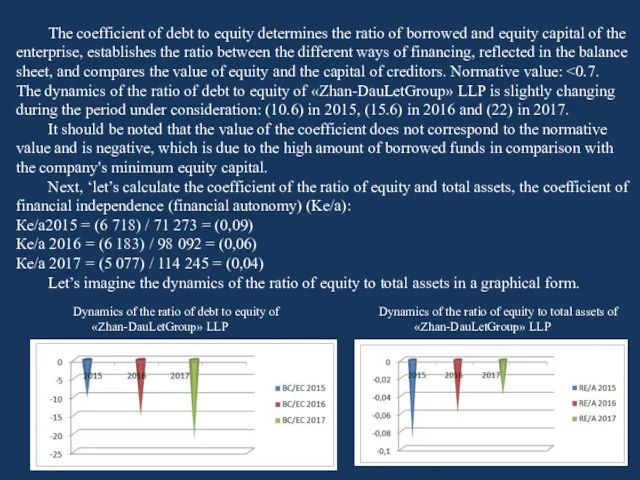

The coefficient of debt to equity determines the ratio of

borrowed and equity capital of the enterprise, establishes the ratio between the different ways of financing, reflected in the balance sheet, and compares the value of equity and the capital of creditors. Normative value: <0.7.

The dynamics of the ratio of debt to equity of «Zhan-DauLetGroup» LLP is slightly changing during the period under consideration: (10.6) in 2015, (15.6) in 2016 and (22) in 2017.

It should be noted that the value of the coefficient does not correspond to the normative value and is negative, which is due to the high amount of borrowed funds in comparison with the company's minimum equity capital.

Next, ‘let’s calculate the coefficient of the ratio of equity and total assets, the coefficient of financial independence (financial autonomy) (Ke/a):

Кe/а2015 = (6 718) / 71 273 = (0,09)

Кe/а 2016 = (6 183) / 98 092 = (0,06)

Кe/а 2017 = (5 077) / 114 245 = (0,04)

Let’s imagine the dynamics of the ratio of equity to total assets in a graphical form.

Dynamics of the ratio of debt to equity of «Zhan-DauLetGroup» LLP

Dynamics of the ratio of equity to total assets of «Zhan-DauLetGroup» LLP

Ринок праці. Лекція 8

Ринок праці. Лекція 8 Теория Колина Крауча о живучести неолиберализма (Странная не-смерть неолиберализма)

Теория Колина Крауча о живучести неолиберализма (Странная не-смерть неолиберализма) Организация работы пассажирской станции

Организация работы пассажирской станции Статистические показатели

Статистические показатели Өндіріс теориясі

Өндіріс теориясі Unemployment

Unemployment Совокупный спрос (AD). Совокупное предложение (AS). Макроэкономическое равновесие совокупного спроса и совокупного предложения

Совокупный спрос (AD). Совокупное предложение (AS). Макроэкономическое равновесие совокупного спроса и совокупного предложения Аралас экономика-қазіргі қоғамдық өндіріс қызмет етуінің обьективті нысаны

Аралас экономика-қазіргі қоғамдық өндіріс қызмет етуінің обьективті нысаны Теорема Столпера-Самуэльсона

Теорема Столпера-Самуэльсона Планирование деятельности организации (предприятия)

Планирование деятельности организации (предприятия) Развитие промышленности в Краснодарском крае

Развитие промышленности в Краснодарском крае Основи економічної теорії. Тема 5. Підприємство (фірма)

Основи економічної теорії. Тема 5. Підприємство (фірма) Международные валютно-кредитные и финансовые организации и их регулирующая роль в мировом хозяйстве

Международные валютно-кредитные и финансовые организации и их регулирующая роль в мировом хозяйстве Методы комплексной оценки финансово-хозяйственной деятельности

Методы комплексной оценки финансово-хозяйственной деятельности Глобализация и её последствия

Глобализация и её последствия Единое экономическое пространство

Единое экономическое пространство Рынок туристических услуг в Санкт-Петербурге

Рынок туристических услуг в Санкт-Петербурге Диагностика социально-экономического развития Южного Федерального округа

Диагностика социально-экономического развития Южного Федерального округа Что такое экономика

Что такое экономика Проблемы занятости: региональный аспект (на примере Гомельской области)

Проблемы занятости: региональный аспект (на примере Гомельской области) Турция в системе международной торговли

Турция в системе международной торговли Новая экономическая политика (1921-1928 гг.)

Новая экономическая политика (1921-1928 гг.) Отчёт об исполнении бюджета Михайловского городского поселения за 2022

Отчёт об исполнении бюджета Михайловского городского поселения за 2022 Глобальные проблемы современности и пути их решения

Глобальные проблемы современности и пути их решения Инвестиционная политика предприятия

Инвестиционная политика предприятия Иностранный капитал в России. Структура, динамика, проблемы

Иностранный капитал в России. Структура, динамика, проблемы Основні види підприємництва. Виробнича підприємницька діяльність

Основні види підприємництва. Виробнича підприємницька діяльність Выбор инновационной стратегии

Выбор инновационной стратегии