Содержание

- 2. REFS A thorough introduction ‘ARCH Models’ Bollerslev T, Engle R F and Nelson D B Handbook

- 3. Until the early 80s econometrics had focused almost solely on modelling the means of series, ie

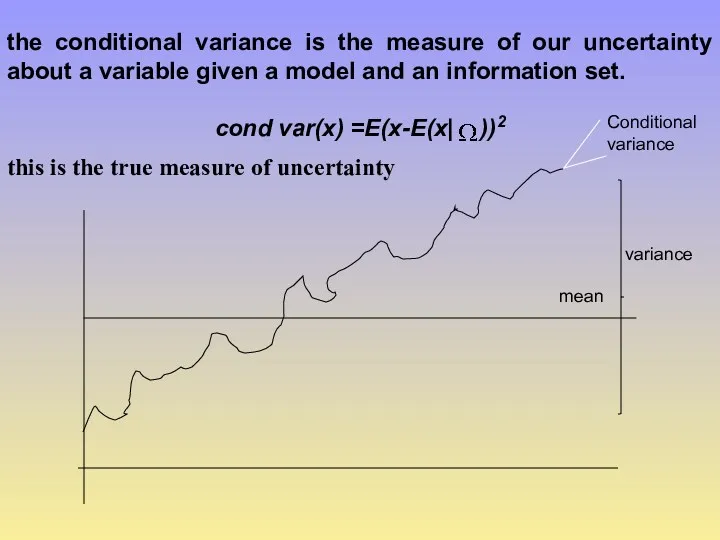

- 4. the conditional variance is the measure of our uncertainty about a variable given a model and

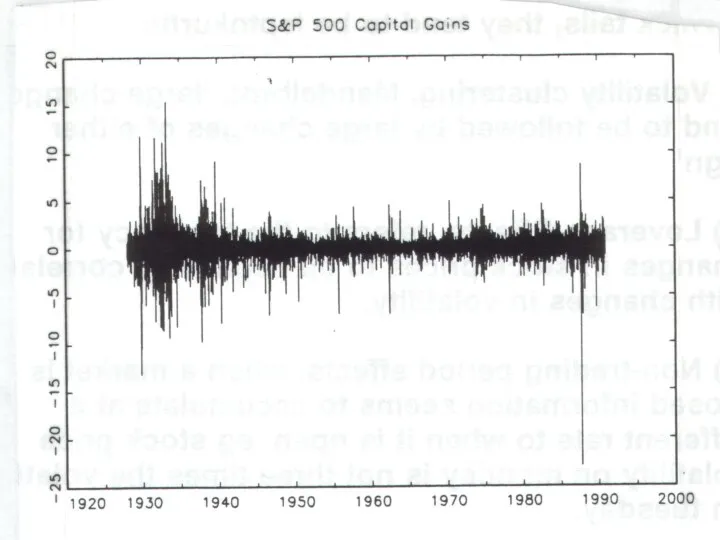

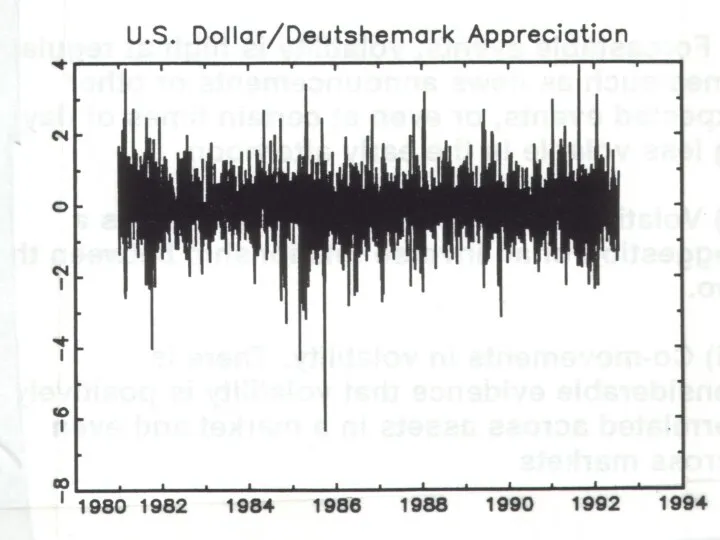

- 5. Stylised Facts of asset returns i) Thick tails, they tend to be leptokurtic ii)Volatility clustering, Mandelbrot,

- 6. vi)Volatility and serial correlation. There is a suggestion of an inverse relationship between the two. vii)

