Содержание

- 2. Learning Objectives To understand theories of international trade To explain how free trade improves global efficiency

- 3. Reference Chapter 6 : International Trade and Factor-Mobility Theory; by John D. Daniels, Lee H. Radebaugh,

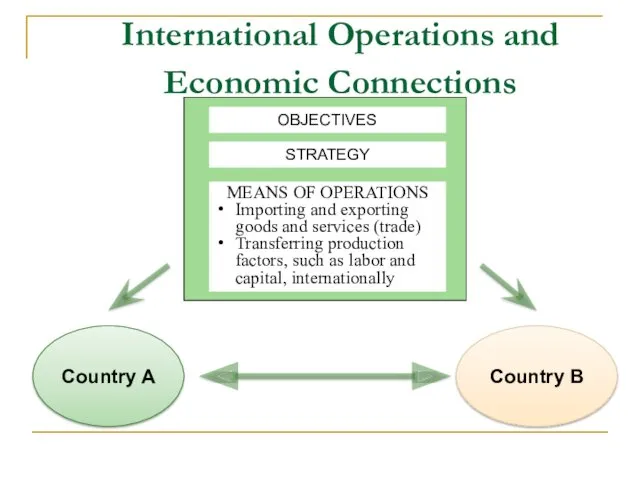

- 4. International Operations and Economic Connections MEANS OF OPERATIONS Importing and exporting goods and services (trade) Transferring

- 5. Questions international managers are facing What products should we import and export? How much should we

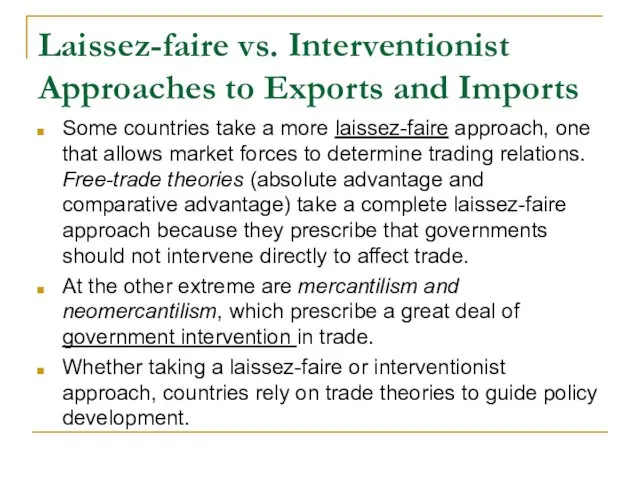

- 6. Laissez-faire vs. Interventionist Approaches to Exports and Imports Some countries take a more laissez-faire approach, one

