Содержание

- 2. CHAPTER 4 Options for Organizing Business CHAPTER 5 Small Business, Entrepreneurship, and Franchising © 2016 by

- 3. Learning Objectives LO 4-1 Define and examine the advantages and disadvantages of the sole proprietorship form

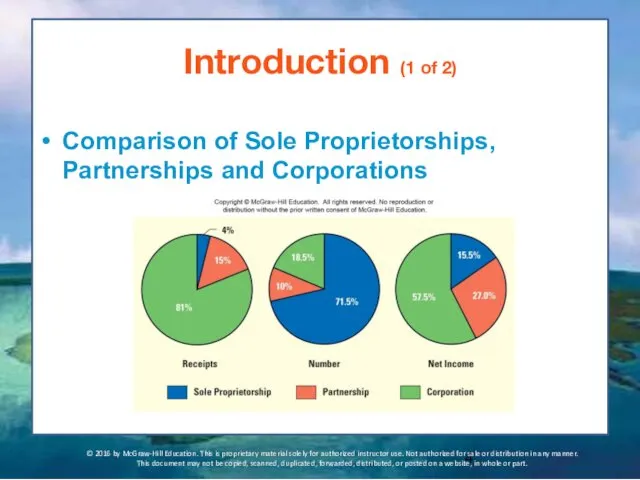

- 4. Introduction (1 of 2) Comparison of Sole Proprietorships, Partnerships and Corporations © 2016 by McGraw-Hill Education.

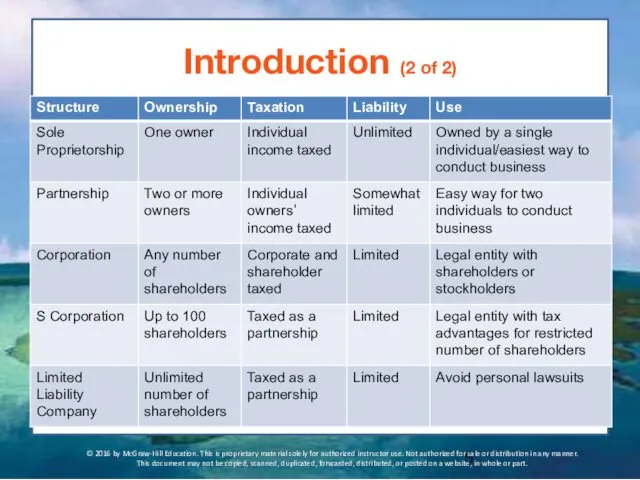

- 5. Introduction (2 of 2) © 2016 by McGraw-Hill Education. This is proprietary material solely for authorized

- 6. Sole Proprietorship Sole Proprietorship Businesses owned and operated by one individual; the most common form of

- 7. Advantages of Sole Proprietorship Advantages Ease and cost of formation Allow a high level of secrecy

- 8. Disadvantages of Sole Proprietorship Disadvantages Unlimited liability Scarce external funding Owners need diverse skills Success is

- 9. Finding Talented Employees Sole proprietorships have greater difficulty attracting talented employees Large corporations such as McDonald’s

- 10. Entrepreneur This entrepreneur opened his small business as a sole proprietorship As sole proprietor, he keeps

- 11. Partnership Partnership A form of business organization defined by the Uniform Partnership Act as “an association

- 12. Types of Partnerships General Partnership Involves a complete sharing in both the management and the liability

- 13. Advantages of Partnerships Advantages Easy to organize Availability of capital & credit Combined knowledge and skills

- 14. Disadvantages of Partnerships Disadvantages Unlimited liability Responsible for each others’ decisions A new agreement is needed

- 15. Partnerships and Taxes Partnerships are quasi-taxable organizations Partnerships do not pay taxes but do file a

- 16. Keys to Success in Business Partnerships © 2016 by McGraw-Hill Education. This is proprietary material solely

- 17. Google In 1996 Stanford students Sergey Brin and Larry Page partnered to form the search engine

- 18. Corporation Corporation A legal entity, created by the state, whose assets and liabilities are separate from

- 19. Stock and Dividends Corporations are typically owned by many individuals and organizations who own shares of

- 20. Creating Corporations Incorporators create the corporation Following state procedure of chartering the corporation Incorporators file legal

