Слайд 74

Liberalization Process: Legislation

The liberalization process of the natural gas market is

a result of the three Directives handed down by the European Commission in 1998 (98/30/EC), 2003 (2003/55/EC), and most recently in 2009 (2009/79/EC).

The Directives aimed to create an internal market for natural gas, which would theoretically lower prices and increase energy security through introducing more competition.

Слайд 75

Liberalization Process

In all of the Directives, there are several components that

comprise the bulk of the liberalization process, and they are: third party access, unbundling, contracts, and a regulatory authority.

The EU emphasized these because they were seen as the primary barriers to a competitive market.

Слайд 76

Liberalization Process

The first portion of the liberalization process requires states to

grant third parties to the gas transmission system and the gas storage system. Third-party access (TPA) is when a firm that does not own the actual pipeline or storage facility must have access to operate it, assuming certain conditions are met by both the owner and operator of the system.

Слайд 77

Liberalization Process

The 2003 Directive extended third-party access to gas storage facilities

in addition to the transmission systems. Since natural gas can be stored, storage facilities play an important role; firms that are not a part of the production process can buy gas, store it, and then eventually sell it to customers at a later date, bringing another actor into the transaction between producing country and consuming country.

Слайд 78

Liberalization . Unbundling.

The next aspect of the Directives is the concept

of unbundling.

At its core, unbundling is separating vertically integrated companies, forcing firms either to be only involved in either production or transmission or distribution.

Emphasizing unbundling is supposed to facilitate the entry of more actors in the market, thus making it more competitive.

Слайд 79

Liberalization. Interruptible contracts

The EU Directives is encouraging shorter and interruptible contracts,

starting in 2003.

The 2009 Directive went further and told Member States explicitly that they “should encourage the development of interruptible supply contracts”.

Слайд 80

Liberalization. Regulatory authority

The last major area of focus in liberalization reform

is the creation of a regulatory authority.

Chapter IX of Directive 2009/72/EC requires each Member State to designate a single National Regulatory Authority (NRA). Member States may designate other regulatory authorities for regions within the Member State, but there must be a senior representative at national level. Member States must ensure that the NRA is able to carry out its regulatory activities independently from government and from any other public or private entity.

Слайд 81

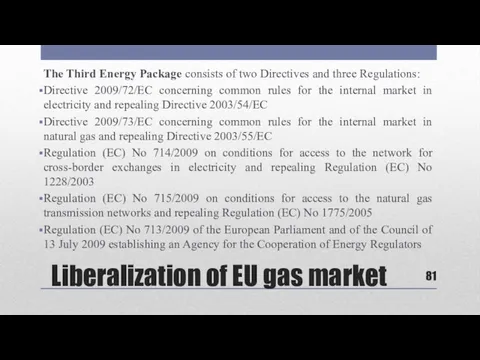

Liberalization of EU gas market

The Third Energy Package consists of two

Directives and three Regulations:

Directive 2009/72/EC concerning common rules for the internal market in electricity and repealing Directive 2003/54/EC

Directive 2009/73/EC concerning common rules for the internal market in natural gas and repealing Directive 2003/55/EC

Regulation (EC) No 714/2009 on conditions for access to the network for cross-border exchanges in electricity and repealing Regulation (EC) No 1228/2003

Regulation (EC) No 715/2009 on conditions for access to the natural gas transmission networks and repealing Regulation (EC) No 1775/2005

Regulation (EC) No 713/2009 of the European Parliament and of the Council of 13 July 2009 establishing an Agency for the Cooperation of Energy Regulators

Слайд 82

Topic 4. EU energy diplomacy and external actions

Слайд 83

Internal and external energy policies cannot be separated from each other

due to their complimentary nature.

High import dependency trends highlight that the Union is in urgent need for a common approach to external energy policy which would shape relations and partnerships of Europe with global energy actors being consumers, producers, transit countries or major companies

Слайд 84

Concerning its ambitious goals about sustainability, renewable resources and fight against

climate change the EU is aware that the efforts of its members have to be combined with the cooperation of other consumer states, developing countries or producer states in order to obtain effective outcomes.

