Содержание

- 2. MENA – key countries

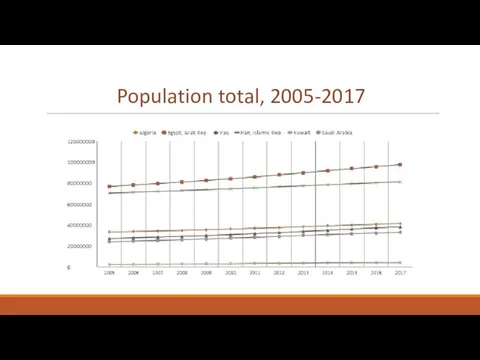

- 3. Population total, 2005-2017

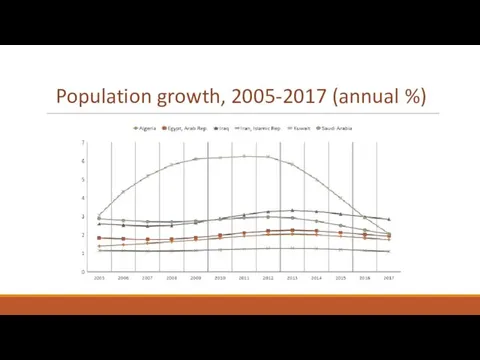

- 4. Population growth, 2005-2017 (annual %)

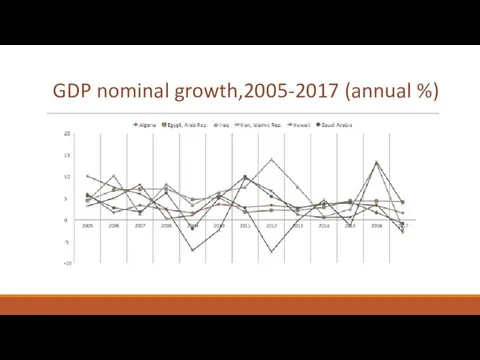

- 5. GDP nominal growth,2005-2017 (annual %)

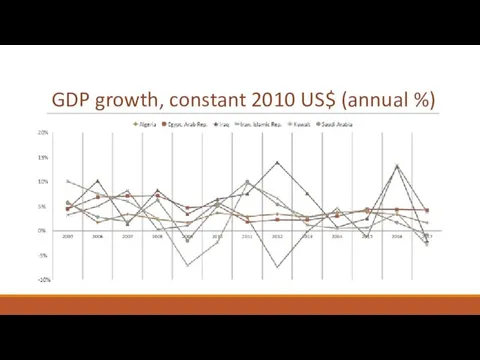

- 6. GDP growth, constant 2010 US$ (annual %)

- 7. GDP per capita, 2005-2017 (current US$)

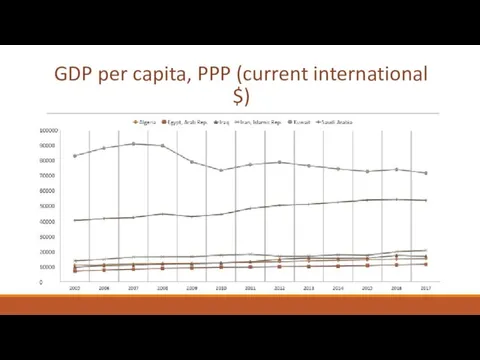

- 8. GDP per capita, PPP (current international $)

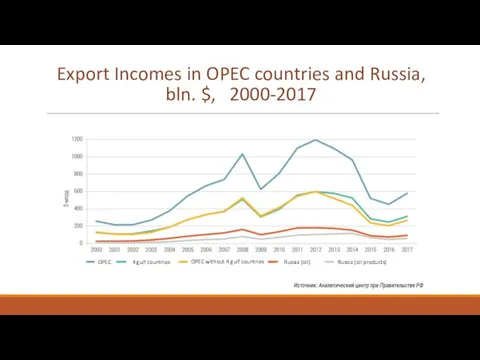

- 9. Export Incomes in OPEC countries and Russia, bln. $, 2000-2017 OPEC 4 gulf countries OPEC without

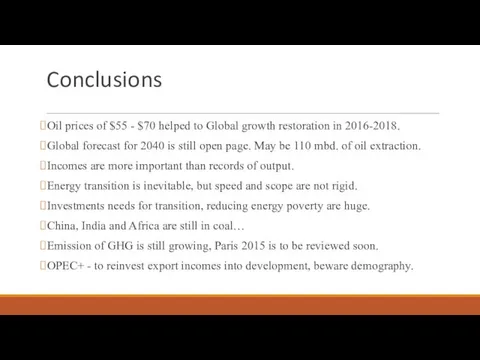

- 10. Conclusions Oil prices of $55 - $70 helped to Global growth restoration in 2016-2018. Global forecast