- 21. Types of Corporations Domestic Corporation If conducting business in the state in which it is chartered

- 22. American Companies with More than Half of Their Revenues from Outside the U.S. © 2016 by

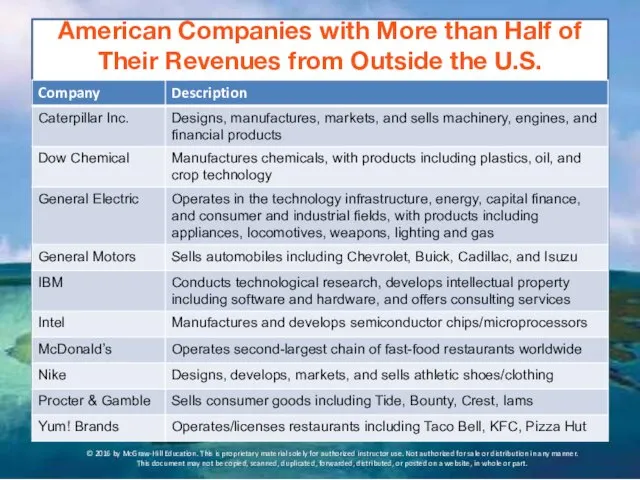

- 23. Private Corporations and Initial Public Offering Private Corporation Owned by just one or a few people

- 24. Mars Corporation © 2016 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use.

- 25. Public Corporations Public Corporations A corporation whose stock anyone may buy, sell, or trade Two types

- 26. Board of Directors A group of individuals, elected by the stockholders to oversee the general operation

- 27. Preferred and Common Stocks Preferred Stock A special type of stock whose owners, though not generally

- 28. Preferred Stock Owners of preferred stock have first claim to profits Dividend payments on preferred stocks

- 29. Advantages of Corporations Advantages Limited liability Ease of transfer of ownership Perpetual life Securing funding is

- 30. Disadvantages of Corporations Disadvantages Double taxation Expensive to form Disclosure of information to the government and

- 31. Volkswagen Volkswagen is the eighth-largest corporation in the world Did You Know? The first corporation with

- 32. Hostile Takeovers Hostile takeovers occur when one individual or company attempts to buy a majority share

- 33. Joint Venture and S Corporation Joint Venture A partnership established for a specific project or for

- 34. Limited Liability Company and Cooperatives Limited Liability Company (LLC) Form of ownership that provides limited liability

- 35. Consumer Cooperative REI REI is organized as a consumer cooperative REI operates a bit differently because

- 36. Employee-Owned Businesses Employee-owned companies have proven to be successful on many fronts whether the company is

- 37. Mergers The combination of two companies (usually corporations) to form a new company Horizontal merger Firms

- 38. Google Acquisitions In 2013, Google paid $3.2 billion for smart home company, Nest Labs Just one

- 39. Trends in Business Ownership (1 of 2) Acquisition The purchase of one company by another, usually

- 40. Trends in Business Ownership (2 of 2) Shark repellant Management requires a large majority of stockholders

- 41. Leveraged Buyout A purchase in which a group of investors borrows money from banks and other

- 42. Build Your Skills Selecting a Form of Business (1 of 2) Ali Bush sees an opportunity

- 43. Build Your Skills Selecting a Form of Business (2 of 2) TASK Using what you’ve learned

