Содержание

- 2. Categories of competition law Dominant position, abuse of dominant position Prohibition of cartels (collusion, conspiracy) Prohibition

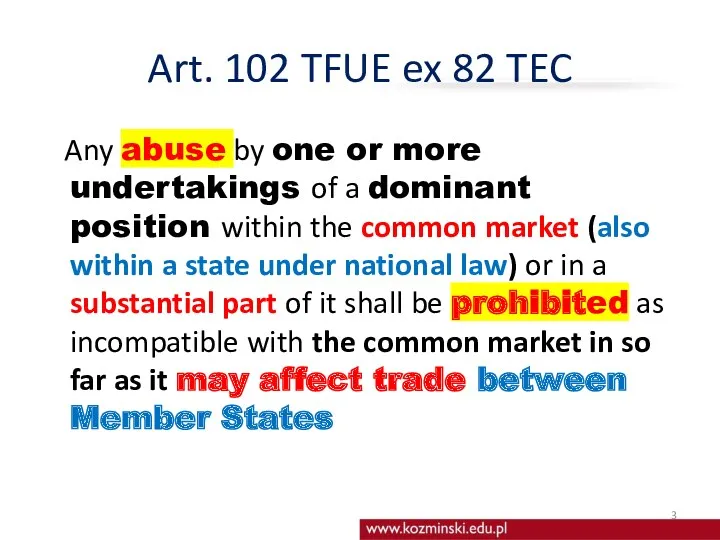

- 3. Art. 102 TFUE ex 82 TEC Any abuse by one or more undertakings of a dominant

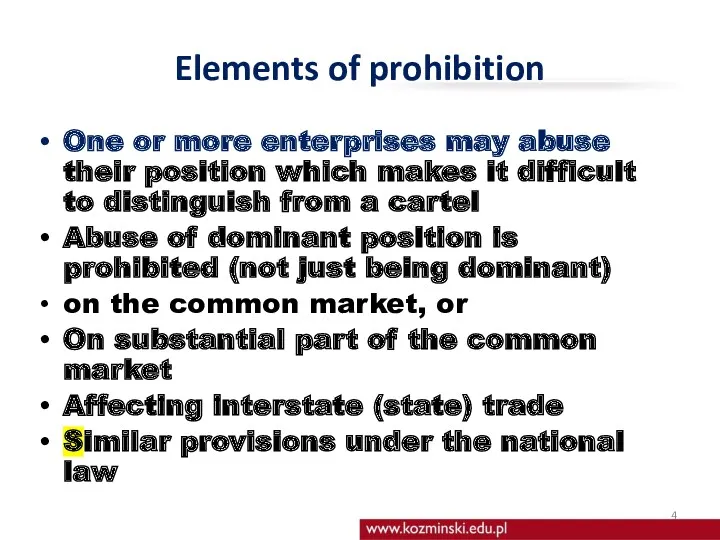

- 4. Elements of prohibition One or more enterprises may abuse their position which makes it difficult to

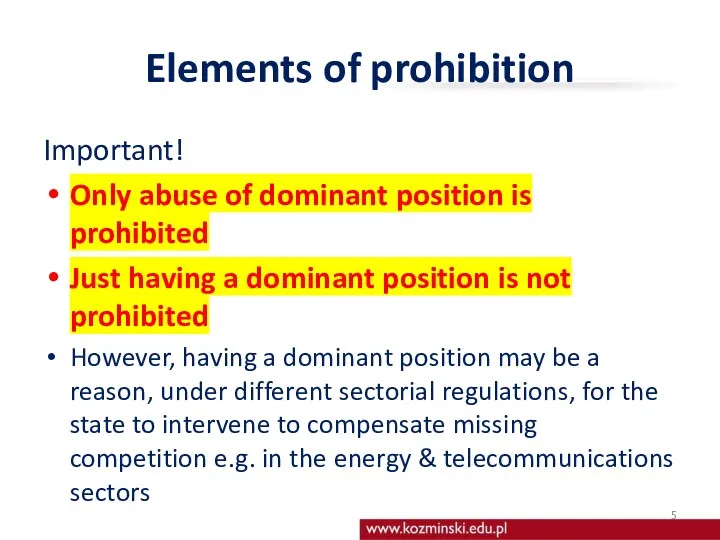

- 5. Elements of prohibition Important! Only abuse of dominant position is prohibited Just having a dominant position

