Содержание

- 2. CHAPTER 2 The Data of Macroeconomics In this chapter, you will learn… …the meaning and measurement

- 3. CHAPTER 2 The Data of Macroeconomics Gross Domestic Product: Expenditure and Income Two definitions: Total expenditure

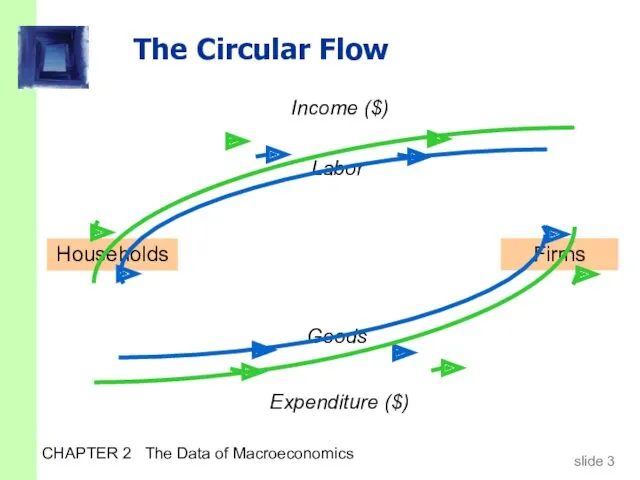

- 4. CHAPTER 2 The Data of Macroeconomics The Circular Flow Households Firms

- 5. CHAPTER 2 The Data of Macroeconomics Value added definition: A firm’s value added is the value

- 6. CHAPTER 2 The Data of Macroeconomics Exercise: (Problem 2, p. 40) A farmer grows a bushel

- 7. CHAPTER 2 The Data of Macroeconomics Final goods, value added, and GDP GDP = value of

- 8. CHAPTER 2 The Data of Macroeconomics The expenditure components of GDP consumption investment government spending net

- 9. CHAPTER 2 The Data of Macroeconomics Consumption (C) durable goods last a long time ex: cars,

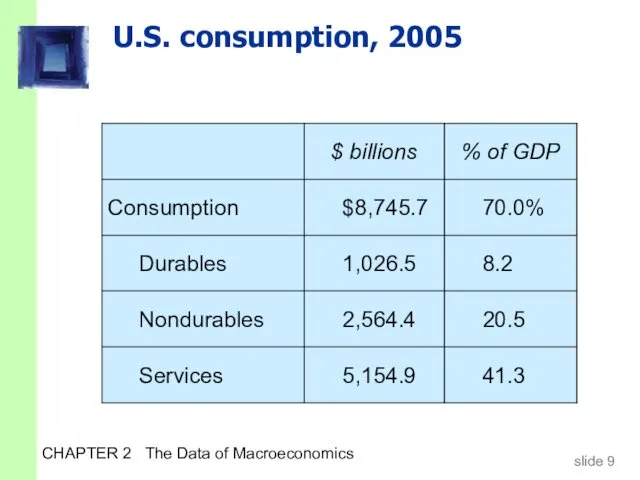

- 10. CHAPTER 2 The Data of Macroeconomics U.S. consumption, 2005 70.0% $8,745.7

- 11. CHAPTER 2 The Data of Macroeconomics Investment (I) Definition 1: Spending on [the factor of production]

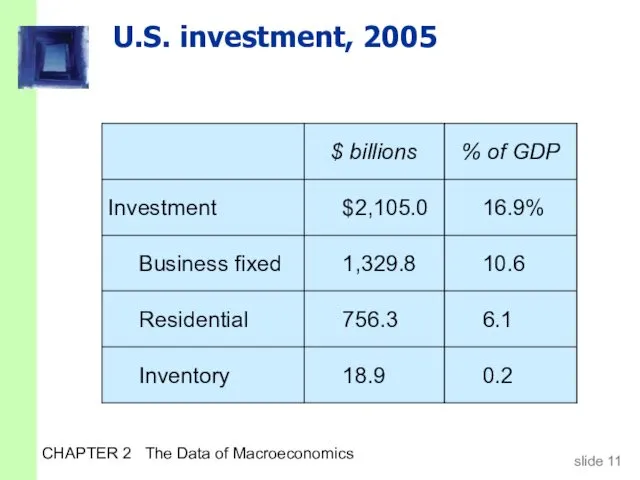

- 12. CHAPTER 2 The Data of Macroeconomics U.S. investment, 2005 16.9% $2,105.0

- 13. CHAPTER 2 The Data of Macroeconomics Investment vs. Capital Note: Investment is spending on new capital.

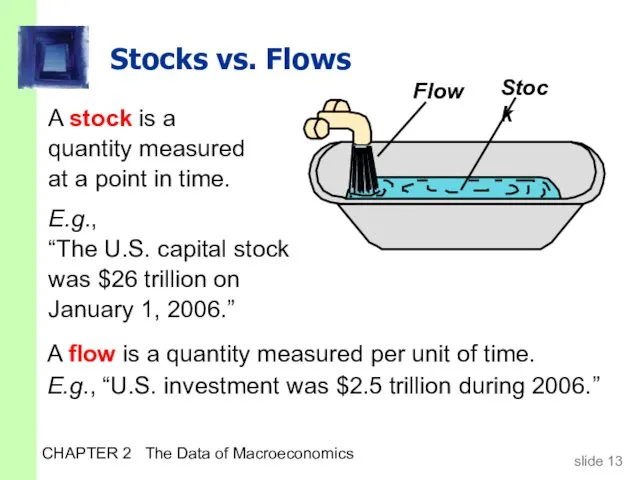

- 14. CHAPTER 2 The Data of Macroeconomics Stocks vs. Flows A flow is a quantity measured per

