Содержание

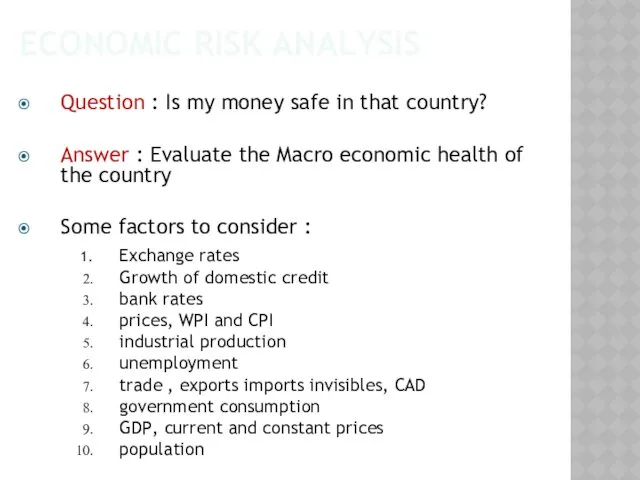

- 2. ECONOMIC RISK ANALYSIS Question : Is my money safe in that country? Answer : Evaluate the

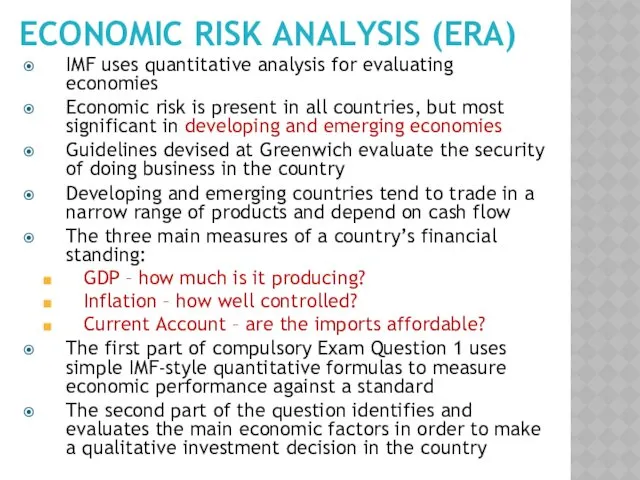

- 3. ECONOMIC RISK ANALYSIS (ERA) IMF uses quantitative analysis for evaluating economies Economic risk is present in

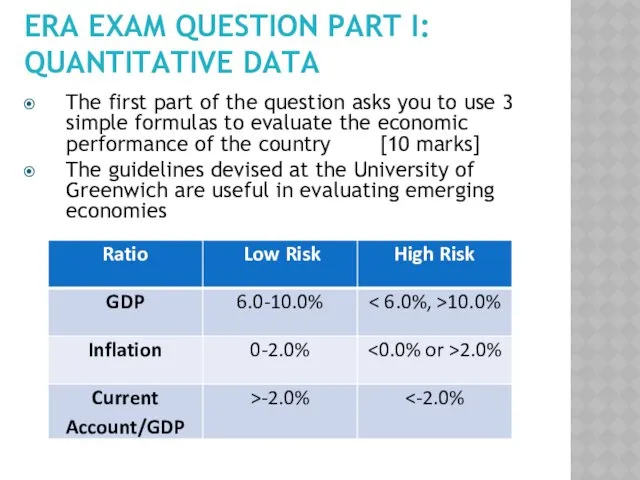

- 4. ERA EXAM QUESTION PART I: QUANTITATIVE DATA The first part of the question asks you to

- 5. FINDING THE DATA Most of the data is available from the World Bank The data is