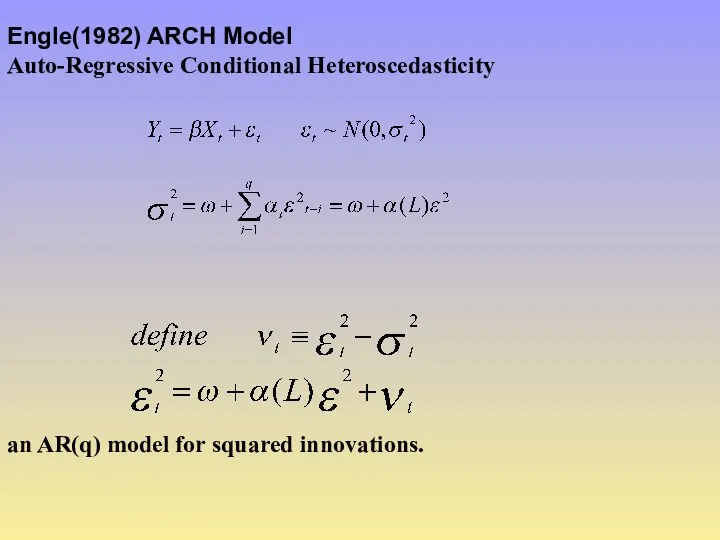

- 9. Engle(1982) ARCH Model Auto-Regressive Conditional Heteroscedasticity an AR(q) model for squared innovations.

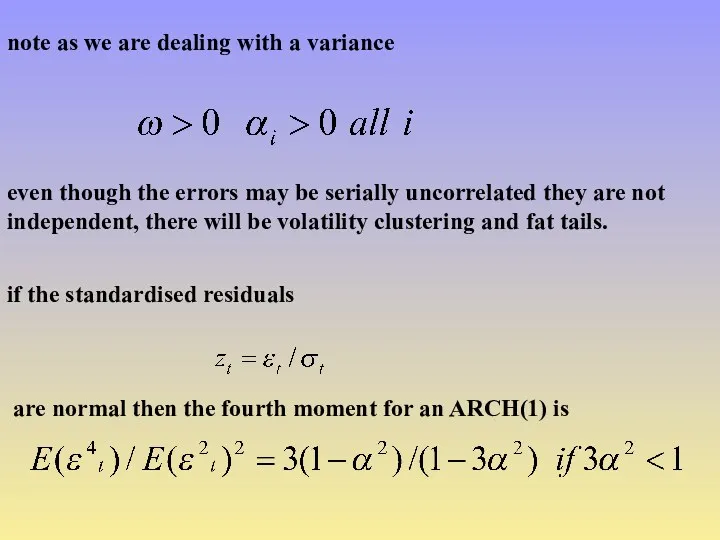

- 10. note as we are dealing with a variance even though the errors may be serially uncorrelated

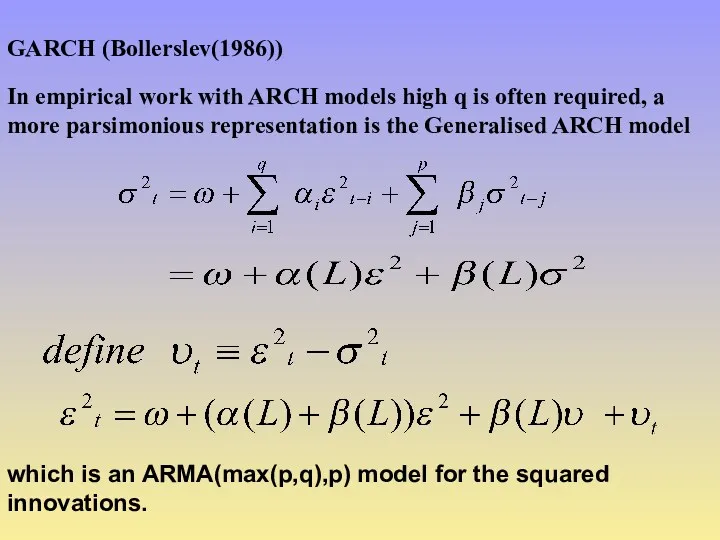

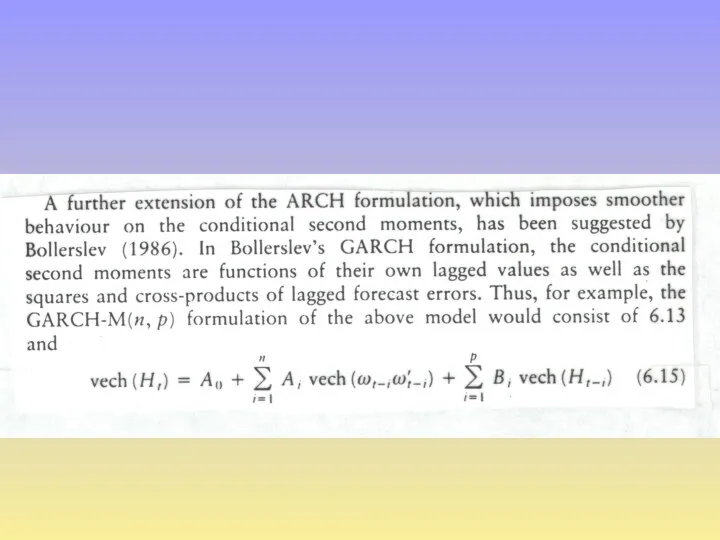

- 11. GARCH (Bollerslev(1986)) In empirical work with ARCH models high q is often required, a more parsimonious

