Содержание

- 2. IN THIS CHAPTER, YOU WILL LEARN: What determines the economy’s total output/ income How the prices

- 3. Outline of model CHAPTER 3 National Income 2 A closed economy, market-clearing model Supply side factor

- 4. Factors of production CHAPTER 3 National Income 3 K = capital: tools, machines, and structures used

- 5. The production function: Y = F (K , L) CHAPTER 3 National Income 4 Shows how

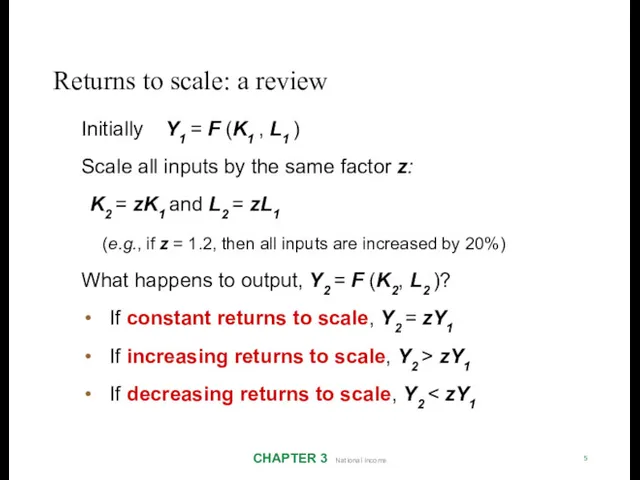

- 6. Returns to scale: a review CHAPTER 3 National Income 5 Initially Y1 = F (K1 ,

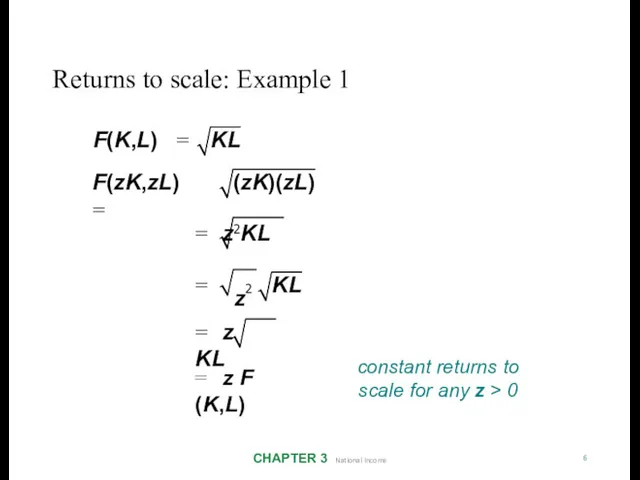

- 7. Returns to scale: Example 1 CHAPTER 3 National Income 6 KL (zK)(zL) F(K,L) = F(zK,zL) =

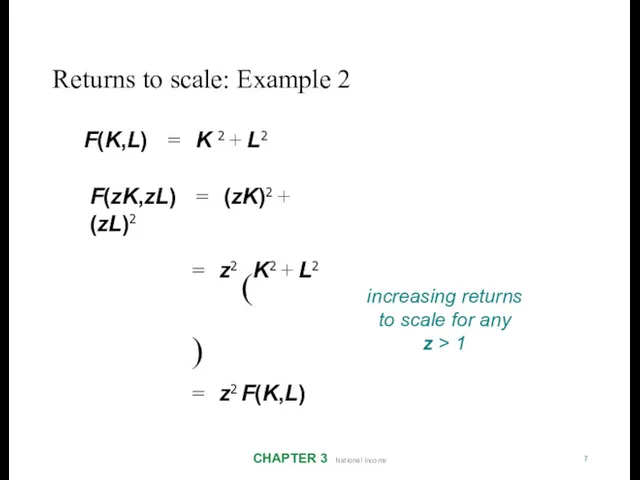

- 8. Returns to scale: Example 2 CHAPTER 3 National Income 7 F(K,L) = K 2 + L2

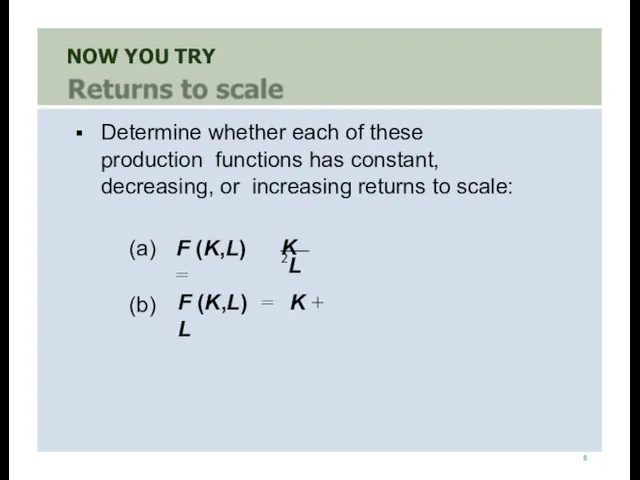

- 9. NOW YOU TRY 8 Determine whether each of these production functions has constant, decreasing, or increasing

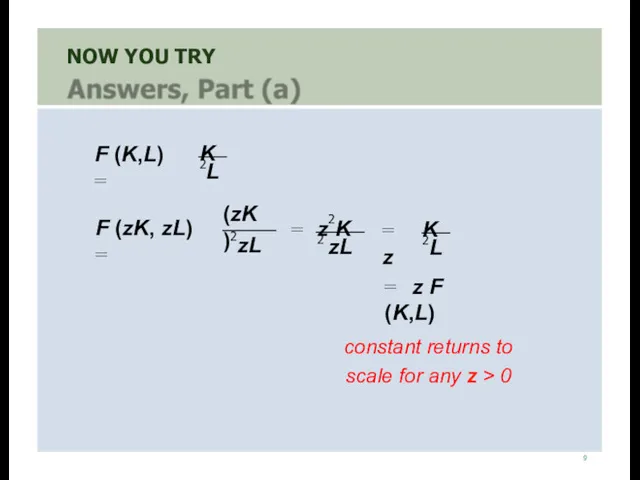

- 10. NOW YOU TRY 9 L F (K,L) = K 2 zL F (zK, zL) = (zK

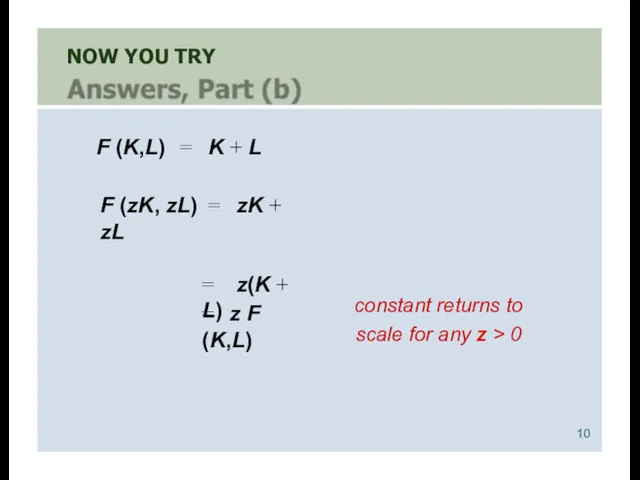

- 11. NOW YOU TRY F (K,L) = K + L F (zK, zL) = zK + zL

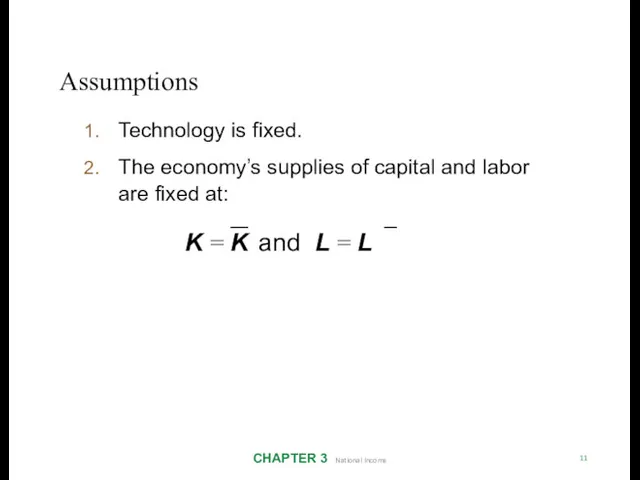

- 12. Assumptions CHAPTER 3 National Income 11 Technology is fixed. The economy’s supplies of capital and labor

