Содержание

- 2. 1 Definition of risk factors 2 Linear decomposition of financial instruments into risk factors 4 Sensitivity

- 3. Class #8 – Linear Risks 1 Definition of risk factors and risk exposures 2 Linear decomposition

- 4. Risk factors Prices of financial instruments can be defined by a number of market or risk

- 5. Risk factors Non-arbitrage pricing Definition of risk factors and risk exposures CAPM

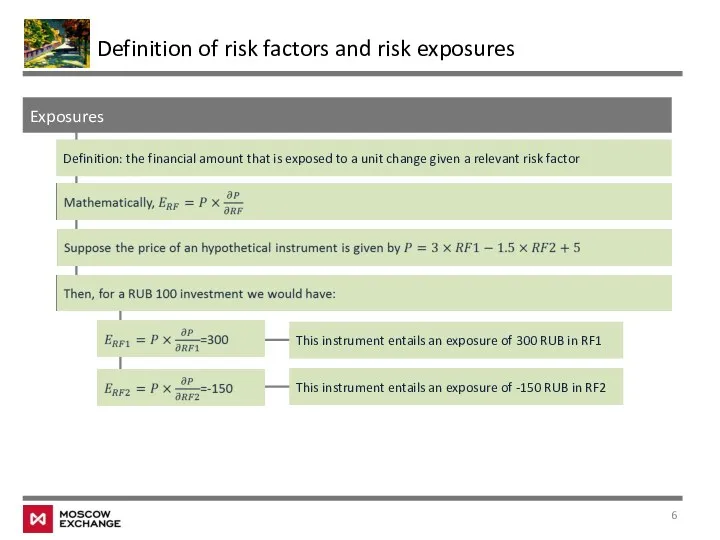

- 6. Exposures Definition: the financial amount that is exposed to a unit change given a relevant risk

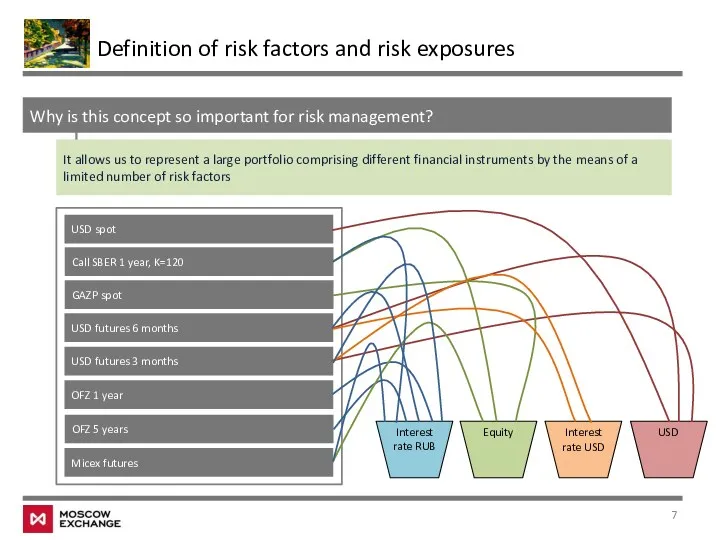

- 7. Why is this concept so important for risk management? It allows us to represent a large

- 8. Class #8 – Linear Risks 1 Definition of risk factors and risk exposures 2 Linear decomposition