Слайд 85

In the study of external energy policy of Europe it is

possible to classify it under three major strategies:

1). the extension of internal energy policies and internal energy market to the international arena, which is also based on the integration of energy into broader external relations, which would eventually end up with a pan-European Energy Community

2). dialogue with third parties

3). diversification is the last major strategy as it basically indicates the strengthening of existing infrastructures and construction of new ones for alternative energy supplies

Слайд 86

Pan-European Energy Community is “common regulatory space” in other words “common

trade, transit and environment rules” between the Member States and EU neighboring countries.

The extension of EU’s own internal market to its neighbors and partners is the strategy that the policy makers are trying to pursue with the argument that only well-functioning international market can assure affordable oil and gas supplies and encourage new investments.

Слайд 87

European Neighbourhood Policy

In the European Neighbourhood Policy Strategy Paper, the

Commission indicates that “Enhancing our strategic energy partnership with neighbouring countries is a major element of the European Neighbourhood Policy”. Hence, in order to increase energy cooperation with EU neighbouring countries which are key players in the energy supply security as suppliers (such as Southern Caucasus countries, Algeria, Egypt and Libya) or as transit countries (Ukraine, Belarus, Morocco and Tunisia), ENP is a way to institutionalize external energy dialogues.

Слайд 88

EU energy goals require efficient usage of financial instruments through European

Investment Bank (EIB), European Bank for Reconstruction and Development (EBRD), Neighbourhood Investment Fund.

Слайд 89

The Kyoto Protocol (1997)

The Kyoto Protocol is an international agreement which

is intended to lower the greenhouse gas emissions of the industrialized world by 2012. Ideally, the end result of the Kyoto Protocol should be a reduction of these emissions to below 1990 levels. The agreement also addresses the issue of the developing world, which is rapidly industrializing and therefore producing a large volume of greenhouse gases.

Слайд 90

NORWAY

Norway is the second major natural gas and oil supplier

to the European Union.

June 1971 is the beginning of the production in the Norwegian continental shelf, and since then twenty billion

barrels of oil have been extracted from the area.

Слайд 91

Norway

Norway differs from other energy suppliers to the Union because

it is a member of European Economic Area. The legislation concerning EU’s internal energy market and related policy arrangements about competition law, environmental regulations, consumer rights and new technologies are already implemented by Norway.

Слайд 92

Norway

Not only the EU needs Norway as a reliable oil

and gas supplier but also Norway needs the EU since EU Members namely, Germany, United Kingdom, France, Belgium, the Netherlands account for the majority of Norway’s natural gas exports in 2008.

Слайд 93

Norway

Norway and the EU act together to further develop their

partnership. The Commission as well emphasizes the potential of Norway in the maximization of Europe’s energy security and suggests the promotion of common exploration projects in the Norwegian continental shelf and the promotion of alternative energy production such as offshore wind in the North Sea

Слайд 94

Africa

Concerning EU’s dialogue with Africa, energy is incorporated within the

development and governance issues. Poverty reduction projects and improvement of energy delivery systems to rural areas attracts the Union’s interests and to this end, initiatives and aid funds are offered.

The example is the EU Initiative for Poverty Eradication and Sustainable Development launched in 2002

Слайд 95

Africa

In the region, the EU policy makers associate the Union’s

energy interests with broader political and security considerations. Still, due to high instability in the region, EU’s efforts remain insufficient in the implementation of development projects. To illustrate despite being the fourth major natural gas supplier of the EU, Nigeria remained as the Africa’s “most under-funded state” since corruption and lack of transparency hindered investment efforts. Instead of rule of law, oil contracts and government positions were used as political means to “buy off” militants.

