Содержание

- 2. 12 Monetary Policy and Fiscal Policy in the Very Short Run Learning objectives Understand that both

- 3. Copyright 2005 © McGraw-Hill Ryerson Ltd. The Very Short Run Chapter 12: Economic Policy in the

- 4. Copyright 2005 © McGraw-Hill Ryerson Ltd. Monetary Policy Monetary Policy: Any decision made by the Bank

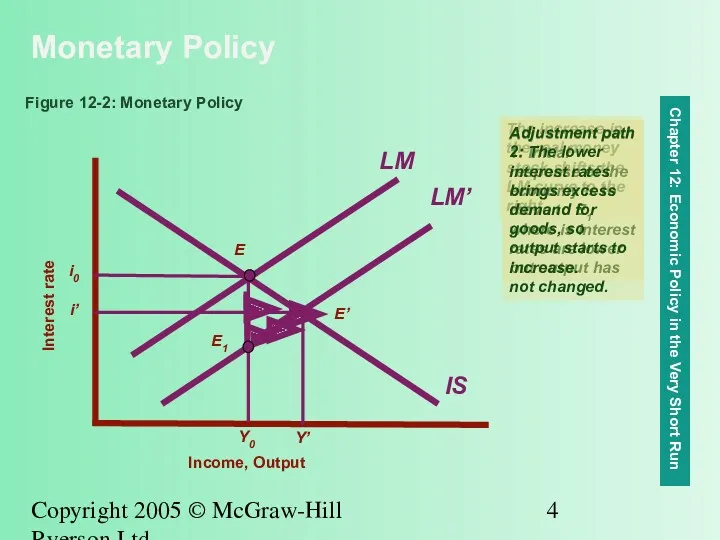

- 5. Copyright 2005 © McGraw-Hill Ryerson Ltd. Monetary Policy Figure 12-2: Monetary Policy Income, Output The increase

- 6. Copyright 2005 © McGraw-Hill Ryerson Ltd. Monetary Policy Liquidity trap: A situation that arises when the

- 7. Copyright 2005 © McGraw-Hill Ryerson Ltd. Policy in Action The liquidity trap on Canada and the

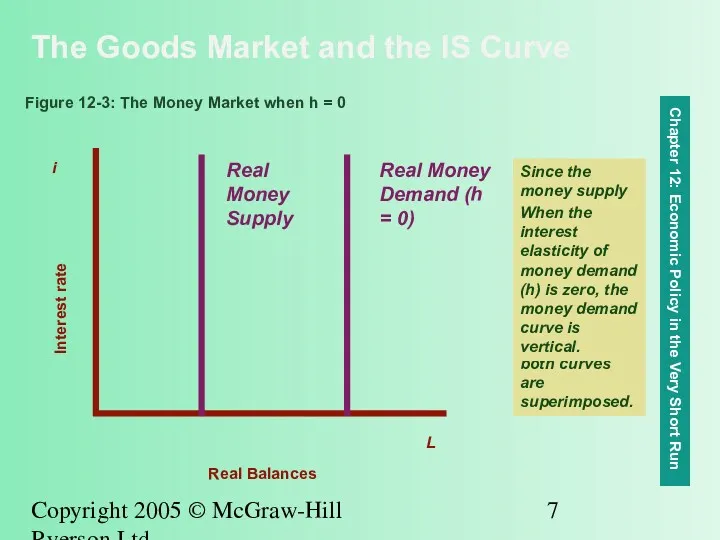

- 8. Copyright 2005 © McGraw-Hill Ryerson Ltd. Since the money supply curve is also vertical, there is

