Содержание

- 2. Key points Discuss how firms analyze foreign markets Outline the process by which firms choose their

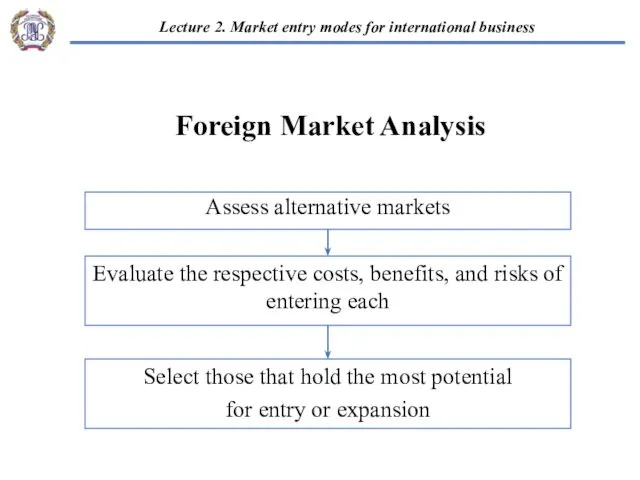

- 3. Foreign Market Analysis Assess alternative markets Evaluate the respective costs, benefits, and risks of entering each

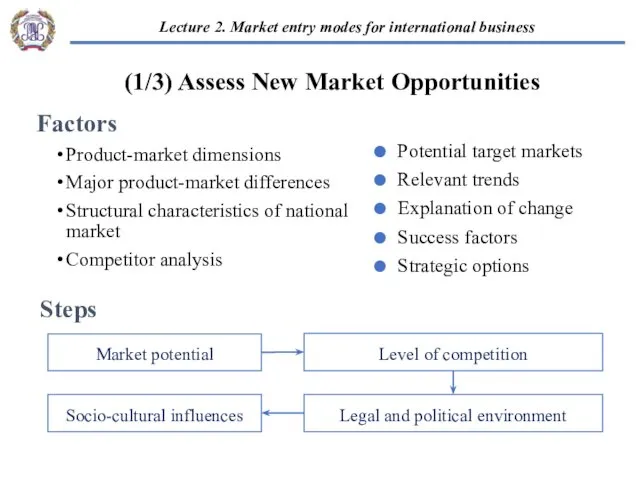

- 4. Factors Product-market dimensions Major product-market differences Structural characteristics of national market Competitor analysis Potential target markets

- 5. Costs: Direct costs and opportunity costs Benefits: Expected sales and profits from the markets. Lower acquisition

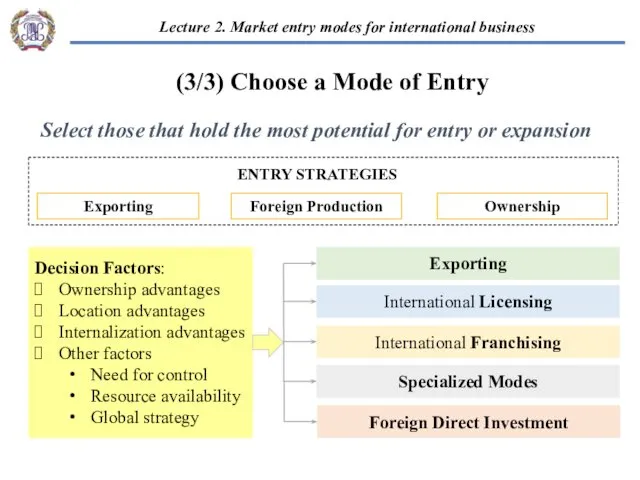

- 6. Select those that hold the most potential for entry or expansion (3/3) Choose a Mode of

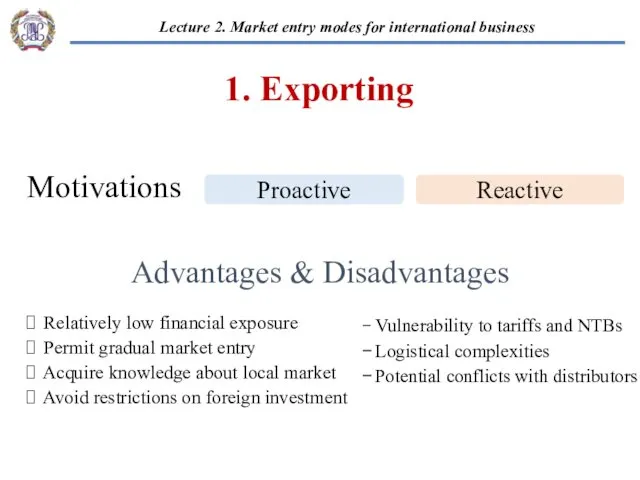

- 7. Motivations Relatively low financial exposure Permit gradual market entry Acquire knowledge about local market Avoid restrictions