Слайд 96

Africa

Nevertheless, Africa, more specifically North Africa has a significant potential

not only in hydrocarbons but also in renewable energy sources. Despite the inconvenient conditions for investments, secure extraction and transportation of resources, Algeria, Egypt, Libya and Nigeria outstand as important suppliers after Russia and Norway, especially in natural gas imports.

Слайд 97

Middle East

Middle East is the world’s important energy producing region and

world’s richest proven oil and natural gas reserves belong to the region. Seeking ways to guarantee its energy security, EU aims to institutionalize its energy relations with the region, especially with the Persian Gulf countries some such as Iraq, Kuwait, Qatar, Saudi Arabia and United Arab Emirates being member of Organization of Petroleum Exporting Countries (OPEC).

Слайд 98

Middle East

Despite the Union’s intense energy dialogues with Russia or Caspian

region, Middle East remains as a “critical player in energy policy” especially due to its rich resources, geographical advantages and its potential to stabilize world market prices in line with its oil supply capacity.

Слайд 99

Middle East

Concerning the region, EU’s effort to achieve international cooperation in

energy is not limited to the dialogue with the Gulf Cooperation Council. The Euro-Mediterranean Energy Partnership (Euromed) is another platform for EU to pursue its goals of energy security and sustainability. The partnership consists of EU Member States and Mediterranean and Middle Eastern partners (Algeria, Egypt, Israel, Jordon, Lebanon, Morocco, Palestinian Authority, Syria, Tunisia and Turkey) and its origins date back to 1995 the Euro-Mediterranean Conference of Ministers of Foreign Affairs.

Слайд 100

Caspian Region

Caspian region refers to five Caspian littoral states namely,

Azerbaijan, Iran, Kazakhstan, Turkmenistan and Russia.

The critical point about the region is the legal status of the Caspian Sea. With the disintegration of the Soviet Union, the determination of official sea boundary between the states emerged as a question. No agreement has been reached between the littoral states concerning the debate on whether the subject matter is a lake or sea.

Слайд 101

Caspian Region

This identification is necessary because, if the Caspian is

a sea, in line with the United Nations Convention on the Law of the Sea, bordering countries will be able to claim 12 miles from the shore as

their territorial waters and beyond that a 200-mile exclusive economic zone and this will cause an uneven distribution of oil and natural gas resources in the basin.

Слайд 102

Caspian Region

Apart from the legal status of the potential reserves,

the fact that Azerbaijan, Kazakhstan and Turkmenistan are landlocked states, the construction of oil and natural gas transit routes create a further challenge for the region.

Слайд 103

Caspian Region

The institutionalization of relations with the Caspian Region countries:

the

INOGATE, Interstate Oil and Gas Transport to Europe program

Baku Initiative

the Black Sea initiative

Слайд 104

Caspian Region

Energy outstands as the main item among the imports

from the region.

Nevertheless, mineral fuels imported from the region represent very small shares among total imports of EU from the world market. Azerbaijan, Turkmenistan, Kazakhstan and Iran correspond to only 2.3%, 0.3%, 3.4 % and 2.8% of EU’s total imports, respectively. Compared with the region’s oil and gas reserves, these results indicate that the potential of these countries is not being efficiently used, yet.

Слайд 105

Southern Gas Corridor

The Southern Gas Corridor is an initiative of the

European Commission for the natural gas supply from Caspian and Middle Eastern regions to Europe. The goals of the Southern Gas Corridor are to reduce Europe's dependency on Russian gas and add diverse sources of energy supply. The route from Azerbaijan to Europe consists of the South Caucasus Pipeline, the Trans-Anatolian Pipeline, and the Trans-Adriatic Pipeline (under construction). The total investment of this route is estimated US$45 billion. The main supply source would be the Shah Deniz gas field, located in the Caspian Sea.

Слайд 106

Topic 4. The EU-Russia energy dialog

Слайд 107

Russia is the main exporter of energy resources to the European

Union. This distinguishes Russia from other energy partners and urges the Union to develop a special partnership with it, as part of EU energy security strategy.

