Содержание

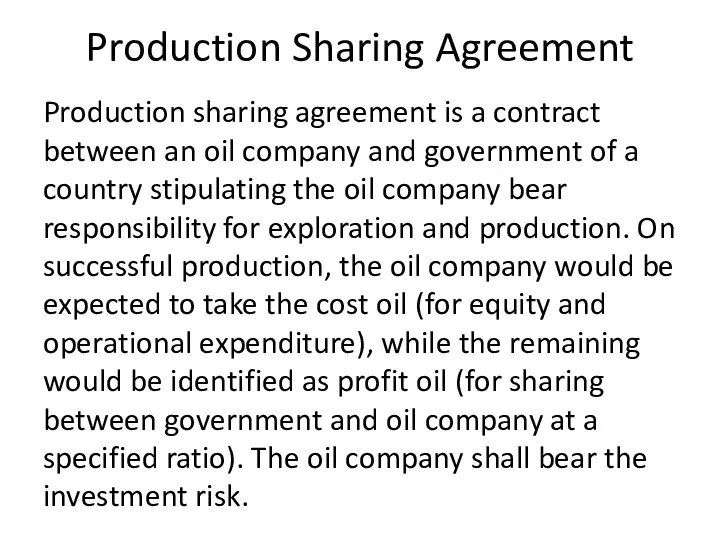

- 2. Production Sharing Agreement Production sharing agreement is a contract between an oil company and government of

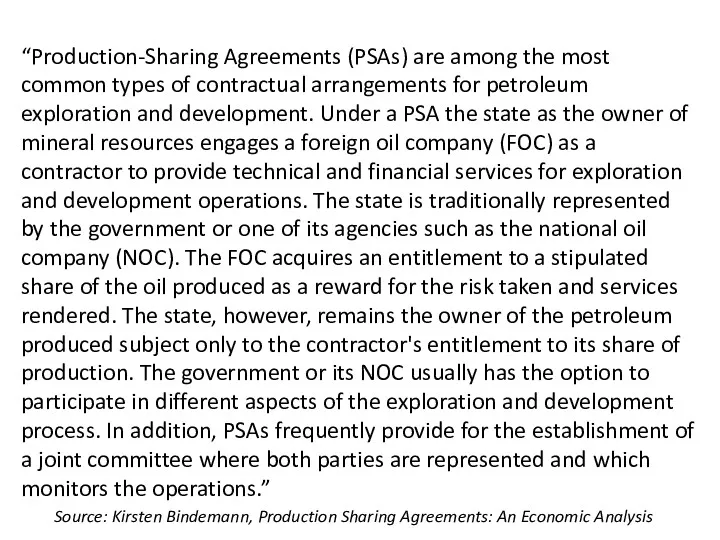

- 3. “Production-Sharing Agreements (PSAs) are among the most common types of contractual arrangements for petroleum exploration and

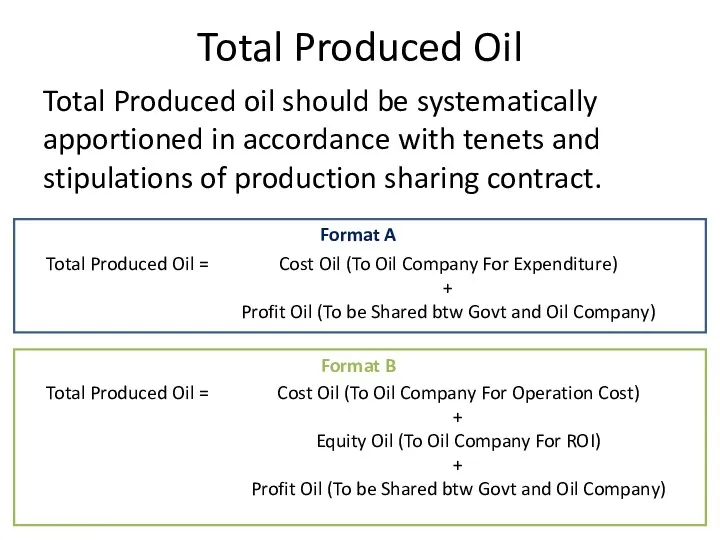

- 4. Total Produced Oil Total Produced oil should be systematically apportioned in accordance with tenets and stipulations

