Содержание

- 2. Growing Impact of Canadian Trade Controls John W. Boscariol, International Trade and Investment Law Group, McCarthy

- 3. What Are Canada’s Trade Controls? John W. Boscariol, International Trade and Investment Law Group, McCarthy Tétrault

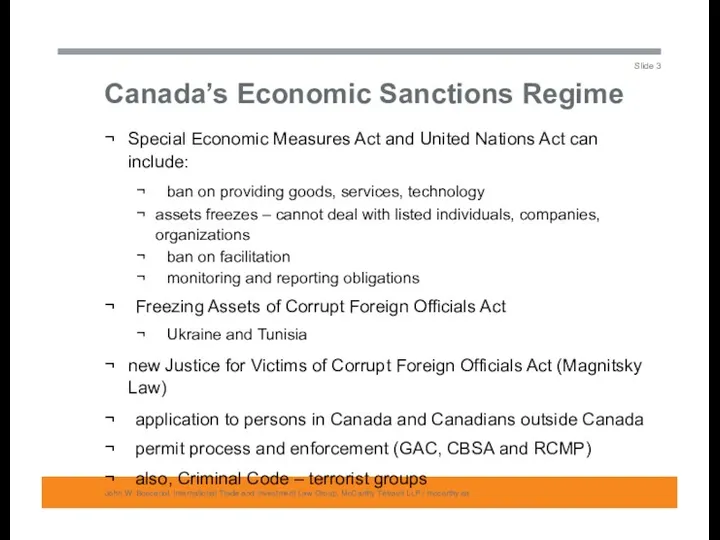

- 4. Slide 3 John W. Boscariol, International Trade and Investment Law Group, McCarthy Tétrault LLP / mccarthy.ca

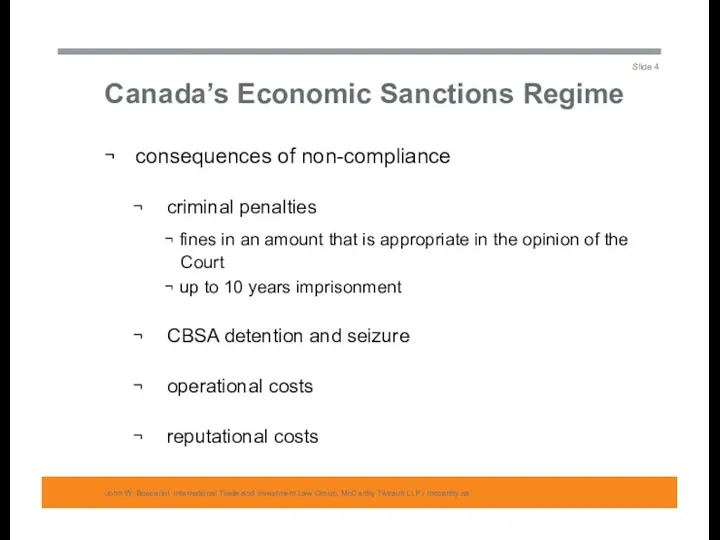

- 5. Canada’s Economic Sanctions Regime John W. Boscariol, International Trade and Investment Law Group, McCarthy Tétrault LLP

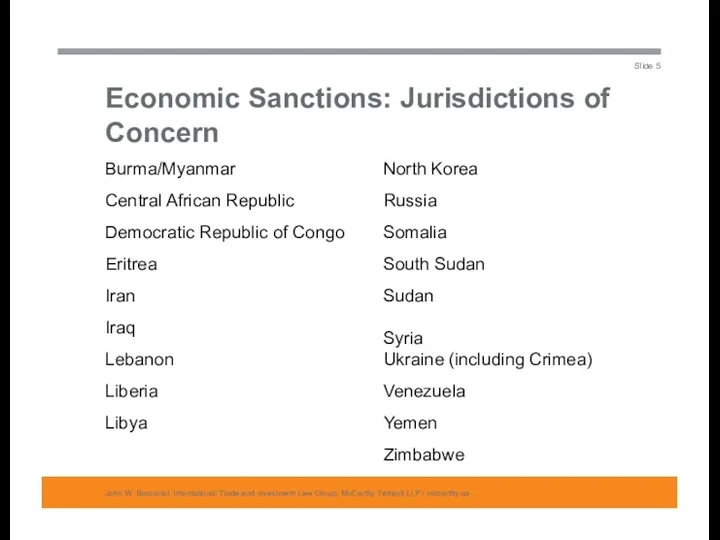

- 6. Economic Sanctions: Jurisdictions of Concern John W. Boscariol, International Trade and Investment Law Group, McCarthy Tétrault