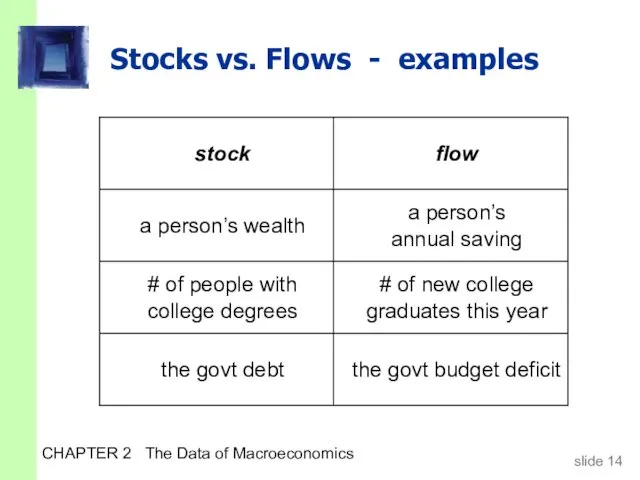

- 15. CHAPTER 2 The Data of Macroeconomics Stocks vs. Flows - examples the govt budget deficit the

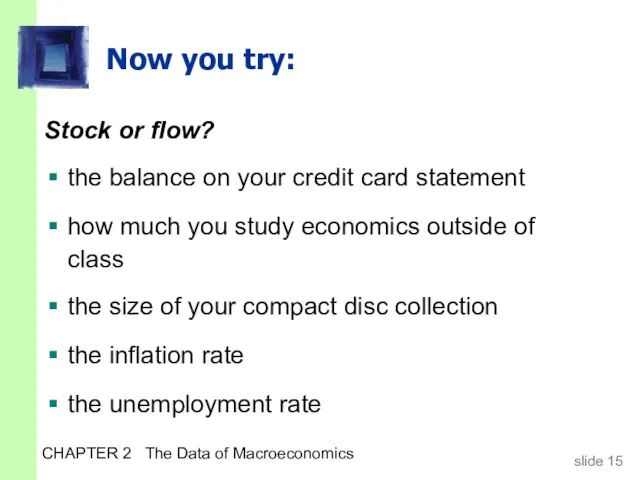

- 16. CHAPTER 2 The Data of Macroeconomics Now you try: Stock or flow? the balance on your

- 17. CHAPTER 2 The Data of Macroeconomics Government spending (G) G includes all government spending on goods

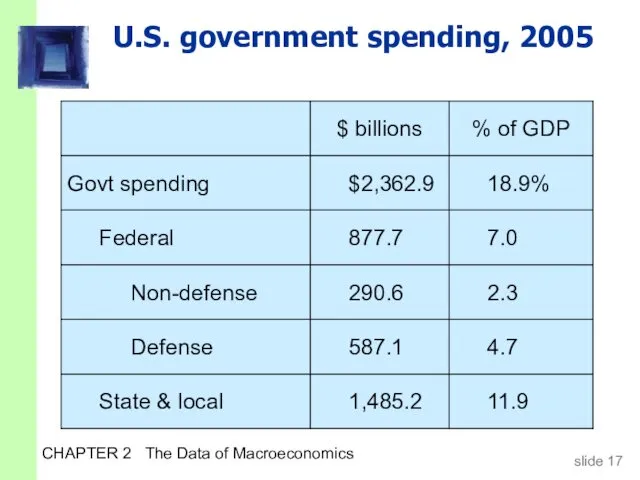

- 18. CHAPTER 2 The Data of Macroeconomics U.S. government spending, 2005 Federal 18.9% $2,362.9 Govt spending State

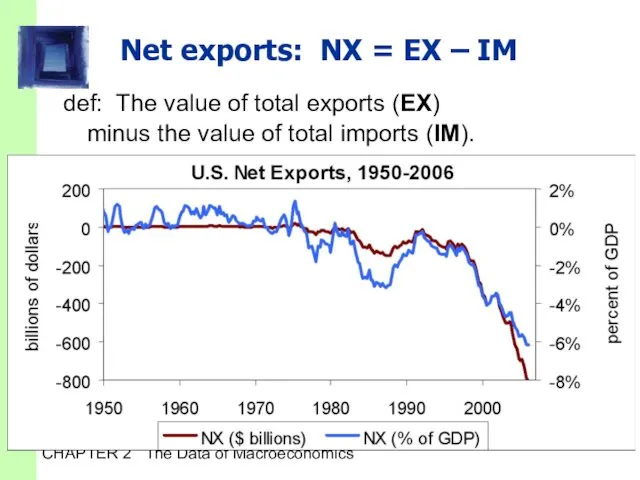

- 19. CHAPTER 2 The Data of Macroeconomics Net exports: NX = EX – IM def: The value