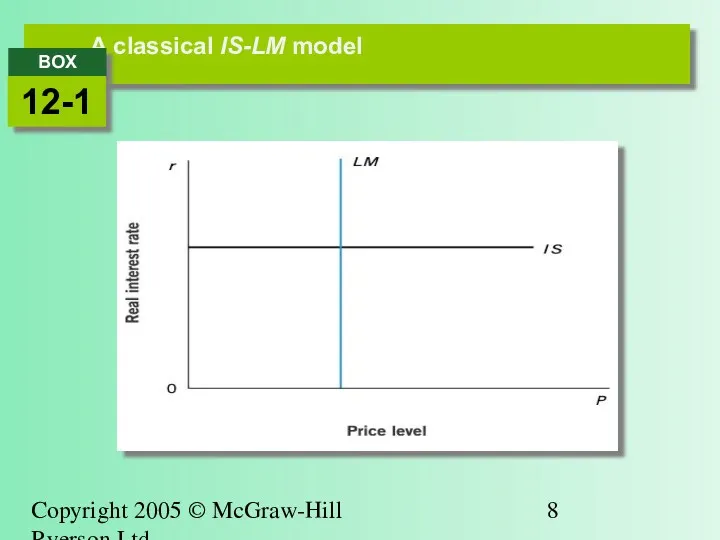

- 9. Copyright 2005 © McGraw-Hill Ryerson Ltd. A classical IS-LM model

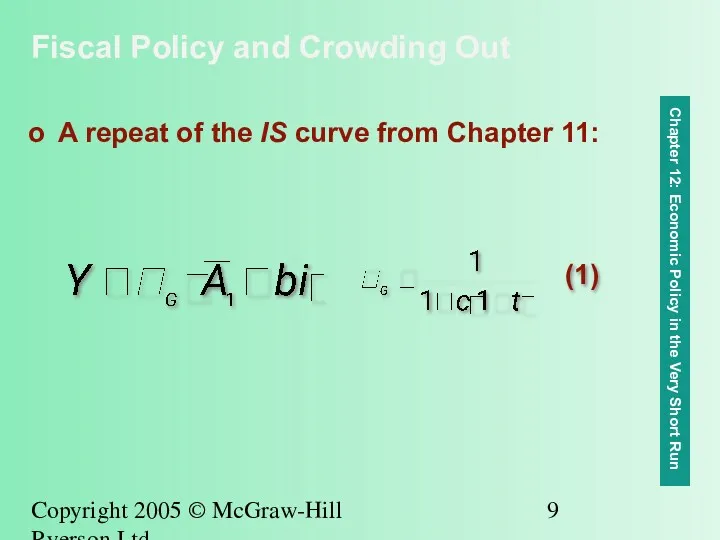

- 10. Copyright 2005 © McGraw-Hill Ryerson Ltd. Fiscal Policy and Crowding Out A repeat of the IS

- 11. Copyright 2005 © McGraw-Hill Ryerson Ltd. Fiscal Policy and Crowding Out Chapter 12: Economic Policy in

