Содержание

- 2. Topic 7. International trade under increasing returns to scale and imperfect competition on the markets. Lecture

- 3. Monopolistic competition Krugman P. (1979) Increasing returns, monopolistic competition, and international trade, Journal of International Economics

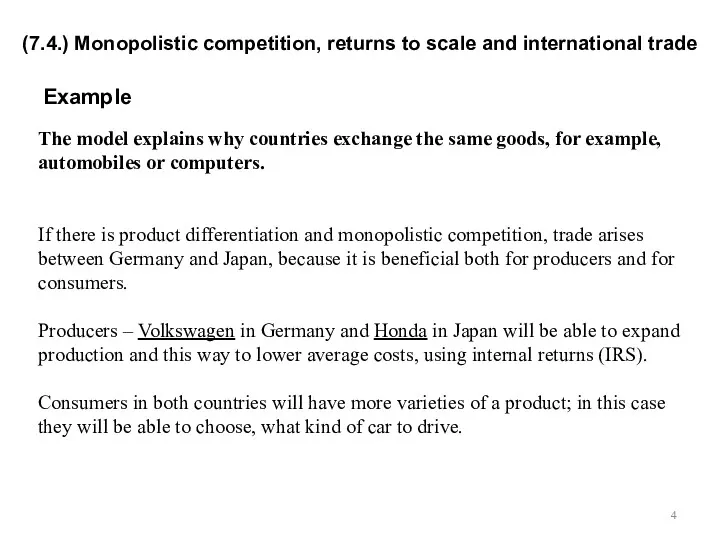

- 4. Example The model explains why countries exchange the same goods, for example, automobiles or computers. If

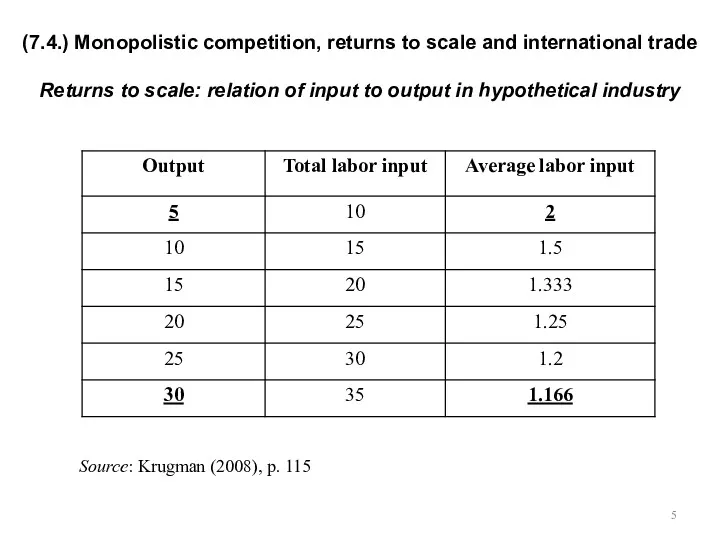

- 5. (7.4.) Monopolistic competition, returns to scale and international trade Returns to scale: relation of input to

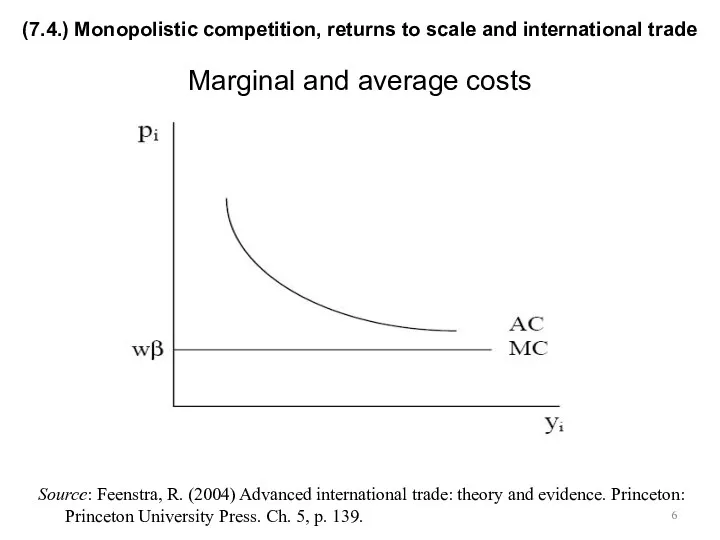

- 6. Marginal and average costs Source: Feenstra, R. (2004) Advanced international trade: theory and evidence. Princeton: Princeton