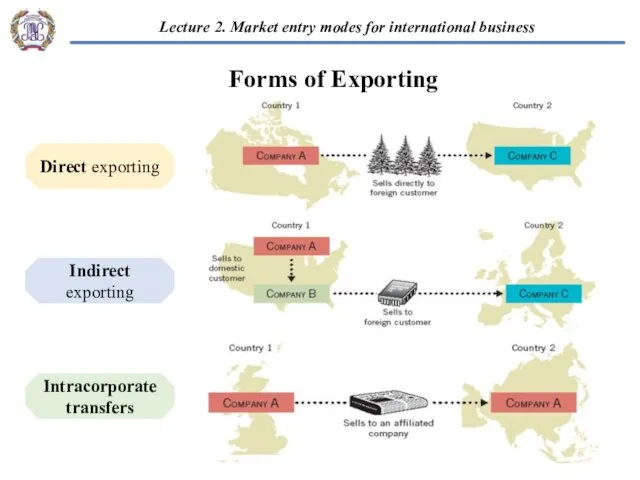

- 8. Forms of Exporting Indirect exporting Direct exporting Intracorporate transfers

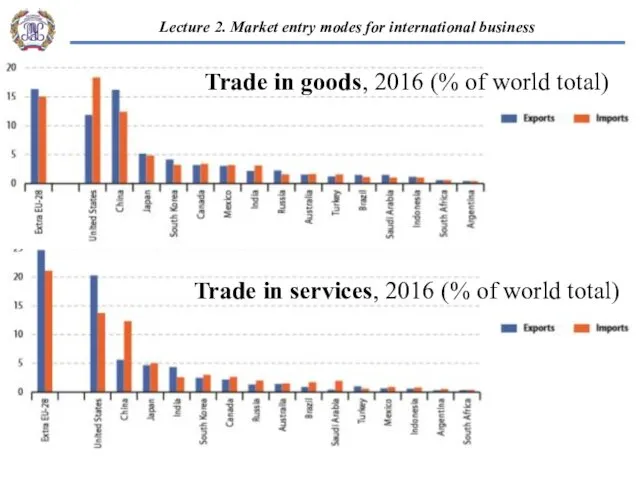

- 9. Trade in services, 2016 (% of world total) Trade in goods, 2016 (% of world total)

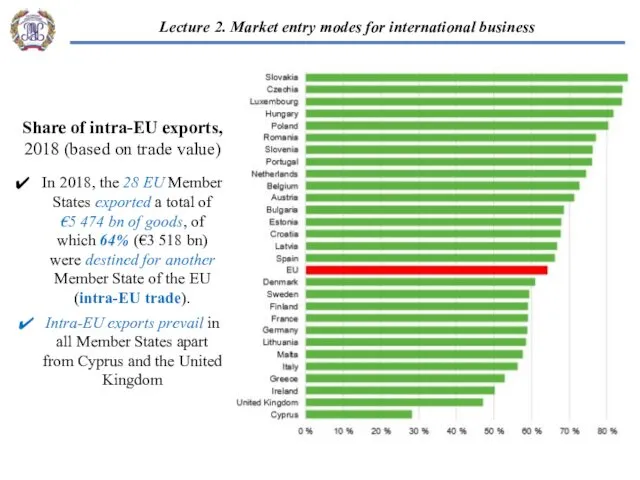

- 10. Share of intra-EU exports, 2018 (based on trade value) In 2018, the 28 EU Member States

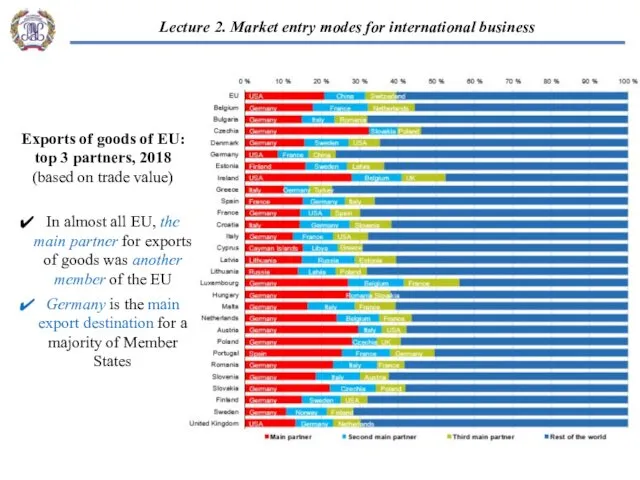

- 11. Exports of goods of EU: top 3 partners, 2018 (based on trade value) In almost all

