Содержание

- 2. CONTENT: 1. General definitions and terms of GE. 2. Theories of the world trade (WT). 3.

- 3. Part 1. General definitions and terms of GE.

- 4. The difference between similar terms: economic/economical Economic pertains to the economy. Economical means not wasteful. economy/economics

- 5. The world economy or global economy is the economy of the world, considered as the international

- 6. A subject matter of GE is WER. WER: trade of goods and services; capital flow; labour

- 7. BACKGROUND OF GE: 1. Global market. 2. International division of labour (IDL) and factors of production.

- 8. IDL - the allocation of various parts of the production process to different places in the

- 9. GENERAL MEANING OF THE TERM «GE»: a system of world economic relations, national economies` cooperation; a

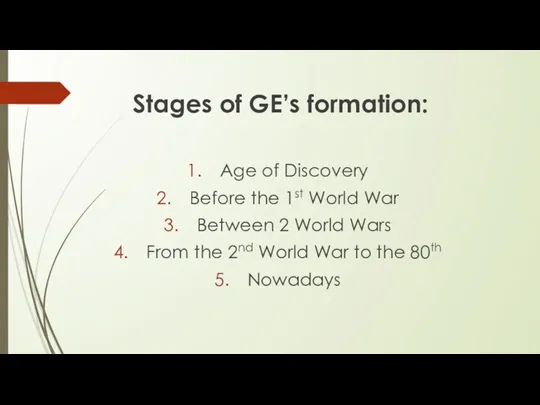

- 10. Stages of GE’s formation: Age of Discovery Before the 1st World War Between 2 World Wars

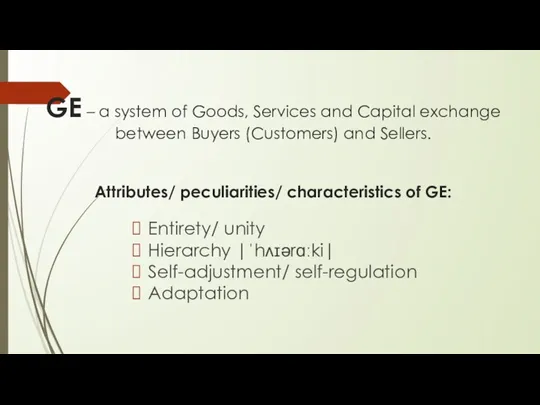

- 12. GE – a system of Goods, Services and Capital exchange between Buyers (Customers) and Sellers. Attributes/

- 13. Part 2. Theories of WT.

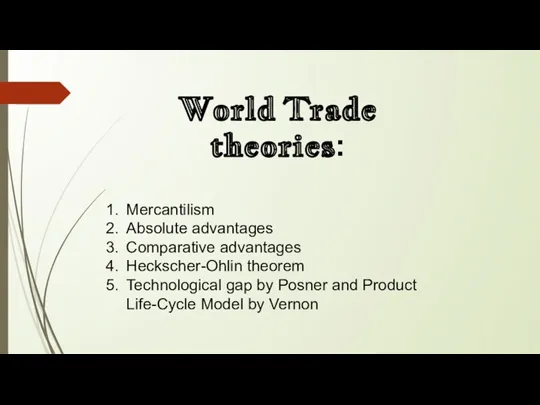

- 14. World Trade theories: Mercantilism Absolute advantages Comparative advantages Heckscher-Ohlin theorem Technological gap by Posner and Product

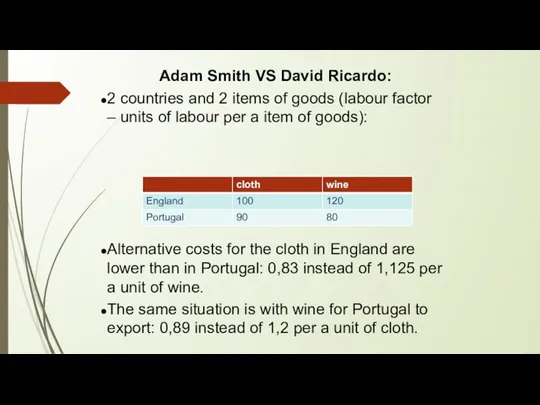

- 15. Adam Smith VS David Ricardo: 2 countries and 2 items of goods (labour factor – units