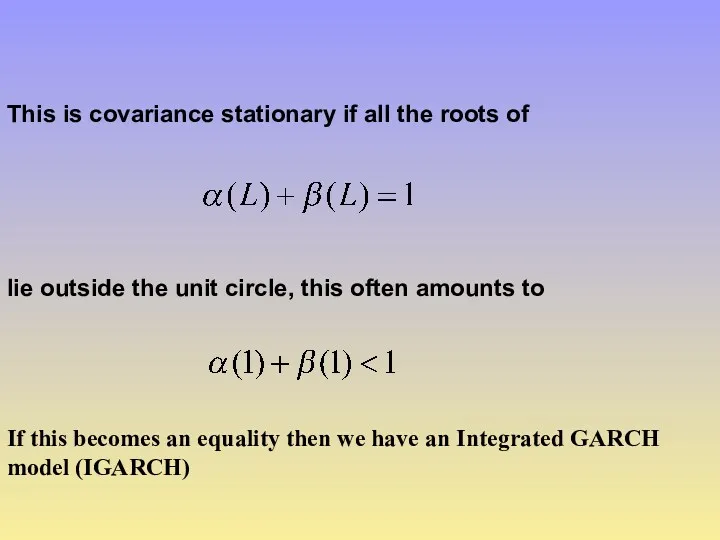

- 12. This is covariance stationary if all the roots of lie outside the unit circle, this often

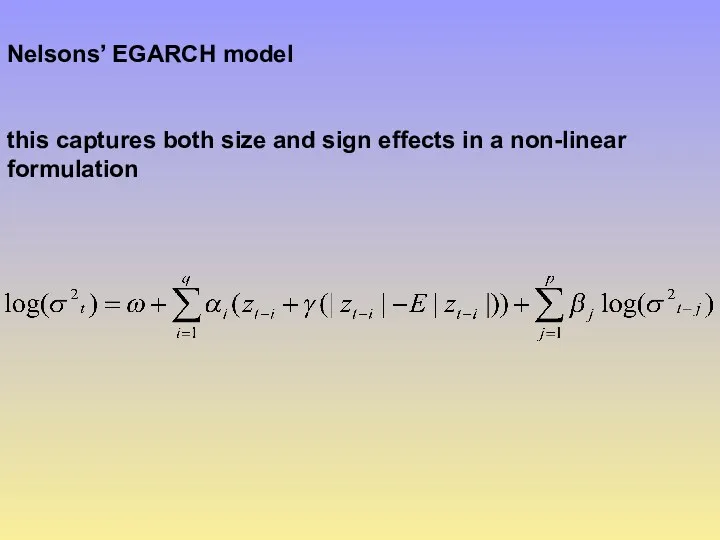

- 13. Nelsons’ EGARCH model this captures both size and sign effects in a non-linear formulation

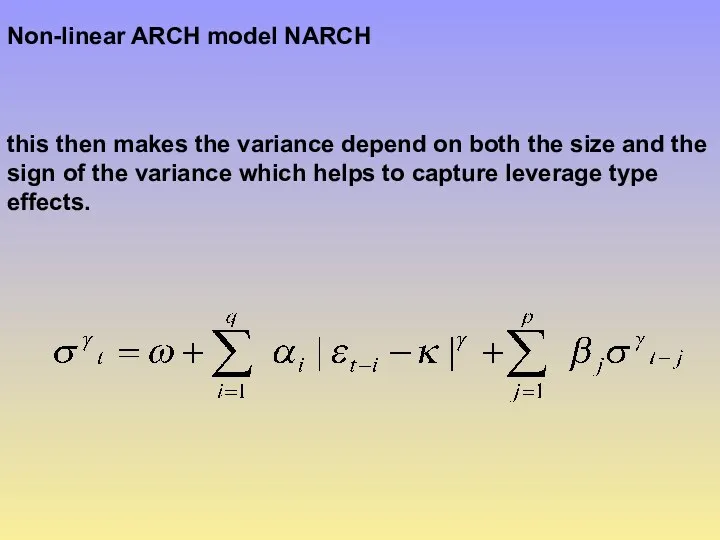

- 14. Non-linear ARCH model NARCH this then makes the variance depend on both the size and the

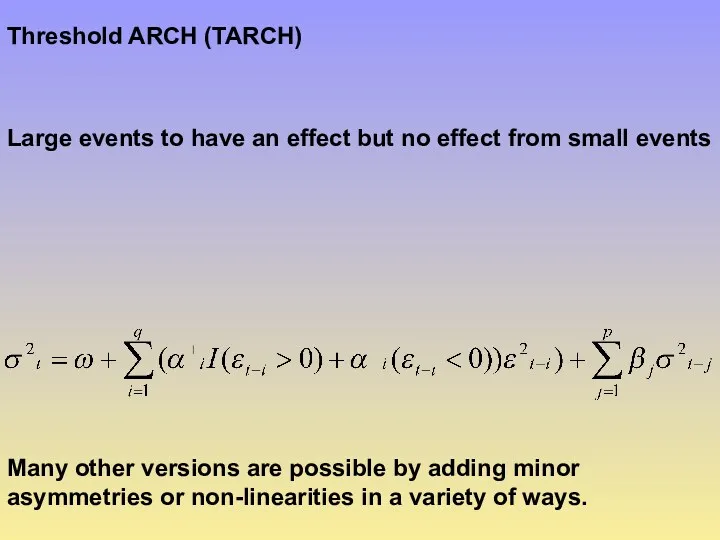

- 15. Threshold ARCH (TARCH) Many other versions are possible by adding minor asymmetries or non-linearities in a