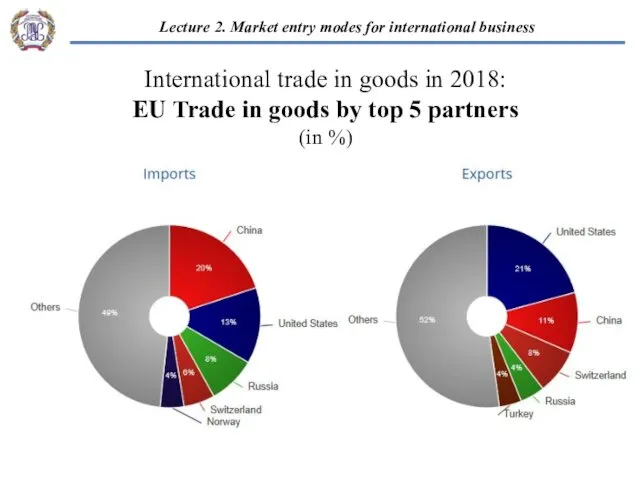

- 12. International trade in goods in 2018: EU Trade in goods by top 5 partners (in %)

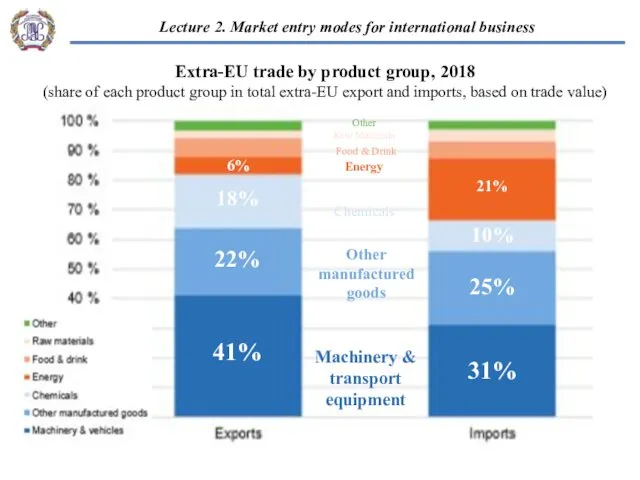

- 13. “EU-Russian business cooperation” 2. Market entry modes for international business: Russian and European peculiarities Extra-EU trade

- 14. “EU-Russian business cooperation” 2. Market entry modes for international business: Russian and European peculiarities

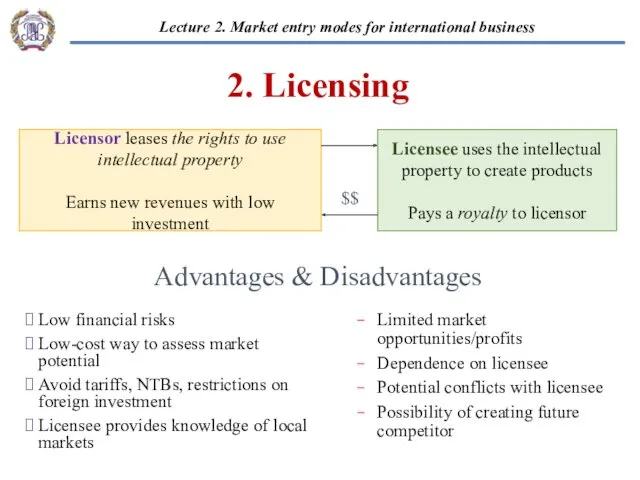

- 15. 2. Licensing Low financial risks Low-cost way to assess market potential Avoid tariffs, NTBs, restrictions on

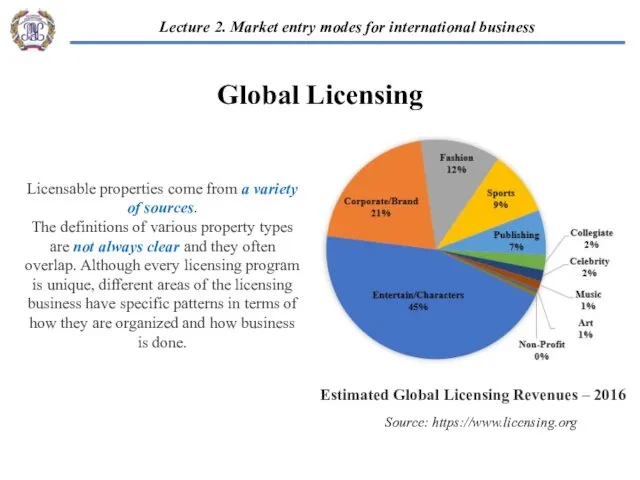

- 16. Global Licensing Licensable properties come from a variety of sources. The definitions of various property types