- 7. The world economy 2 countries (h, f) Final good is tradable Production factor is immobile between

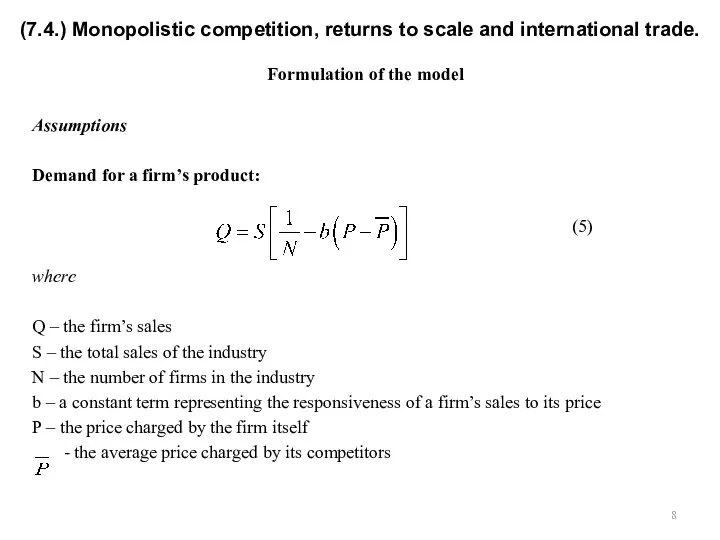

- 8. Formulation of the model Assumptions Demand for a firm’s product: (5) where Q – the firm’s

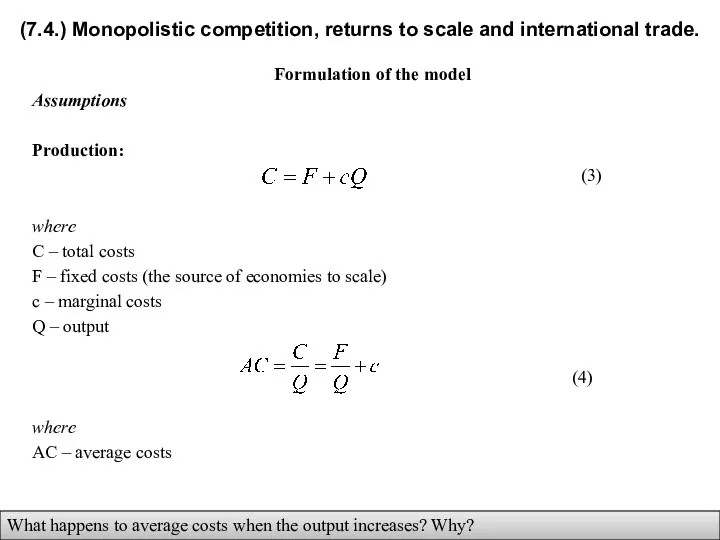

- 9. Formulation of the model Assumptions Production: (3) where C – total costs F – fixed costs

- 10. Formulation of the model Market equilibrium All firms in the industry are symmetric – the demand

- 11. (2) N and P Home task: derive MR (see Krugman, Obstfeld, Melitz (2012), Appendix to Ch.