- 7. Rise of Targeted or “Smart” Sanctions John W. Boscariol, International Trade and Investment Law Group, McCarthy

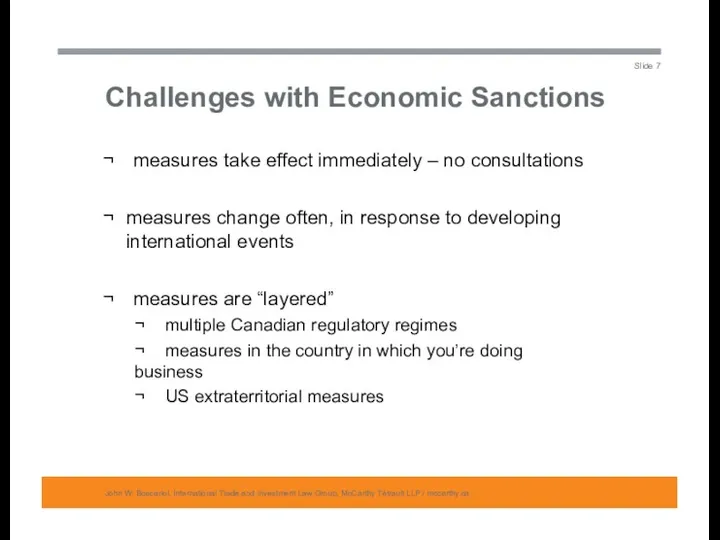

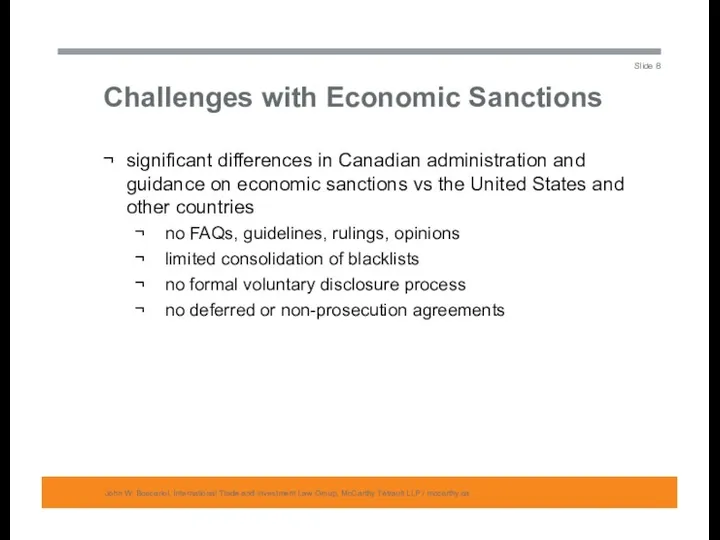

- 8. Challenges with Economic Sanctions John W. Boscariol, International Trade and Investment Law Group, McCarthy Tétrault LLP

- 9. Challenges with Economic Sanctions John W. Boscariol, International Trade and Investment Law Group, McCarthy Tétrault LLP

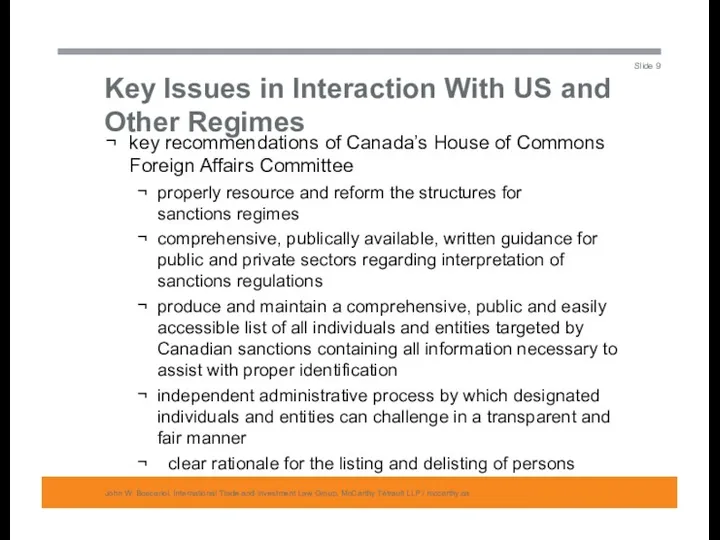

- 10. Key Issues in Interaction With US and Other Regimes John W. Boscariol, International Trade and Investment