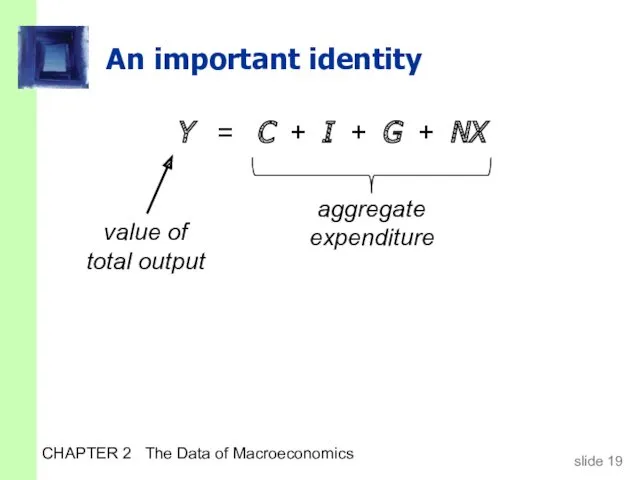

- 20. CHAPTER 2 The Data of Macroeconomics An important identity Y = C + I + G

- 21. CHAPTER 2 The Data of Macroeconomics A question for you: Suppose a firm produces $10 million

- 22. CHAPTER 2 The Data of Macroeconomics Why output = expenditure Unsold output goes into inventory, and

- 23. CHAPTER 2 The Data of Macroeconomics GDP: An important and versatile concept We have now seen

- 24. CHAPTER 2 The Data of Macroeconomics GNP vs. GDP Gross National Product (GNP): Total income earned

- 25. CHAPTER 2 The Data of Macroeconomics Discussion question: In your country, which would you want to

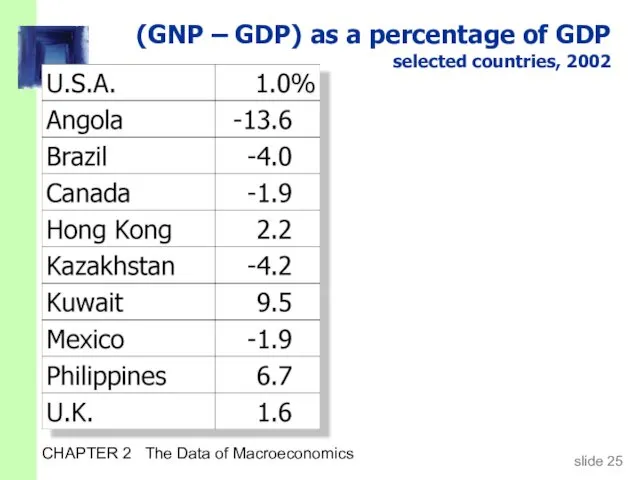

- 26. CHAPTER 2 The Data of Macroeconomics (GNP – GDP) as a percentage of GDP selected countries,

- 27. CHAPTER 2 The Data of Macroeconomics Real vs. nominal GDP GDP is the value of all

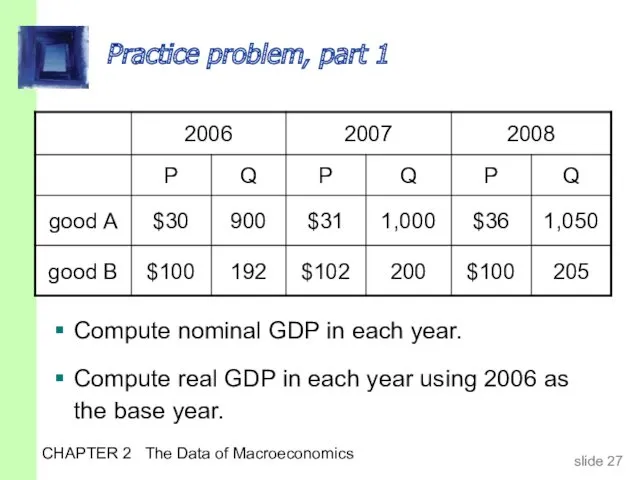

- 28. CHAPTER 2 The Data of Macroeconomics Practice problem, part 1 Compute nominal GDP in each year.

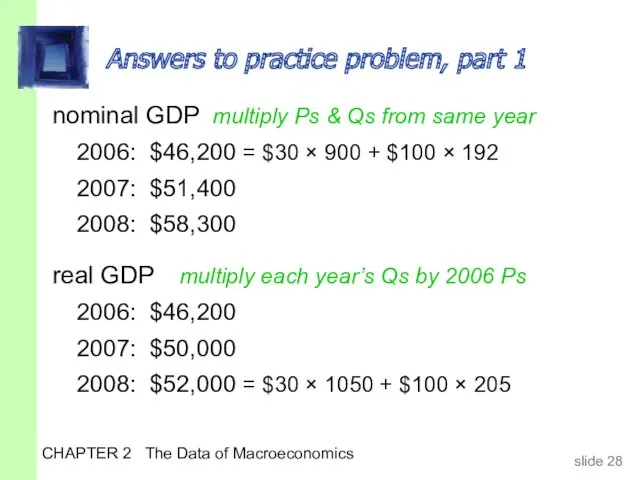

- 29. CHAPTER 2 The Data of Macroeconomics Answers to practice problem, part 1 nominal GDP multiply Ps

- 30. CHAPTER 2 The Data of Macroeconomics Real GDP controls for inflation Changes in nominal GDP can