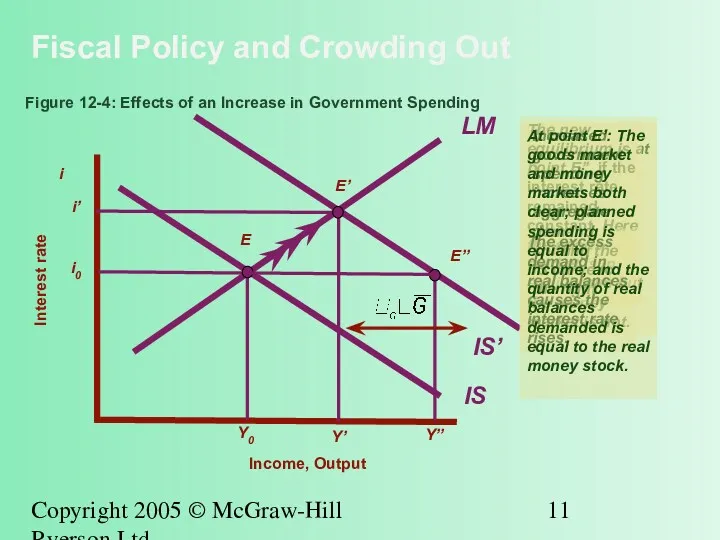

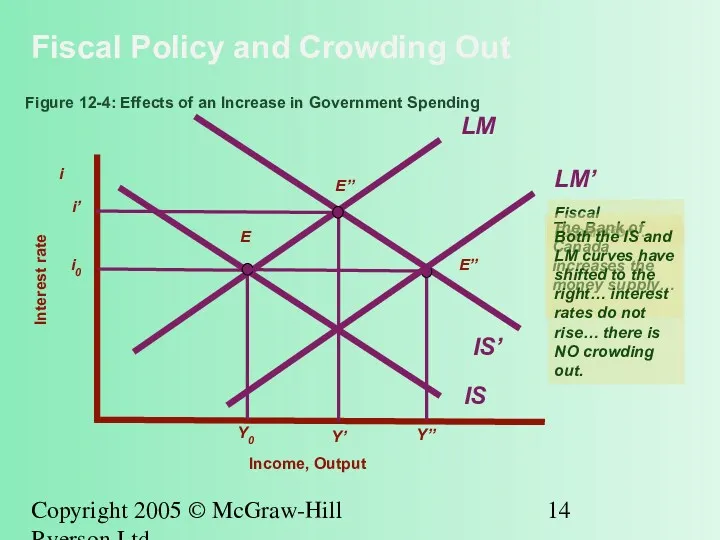

- 12. Copyright 2005 © McGraw-Hill Ryerson Ltd. Fiscal Policy and Crowding Out Figure 12-4: Effects of an

- 13. Copyright 2005 © McGraw-Hill Ryerson Ltd. Fiscal Policy and Crowding Out Chapter 12: Economic Policy in

- 14. Copyright 2005 © McGraw-Hill Ryerson Ltd. Fiscal Policy and Crowding Out Chapter 12: Economic Policy in

- 15. Copyright 2005 © McGraw-Hill Ryerson Ltd. Fiscal Policy and Crowding Out Figure 12-4: Effects of an

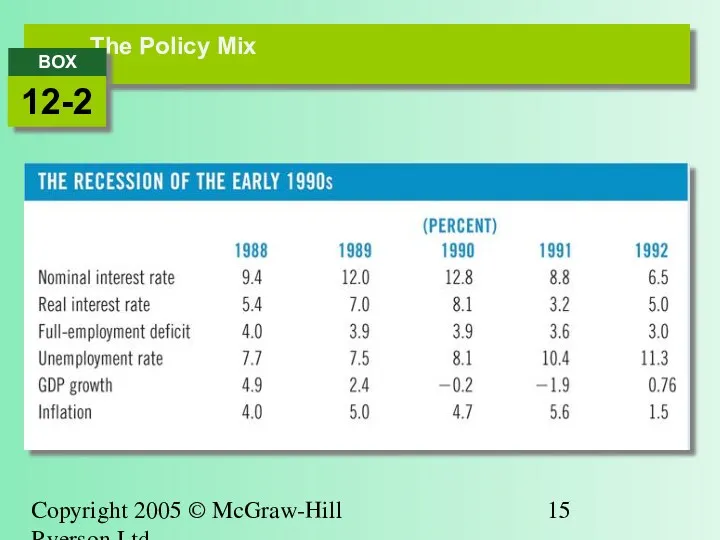

- 16. Copyright 2005 © McGraw-Hill Ryerson Ltd. The Policy Mix

- 17. Copyright 2005 © McGraw-Hill Ryerson Ltd. Monetary Policy and the Interest Rate Rule Chapter 12: Economic

