Содержание

- 2. Global economic governance: The evolution of the Bretton Woods System 1944 Bretton Wood Agreement was negotiated

- 3. Making of the Bretton Woods system There was a need for establishing a framework of norms,

- 4. Making of the Bretton Woods system These bodies were: The International Monetary Fund (IMF) which came

- 5. Making of the Bretton Woods system USA emerged from the WWII as the world’s predominant military

- 6. Making of the Bretton Woods system Second, US thinking was shaped by a growing awareness of

- 7. Making of the Bretton Woods system At the centre of the Bretton Woods system was a

- 8. Making of the Bretton Woods system Bretton Woods was shaped by the fear that an unregulated

- 9. Making of the Bretton Woods system Bretton Woods reflected an attempt to establish a Keynesian –style

- 10. Fate of the Bretton Woods system How far Bretton Woods contributed to the economic boom of

- 11. Fate of the Bretton Woods system The US economy was troubled because it was attempting to

- 12. Evaluating global economic governance: the International Monetary Fund The chief purpose was to encourage international cooperation

- 13. Evaluating global economic governance: the International Monetary Fund The system of fixed exchange rates established by

- 14. Evaluating global economic governance: the International Monetary Fund The most controversial aspect of the loans that

- 15. Evaluating global economic governance: the International Monetary Fund Structural adjustment programs rarely provided good results- e.g

- 16. The World Bank Partner organization of the IMF. Both organizations created by the Bretton Woods agreement,

- 17. The World Bank Initially, it mainly supported large infrastructure projects in areas such as energy, telecommunications

- 18. The World Bank Yet, from early 1990s it has responded to criticism from both without and

- 19. The World Trade Organization The WTO was formed in 1995 as a replacement for GATT, established

- 20. The World Trade Organization The GATT had certain limitations: its focus was restricted to the reduction

- 21. The World Trade Organization The WTO is stronger than GATT, especially in the issue of dispute

- 22. Global economic governance and the 2007-09 crisis The global financial crisis of 2007-09 posed a series

- 23. Global economic governance and the 2007-09 crisis Second, although its severity varied from country to country,

- 24. Global economic governance and the 2007-09 crisis But what would reformed global economic governance look like?

- 25. Global economic governance and the 2007-09 crisis From the market fundamentalist perspective, the most appropriate response

- 26. Global economic governance and the 2007-09 crisis Even though a series of ideas have been expressed,

- 27. Global economic governance and the 2007-09 crisis However, apart from this, the institutional response to the

- 28. Global economic governance and the 2007-09 crisis The chief institutional development: the establishment of the Financial

- 29. Obstacles to reform “Business as usual” after 2007-2009 crisis. Why? Crisis was initially managed by the

- 30. Obstacles to reform Another factor: changing balance of power within the world economy. The USA has

- 32. Скачать презентацию

Теорема Пифагора. Применение

Теорема Пифагора. Применение Акционерные общества как форма организации крупного бизнеса

Акционерные общества как форма организации крупного бизнеса Технологии эффективного командообразования

Технологии эффективного командообразования Культура Древнего Рима. Религия, обычаи, нравы, культура

Культура Древнего Рима. Религия, обычаи, нравы, культура Презентация; Концепция, как компонент целостного педагогического процесса

Презентация; Концепция, как компонент целостного педагогического процесса Зональные структуры Урала.

Зональные структуры Урала. Речевые игры как метод коррекции ТНР

Речевые игры как метод коррекции ТНР Обработка накладного кармана

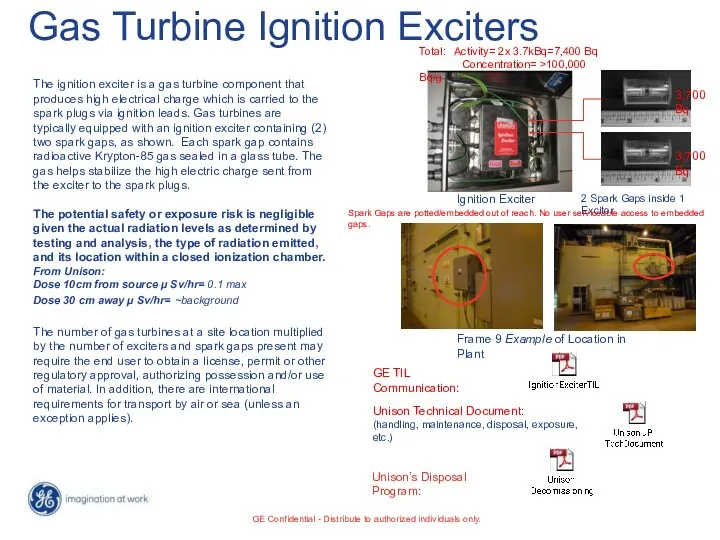

Обработка накладного кармана Gas Turbine

Gas Turbine Властивості ґрунтів. Ґрунтовий покрив, карта ґрунтів

Властивості ґрунтів. Ґрунтовий покрив, карта ґрунтів Открытый урок на тему: Основания

Открытый урок на тему: Основания Презентация по технологии 3 класс ОС Школа 2100

Презентация по технологии 3 класс ОС Школа 2100 Одаренные дети: особенности психического развития

Одаренные дети: особенности психического развития Машины и оборудование для свайных работ

Машины и оборудование для свайных работ Станция 6: “Умники и умницы”

Станция 6: “Умники и умницы” Гендерная эпистемология

Гендерная эпистемология Средства и методы оценки качества непродовольственных товаров

Средства и методы оценки качества непродовольственных товаров Девиантное поведение подростков

Девиантное поведение подростков Информационные и автоматизированные информационные системы

Информационные и автоматизированные информационные системы Русская масленица

Русская масленица Экономический и политический кризис начала 1920 годов. Переход к НЭПУ

Экономический и политический кризис начала 1920 годов. Переход к НЭПУ Презентация к разговору с учащимися по теме: Нам не дано предугадать как наше слово отзовется

Презентация к разговору с учащимися по теме: Нам не дано предугадать как наше слово отзовется Моя майбутня професія бухгалтер

Моя майбутня професія бухгалтер М.А. Булгаков. Сатирические произведения

М.А. Булгаков. Сатирические произведения ENGLISH

ENGLISH Healthy body, healthy mind

Healthy body, healthy mind ПрезентацияМемориал Героическим защитникам Ленинграда

ПрезентацияМемориал Героическим защитникам Ленинграда ножницы

ножницы