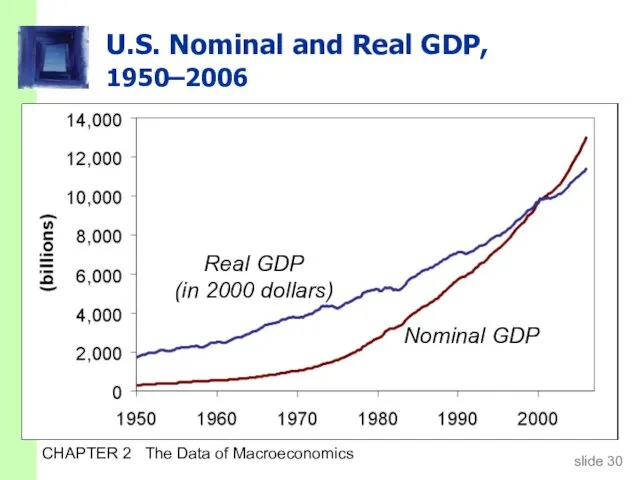

- 31. CHAPTER 2 The Data of Macroeconomics U.S. Nominal and Real GDP, 1950–2006 Nominal GDP Real GDP

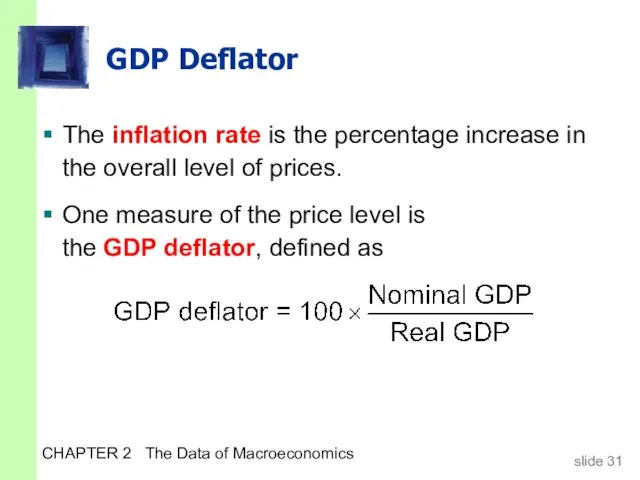

- 32. CHAPTER 2 The Data of Macroeconomics GDP Deflator The inflation rate is the percentage increase in

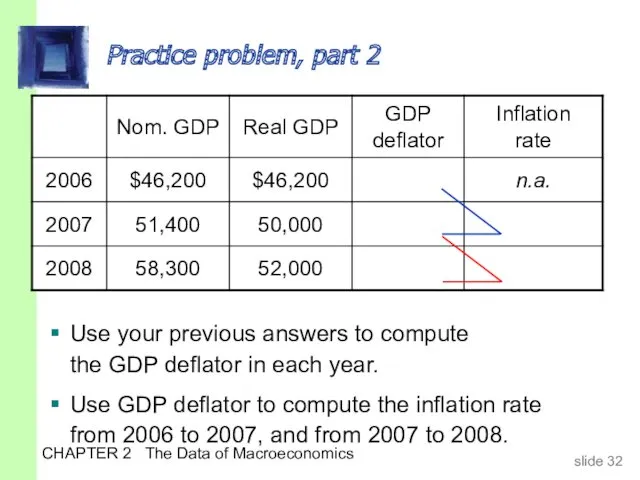

- 33. CHAPTER 2 The Data of Macroeconomics Practice problem, part 2 Use your previous answers to compute

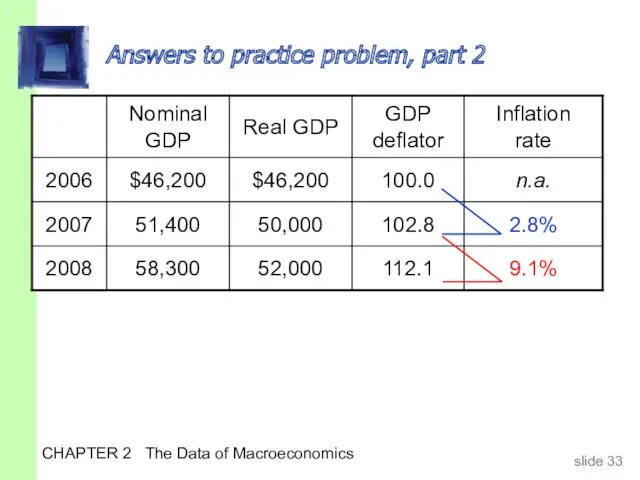

- 34. CHAPTER 2 The Data of Macroeconomics Answers to practice problem, part 2

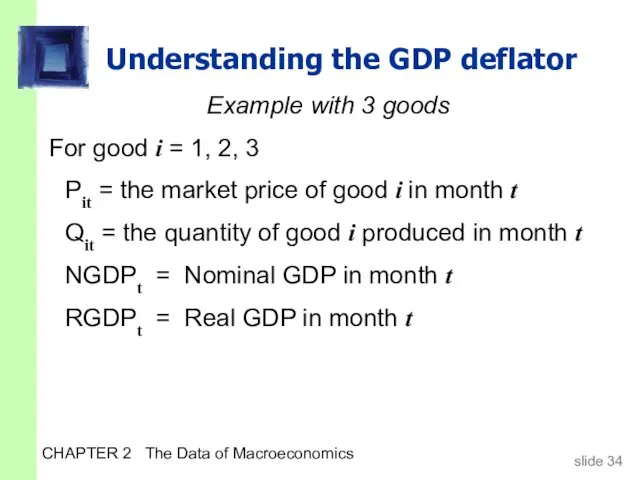

- 35. CHAPTER 2 The Data of Macroeconomics Understanding the GDP deflator Example with 3 goods For good

