Содержание

- 2. 1. Agenda Category situation Competitors position SWOT analysis Strategic objectives Conclusions Cogeneration project – Klin Cogeneration

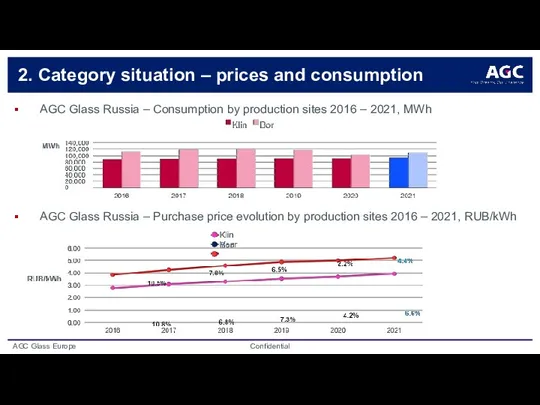

- 3. 2. Category situation – prices and consumption AGC Glass Russia – Consumption by production sites 2016

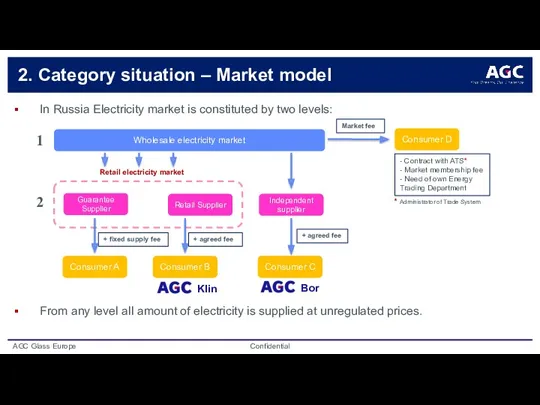

- 4. 2. Category situation – Market model In Russia Electricity market is constituted by two levels: From

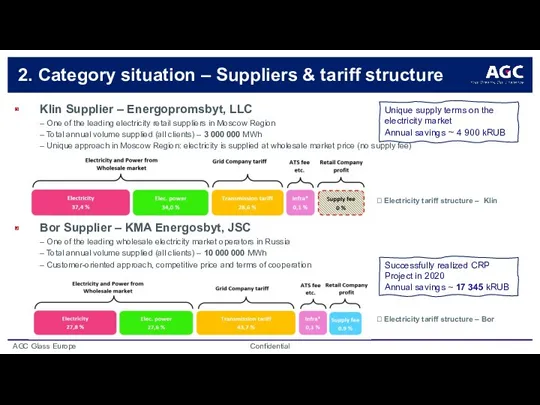

- 5. 2. Category situation – Suppliers & tariff structure Klin Supplier – Energopromsbyt, LLC – One of

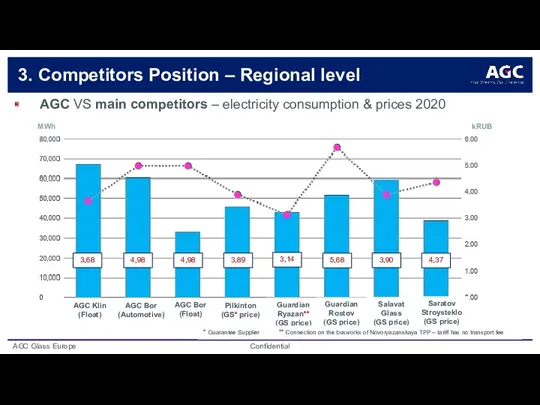

- 6. AGC VS main competitors – electricity consumption & prices 2020 3. Competitors Position – Regional level

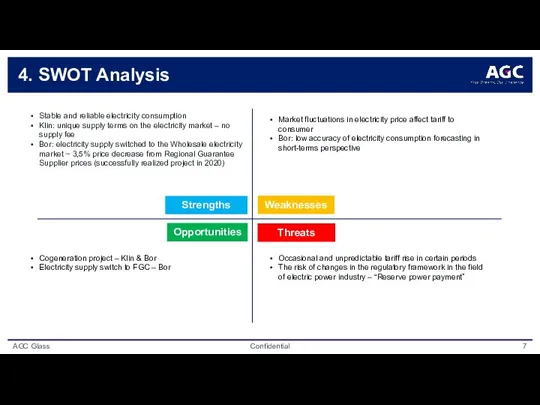

- 7. 4. SWOT Analysis Opportunities Stable and reliable electricity consumption Klin: unique supply terms on the electricity

- 8. 5. Strategic Objectives Targets Global targets ?To be more efficient than our competitors Local targets ?