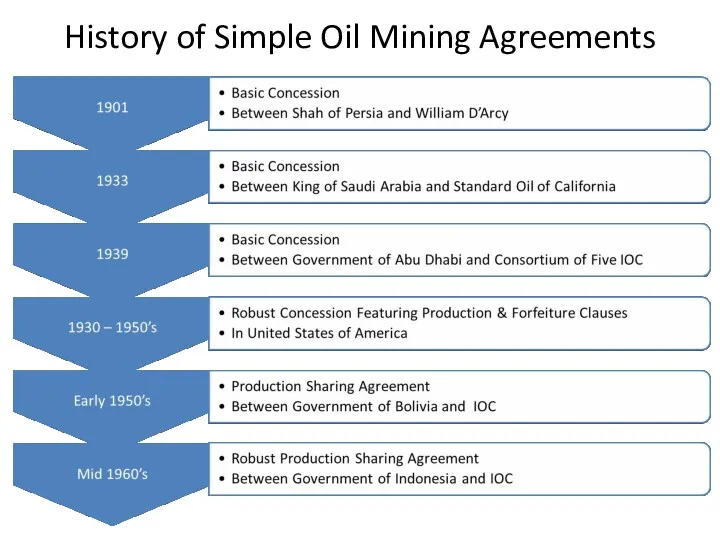

- 5. History of Simple Oil Mining Agreements

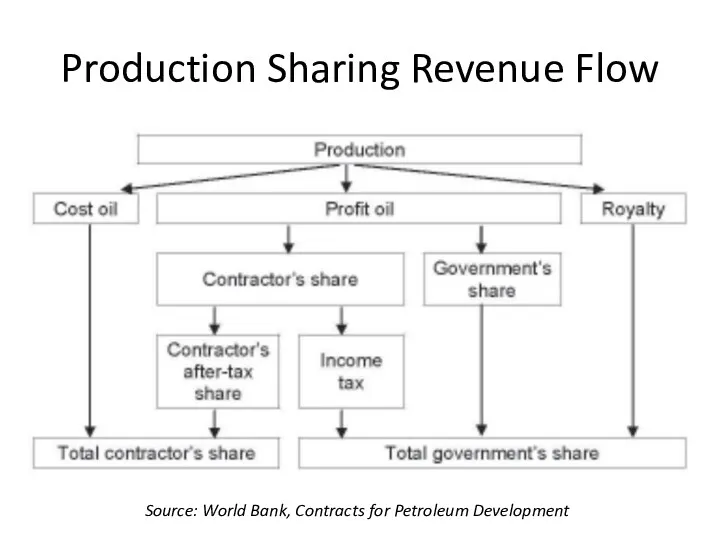

- 6. Production Sharing Revenue Flow Source: World Bank, Contracts for Petroleum Development

- 7. Elements of Production Sharing Contract Royalty Tax Cost Oil Bonus Profit Oil Validation of Commerciality Domestic

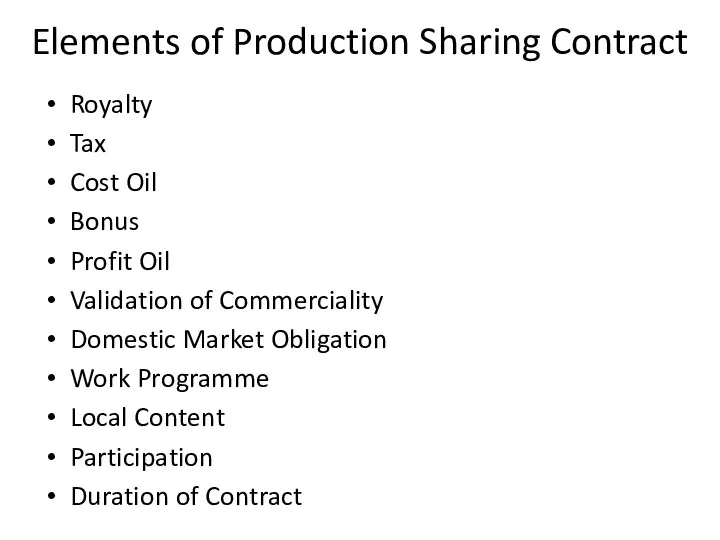

- 8. Royalty Royalty No Royalty Sliding Scale Royalty

- 9. Tax No Tax Progressive Tax Fixed Tax

- 10. Cost Oil No Cost Oil Low Cost Oil Fixed Cost Oil R-Factor Based Cost Oil Unlimited

