METHODS

In the past few years in Kazakhstan, there has been a

tendency to consolidate banks by merging them and, accordingly, there is a decrease in the number of banks in the country.

The analysis of the legal framework of Kazakhstan was chosen as the research method.

The Law of the Republic of Kazakhstan of August 31, 1995 “On banks and banking activities in the Republic of Kazakhstan”; the Law of the Republic of Kazakhstan dated March 30, 1995 “On the National Bank of the Republic of Kazakhstan”; the law of the Republic of Kazakhstan dated July 4, 2003 “On state regulation, control and supervision of the financial market and financial organizations”; the Law of the Republic of Kazakhstan dated April 25, 2001 “On the Development Bank of Kazakhstan” were selected as a basement.

I.M. Uteshova in her article “Bankinglaw as an independent branch of law in Kazakhstan” gives a detailed explanation of banking law and also compares the different opinions of scientists as Khudyakov A.I., Gurevich I.S., Yefimova L.G and other`s.

It is worth noting that the Republic of Kazakhstan has a two-tier banking system. The National Bank is the central bank of the state and represents the upper (first) level of the banking system. All other banks represent the lower (second) level of the banking system.

In addition, it should be marked, that to reveal the complete information about the banking system there was a lack of sufficient literature.In order to write a research paper, there were studied the works of lawyers in the field of banking law.

Работа с одаренными детьми в условиях общеобразовательной школы

Работа с одаренными детьми в условиях общеобразовательной школы Требования к современному уроку в рамках ФГОС

Требования к современному уроку в рамках ФГОС Малая Октябрьская Железная дорога. Добро пожаловать в РЖД

Малая Октябрьская Железная дорога. Добро пожаловать в РЖД Науково-методичне забезпечення навчальної дисципліни

Науково-методичне забезпечення навчальної дисципліни Основные задачи работы психолого-медико-педагогических комиссий

Основные задачи работы психолого-медико-педагогических комиссий Мой выбор. План-проспект занятий

Мой выбор. План-проспект занятий Образование как проблема

Образование как проблема Активизация познавательной деятельности

Активизация познавательной деятельности Методика подготовки научного исследования

Методика подготовки научного исследования Своя игра. Обществознание

Своя игра. Обществознание Векторы развития СПО и нормативно-правовое обеспечение деятельности ПОО

Векторы развития СПО и нормативно-правовое обеспечение деятельности ПОО Формирование УУД на уроках в начальной школе

Формирование УУД на уроках в начальной школе Система уровней владения иностранным языком

Система уровней владения иностранным языком The University of Edinburgh

The University of Edinburgh Советы выпускникам

Советы выпускникам Конференция: “Удивительный мир научных книг”

Конференция: “Удивительный мир научных книг” Итоговая зачетная работа на тему Методика организации учебного процесса с применением ОЭИР

Итоговая зачетная работа на тему Методика организации учебного процесса с применением ОЭИР Презентация Работа со слабоуспевающими

Презентация Работа со слабоуспевающими Социологическое исследование для первокурсников Проблемы и интересы студентов

Социологическое исследование для первокурсников Проблемы и интересы студентов Традиционный урок в образовательном заведении

Традиционный урок в образовательном заведении Федеральный государственный образовательный стандарт общего образования

Федеральный государственный образовательный стандарт общего образования Система образования в РФ

Система образования в РФ Проектная деятельность в курсе ОРКСЭ

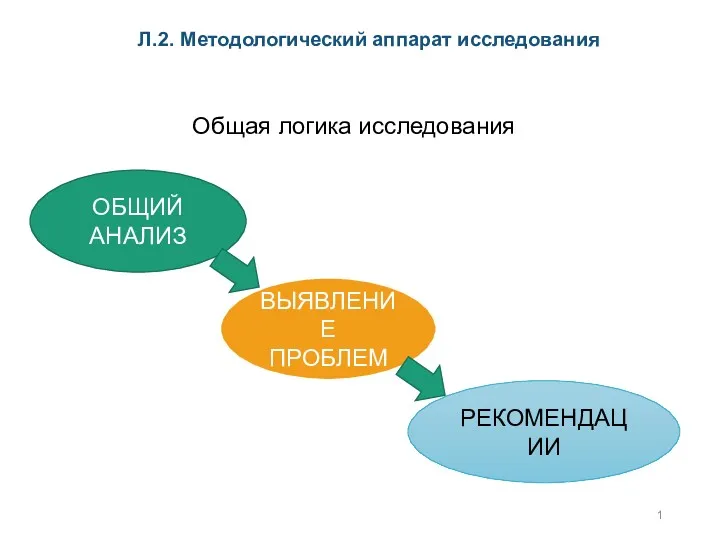

Проектная деятельность в курсе ОРКСЭ Методологический аппарат исследования. Общая логика исследования

Методологический аппарат исследования. Общая логика исследования Групповая форма работы на уроках технологии в рамках реализации ФГОС

Групповая форма работы на уроках технологии в рамках реализации ФГОС Индивидуальный проект обучающихся 10 классов

Индивидуальный проект обучающихся 10 классов Метод учебных проектов

Метод учебных проектов Традиционные и нетрадиционные формы и методы работы на уроке в начальной школе

Традиционные и нетрадиционные формы и методы работы на уроке в начальной школе