Содержание

- 2. Basic Assumptions Changes in production/sales volume are the sole cause for cost and revenue changes Total

- 3. Basic Assumptions, continued Selling price, variable cost per unit, and fixed costs are all known and

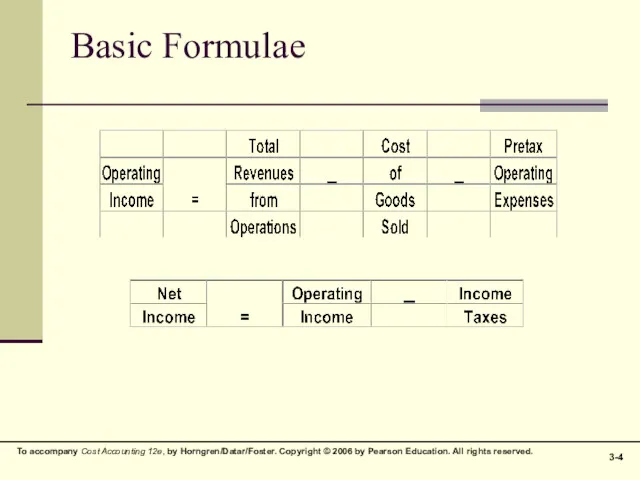

- 4. Basic Formulae

- 5. Contribution Margin Contribution Margin equals sales less variable costs CM = S – VC Contribution Margin

- 6. Contribution Margin Contribution Margin also equals contribution margin per unit multiplied by the number of units

- 7. Contribution Margin Income Statement Derivations A horizontal presentation of the Contribution Margin Income Statement: Sales –

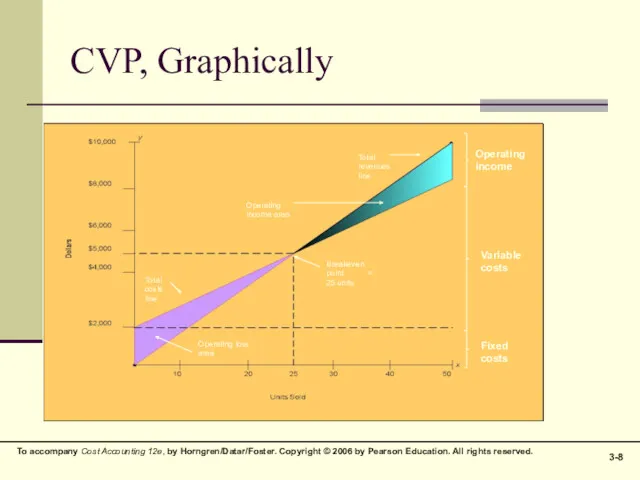

- 8. CVP, Graphically Total costs line Operating loss area Breakeven point = 25 units Total costs line

- 9. Breakeven Point Recall the last equation in an earlier slide: Q (CMu) – FC = OI

- 10. Breakeven Point, continued If per-unit values are not available, the Breakeven Point may be restated in

- 11. Breakeven Point, extended: Profit Planning With a simple adjustment, the Breakeven Point formula can be modified

- 12. CVP and Income Taxes From time to time it is necessary to move back and forth

- 13. Sensitivity Analysis CVP provides structure to answer a variety of “what-if” scenarios “What” happens to profit

- 14. Margin of Safety One indicator of risk, the Margin of Safety (MOS) measures the distance between

- 15. Operating Leverage Operating Leverage (OL) is the effect that fixed costs have on changes in operating

- 16. Effects of Sales-Mix on CVP The formulae presented to this point have assumed a single product

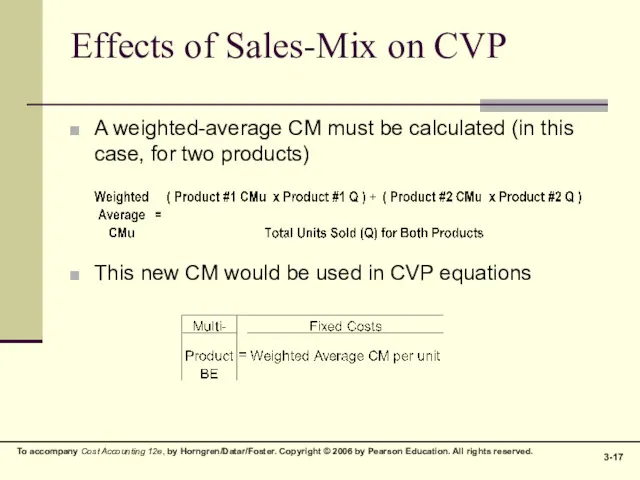

- 17. Effects of Sales-Mix on CVP A weighted-average CM must be calculated (in this case, for two