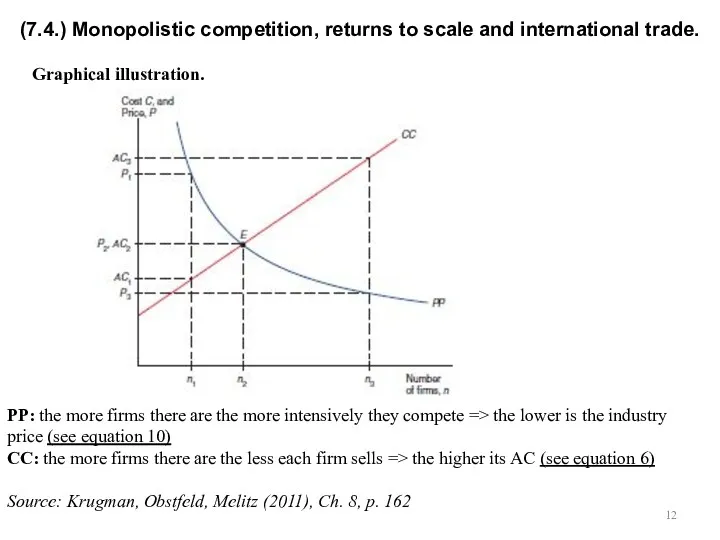

- 12. Graphical illustration. (7.4.) Monopolistic competition, returns to scale and international trade. PP: the more firms there

- 13. Within the model of a monopolistically competitive industry developed here we can determine the equilibrium number

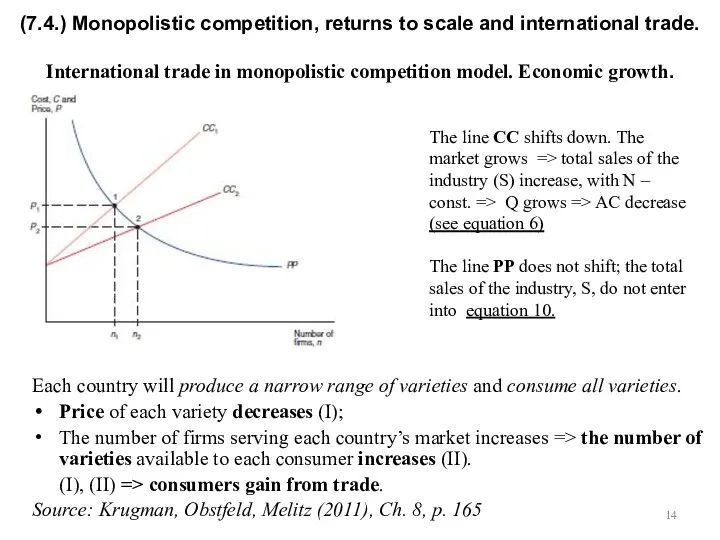

- 14. Each country will produce a narrow range of varieties and consume all varieties. Price of each

- 15. (7.4.) Monopolistic competition, returns to scale and international trade. Conclusions. Interrelation of monopolistic competition and international

- 16. Specific features and limitations of the monopolistic competition model: A highly differentiated product; A large number

- 17. Explain the sources of internal returns to scale - Increasing returns to scale (IRS). Explain microeconomic

- 18. (7.5.) Models with heterogeneous firms Heterogeneity of firms inside a sector: exporters and non-exporters Source: Lectures

