Содержание

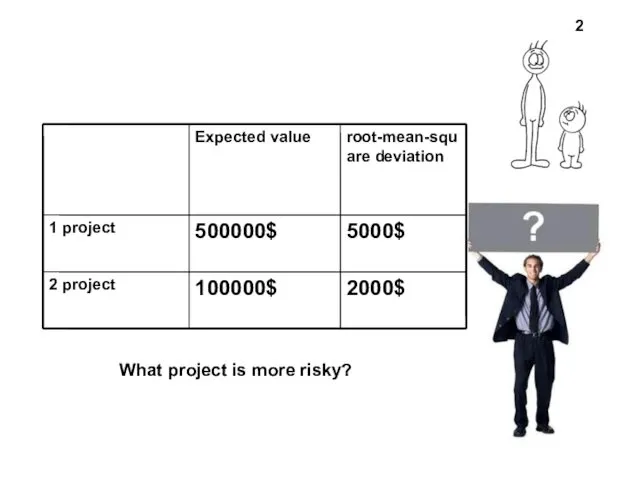

- 2. What project is more risky? 2

- 3. If taking into account root-mean-squire deviation, the first (bigger) project is more risky But if taking

- 4. 4 In order to compare the risk of projects with very different values of investments, outcomes

- 5. Relative risk measurement: constant of variation 5

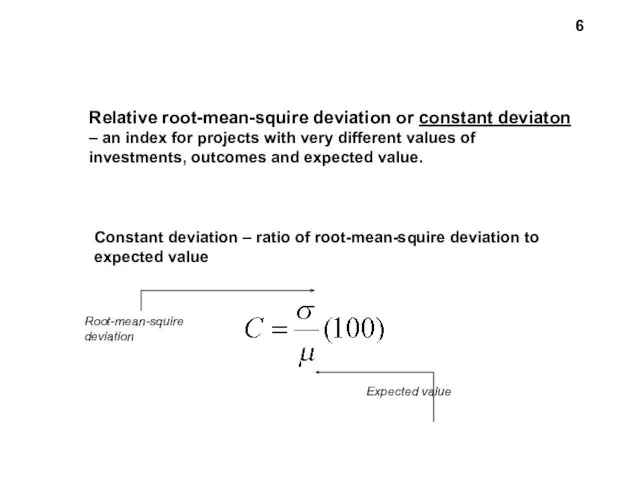

- 6. Relative root-mean-squire deviation or constant deviaton – an index for projects with very different values of

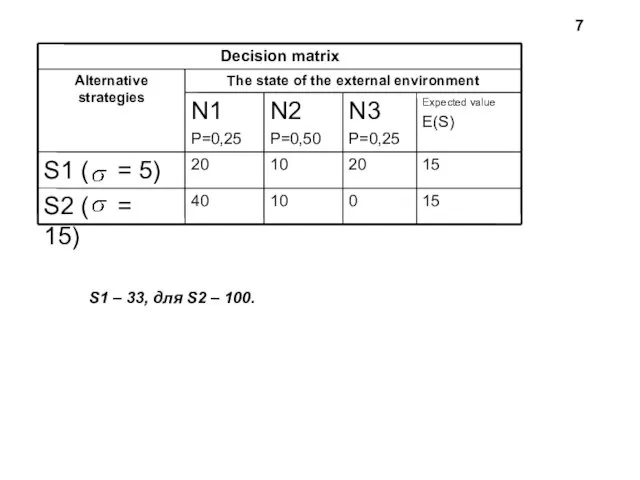

- 7. S1 – 33, для S2 – 100. 7

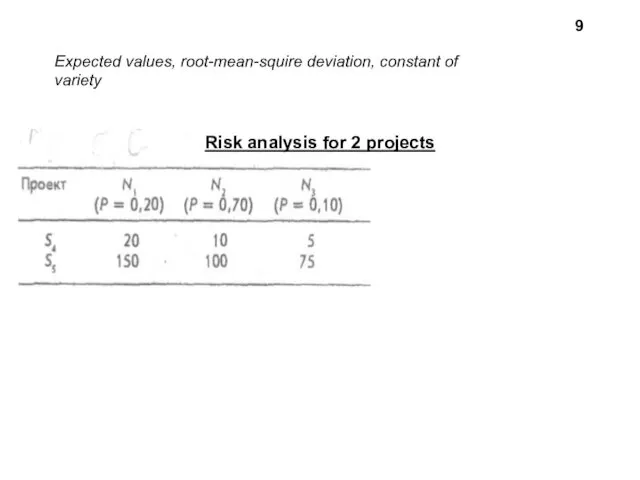

- 9. 9 Expected values, root-mean-squire deviation, constant of variety Risk analysis for 2 projects

- 10. A higher root-mean-squire deviation means a higher absolute risk A higher constant of variety indicates a

- 11. What index I’m taking into account and what decision I make? Depends on the attitude to