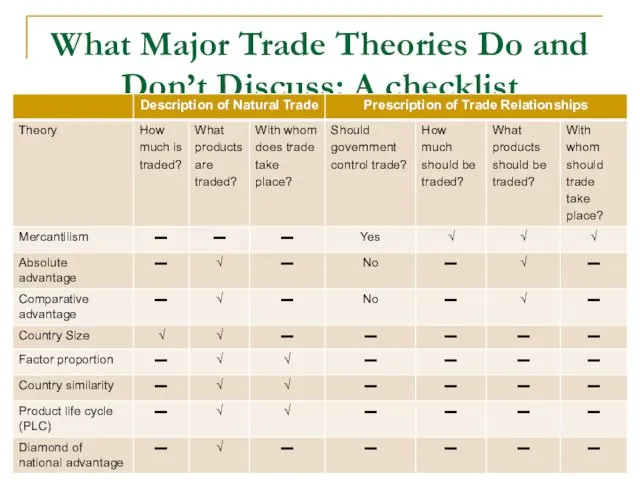

- 7. What Major Trade Theories Do and Don’t Discuss: A checklist

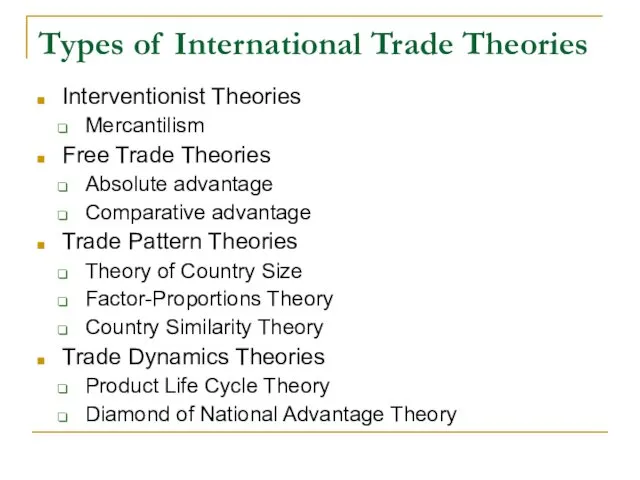

- 8. Types of International Trade Theories Interventionist Theories Mercantilism Free Trade Theories Absolute advantage Comparative advantage Trade

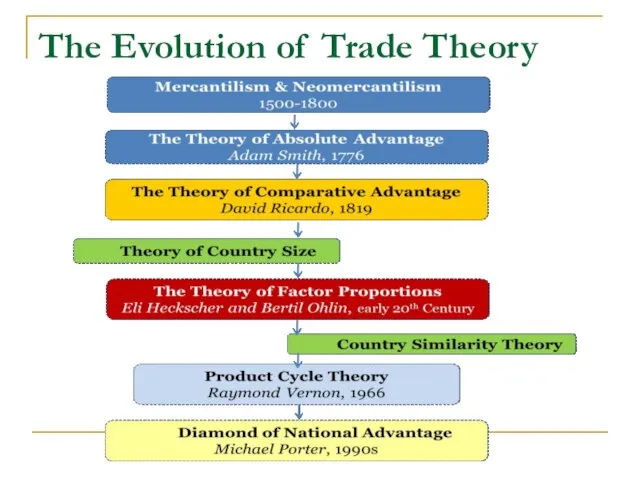

- 9. The Evolution of Trade Theory

- 10. Mercantilism 重商主义 Mercantilism is a trade theory holding that a country’s wealth is measured by its

- 11. (Un)favorable Balance of Trade Some terminology of the mercantilist era has endured. For example, a favorable

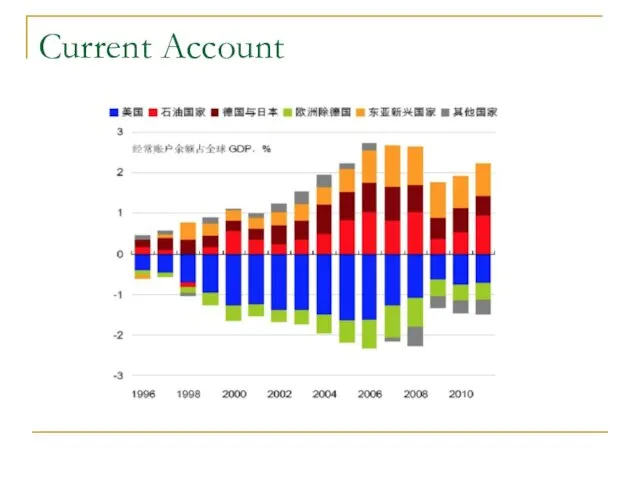

- 12. Current Account

- 13. Early Mercantilism and Late Mercantilism Early Mercantilism: 15-16century Late Mercantilism: 16-17century Difference?

- 14. Like a miser, his hands clung to his beloved purse and looked at his neighbor with

- 15. Revival of Mercantilism

- 16. Free Trade Theory Absolute Advantage and comparative advantage both hold that nations should neither artificially limit

- 17. Free Trade Theory Absolute Advantage (Adam Smith, 1776) According to Adam Smith, a country’s wealth is

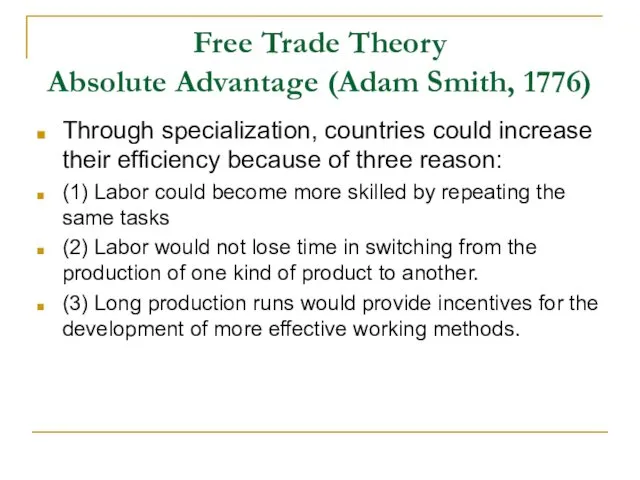

- 18. Free Trade Theory Absolute Advantage (Adam Smith, 1776) Through specialization, countries could increase their efficiency because