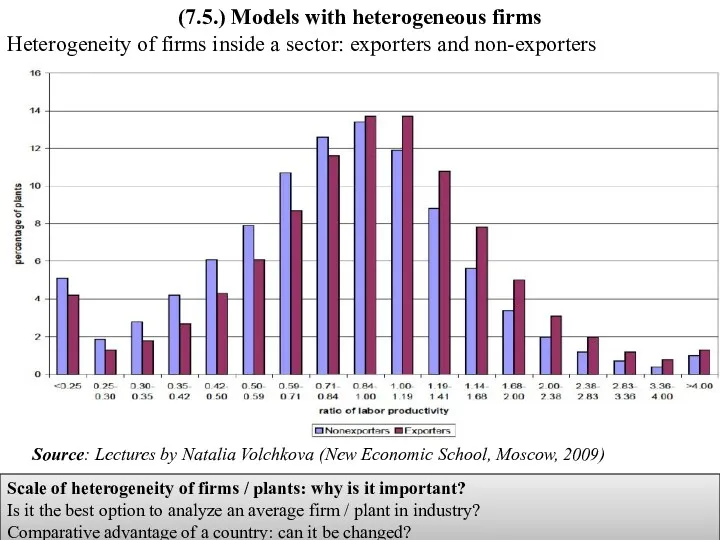

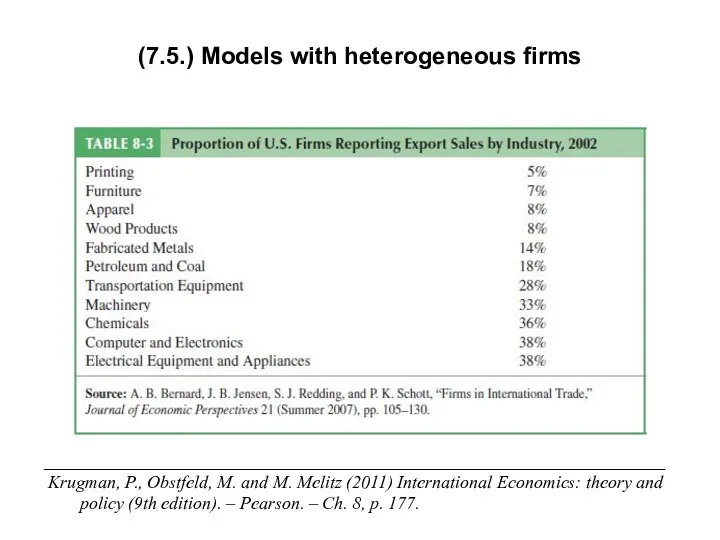

- 19. (7.5.) Models with heterogeneous firms _____________________________________________________________________ Krugman, P., Obstfeld, M. and M. Melitz (2011) International Economics:

- 20. (7.5.) Models with heterogeneous firms The following facts are taken into account in models with firms’

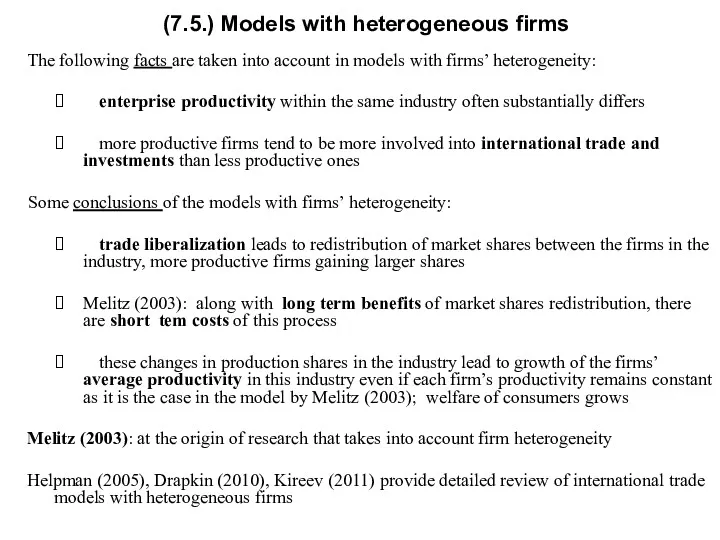

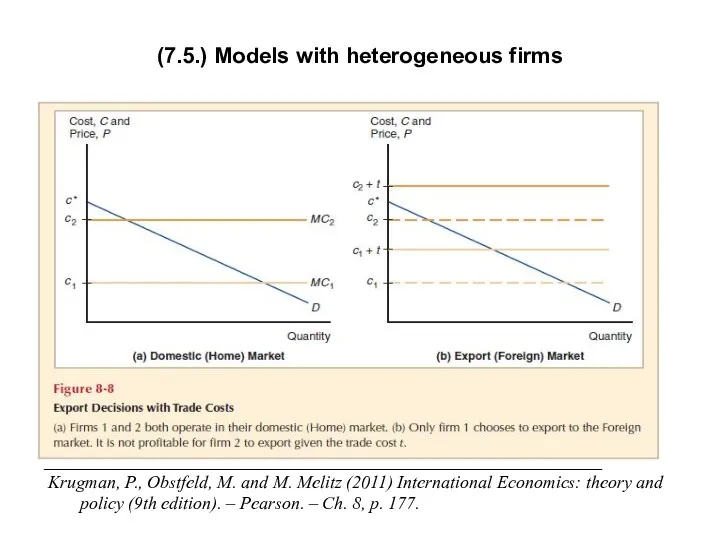

- 21. ______________________________________________________________ Krugman, P., Obstfeld, M. and M. Melitz (2011) International Economics: theory and policy (9th edition).