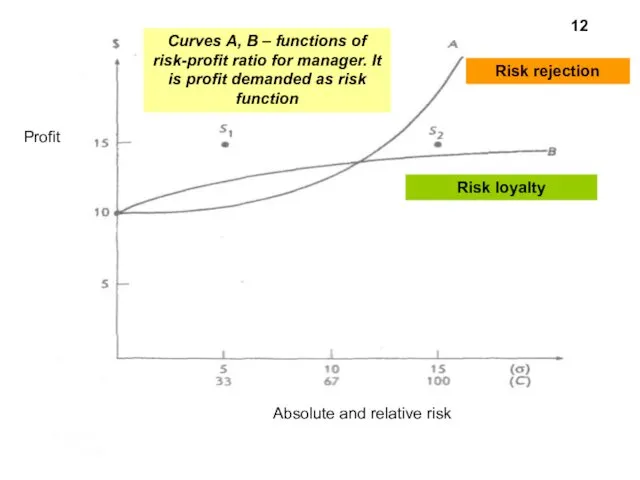

- 12. Отношение к риску -- это понятие в экономике, характеризующее склонность потребителей и инвесторов к принятию того

- 13. In the vast sea of human personalities, there are people who take risks, and people who

- 14. To risk or not to risk? Most investors and managers try to avoid risk Why? 14

- 15. Theory of utility 15

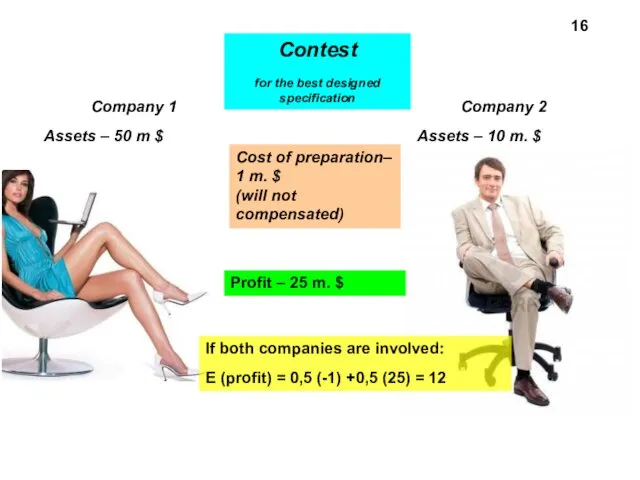

- 16. Company 1 Assets – 50 m $ Company 2 Assets – 10 m. $ Cost of

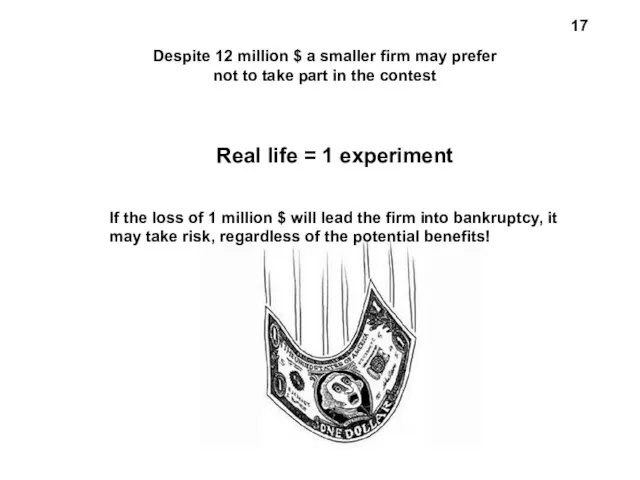

- 17. Despite 12 million $ a smaller firm may prefer not to take part in the contest

- 18. Conclusion: the conversion of dollar returns in some other incentive structure may be necessary before you

- 19. Managers use this concept when choosing from a number of alternatives The dollar return does not

- 20. Profits and losses should be measured from the point of view of marginal utility (not from

- 21. The smaller company has appointed a greater marginal utility to the potentially lost dollars, not to

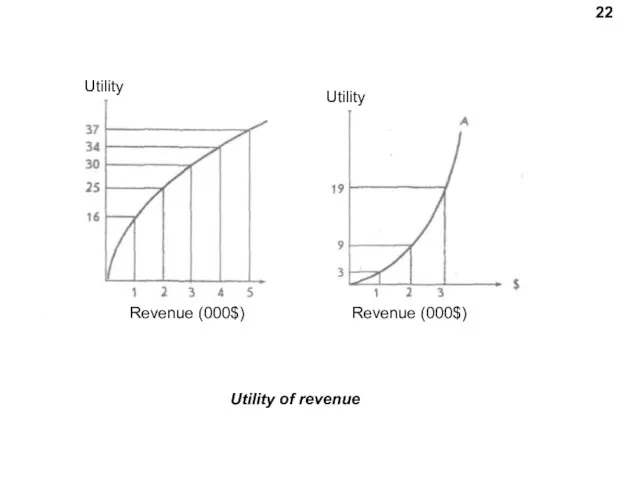

- 22. Utility of revenue 22 Utility Utility Revenue (000$) Revenue (000$)