- 19. Free Trade Theory Absolute Advantage (Adam Smith, 1776) According to the theory of absolute advantage, a

- 20. Key Concepts ~ ‘Absolute advantage’ 绝对优势 An advantage of one nation or area over another in

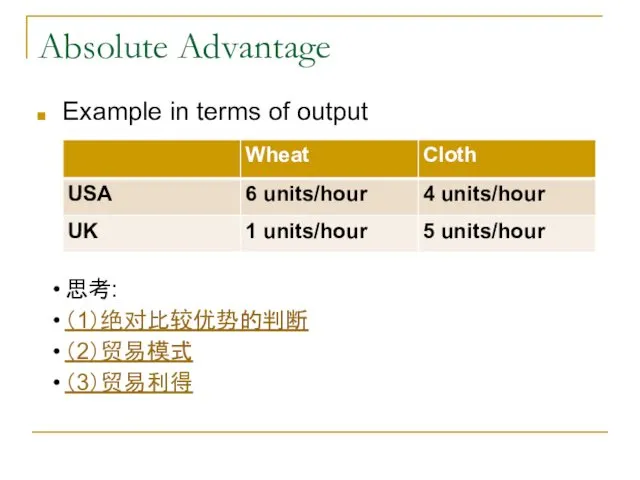

- 21. Absolute Advantage Example in terms of output 思考: (1)绝对比较优势的判断 (2)贸易模式 (3)贸易利得

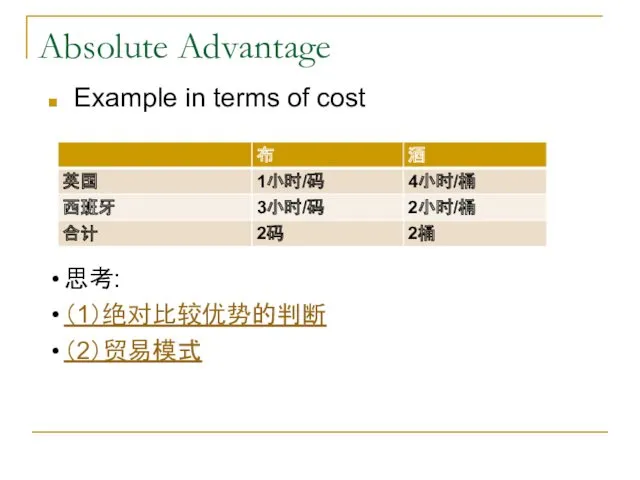

- 22. Absolute Advantage Example in terms of cost 思考: (1)绝对比较优势的判断 (2)贸易模式

- 23. Comparative advantage (David Ricardo, 1817) Comparative advantage theory also proposes specialization through free trade because it

- 24. Key Concepts ~ ‘comparative advantage’ 比较优势 It is a central concept in international trade theory which

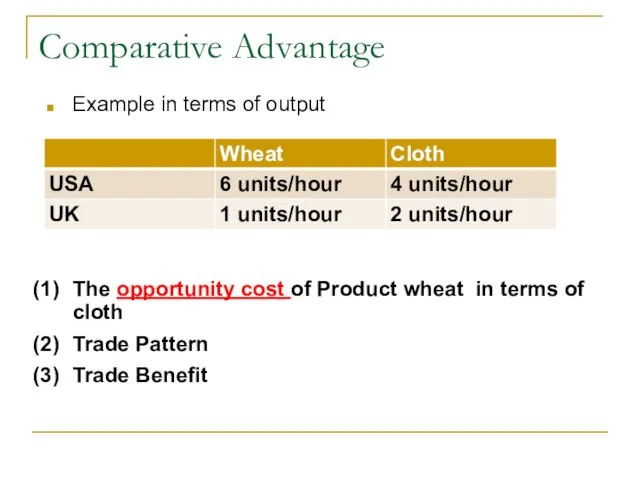

- 25. Comparative Advantage Example in terms of output The opportunity cost of Product wheat in terms of