- 22. (7.5.) Models with heterogeneous firms The results of the models with heterogeneous firms developed by Bernard

- 23. The firm’s choice between exporting and FDI is associated with proximity-concentration trade off (выбор между близостью

- 24. (7.6.) Dumping (Демпинг) Monopolistic competition models: recognize that imperfect competition is a necessary consequence of economies

- 25. (7.6.) Dumping The practice of charging different customers different prices is called price discrimination. The most

- 26. (7.6.) Dumping The reason for dumping: The difference in the responsiveness of sales to price in

- 27. (7.6.) Reciprocal dumping (взаимный демпинг) Two monopolies producing the same good in country F and H

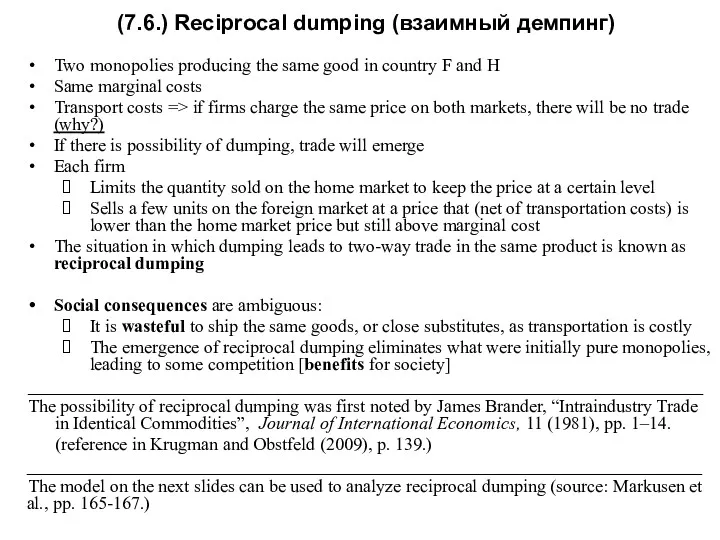

- 28. (7.6.) Structure of the international trade model under imperfect competition: the case of international oligopoly Structure

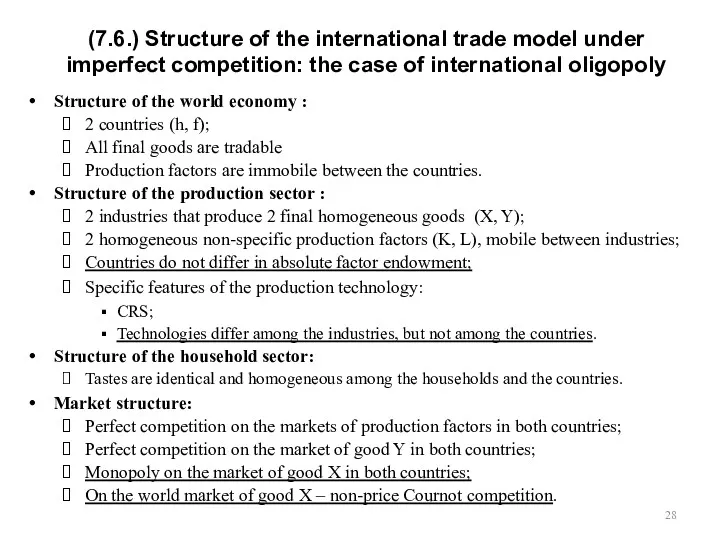

- 29. (7.6.) Exogenous parameters of the international trade model under imperfect competition: the case of international oligopoly