- 16. Basics of Heckscher Ohlin theory: 2 countries 2 items of goods – cloth and food 2

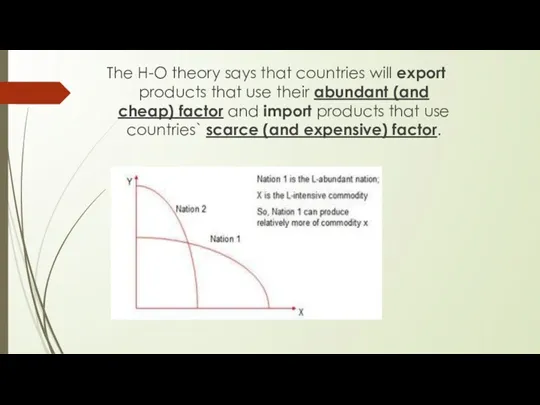

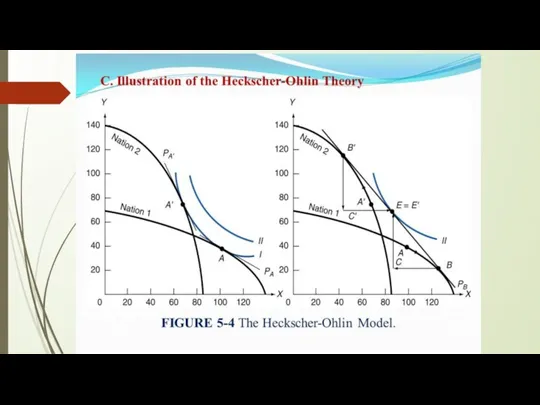

- 17. The H-O theory says that countries will export products that use their abundant (and cheap) factor

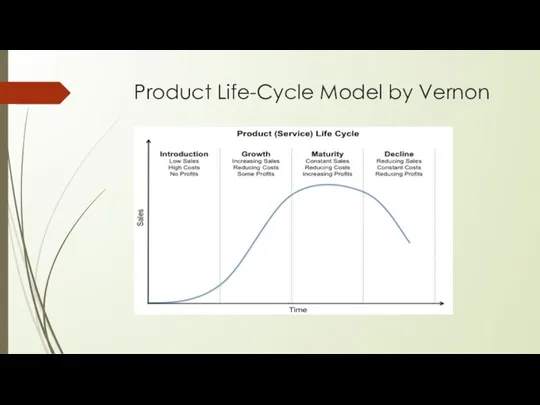

- 19. Product Life-Cycle Model by Vernon

- 20. Part 3. WT regulation. Free trading and protectionism. INCOTERMS 2010.

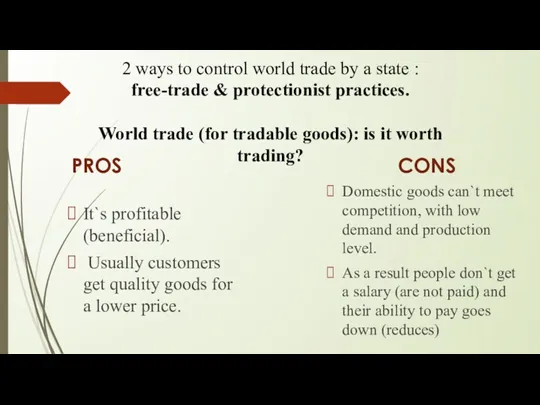

- 21. 2 ways to control world trade by a state : free-trade & protectionist practices. World trade

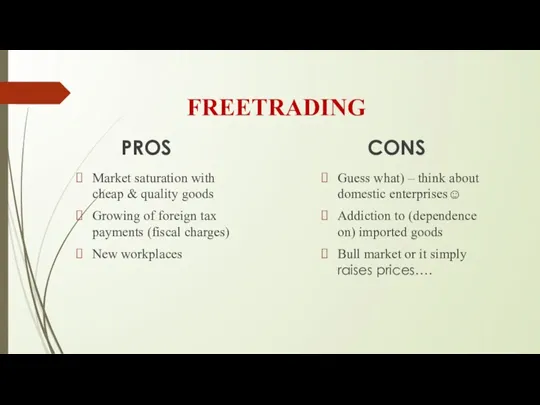

- 22. FREETRADING PROS Market saturation with cheap & quality goods Growing of foreign tax payments (fiscal charges)