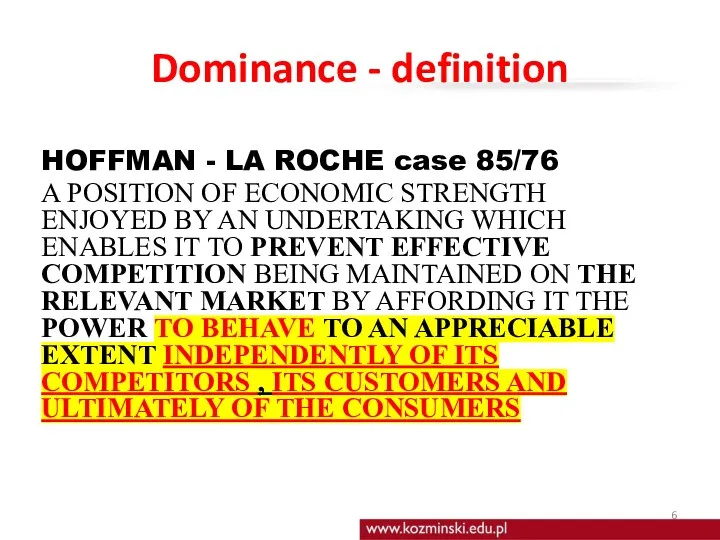

- 6. Dominance - definition HOFFMAN - LA ROCHE case 85/76 A POSITION OF ECONOMIC STRENGTH ENJOYED BY

- 7. Dominance - definition SUCH A POSITION DOES NOT PRECLUDE SOME COMPETITION , WHICH IT DOES WHERE

- 8. Collective dominant position The case Italian Flat Glass was the first case in which the Court

- 9. Market analysis Antimonopoly authorities have to determine: - structure of the market: legal and factual monopolies,

- 10. Relevant market European Commission or national antimonopoly authorities must determine the relevant market for the case

- 11. Relevant market A geographical relevant market is a market where conditions of competition are homogenous (the

- 12. Abuse - definition Abuse is not defined in TFUE but by the ECJ – The European

- 13. Abuse - examples TFUE gives the following examples of an abuse: directly or indirectly imposing unfair

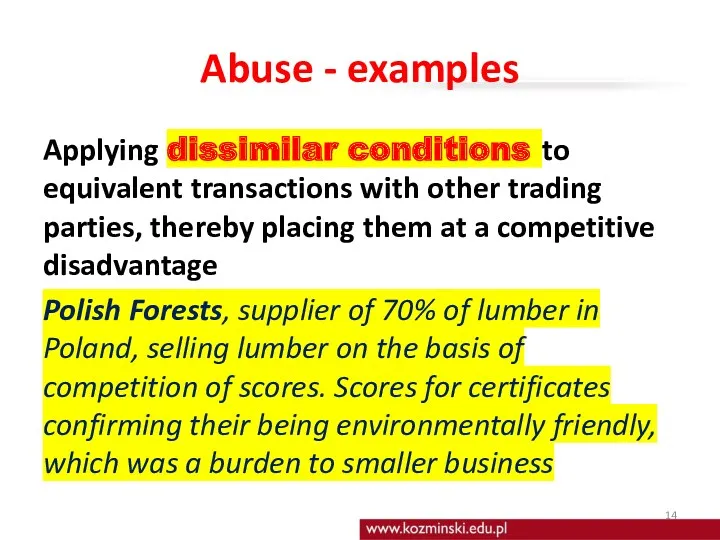

- 14. Abuse - examples Applying dissimilar conditions to equivalent transactions with other trading parties, thereby placing them

