Содержание

- 2. Class #7 – Derivatives Pricing II 1 The binomial model 2 The Black –Scholes model 3

- 3. Class #7 – Derivatives Pricing II 1 The binomial model 2 The Black –Scholes model 3

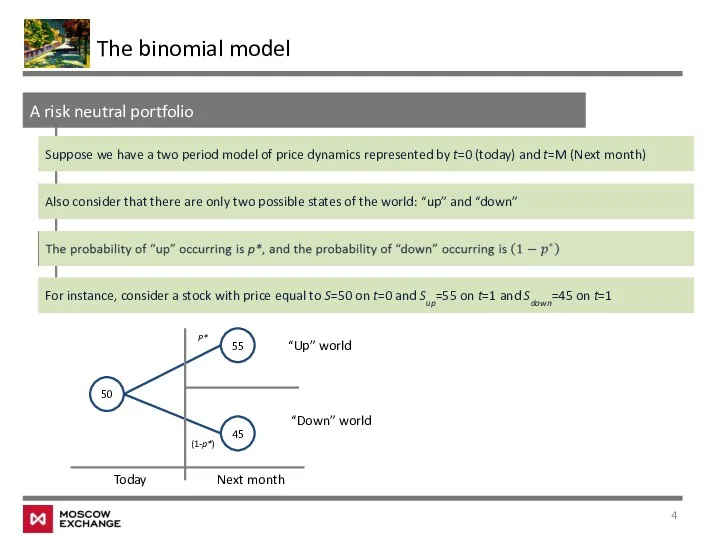

- 4. The binomial model A risk neutral portfolio Suppose we have a two period model of price

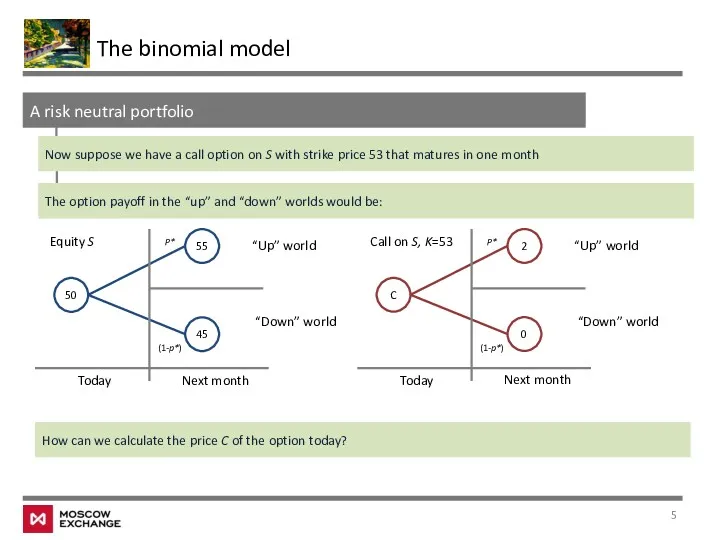

- 5. The binomial model A risk neutral portfolio Now suppose we have a call option on S

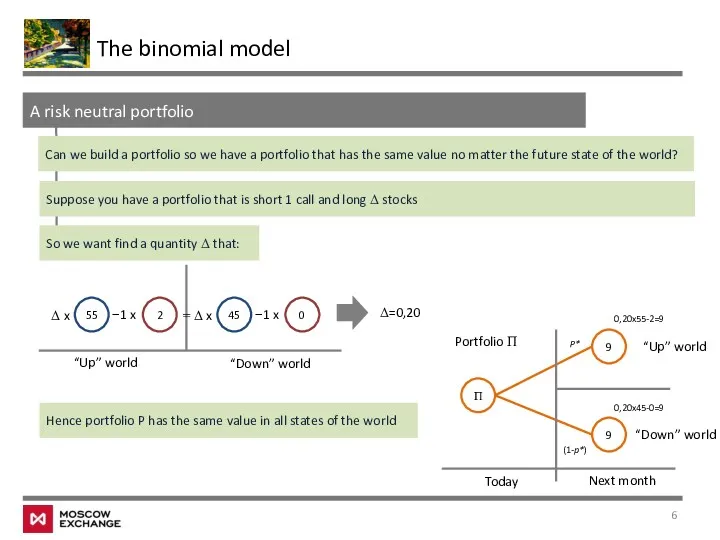

- 6. The binomial model A risk neutral portfolio Can we build a portfolio so we have a