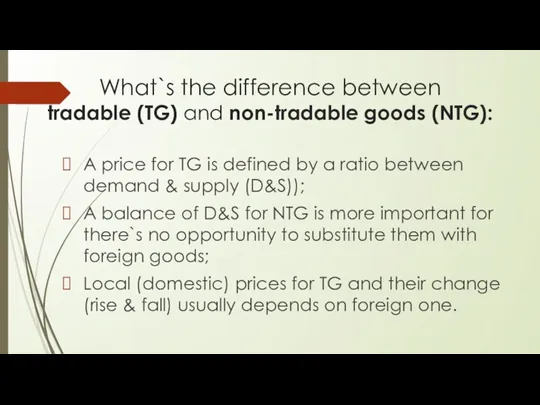

- 23. What`s the difference between tradable (TG) and non-tradable goods (NTG): A price for TG is defined

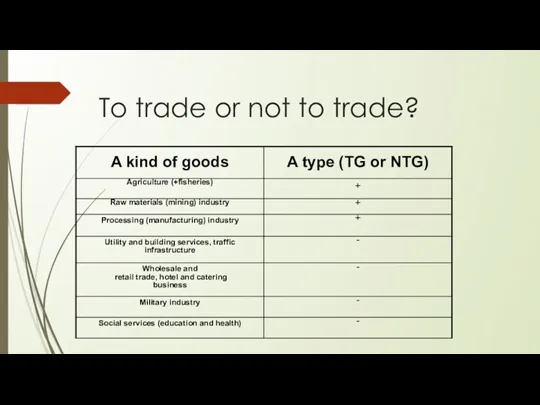

- 24. To trade or not to trade?

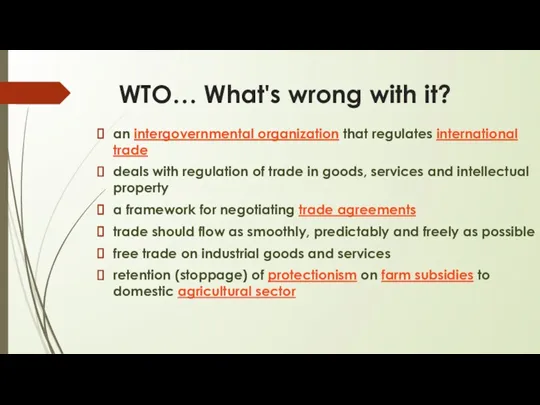

- 25. WTO… What's wrong with it? an intergovernmental organization that regulates international trade deals with regulation of

- 26. 2012….How long and difficult was it… Is it worth doing that?

- 27. 5 principles of WTO: Non-discrimination (MFN) Reciprocity (mutual agreement or win-win☺) Binding and enforceable commitments (legitimate

- 28. Let`s have a small talk about world trade regulation… Should it be regulated at all? No

- 29. Eurasian Economic Union is an economic union of states located primarily in northern Eurasia. The Treaty

- 30. 4 degrees of freedom given by EAEU: Goods Services Capital Labour

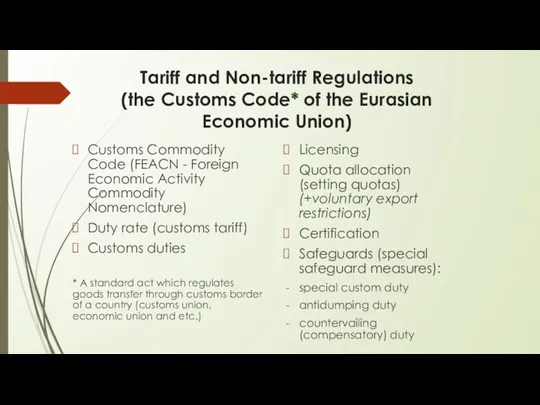

- 31. Tariff and Non-tariff Regulations (the Customs Code* of the Eurasian Economic Union) Customs Commodity Code (FEACN