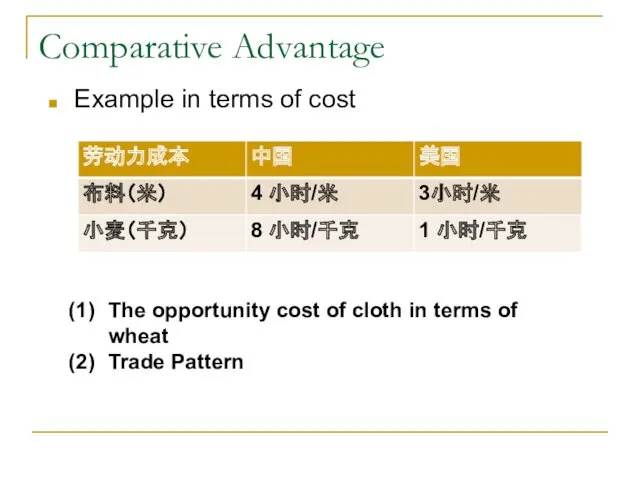

- 26. Comparative Advantage Example in terms of cost The opportunity cost of cloth in terms of wheat

- 27. Theories of Specialization: Assumptions and Limitations Policymakers have questioned some of the assumptions of the absolute

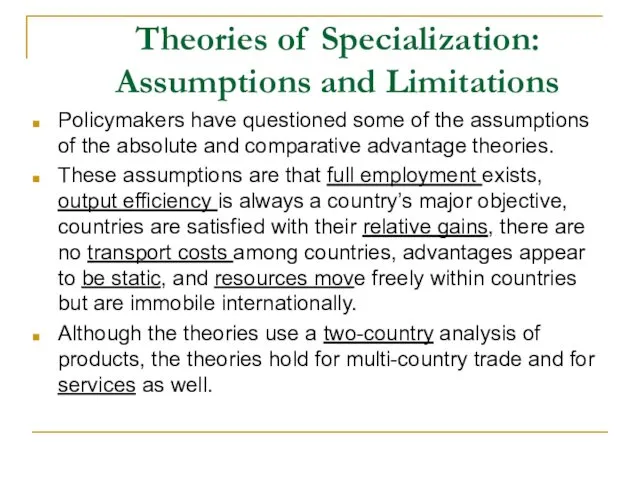

- 28. Theories of Specialization: Assumptions and Limitations full employment economic efficiency division of gains two countries and

- 29. Comparative Advantage Trap

- 30. Theory of Country Size (How much does a country trade?) The theory of country size holds

- 31. Largest countries by total international trade

- 32. Factor-Proportions Theory 要素禀赋理论 (What types of products does a country trade?) The factor-proportions theory holds that

- 33. Leontief Paradox Class Discussion: How to explain the Leontief Paradox?

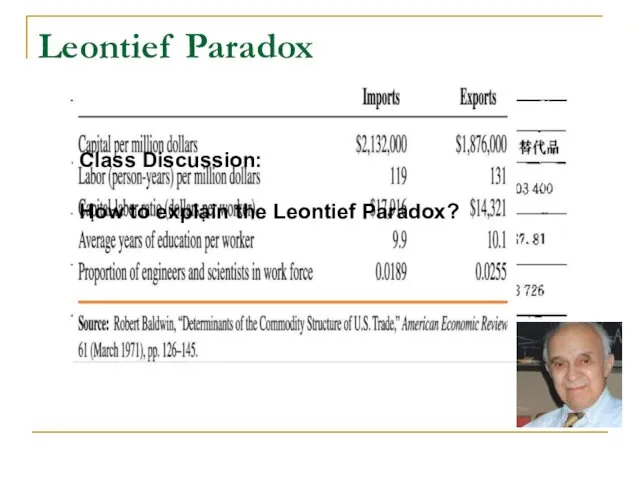

- 34. Preference Similarity Theory (With whom do countries trade?) According to the country-similarity theory, most trade today