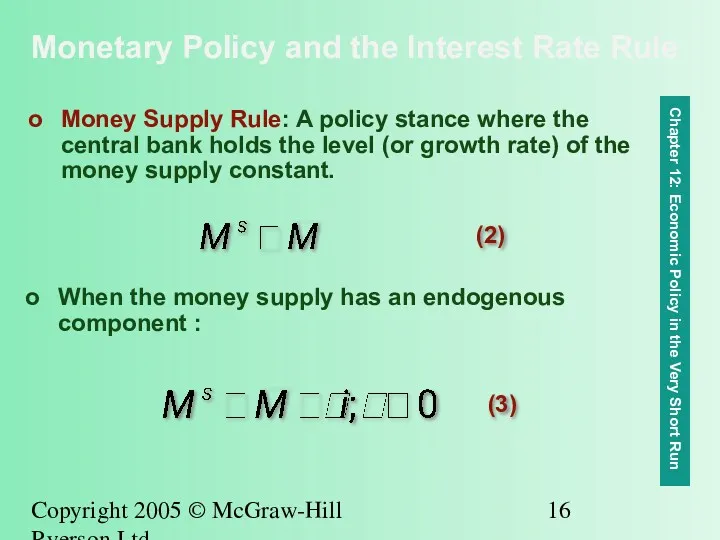

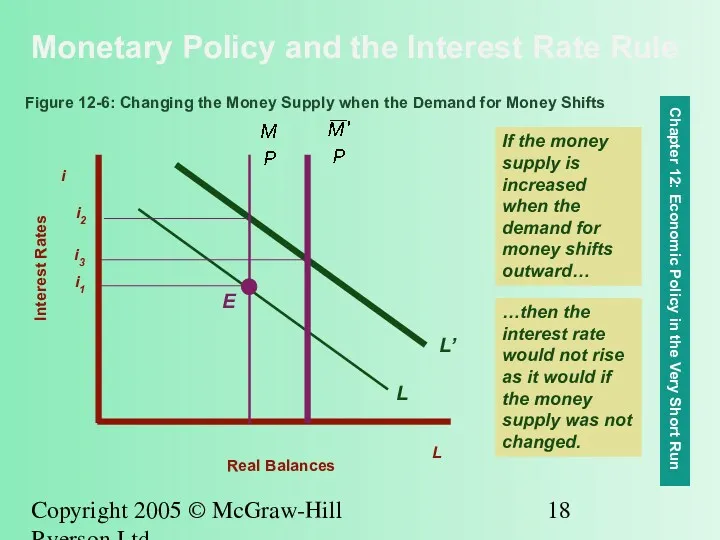

- 18. Copyright 2005 © McGraw-Hill Ryerson Ltd. Monetary Policy and the Interest Rate Rule Chapter 12: Economic

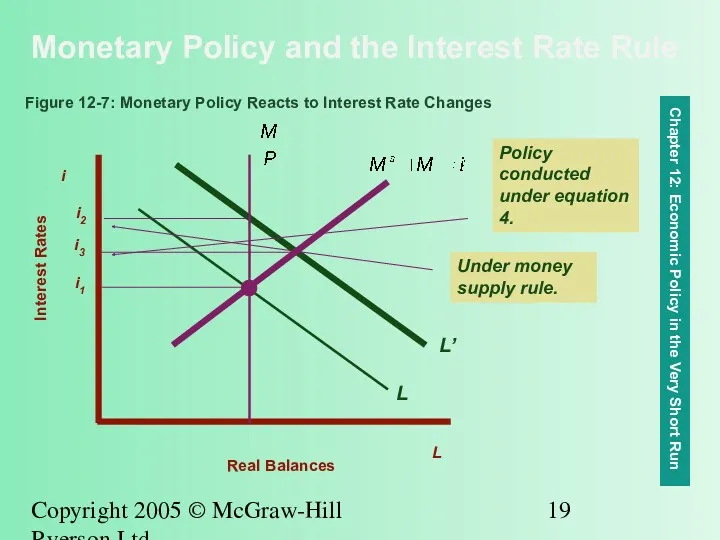

- 19. Copyright 2005 © McGraw-Hill Ryerson Ltd. Monetary Policy and the Interest Rate Rule Chapter 12: Economic

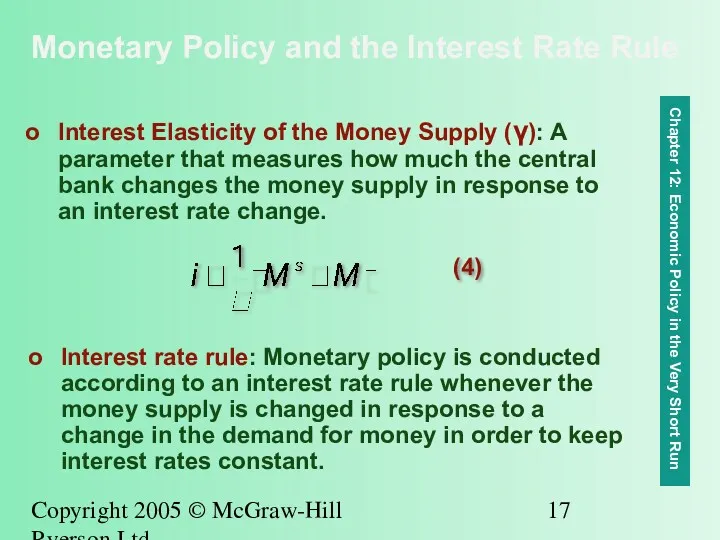

- 20. Copyright 2005 © McGraw-Hill Ryerson Ltd. Monetary Policy and the Interest Rate Rule Chapter 12: Economic