Слайд 108

When Russia’s internal energy sector is examined the most outstanding feature

is state’s control over resources. Russia’s oil exports are under the jurisdiction of Transneft which is Russia’s state owned pipeline monopoly.

Three oil pipelines:

Druzhba Pipeline

the Baltic Pipeline System (BPS)

Adria Pipeline

Слайд 109

Concerning the natural gas sector, again a state run monopoly, Gazprom

accounts for almost 90% of Russian natural gas production and controls the country’s gas exports.

Main gas pipelines:

1. NORD STREAM

Capacity: 55 billion cubic meters per year. Partners: Gazprom, Wintershall, E.ON, Gasunie, Engie.

The Nord Stream pipeline became operational in 2011. First proposed in 1997, disputes between Kiev and Moscow in 2006 and 2009 prompted Russia to stop natural gas flows through Ukraine, depriving Europe of natural gas and accelerating Nord Stream construction. The pipeline enables Russia to deliver energy directly to Germany and parts of Central Europe.

Слайд 110

2. NORTHERN LIGHTS AND YAMAL EUROPE

Capacity: 84 bilion cubic meters per

year. Partners: Gazprom, Beltrangaz, PGNiG.

The Northern Lights and Yamal-Europe pipelines are two major systems that deliver Russian gas to Eastern Europe.

3. SOYUZ

Capacity: 26 billion cubic meters per year. Partners: Gazprom, Ukrtransgaz.

The Soyuz and Brotherhood pipelines are Gazprom’s major export routes for delivering gas to Europe through Ukraine. They have a total capacity of over 150 billion cubic meters. In an effort to avoid using Ukraine as a transit state, Gazprom is seeking alternative routes from 2019 onward.

Слайд 111

4. BLUE STREAM

Capacity: 16 bilion cubic meters per year (expanding to

19 bcm). Partners: Gazprom, BOTAS, Eni.

One of two major pipeline systems that Gazprom uses to deliver natural gas to Turkey. Gazprom can deliver about 16 bcm to Turkey via Ukraine, and another 16 bcm directly to Turkey via Blue Stream. At the moment, neither pipeline alone has the capacity to meet Turkey’s energy demands. In 2014, Turkey and Russia agreed to expand the capacity of Blue Stream by 3 bcm.

5. RUSSIAN GAS-WEST PIPELINE

Capacity: 16 billion cubic meters per year. Partners: BOTAS, Transgaz, Bulgartransgaz.

The Russian Gas-West pipelines deliver gas to Turkey through Ukraine, Romania and Bulgaria. In the future Turkish demand will exceed both the existing pipelines’ capacity and a third will be needed.

Слайд 112

6. NORD STREAM 2

Capacity: 55 billion cubic meters per year. Partners:

Gazprom, Shell, OMV, E.ON.

Gazprom signed a memorandum of understanding with Shell, OMV, and E.ON at the 2015 St Petersburg International Economic Forum to build the Nord Stream-2 pipeline. As proposed, Nord Stream-2 would be the same size as the original pipeline and go operational in late 2019. The pipeline will increase capacity over time to balance out reduced North Sea production.

7. TURKISH STREAM

Capacity: 63 billion cubic meters per year. Partners: BOTAS, Gazprom.

The pipeline is designed to provide an alternative route to deliver natural gas into southern Europe, bypassing Ukraine.

Слайд 113

8. EASTRING PIPELINE

Capacity: 20 billion to 40 billion cubic meters per

year. Partners: Eustream, Transgaz, Bulgartransgaz.

Eastring would connect infrastructure in Slovakia to Romania and Bulgaria. Slovakia has taken the lead on the project and even suggested connecting to TurkStream. Bratislava wants to be part of Gazprom’s plans to diversify transit options away from Ukraine because Slovakia is the critical link between pipelines in Ukraine and central Europe.