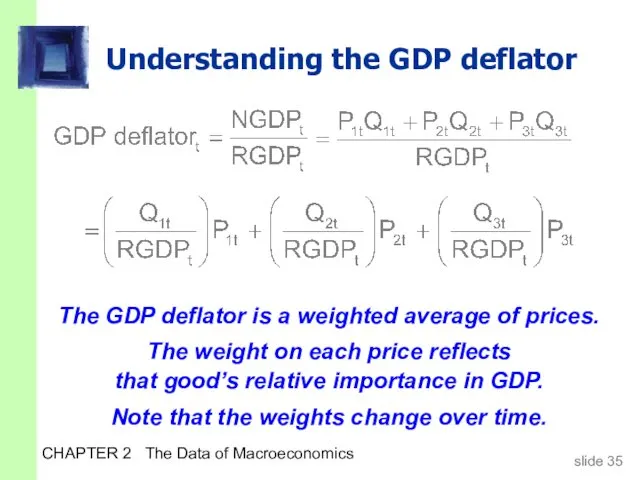

- 36. CHAPTER 2 The Data of Macroeconomics Understanding the GDP deflator The GDP deflator is a weighted

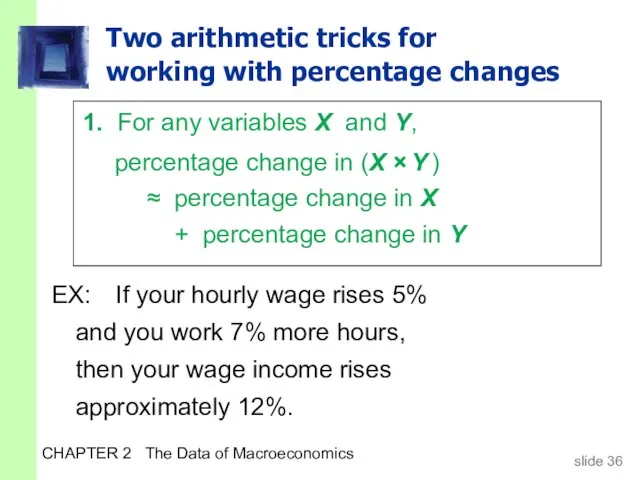

- 37. CHAPTER 2 The Data of Macroeconomics Two arithmetic tricks for working with percentage changes EX: If

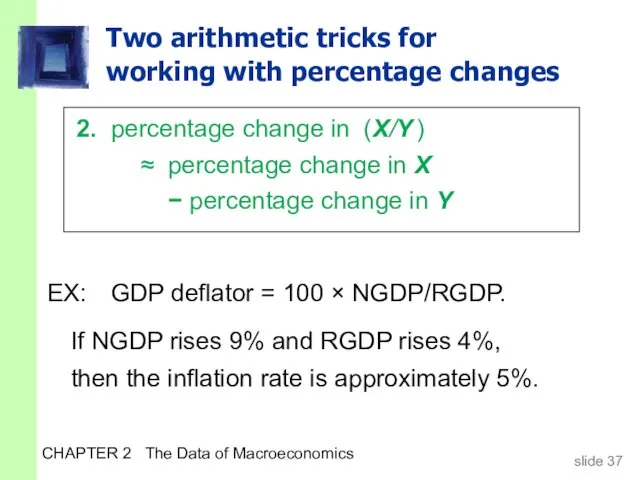

- 38. CHAPTER 2 The Data of Macroeconomics Two arithmetic tricks for working with percentage changes EX: GDP

- 39. CHAPTER 2 The Data of Macroeconomics Chain-Weighted Real GDP Over time, relative prices change, so the

- 40. CHAPTER 2 The Data of Macroeconomics Consumer Price Index (CPI) A measure of the overall level

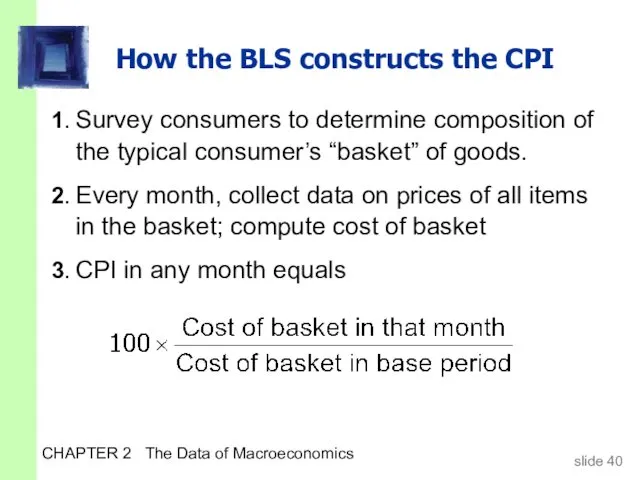

- 41. CHAPTER 2 The Data of Macroeconomics How the BLS constructs the CPI 1. Survey consumers to