- 13. Determining GDP CHAPTER 3 National Income 12 Output is determined by the fixed factor supplies and

- 14. The distribution of national income CHAPTER 3 National Income 13 determined by factor prices, the prices

- 15. Notation CHAPTER 3 National Income 14 W = nominal wage R = nominal rental rate P

- 16. How factor prices are determined CHAPTER 3 National Income 15 Factor prices are determined by supply

- 17. Demand for labor CHAPTER 3 National Income 16 Assume markets are competitive: each firm takes W,

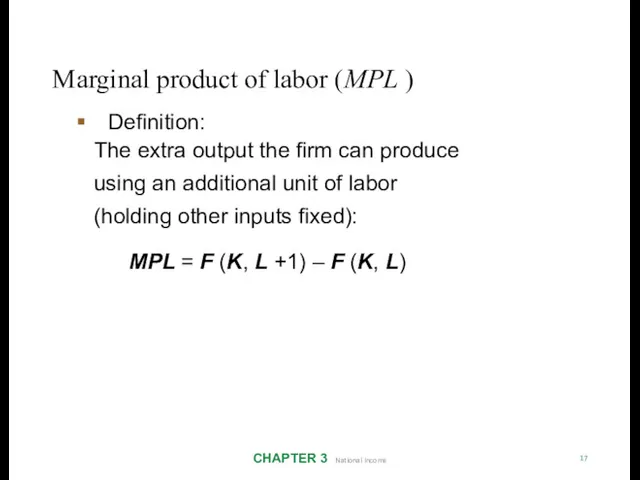

- 18. Marginal product of labor (MPL ) CHAPTER 3 National Income 17 Definition: The extra output the

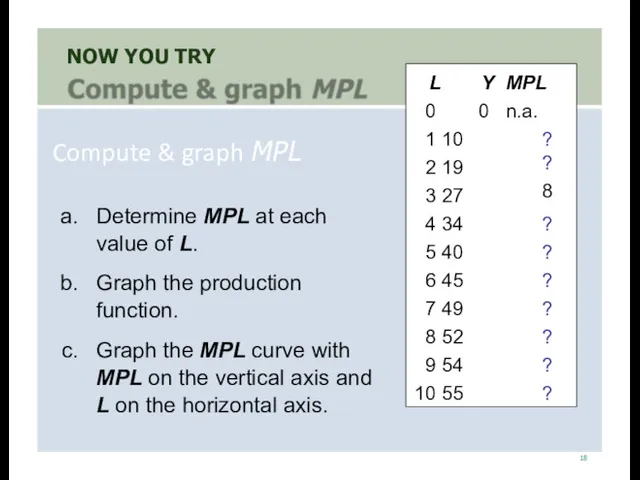

- 19. NOW YOU TRY Compute & graph MPL 18 Determine MPL at each value of L. Graph

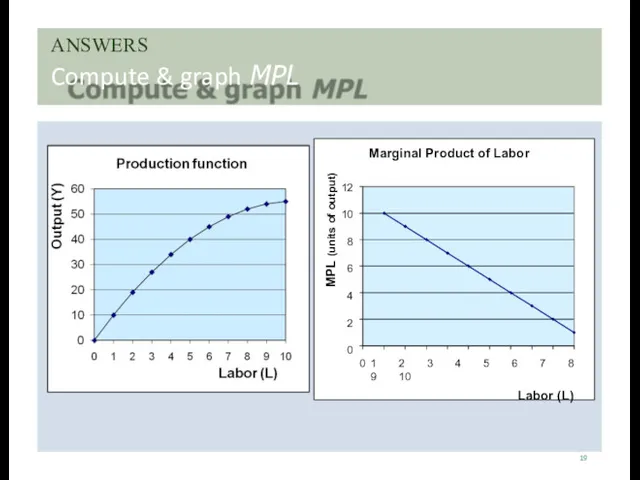

- 20. ANSWERS Compute & graph MPL 19 MPL (units of output) Marginal Product of Labor 12 10

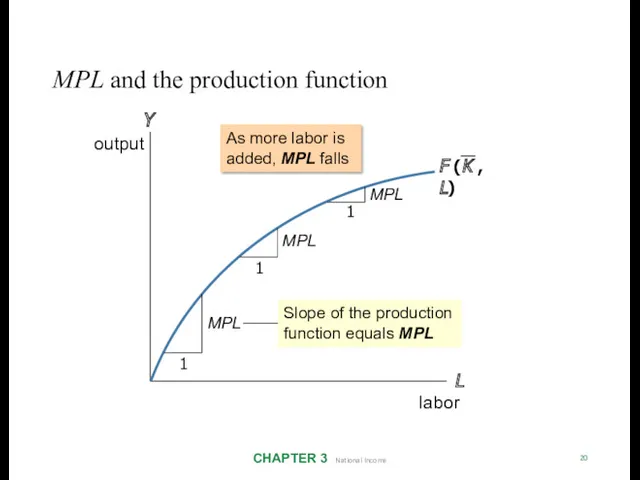

- 21. Y output MPL and the production function CHAPTER 3 National Income 20 L labor F (K

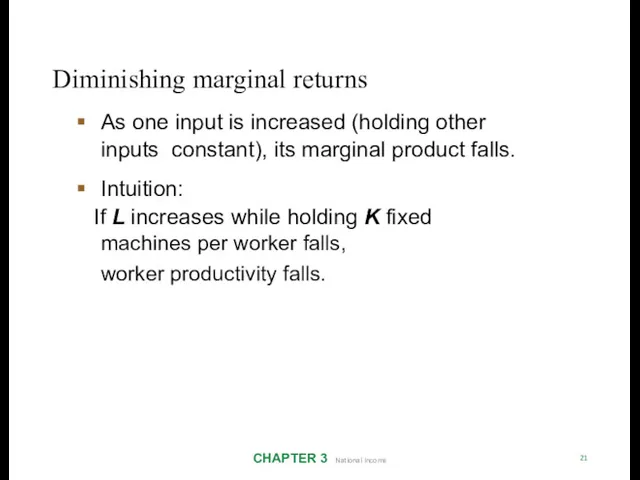

- 22. Diminishing marginal returns CHAPTER 3 National Income 21 As one input is increased (holding other inputs

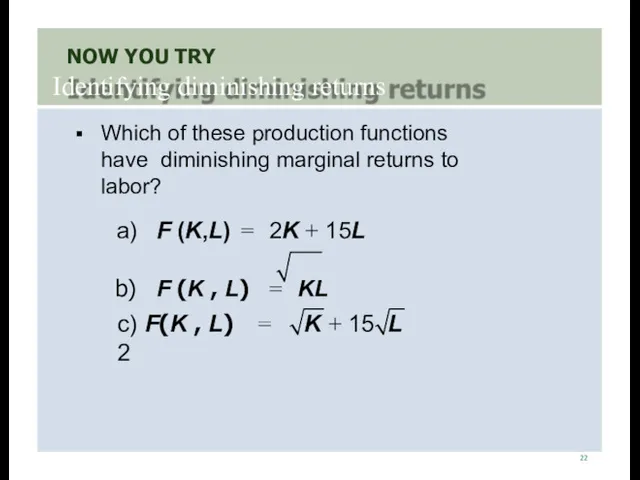

- 23. NOW YOU TRY Identifying diminishing returns 22 Which of these production functions have diminishing marginal returns

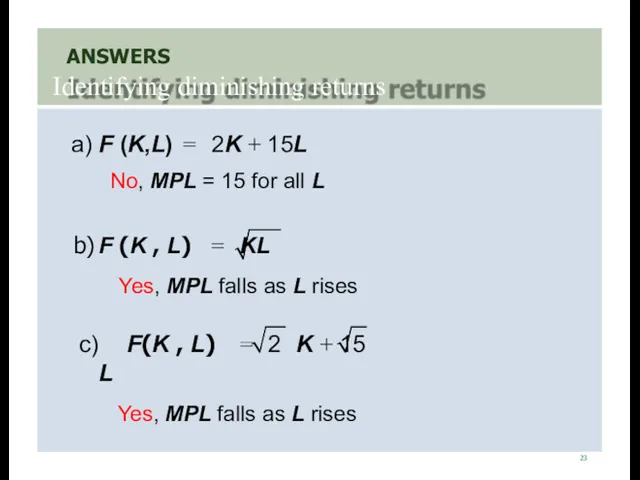

- 24. ANSWERS Identifying diminishing returns 23 a) F (K,L) = 2K + 15L No, MPL = 15