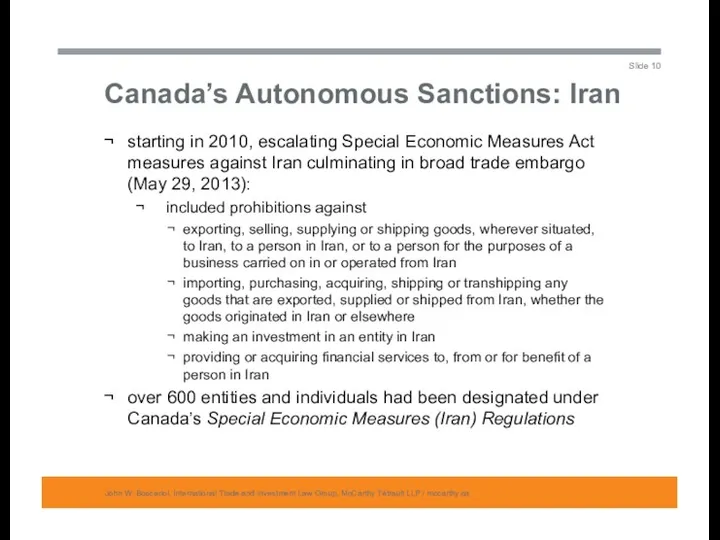

- 11. Canada’s Autonomous Sanctions: Iran John W. Boscariol, International Trade and Investment Law Group, McCarthy Tétrault LLP

- 12. Canada’s Autonomous Sanctions: Iran John W. Boscariol, International Trade and Investment Law Group, McCarthy Tétrault LLP

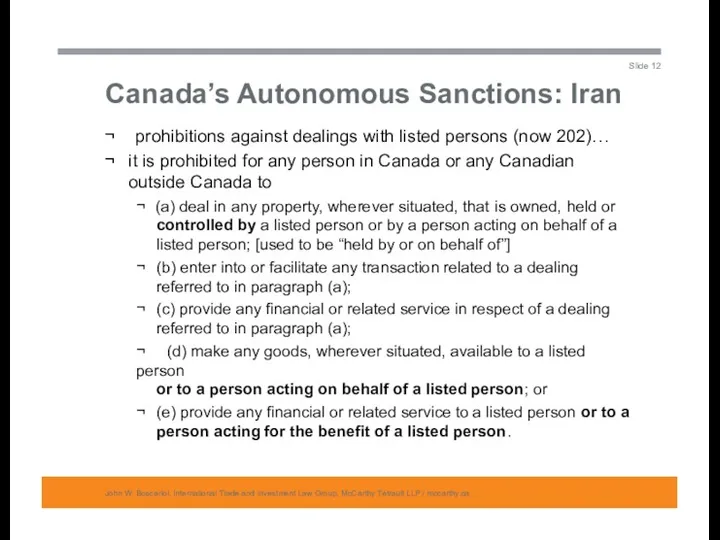

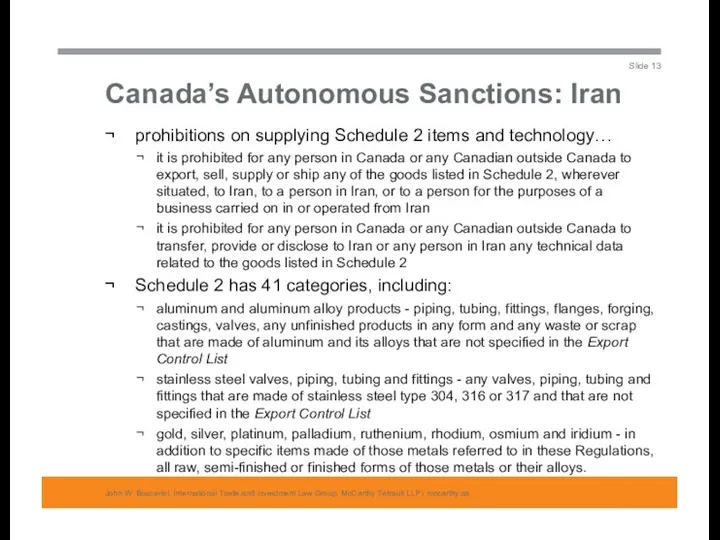

- 13. Canada’s Autonomous Sanctions: Iran John W. Boscariol, International Trade and Investment Law Group, McCarthy Tétrault LLP