- 11. World Energy Transition and Future World is undergoing Energy transition, but still not that fast as

- 12. Current situation

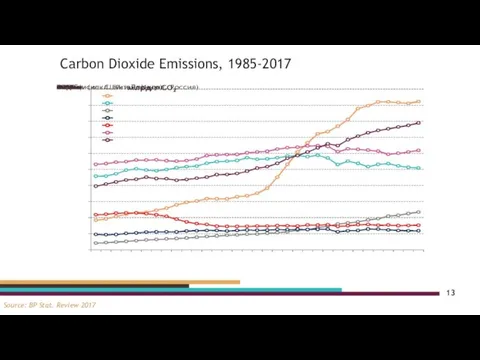

- 13. Carbon Dioxide Emissions, 1985-2017 Source: BP Stat. Review 2017

- 14. Oil Prices and World Oil Extraction, 2014-2018 Brent price Oil extraction (right axis)

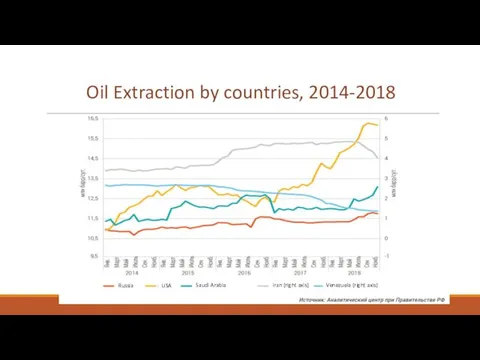

- 15. Oil Extraction by countries, 2014-2018 Russia USA Saudi Arabia Iran (right axis) Venezuela (right axis)

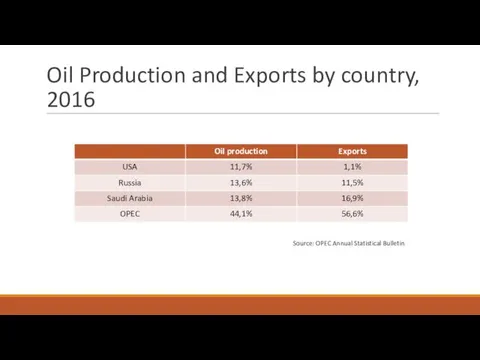

- 16. Oil Production and Exports by country, 2016 Source: OPEC Annual Statistical Bulletin

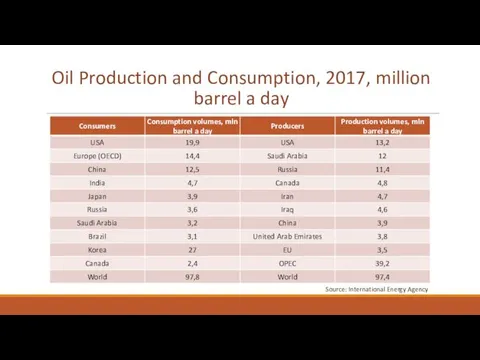

- 17. Oil Production and Consumption, 2017, million barrel a day Source: International Energy Agency

- 18. Global Balance and Future

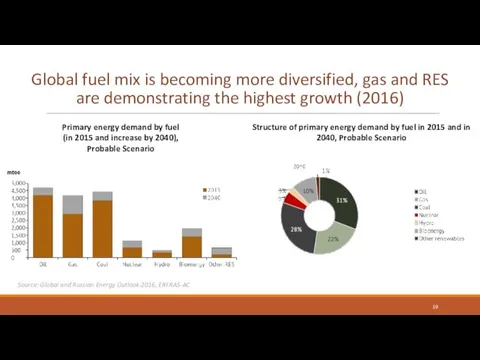

- 19. Primary energy demand by fuel (in 2015 and increase by 2040), Probable Scenario Source: Global and

- 20. The Structure of World Energy Consumption, 1971 and 2015, % total consumption Источник: МЭА