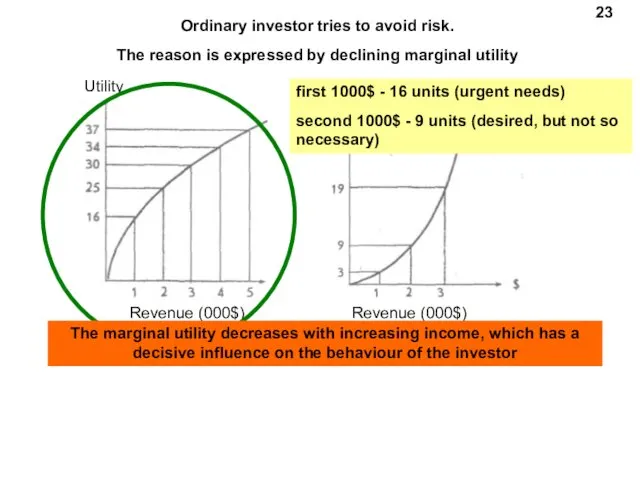

- 23. Revenue (000$) Utility Revenue (000$) Utility 23 Ordinary investor tries to avoid risk. The reason is

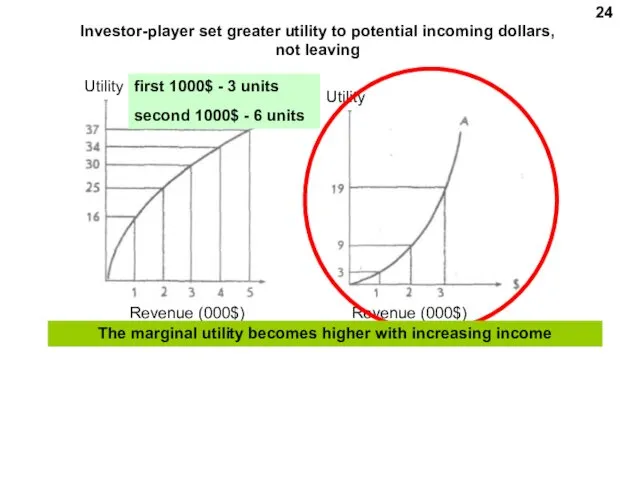

- 24. Revenue (000$) Utility 24 Investor-player set greater utility to potential incoming dollars, not leaving Utility Revenue

- 25. Leaders may be of different types Most of the leaders belong to type "a". They feel

- 27. Скачать презентацию

Личность и мотивация

Личность и мотивация Беседа по эффективности

Беседа по эффективности Менеджер проекта: координатор, лидер или начальник

Менеджер проекта: координатор, лидер или начальник Strategic Human Resource Management Research Methods

Strategic Human Resource Management Research Methods Анализ состояния нормирования труда в организации

Анализ состояния нормирования труда в организации Turistik deneyim

Turistik deneyim Стиль руководства

Стиль руководства Транспортировка в логистических системах

Транспортировка в логистических системах Соотношение государственного управления и исполнительной власти

Соотношение государственного управления и исполнительной власти Организация работы закусочной Блинная на 75 мест

Организация работы закусочной Блинная на 75 мест Фармацевтикалық ұйымдарды логистикалық жүйе арқылы басқару

Фармацевтикалық ұйымдарды логистикалық жүйе арқылы басқару ОИП_стандарт

ОИП_стандарт Создание и продвижение музыкального проекта

Создание и продвижение музыкального проекта Басшылық және ықпал ету

Басшылық және ықпал ету Управление транспортными системами. Технико-экономическая характеристика магистральных видов транспорта

Управление транспортными системами. Технико-экономическая характеристика магистральных видов транспорта Понятие стратегического менеджмента

Понятие стратегического менеджмента Анализ рынка. Состояние. Тренды

Анализ рынка. Состояние. Тренды Активные методы обучения

Активные методы обучения Системный подход к управлению качеством. Система управления качеством процессов на основе стандартов ИСО серии 9000: 2000-2008

Системный подход к управлению качеством. Система управления качеством процессов на основе стандартов ИСО серии 9000: 2000-2008 Спортивный бизнес, как новое явление российской экономики

Спортивный бизнес, как новое явление российской экономики История управленческой и организационной мысли

История управленческой и организационной мысли Планирование и организация логистического процесса в организациях

Планирование и организация логистического процесса в организациях Визначення і концепції управління проектами. (Тема 2)

Визначення і концепції управління проектами. (Тема 2) Планирование и управление закупками и выбором поставщиков в логистической системе на предприятии ООО Оконные системы

Планирование и управление закупками и выбором поставщиков в логистической системе на предприятии ООО Оконные системы Правила деловых отношений

Правила деловых отношений Управление качеством

Управление качеством Этика руководителя. (Лекция 6)

Этика руководителя. (Лекция 6) Помещения гостиниц и их оборудование

Помещения гостиниц и их оборудование