Содержание

- 2. Main Messages Robust growth supported by high energy prices, large capital inflows, rising domestic demand and

- 3. I. Recent Economic Developments

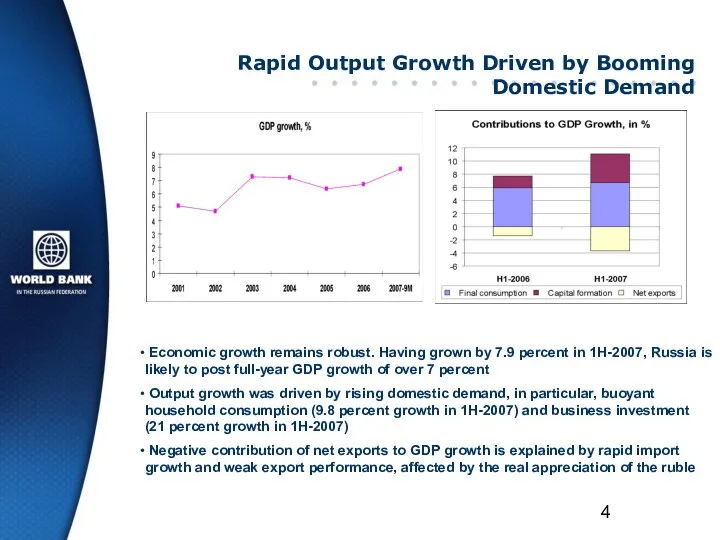

- 4. Rapid Output Growth Driven by Booming Domestic Demand Economic growth remains robust. Having grown by 7.9

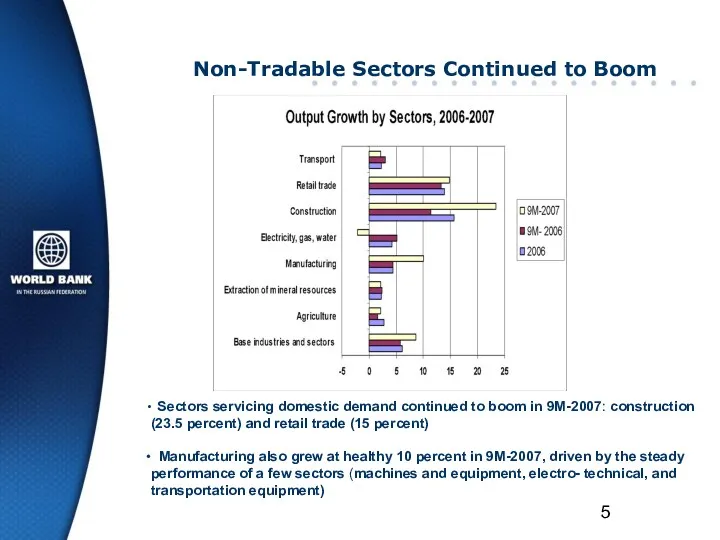

- 5. Non-Tradable Sectors Continued to Boom Sectors servicing domestic demand continued to boom in 9M-2007: construction (23.5

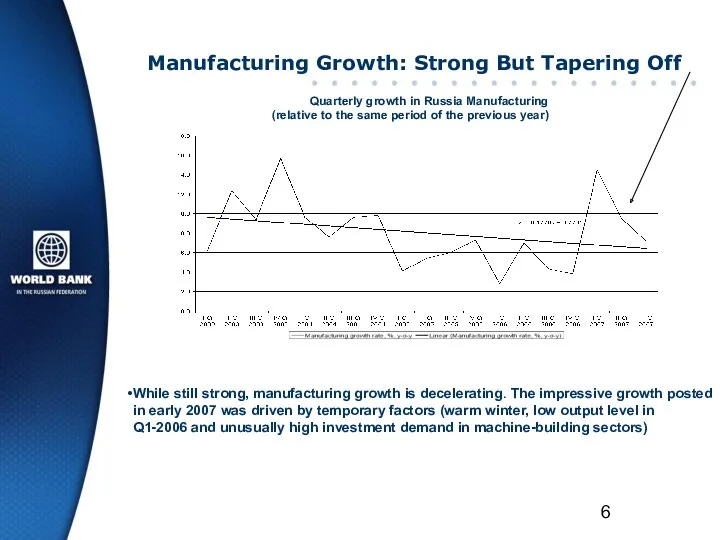

- 6. Manufacturing Growth: Strong But Tapering Off While still strong, manufacturing growth is decelerating. The impressive growth