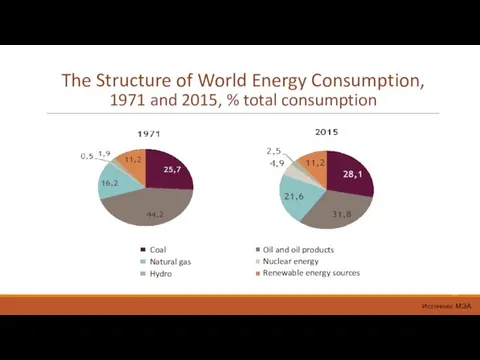

- 21. Carbon Dioxide Emissions, 1985-2017 Source: BP Stat. Review 2017

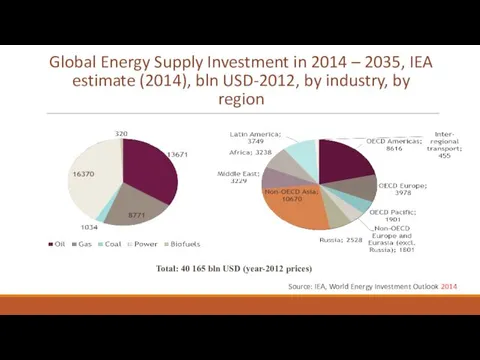

- 22. Global Energy Supply Investment in 2014 – 2035, IEA estimate (2014), bln USD-2012, by industry, by

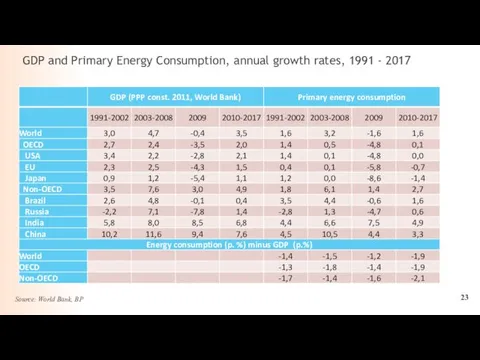

- 23. GDP and Primary Energy Consumption, annual growth rates, 1991 - 2017 Source: World Bank, BP

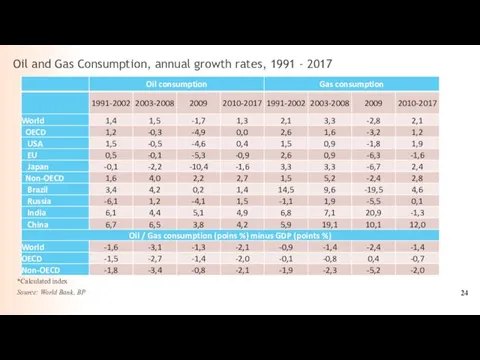

- 24. Oil and Gas Consumption, annual growth rates, 1991 - 2017 Source: World Bank, BP *Calculated index

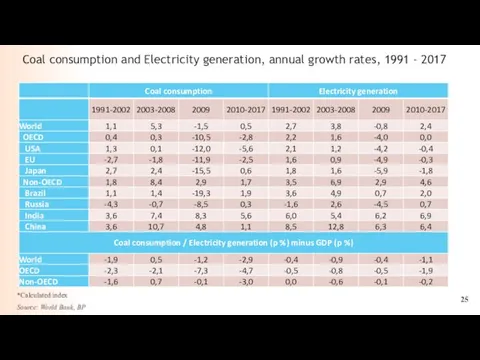

- 25. Coal consumption and Electricity generation, annual growth rates, 1991 - 2017 Source: World Bank, BP *Calculated

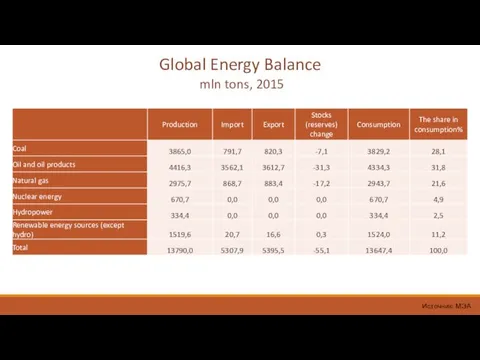

- 26. Global Energy Balance mln tons, 2015 Источник: МЭА

- 27. Literature 1 Григорьев Л.М., Чапыгина А.В. «Саудовская Аравия – нефть и развитие», «Мировая Энергетическая политика», №7,

- 29. Скачать презентацию

Голосеменные растения

Голосеменные растения Этика как философская наука о морали

Этика как философская наука о морали Родительское собрание Трудности адаптации.