- 9. 7. Conclusions Set of market-based CRP measures are almost realized Some peripheral instruments will not give

- 10. 8. Cogeneration project – Klin Construction of compact power plant in order to supply needs of

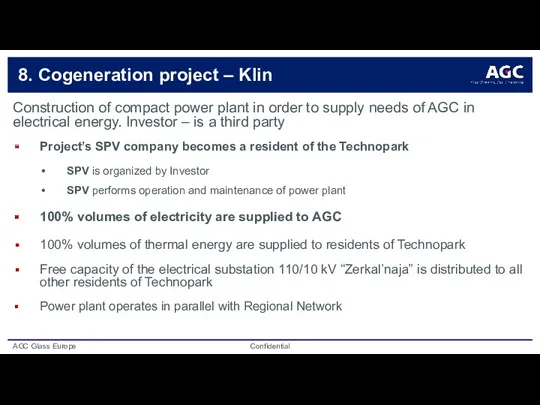

- 11. 8. Cogeneration project – Klin Basic Commercial Offer Discount from current electricity tariff: During payback period

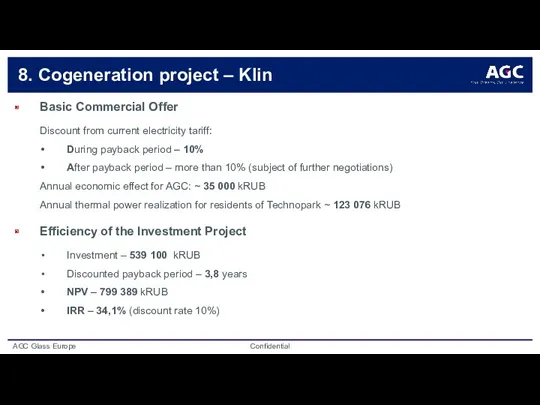

- 12. 8. Cogeneration project – Klin Needs of AGC Optimum electrical power capacity – 10 MW Forecasted

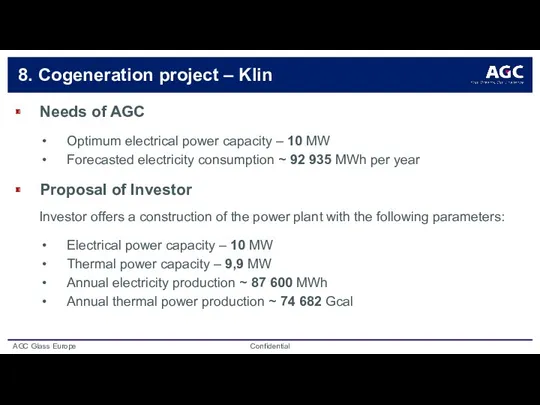

- 13. 11. Cogeneration Road Map Project main steps: Green light for the Project Organization of tender procedures

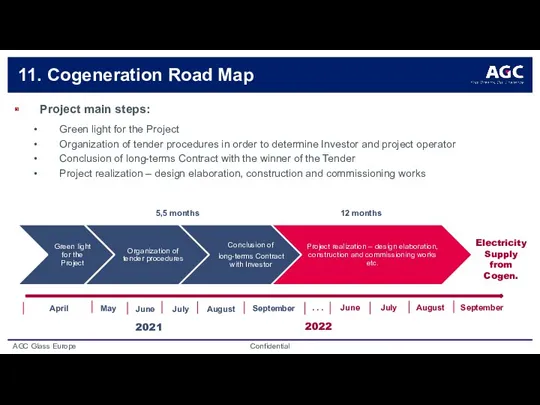

- 14. 9. Cogeneration project – Bor Construction of compact power plant in order to supply needs of

- 15. 9. Cogeneration project – Bor Basic Commercial Offer for AGC Discount from current electricity tariff: 10%

- 16. 9. Cogeneration project – Bor Needs of AGC Optimum electrical power capacity ~ 12,5 MW Thermal