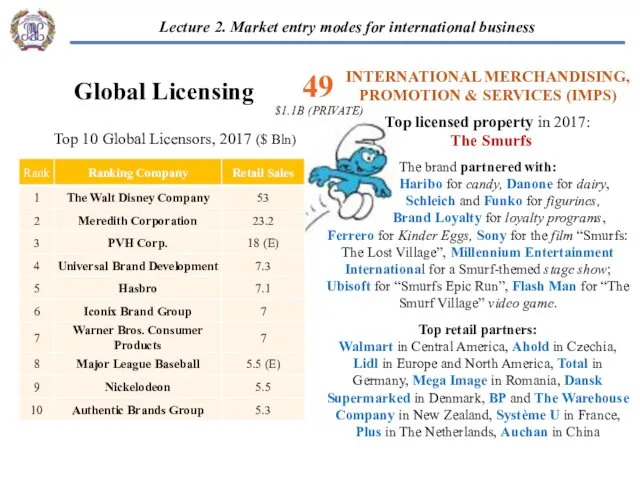

- 17. Global Licensing Top retail partners: Walmart in Central America, Ahold in Czechia, Lidl in Europe and

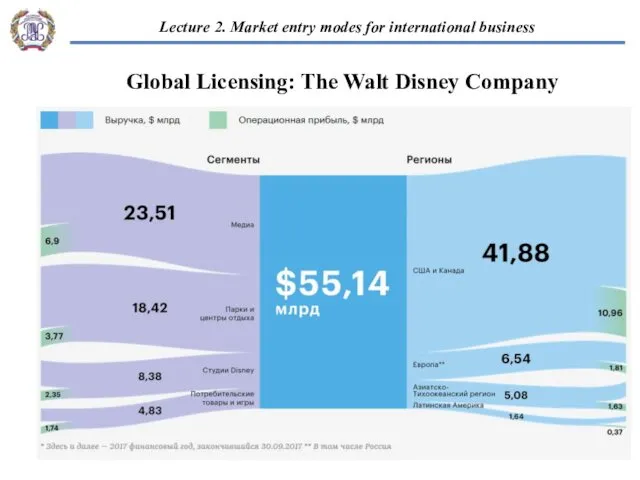

- 18. Global Licensing: The Walt Disney Company

- 19. “EU-Russian business cooperation” 2. Market entry modes for international business: Russian and European peculiarities Global Licensing

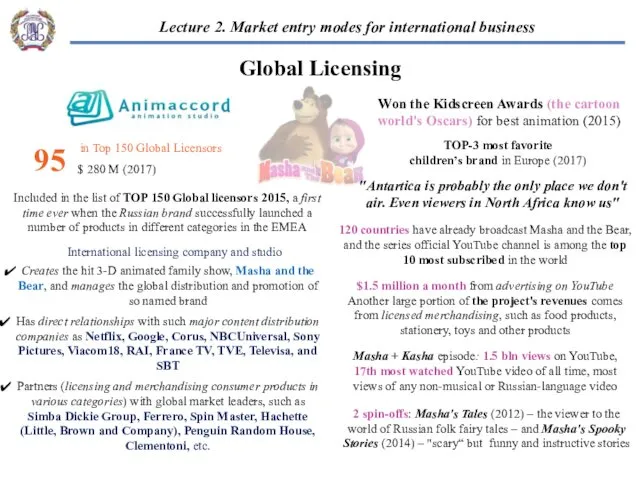

- 20. Low financial risks Low-cost way to assess market potential Avoid tariffs, NTBs, restrictions on foreign investment