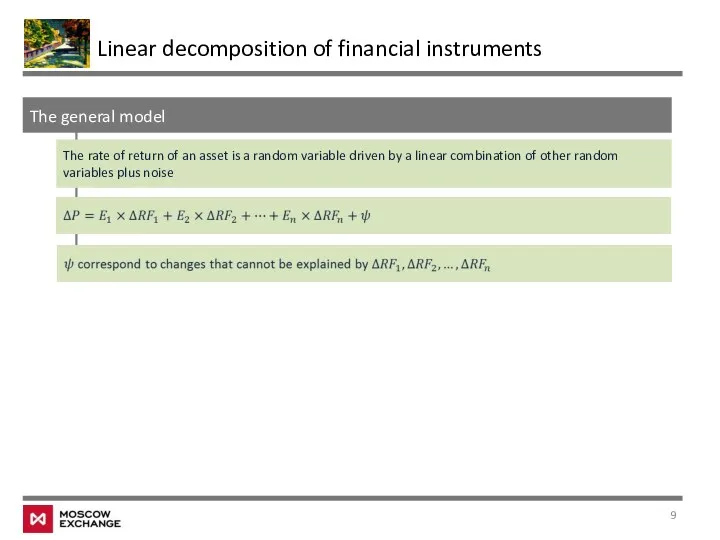

- 9. The general model The rate of return of an asset is a random variable driven by

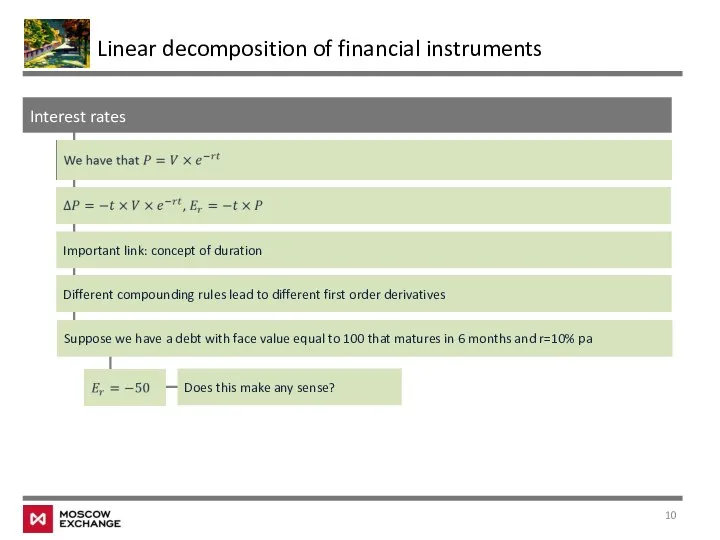

- 10. Interest rates Linear decomposition of financial instruments Suppose we have a debt with face value equal

