Содержание

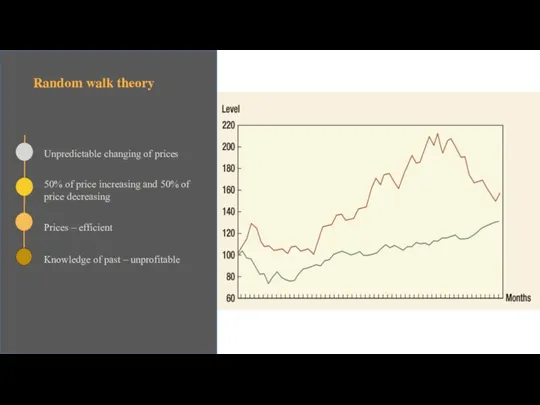

- 2. Random walk theory Unpredictable changing of prices 50% of price increasing and 50% of price decreasing

- 3. BUBBLE- uncontrollable and sharp growth of prices

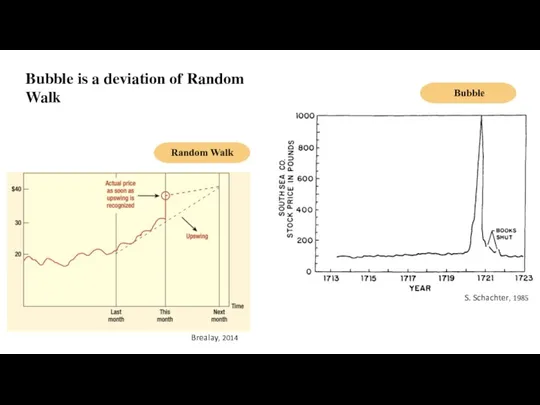

- 4. Bubble is a deviation of Random Walk Random Walk Bubble Brealay, 2014 S. Schachter, 1985

- 5. Historical bubble

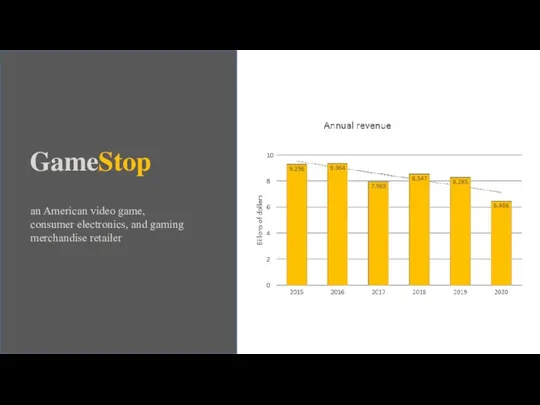

- 6. GameStop an American video game, consumer electronics, and gaming merchandise retailer

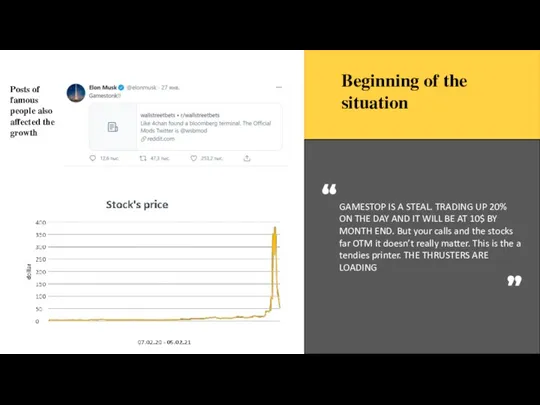

- 7. Beginning of the situation GAMESTOP IS A STEAL. TRADING UP 20% ON THE DAY AND IT

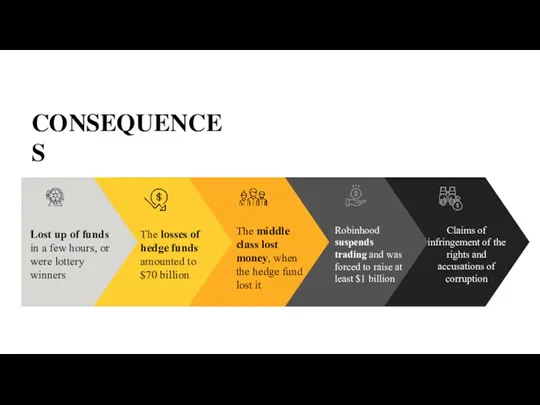

- 8. CONSEQUENCES Lost up of funds in a few hours, or were lottery winners The losses of