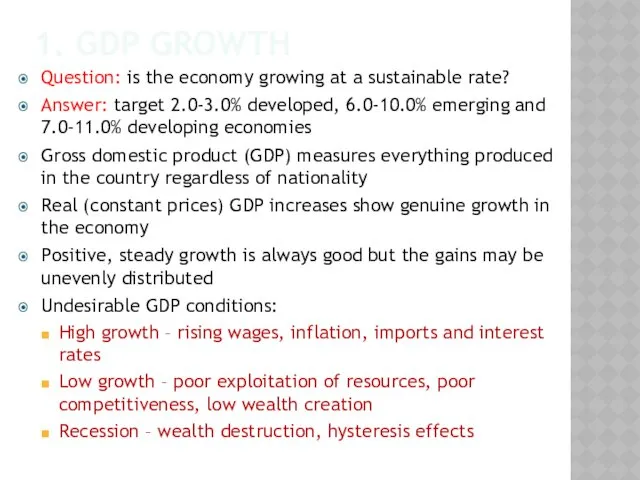

- 6. 1. GDP GROWTH Question: is the economy growing at a sustainable rate? Answer: target 2.0-3.0% developed,

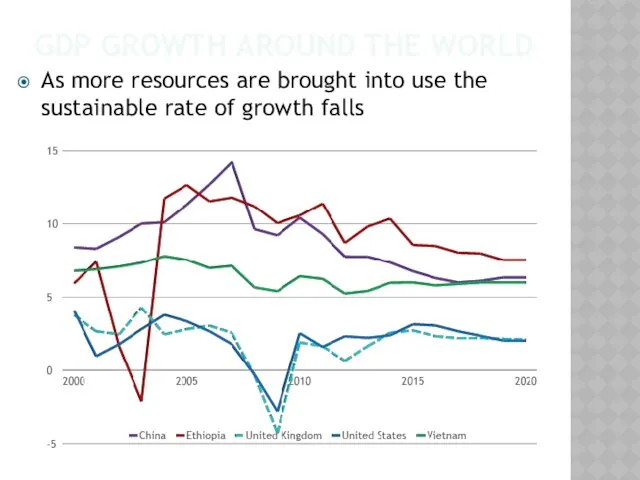

- 7. GDP GROWTH AROUND THE WORLD As more resources are brought into use the sustainable rate of

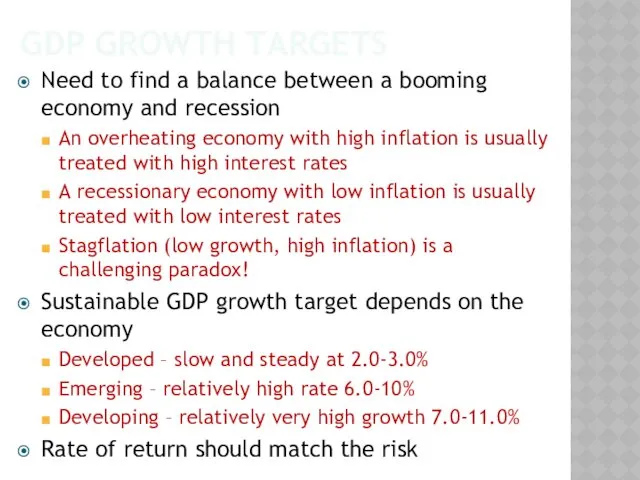

- 8. GDP GROWTH TARGETS Need to find a balance between a booming economy and recession An overheating

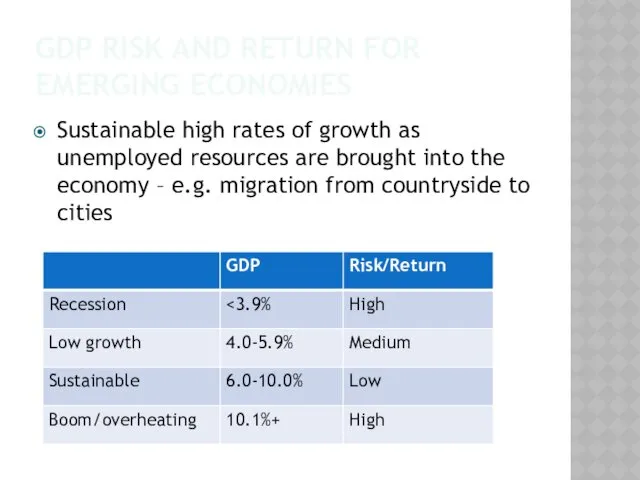

- 9. GDP RISK AND RETURN FOR EMERGING ECONOMIES Sustainable high rates of growth as unemployed resources are