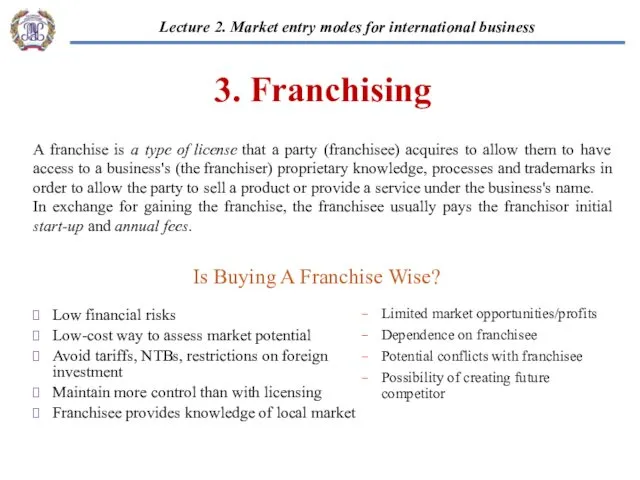

- 21. FRANCHISE BUSINESSES CREATE JOBS FASTER THAN OTHER BUSINESSES “EU-Russian business cooperation” 2. Market entry modes for

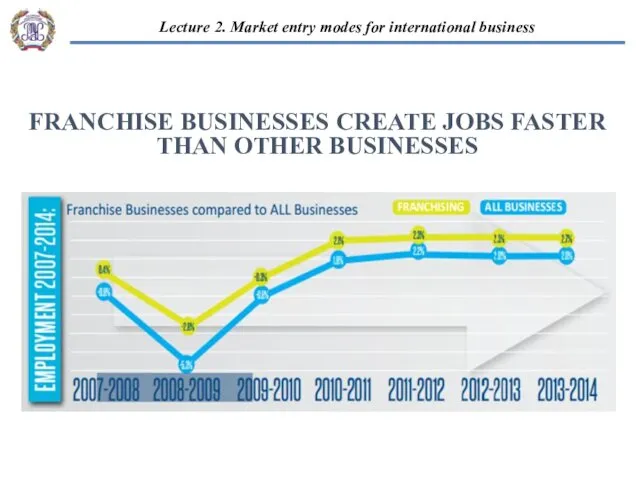

- 22. “EU-Russian business cooperation” 2. Market entry modes for international business: Russian and European peculiarities Franchising: Employment

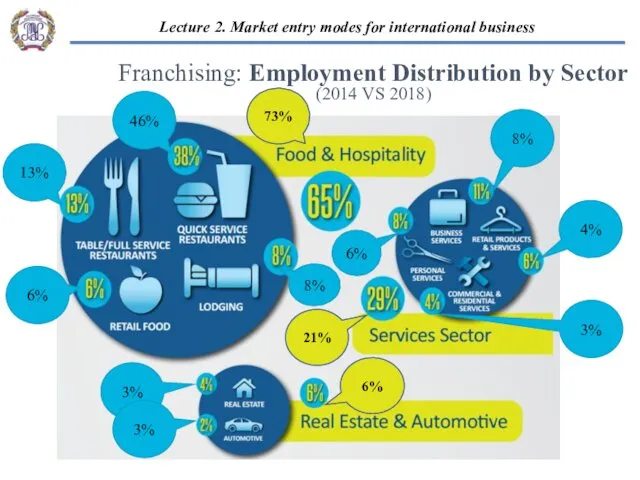

- 23. Franchising

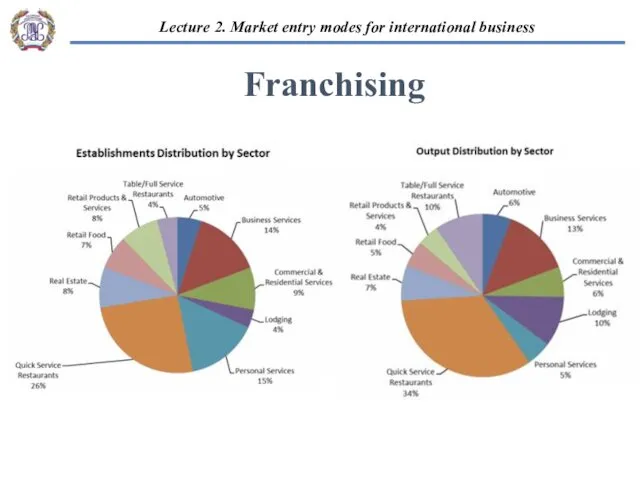

- 24. Franchising Top 10 Global Franchises for 2015 Top 10 Global Franchises for 2018 “EU-Russian business cooperation”

- 25. “EU-Russian business cooperation” 2. Market entry modes for international business: Russian and European peculiarities Top 500

- 26. Franchise Opportunities in Russia Most popular among buyers of franchises trademarks RBC annual rating of the