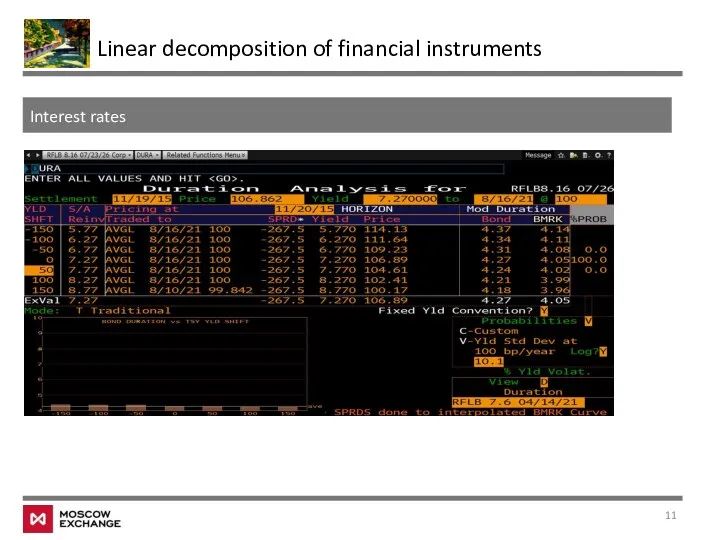

- 11. Interest rates Linear decomposition of financial instruments

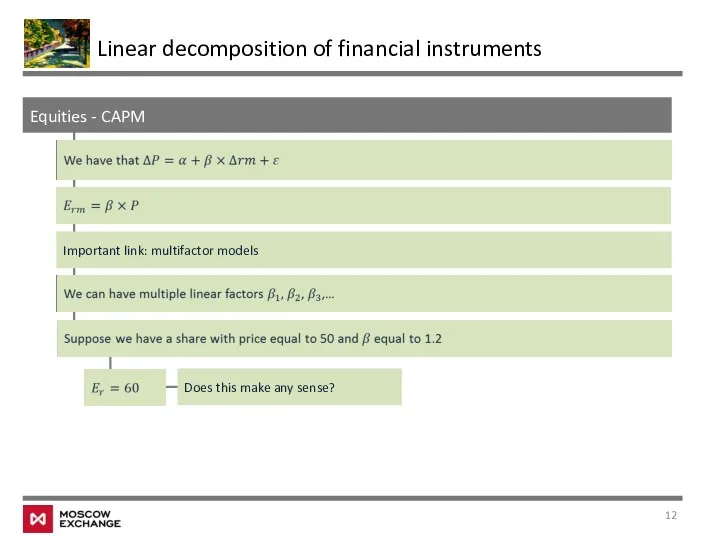

- 12. Equities - CAPM Linear decomposition of financial instruments Important link: multifactor models Does this make any

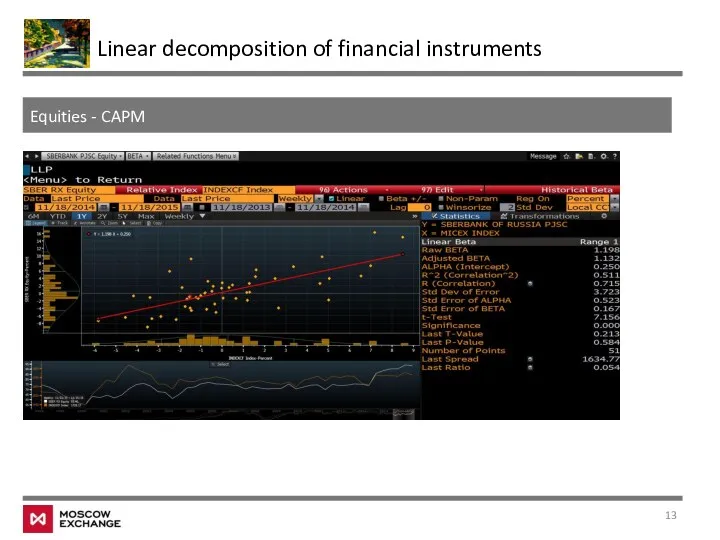

- 13. Equities - CAPM Linear decomposition of financial instruments

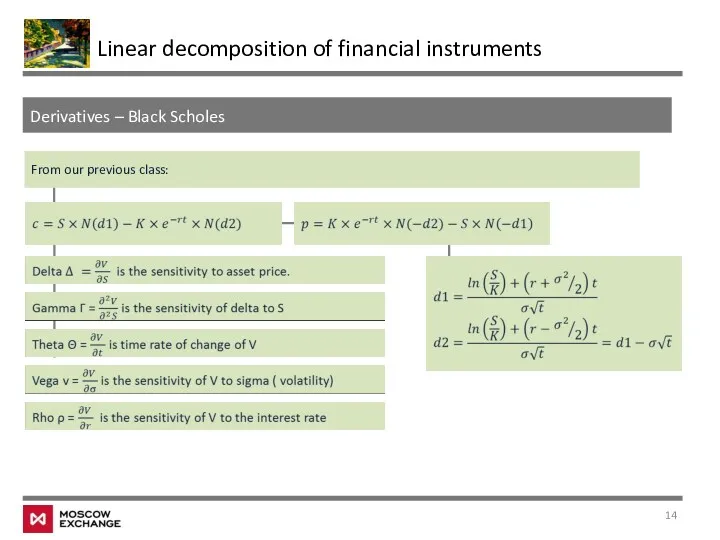

- 14. Derivatives – Black Scholes Linear decomposition of financial instruments From our previous class:

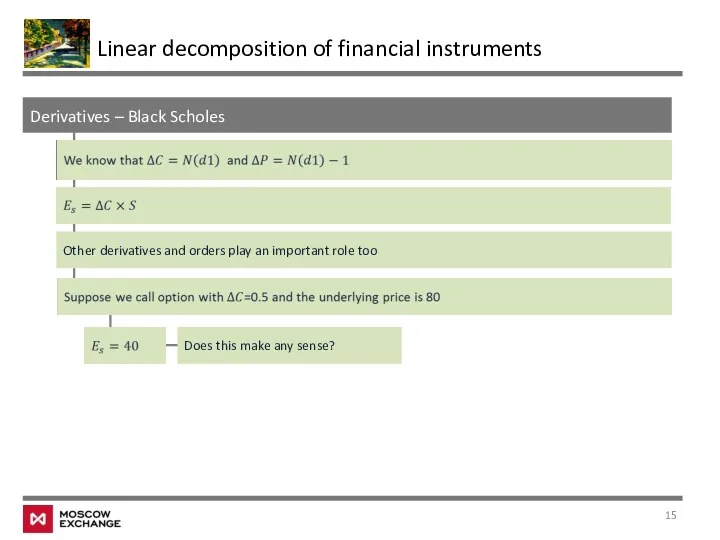

- 15. Derivatives – Black Scholes Linear decomposition of financial instruments Other derivatives and orders play an important

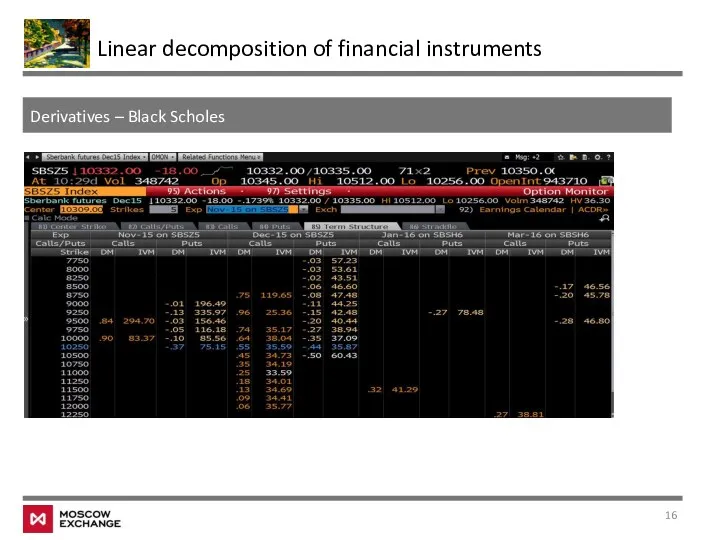

- 16. Derivatives – Black Scholes Linear decomposition of financial instruments

- 17. Class #8 – Linear Risks 1 Definition of risk factors and risk exposures 2 Linear decomposition

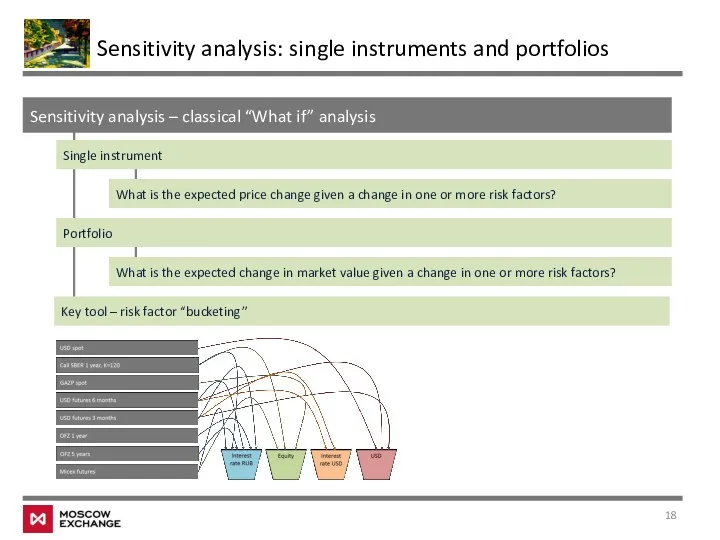

- 18. Sensitivity analysis – classical “What if” analysis Sensitivity analysis: single instruments and portfolios Single instrument What

- 19. Sensitivity analysis – classical “What if” analysis Sensitivity analysis: single instruments and portfolios Suppose that you