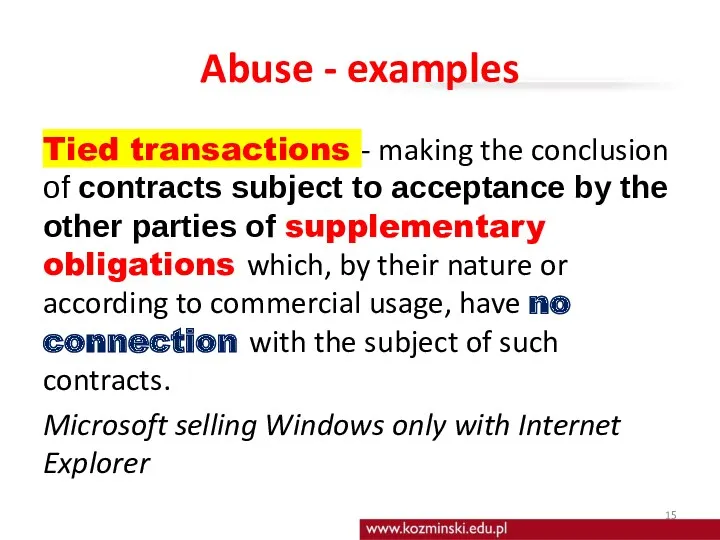

- 15. Abuse - examples Tied transactions - making the conclusion of contracts subject to acceptance by the

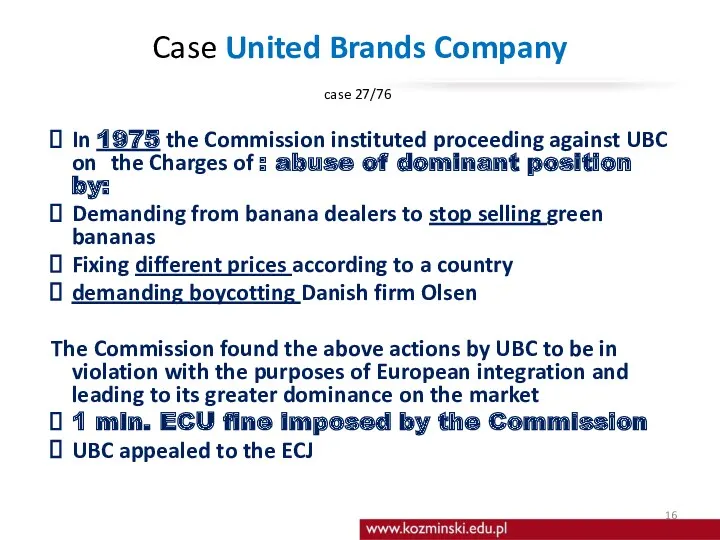

- 16. Case United Brands Company case 27/76 In 1975 the Commission instituted proceeding against UBC on the

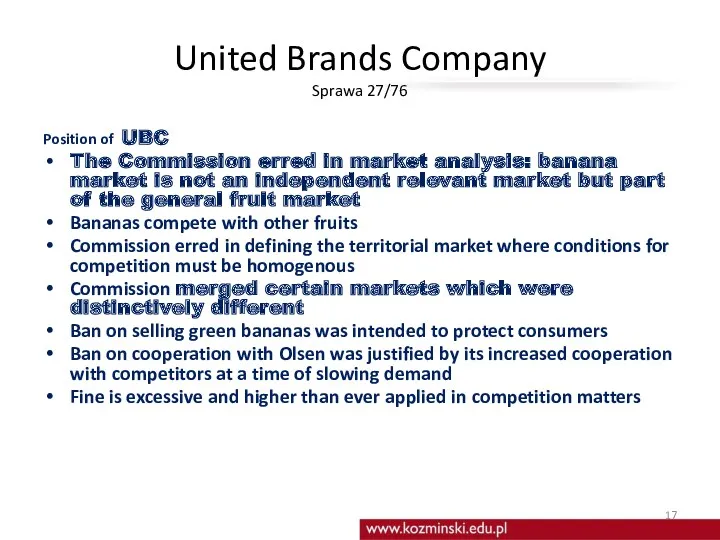

- 17. United Brands Company Sprawa 27/76 Position of UBC The Commission erred in market analysis: banana market

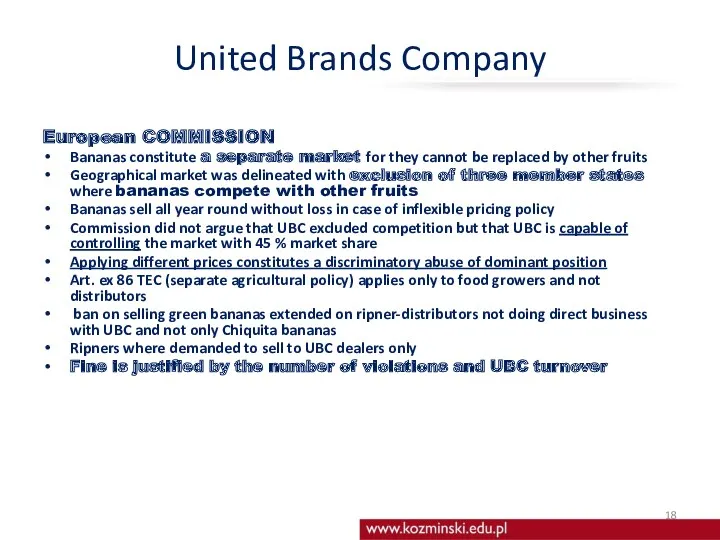

- 18. United Brands Company European COMMISSION Bananas constitute a separate market for they cannot be replaced by