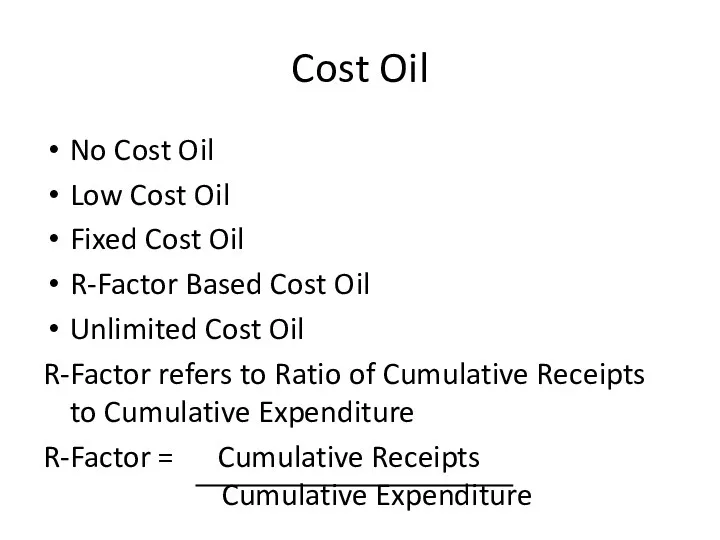

- 11. Bonus Fixed Production Bonus Sliding Scale Production Bonus Signature Bonus No Signature Bonus Discovery Bonus No

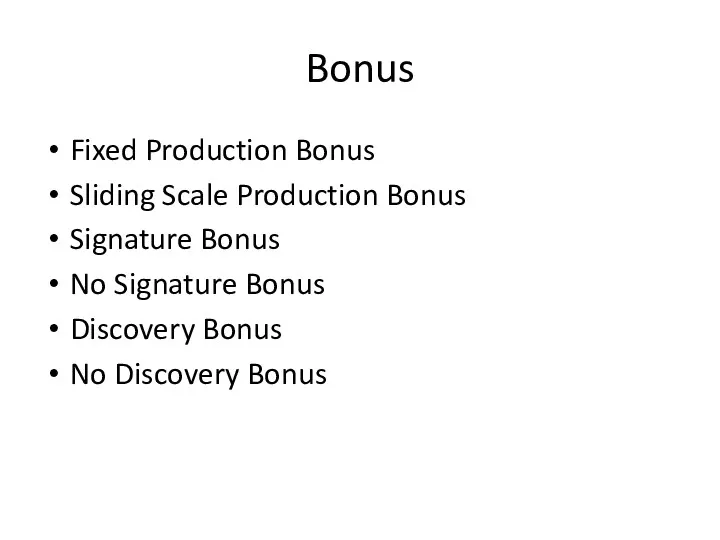

- 12. Profit Oil Low Profit Oil Fixed Profit Oil Volume Based Profit Oil R-Factor Based Profit Oil

