Содержание

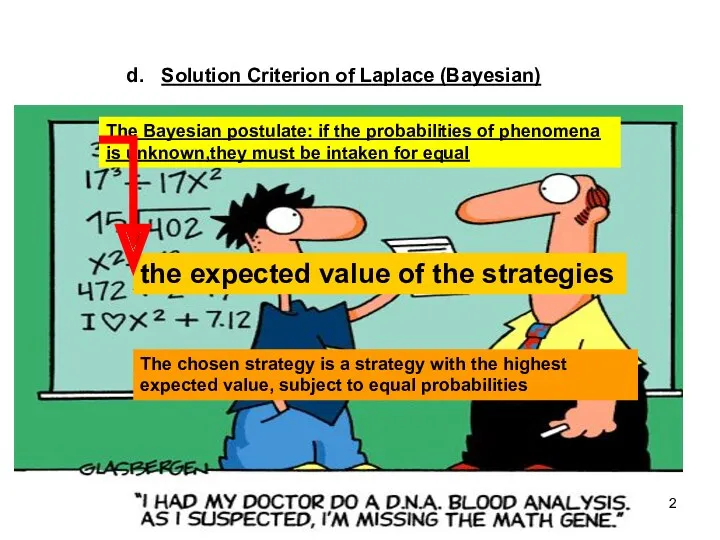

- 2. Solution Criterion of Laplace (Bayesian) The Bayesian postulate: if the probabilities of phenomena is unknown,they must

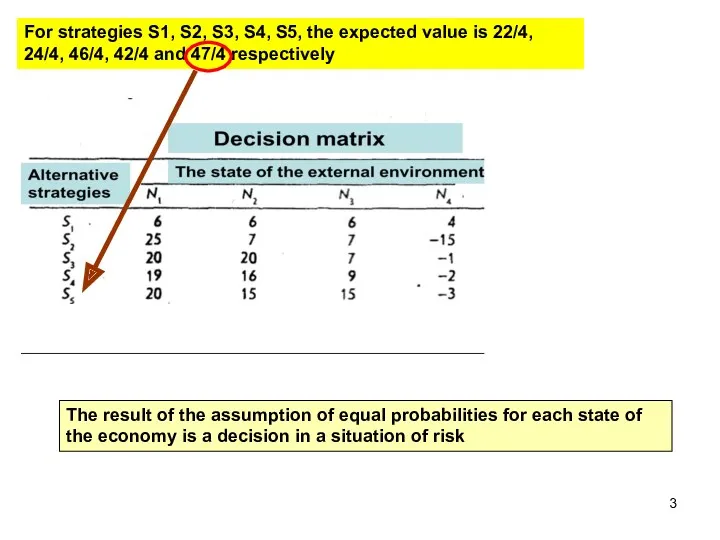

- 3. For strategies S1, S2, S3, S4, S5, the expected value is 22/4, 24/4, 46/4, 42/4 and

- 4. The criterion of Laplace - is the criterion of rationality, completely insensitive to the decision-makers Suitable

- 5. Conclusion : The process of decision-making under uncertainty is the process of criteria selection, and then

- 6. Other methods of evoidance of uncertainty Hedging - method in which future uncertainty is replaced with

- 7. Manufacturer buys oil and plans to sell gasoline made of this oil after 3 months. To

- 8. FLEXIBLE INVESTMENT I don't want to be locked in investments in specialized assets unless it will

- 9. Other methods of evoidance of uncertainty DIVERSIFICATION OF THE COMPANY'S INTERESTS This approach is illustrated by

- 10. Other methods of evoidance of uncertainty THE ACQUISITION OF ADDITIONAL INFORMATION Obviously, the more information you

- 11. Tropical Products

- 13. Скачать презентацию

Инновации и предпринимательство в туризме

Инновации и предпринимательство в туризме Разделение и кооперация труда

Разделение и кооперация труда Лидерство и менеджмент. Делегирование полномочий

Лидерство и менеджмент. Делегирование полномочий Integrated project management

Integrated project management Научные школы на которых базируется стратегическое государственное управление

Научные школы на которых базируется стратегическое государственное управление Семь новых инструментов менеджмента качества

Семь новых инструментов менеджмента качества Форматы Welcome-тренинга в современных организациях. Понятие Welcome-тренинг

Форматы Welcome-тренинга в современных организациях. Понятие Welcome-тренинг Формирование программы кадрового резерва университета

Формирование программы кадрового резерва университета презентация Принципы СМК

презентация Принципы СМК Ростелеком. Сибирь, Урал и Юг

Ростелеком. Сибирь, Урал и Юг Chapter 2. Global e-business and collaboration

Chapter 2. Global e-business and collaboration Методологические основы инноватики. Инновационные процессы

Методологические основы инноватики. Инновационные процессы Контроль качества на предприятии. Стандарты группы ISO 9000

Контроль качества на предприятии. Стандарты группы ISO 9000 Ситуационный подход

Ситуационный подход Басқарудың классикалық мектептері

Басқарудың классикалық мектептері Состояние и перспективы развития логистического аутсорсинга в США и европейских странах

Состояние и перспективы развития логистического аутсорсинга в США и европейских странах Подбор и отбор персонала

Подбор и отбор персонала Методы воздействия в деловом общении. Критика, поощрения и наказания

Методы воздействия в деловом общении. Критика, поощрения и наказания Внедрение инновационных процессов в ресторанном обслуживании

Внедрение инновационных процессов в ресторанном обслуживании Лидерство и стили управления

Лидерство и стили управления Организация работы с документами. Документооборот

Организация работы с документами. Документооборот Процессы управления: общее и особенное. Системный подход к управлению

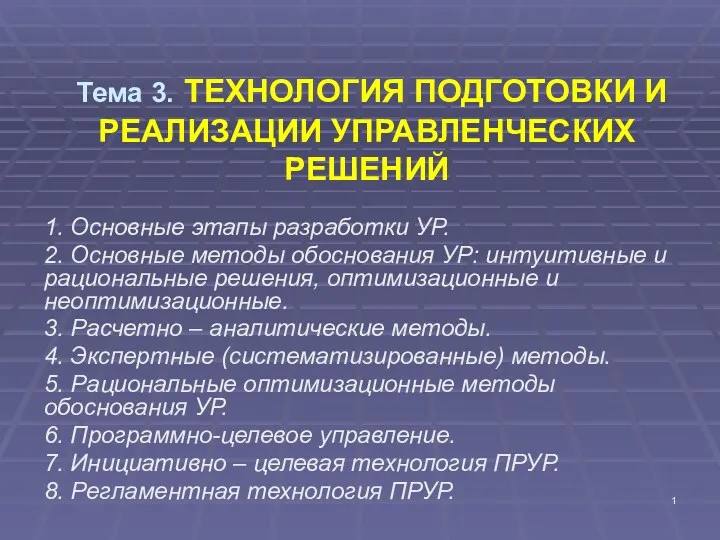

Процессы управления: общее и особенное. Системный подход к управлению Технология подготовки и реализации управленческих решений

Технология подготовки и реализации управленческих решений Примеры внедрения momentum operations. Схема использования на заводе Puffin

Примеры внедрения momentum operations. Схема использования на заводе Puffin Управление качеством и рисками проекта

Управление качеством и рисками проекта Школы и теории управления

Школы и теории управления Нотация моделирования бизнес-процессов BPMN

Нотация моделирования бизнес-процессов BPMN Shopping Live. Прием на работу

Shopping Live. Прием на работу