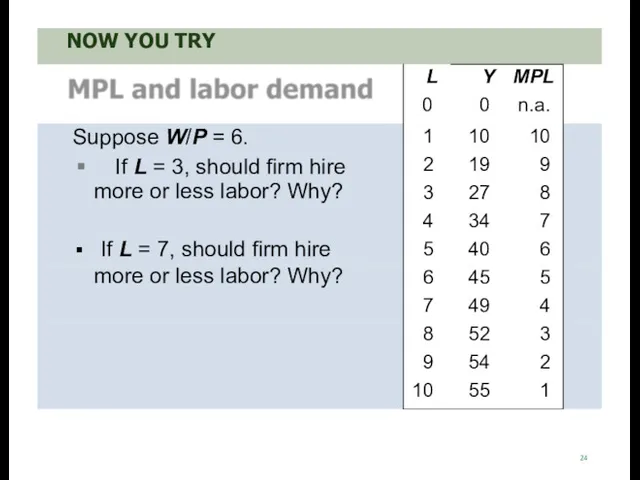

- 25. 24

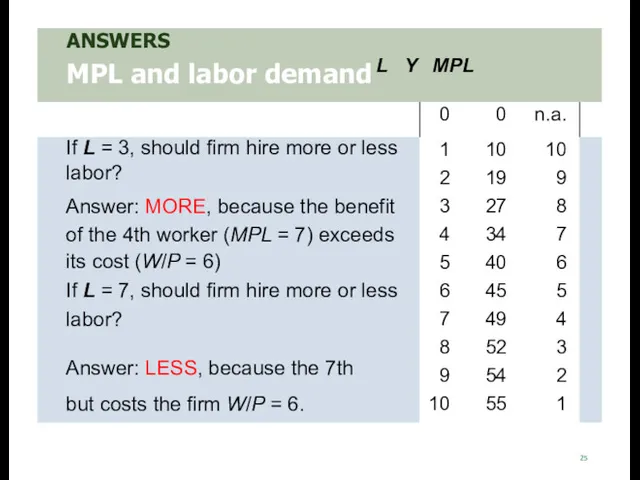

- 26. worker adds MPL = 4 units of output 25

- 27. MPL and the demand for labor CHAPTER 3 National Income 26 Each firm hires labor up

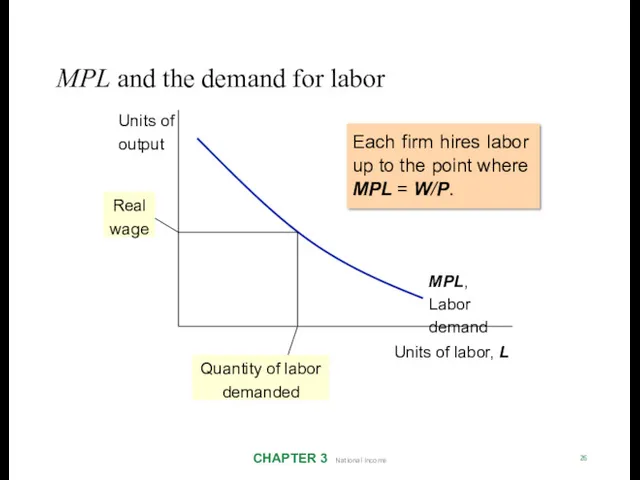

- 28. The equilibrium real wage CHAPTER 3 National Income 27 The real wage adjusts to equate labor

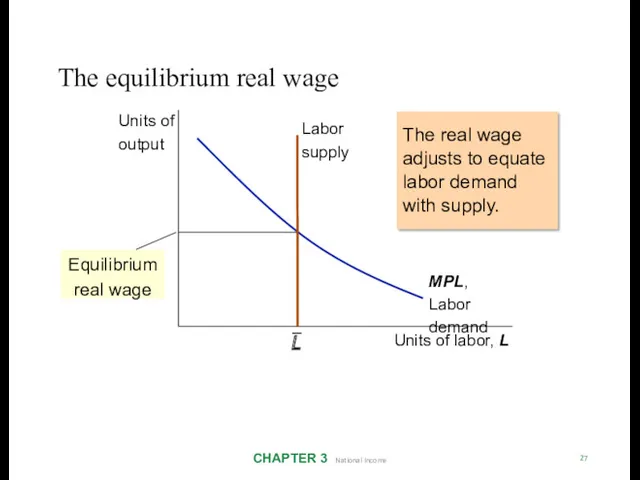

- 29. Determining the rental rate CHAPTER 3 National Income 28 We have just seen that MPL =

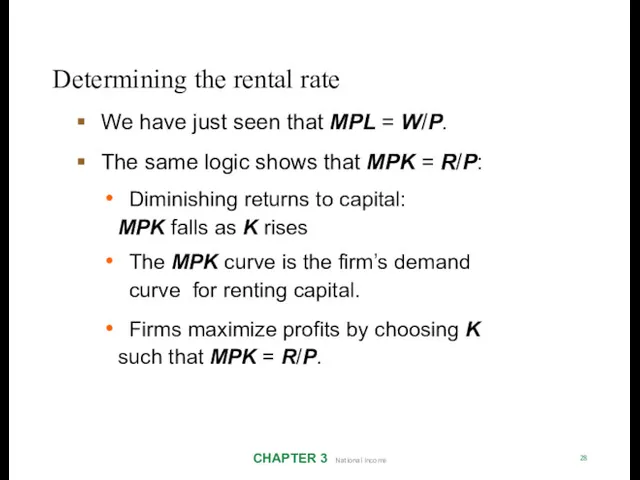

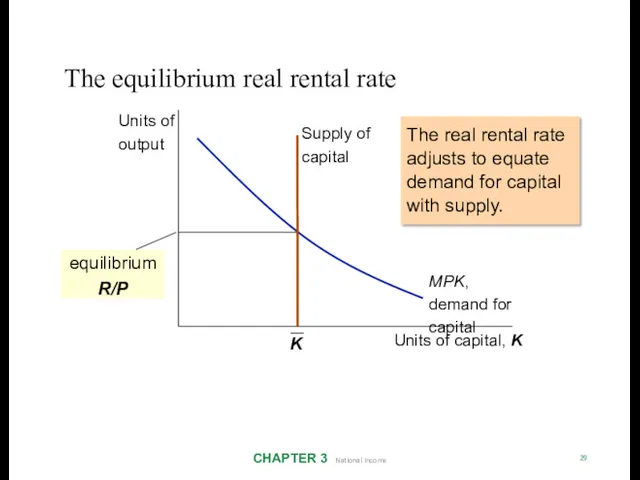

- 30. The equilibrium real rental rate CHAPTER 3 National Income 29 The real rental rate adjusts to

- 31. The neoclassical theory of distribution CHAPTER 3 National Income 30 States that each factor input is

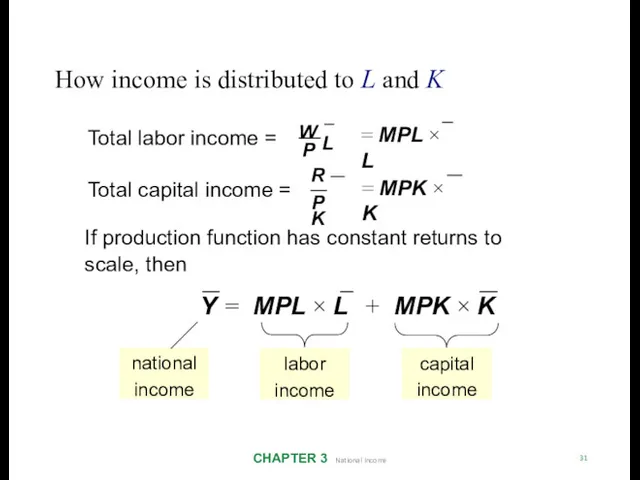

- 32. How income is distributed to L and K CHAPTER 3 National Income 31 Total labor income