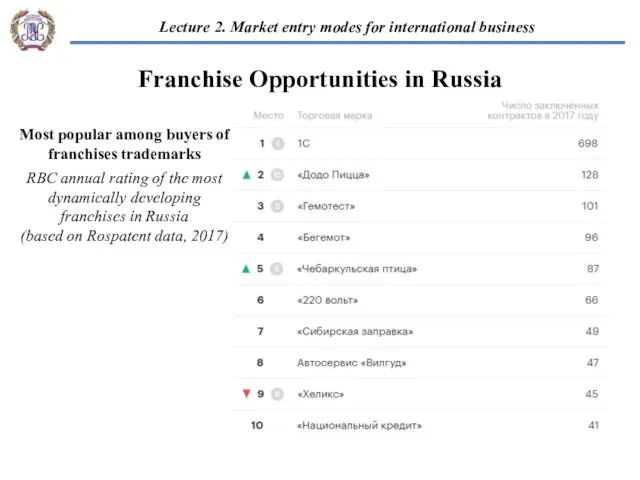

- 27. A strategic alliance is a business arrangement whereby two or more firms choose to cooperate for

- 28. The Scope of Strategic Alliances

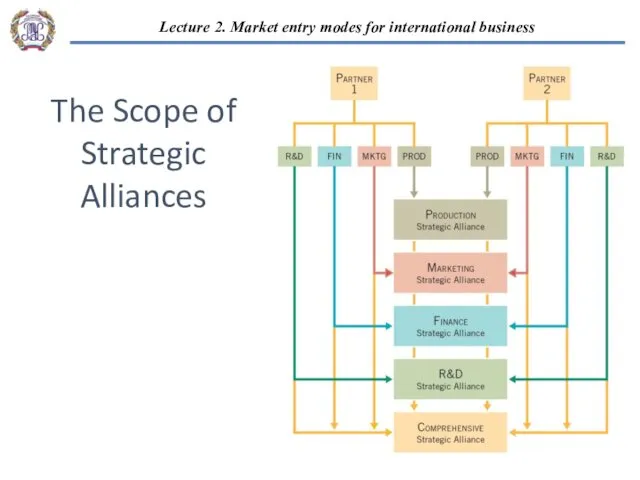

- 29. Approaches to Joint Management Shared management agreements Delegated arrangements Assigned arrangements Each partner fully and actively

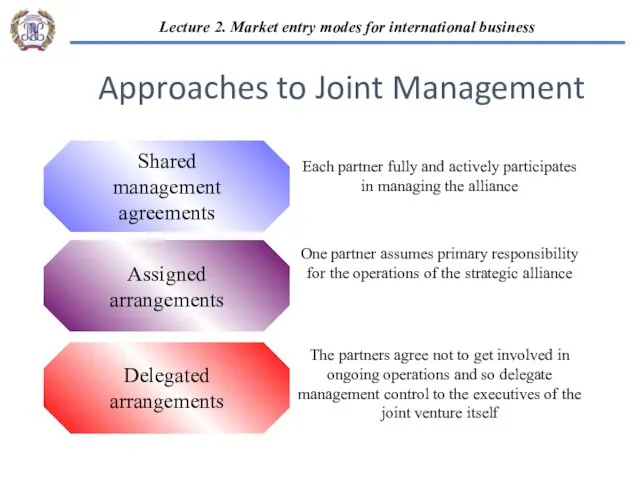

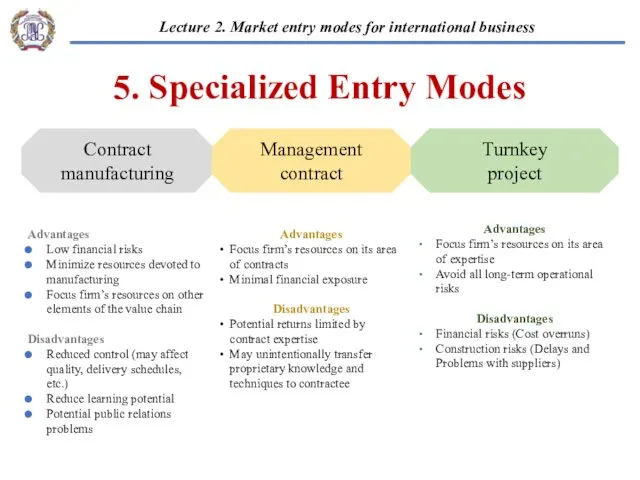

- 31. Contract manufacturing Turnkey project Management contract 5. Specialized Entry Modes Advantages Focus firm’s resources on its

