Содержание

- 2. Plan: Achievements and awards Subsidiaries Tsesnabank & State Programs Strategic plans

- 4. Kazakhstan’s 3rd largest bank, with a reputation for quality service and a developed branch network Over

- 5. The Bank’s core business lines are

- 8. Subsidiaries

- 9. TSESNABANK & STATE PROGRAMS Business Road Map-2020 for SMEs in the manufacturing sector, housing construction program

- 10. Agrarian Credit Corporation: * Agro-export program * Ken Dala program to support and develop agricultural entities

- 11. Strategic plans Building on position as a top-3 bank Maintaining asset quality Improving yield and efficiency

- 12. Financial goals Lending for corporates, SMEs and individuals through government programs. Maintaining deposit base to cover

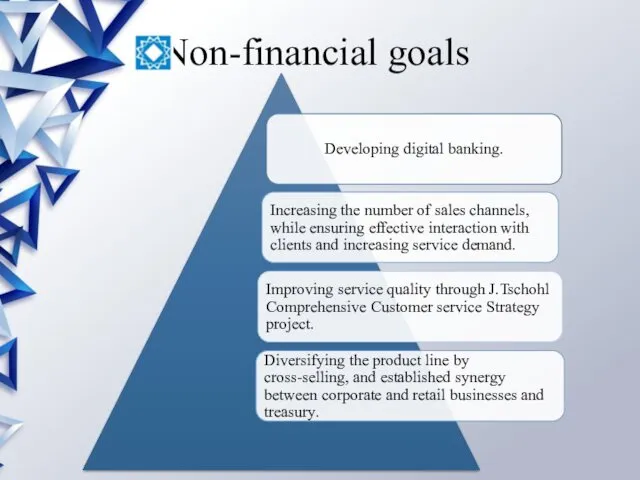

- 13. Non-financial goals

- 15. Скачать презентацию

Алкоголсіз сусындарды өндіруге арналған шикізат

Алкоголсіз сусындарды өндіруге арналған шикізат Основные фонды предприятия

Основные фонды предприятия Англия в раннее Средневековье

Англия в раннее Средневековье Автономные системы навигации летательных аппаратов

Автономные системы навигации летательных аппаратов Город Сокол. Бюджет для граждан на 2016 год

Город Сокол. Бюджет для граждан на 2016 год Проект одномодельного технологічного потіку з виготовлення жакету жіночого з костюмних тканин

Проект одномодельного технологічного потіку з виготовлення жакету жіночого з костюмних тканин Правила дорожного движения

Правила дорожного движения Бизнес-кейс Илона Маска

Бизнес-кейс Илона Маска презентация А. С. Пушкин 1 часть для начальной школы 3 класс

презентация А. С. Пушкин 1 часть для начальной школы 3 класс Теория вероятностей и математическая статистика

Теория вероятностей и математическая статистика приглашение

приглашение Всеобщая декларация прав человека - идеал права

Всеобщая декларация прав человека - идеал права Технология разработки прогнозов разных уровней. Макроэкономическое прогнозирование

Технология разработки прогнозов разных уровней. Макроэкономическое прогнозирование Личная карта здоровья. Поставщики продукции Вивасан

Личная карта здоровья. Поставщики продукции Вивасан Мы за безопасность на дорогах

Мы за безопасность на дорогах Здравствуй, школа!

Здравствуй, школа! Урок 105 Сложение однозначных чисел с переходом через десяток

Урок 105 Сложение однозначных чисел с переходом через десяток Кижи

Кижи Радиосвязное оборудование воздушных судов

Радиосвязное оборудование воздушных судов Клинический случай

Клинический случай Ишемический инсульт

Ишемический инсульт Ветер

Ветер Строительство. Гигиенические требования к строительным материалам

Строительство. Гигиенические требования к строительным материалам Этапы компьютерного моделирования

Этапы компьютерного моделирования Инженерно- геологические изыскания при строительстве тоннелей

Инженерно- геологические изыскания при строительстве тоннелей Урок по теме Добро и зло

Урок по теме Добро и зло Православный этикет

Православный этикет Взаимодествие детей и воспитателя в образовательной области Социально- коммуникативное развитие

Взаимодествие детей и воспитателя в образовательной области Социально- коммуникативное развитие