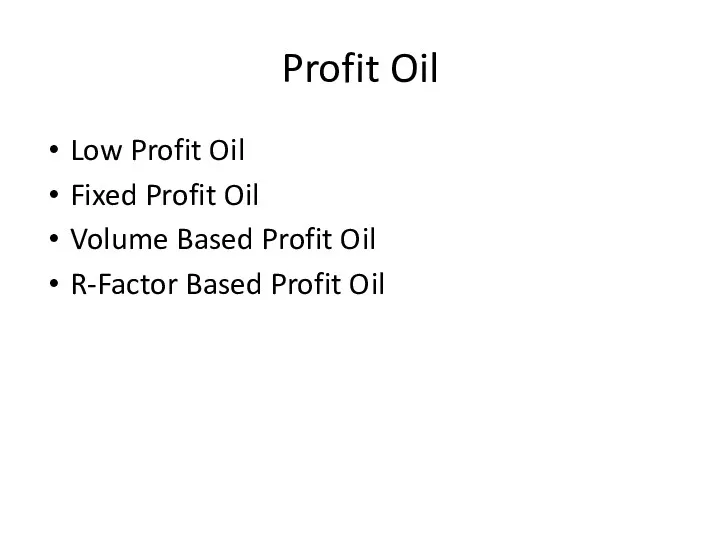

- 13. Factors that Affect Scope of Incentives, Risk & Reward Influence Negotiation Competence Brand Value Bilateral Intergovernmental

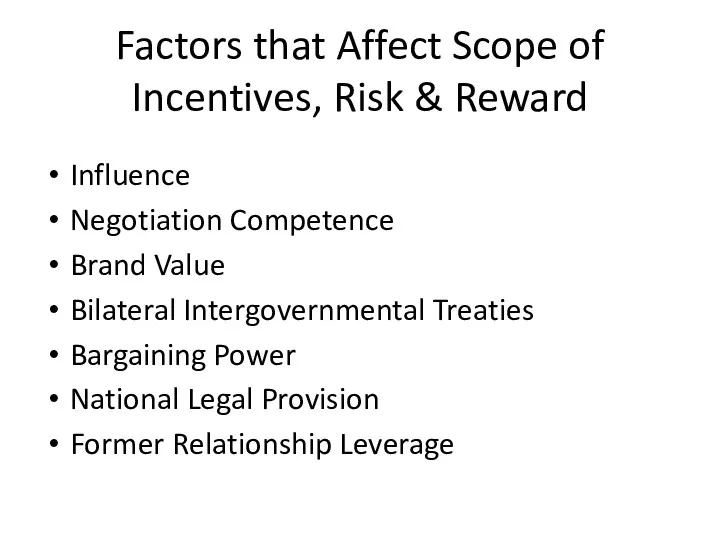

- 14. General Risk & Uncertainty in Oil and Gas Exploration, Development & Production Size of Resource at

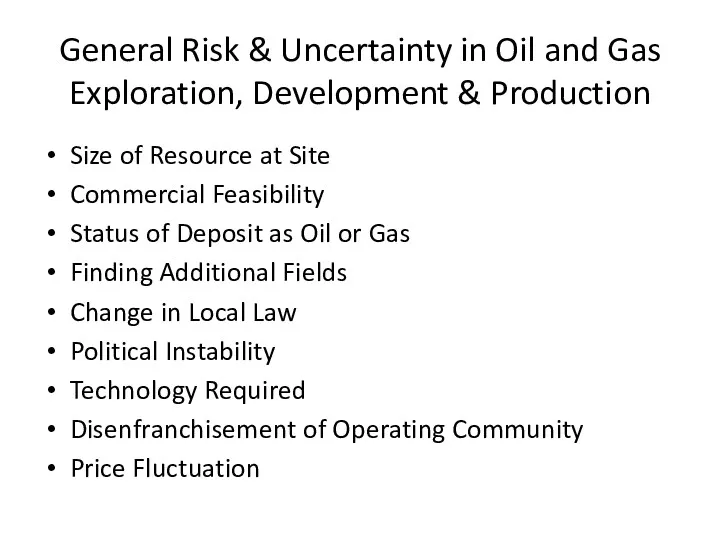

- 15. Models of Principal-Agent Relationships Between IOC and Government Simple Complex Government International Oil Company Government International