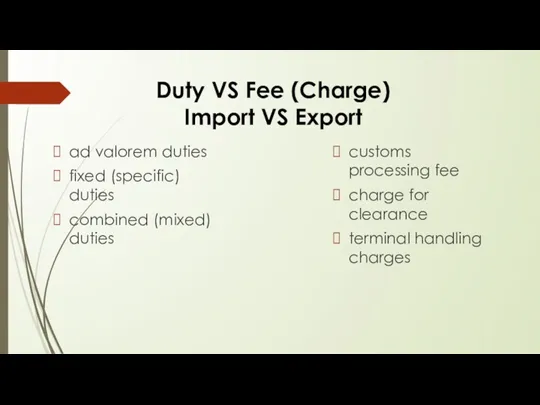

- 32. Duty VS Fee (Charge) Import VS Export ad valorem duties fixed (specific) duties combined (mixed) duties

- 33. How does Russia trade with other countries? General rate of duties Most favoured nation treatment Preferential

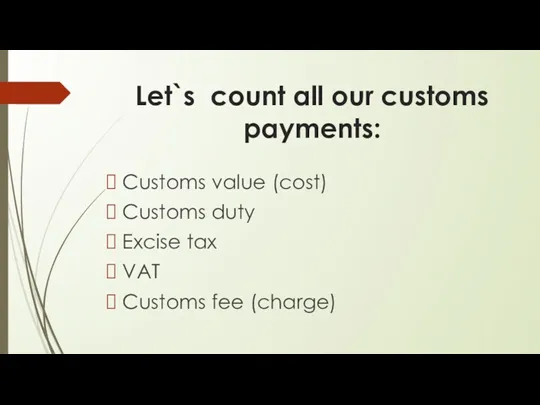

- 34. Let`s count all our customs payments: Customs value (cost) Customs duty Excise tax VAT Customs fee

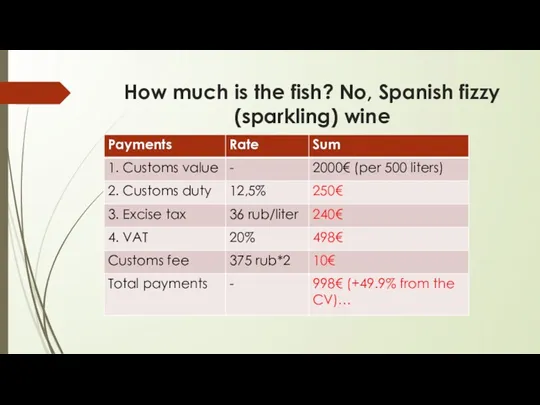

- 35. How much is the fish? No, Spanish fizzy (sparkling) wine

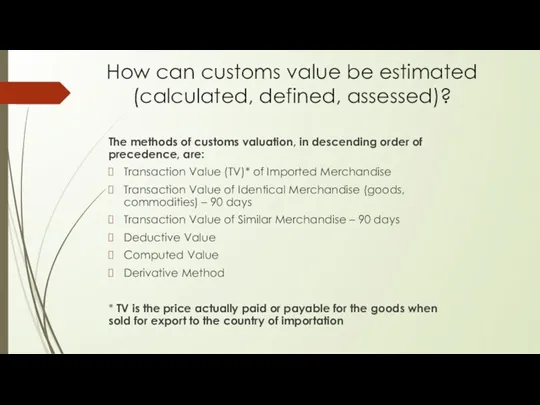

- 36. How сan customs value be estimated (calculated, defined, assessed)? The methods of customs valuation, in descending

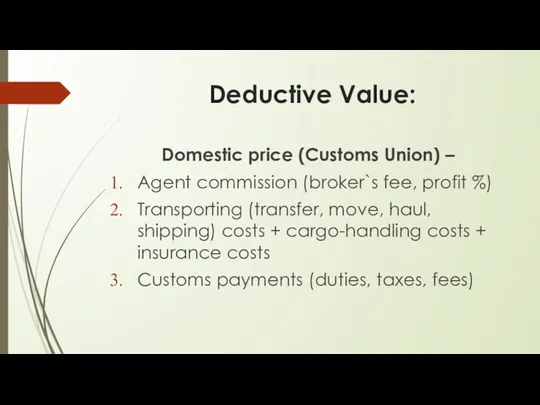

- 37. Deductive Value: Domestic price (Customs Union) – Agent commission (broker`s fee, profit %) Transporting (transfer, move,