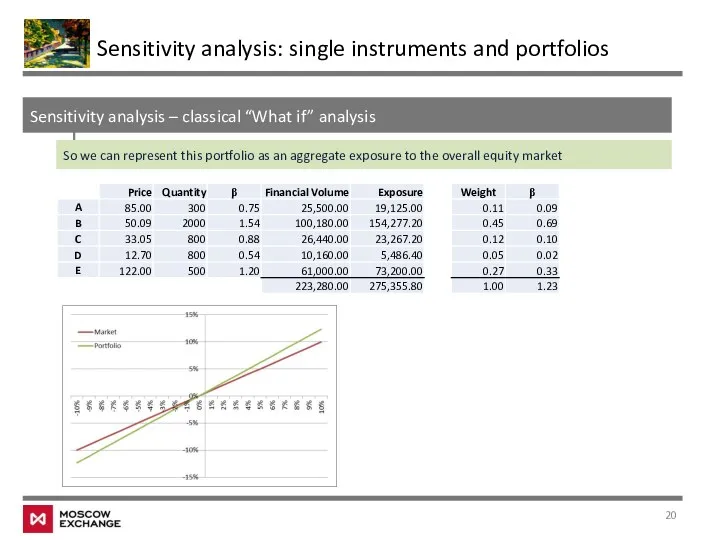

- 20. Sensitivity analysis – classical “What if” analysis Sensitivity analysis: single instruments and portfolios So we can

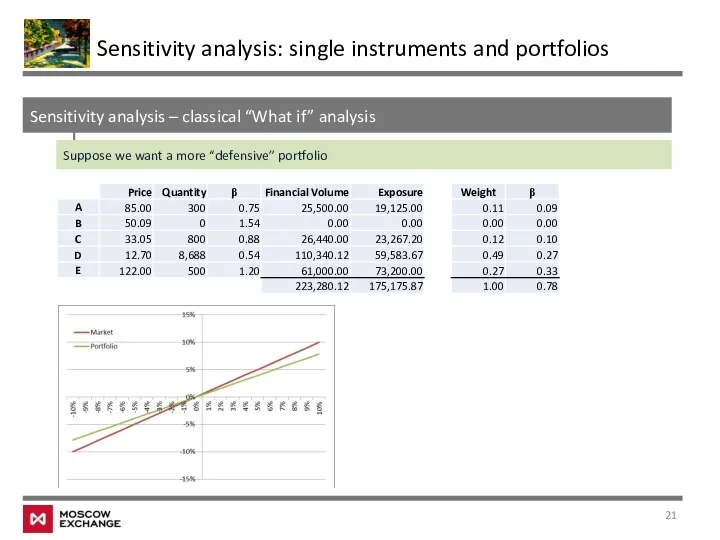

- 21. Sensitivity analysis – classical “What if” analysis Sensitivity analysis: single instruments and portfolios Suppose we want

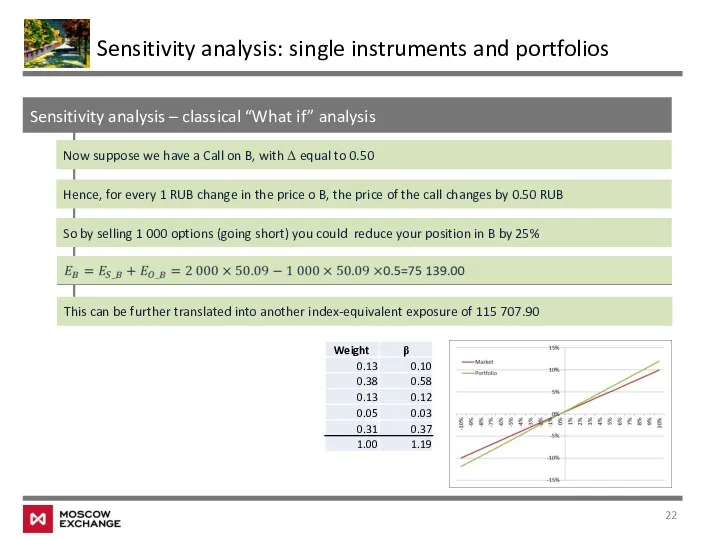

- 22. Sensitivity analysis – classical “What if” analysis Sensitivity analysis: single instruments and portfolios Now suppose we