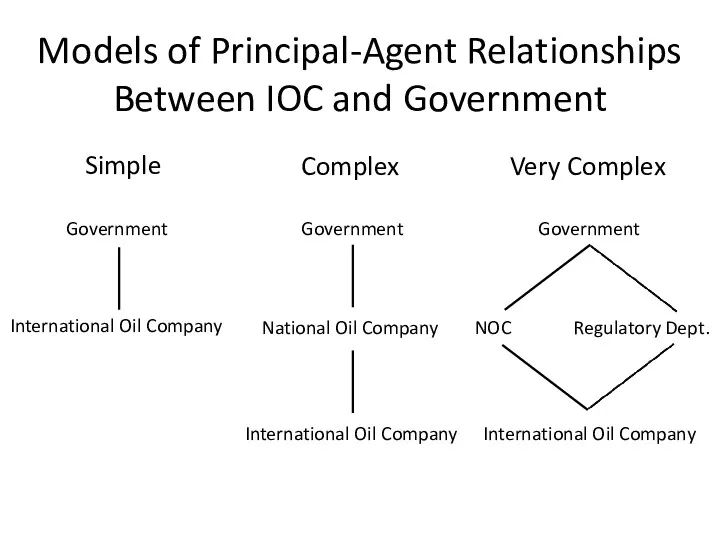

- 16. Service Contracts Service Contracts provide for a Host Government to have greatest control of the oil

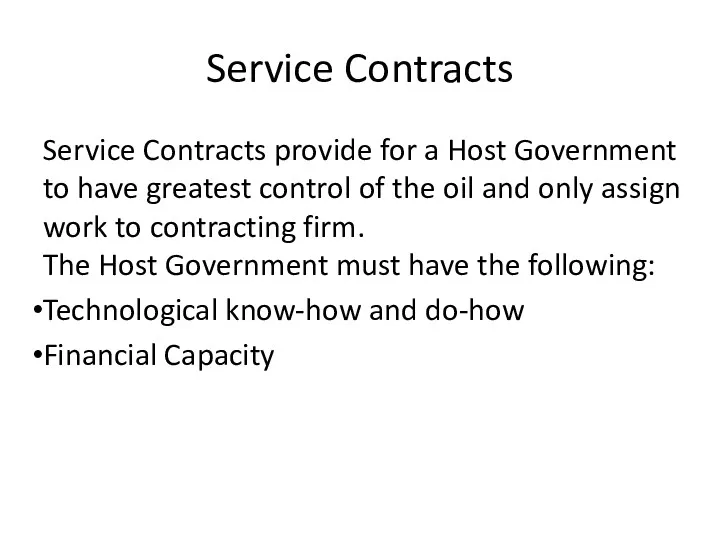

- 17. Types of Service Contracts Technical Assistance Contract Provision of Technical Service Without Bearing Any Risk Lean

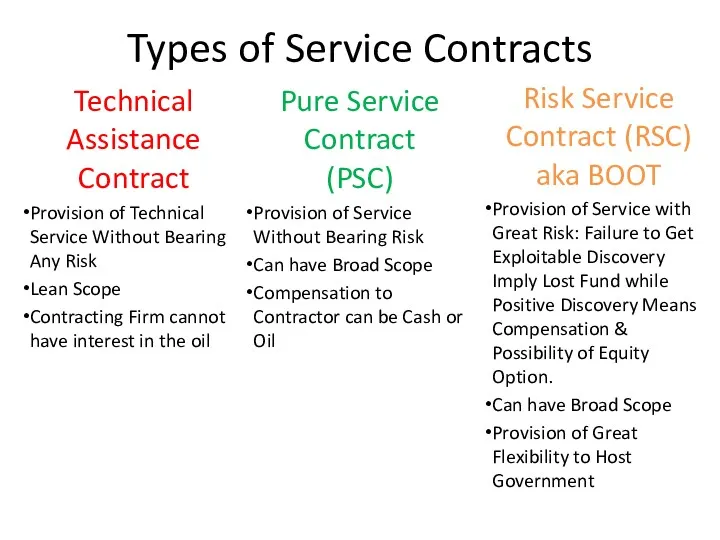

- 18. “Alliances are institutional arrangements that combine resources and governance forms of several partnering organizations, making them