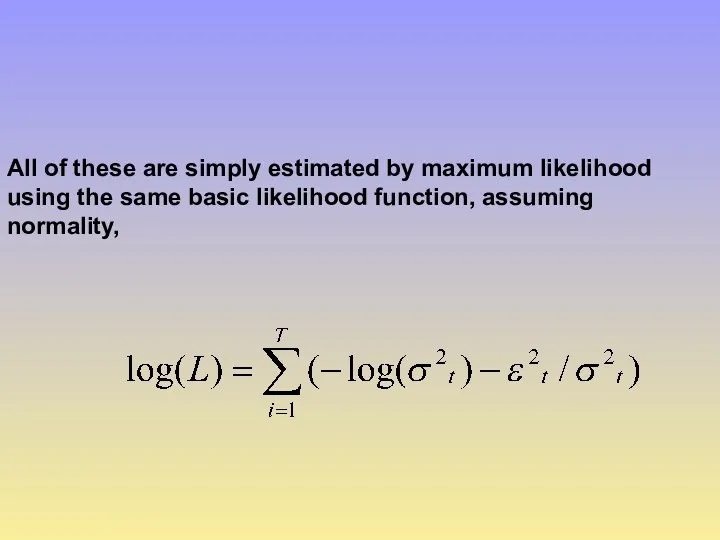

- 16. All of these are simply estimated by maximum likelihood using the same basic likelihood function, assuming