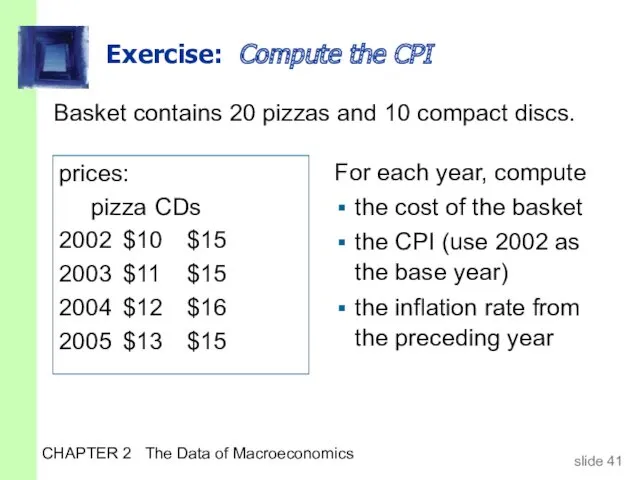

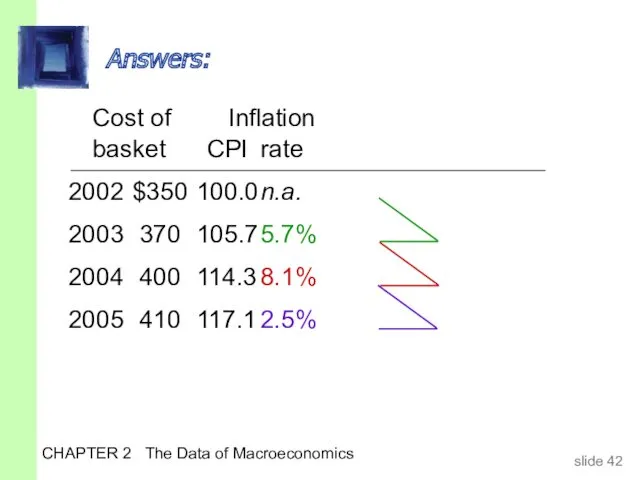

- 42. CHAPTER 2 The Data of Macroeconomics Exercise: Compute the CPI Basket contains 20 pizzas and 10

- 43. CHAPTER 2 The Data of Macroeconomics Cost of Inflation basket CPI rate 2002 $350 100.0 n.a.

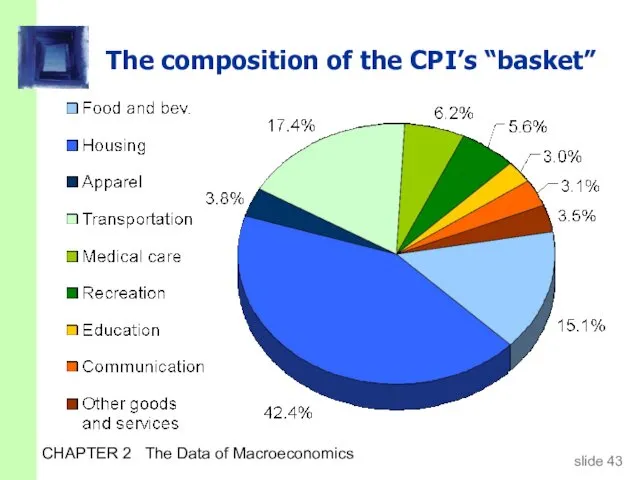

- 44. CHAPTER 2 The Data of Macroeconomics The composition of the CPI’s “basket”

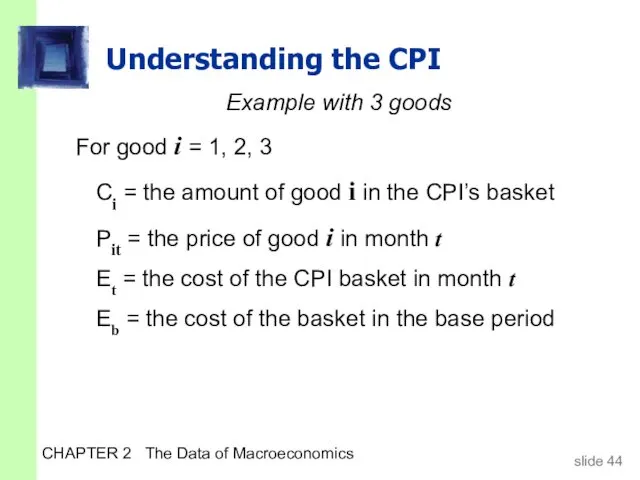

- 45. CHAPTER 2 The Data of Macroeconomics Understanding the CPI Example with 3 goods For good i

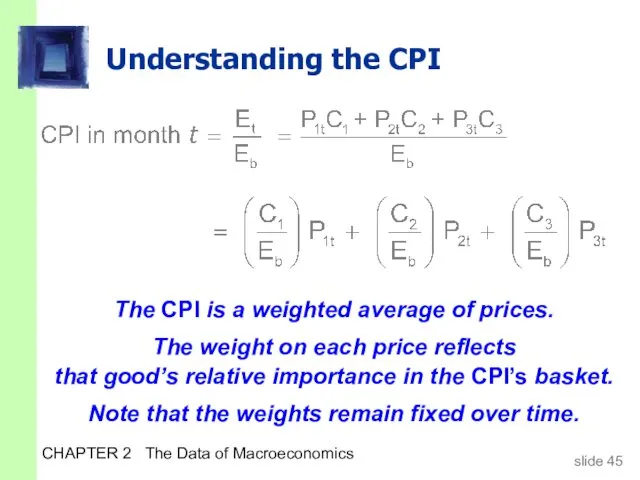

- 46. CHAPTER 2 The Data of Macroeconomics Understanding the CPI The CPI is a weighted average of