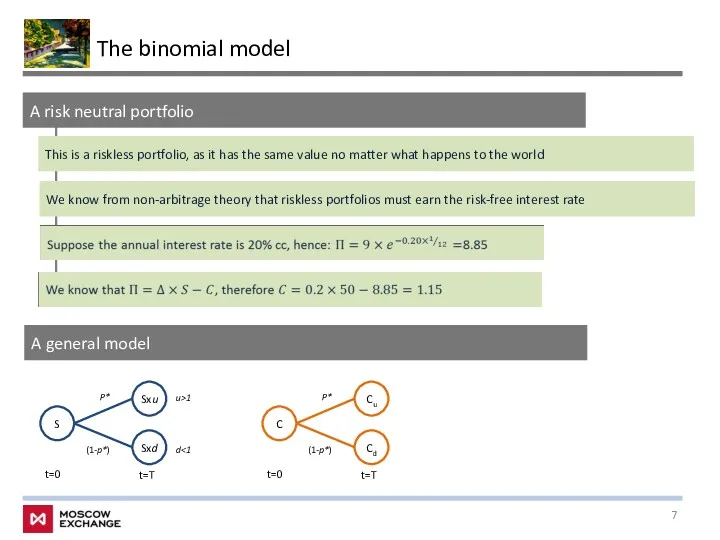

- 7. The binomial model A risk neutral portfolio This is a riskless portfolio, as it has the

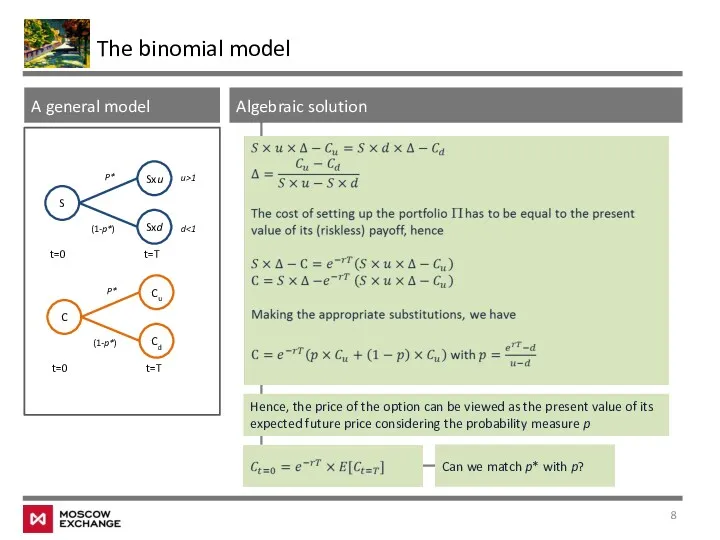

- 8. The binomial model S Sxd t=0 P* (1-p*) Sxu t=T C Cd t=0 P* (1-p*) Cu

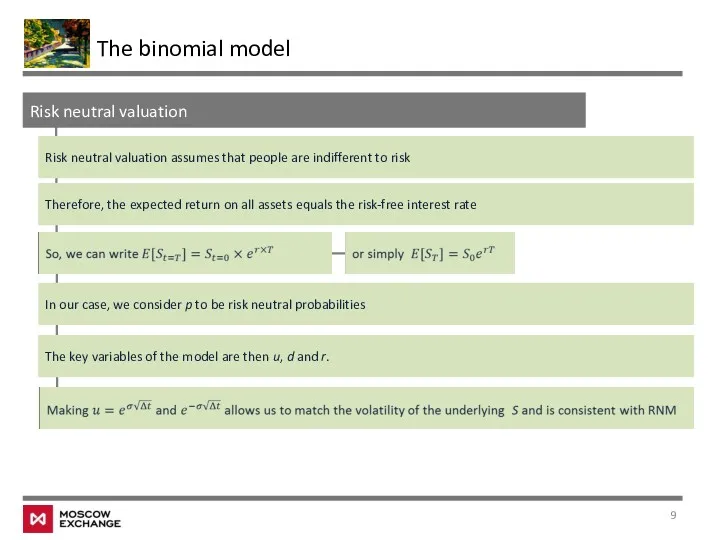

- 9. The binomial model Risk neutral valuation Risk neutral valuation assumes that people are indifferent to risk