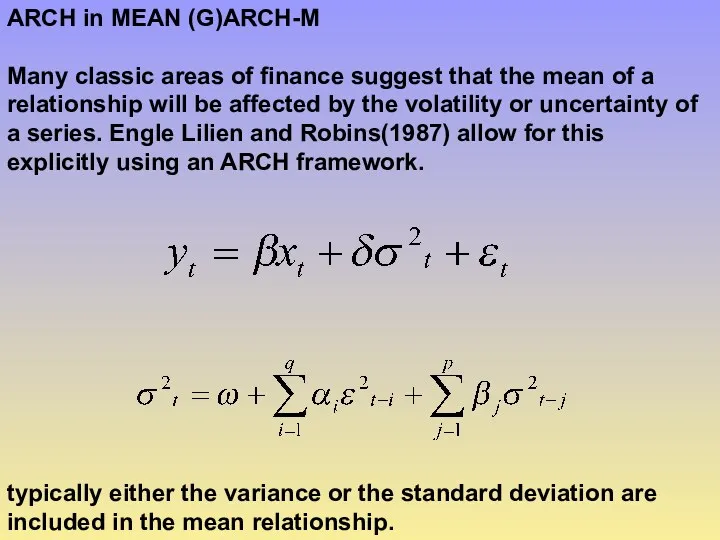

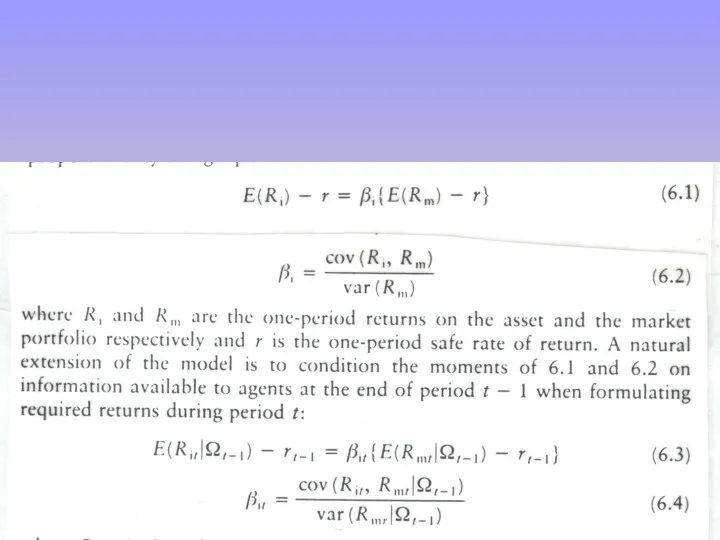

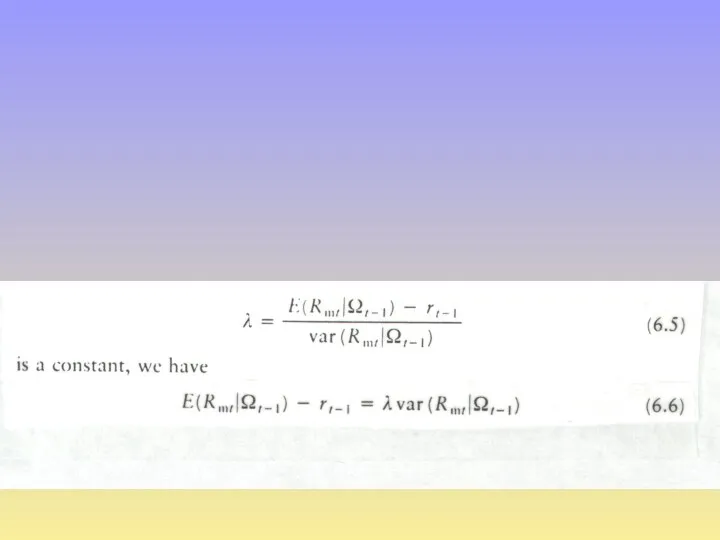

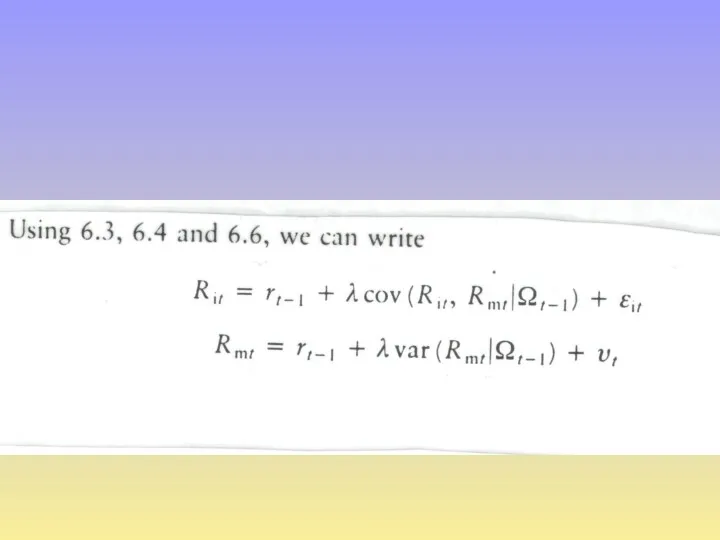

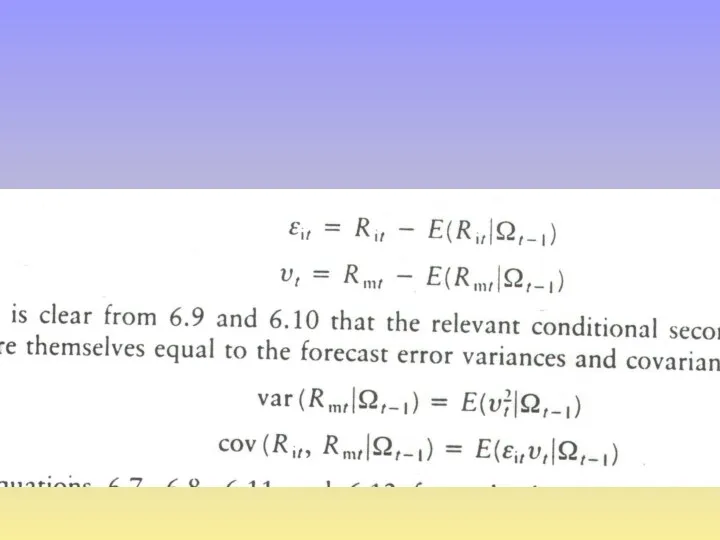

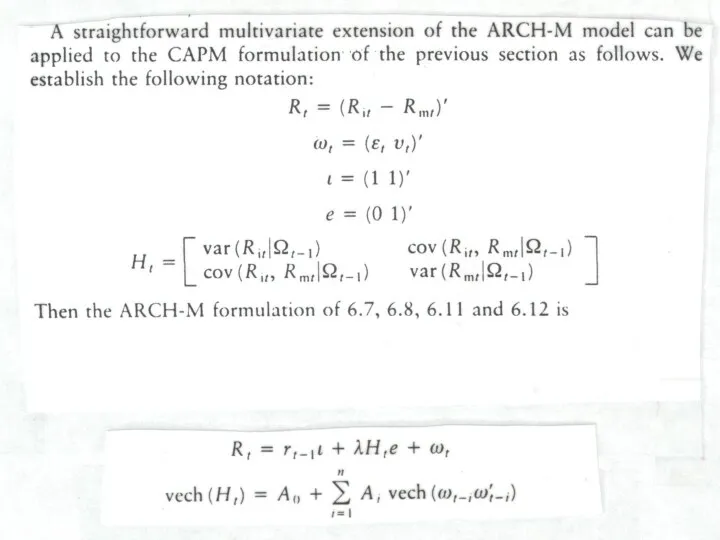

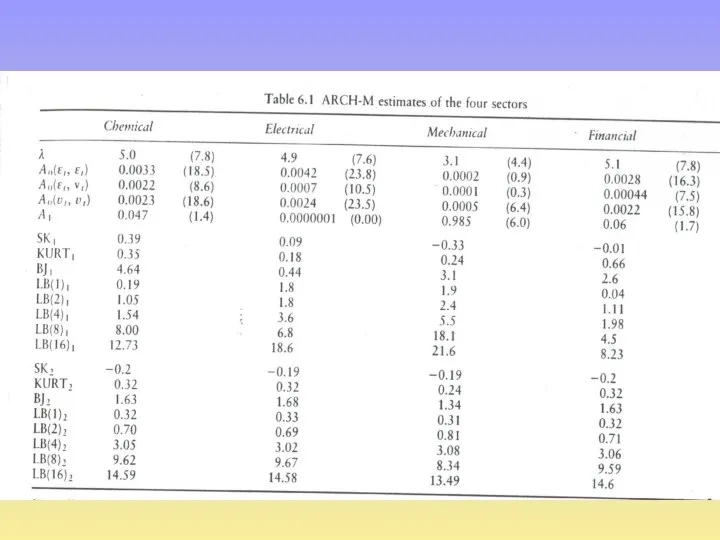

- 17. ARCH in MEAN (G)ARCH-M Many classic areas of finance suggest that the mean of a relationship

- 18. often finance stresses the importance of covariance terms. The above model can handle this if y

- 19. Non normality assumptions While the basic GARCH model allows a certain amount of leptokurtic behaviour this