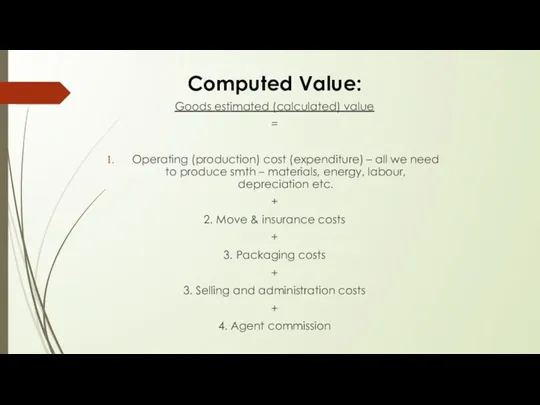

- 38. Computed Value: Goods estimated (calculated) value = Operating (production) cost (expenditure) – all we need to

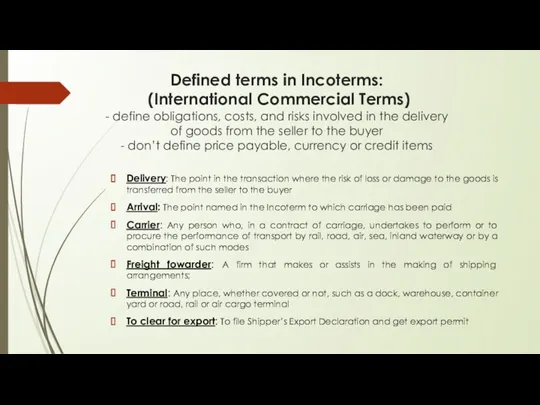

- 39. Defined terms in Incoterms: (International Commercial Terms) - define obligations, costs, and risks involved in the

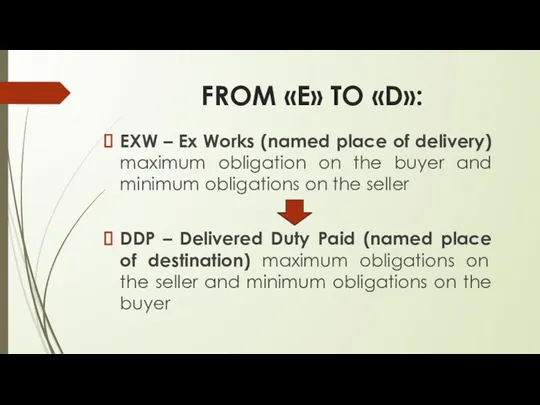

- 40. FROM «E» TO «D»: EXW – Ex Works (named place of delivery) maximum obligation on the

- 41. Part 4. Economic integration.

- 42. The Economic Integration between two countries is a measure of how much two or more countries

- 43. Economic integration: is the unification of economic policies between different states; the partial or full abolition

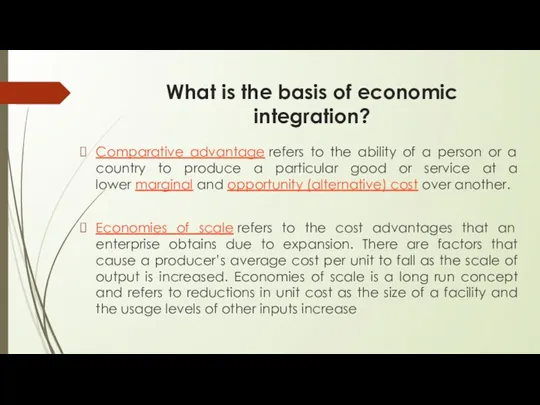

- 44. What is the basis of economic integration? Comparative advantage refers to the ability of a person

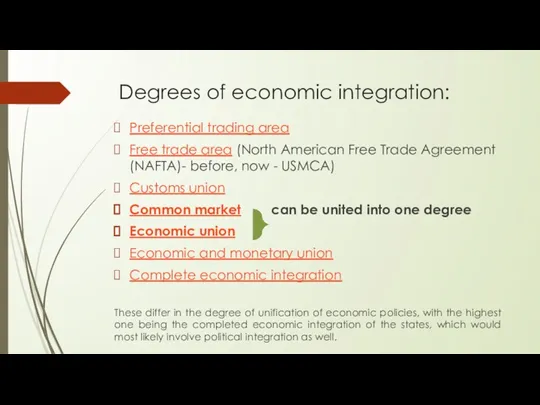

- 45. Degrees of economic integration: Preferential trading area Free trade area (North American Free Trade Agreement (NAFTA)-