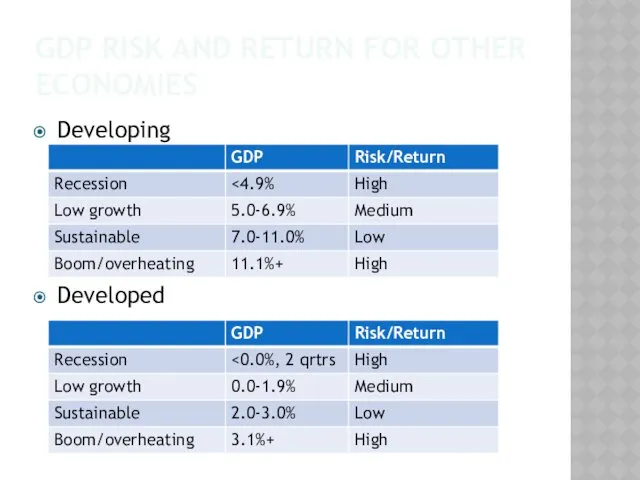

- 10. GDP RISK AND RETURN FOR OTHER ECONOMIES Developing Developed

- 11. 2: INFLATION – % CONSUMER PRICES

- 12. INFLATION Question: Are prices under control? Answer: compare the inflation with the 2.0% target Various measures

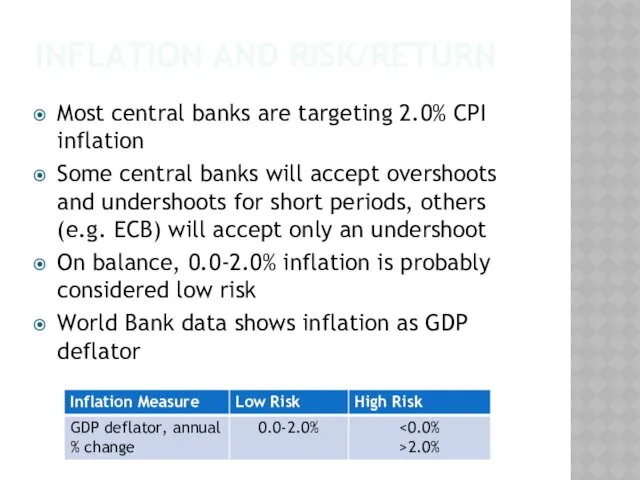

- 13. INFLATION AND RISK/RETURN Most central banks are targeting 2.0% CPI inflation Some central banks will accept

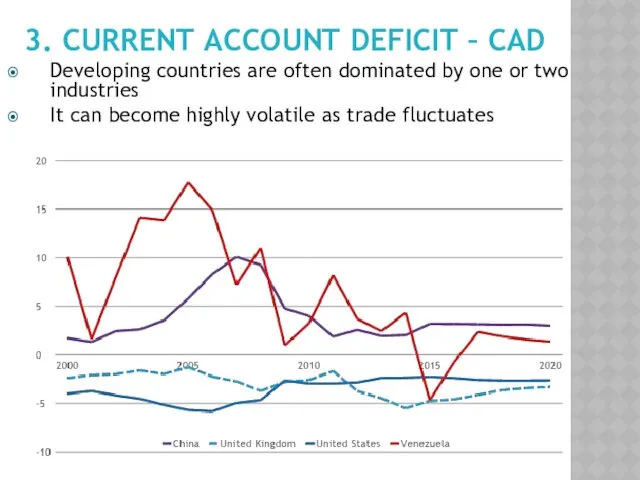

- 14. 3. CURRENT ACCOUNT DEFICIT – CAD Developing countries are often dominated by one or two industries