Родительское собрание Трудности адаптации. Конспект занятия по нравственно патриотическому воспитанию Путешествие в г.Тольятти на завод по автомобилестроению. Воспитатель: Колядова Наталья Геннадьевна МБДОУ Д/с Тополекг.Абакана

Конспект занятия по нравственно патриотическому воспитанию Путешествие в г.Тольятти на завод по автомобилестроению. Воспитатель: Колядова Наталья Геннадьевна МБДОУ Д/с Тополекг.Абакана Внутриполитические условия для развития парадипломатии. Этническая и национальная идентичность. (Часть 1)

Внутриполитические условия для развития парадипломатии. Этническая и национальная идентичность. (Часть 1) Demin_MR-11_Presentation

Demin_MR-11_Presentation ВКЛЮЧЕНИЕ ТВОРЧЕСКИХ ИГР В ЛОГОПЕДИЧЕСКИЕ ЗАНЯТИЯ С МЛАДШИМИ ШКОЛЬНИКАМИ ОБЩЕОБРАЗОВАТЕЛЬНОЙ ШКОЛЫ

ВКЛЮЧЕНИЕ ТВОРЧЕСКИХ ИГР В ЛОГОПЕДИЧЕСКИЕ ЗАНЯТИЯ С МЛАДШИМИ ШКОЛЬНИКАМИ ОБЩЕОБРАЗОВАТЕЛЬНОЙ ШКОЛЫ Царства живой природы

Царства живой природы Презентация для 8 класса Растворение. Растворимость. Типы растворов.

Презентация для 8 класса Растворение. Растворимость. Типы растворов. ЕГАИС: Формат v3. Часть 3

ЕГАИС: Формат v3. Часть 3 Предмет химии. 10 класс

Предмет химии. 10 класс Отчет (в форме презентации) о проведении Дня мамы в разновозрастной группе

Отчет (в форме презентации) о проведении Дня мамы в разновозрастной группе Австралия. Географическое положение. История открытия. Рельеф и полезные ископаемые.

Австралия. Географическое положение. История открытия. Рельеф и полезные ископаемые. Математика в наших будущих профессиях

Математика в наших будущих профессиях Протитанковий ракетний комплекс 9К115 Метис (Заняття 3.8)

Протитанковий ракетний комплекс 9К115 Метис (Заняття 3.8) Курс по основам программирования на Python. Списки

Курс по основам программирования на Python. Списки Планирование работы по коррекции тревожности.

Планирование работы по коррекции тревожности. Логопедическая работа с учащимися 1 классов.

Логопедическая работа с учащимися 1 классов. Times

Times Ценностный потенциал культуры взаимопонимания студентов в процессе адаптации

Ценностный потенциал культуры взаимопонимания студентов в процессе адаптации История принятия и общая характеристика Конституции России

История принятия и общая характеристика Конституции России Chirac etait trop fort

Chirac etait trop fort Современная пирамида здорового питания

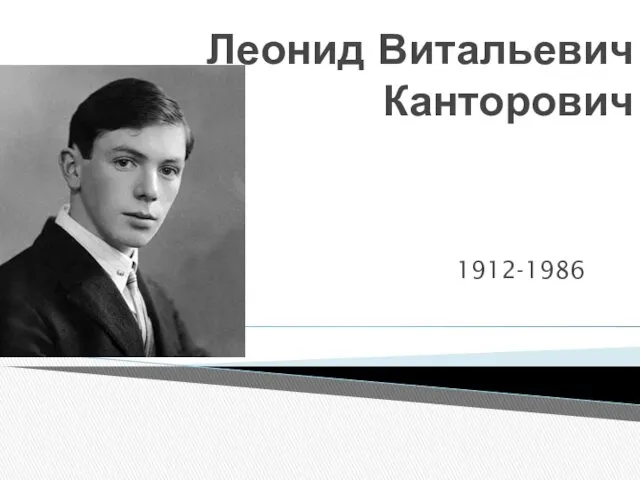

Современная пирамида здорового питания Леонид Витальевич Канторович (1912-1986)

Леонид Витальевич Канторович (1912-1986) Виды корпусов персональных компьютеров

Виды корпусов персональных компьютеров Интеллектуальный марафон Химия и искусстводля 8-11 классов

Интеллектуальный марафон Химия и искусстводля 8-11 классов Происхождение человека. Доказательства происхождения от животных. 9 класс

Происхождение человека. Доказательства происхождения от животных. 9 класс Проект Готовимся к школе Drive

Проект Готовимся к школе Drive