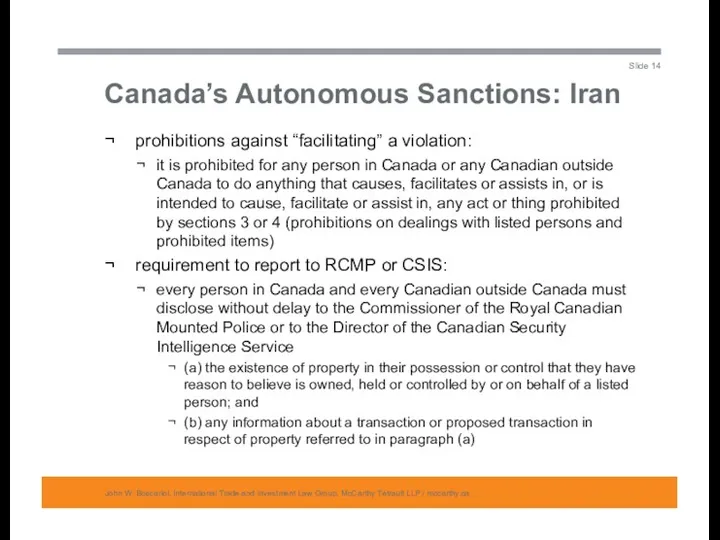

- 14. Canada’s Autonomous Sanctions: Iran John W. Boscariol, International Trade and Investment Law Group, McCarthy Tétrault LLP

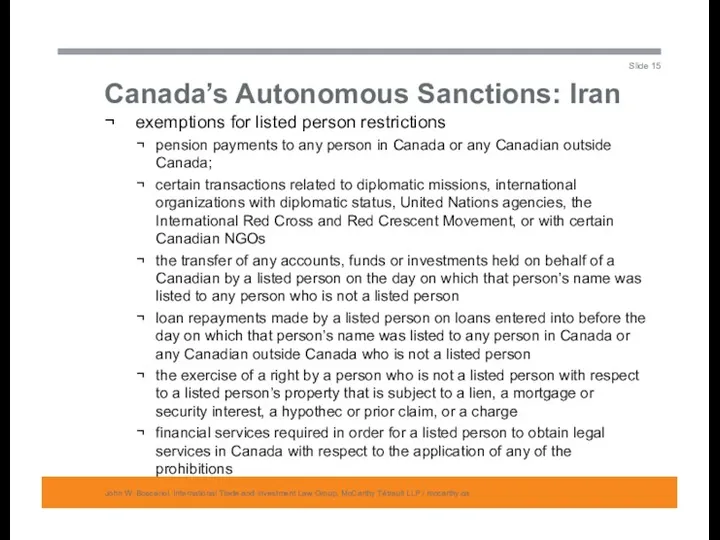

- 15. Canada’s Autonomous Sanctions: Iran John W. Boscariol, International Trade and Investment Law Group, McCarthy Tétrault LLP

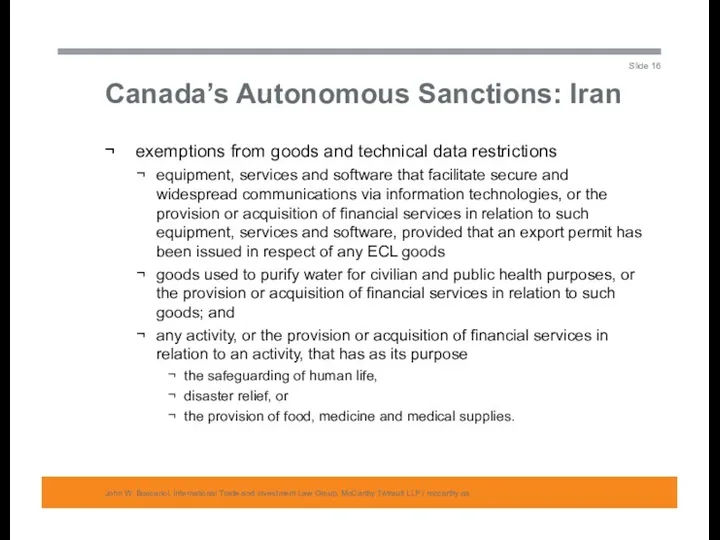

- 16. Canada’s Autonomous Sanctions: Iran John W. Boscariol, International Trade and Investment Law Group, McCarthy Tétrault LLP

