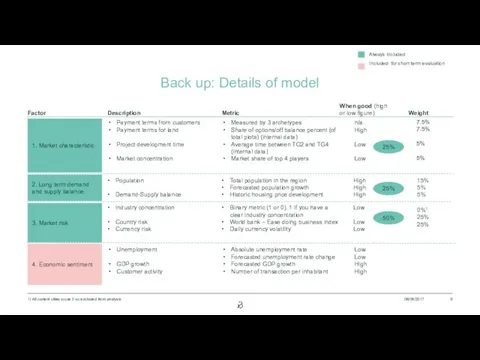

Back up: Details of model

1. Market characteristic

4. Economic sentiment

Factor

Description

Payment terms from

customers

Payment terms for land

Project development time

Market concentration

Unemployment

GDP growth

Customer activity

08/06/2017

Always included

Included for short term evaluation

Measured by 3 archetypes

Share of options/off balance percent (of total plots) (internal data)

Average time between TG2 and TG4 (internal data)

Market share of top 4 players

Absolute unemployment rate

Forecasted unemployment rate change

Forecasted GDP growth

Number of transaction per inhabitant

Metric

When good (high or low figure)

n/a

High

Low

Low

Low

Low

High

High

Weight

25%

2. Long term demand and supply balance

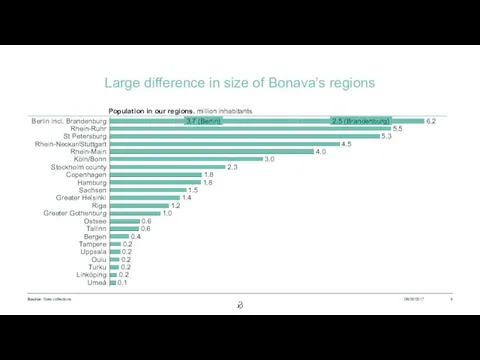

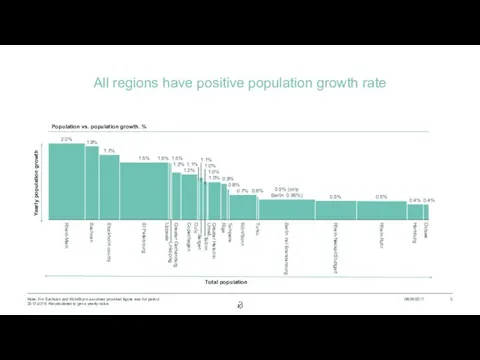

Population

Demand-Supply balance

Total population in the region

Forecasted population growth

Historic housing price development

High

High

High

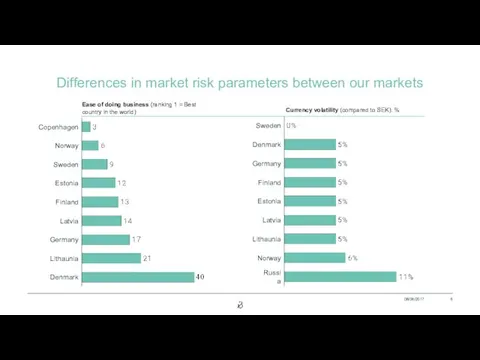

3. Market risk

Industry concentration

Country risk

Currency risk

Binary metric (1 or 0). 1 if you have a clear industry concentration

World bank – Ease doing business index

Daily currency volatility

Low

Low

Low

25%

50%

7.5%

7.5%

5%

5%

15%

5%

5%

0%1

25%

25%

1) All current cities score 0 so excluded from analysis

Управление проектами: основные понятия

Управление проектами: основные понятия Использование ПО при реализации процессного управления предприятием

Использование ПО при реализации процессного управления предприятием Стратегический менеджмент

Стратегический менеджмент Содержание и специфика психологии управления

Содержание и специфика психологии управления Базові функції управління

Базові функції управління Організаційний механізм управління корпораціями в туристичному бізнесі

Організаційний механізм управління корпораціями в туристичному бізнесі Взаимодействие при повышении производственной эффективности

Взаимодействие при повышении производственной эффективности Процесс принятия решения

Процесс принятия решения Памятка для операторов

Памятка для операторов Управление персоналом

Управление персоналом Совершенствование механизма государственно-частного партнерства в области физической культуры и спорта

Совершенствование механизма государственно-частного партнерства в области физической культуры и спорта Идеальный день начальника ОПС Салми

Идеальный день начальника ОПС Салми Бизнес-план организации

Бизнес-план организации Варианты стратегии создания фитнес - клуба

Варианты стратегии создания фитнес - клуба Кәсіпорынның құрылымы және оны жетілдіру жолдары

Кәсіпорынның құрылымы және оны жетілдіру жолдары Системный анализ в управлении

Системный анализ в управлении Процеси управління стратегічними ресурсами будівельної компанії ТОВ БК Пролетар

Процеси управління стратегічними ресурсами будівельної компанії ТОВ БК Пролетар Что такое организация. Ее цели и миссия

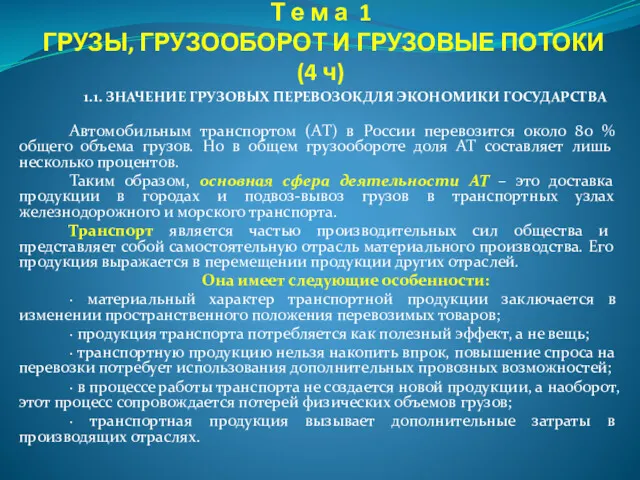

Что такое организация. Ее цели и миссия Грузы, грузооборот и грузовые перевозки

Грузы, грузооборот и грузовые перевозки Elements of a joint venture

Elements of a joint venture Содержание и оценка результатов исследования

Содержание и оценка результатов исследования Маленькие хитрости большого бизнеса (2). Дружелюбное отношение руководства с сотрудниками в Макдональдс

Маленькие хитрости большого бизнеса (2). Дружелюбное отношение руководства с сотрудниками в Макдональдс Механизм управления предприятием

Механизм управления предприятием Теория усиления мотивации Скиннера

Теория усиления мотивации Скиннера Управление закупками и запасами

Управление закупками и запасами Индивид в организации

Индивид в организации Мозговой штурм

Мозговой штурм Региональный менеджер

Региональный менеджер