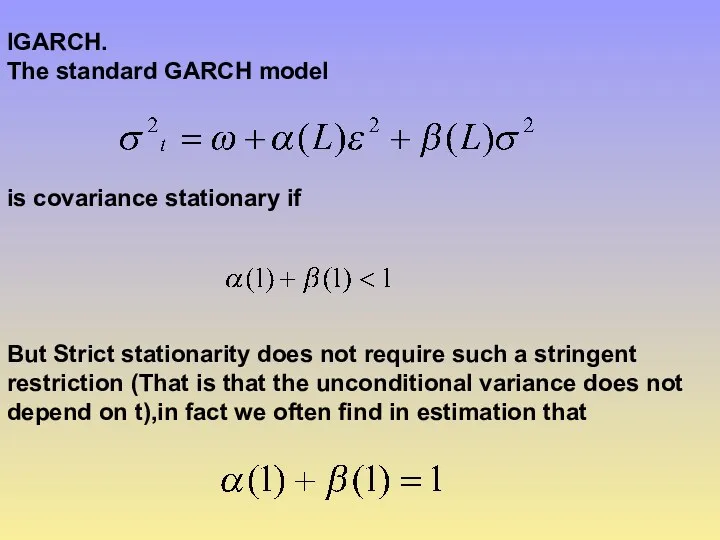

- 20. IGARCH. The standard GARCH model is covariance stationary if But Strict stationarity does not require such

- 21. this is then termed an Integrated GARCH model (IGARCH), Nelson has established that as this satisfies

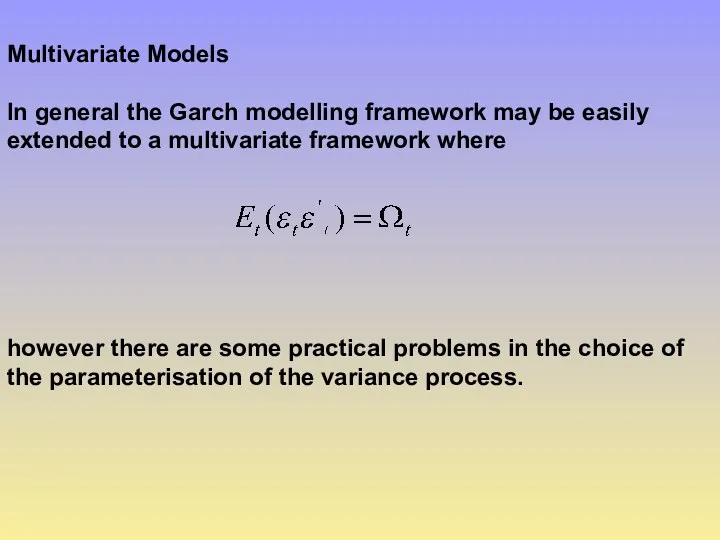

- 22. Multivariate Models In general the Garch modelling framework may be easily extended to a multivariate framework

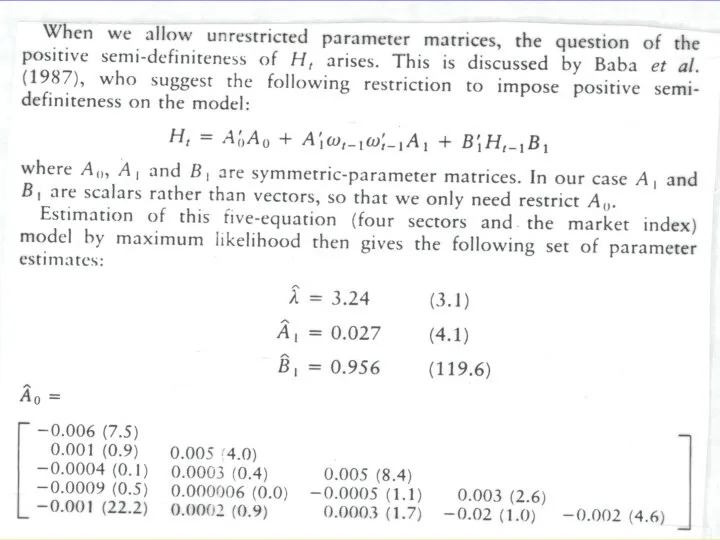

- 23. The conditional variance could easily become negative even when all the parameters are positive. A direct