9. SOUTH STREAM

Capacity: 63 billion cubic meters per year. Partners: Gazprom, Eni, others.

South Stream was a pipeline system that would have sent gas from Russia to Bulgaria across the Black Sea and then onward through Serbia into Central Europe. Gazprom canceled the project in December 2013 and is pursuing the TurkStream pipeline project instead, hoping to achieve the same strategic goal of bypassing Ukraine. The European Commission opposed South Stream and contributed to Gazprom’s cancellation of the project.

Слайд 114

The institutionalization of EU-Russia relationship concerning energy can be identified by

three main legal grounds: European Energy Charter, EU-Russia Energy Dialogue and “Four Common Spaces”. However, the initial move which transformed this relationship into a “partnership” is the ten year bilateral treaty Partnership and Cooperation Agreement (PCA) which came into force in 1997. Article 65 of the Agreement directly addresses energy and offers cooperation in issues such as supply security, infrastructure, energy efficiency and formulation of energy policy.

Слайд 115

Due to Russia’s non-ratification of Energy Charter Treaty, the relationship between

EU and Russia has to be conducted in another platform. EU-Russia Summits compensated this deficiency and helped to increase the coordination between the parties.

In May 2003, EU and Russia decided to set a framework for cooperation. As the name suggested the new framework “Four

Common Spaces” focused on four main areas: economy, foreign and security policy, justice and home affairs, and culture, information and education”, energy being included under the economy section.

Загрязнение пластиком океанов России

Загрязнение пластиком океанов России Экологические общественные организации

Экологические общественные организации Человек- ты за все в ответе

Человек- ты за все в ответе Государственное регулирование природоохранной деятельности

Государственное регулирование природоохранной деятельности Изучение факторов формирования склоновых ландшафтов города Уфа

Изучение факторов формирования склоновых ландшафтов города Уфа Экологические проблемы химической промышленности. Производство неорганических веществ

Экологические проблемы химической промышленности. Производство неорганических веществ История экологического образования в России

История экологического образования в России Альтернативные источники энергии

Альтернативные источники энергии Демографическая информация в исследованиях по экологии человека

Демографическая информация в исследованиях по экологии человека Собирайка. Социально-экологический проект для школ и детских садов города Санкт-Петербурга

Собирайка. Социально-экологический проект для школ и детских садов города Санкт-Петербурга Презентация Табигатьне саклыйк!!!

Презентация Табигатьне саклыйк!!! Учение о биосфере В.И. Вернадского

Учение о биосфере В.И. Вернадского Оценка рекреационного потенциала городских лесов г. Ижевска и мероприятия по его улучшению

Оценка рекреационного потенциала городских лесов г. Ижевска и мероприятия по его улучшению Техногенные ландшафты

Техногенные ландшафты Забруднення навколишнього середовища

Забруднення навколишнього середовища Рациональное природопользование в профессии дизайнера среды

Рациональное природопользование в профессии дизайнера среды Обеспечение пожарной и экологической безопасности при функционировании АЗС в г.Уфе(на примере АЗС № 02-101 ООО АНК Башнефть)

Обеспечение пожарной и экологической безопасности при функционировании АЗС в г.Уфе(на примере АЗС № 02-101 ООО АНК Башнефть) Влияние загрязнения атмосферы на человека и окружающую среду

Влияние загрязнения атмосферы на человека и окружающую среду Принципы гигиенической регламентации факторов окружающей среды

Принципы гигиенической регламентации факторов окружающей среды взаимоотношения с природой в исламе

взаимоотношения с природой в исламе Ліси. День без паперу

Ліси. День без паперу День заповедников и парков 2022

День заповедников и парков 2022 Птицы на кормушках

Птицы на кормушках Ecological problems

Ecological problems У природі все взаємопов'язано

У природі все взаємопов'язано Право природопользования

Право природопользования Тимуровский отряд Прометей

Тимуровский отряд Прометей Мы выбираем здоровье

Мы выбираем здоровье