Содержание

- 2. Introduction Structure of course Chapter 1 The date and methods of macroeconomics Chapter 2-4 The National

- 3. Introduction Structure of course Chapter 5 The Determination of Output, Income, Expenditure and a Model of

- 4. Introduction Structure of course Chapter 7 Labour Market, Employment, Unemployment Chapter 8 Economic Fluctuations

- 5. Introduction Structure of course Chapter 9 The Keynsian Model of Short-Run Equilibrium Chapter 10 Aggregate Supply

- 6. Introduction Definition “Macroeconomics was born as distinct in the 1940, as part of intellectual response to

- 7. Introduction Definition Since then, economic science is divided into two fields Microeconomics, which develops the theories

- 8. Introduction Definition Since then, economic science is divided into two fields Macroeconomics, which develops the theories

- 9. Introduction Relationships between two sub- disciplines Examples - how agents see the future and build their

- 10. Introduction An overview of the macroeconomic theories Two main theories: - Classical theory gives a central

- 11. Introduction An overview of the macroeconomic theories Classical theory- economic policies are not helpful. Market can

- 12. Introduction An overview of the macroeconomic theories Keynesian theory – economic policies are useful because the

- 13. Introduction An overview of the macroeconomic theories Classical theory- Hypothesis of flexible prices, macroeconomic theories may

- 14. Introduction An overview of the macroeconomic theories Keynsian theory helps to explain the short-run fluctuations in

- 15. Introduction The Empirical Aspects of the Macro-economics The macro circuit means a non-theoretical representation of economic

- 16. Introduction The Empirical Aspects of the Macro-economics The output is the value, expressed in money. This

- 17. Introduction The Empirical Aspects of the Macro-economics Expenditure means the money value of purchases of goods

- 18. Introduction The Empirical Aspects of the Macro-economics Macroeconomic subjects

- 19. Introduction The Empirical Aspects of the Macro-economics OUTPUT=INCOME=EXPENDITURE

- 20. Introduction The measurement of macroeconomic facts Economic variables -Stock variables measure a quantity at a given

- 21. Introduction The measurement of macroeconomic facts Measurement of output The nominal output QV ALt =q At

- 22. Introduction The measurement of macroeconomic facts Measurement of output The real output QVOLt = ∑qit x

- 23. Introduction The measurement of macroeconomic facts Measurement the changes Measurement of price changes I (P) t/t-k

- 24. Introduction The measurement of macroeconomic facts Measurement the productivity Y/H hourly labour productivity

- 25. Introduction Methods and Assumptions of Macro-economic What is a model? Model is a theoretical construct designed

- 26. Introduction Methods and Assumptions of Macro-economic What is a model? Example- a model of economic equilibrium

- 27. The determination of Output, Income, Expenditure and a model of Real Equilibrium The production function and

- 28. The determination of Output, Income, Expenditure and a model of Real Equilibrium The production function and

- 29. The determination of Output, Income, Expenditure and a model of Real Equilibrium The production function and

- 30. The determination of Output, Income, Expenditure and a model of Real Equilibrium The production function and

- 31. The determination of Output, Income, Expenditure and a model of Real Equilibrium The production function and

- 32. The determination of Output, Income, Expenditure and a model of Real Equilibrium The production function and

- 33. The determination of Output, Income, Expenditure and a model of Real Equilibrium The production function and

- 34. The determination of Output, Income, Expenditure and a model of Real Equilibrium The distribution of national

- 35. The determination of Output, Income, Expenditure and a model of Real Equilibrium The distribution of national

- 36. The determination of Output, Income, Expenditure and a model of Real Equilibrium The distribution of national

- 37. The determination of Output, Income, Expenditure and a model of Real Equilibrium The distribution of national

- 38. The determination of Output, Income, Expenditure and a model of Real Equilibrium The expense of national

- 39. The determination of Output, Income, Expenditure and a model of Real Equilibrium The expense of national

- 40. The determination of Output, Income, Expenditure and a model of Real Equilibrium The expense of national

- 41. The determination of Output, Income, Expenditure and a model of Real Equilibrium The expense of national

- 42. The determination of Output, Income, Expenditure and a model of Real Equilibrium The expense of national

- 43. The determination of Output, Income, Expenditure and a model of Real Equilibrium The expense of national

- 44. The determination of Output, Income, Expenditure and a model of Real Equilibrium The expense of national

- 45. The determination of Output, Income, Expenditure and a model of Real Equilibrium The expense of national

- 46. The determination of Output, Income, Expenditure and a model of Real Equilibrium The expense of national

- 47. The determination of Output, Income, Expenditure and a model of Real Equilibrium The equilibrium in the

- 48. The determination of Output, Income, Expenditure and a model of Real Equilibrium The equilibrium in the

- 49. The determination of Output, Income, Expenditure and a model of Real Equilibrium The equilibrium in the

- 50. The determination of Output, Income, Expenditure and a model of Real Equilibrium The impact of budget

- 51. Money, prices and interest rates What is the impact of change in the quantity of money

- 52. Money, prices and interest rates Money is one of the asset which is the easiest to