- 17. 10. Cogeneration project – SWOT Analysis Opportunities Attaining a substantial economic effect – up to 15%

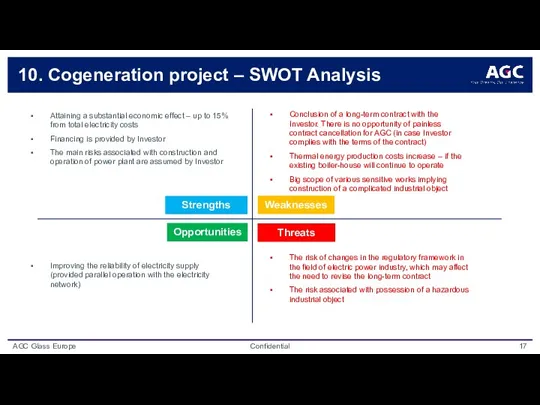

- 18. 9. Connection to Federal Grid Company (FGC) Project implies to switch electricity supply of AGC BGW

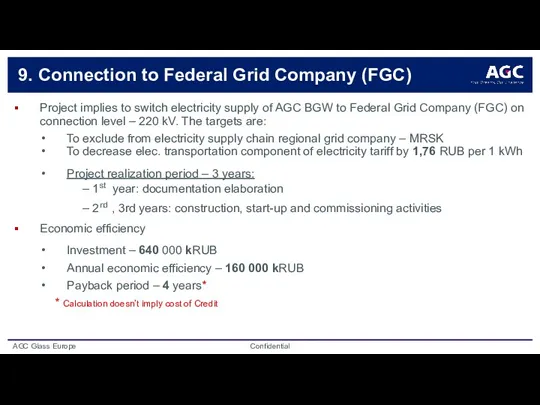

- 20. Скачать презентацию

Соединение деталей шурупами

Соединение деталей шурупами Режимы сварки и настройки аппарата

Режимы сварки и настройки аппарата Использование мяча на этапе автоматизации звуков.

Использование мяча на этапе автоматизации звуков. Конспект открытого индивидуального занятия по развитию речевого слуха и формированию произносительной стороны речи у детей с нарушением слуха в 9 классе

Конспект открытого индивидуального занятия по развитию речевого слуха и формированию произносительной стороны речи у детей с нарушением слуха в 9 классе Презинтация

Презинтация Народы Байкала

Народы Байкала Женевские переговоры по Сирии, 2016 год

Женевские переговоры по Сирии, 2016 год Основание греческих колоний

Основание греческих колоний Мигрень. Хроническая мигрень и мигренозный статус

Мигрень. Хроническая мигрень и мигренозный статус Константи́н Дми́триевич Уши́нский (19 февраля 1839 — 22 декабря 1870). Сказка-быль Как выросла в поле рубашка

Константи́н Дми́триевич Уши́нский (19 февраля 1839 — 22 декабря 1870). Сказка-быль Как выросла в поле рубашка Путешествие в Норвегию. Эдвард Григ

Путешествие в Норвегию. Эдвард Григ Образование централизованных монархий в Западной Европе. (10 класс)

Образование централизованных монархий в Западной Европе. (10 класс) Общая характеристика власти. Государственная власть. (тема 3)

Общая характеристика власти. Государственная власть. (тема 3) Презентация Проект Экологическое содружество

Презентация Проект Экологическое содружество Агропромышленный комплекс России

Агропромышленный комплекс России ҚР тұрақты даму концепциясы

ҚР тұрақты даму концепциясы Классные часы

Классные часы Пасха

Пасха Современные конструкции ИС и способы повышения их основных характеристик

Современные конструкции ИС и способы повышения их основных характеристик Инновационная конкурентоспособная технология в горном машиностроении Кузбасса

Инновационная конкурентоспособная технология в горном машиностроении Кузбасса Школьная форма будущего

Школьная форма будущего Картина – особый мир. Игра Третий лишний

Картина – особый мир. Игра Третий лишний 7 программ, которые должны быть на каждом компьютере

7 программ, которые должны быть на каждом компьютере Природные каменные материалы

Природные каменные материалы Портфолио учащегося

Портфолио учащегося Автоматизация звука Р

Автоматизация звука Р Спортивная гимнастика

Спортивная гимнастика Озон. Строение молекулы озона

Озон. Строение молекулы озона