- 19. Rationale for Alliance

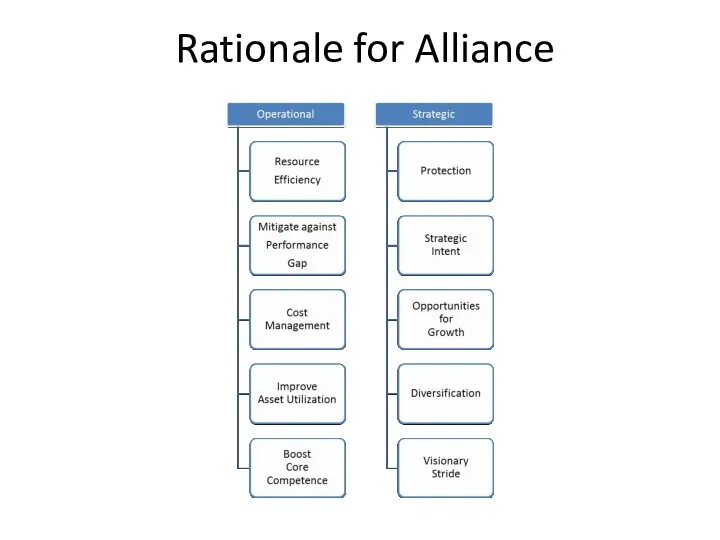

- 20. Alliance Stability Model by Elijah Ezendu

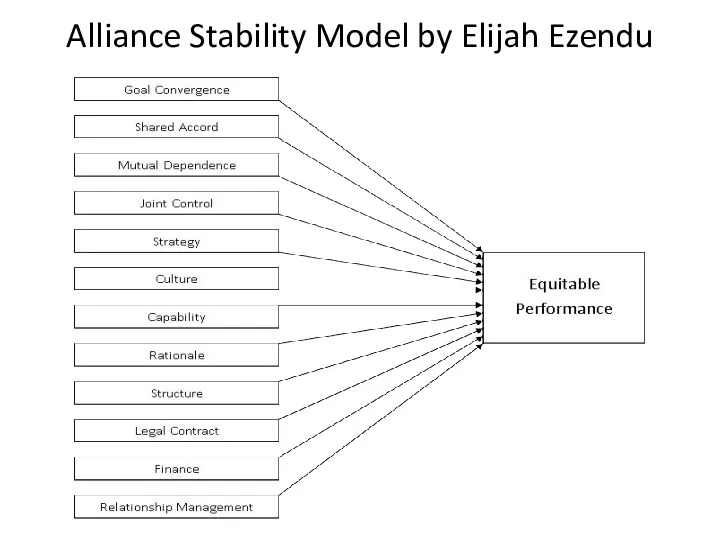

- 21. Short Long None High Duration of Commitment Extent of Joint Decision-Making One-off arms length purchase Competitive

