Содержание

- 2. The aim: to provide recommendations concerning tools and schemes that could help company increase quality of

- 3. Content Customer-centric approach Case company and Industry Recommendations

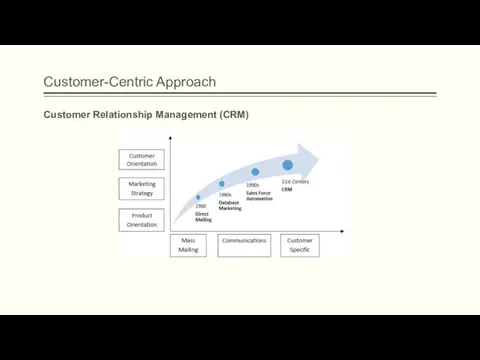

- 4. Customer-Centric Approach Customer Relationship Management (CRM)

- 5. Customer-Centric Approach Customer Service Customers have a problem that needs to be solved Customers are more

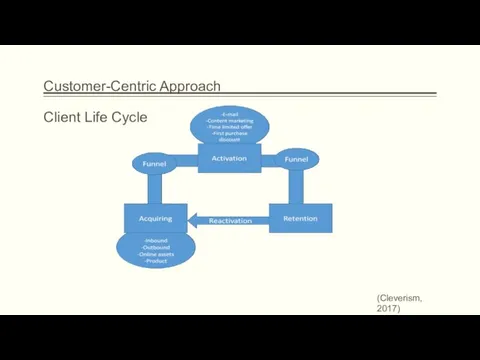

- 6. Customer-Centric Approach Client Life Cycle (Cleverism, 2017)

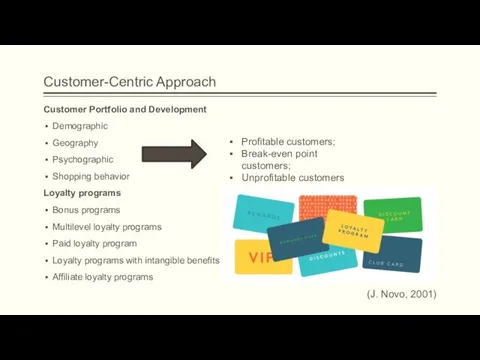

- 7. Customer-Centric Approach Customer Portfolio and Development Demographic Geography Psychographic Shopping behavior Loyalty programs Bonus programs Multilevel

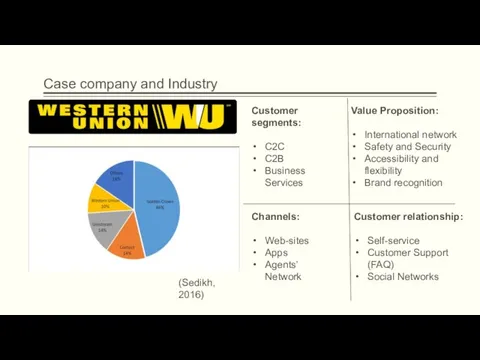

- 8. Case company and Industry Customer segments: C2C C2B Business Services Value Proposition: International network Safety and

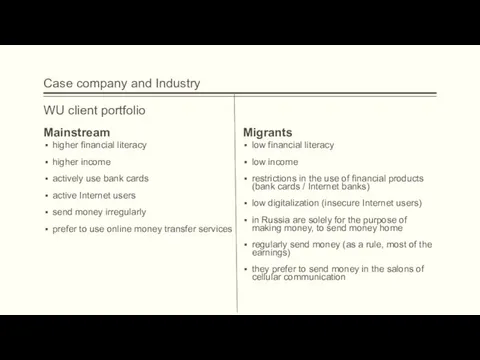

- 10. Case company and Industry WU client portfolio Mainstream higher financial literacy higher income actively use bank

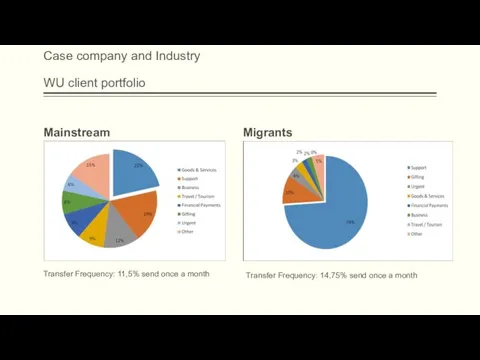

- 11. Case company and Industry WU client portfolio Mainstream Transfer Frequency: 11,5% send once a month Migrants

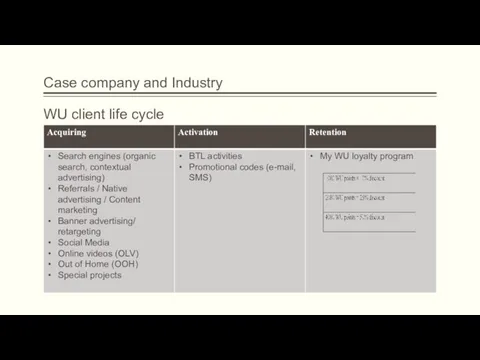

- 12. Case company and Industry WU client life cycle

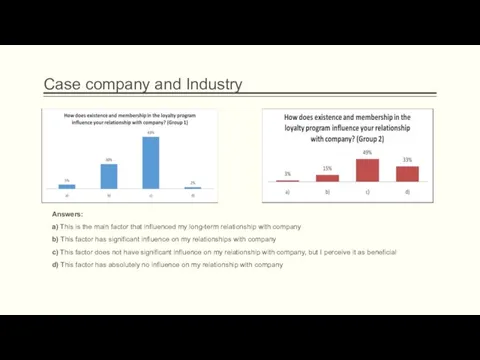

- 13. Case company and Industry Answers: a) This is the main factor that influenced my long-term relationship