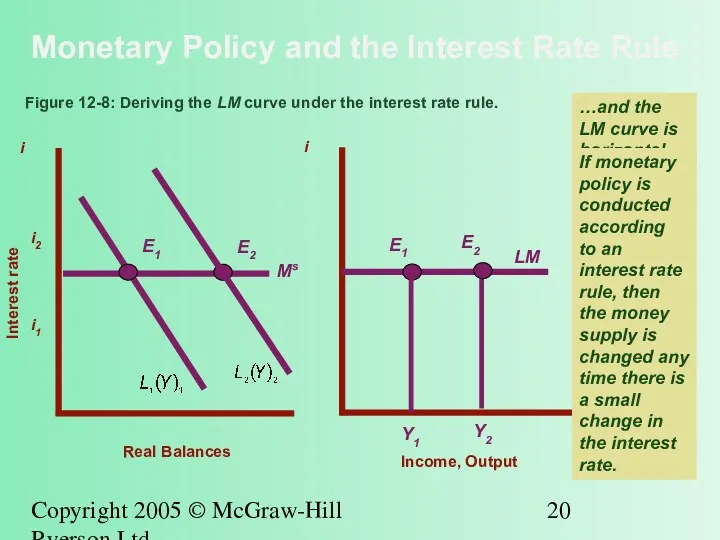

- 21. Copyright 2005 © McGraw-Hill Ryerson Ltd. Monetary Policy and the Interest Rate Rule Figure 12-8: Deriving

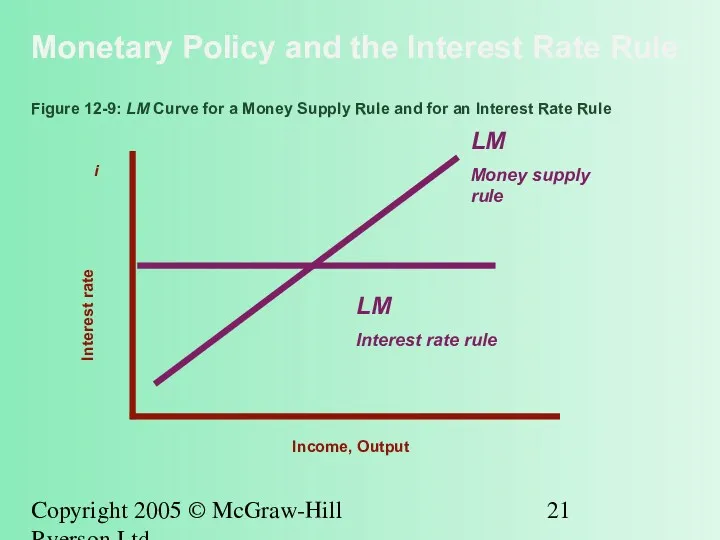

- 22. Copyright 2005 © McGraw-Hill Ryerson Ltd. Monetary Policy and the Interest Rate Rule Figure 12-9: LM

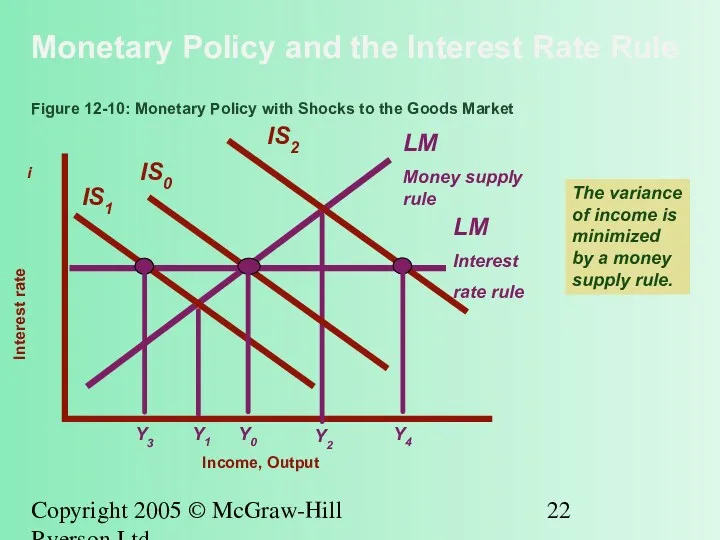

- 23. Copyright 2005 © McGraw-Hill Ryerson Ltd. Monetary Policy and the Interest Rate Rule Figure 12-10: Monetary