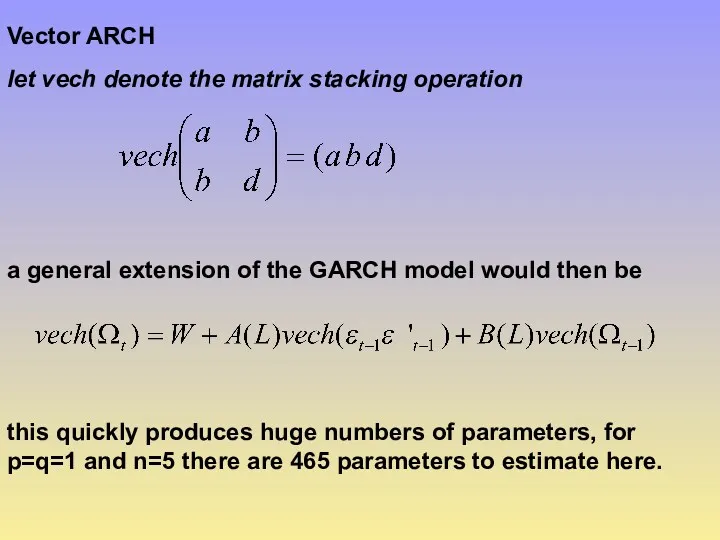

- 24. Vector ARCH let vech denote the matrix stacking operation a general extension of the GARCH model

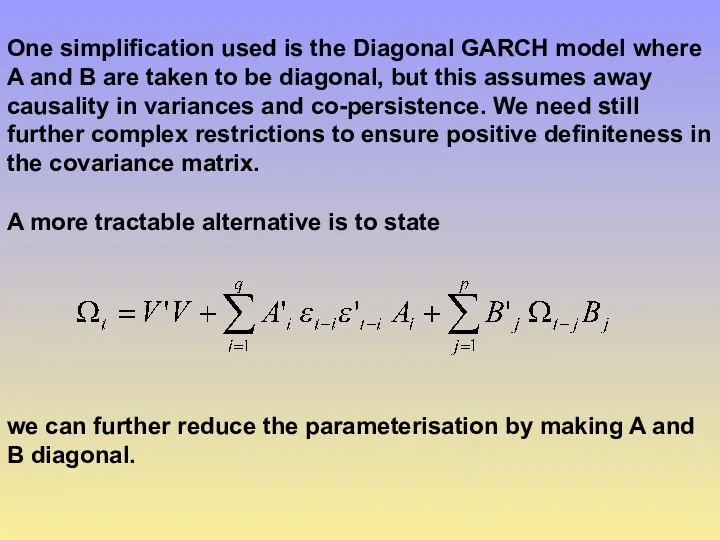

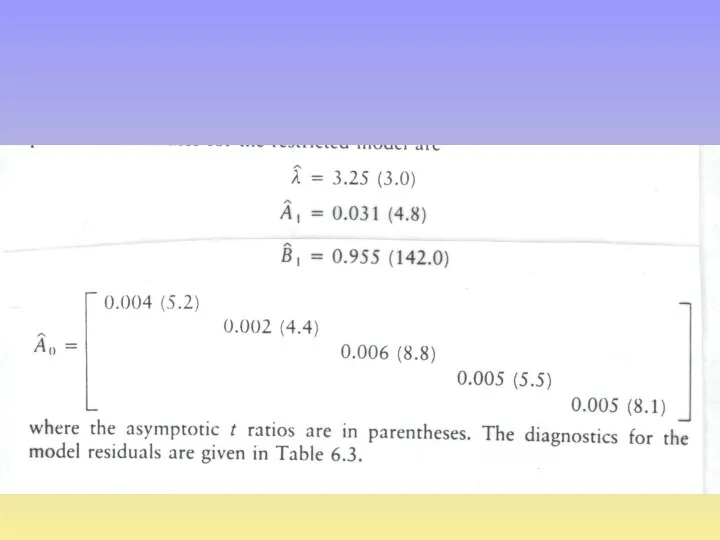

- 25. One simplification used is the Diagonal GARCH model where A and B are taken to be