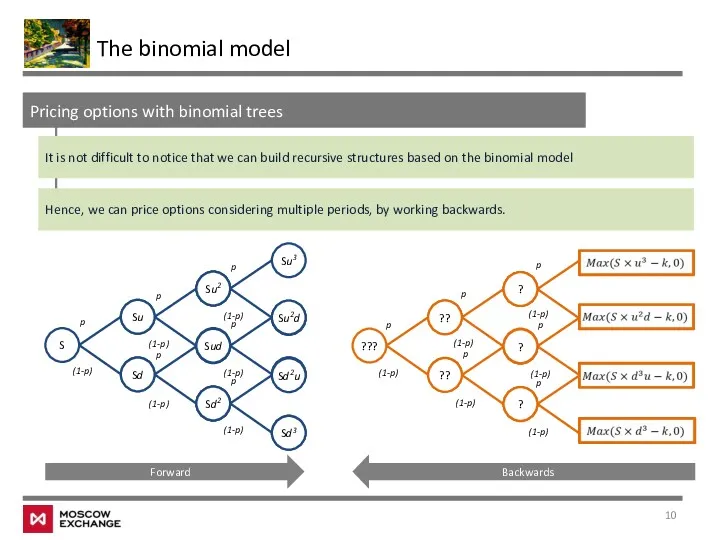

- 10. The binomial model Pricing options with binomial trees It is not difficult to notice that we

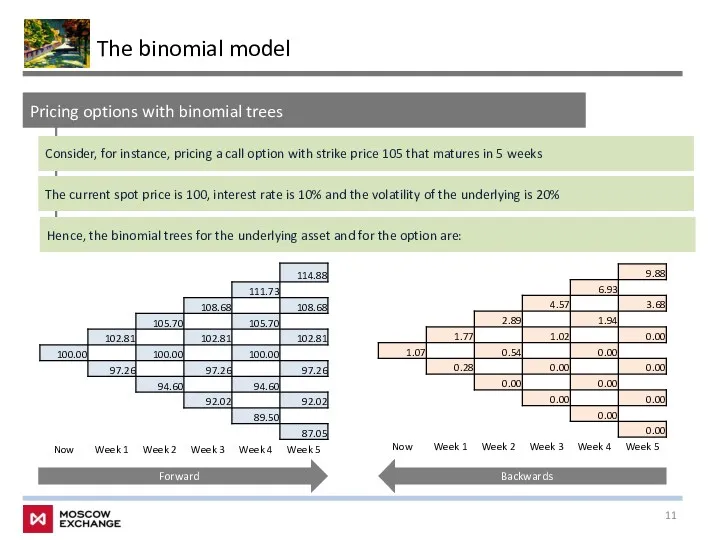

- 11. The binomial model Pricing options with binomial trees Consider, for instance, pricing a call option with

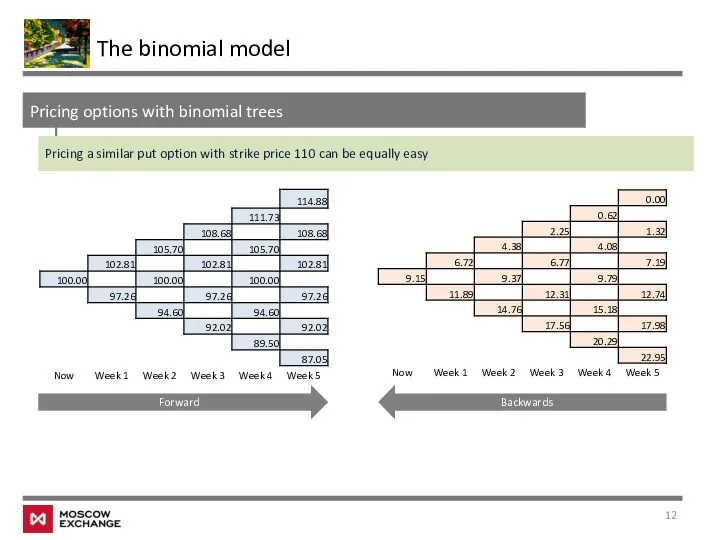

- 12. The binomial model Pricing options with binomial trees Pricing a similar put option with strike price