- 35. Intra-industry trade

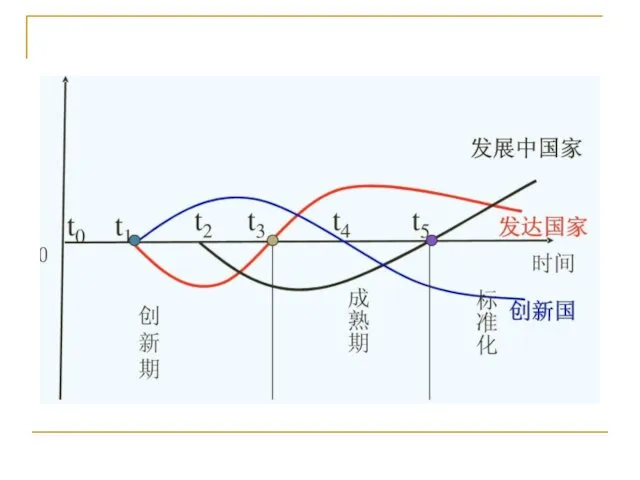

- 36. Product Life Cycle Theory (How countries develop, maintain, and lose their competitive advantages?) The international product

- 37. Stages of the Product cycle Stage I: The Phase of Introduction highly skilled labor; non-standardized; high

- 38. Stages of the Product cycle Stage II: The Phase of Maturation Increasingly standardized flexibility in design;

- 39. Stages of the Product cycle Stage III: The Phase of Standardization completely standardized technology accounts less

- 41. Limitations of PLC Theory There are many types of products for which shifts in production location

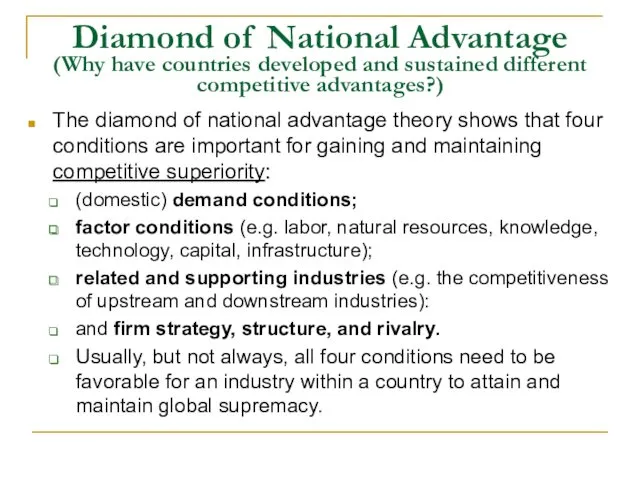

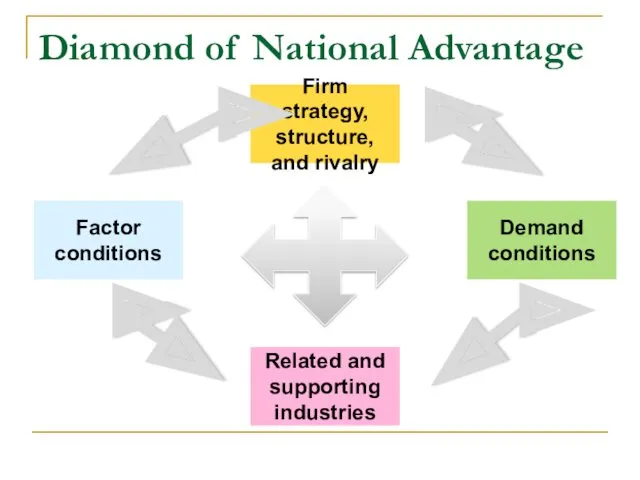

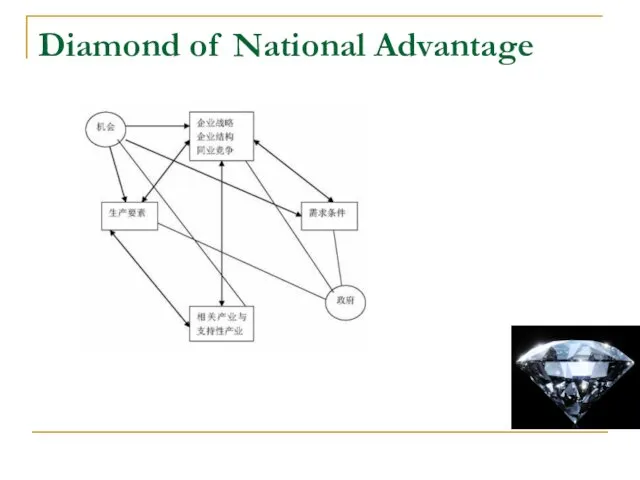

- 42. Diamond of National Advantage (Why have countries developed and sustained different competitive advantages?) The diamond of