- 17. Canada’s Autonomous Sanctions: Iran John W. Boscariol, International Trade and Investment Law Group, McCarthy Tétrault LLP

- 18. Canada’s UN Sanctions: Iran John W. Boscariol, International Trade and Investment Law Group, McCarthy Tétrault LLP

- 19. Export Controls: Iran John W. Boscariol, International Trade and Investment Law Group, McCarthy Tétrault LLP /

- 20. Canada vs United States Sanctions: Iran John W. Boscariol, International Trade and Investment Law Group, McCarthy

- 21. Prosecutions: R. v. Yadegari John W. Boscariol, International Trade and Investment Law Group, McCarthy Tétrault LLP

- 22. Prosecutions: R. v. Lee Specialties Ltd. John W. Boscariol, International Trade and Investment Law Group, McCarthy

- 23. Russia / Ukraine Economic Sanctions Measures John W. Boscariol, International Trade and Investment Law Group, McCarthy

- 24. Russia / Ukraine Economic Sanctions Measures John W. Boscariol, International Trade and Investment Law Group, McCarthy

- 25. Russia / Ukraine Economic Sanctions Measures John W. Boscariol, International Trade and Investment Law Group, McCarthy

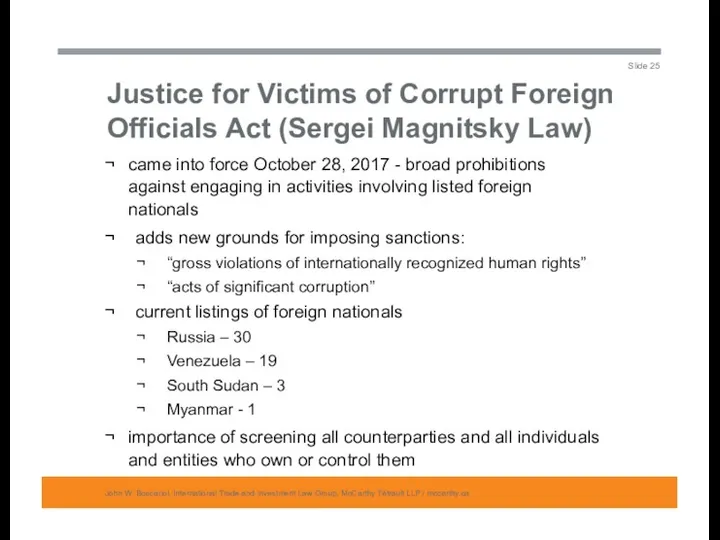

- 26. Justice for Victims of Corrupt Foreign Officials Act (Sergei Magnitsky Law) John W. Boscariol, International Trade

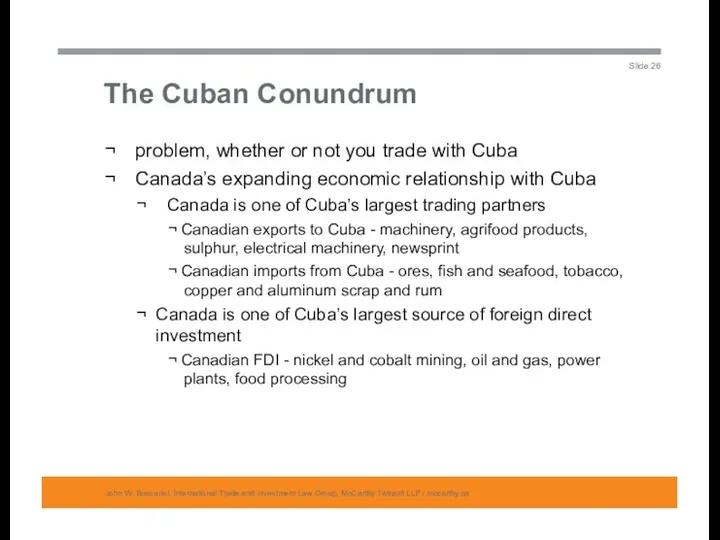

- 27. The Cuban Conundrum John W. Boscariol, International Trade and Investment Law Group, McCarthy Tétrault LLP /