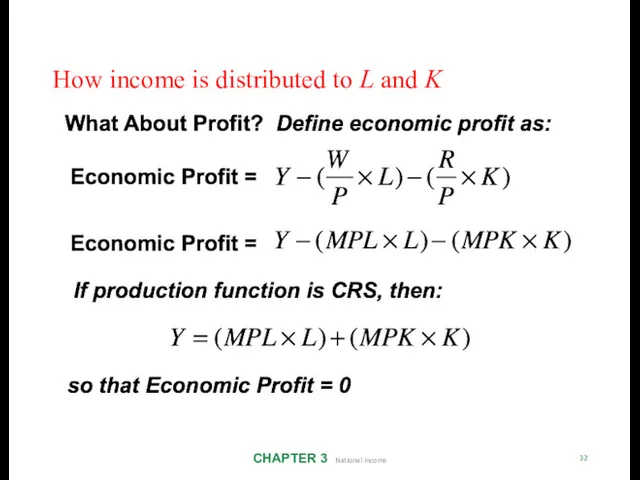

- 33. How income is distributed to L and K CHAPTER 3 National Income 32

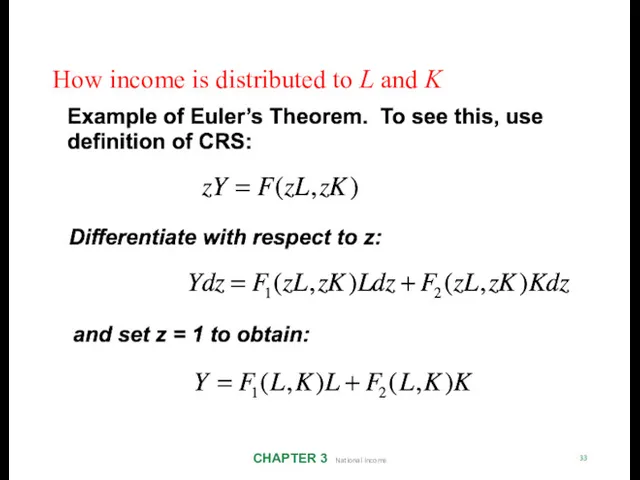

- 34. How income is distributed to L and K CHAPTER 3 National Income 33

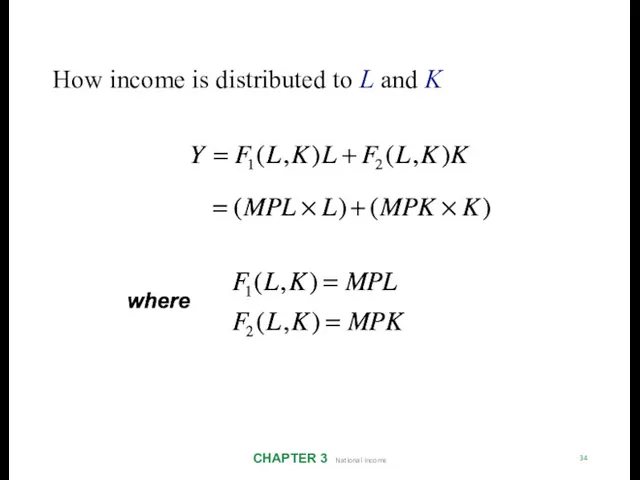

- 35. How income is distributed to L and K CHAPTER 3 National Income 34

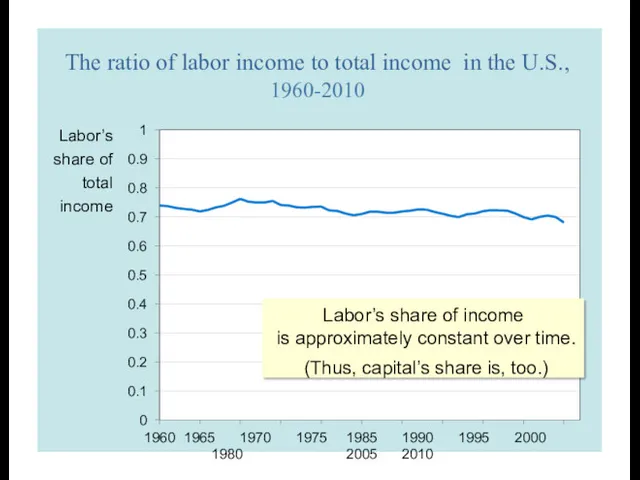

- 36. 0.1 0 0.2 0.3 0.4 0.7 0.6 0.5 0.8 0.9 1 1960 1965 1970 1975 1980

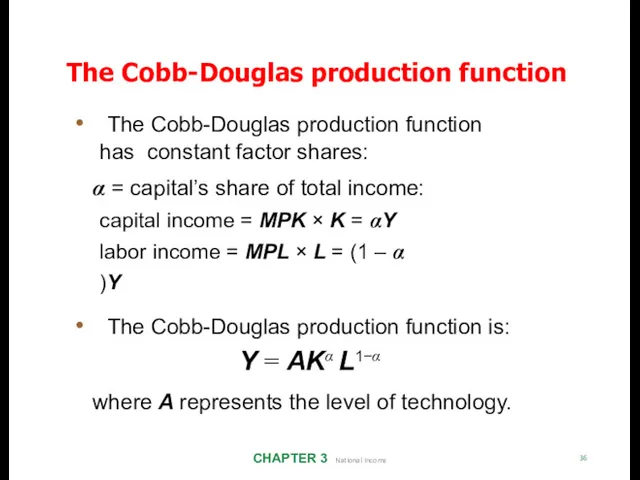

- 37. The Cobb-Douglas production function has constant factor shares: CHAPTER 3 National Income 36 The Cobb-Douglas production

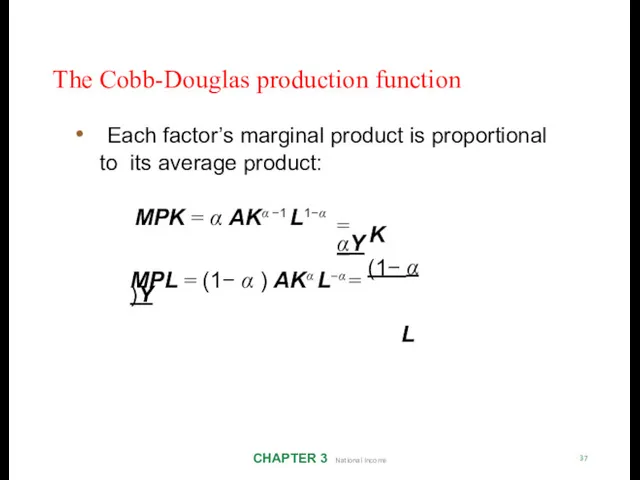

- 38. The Cobb-Douglas production function CHAPTER 3 National Income 37 Each factor’s marginal product is proportional to

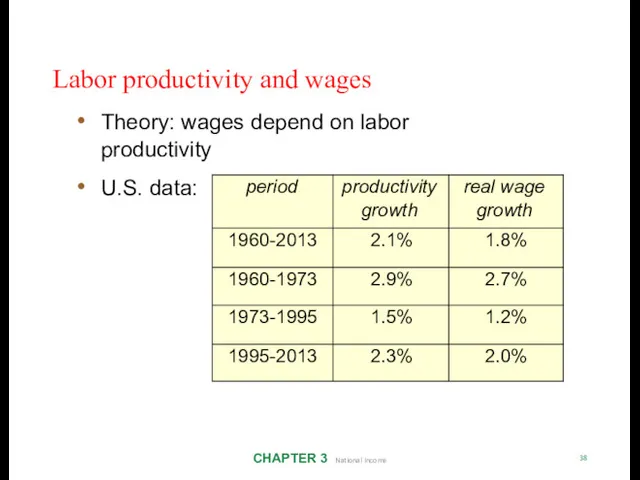

- 39. Labor productivity and wages CHAPTER 3 National Income 38 Theory: wages depend on labor productivity U.S.