- 43. Diamond of National Advantage Firm strategy, structure, and rivalry Demand conditions Factor conditions Related and supporting

- 44. Diamond of National Advantage

- 45. Chinese Entertainment Industry Factor conditions: natural resources

- 46. Chinese Entertainment Industry Factor conditions: cultural resources

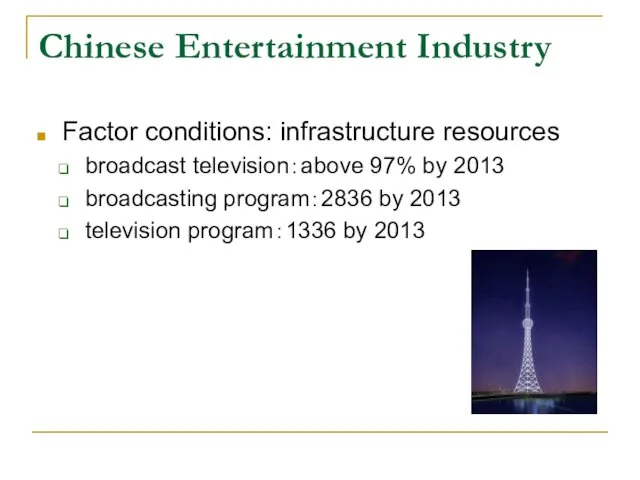

- 47. Chinese Entertainment Industry Factor conditions: infrastructure resources broadcast television:above 97% by 2013 broadcasting program:2836 by 2013

- 48. Chinese Entertainment Industry Factor conditions: capital resources Broadcast television income structure of China

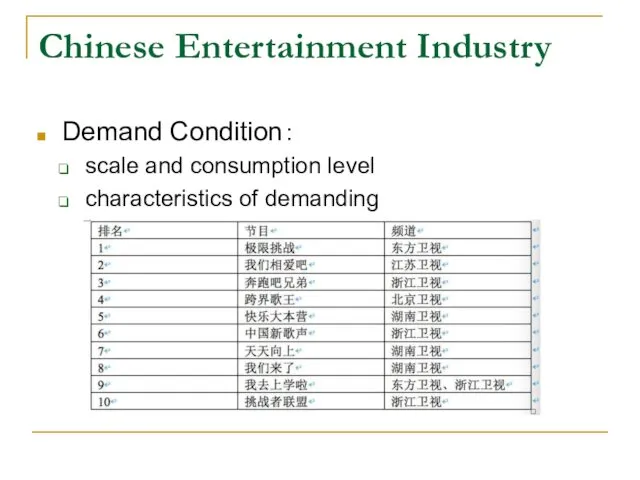

- 49. Chinese Entertainment Industry Demand Condition: scale and consumption level characteristics of demanding

- 50. Chinese Entertainment Industry Related and supporting industry information industry advertisement industry industrial chain of derivative product

- 51. Chinese Entertainment Industry Firm strategy, structure, and rivalry firm strategy and structure: broadcasting group and TV

- 52. Korea Entertainment Industry

- 53. Factor-Mobility Theory When the quantity and quality of countries’ factor conditions change, countries’ relative capabilities (comparative

- 54. Factor-Mobility Theory People: people move for economic reasons as well as political reasons. Capital: capital especially

- 55. Immigration Waves 1st Immigration Waves:studying abroad 2nd Skilled Migration 3rd Investment immigration