- 47. CHAPTER 2 The Data of Macroeconomics Reasons why the CPI may overstate inflation Substitution bias: The

- 48. CHAPTER 2 The Data of Macroeconomics The size of the CPI’s bias In 1995, a Senate-appointed

- 49. CHAPTER 2 The Data of Macroeconomics Discussion questions: If your grandmother receives Social Security, how is

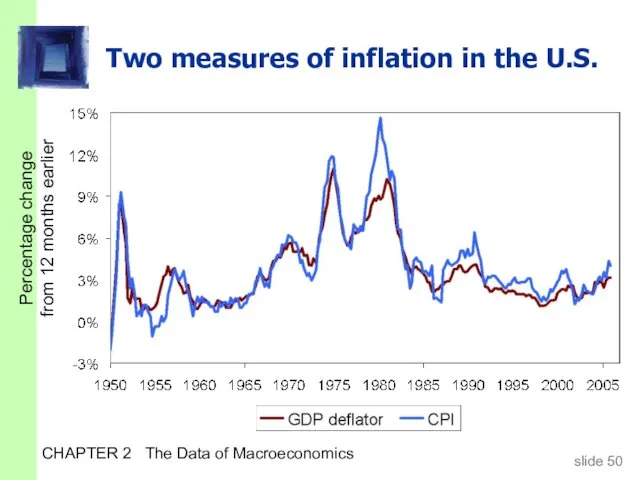

- 50. CHAPTER 2 The Data of Macroeconomics CPI vs. GDP Deflator prices of capital goods included in

- 51. CHAPTER 2 The Data of Macroeconomics Two measures of inflation in the U.S. Percentage change from

- 52. CHAPTER 2 The Data of Macroeconomics Categories of the population employed working at a paid job

- 53. CHAPTER 2 The Data of Macroeconomics Two important labor force concepts unemployment rate percentage of the

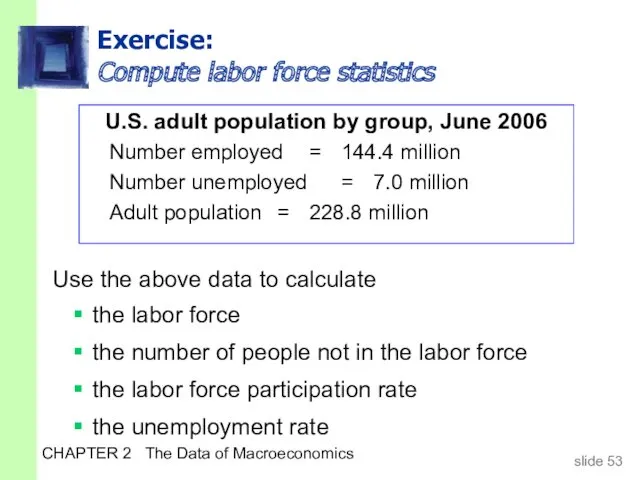

- 54. CHAPTER 2 The Data of Macroeconomics Exercise: Compute labor force statistics U.S. adult population by group,

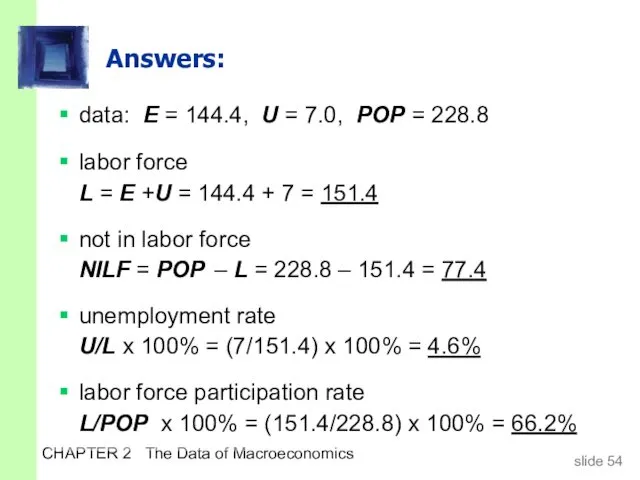

- 55. CHAPTER 2 The Data of Macroeconomics Answers: data: E = 144.4, U = 7.0, POP =

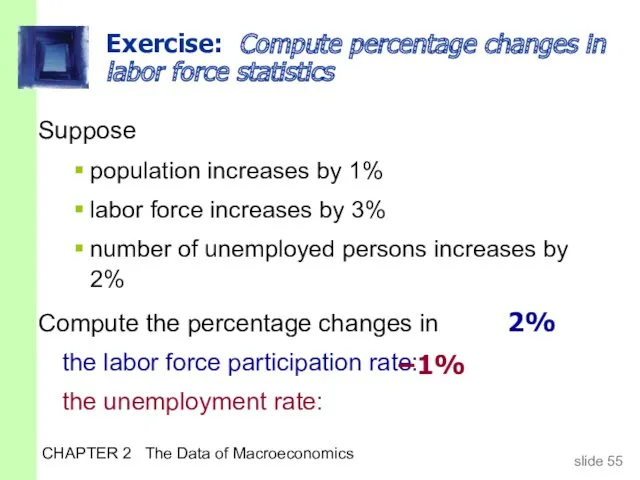

- 56. CHAPTER 2 The Data of Macroeconomics Exercise: Compute percentage changes in labor force statistics Suppose population

