Содержание

- 2. After studying Chapter 1, you should be able to: Explain why the role of the financial

- 3. Historical Perspective In early 1900, financial managers had the responsibility to raise funds and manage cash

- 4. What is Financial Management? Concerns the acquisition, financing, and management of assets with some overall goal

- 5. Investment Decisions What is the optimal firm size? What specific assets should be acquired? What assets

- 6. Financing Decisions What is the best type of financing? What is the best financing mix? What

- 7. Asset Management Decisions How do we manage existing assets efficiently? Financial Manager has varying degrees of

- 8. What is the Goal of the Firm? Maximization of Shareholder Wealth! Value creation occurs when we

- 9. Shortcomings of Alternative Perspectives Could increase current profits while harming firm (e.g., defer maintenance, issue common

- 10. Shortcomings of Alternative Perspectives Does not specify timing or duration of expected returns. Ignores changes in

- 11. Strengths of Shareholder Wealth Maximization Takes account of: current and future profits and EPS; the timing,

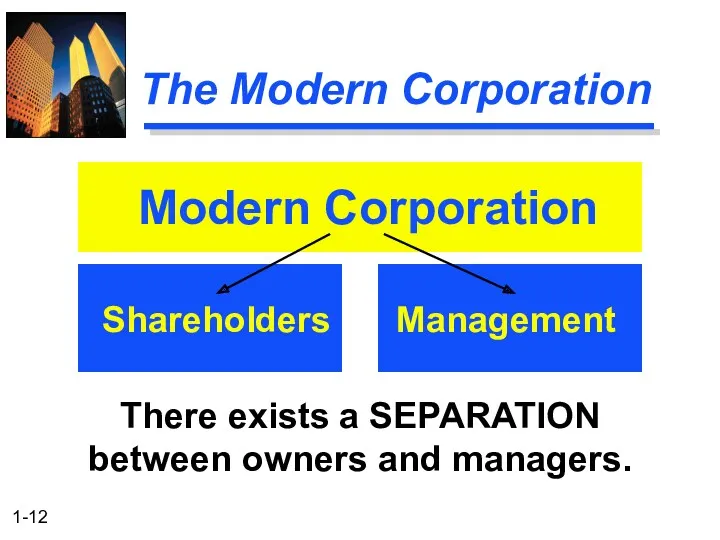

- 12. The Modern Corporation There exists a SEPARATION between owners and managers. Modern Corporation Shareholders Management

- 13. Role of Management An agent is an individual authorized by another person, called the principal, to

- 14. Agency Theory Agency Theory is a branch of economics relating to the behavior of principals and

- 15. Agency Theory Incentives include stock options, perquisites, and bonuses. Principals must provide incentives so that management

- 16. Social Responsibility Wealth maximization does not preclude the firm from being socially responsible. Assume we view

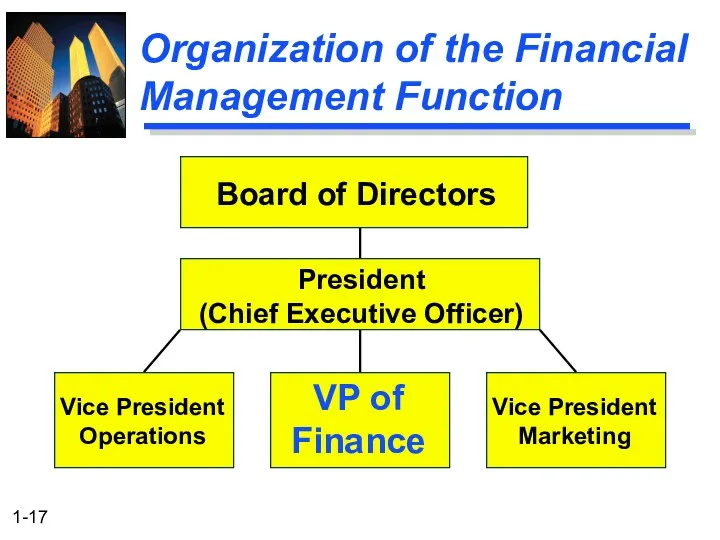

- 17. Organization of the Financial Management Function Board of Directors President (Chief Executive Officer) Vice President Operations

- 19. Скачать презентацию

Эффективное планирование ресурсного обеспечения стратегических целей

Эффективное планирование ресурсного обеспечения стратегических целей Теоретические основы формирования экономических и эффективных систем управления персоналом

Теоретические основы формирования экономических и эффективных систем управления персоналом Внутрифирменный кодекс корпоративной этики

Внутрифирменный кодекс корпоративной этики Методы планирования потребности в персонале

Методы планирования потребности в персонале Методология Дабл Даймонд

Методология Дабл Даймонд Понятие и виды организаций

Понятие и виды организаций Техническое задание на НИР. Лекция 5

Техническое задание на НИР. Лекция 5 Планирование и проведение собеседования с кандидатами на замещение вакантных должностей

Планирование и проведение собеседования с кандидатами на замещение вакантных должностей Поняття бенчмаркінгу та його суть

Поняття бенчмаркінгу та його суть Менеджмент качества физкультурно-оздоровительных и спортивных услуг: методы определения качества услуг

Менеджмент качества физкультурно-оздоровительных и спортивных услуг: методы определения качества услуг 1С:ERP. Управление предприятием 2.0

1С:ERP. Управление предприятием 2.0 Понятие управления и управленческого процесса в таможенных органах. (Тема 2)

Понятие управления и управленческого процесса в таможенных органах. (Тема 2) ОптимаСофт. Моделирование бизнес-процессов в нотации IDEF0

ОптимаСофт. Моделирование бизнес-процессов в нотации IDEF0 Структура управления организацией

Структура управления организацией Личность в системе управления

Личность в системе управления Стратегическое и оперативное планирование

Стратегическое и оперативное планирование Controlling as a Management Function

Controlling as a Management Function Менеджеры в системе управления

Менеджеры в системе управления Технология социального проектирования. (Лекция 16)

Технология социального проектирования. (Лекция 16) Инновационный менеджмент

Инновационный менеджмент Ведомстволық архивке қойылатын талаптар

Ведомстволық архивке қойылатын талаптар Номенклатура дел: значение и алгоритм разработки. Мастер-класс

Номенклатура дел: значение и алгоритм разработки. Мастер-класс Функция руководства в теории организации. (Тема 18)

Функция руководства в теории организации. (Тема 18) Организация как процесс управления

Организация как процесс управления Подходы в менеджменте. Система управления. Закономерности и принципы управления

Подходы в менеджменте. Система управления. Закономерности и принципы управления Тема 8. Успішна співбесіда з працедавцем

Тема 8. Успішна співбесіда з працедавцем Жизненный цикл организации. Закон онтогенеза

Жизненный цикл организации. Закон онтогенеза Анри Файоль – классическая школа менеджмента

Анри Файоль – классическая школа менеджмента