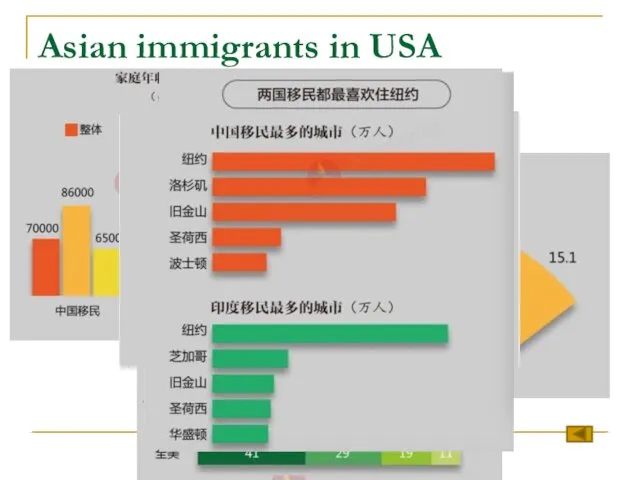

- 56. Asian immigrants in USA

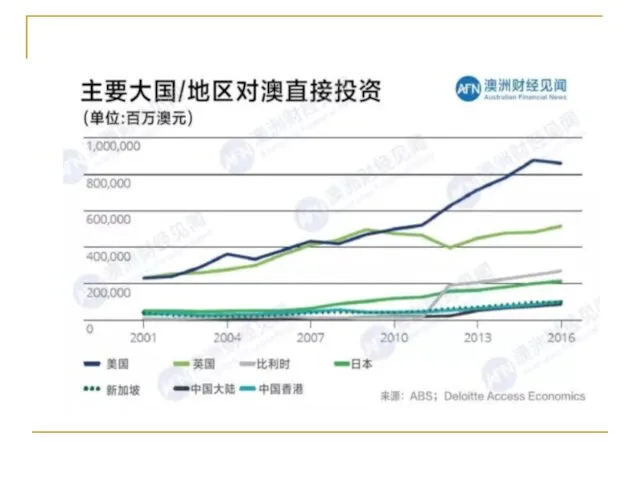

- 57. Capital Movement

- 59. The Relationship between Trade and Factor Mobility Factor movements alter factor endowments. Capital and labor move

- 61. Скачать презентацию

Облік фінансових інвестицій у спільну діяльність

Облік фінансових інвестицій у спільну діяльність Бейтарифтік шара үлкен екі топқа бөлінеді

Бейтарифтік шара үлкен екі топқа бөлінеді Исследование рынка

Исследование рынка Экономика организации. Трудовые ресурсы организации. Основы организации труда и его оплаты

Экономика организации. Трудовые ресурсы организации. Основы организации труда и его оплаты Основные макроэкономические показатели

Основные макроэкономические показатели Анализ численности и структуры населения России, его распределения по регионам и территориям, воспроизводство

Анализ численности и структуры населения России, его распределения по регионам и территориям, воспроизводство Государство в макроэкономике. Фискальная политика

Государство в макроэкономике. Фискальная политика Научно-техническая революция и мировое хозяйство

Научно-техническая революция и мировое хозяйство Теоретико-методологические основы планирования и прогнозирования

Теоретико-методологические основы планирования и прогнозирования Транспортная стратегия Российской Федерации на период до 2030 года

Транспортная стратегия Российской Федерации на период до 2030 года Презентация Структура населения

Презентация Структура населения Парадокс Гиффена

Парадокс Гиффена Модель Леонтьева

Модель Леонтьева Развитие экономической мысли в первой половине XX века

Развитие экономической мысли в первой половине XX века Индикаторы технического анализа

Индикаторы технического анализа Инфляция. Лекция 11

Инфляция. Лекция 11 Актуальные проблемы экономики таможенного дела. Лекция № 1

Актуальные проблемы экономики таможенного дела. Лекция № 1 Индекс человеческого развития субъектов Российской Федерации

Индекс человеческого развития субъектов Российской Федерации Өндірістік ресурстарын пайдалануын талдау

Өндірістік ресурстарын пайдалануын талдау Роль экономики в жизни общества

Роль экономики в жизни общества Экспорт и импорт в Казахстане

Экспорт и импорт в Казахстане Статистиканың даму кезеңдері

Статистиканың даму кезеңдері Организация функционирования электронного правительства

Организация функционирования электронного правительства Экономика родного края

Экономика родного края Проблемы развития цифровой экономики

Проблемы развития цифровой экономики Международное разделение труда в мировом хозяйстве

Международное разделение труда в мировом хозяйстве Стратегия экономического развития Санкт‑Петербурга на период до 2030 года

Стратегия экономического развития Санкт‑Петербурга на период до 2030 года Экономика и её основные участники

Экономика и её основные участники