- 57. CHAPTER 2 The Data of Macroeconomics The establishment survey The BLS obtains a second measure of

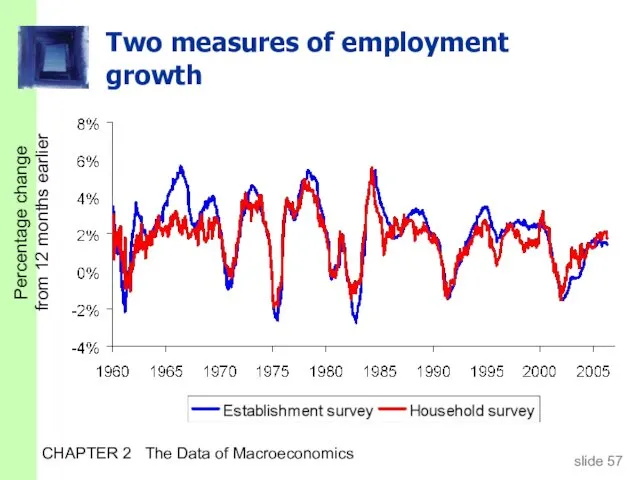

- 58. CHAPTER 2 The Data of Macroeconomics Two measures of employment growth Percentage change from 12 months

- 59. CHAPTER 2 The Data of Macroeconomics Chapter Summary 1. Gross Domestic Product (GDP) measures both total

- 61. Скачать презентацию

Безработица. (11 класс, обществознание)

Безработица. (11 класс, обществознание) Итоги финансово-хозяйственной деятельности предприятий жилищно-коммунального хозяйства области за 1 квартал 2018 года

Итоги финансово-хозяйственной деятельности предприятий жилищно-коммунального хозяйства области за 1 квартал 2018 года Collaboration proposal between NCSR “Demokritos” & almaty Кazakhstan

Collaboration proposal between NCSR “Demokritos” & almaty Кazakhstan Региональная политика государства

Региональная политика государства Фирма. Производство и издержки

Фирма. Производство и издержки Предложение на рынке с совершенной конкуренцией

Предложение на рынке с совершенной конкуренцией Способы минимизации предпринимательских рисков

Способы минимизации предпринимательских рисков Unternehmertum in Belarus

Unternehmertum in Belarus Макроэкономика. Совокупный спрос и предложение

Макроэкономика. Совокупный спрос и предложение Планирование материально-технического обеспечения производства

Планирование материально-технического обеспечения производства Проблема внешнеторговых отношений России и ЕС в условиях санкций

Проблема внешнеторговых отношений России и ЕС в условиях санкций Человеческий и социальный капитал: общая характеристика

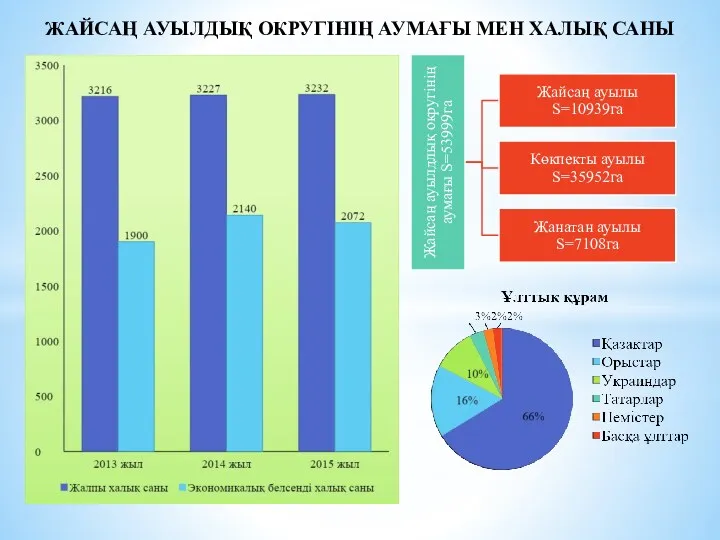

Человеческий и социальный капитал: общая характеристика Саны экономикалық белсенді халық

Саны экономикалық белсенді халық Обществознание. 7 класс

Обществознание. 7 класс Что такое экономика

Что такое экономика Руководство Фраскати

Руководство Фраскати Теоретические аспекты формирования бизнес-моделей предприятия

Теоретические аспекты формирования бизнес-моделей предприятия Моделі соціальної політики держав з ринковою економікою. Японська модель

Моделі соціальної політики держав з ринковою економікою. Японська модель Сметное дело в строительстве. Модуль 1. Основы сметного дела

Сметное дело в строительстве. Модуль 1. Основы сметного дела Экономические взгляды Ибн-Хальдуна

Экономические взгляды Ибн-Хальдуна Модель совокупный спрос – совокупное предложение

Модель совокупный спрос – совокупное предложение Обеспечение международных перевозок и организационно - функциональные структуры международных транспортных систем (лекция 4)

Обеспечение международных перевозок и организационно - функциональные структуры международных транспортных систем (лекция 4) Платёжный баланс

Платёжный баланс Что почитать про ЭКО?

Что почитать про ЭКО? Что такое экономика?

Что такое экономика? Главные вопросы экономики. 9 класс

Главные вопросы экономики. 9 класс Открытый урок по УП по профессии Бухгалтер

Открытый урок по УП по профессии Бухгалтер Учебник в системе средств обучения экономике. Лекция 14

Учебник в системе средств обучения экономике. Лекция 14