- 9. CURRENT BUBBLE

- 10. INDUSTRY: Business intelligence and mobile software An American PUBLIC COMPANY with the revenue of $486 million

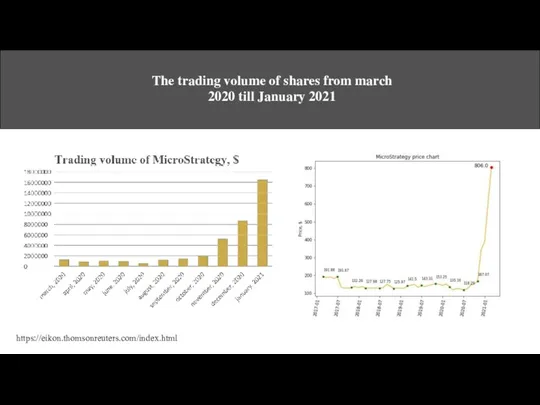

- 11. The trading volume of shares from march 2020 till January 2021 https://eikon.thomsonreuters.com/index.html

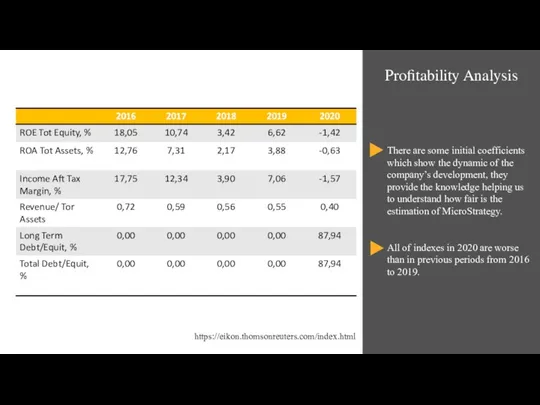

- 12. Profitability Analysis There are some initial coefficients which show the dynamic of the company’s development, they

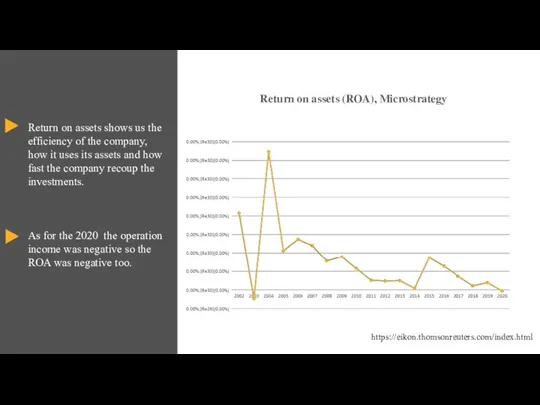

- 13. Return on assets shows us the efficiency of the company, how it uses its assets and

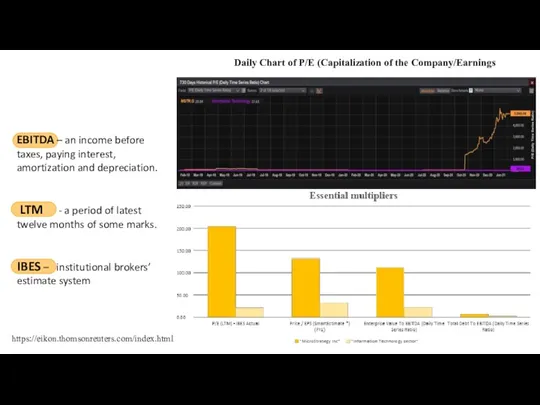

- 14. The trading volume of shares from march 2020 till January 2021 https://eikon.thomsonreuters.com/index.html Daily Chart of P/E