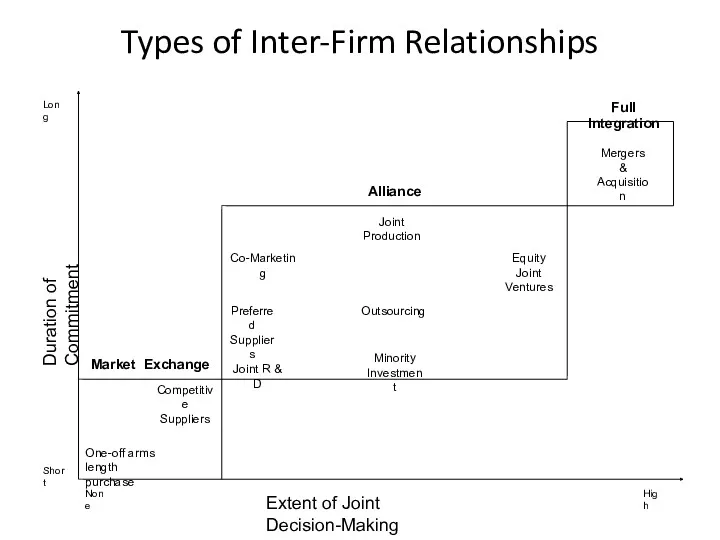

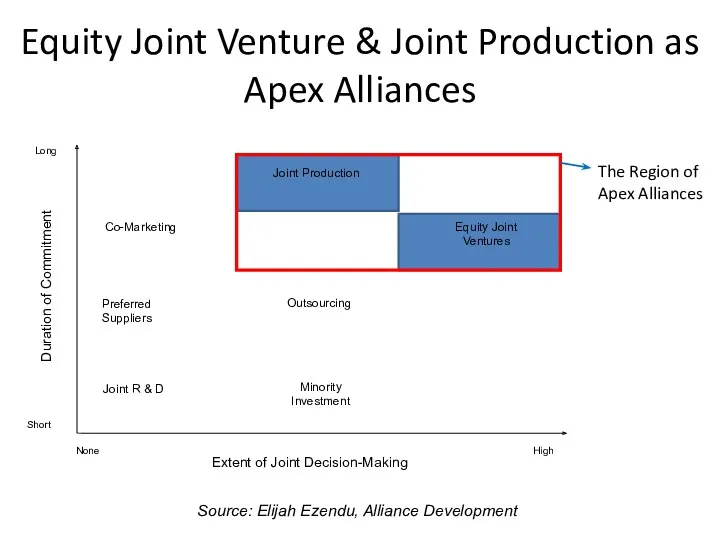

- 22. Equity Joint Venture & Joint Production as Apex Alliances Joint R & D Preferred Suppliers Co-Marketing

- 23. Joint Ventures in Oil & Gas Primary Form of Joint Venture: This involves venturing parties (namely

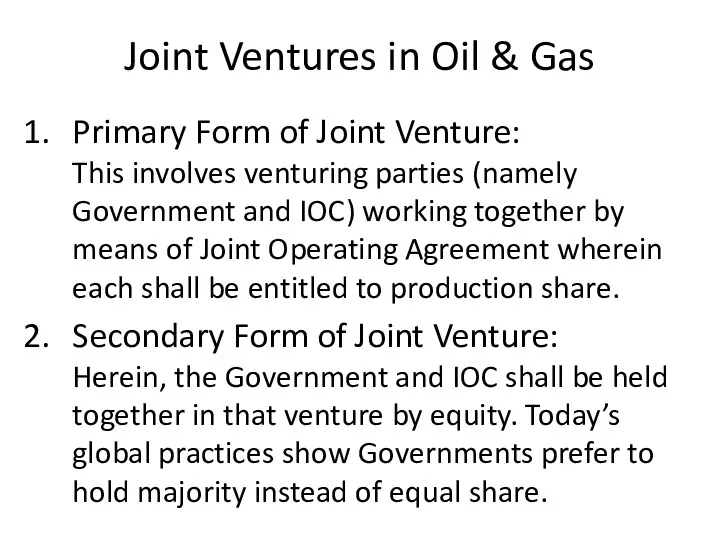

- 24. Differentiating PSA from Joint Venture PSA Joint Venture Production Cost Oil Profit Oil Royalty IOC share

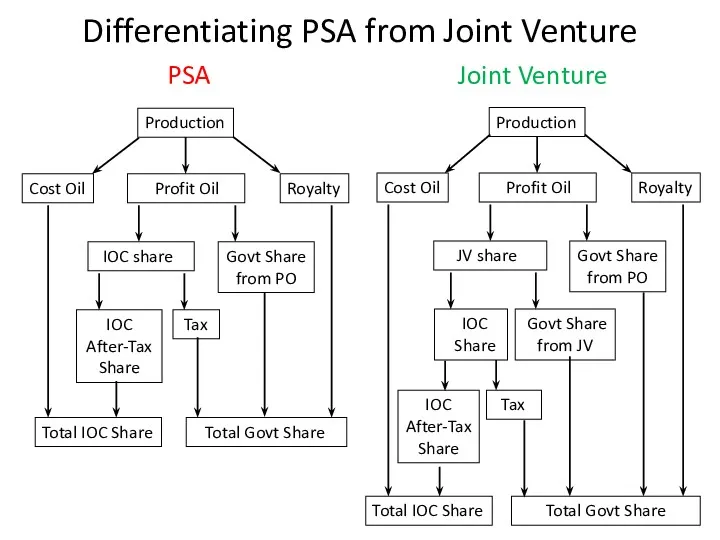

- 25. Regional Governments The search for revenue centres in local communities spurred regional governments to take action