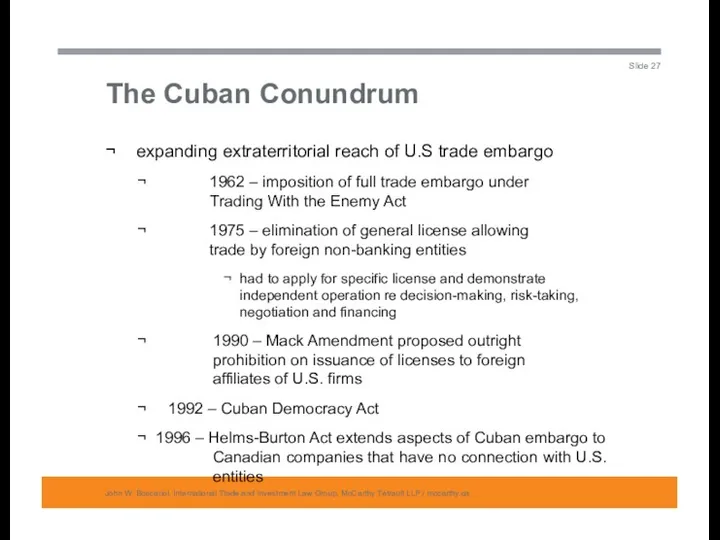

- 28. The Cuban Conundrum John W. Boscariol, International Trade and Investment Law Group, McCarthy Tétrault LLP /

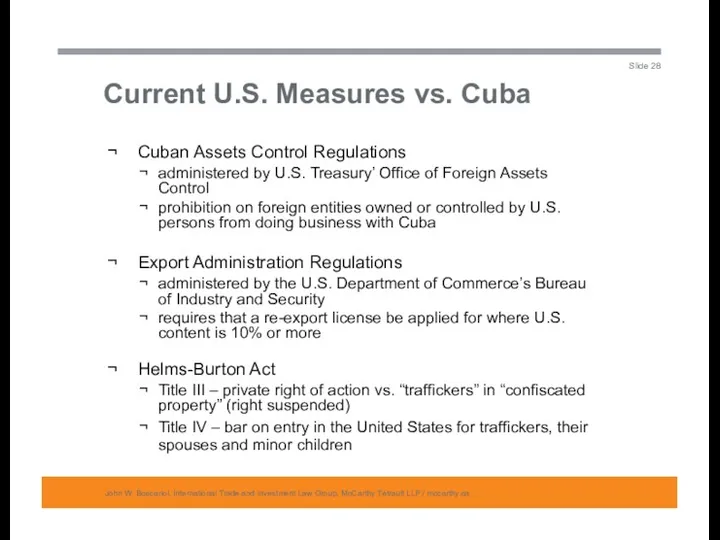

- 29. Current U.S. Measures vs. Cuba John W. Boscariol, International Trade and Investment Law Group, McCarthy Tétrault

- 30. Canadian Response to U.S. Trade Embargo of Cuba John W. Boscariol, International Trade and Investment Law

- 31. The Foreign Extraterritorial Measures Act John W. Boscariol, International Trade and Investment Law Group, McCarthy Tétrault

- 32. The Notification Obligation John W. Boscariol, International Trade and Investment Law Group, McCarthy Tétrault LLP /

- 33. The Non-Compliance Obligation John W. Boscariol, International Trade and Investment Law Group, McCarthy Tétrault LLP /

- 34. FEMA Enforcement Experience John W. Boscariol, International Trade and Investment Law Group, McCarthy Tétrault LLP /

- 35. Critical FEMA Conflict Points John W. Boscariol, International Trade and Investment Law Group, McCarthy Tétrault LLP

- 36. Managing the Relationship Between U.S. and Canadian Export Controls and Trade Sanctions John W. Boscariol, International

- 37. Managing the Relationship Between U.S. and Canadian Export Controls and Trade Sanctions John W. Boscariol, International