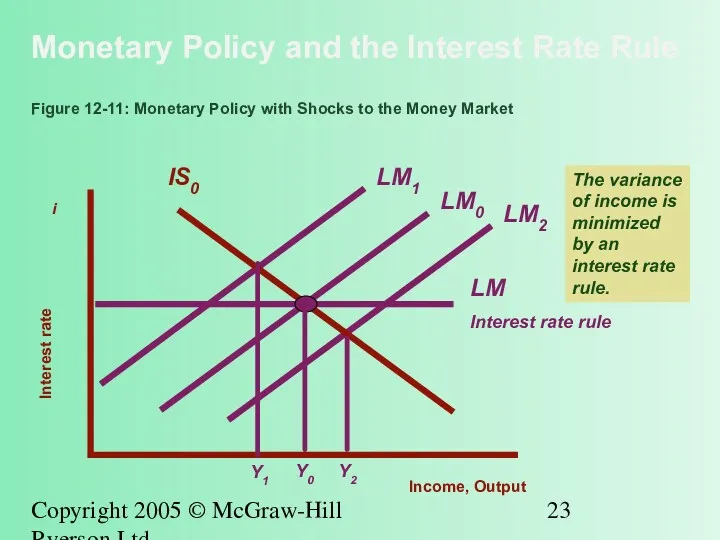

- 24. Copyright 2005 © McGraw-Hill Ryerson Ltd. Monetary Policy and the Interest Rate Rule Figure 12-11: Monetary

- 25. Copyright 2005 © McGraw-Hill Ryerson Ltd. Chapter Summary Monetary policy affects the economy, first by affecting

- 26. Copyright 2005 © McGraw-Hill Ryerson Ltd. Chapter Summary (cont’d) The two extreme cases, the liquidity trap

- 28. Скачать презентацию

Евразийская геополитическая концепция

Евразийская геополитическая концепция Теория и анализ отраслевых рынков. Характеристика основных рыночных структур

Теория и анализ отраслевых рынков. Характеристика основных рыночных структур Презентация к уроку экономика 11 класс Профсоюзы. Их роль на рынке труда

Презентация к уроку экономика 11 класс Профсоюзы. Их роль на рынке труда Оценка эффективности деятельности строительного предприятия

Оценка эффективности деятельности строительного предприятия Сущность коммерческой деятельности

Сущность коммерческой деятельности Меркосур. Руководящие органы. Развитие интеграции

Меркосур. Руководящие органы. Развитие интеграции Потребности и ресурсы

Потребности и ресурсы Роль экономики в жизни общества. Потребности и ресурсы. Свободные и экономические блага

Роль экономики в жизни общества. Потребности и ресурсы. Свободные и экономические блага Еуразия Экономикалық Қауымдастығы

Еуразия Экономикалық Қауымдастығы Производитель на рынке. Сфера производства

Производитель на рынке. Сфера производства Анализ федерального бюджета на 2016 год

Анализ федерального бюджета на 2016 год Монетарная экономика: предложение денег. Макроэкономика. Тема 7

Монетарная экономика: предложение денег. Макроэкономика. Тема 7 Electricity markets. Natural monopoly model

Electricity markets. Natural monopoly model Мировое хозяйство. Отраслевая и территориальная структура мирового хозяйства

Мировое хозяйство. Отраслевая и территориальная структура мирового хозяйства Введение в макроэкономический анализ

Введение в макроэкономический анализ Возникновение и основные этапы развития экономической науки

Возникновение и основные этапы развития экономической науки Что такое бюджет?

Что такое бюджет? Обеспечение операционной деятельности производственной мощностью

Обеспечение операционной деятельности производственной мощностью Производство. Затраты, выручка, прибыль

Производство. Затраты, выручка, прибыль Анализ рынка недвижимости в г. Нижний Новгород

Анализ рынка недвижимости в г. Нижний Новгород Классификация затрат рабочего времени

Классификация затрат рабочего времени Монополистическая конкуренция

Монополистическая конкуренция Логістика – наука та інструмент ринкової економіки. Лекція № 1

Логістика – наука та інструмент ринкової економіки. Лекція № 1 Optimization. Maximizing profit, minimizing cost

Optimization. Maximizing profit, minimizing cost Предпринимательская деятельность и ее формы. (Тема 3)

Предпринимательская деятельность и ее формы. (Тема 3) Технические средства наноэлектроники. Нанолитография. (Тема 3.13.2)

Технические средства наноэлектроники. Нанолитография. (Тема 3.13.2) Мировой рынок и международная торговля

Мировой рынок и международная торговля Производительность труда. (10 класс)

Производительность труда. (10 класс)