- 32. CM is used in situations when one company arranges for another company in a different country

- 33. High profit potential Maintain control over operations Acquire knowledge of local market Avoid tariffs and NTBs

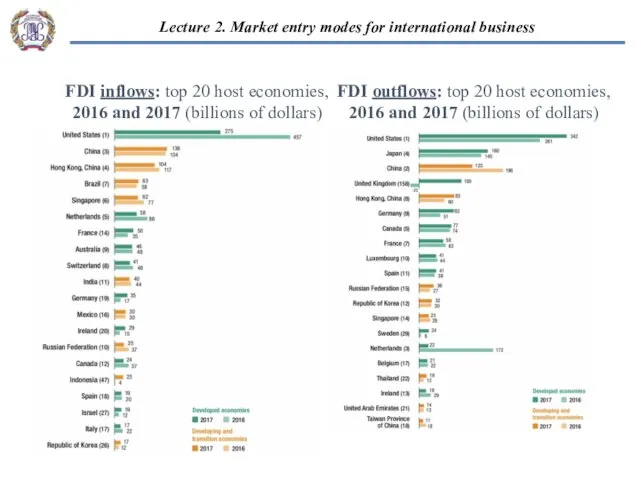

- 34. FDI inflows: top 20 host economies, 2016 and 2017 (billions of dollars) FDI outflows: top 20

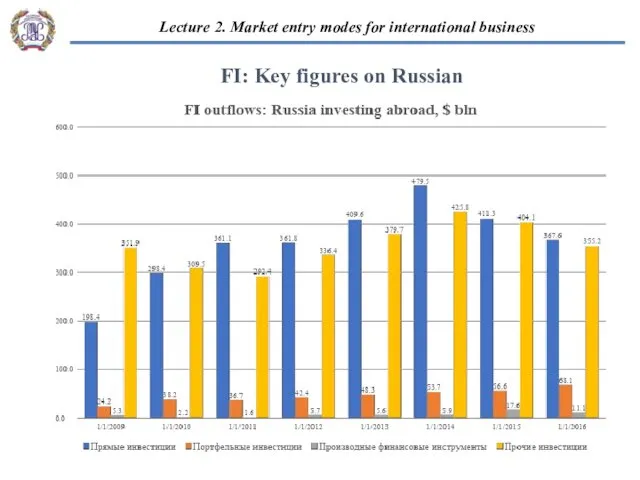

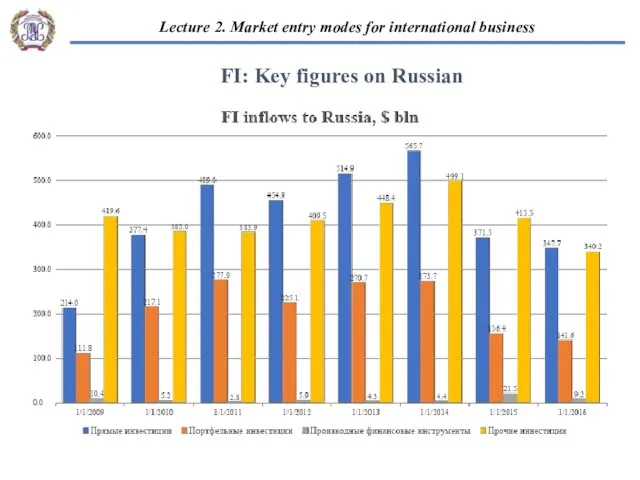

- 35. “EU-Russian business cooperation” 2. Market entry modes for international business: Russian and European peculiarities FI: Key

- 36. “EU-Russian business cooperation” 2. Market entry modes for international business: Russian and European peculiarities FI: Key

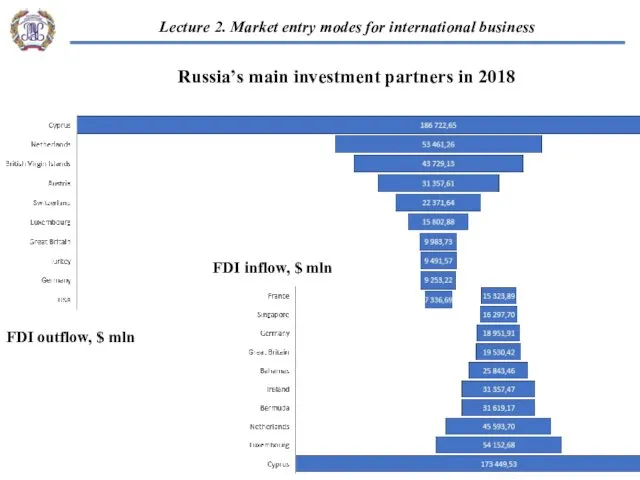

- 37. Russia’s main investment partners in 2018 FDI outflow, $ mln FDI inflow, $ mln