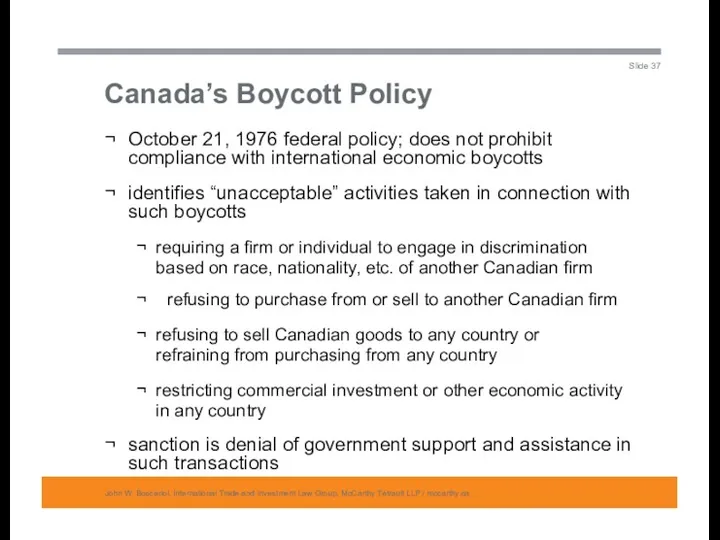

- 38. Canada’s Boycott Policy John W. Boscariol, International Trade and Investment Law Group, McCarthy Tétrault LLP /

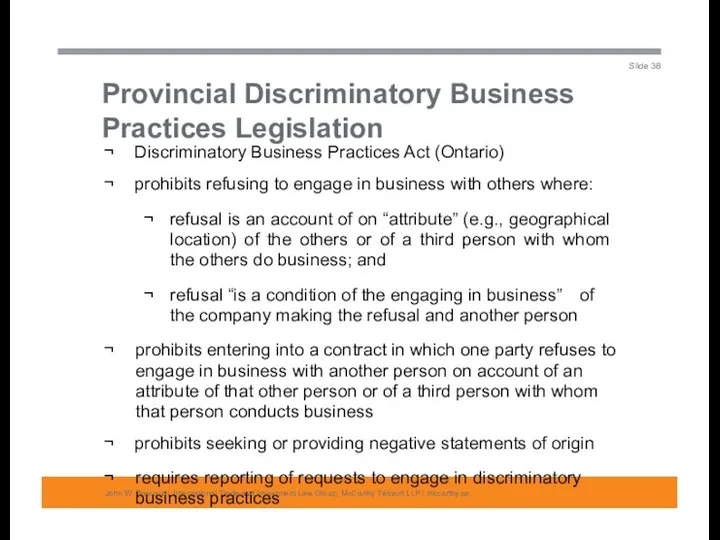

- 39. Provincial Discriminatory Business Practices Legislation John W. Boscariol, International Trade and Investment Law Group, McCarthy Tétrault

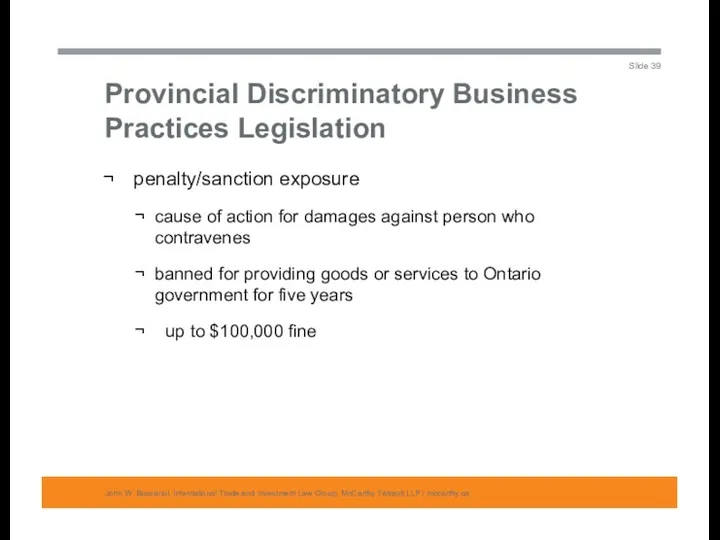

- 40. Provincial Discriminatory Business Practices Legislation John W. Boscariol, International Trade and Investment Law Group, McCarthy Tétrault