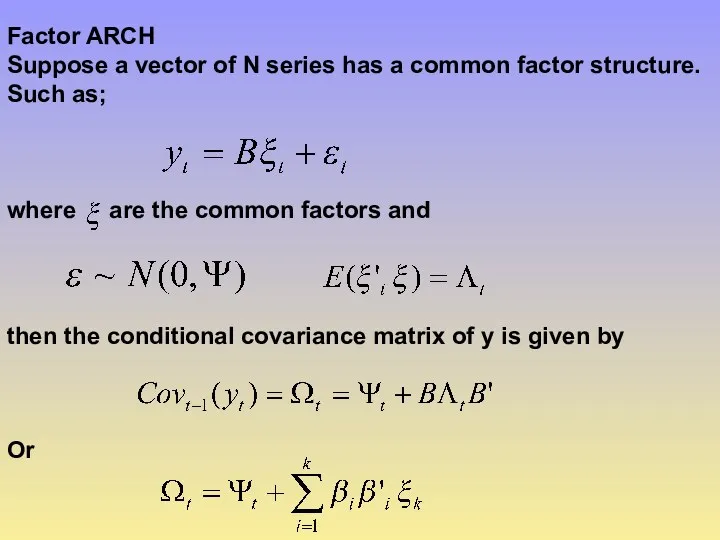

- 26. Factor ARCH Suppose a vector of N series has a common factor structure. Such as; where

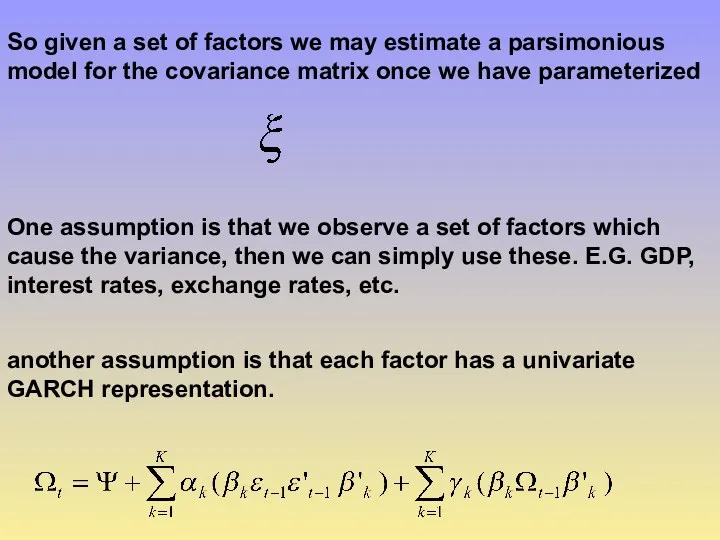

- 27. So given a set of factors we may estimate a parsimonious model for the covariance matrix

- 40. Скачать презентацию

Підприємство в соціально-орієнтованій ринковій економіці

Підприємство в соціально-орієнтованій ринковій економіці The pros and cons of migration

The pros and cons of migration Региональная политика в основе управления экономикой региона

Региональная политика в основе управления экономикой региона Економічна теорія: предмет, метод, функції. Людина у світі економіки. Історичний погляд на економічний розвиток країни

Економічна теорія: предмет, метод, функції. Людина у світі економіки. Історичний погляд на економічний розвиток країни Финансовая система США

Финансовая система США Открытая экономика и платежный баланс

Открытая экономика и платежный баланс Ожидаемый уровень качества марочного товара

Ожидаемый уровень качества марочного товара Теория производства: издержки и прибыль

Теория производства: издержки и прибыль Внутренняя и внешняя среда предприятия

Внутренняя и внешняя среда предприятия Государственная поддержка малого и среднего бизнеса

Государственная поддержка малого и среднего бизнеса Демографическая проблема

Демографическая проблема Россия в современном мире. Основные направления социально-экономического, политического и военно-технического развития страны

Россия в современном мире. Основные направления социально-экономического, политического и военно-технического развития страны Роль государства в экономике

Роль государства в экономике Ekonomia behawioralna. Ograniczenia poznawcze jednostki i heurystyki w analizie behawioralnej

Ekonomia behawioralna. Ograniczenia poznawcze jednostki i heurystyki w analizie behawioralnej Человек и экономика. Экономика и ее основные участники. (7 класс)

Человек и экономика. Экономика и ее основные участники. (7 класс) Бережливое производство

Бережливое производство Формування нових форм організації праці в умовах співробітництва України з ЄС

Формування нових форм організації праці в умовах співробітництва України з ЄС Экономическая теория: предмет, цели и задачи

Экономическая теория: предмет, цели и задачи Экономический потенциал Приморского края и его место в развитии экономики России

Экономический потенциал Приморского края и его место в развитии экономики России Государственная поддержка малого и среднего предпринимательства в Саратовской области

Государственная поддержка малого и среднего предпринимательства в Саратовской области Национальный инновационный фонд

Национальный инновационный фонд Макроэкономика. Модель IS-LM

Макроэкономика. Модель IS-LM Транснационализация и социализация международного бизнеса

Транснационализация и социализация международного бизнеса Экономикалық теорияның пәні және зерттеу әдістері

Экономикалық теорияның пәні және зерттеу әдістері Конкурентоспособность продукции ООО ЭКОМ и факторы ее определяющие

Конкурентоспособность продукции ООО ЭКОМ и факторы ее определяющие Экономика, как наука

Экономика, как наука Россия в системе международного (мирового) разделения труда

Россия в системе международного (мирового) разделения труда Основной капитал предприятия

Основной капитал предприятия