- 53. Money, prices and interest rates Agents will want to have a greater or lesser amount of

- 54. Money, prices and interest rates The Quantity theory of money MV=PY V=PY/M =nominal GDP/Money stock

- 55. Money, prices and interest rates The Quantity theory of money Demand for money Md=(1/V)PY 1/V=k Md

- 56. Money, prices and interest Rates The Interest Rate, the demand for money and Inflation The nominal

- 57. Money, prices and interest Rates The Interest Rate, the demand for money and Inflation NIR and

- 58. Money, prices and interest Rates The Interest Rate, the demand for money and Inflation NIR depends

- 59. Money, prices and interest Rates Interest rate and money demand Md/P = L(i,Y) Demand for real

- 60. Money, prices and interest Rates The money supply and expected price level M/P =Md/P M/P=L (i,

- 61. Money, prices and interest rates The money supply and expected price level M/P=L (r+ הּe, Y

- 62. Money, prices and interest rates The Problems with Too Large Fluctuation in Price Level Inflation is

- 63. Money, prices and interest rates The Problems with Too Large Fluctuation in Price Level Deflation is

- 64. Labour market, employment, unemployment Labour demand comes from com-panies that want to produce. Labour supply comes

- 65. Labour market, employment, unemployment The labour force is an aggregate that includes the employed labour force

- 66. Labour market, employment, unemployment The labour force is an aggregate that includes the employed labour force

- 67. Labour market, employment, unemployment The labour force is an aggregate that includes the employed labour force

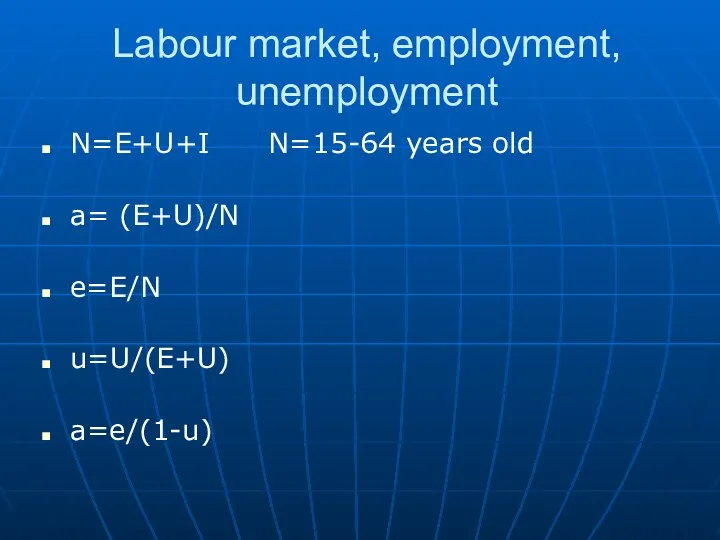

- 68. Labour market, employment, unemployment N=E+U+I N=15-64 years old a= (E+U)/N e=E/N u=U/(E+U) a=e/(1-u)

- 69. Labour market, employment, unemployment Share of long length unemployed (those unemployed for one year and more)

- 70. Labour market, employment, unemployment The flow of workers It is the number of people who, over

- 71. The Long-Run Rate of Unemployment L =E+U u=U/L Job acquisition rate a=A/U percentage of unemployed during

- 72. The Long-Run Rate of Unemployment L =E+U u=U/L Job loss rate p=P/U percentage of employees who

- 73. The Long-Run Rate of Unemployment Natural rate of unemployment=long-run rate of unemployment A=P

- 74. Economic fluctuations The economy is experiencing fluctuations that result in variations in the level of output

- 75. Economic fluctuations Acceleration phases (economic boom) Contraction phase (economic recession)

- 76. Economic fluctuations Changes in output and unemployment When the economy is bad, cyclical unemployment, adds to

- 77. Economic fluctuations Changes in output and unemployment When the economy is bad, cyclical unemployment, adds to

- 78. Economic fluctuations Changes in output and unemployment When the economy is bad, cyclical unemployment, adds to

- 79. Economic fluctuations Aggregate demand and aggregate supply The aggregate demand is deduced from the quantity aquation

- 80. Economic fluctuations Aggregate demand and aggregate supply The aggregate supply The long-run aggregate supply (LRAS) Production

- 81. Economic fluctuations Aggregate demand and aggregate supply AS-AD model Long-run effect of change in AD In

- 82. Economic fluctuations Aggregate demand and aggregate supply AS-AD model Short-run effect of change in AD In

- 83. Economic fluctuations Aggregate demand and aggregate supply AS-AD model The Effect of Monetary Policy The Central

- 84. Economic fluctuations Aggregate demand and aggregate supply AS-AD model The Effect of Monetary Policy 1) a

- 85. Economic fluctuations Aggregate demand and aggregate supply AS-AD model The Effect of Monetary Policy 1) a

- 86. Economic fluctuations Aggregate demand and aggregate supply AS-AD model The Effect of Monetary Policy 1) a

- 87. Economic fluctuations External shock –an event that affects suddenly the economy and rules out output of