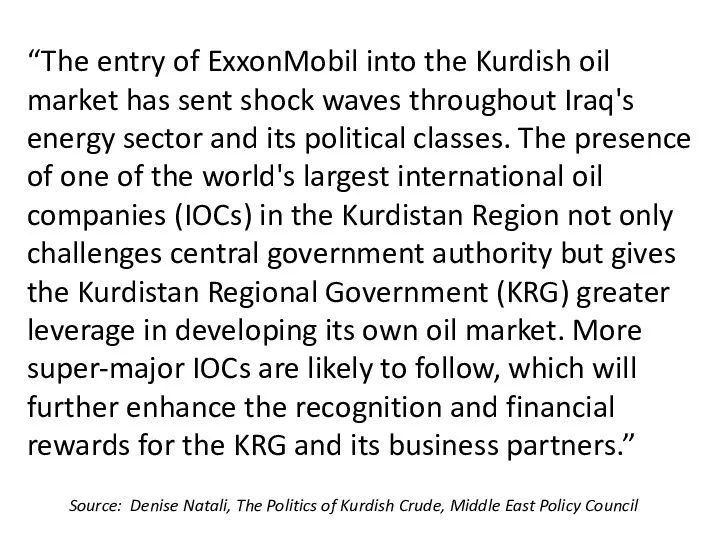

- 26. “The entry of ExxonMobil into the Kurdish oil market has sent shock waves throughout Iraq's energy

- 27. Exercise Compare and Contrast Highlighting Pros and Cons to Host Government and International Oil Company. Production

- 29. Скачать презентацию

Становление и сущность мирового хозяйства. Закономерности и тенденции развития

Становление и сущность мирового хозяйства. Закономерности и тенденции развития Инфляция и антиинфляционная политика

Инфляция и антиинфляционная политика Экономическая основа местного самоуправления

Экономическая основа местного самоуправления Прибыль и рентабельность организации

Прибыль и рентабельность организации Основоположники институционализма

Основоположники институционализма Еңбекақы мәні мен принциптері

Еңбекақы мәні мен принциптері Основы теории риска проектов

Основы теории риска проектов Экономика родного края

Экономика родного края Экономическая сфера жизни общества

Экономическая сфера жизни общества Игровые технологии обучения экономике. Лекция 10

Игровые технологии обучения экономике. Лекция 10 Институциональная теория государства

Институциональная теория государства Экономика инженерной деятельности практические занятия

Экономика инженерной деятельности практические занятия Экономикалық теория пәні, әдістері мен қызметтері

Экономикалық теория пәні, әдістері мен қызметтері Основний капітал підприємства. (Лекція 2)

Основний капітал підприємства. (Лекція 2) Корпорация ТехноНИКОЛЬ

Корпорация ТехноНИКОЛЬ Проект. Зелена економіка

Проект. Зелена економіка Рыночные отношения в экономике

Рыночные отношения в экономике Безработица. Трудоспособное и нетрудоспособное население

Безработица. Трудоспособное и нетрудоспособное население Международная трудовая миграция

Международная трудовая миграция Модель оптового рынка электроэнергии и мощности (ОРЭМ)

Модель оптового рынка электроэнергии и мощности (ОРЭМ) Лекция 2. Цикличность экономики. Бизнес идея. Бизнес-модель

Лекция 2. Цикличность экономики. Бизнес идея. Бизнес-модель Экономическая доктрина марксизма

Экономическая доктрина марксизма Шляхи підвищення платоспроможності та ліквідності підприємства

Шляхи підвищення платоспроможності та ліквідності підприємства Principles of Economics

Principles of Economics Региональная экономическая политика: федеральный уровень

Региональная экономическая политика: федеральный уровень Статистика национального богатства и национального имущества

Статистика национального богатства и национального имущества Экономика ветеринарных мероприятий

Экономика ветеринарных мероприятий Viduseiropas valstis

Viduseiropas valstis