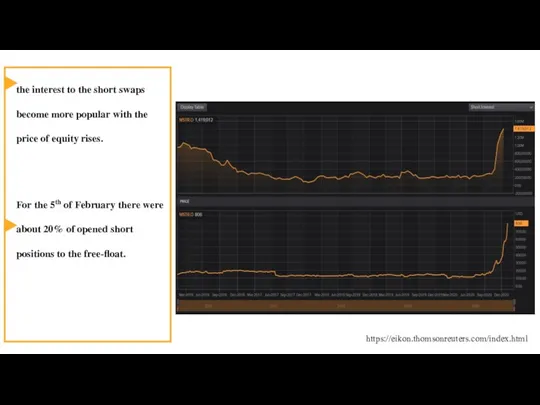

- 15. the interest to the short swaps become more popular with the price of equity rises. For

- 16. Bitcoin Price Chart MicroStrategy spent over 1 billion $ on this investment and the average price

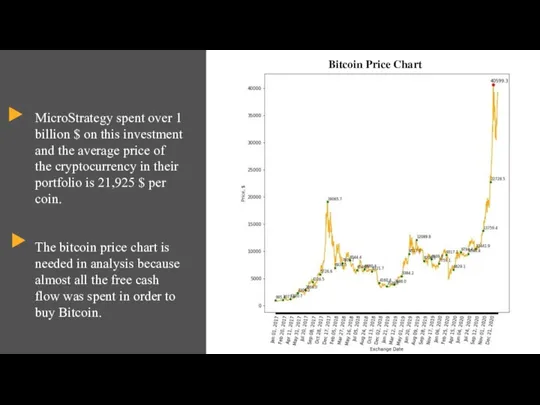

- 17. Investors’ action The investors demonstrate a high interest to MicroStrategy shares as managers decided to invest

- 18. Sources 1. Schachter, S., Gerin, W., Hood, D. C., & Anderassen, P. (1985a). I. Was the

- 20. Скачать презентацию

Повышение эффективности предпринимательской деятельности малого предприятия на примере ООО Росстандарт

Повышение эффективности предпринимательской деятельности малого предприятия на примере ООО Росстандарт Основы экономики организации. Модель разработки эффективной системы оплаты труда

Основы экономики организации. Модель разработки эффективной системы оплаты труда Стратегия экономического развития Санкт‑Петербурга на период до 2030 года

Стратегия экономического развития Санкт‑Петербурга на период до 2030 года Глобальна економічна політика. (Лекція 7)

Глобальна економічна політика. (Лекція 7) Протекционизм в международной торговле

Протекционизм в международной торговле Роль финансовых рынков в социально экономическом развитии государства

Роль финансовых рынков в социально экономическом развитии государства Эластичность спроса, ее виды и причины существования

Эластичность спроса, ее виды и причины существования Ирвинг Фишер

Ирвинг Фишер Система государственного стратегического планирования

Система государственного стратегического планирования Біржа

Біржа Анализ формирования и исполнения бюджета пенсионного фонда РФ

Анализ формирования и исполнения бюджета пенсионного фонда РФ Лесное хозяйство

Лесное хозяйство Кәсіпорынының негізгі қорлары

Кәсіпорынының негізгі қорлары Эластичность спроса и предложения. Тема 6

Эластичность спроса и предложения. Тема 6 Меншік және әлеуметтік экономика

Меншік және әлеуметтік экономика Экономика экологической безопасности

Экономика экологической безопасности Управление качеством

Управление качеством Ұсыныс қисығының жылжуы. Ұсыныстың икемділігі

Ұсыныс қисығының жылжуы. Ұсыныстың икемділігі Экономическая и социальная политика государства

Экономическая и социальная политика государства Innovation attractiveness of the region

Innovation attractiveness of the region Екологічна та енергетична проблеми у світі. Способи їх вирішення

Екологічна та енергетична проблеми у світі. Способи їх вирішення Комплексная оценка эффективности деятельности коммерческой организации

Комплексная оценка эффективности деятельности коммерческой организации Externalitäten und öffentliche Güter

Externalitäten und öffentliche Güter Лекция № 12. Основные макроэкономические показатели

Лекция № 12. Основные макроэкономические показатели Микроэкономика. Макроэкономика

Микроэкономика. Макроэкономика Світовий ринок товарів та послуг

Світовий ринок товарів та послуг spros_vsyo

spros_vsyo Макроэкономика после Дж.М. Кейнса

Макроэкономика после Дж.М. Кейнса