Содержание

- 2. Principle of LBO DEAL AFTER DEAL Shareholders XYZ 100% Investor $200 Debt $140 $200 $60 Equity

- 3. Object of the deal: structure of revenue Wind Telecom 7 377 antenna tower stations Figure 1

- 4. Expected revenue calculation Figure 4 – Revenue dynamics Figure 5 – Structure of revenue in 2016

- 6. Скачать презентацию

Слайд 2

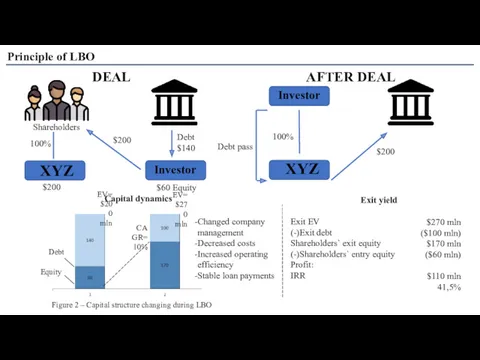

Principle of LBO

DEAL

AFTER DEAL

Shareholders

XYZ

100%

Investor

$200

Debt

$140

$200

$60 Equity

XYZ

100%

Debt pass

$200

Debt

Equity

EV=$200 mln

EV=$270 mln

CAGR=10%

Capital dynamics

Exit yield

Changed

Principle of LBO

DEAL

AFTER DEAL

Shareholders

XYZ

100%

Investor

$200

Debt

$140

$200

$60 Equity

XYZ

100%

Debt pass

$200

Debt

Equity

EV=$200 mln

EV=$270 mln

CAGR=10%

Capital dynamics

Exit yield

Changed

company management

Decreased costs

Increased operating efficiency

Stable loan payments

Decreased costs

Increased operating efficiency

Stable loan payments

Exit EV

(-)Exit debt

Shareholders` exit equity

(-)Shareholders` entry equity

Profit:

IRR

$270 mln

($100 mln)

$170 mln

($60 mln)

$110 mln 41,5%

Investor

Figure 2 – Capital structure changing during LBO

Слайд 3

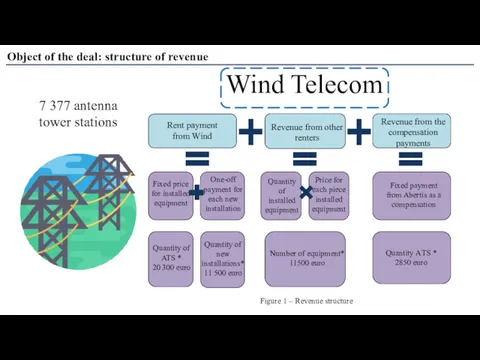

Object of the deal: structure of revenue

Wind Telecom

7 377 antenna tower

Object of the deal: structure of revenue

Wind Telecom

7 377 antenna tower

stations

Figure 1 – Revenue structure

Слайд 4

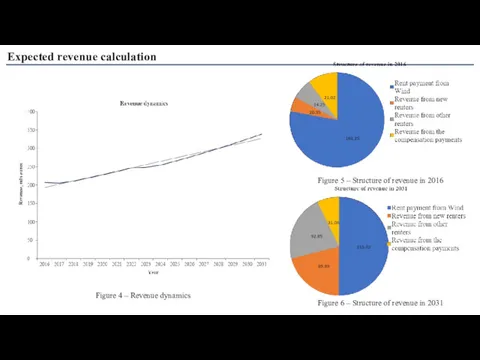

Expected revenue calculation

Figure 4 – Revenue dynamics

Figure 5 – Structure of

Expected revenue calculation

Figure 4 – Revenue dynamics

Figure 5 – Structure of

revenue in 2016

Figure 6 – Structure of revenue in 2031

- Предыдущая

Методи фінансового прогнозуванняСледующая -

Монтаж РЭА

Формування фінансових джерел санації підприємства

Формування фінансових джерел санації підприємства Косметическая отрасль Республики Беларусь

Косметическая отрасль Республики Беларусь Japan. The relationship between real GDP and real primary exports

Japan. The relationship between real GDP and real primary exports Презентация к уроку Экономика Саратовской области

Презентация к уроку Экономика Саратовской области The program “Kazakhstan-2050”. A new development strategy

The program “Kazakhstan-2050”. A new development strategy Причины и последствия краха Уолл-стрит

Причины и последствия краха Уолл-стрит Виды барьеров входа-выхода

Виды барьеров входа-выхода Концепции региональной субъективности: регион-квазигосударство, регион-корпорация, регион-рынок, регион-социум

Концепции региональной субъективности: регион-квазигосударство, регион-корпорация, регион-рынок, регион-социум Методология экономического анализа

Методология экономического анализа Предпринимательство. Признаки юридического лица

Предпринимательство. Признаки юридического лица Анализ деловых данных. Решение задач оптимизации в MS Excel

Анализ деловых данных. Решение задач оптимизации в MS Excel Политика продвижения. Практика 6

Политика продвижения. Практика 6 Основы макроэкономики. Лекция № 4

Основы макроэкономики. Лекция № 4 Рынок транспортных услуг. Лекция 2

Рынок транспортных услуг. Лекция 2 Себестоимость. Прибыль. Рентабельность. Ценообразование на предприятии

Себестоимость. Прибыль. Рентабельность. Ценообразование на предприятии Финансово-кредитная система зарубежных стран

Финансово-кредитная система зарубежных стран Принципы и основные направления государственной миграционной политики Российской Федерации

Принципы и основные направления государственной миграционной политики Российской Федерации Границы государственного вмешательства в экономику

Границы государственного вмешательства в экономику Джон Кейнс. Кейнсианство

Джон Кейнс. Кейнсианство Институциональные механизмы регулирования природопользования

Институциональные механизмы регулирования природопользования Типы экономических систем

Типы экономических систем Последователи либерализма

Последователи либерализма Теория производства фирмы

Теория производства фирмы Создание ЕАЭС как закономерный процесс интеграции бывших республик СССР

Создание ЕАЭС как закономерный процесс интеграции бывших республик СССР Глобальна економічна політика. (Лекція 7)

Глобальна економічна політика. (Лекція 7) Глобальные проблемы. Урок 1

Глобальные проблемы. Урок 1 Формирование уставного капитала и его назначение. Потребности в основных и оборотных средствах. Тема № 3

Формирование уставного капитала и его назначение. Потребности в основных и оборотных средствах. Тема № 3 Методи фінансового прогнозування

Методи фінансового прогнозування