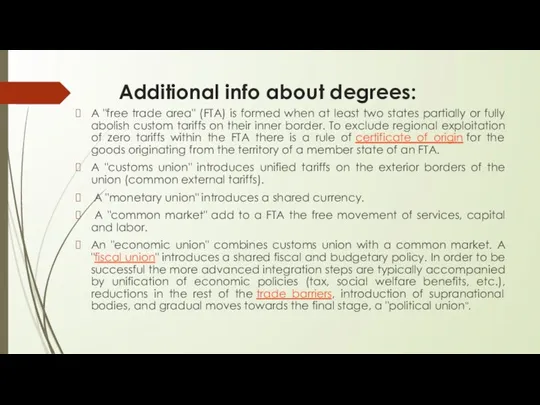

- 46. Additional info about degrees: A "free trade area" (FTA) is formed when at least two states

- 47. Pros and Cons of Economic Integration: Trade benefits: a reduction in the trade cost; an improved

- 49. Скачать презентацию

Производство человеческого капитала. Инвестиции в человеческий капитал

Производство человеческого капитала. Инвестиции в человеческий капитал Социальная сфера в системе национальной экономики

Социальная сфера в системе национальной экономики Анализ рынка труда Курской области

Анализ рынка труда Курской области Особенности экономического развития современной Италии

Особенности экономического развития современной Италии Что такое эконометрика. Модель парной регрессии

Что такое эконометрика. Модель парной регрессии Методы и методики преподавания экономических дисциплин

Методы и методики преподавания экономических дисциплин Атлас специализации регионов России

Атлас специализации регионов России Сущность экономического анализа, его содержание и задачи

Сущность экономического анализа, его содержание и задачи Рынок социальных услуг для стареющих поколений в российских городах

Рынок социальных услуг для стареющих поколений в российских городах Studiu Individual la disciplina ,,Economia Turismului”

Studiu Individual la disciplina ,,Economia Turismului” Региональная экономика и региональная политика

Региональная экономика и региональная политика Формирование уставного капитала и его назначение. Потребности в основных и оборотных средствах. Тема № 3

Формирование уставного капитала и его назначение. Потребности в основных и оборотных средствах. Тема № 3 Инфляция. Деньги

Инфляция. Деньги Предпринимательская деятельность

Предпринимательская деятельность Социально-экономические стратегии

Социально-экономические стратегии Rachunek dochodu narodowego. Wzrost i rozwój gospdoarczy

Rachunek dochodu narodowego. Wzrost i rozwój gospdoarczy Экономикалық даму модельдері: халықаралық мамандану

Экономикалық даму модельдері: халықаралық мамандану Модель рынка электроэнергии и мощности

Модель рынка электроэнергии и мощности Моделі соціальної політики держав з ринковою економікою. Японська модель

Моделі соціальної політики держав з ринковою економікою. Японська модель Prospective Areas of Collaboration

Prospective Areas of Collaboration Статические модели исследования операций в экономике

Статические модели исследования операций в экономике Специфика и следствия российского монополизма

Специфика и следствия российского монополизма Преступления в сфере экономической деятельности

Преступления в сфере экономической деятельности Эластичность спроса и предложения

Эластичность спроса и предложения Цифрова економіка та електронна комерція. Загальний огляд та перспективи реалізації в Україні

Цифрова економіка та електронна комерція. Загальний огляд та перспективи реалізації в Україні Экономическая эффективность

Экономическая эффективность Анализ внешней среды предприятия ЗАО Костромской завод автокомпонентов

Анализ внешней среды предприятия ЗАО Костромской завод автокомпонентов Анализ и алгоритм входа. Анализ старших и младших таймфреймов. Фаза рынка. (Занятие 3)

Анализ и алгоритм входа. Анализ старших и младших таймфреймов. Фаза рынка. (Занятие 3)