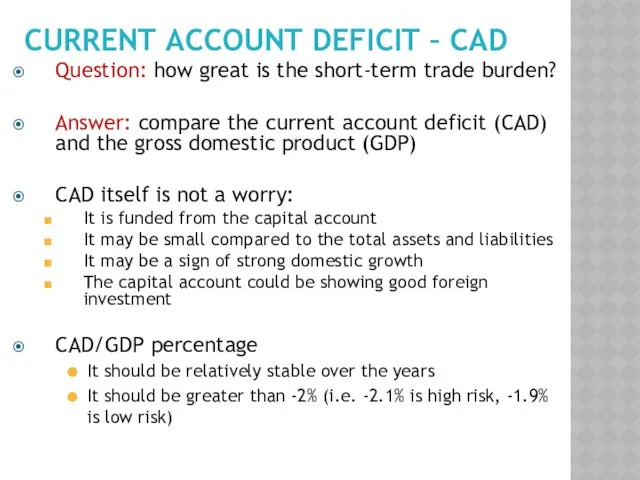

- 15. CURRENT ACCOUNT DEFICIT – CAD Question: how great is the short-term trade burden? Answer: compare the

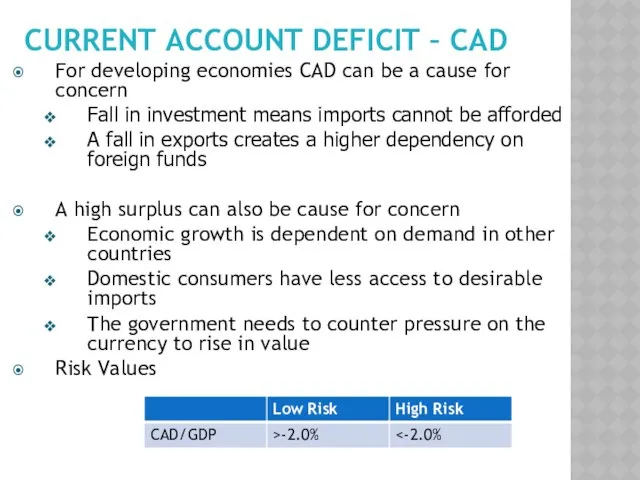

- 16. CURRENT ACCOUNT DEFICIT – CAD For developing economies CAD can be a cause for concern Fall

- 17. DEVELOPED COUNTRY COMPARISON: USA Our analysis shows that GDP growth and inflation are both low risk

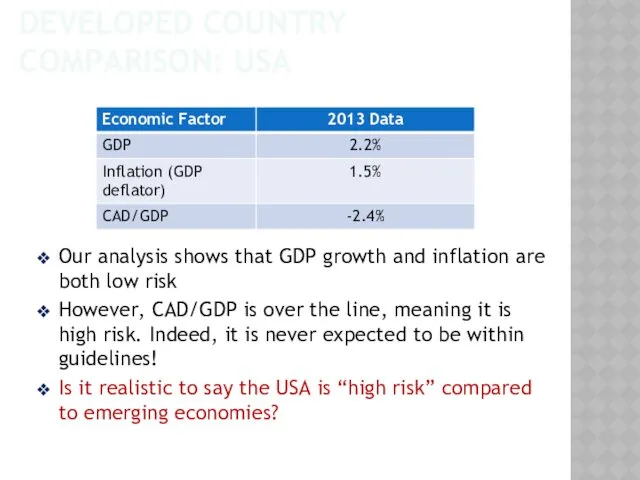

- 18. CRITICISM OF THE IMF QUANTITATIVE APPROACH Many feel that the IMF style of analysis does more

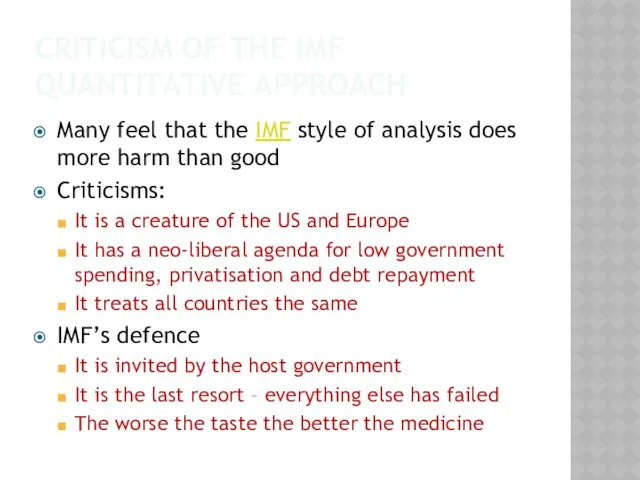

- 19. ERA EXAM QUESTION PART II: FDI INVESTMENT DECISION The second half of Exam Question 1 concerns