- 18. Multiple Cost Drivers Variable costs may arise from multiple cost drivers or activities. A separate variable

- 20. Скачать презентацию

Сводка и группровка статистических данных

Сводка и группровка статистических данных Салықтар және салық салу. Тақырып 6

Салықтар және салық салу. Тақырып 6 Сборы за пользование объектами животного мира и за пользование объектами водных биологических ресурсов

Сборы за пользование объектами животного мира и за пользование объектами водных биологических ресурсов Предложение о продаже объекта недвижимости

Предложение о продаже объекта недвижимости Электронные деньги

Электронные деньги Міжнародний рух інвестиційного капіталу та виробнича діяльність

Міжнародний рух інвестиційного капіталу та виробнича діяльність Понятие и виды прибыли

Понятие и виды прибыли Бухгалтерське законодавство та особливості обліку у Франції

Бухгалтерське законодавство та особливості обліку у Франції Витрати виробництва та витрати операційної діяльності (тема 4)

Витрати виробництва та витрати операційної діяльності (тема 4) Себестоимость. Учет затрат на производство и реализацию продукции и калькулирование себестоимости продукции

Себестоимость. Учет затрат на производство и реализацию продукции и калькулирование себестоимости продукции Исполнение обязанности по уплате налогов и сборов

Исполнение обязанности по уплате налогов и сборов Диагностика финансово-хозяйственной деятельности ПАО Челябинский металлургический комбинат

Диагностика финансово-хозяйственной деятельности ПАО Челябинский металлургический комбинат Анализ финансовых результатов деятельности предприятия ФГУП ФЯО ГХК

Анализ финансовых результатов деятельности предприятия ФГУП ФЯО ГХК Учет и аудит собственного капитала и резервов

Учет и аудит собственного капитала и резервов Пусть ваши деньги работают Version 2.6 Euro

Пусть ваши деньги работают Version 2.6 Euro Понятие ценных бумаг

Понятие ценных бумаг Косвенные налоги. Налог на добавленную стоимость (НДС) (глава 21 НК РФ)

Косвенные налоги. Налог на добавленную стоимость (НДС) (глава 21 НК РФ) Финансовые рынки и институты

Финансовые рынки и институты T2_L10

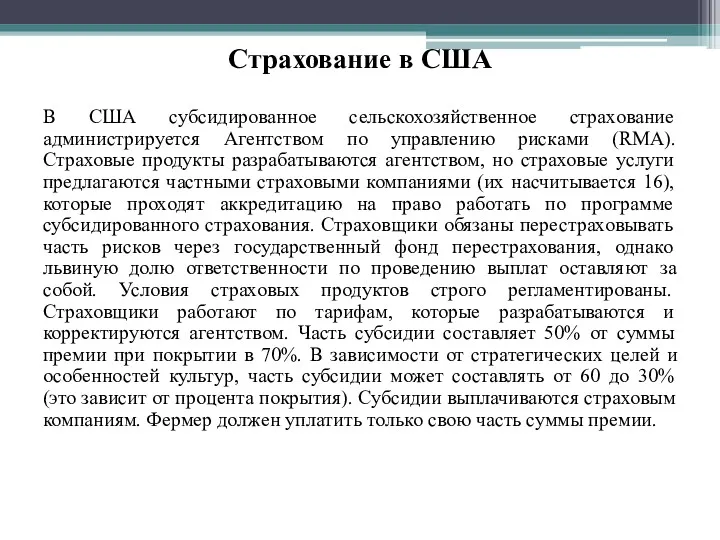

T2_L10 Субсидированное сельскохозяйственное страхование в США

Субсидированное сельскохозяйственное страхование в США Распределение, неравенство доходов. Перераспределение

Распределение, неравенство доходов. Перераспределение Анализ ликвидности бухгалтерского баланса

Анализ ликвидности бухгалтерского баланса Финансовая система

Финансовая система Небольшой опрос по прошедшим темам

Небольшой опрос по прошедшим темам Деньги: причины возникновения, формы и функции

Деньги: причины возникновения, формы и функции Налог на доходы физических лиц

Налог на доходы физических лиц Виды кредитов

Виды кредитов Валютное регулирование и валютный контроль. Лекция 2 - Валютное регулирование

Валютное регулирование и валютный контроль. Лекция 2 - Валютное регулирование