- 13. The binomial model Pricing options with binomial trees – some stylized facts Very flexible and intuitive

- 14. Class #7 – Derivatives Pricing II 1 The binomial model 2 The Black –Scholes model 3

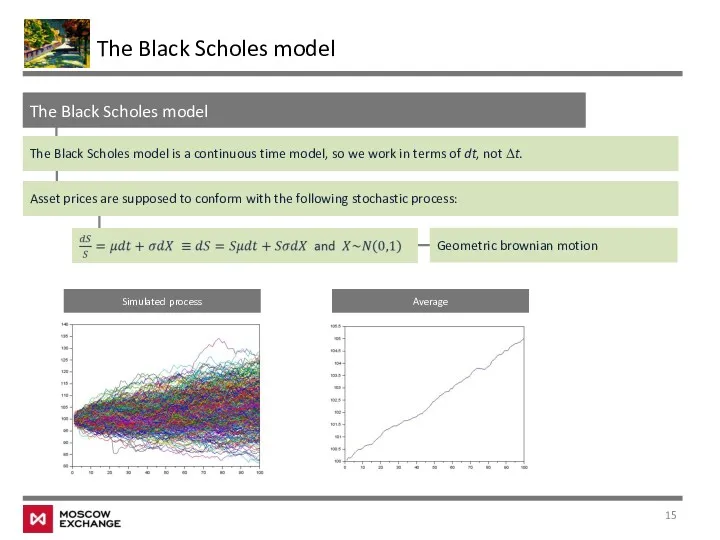

- 15. The Black Scholes model The Black Scholes model The Black Scholes model is a continuous time

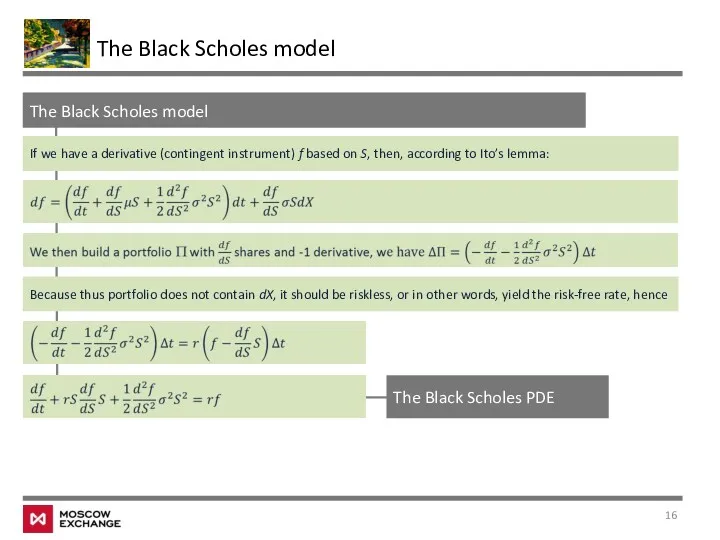

- 16. The Black Scholes model The Black Scholes model If we have a derivative (contingent instrument) f