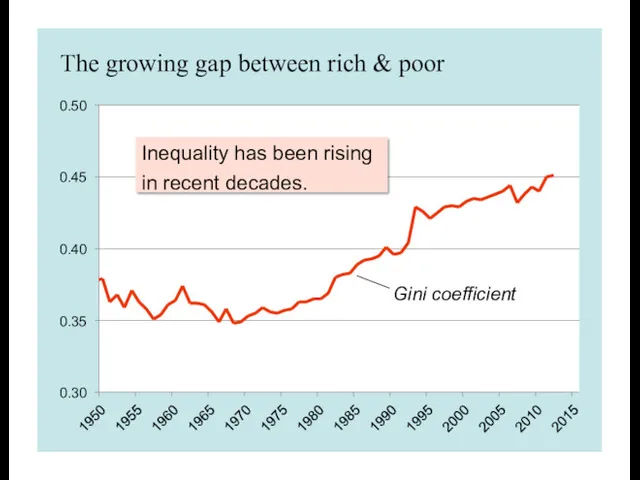

- 40. The growing gap between rich & poor 0.30 0.45 0.50 0.40 Gini coefficient 0.35 Inequality has

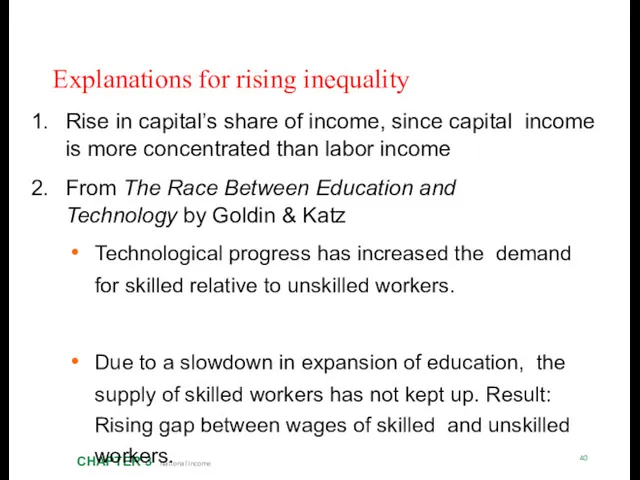

- 41. Explanations for rising inequality CHAPTER 3 National Income 40 Rise in capital’s share of income, since

- 42. Outline of model CHAPTER 3 National Income 41 A closed economy, market-clearing model Supply side DONE

- 43. Demand for goods and services CHAPTER 3 National Income 42 Components of aggregate demand: C =

- 44. Consumption, C CHAPTER 3 National Income 43 Disposable income is total income minus total taxes: Y

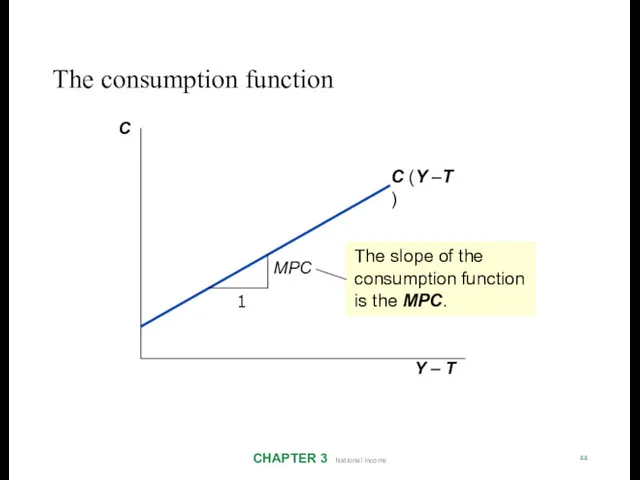

- 45. The consumption function CHAPTER 3 National Income 44 C Y – T C (Y –T )

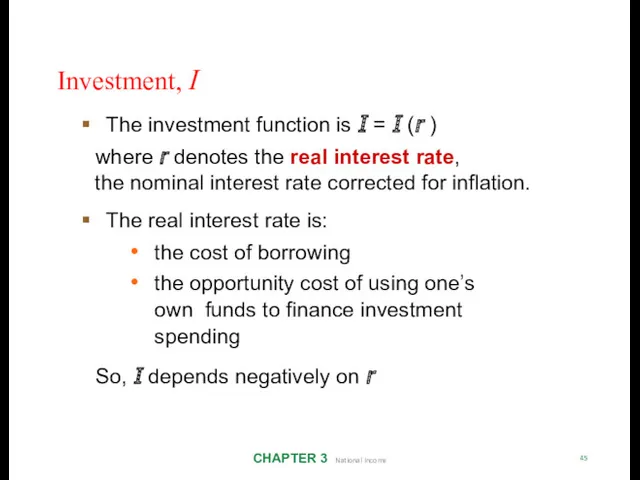

- 46. Investment, I CHAPTER 3 National Income 45 The investment function is I = I (r )

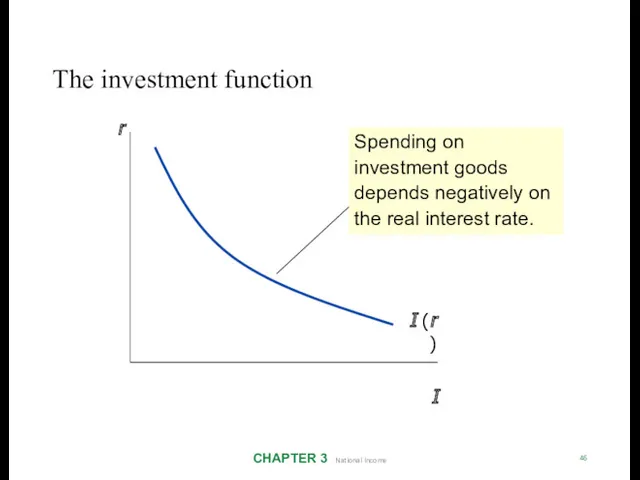

- 47. The investment function CHAPTER 3 National Income 46 r I (r ) I Spending on investment

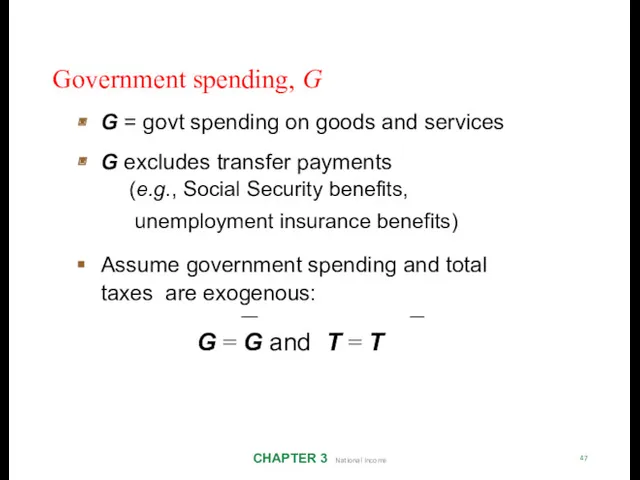

- 48. Government spending, G CHAPTER 3 National Income 47 G = govt spending on goods and services

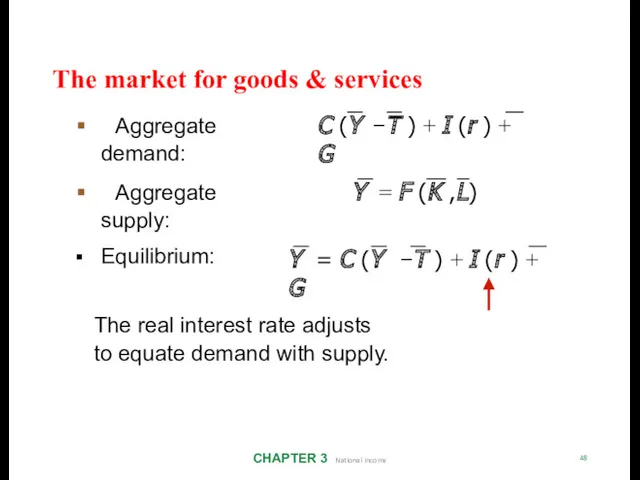

- 49. The market for goods & services CHAPTER 3 National Income 48 Aggregate demand: Aggregate supply: Equilibrium:

- 50. The loanable funds market CHAPTER 3 National Income 49 A simple supply–demand model of the financial

- 51. Demand for funds: investment CHAPTER 3 National Income 50 The demand for loanable funds . .