- 88. The Keynesian Model of Short-Run Equilibrium Model IS-LM Keynesian Macroeconomics (KM) - prices are sticky in

- 89. The Keynesian Model of Short-Run Equilibrium Model IS-LM Keynesian Macroeconomics (KM) C=c(Y-T) E=c (Y-T)+I+G E=cY+(I+G-cT) Keynesian

- 90. The Keynesian Model of Short-Run Equilibrium Model IS-LM The impact of budget policy ∆Y=(1/1-c)/ ∆G ∆

- 91. The Keynesian Model of Short-Run Equilibrium Model IS-LM The impact of budget policy Balanced budget ∆Y=

- 92. The Keynesian Model of Short-Run Equilibrium Model IS-LM I =I(r) IS curve shows all possible com-binations

- 93. The Keynesian Model of Short-Run Equilibrium Model IS-LM Budget policy and IS-curve - An increase in

- 94. The Keynesian Model of Short-Run Equilibrium Model IS-LM Money market and LM Curve The money supply

- 95. The Keynesian Model of Short-Run Equilibrium Model IS-LM Money market and LM Curve The demand for

- 96. The Keynesian Model of Short-Run Equilibrium Model IS-LM Definition: the LM curve represents all possible combinations

- 97. The Keynesian Model of Short-Run Equilibrium Model IS-LM Short-Run Equilibrium Y=C(Y-T)+I(r)+G M/P=L(i,Y)

- 98. The Keynesian Model of Short-Run Equilibrium Model IS-LM Economic Policy through the IS-LM model. The stabilization

- 99. The Keynesian Model of Short-Run Equilibrium Model IS-LM Economic Policy through the IS-LM model. The stabilization

- 100. The Keynesian Model of Short-Run Equilibrium Model IS-LM IS-LM and aggregate demand IS-LM and deflation

- 101. Aggregate Supply LRAS –level of output is determined only by amounts of factors available. SRAS is

- 102. Aggregate Supply Nominal wage rigidity w=W/Pe W/P=wxPe/P

- 104. Скачать презентацию

Формирование политики доходов населения в Монако

Формирование политики доходов населения в Монако Alternative sources of energy

Alternative sources of energy Международные аспекты экономической теории

Международные аспекты экономической теории Міжнародна конкурентоспроможність національних економік

Міжнародна конкурентоспроможність національних економік Российско-германское сотрудничество

Российско-германское сотрудничество Критерии эффективности региональной инвестиционной политики. На примере Краснодарского края

Критерии эффективности региональной инвестиционной политики. На примере Краснодарского края Основные фонды предприятия

Основные фонды предприятия Сукупний попит та сукупна пропозиція: макроекономічна рівновага. (Тема 5)

Сукупний попит та сукупна пропозиція: макроекономічна рівновага. (Тема 5) Жұмыссыздықтың түрлері мен негізгі себептері және оны төмендегі мемлекеттің іс-әрекеті

Жұмыссыздықтың түрлері мен негізгі себептері және оны төмендегі мемлекеттің іс-әрекеті Безробіття

Безробіття Развитие классической школы политэкономии после А. Смита. (Лекция 4)

Развитие классической школы политэкономии после А. Смита. (Лекция 4) Канашский район. Среда для развития предпринимательства

Канашский район. Среда для развития предпринимательства Регулювання ринку праці

Регулювання ринку праці Экономические блага

Экономические блага Показатели струкртуры занятости населения, их взаимосвязь. Определение состава семьи, значение

Показатели струкртуры занятости населения, их взаимосвязь. Определение состава семьи, значение презентация для подготовки к ЕГЭ по обществознанию. Блок Экономика

презентация для подготовки к ЕГЭ по обществознанию. Блок Экономика Экономический рост

Экономический рост Экономическая теория Йозефа Шумпетера

Экономическая теория Йозефа Шумпетера Семинар на тему Дж.М. Кейнс и его работа Общая теория занятости, процента и денег

Семинар на тему Дж.М. Кейнс и его работа Общая теория занятости, процента и денег Теоретико-методологические основания модернизации государственного управления

Теоретико-методологические основания модернизации государственного управления Трудовые ресурсы, их воспроизводство, показатели (экономика труда, лекция 3)

Трудовые ресурсы, их воспроизводство, показатели (экономика труда, лекция 3) Федеральная целевая программа Развитие внутреннего и въездного туризма в Российской Федерации (2011 - 2018 годы)

Федеральная целевая программа Развитие внутреннего и въездного туризма в Российской Федерации (2011 - 2018 годы) Рациональное экономическое поведение потребителя

Рациональное экономическое поведение потребителя Умный город, Череповец, 2019

Умный город, Череповец, 2019 ИСО-ның ұйымдастырушылық құрылымы

ИСО-ның ұйымдастырушылық құрылымы Economics. What is it?

Economics. What is it? Макроэкономические показатели и качество жизни_ 10 кл

Макроэкономические показатели и качество жизни_ 10 кл Компьютерные технологии 1С

Компьютерные технологии 1С