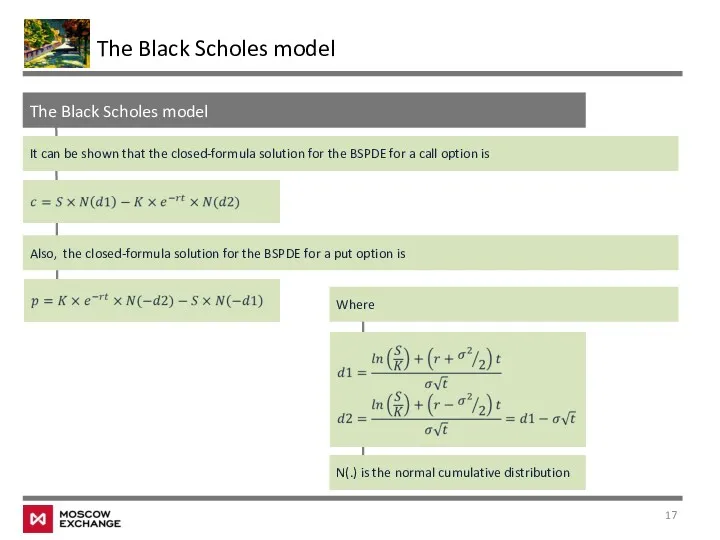

- 17. The Black Scholes model The Black Scholes model It can be shown that the closed-formula solution

- 18. The Black Scholes model The Black Scholes model Consider our previous example of pricing a call

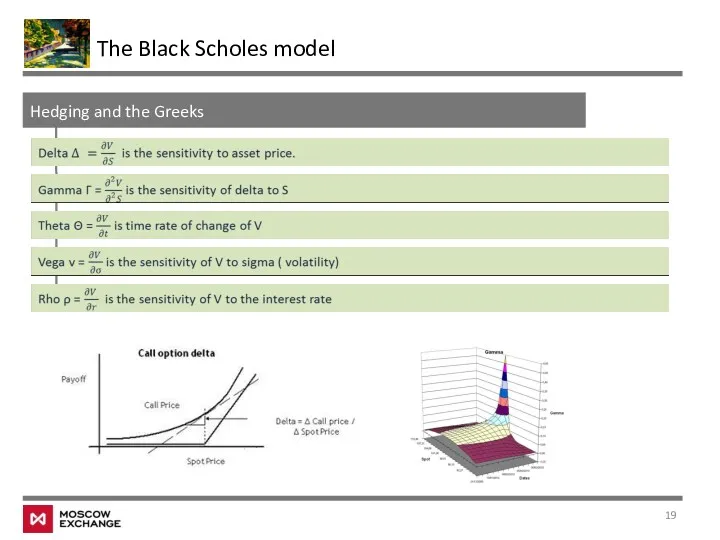

- 19. Hedging and the Greeks The Black Scholes model

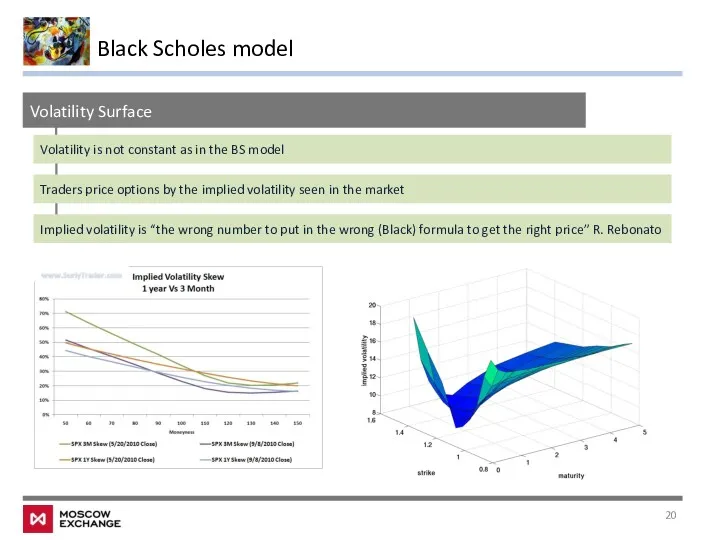

- 20. Black Scholes model Volatility Surface Implied volatility is “the wrong number to put in the wrong

- 21. Dynamic Delta hedging “In theory there is no difference between theory and practice. In practice there

- 22. Class #7 – Derivatives Pricing II 1 The binomial model 2 The Black –Scholes model 3

- 23. Monte Carlo is a simulation technique Monte Carlo pricing We simulate every possible path for the