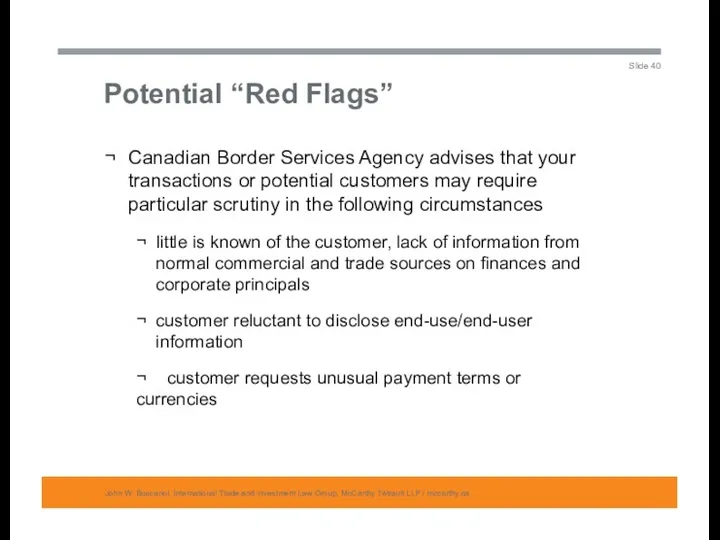

- 41. Potential “Red Flags” John W. Boscariol, International Trade and Investment Law Group, McCarthy Tétrault LLP /

- 42. Potential “Red Flags” John W. Boscariol, International Trade and Investment Law Group, McCarthy Tétrault LLP /

- 43. Potential “Red Flags” John W. Boscariol, International Trade and Investment Law Group, McCarthy Tétrault LLP /

- 44. Best Practice #1 – Screening for Designated Persons John W. Boscariol, International Trade and Investment Law

- 45. Best Practice #2 – Contract Clauses and Certifications John W. Boscariol, International Trade and Investment Law

- 46. Best Practice #3 – “Home Grown” Compliance Policies John W. Boscariol, International Trade and Investment Law

- 47. Best Practice #4 – Keeping Your Bank Happy John W. Boscariol, International Trade and Investment Law

- 48. Best Practice #5 – Using Voluntary Disclosure Mechanisms John W. Boscariol, International Trade and Investment Law

- 49. Core Elements of Your Economic Sanctions Compliance Program John W. Boscariol, International Trade and Investment Law

- 51. Скачать презентацию

Экономические циклы

Экономические циклы Экономика и экономическая наука

Экономика и экономическая наука Digital transformation of national economy of the republic of Belarus

Digital transformation of national economy of the republic of Belarus Оценка персонала

Оценка персонала Рыночные отношения в здравоохранении

Рыночные отношения в здравоохранении Национальные планы и программы по противодействию коррупции. Тема 3

Национальные планы и программы по противодействию коррупции. Тема 3 Экономика и ее роль в жизни общества

Экономика и ее роль в жизни общества Швеция в мировой экономике

Швеция в мировой экономике Управление интеллектуальным капиталом

Управление интеллектуальным капиталом Себестоимость продукции и прибыль предприятия

Себестоимость продукции и прибыль предприятия Внешнеэкономическая деятельность предприятий (лекция 13)

Внешнеэкономическая деятельность предприятий (лекция 13) Рыночные отношения в экономике

Рыночные отношения в экономике Экономика. Макроэкономика

Экономика. Макроэкономика Что такое трудовые ресурсы?

Что такое трудовые ресурсы? Безработица и ее виды

Безработица и ее виды Современные экономические концепции. Эволюция для обеспечения эффективного управления. (Тема 1)

Современные экономические концепции. Эволюция для обеспечения эффективного управления. (Тема 1) Шерінгова економіка

Шерінгова економіка Агрегований баланс підприємства ДП Лісгосп за 2014-2016 роки

Агрегований баланс підприємства ДП Лісгосп за 2014-2016 роки Экономическая теория. Международная экономика. Теория сравнительных преимуществ и международная торговля. (Модуль 2.13)

Экономическая теория. Международная экономика. Теория сравнительных преимуществ и международная торговля. (Модуль 2.13) Распределение доходов. Доходы населения: их структура и динамика. Уровень жизни и его составляющие. (Тема 10)

Распределение доходов. Доходы населения: их структура и динамика. Уровень жизни и его составляющие. (Тема 10) Дом будущего

Дом будущего Экономика природопользования

Экономика природопользования Совокупный спрос. Причины отрицательного наклона кривой совокупного спроса. Неценовые факторы совокупного спроса

Совокупный спрос. Причины отрицательного наклона кривой совокупного спроса. Неценовые факторы совокупного спроса Современные особенности международной торговли товарами

Современные особенности международной торговли товарами Инвестиционная среда Сибирского ФО

Инвестиционная среда Сибирского ФО Презентация Спрос и предложение 10 класс

Презентация Спрос и предложение 10 класс Экономическая политика государства. Тема 6

Экономическая политика государства. Тема 6 Проблема бедности

Проблема бедности