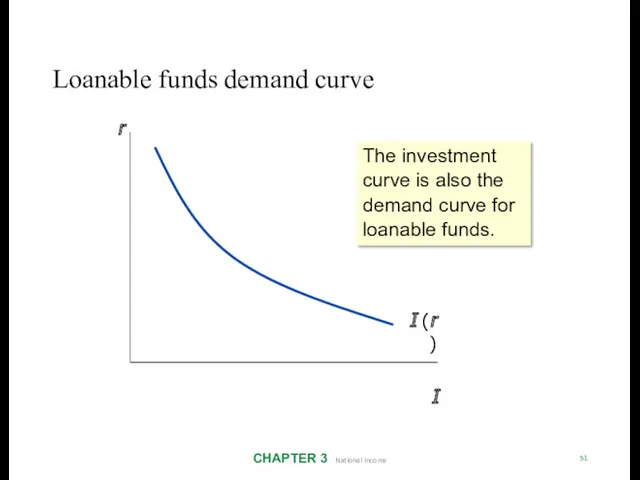

- 52. Loanable funds demand curve CHAPTER 3 National Income 51 r I (r ) I The investment

- 53. Supply of funds: saving CHAPTER 3 National Income 52 The supply of loanable funds comes from

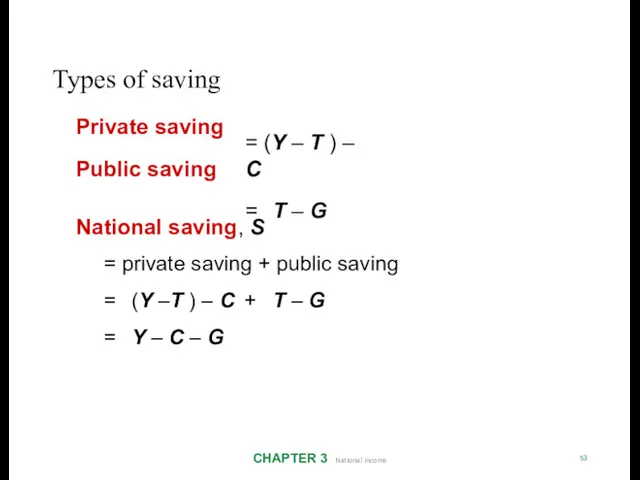

- 54. Types of saving CHAPTER 3 National Income 53 Private saving Public saving = (Y – T

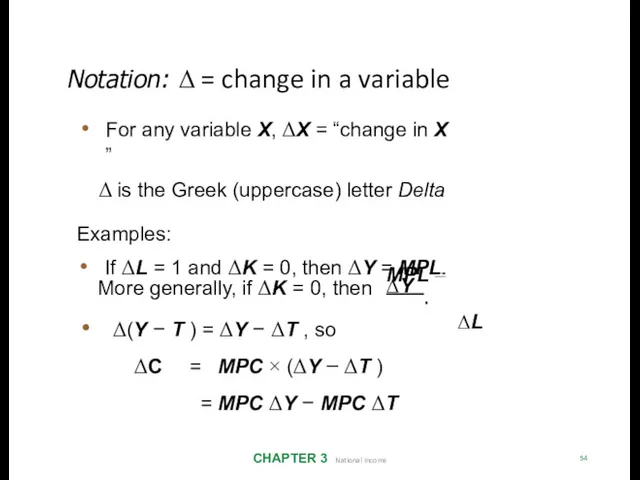

- 55. Notation: Δ = change in a variable CHAPTER 3 National Income 54 For any variable X,

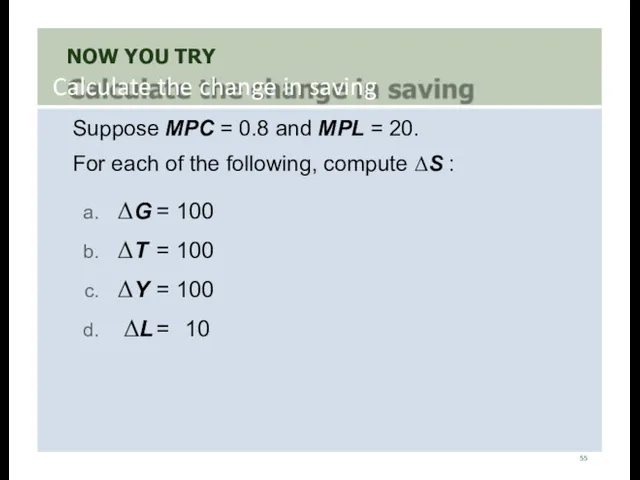

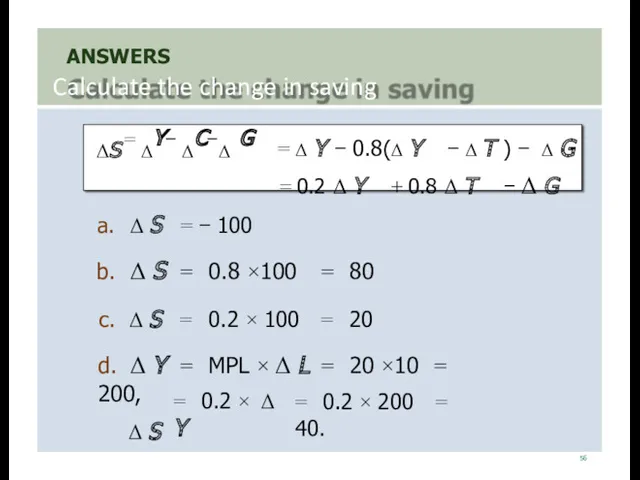

- 56. NOW YOU TRY Calculate the change in saving 55 Suppose MPC = 0.8 and MPL =

- 57. ANSWERS Calculate the change in saving 56 ΔS = ΔY− ΔC−Δ G = Δ Y −

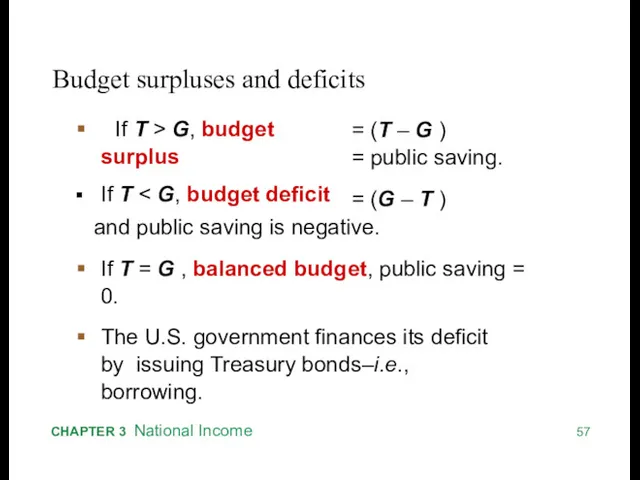

- 58. 57 CHAPTER 3 National Income Budget surpluses and deficits If T > G, budget surplus If

- 59. 1940-2016 Percent of GDP 10 5 0 -5 -10 -15 -20 -25 -30 -35 1940 1950

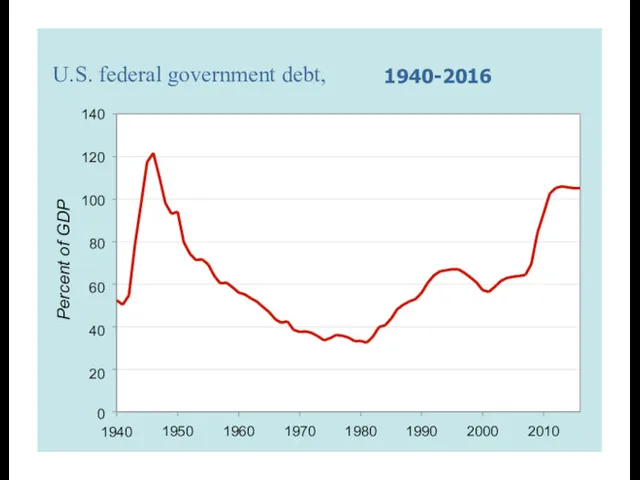

- 60. U.S. federal government debt, 1940-2016 Percent of GDP 140 120 100 80 60 40 20 0