- 38. What are the main incentives to attract foreign investment in Russia? In recent years, the Russian

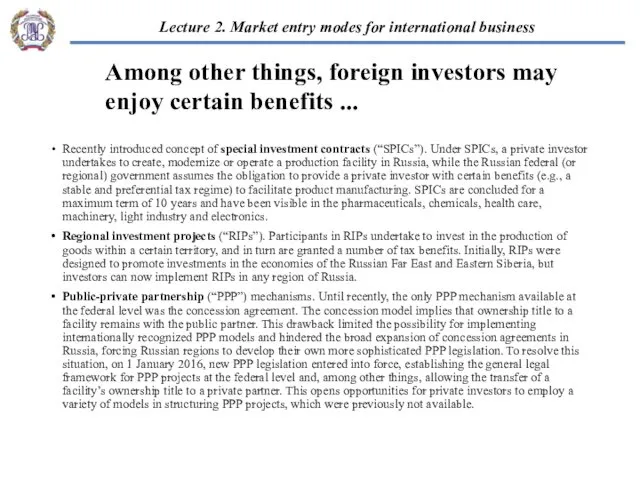

- 39. “EU-Russian business cooperation” 2. Market entry modes for international business: Russian and European peculiarities Recently introduced

- 41. Скачать презентацию

Повышение эффективности использования основных производственных фондов спортивного сооружения

Повышение эффективности использования основных производственных фондов спортивного сооружения Түйіндеме, ілеспе хат және оларды жұмысқа орналасудағы рөлі

Түйіндеме, ілеспе хат және оларды жұмысқа орналасудағы рөлі Особенности профессиональной этики в сфере сервиса

Особенности профессиональной этики в сфере сервиса Понятие проект. Проект устойчивого развития

Понятие проект. Проект устойчивого развития Iformation in humanresoure management

Iformation in humanresoure management Программирование и конфигурирование в корпоративных ИС. Система 1С:Предприятие. (Лекция 1)

Программирование и конфигурирование в корпоративных ИС. Система 1С:Предприятие. (Лекция 1) Стратегическое управление организацией. (Лекция 5)

Стратегическое управление организацией. (Лекция 5) Формирование индивидуального плана развития

Формирование индивидуального плана развития Мотивация сотрудников

Мотивация сотрудников Основи раціональної організації праці у галузі ресторанного господарства

Основи раціональної організації праці у галузі ресторанного господарства Определение лидерства

Определение лидерства Разработка ИТ-стратегии. Сбор данных. (Лекция 5)

Разработка ИТ-стратегии. Сбор данных. (Лекция 5) Мерчендайзер. Три вида мерчендайзеров

Мерчендайзер. Три вида мерчендайзеров Методы принятия управленческих решений. Алгоритм принятия решения

Методы принятия управленческих решений. Алгоритм принятия решения Адаптация персонала в новом коллективе

Адаптация персонала в новом коллективе Командные роли по М. Белбин

Командные роли по М. Белбин Лекция №3. Тема №1. Кадровый менеджмент. Тема №2. Управление человеческими ресурсами

Лекция №3. Тема №1. Кадровый менеджмент. Тема №2. Управление человеческими ресурсами Стратегия управления предприятием

Стратегия управления предприятием Эффективность управления предприятием. Объединение информационных потоков

Эффективность управления предприятием. Объединение информационных потоков Zahtjevi za implementaciju lean i agilnog opskrbnog lanca

Zahtjevi za implementaciju lean i agilnog opskrbnog lanca Оптимизация принятия управленческого решения с применением математических моделей

Оптимизация принятия управленческого решения с применением математических моделей The role of accounting in business. (Chapter 12)

The role of accounting in business. (Chapter 12) Мотивация и стимулирование труда

Мотивация и стимулирование труда Управление временем выполнения проекта

Управление временем выполнения проекта Компания HR Solutions. Система управления подбором персонала

Компания HR Solutions. Система управления подбором персонала Конфликты и социальная напряженность в коллективе

Конфликты и социальная напряженность в коллективе Charting a company’s direction. Its vision, mission, objectives, and strategy. (Chapter 2)

Charting a company’s direction. Its vision, mission, objectives, and strategy. (Chapter 2) Менеджмент освітньої організації

Менеджмент освітньої організації