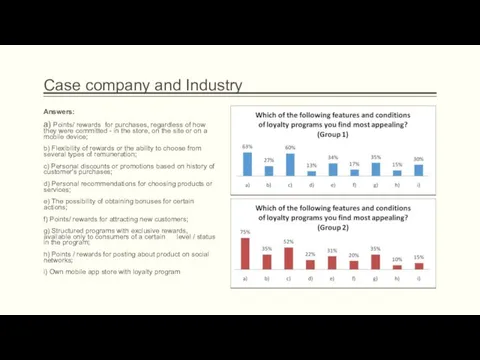

- 14. Case company and Industry Answers: a) Points/ rewards for purchases, regardless of how they were committed

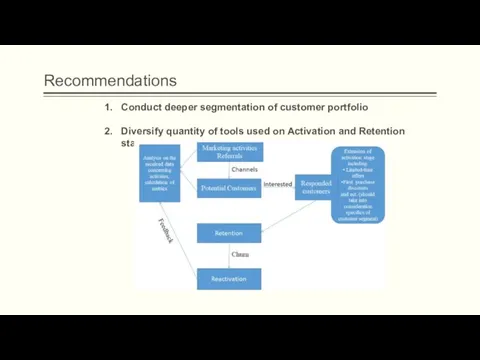

- 15. Recommendations Conduct deeper segmentation of customer portfolio Diversify quantity of tools used on Activation and Retention

- 17. Скачать презентацию

Пропозиція бізнесу з компанією OVB Vermogensberatung A.G. Аналіз потенціалу

Пропозиція бізнесу з компанією OVB Vermogensberatung A.G. Аналіз потенціалу Ипотека: состояние и перспектива развития в России

Ипотека: состояние и перспектива развития в России Статистика финансовой деятельности предприятия

Статистика финансовой деятельности предприятия Автономия. О компании

Автономия. О компании Сущность и функции финансов

Сущность и функции финансов Қаржы құқығының ұғымы, пәні мен жүйесі

Қаржы құқығының ұғымы, пәні мен жүйесі Агентство регионального развития. Малый и средний бизнес и поддержка индивидуальной предпринимательской инициативы

Агентство регионального развития. Малый и средний бизнес и поддержка индивидуальной предпринимательской инициативы Ликвидность и платежеспособность организации

Ликвидность и платежеспособность организации Бюджет для граждан

Бюджет для граждан Денежное обращение и равновесие на денежном рынке

Денежное обращение и равновесие на денежном рынке Предварительный антимонопольный контроль за созданием и реорганизацией коммерческих организаций

Предварительный антимонопольный контроль за созданием и реорганизацией коммерческих организаций Прошлое и будущее международной валютной системы

Прошлое и будущее международной валютной системы Комплексний договір страхування подорожуючих за кордон. Навчальна презентація 2013. © УСК Княжа вієнна іншуранс груп

Комплексний договір страхування подорожуючих за кордон. Навчальна презентація 2013. © УСК Княжа вієнна іншуранс груп Оборотные средства предприятия

Оборотные средства предприятия Порядок учета территориальными органами Федерального казначейства бюджетных и денежных обязательств в РФ

Порядок учета территориальными органами Федерального казначейства бюджетных и денежных обязательств в РФ Определение ожидаемой доходности бизнеса (ставки дисконтирования)

Определение ожидаемой доходности бизнеса (ставки дисконтирования) Персонифицированное финансирование дополнительного образования детей

Персонифицированное финансирование дополнительного образования детей Ұйымның қысқа мерзімді міндеттемелерінің есебі және аудиті

Ұйымның қысқа мерзімді міндеттемелерінің есебі және аудиті Мировые финансовые рынки

Мировые финансовые рынки Оценка кредитоспособности заемщика (на примере ООО 162 КЖИ)

Оценка кредитоспособности заемщика (на примере ООО 162 КЖИ) Пути повышения ликвидности и платежеспособности предприятия ООО НефтеГазСервис

Пути повышения ликвидности и платежеспособности предприятия ООО НефтеГазСервис Пасивні операції банків із залучення та запозичення коштів

Пасивні операції банків із залучення та запозичення коштів Беларусбанк. Потребительские кредиты

Беларусбанк. Потребительские кредиты Оценка качества зданий. Показатели качества зданий

Оценка качества зданий. Показатели качества зданий Знаковые решения Верховного суда РФ по налоговым спорам в 2018 году (НДС, налог на прибыль, налог на имущество)

Знаковые решения Верховного суда РФ по налоговым спорам в 2018 году (НДС, налог на прибыль, налог на имущество) Теории денег

Теории денег Развитие страхового рынка в зарубежных странах

Развитие страхового рынка в зарубежных странах Операции на финансовых рынках. Принципы инвестирования

Операции на финансовых рынках. Принципы инвестирования