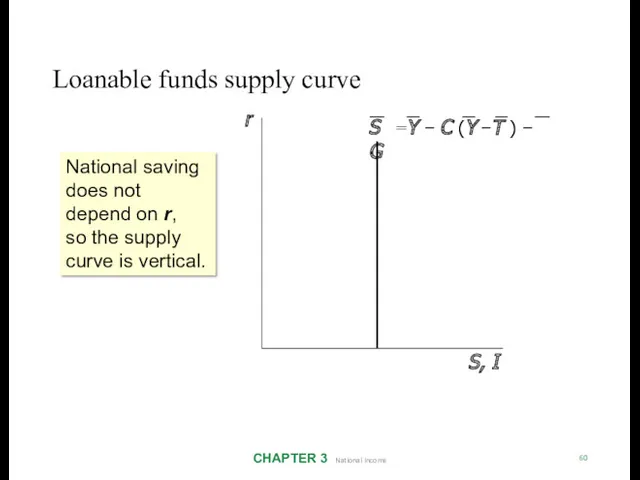

- 61. Loanable funds supply curve CHAPTER 3 National Income 60 r S, I S =Y − C

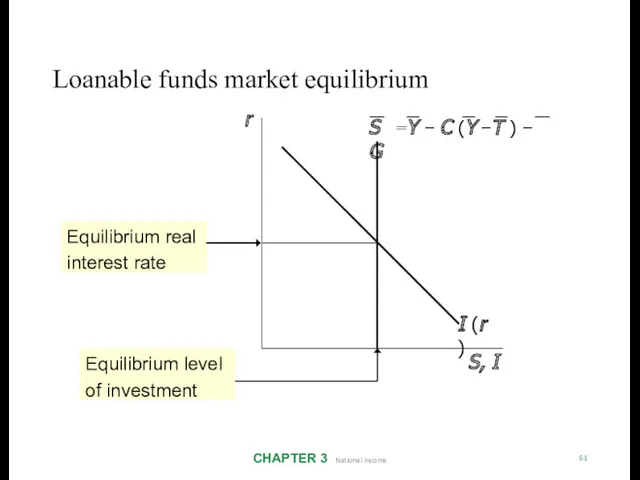

- 62. Loanable funds market equilibrium CHAPTER 3 National Income 61 r S, I I (r ) S

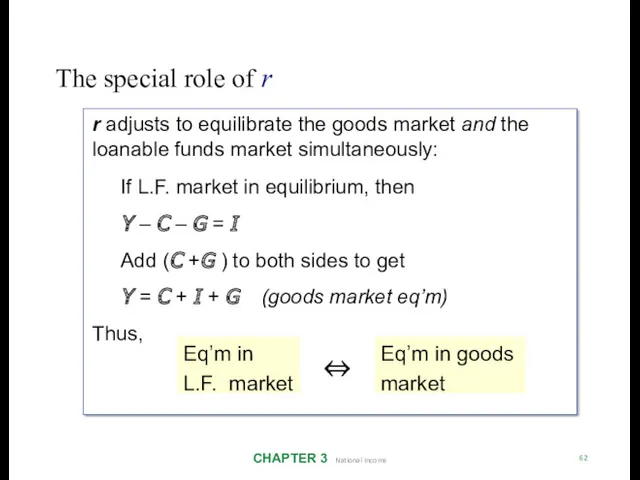

- 63. The special role of r CHAPTER 3 National Income 62 r adjusts to equilibrate the goods

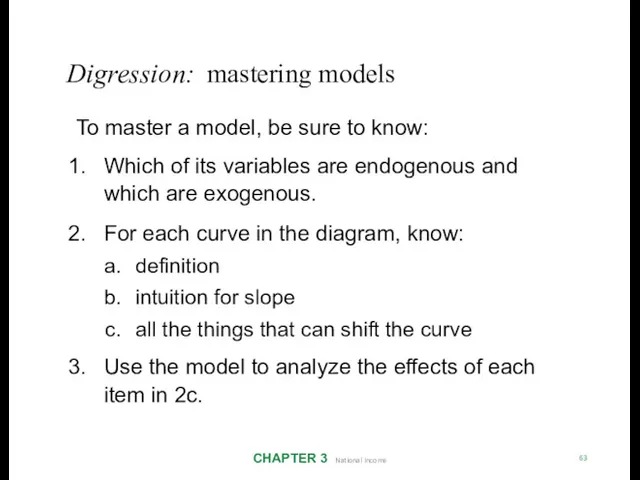

- 64. Digression: mastering models CHAPTER 3 National Income 63 To master a model, be sure to know:

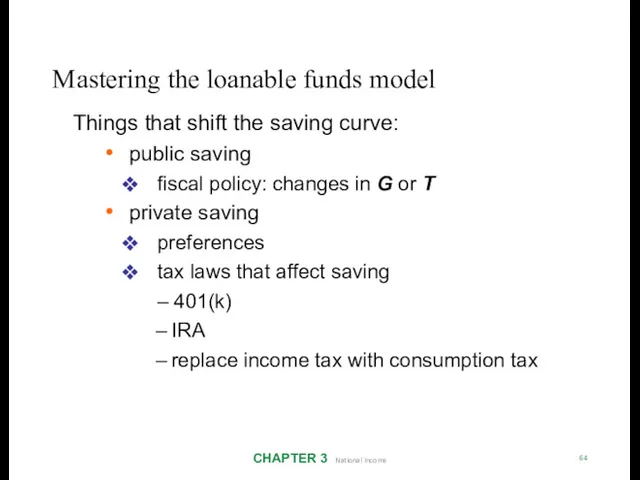

- 65. Mastering the loanable funds model CHAPTER 3 National Income 64 Things that shift the saving curve:

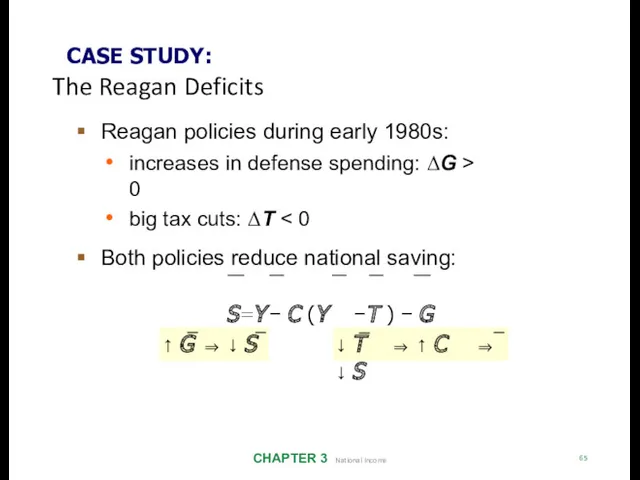

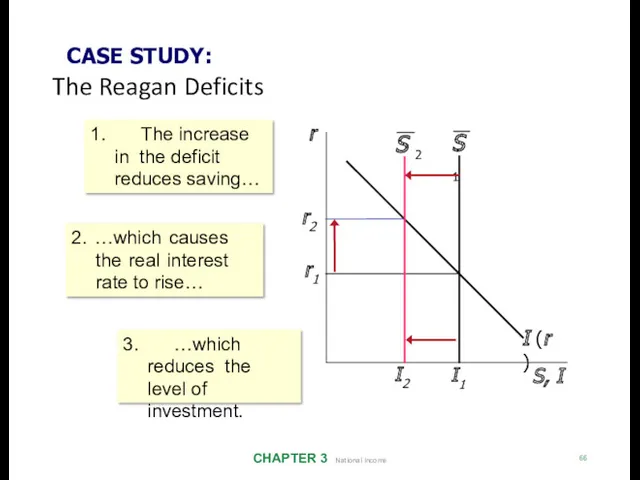

- 66. CASE STUDY: The Reagan Deficits CHAPTER 3 National Income 65 Reagan policies during early 1980s: increases

- 67. CASE STUDY: The Reagan Deficits CHAPTER 3 National Income 66 r S, I S 1 I

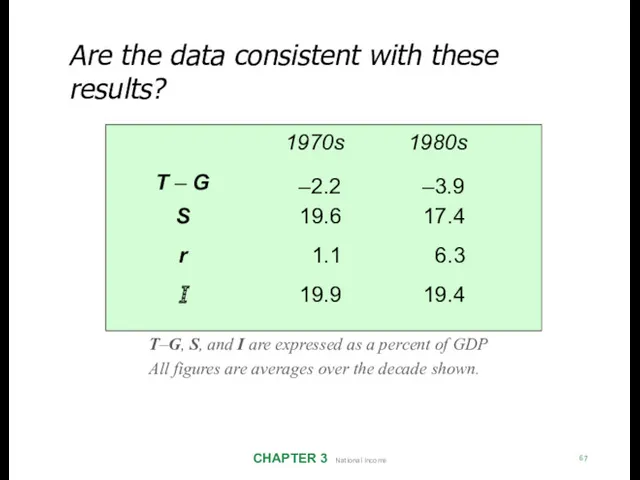

- 68. Are the data consistent with these results? CHAPTER 3 National Income 67 T–G, S, and I