- 20. FACTORS INFLUENCING FDI The economic factors that are appropriate to the FDI decision depend upon the

- 21. GREENWICH MNEMONIC - GLIFTS GLIFTS is only there to help you remember – it should not

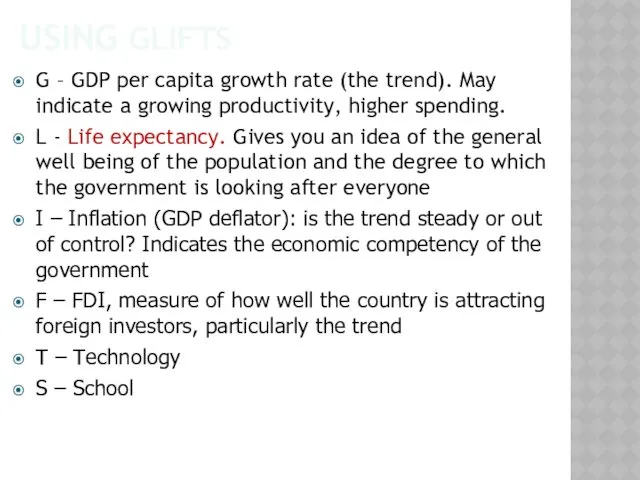

- 22. USING GLIFTS G – GDP per capita growth rate (the trend). May indicate a growing productivity,

- 23. OTHER INTERESTING DATA… An entrepreneur will browse data looking for items of interest This is when

- 24. SEMINAR TASK Come prepared with your calculators. We will be doing two sets of exercises Working

- 26. Скачать презентацию

Планирование и прогнозирование социально-экономического развития

Планирование и прогнозирование социально-экономического развития Конкуренция и модели современного рынка

Конкуренция и модели современного рынка Финансовая система и фискальная политика государства

Финансовая система и фискальная политика государства Безработица. Трудоспособное и нетрудоспособное население

Безработица. Трудоспособное и нетрудоспособное население Теория общественного выбора. (Тема 14)

Теория общественного выбора. (Тема 14) Фінансування міжнародного валютного фонду

Фінансування міжнародного валютного фонду Характеристика логистической инфраструктуры Алжира

Характеристика логистической инфраструктуры Алжира Макроэкономическое равновесие. Модель AD –AS. Кейнсианская модель

Макроэкономическое равновесие. Модель AD –AS. Кейнсианская модель Производство и издержки

Производство и издержки Производство продукции растениеводства в 2018 году, млн.тонн

Производство продукции растениеводства в 2018 году, млн.тонн Экономическая безопасность на мезо-уровне

Экономическая безопасность на мезо-уровне Транспорттағы метеорологиялық болжамдардың экономикалық тиімділігі

Транспорттағы метеорологиялық болжамдардың экономикалық тиімділігі Economics and management of network. Industries

Economics and management of network. Industries Економічна таблиця Франсуа Кене та її наукове значення

Економічна таблиця Франсуа Кене та її наукове значення Индекс производительности труда

Индекс производительности труда Теория производства

Теория производства Особенности политики профсоюзов в области заработной платы

Особенности политики профсоюзов в области заработной платы Международное движение капитала. Сущность и формы вывоза капитала

Международное движение капитала. Сущность и формы вывоза капитала PEST-анализ

PEST-анализ Розрахунково - графічна робота Регіональна економіка

Розрахунково - графічна робота Регіональна економіка История управления человеческими ресурсами в американской системе

История управления человеческими ресурсами в американской системе Новости. На российском Дальнем Востоке появится McDonald’s

Новости. На российском Дальнем Востоке появится McDonald’s Исследовательский проект по экономике Путевка в жизнь

Исследовательский проект по экономике Путевка в жизнь Добыча нефти

Добыча нефти Регионоведение. Введение

Регионоведение. Введение Модели и методы в институциональной экономической теории

Модели и методы в институциональной экономической теории Школа институционализма

Школа институционализма Царство пиццы (бизнес-план)

Царство пиццы (бизнес-план)