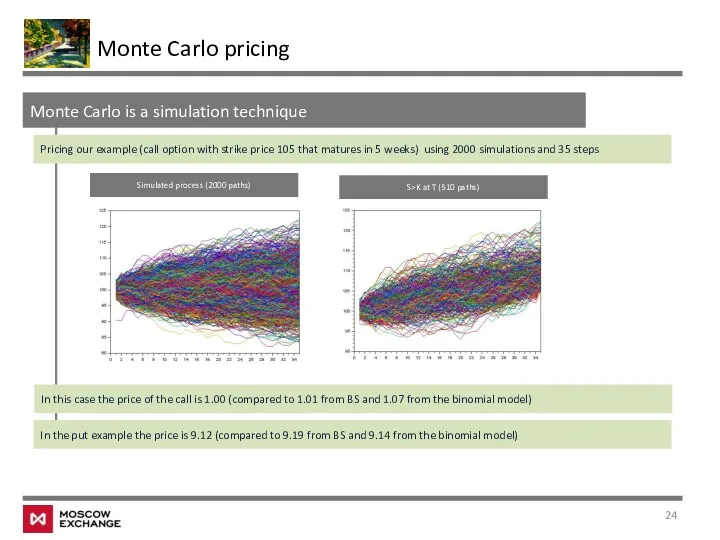

- 24. Monte Carlo is a simulation technique Monte Carlo pricing Pricing our example (call option with strike

- 25. Drawbacks with MC Slow convergence Computationally expensive if multi -period or non- recombinant Stability of the

- 26. Class #7 – Derivatives Pricing II 1 The binomial model 2 The Black –Scholes model 3

- 27. Annex Useful References Options, Futures and Other Derivatives, John Hull, (2014); The Mathematics of Financial Derivatives

- 29. Скачать презентацию

Управление сбытом продукции в организации (на материалах ООО Ахтамар)

Управление сбытом продукции в организации (на материалах ООО Ахтамар) Подбор персонала. Фриланс-рекрутинг

Подбор персонала. Фриланс-рекрутинг Организация работы ресторана итальянской кухни на 150 мест

Организация работы ресторана итальянской кухни на 150 мест Принятие управленческих решений

Принятие управленческих решений Конкурс на присвоение звания Лучший по профессии молодой работник Октябрьской дирекции управления движением 2016

Конкурс на присвоение звания Лучший по профессии молодой работник Октябрьской дирекции управления движением 2016 Теория управления

Теория управления Обучение новых сотрудников

Обучение новых сотрудников Карта инструментов работы управляющего

Карта инструментов работы управляющего Управление затратами на качество

Управление затратами на качество Теория контрактов. Тема 4

Теория контрактов. Тема 4 Выявление профессиональных компетенций инновационного менеджера

Выявление профессиональных компетенций инновационного менеджера Организация технического обслуживания производства

Организация технического обслуживания производства Этика и этикет делового общения

Этика и этикет делового общения Бережливое производство. Учимся видеть потери

Бережливое производство. Учимся видеть потери Научные школы менеджмента

Научные школы менеджмента Совершенствование кадровой политики государственного унитарного предприятия ГУП Водоканал Санкт-Петербурга

Совершенствование кадровой политики государственного унитарного предприятия ГУП Водоканал Санкт-Петербурга Туристский комплекс как объект управления

Туристский комплекс как объект управления Организация электронного документооборота в компании

Организация электронного документооборота в компании Методы управления рисками

Методы управления рисками Розробка стратегії антикризового менеджменту туристичного підприємства

Розробка стратегії антикризового менеджменту туристичного підприємства Понятие, содержание и значение делопроизводства

Понятие, содержание и значение делопроизводства Общественное мнение и управленческая деятельность (тема 15)

Общественное мнение и управленческая деятельность (тема 15) Жизненный цикл проекта и продукта

Жизненный цикл проекта и продукта Оценка персонала компании

Оценка персонала компании Ситуационные центры: фокус кросс-отраслевых интересов

Ситуационные центры: фокус кросс-отраслевых интересов Управление инновационными преобразованиями. Реинжиниринг и инновационные деловые процессы

Управление инновационными преобразованиями. Реинжиниринг и инновационные деловые процессы Обеспечение транспортно-логистических терминалов. Эксплуатация и автоматизация работы портов. Опасные грузы. (Тема 3)

Обеспечение транспортно-логистических терминалов. Эксплуатация и автоматизация работы портов. Опасные грузы. (Тема 3) Разработка управленческих решений

Разработка управленческих решений