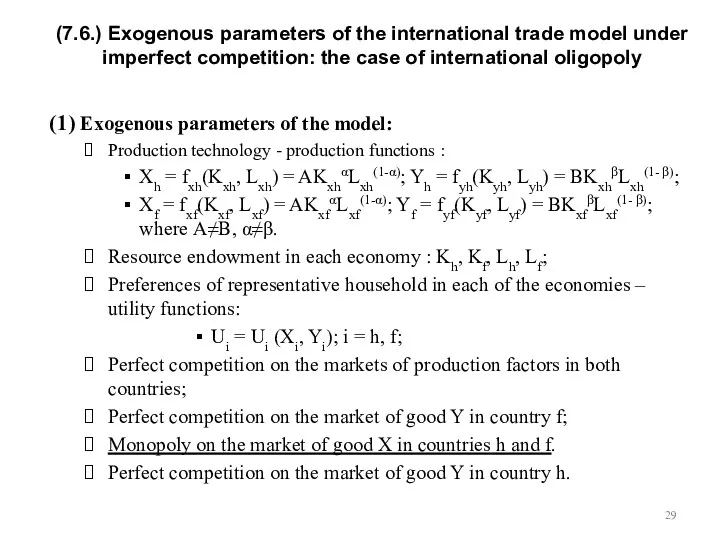

- 30. (7.6.) Endogenous parameters of the international trade model under imperfect competition: the case of international oligopoly

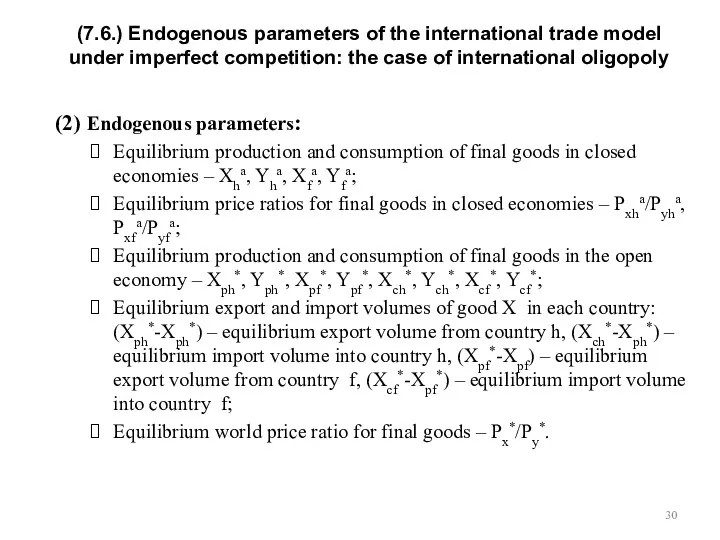

- 31. (7.6.) Specific features of general equilibrium in the model of international trade in imperfect competition: the

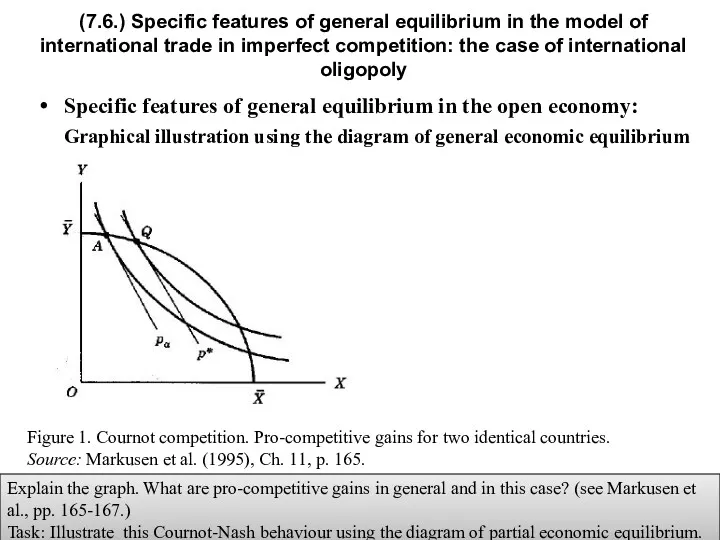

- 32. (7.6.) Specific features of general equilibrium in the model of international trade in imperfect competition: the

- 33. (7.6.) Specific features of general equilibrium in the model of international trade in imperfect competition: the

- 34. (7.6.) The main results in the model of international trade under imperfect competition Structure of international

- 35. Exercise sessions 6 and 7. (2) Think about topics for reports during exercise sessions; work on

- 37. Скачать презентацию

Takeovers & mergers

Takeovers & mergers Особенности участия субъектов МСП в закупках крупнейших заказчиков в моногородах