- 69. NOW YOU TRY 68 Draw the diagram for the loanable funds model. Suppose the tax laws

- 70. Mastering the loanable funds model CHAPTER 3 National Income 69 (continued) Things that shift the investment

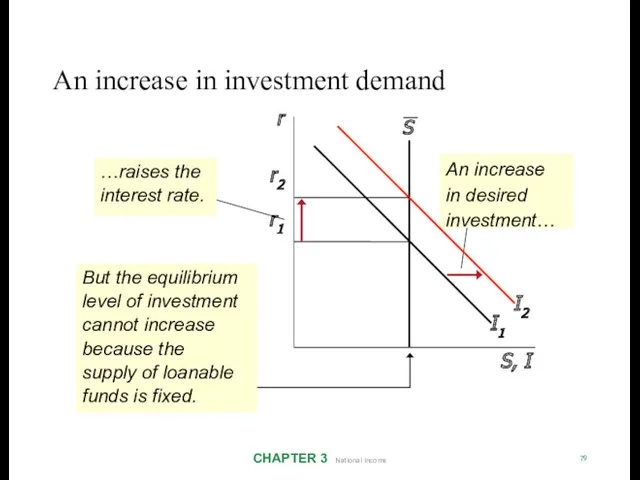

- 71. An increase in investment demand CHAPTER 3 National Income 79 An increase in desired investment… r

- 72. Saving and the interest rate CHAPTER 3 National Income 71 Why might saving depend on r

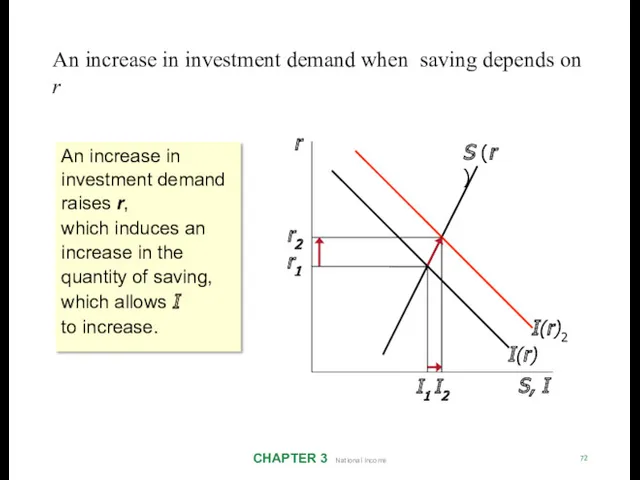

- 73. An increase in investment demand when saving depends on r CHAPTER 3 National Income 72 r

- 74. C H A P T E R S U M M A R Y Total output

- 75. C H A P T E R S U M M A R Y A closed

- 77. Скачать презентацию

Формализация задач мониторинга и оценки новаций в проектировании регионального устойчивого инновационного развития

Формализация задач мониторинга и оценки новаций в проектировании регионального устойчивого инновационного развития Международное разделение труда в мировом хозяйстве

Международное разделение труда в мировом хозяйстве Типы экономических систем

Типы экономических систем Платежный баланс

Платежный баланс Цена. Основные функции цены

Цена. Основные функции цены Економічний аналіз та методи економічної оцінки в сфері охорони здоров’я

Економічний аналіз та методи економічної оцінки в сфері охорони здоров’я Искусство и экономика. Художественный аукцион

Искусство и экономика. Художественный аукцион Итоги производственной и финансово-экономической деятельности эксплуатационного локомотивного депо Уссурийск

Итоги производственной и финансово-экономической деятельности эксплуатационного локомотивного депо Уссурийск Особенности методики школьного экономического образования. (Лекция 2)

Особенности методики школьного экономического образования. (Лекция 2) Аралас экономика және қазіргі қоғамдық өндіріс қызмет етуінің объективті нысаны

Аралас экономика және қазіргі қоғамдық өндіріс қызмет етуінің объективті нысаны Безработица как социально-экономическая проблема

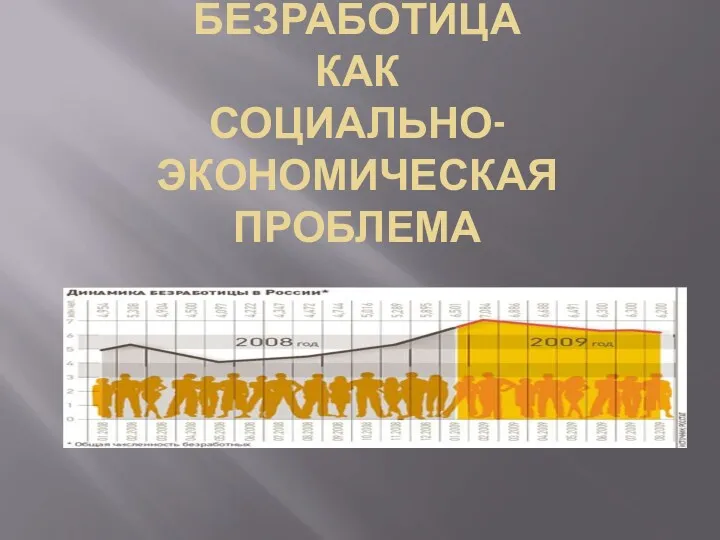

Безработица как социально-экономическая проблема Общая характеристика рыночной экономики

Общая характеристика рыночной экономики Анализ экономических показателей на основе применения метода динамических рядов

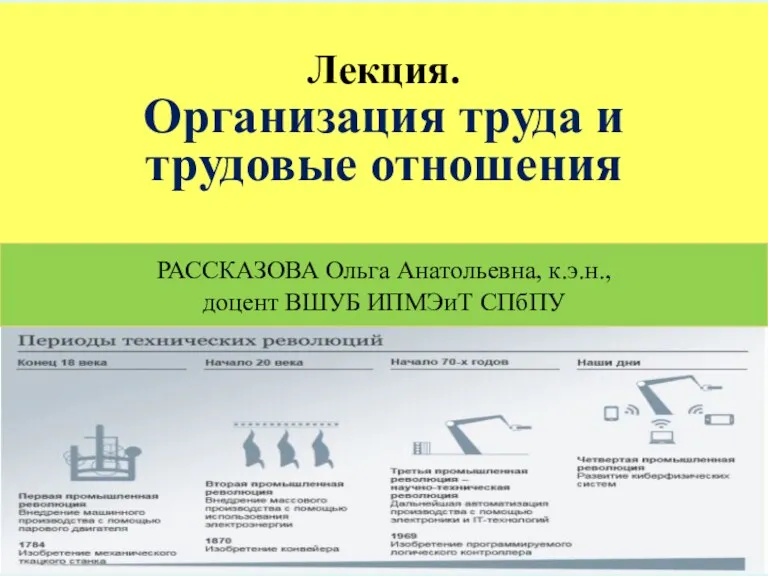

Анализ экономических показателей на основе применения метода динамических рядов Организация труда и трудовые отношения

Организация труда и трудовые отношения Экономическая свобода и социальная ответственность

Экономическая свобода и социальная ответственность Prezentatsia_kursovoy_raboty

Prezentatsia_kursovoy_raboty Финансы как экономическая категория

Финансы как экономическая категория Экономика. Экономические блага и ресурсы

Экономика. Экономические блага и ресурсы Forecast combinations

Forecast combinations Definition capacity

Definition capacity Правовые и экономические особенности закупки ТРУ отдельными юридическими лицами

Правовые и экономические особенности закупки ТРУ отдельными юридическими лицами Мектеп кеме-білім теңіз

Мектеп кеме-білім теңіз Народосбережение. Демографическая ситуация, основные причины сложившегося положения дел, задачи народосбережения

Народосбережение. Демографическая ситуация, основные причины сложившегося положения дел, задачи народосбережения Сельское хозяйство Великобритании

Сельское хозяйство Великобритании Система национальных счетов. Основные макроэкономические показатели

Система национальных счетов. Основные макроэкономические показатели Собственность, как экономическая категория

Собственность, как экономическая категория Планирование материально-технического обеспечения и механизации. Планирование труда и прибыли

Планирование материально-технического обеспечения и механизации. Планирование труда и прибыли Современная система ценообразования в энергетике. Оптовый рынок электроэнергии (мощности)

Современная система ценообразования в энергетике. Оптовый рынок электроэнергии (мощности)