- 24. Скачать презентацию

Проблемы формулирования при изложении научных исследований

Проблемы формулирования при изложении научных исследований Презентация Требования ФГОС к написанию программы отдельного учебного предмета на примере УМК Перспективная начальная школа

Презентация Требования ФГОС к написанию программы отдельного учебного предмета на примере УМК Перспективная начальная школа Вводный урок по обществознанию 9 класс

Вводный урок по обществознанию 9 класс Жоо-дағы студенттердің оқу үрдісіне әсер ететін факторлар

Жоо-дағы студенттердің оқу үрдісіне әсер ететін факторлар Мастер-класс Преемственность предпрофильной подготовки между начальным и средним звеном

Мастер-класс Преемственность предпрофильной подготовки между начальным и средним звеном Педагогический баттл-16

Педагогический баттл-16 Исследование опыта подготовки кадров парикмахеров в системе СПО

Исследование опыта подготовки кадров парикмахеров в системе СПО Как подготовить курсовую работу

Как подготовить курсовую работу Колледж экономики, управления и права ДГТУ. История. Цели и задачи курса

Колледж экономики, управления и права ДГТУ. История. Цели и задачи курса Новые поступления литературы в НБ УГГУ. Учебные пособия

Новые поступления литературы в НБ УГГУ. Учебные пособия Отчет по производственной практике

Отчет по производственной практике Конспект непосредственно образовательной деятельности с использованием электронных образовательных ресурсов (презентация) с детьми старшего дошкольного возраста.Русский народный костюм – хранитель истории

Конспект непосредственно образовательной деятельности с использованием электронных образовательных ресурсов (презентация) с детьми старшего дошкольного возраста.Русский народный костюм – хранитель истории Основная образовательная программа дошкольного образования Детского сада Мэри Поппинс

Основная образовательная программа дошкольного образования Детского сада Мэри Поппинс Планирование работы БОУ города Омска Казачья кадетская школа-интернат среднего общего образования на 2023/2024 гг

Планирование работы БОУ города Омска Казачья кадетская школа-интернат среднего общего образования на 2023/2024 гг Методология научных исследований

Методология научных исследований Роль организаторов при проведении устной части ОГЭ по иностранным языкам, русскому языку, физике, информатике и ИКТ, географии

Роль организаторов при проведении устной части ОГЭ по иностранным языкам, русскому языку, физике, информатике и ИКТ, географии Київський професійний будівельний ліцей. Професія - опоряджувальник будівельний

Київський професійний будівельний ліцей. Професія - опоряджувальник будівельний ФГОС: первый опыт, проблемы и перспективы

ФГОС: первый опыт, проблемы и перспективы VII региональный конкурс ученических инициатив Молодежь Севастополя – взгляд в будущее!

VII региональный конкурс ученических инициатив Молодежь Севастополя – взгляд в будущее! Мобильное электронное образование для детей с ОВЗ. Инклюзивное образование

Мобильное электронное образование для детей с ОВЗ. Инклюзивное образование Современный урок

Современный урок Технологические направления (образовательные программы)

Технологические направления (образовательные программы) Наша школа- наши учителя. Республика Коми, район Сосногорск, поселок городского типа Войвож

Наша школа- наши учителя. Республика Коми, район Сосногорск, поселок городского типа Войвож Інавацыйнае развіццё. Планшэт у адукацыі

Інавацыйнае развіццё. Планшэт у адукацыі Анализ предметной области. Понятие бизнес-процессов

Анализ предметной области. Понятие бизнес-процессов Всероссийский образовательный СТЕМ-проект Закрутим спираль

Всероссийский образовательный СТЕМ-проект Закрутим спираль Шаблон презентации проекта

Шаблон презентации проекта Красноярский государственный педагогический университет. Бизнес-психология. Институт психолого-педагогического образования

Красноярский государственный педагогический университет. Бизнес-психология. Институт психолого-педагогического образования