Особенности участия субъектов МСП в закупках крупнейших заказчиков в моногородах Стратегия социально-экономического развития муниципального образования Ахтубинский район

Стратегия социально-экономического развития муниципального образования Ахтубинский район Анализ себестоимости продукции

Анализ себестоимости продукции Қазақстанның моноқалалары

Қазақстанның моноқалалары Economic strategy of the enterprise

Economic strategy of the enterprise The basic concepts of the world economy

The basic concepts of the world economy Условия размещения производительных сил. Экономико-географическое положение и территориальное деление РФ. (Тема 3)

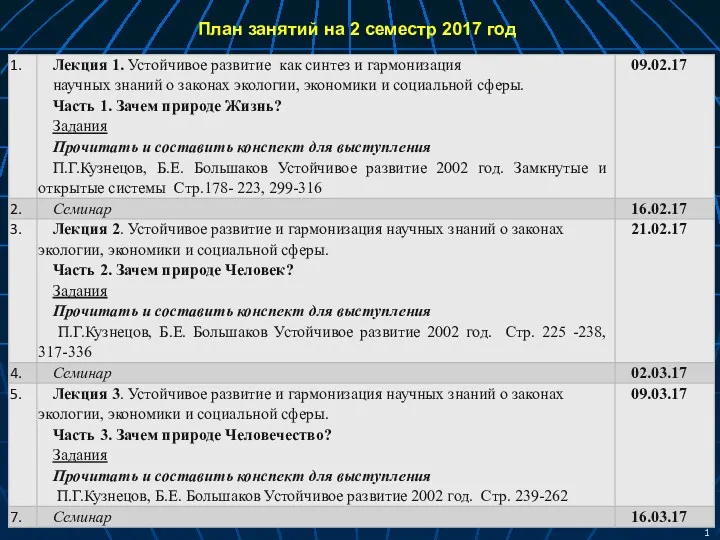

Условия размещения производительных сил. Экономико-географическое положение и территориальное деление РФ. (Тема 3) Устойчивое развитие, как синтез научных знаний и законов экологии, экономики и социальной сферы. (Лекциия 1)

Устойчивое развитие, как синтез научных знаний и законов экологии, экономики и социальной сферы. (Лекциия 1) Реализация инструментов бережливого производства на машиностроительном предприятии

Реализация инструментов бережливого производства на машиностроительном предприятии Модели и формы реализации НВТиТ

Модели и формы реализации НВТиТ Производство: затраты, выручка, прибыль

Производство: затраты, выручка, прибыль Құрылыстың сметалық құны

Құрылыстың сметалық құны Глобальная экономика. Тема 9. Прогнозные сценарии глобального развития

Глобальная экономика. Тема 9. Прогнозные сценарии глобального развития Карл Менгер

Карл Менгер Публичный доклад о результатах деятельности главы города Устюжна Вологодской области за 2017 год

Публичный доклад о результатах деятельности главы города Устюжна Вологодской области за 2017 год Неоконсерватизм

Неоконсерватизм Анализ и планирование валового дохода аптечной организации

Анализ и планирование валового дохода аптечной организации Функции государства в экономике

Функции государства в экономике Фонд Сколково. Инновации в ТЭК и предложение по сотрудничеству со странами БРИКС

Фонд Сколково. Инновации в ТЭК и предложение по сотрудничеству со странами БРИКС Энергетическая безопасность Китая

Энергетическая безопасность Китая Торговая политика государств СНГ. Современная методология обзора и транспарентности экономических показателей

Торговая политика государств СНГ. Современная методология обзора и транспарентности экономических показателей Рынок и его функции

Рынок и его функции Кейнсианская модель реального сектора

Кейнсианская модель реального сектора Поддержка и развитие кадрового потенциала в АПК

Поддержка и развитие кадрового потенциала в АПК Инвестиционная деятельность энергетических предприятий

Инвестиционная деятельность энергетических предприятий Государственное управление территориями с особым организационно-правовым и экономическим режимом

Государственное управление территориями с особым организационно-правовым и экономическим режимом Долгосрочный экономический рост

Долгосрочный экономический рост