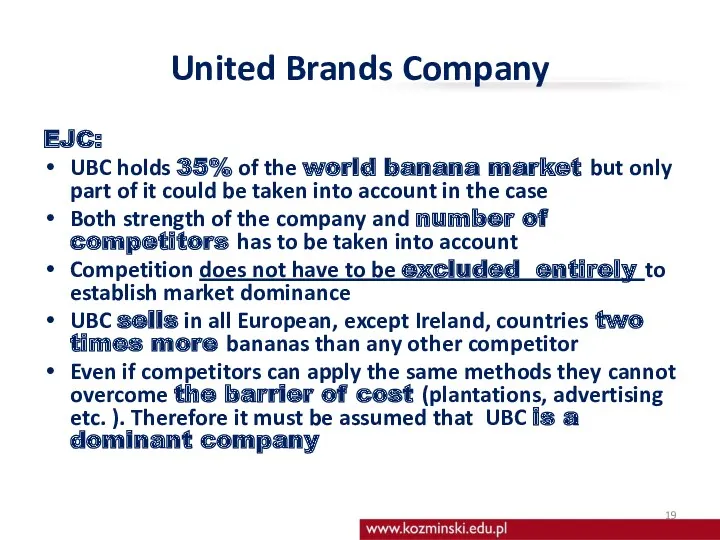

- 19. United Brands Company EJC: UBC holds 35% of the world banana market but only part of

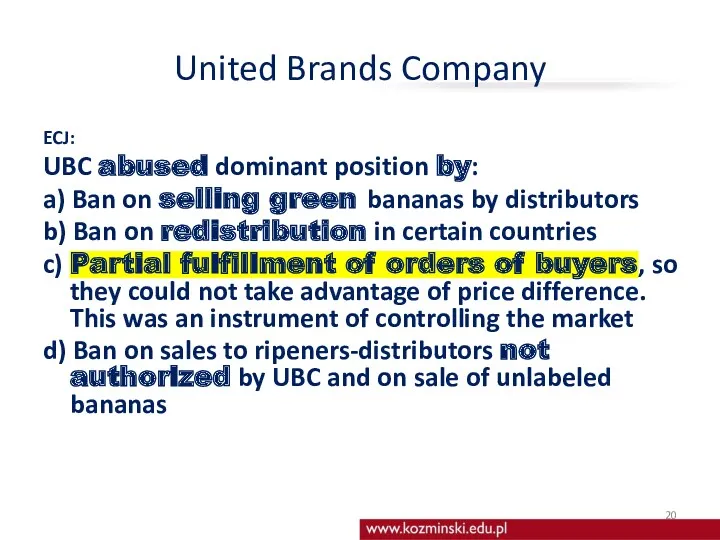

- 20. United Brands Company ECJ: UBC abused dominant position by: a) Ban on selling green bananas by

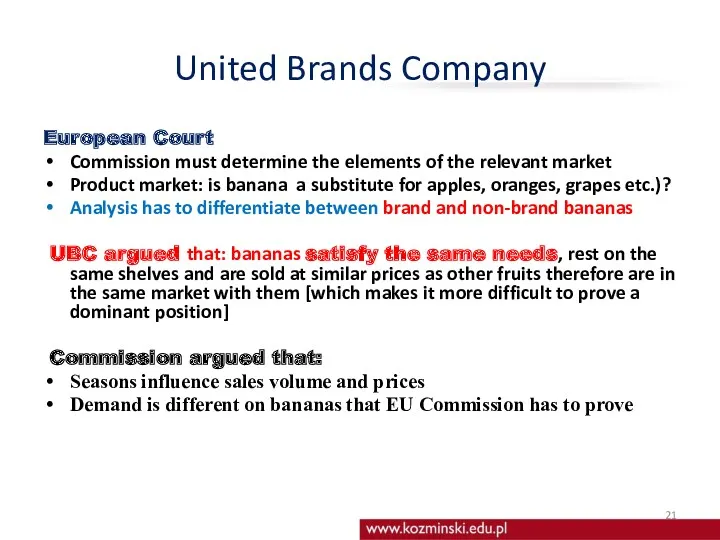

- 21. United Brands Company European Court Commission must determine the elements of the relevant market Product market:

- 22. United Brands Company Most consumers continue to buy bananas regardless of seasonal fruits coming and going

- 23. Loyalty rebates – British Airways Case British Airways v. the Commission, T-219/99 British Airways devised a

- 24. Loyalty rebates British Airways Court: An undertaking may hold a dominant position not only in its

- 25. Loyalty rebates – British Airways ECJ: An abuse of a dominant position committed on the dominated

- 26. Hellenic Composers Greek case of 6 composers Hellenic Composers’ Union against the copyright society AEPI for

- 27. Napp Pharmaceuticals Napp Pharmaceuticals, Cambridge produced a slow release morphine tablet taken by terminally ill patients

- 28. Essential facility doctrine Abuse of dominant position by refusal of granting access for other ennterprises to

- 29. Essential Facility IMS HEALTH - Commission decision C(2003) 2920) an American company engaged in collection, processing

- 30. Essential facility Magill case C-241/91 Two TV stations in Ireland distributed individual their own TV guides.

- 31. ESSENTIAL FACILITY – ROSCOFF 1 Commission Decision CMLR 4/35.388 1995 The Chamber of Commerce at Morlaix,

- 32. ESSENTIAL FACILITY – ROSCOFF 2 Therefore the Commission applied the essential facility doctrine: The infrastructure in

- 34. Скачать презентацию

LOTTE. Отель 5*

LOTTE. Отель 5* Мастер-класс Секреты создания личного бренда руководителя

Мастер-класс Секреты создания личного бренда руководителя Бизнес-барометр коррупции

Бизнес-барометр коррупции Кав’ярня ArtCoffee

Кав’ярня ArtCoffee Starbucks SEC 10K Company Timeline

Starbucks SEC 10K Company Timeline Бизнес - план. Пошив одежды для животных

Бизнес - план. Пошив одежды для животных Международный бизнес

Международный бизнес Problems of small business in Kazakhstan

Problems of small business in Kazakhstan Greenhouse business in Kazakhstan

Greenhouse business in Kazakhstan Проект магазина изделий ручной работы Find

Проект магазина изделий ручной работы Find Открытие первой гостиницы

Открытие первой гостиницы Бизнес-план Прокат автомобилей

Бизнес-план Прокат автомобилей Услуги розничной торговли. Основы коммерческой деятельности

Услуги розничной торговли. Основы коммерческой деятельности Франшиза центров выдачи интернет-заказов

Франшиза центров выдачи интернет-заказов Открытие золотодобывающего предприятия

Открытие золотодобывающего предприятия Родом из Сибири

Родом из Сибири Совершенствование деятельности туристского предприятия

Совершенствование деятельности туристского предприятия Бізнес-ідея. Створення реабілітаційно-оздоровчого комплексу для відпочинку, оздоровлення та реабілітації учасників бойових дій

Бізнес-ідея. Створення реабілітаційно-оздоровчого комплексу для відпочинку, оздоровлення та реабілітації учасників бойових дій The Coca-Cola company

The Coca-Cola company Гүл дүкенін ашу

Гүл дүкенін ашу Эргономическая программа Центр развития ребенка

Эргономическая программа Центр развития ребенка техники эффективных продаж

техники эффективных продаж Southwest airlines

Southwest airlines Бизнес-проект Енот-полоскун. Прачечная самообслуживания

Бизнес-проект Енот-полоскун. Прачечная самообслуживания Детский развлекательный центр Аспект. Проект

Детский развлекательный центр Аспект. Проект Франшиза Shoe Concept - завоюйте обувной рынок

Франшиза Shoe Concept - завоюйте обувной рынок Рынок окон ПВХ сегодня. Завтра. Стратегия

Рынок окон ПВХ сегодня. Завтра. Стратегия Оценка бизнеса, просто о сложном

Оценка бизнеса, просто о сложном