- 45. Скачать презентацию

Entrepreneurship

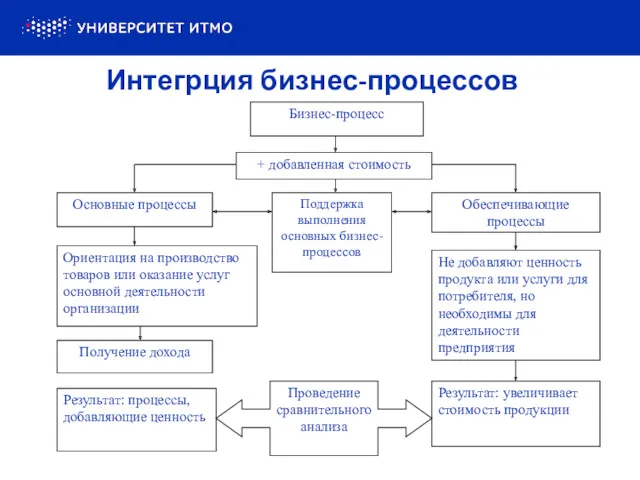

Entrepreneurship Интеграция бизнес-процессов

Интеграция бизнес-процессов Бизнес перезагрузка

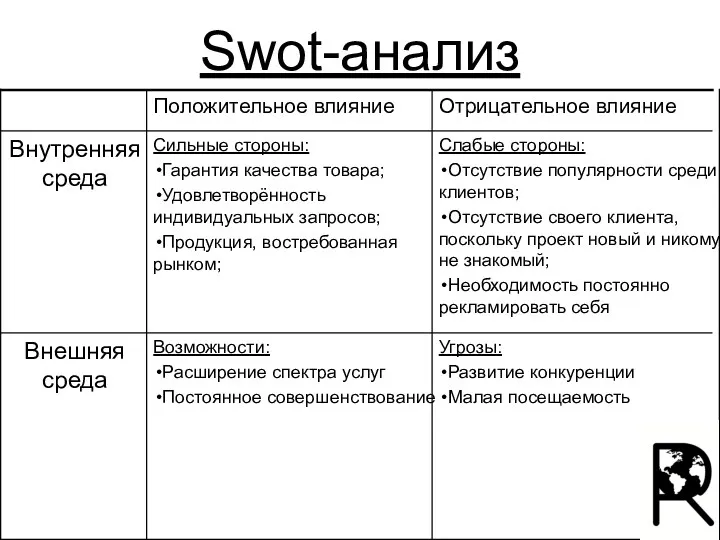

Бизнес перезагрузка Swot-анализ

Swot-анализ Принцип зависимости (или принцип внешнего воздействия)

Принцип зависимости (или принцип внешнего воздействия) Концепция развития розничной сети

Концепция развития розничной сети Бизнес-планирование

Бизнес-планирование Экологический туризм Челябинской области и перспективы его развития

Экологический туризм Челябинской области и перспективы его развития LG Group (Life is Good, элджи груп) – тұрмыстық электроника

LG Group (Life is Good, элджи груп) – тұрмыстық электроника Southwest airlines

Southwest airlines Cоңғы модель - бағасы бұрынғы. Бизнес мектеп

Cоңғы модель - бағасы бұрынғы. Бизнес мектеп Фонд содействия инновациям. Название проекта. Направление отбора. Шаблон

Фонд содействия инновациям. Название проекта. Направление отбора. Шаблон Бизнес-план 2015 дилерского центра MAN

Бизнес-план 2015 дилерского центра MAN Готовое бизнесрешение

Готовое бизнесрешение Strategies for development of hotel business. Practicum. Theme 1

Strategies for development of hotel business. Practicum. Theme 1 Кәсіпкерлік: мәні, мазмұны мен қалыптасу шарттары. (Тақырып 1)

Кәсіпкерлік: мәні, мазмұны мен қалыптасу шарттары. (Тақырып 1) Бізнес-план кафе White&black

Бізнес-план кафе White&black Авто электроника по оптовым ценам

Авто электроника по оптовым ценам Номерной фонд. Классификация гостиничных номеров

Номерной фонд. Классификация гостиничных номеров Бизнес-план кафе

Бизнес-план кафе Рекламное агентство Аравт

Рекламное агентство Аравт Бизнес-проект Школьная фабрика по изготовлению сувениров 1000 подарков

Бизнес-проект Школьная фабрика по изготовлению сувениров 1000 подарков История компании Coca-Cola

История компании Coca-Cola SWOT-анализ малого и среднего бизнеса Кемеровской области

SWOT-анализ малого и среднего бизнеса Кемеровской области Бизнес-план. Национальный проект по развитию предпринимательства на 2021-2025 годы

Бизнес-план. Национальный проект по развитию предпринимательства на 2021-2025 годы Показатели бизнес-процессов

Показатели бизнес-процессов Комплексная юридическая поддержка бизнеса на расстоянии звонка

Комплексная юридическая поддержка бизнеса на расстоянии звонка Establishment of a Central European Air Cargo Logistics Hub & European Aviation

Establishment of a Central European Air Cargo Logistics Hub & European Aviation