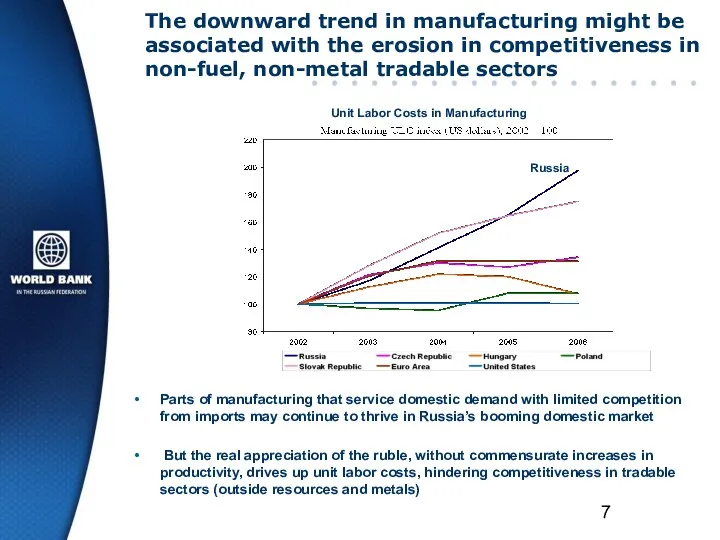

- 7. The downward trend in manufacturing might be associated with the erosion in competitiveness in non-fuel, non-metal

- 8. Russia continues to experience an investment boom Capital investment growth, % to previous year The aggregate

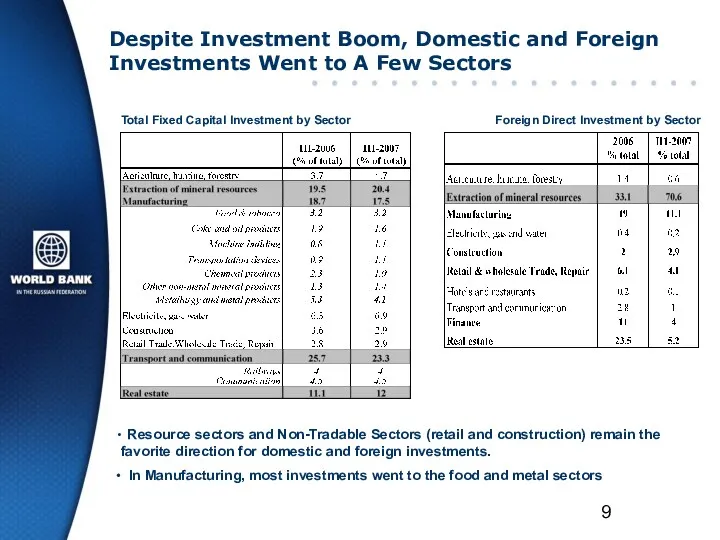

- 9. Despite Investment Boom, Domestic and Foreign Investments Went to A Few Sectors Total Fixed Capital Investment

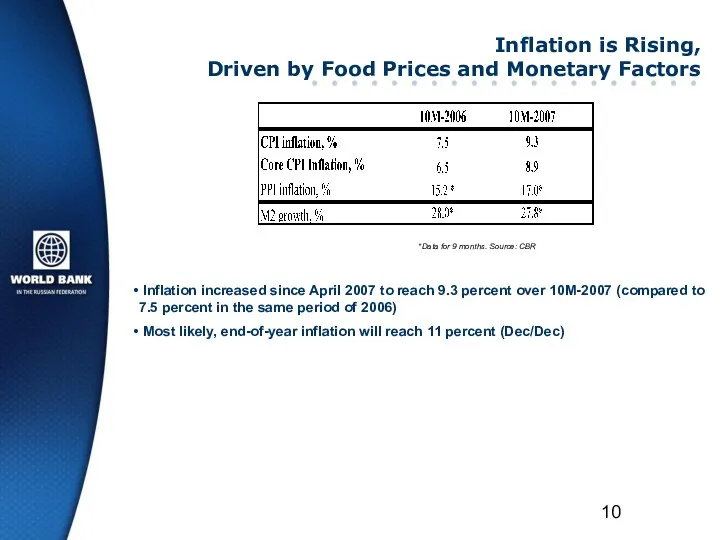

- 10. Inflation is Rising, Driven by Food Prices and Monetary Factors *Data for 9 months. Source: CBR

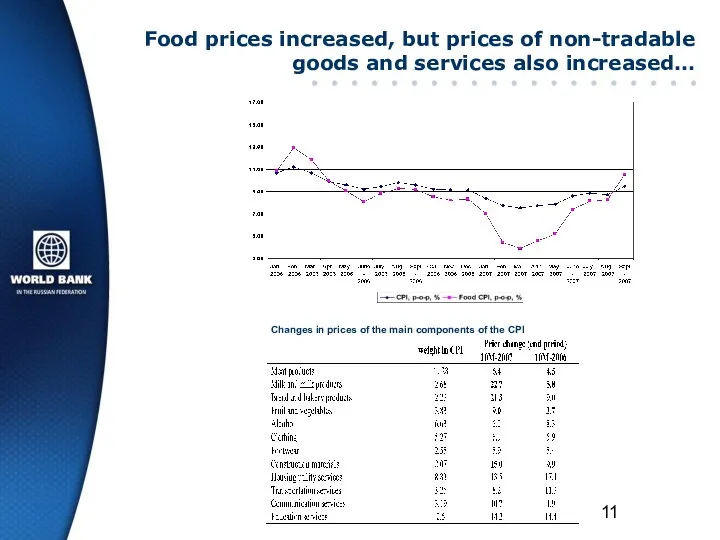

- 11. Food prices increased, but prices of non-tradable goods and services also increased… Changes in prices of

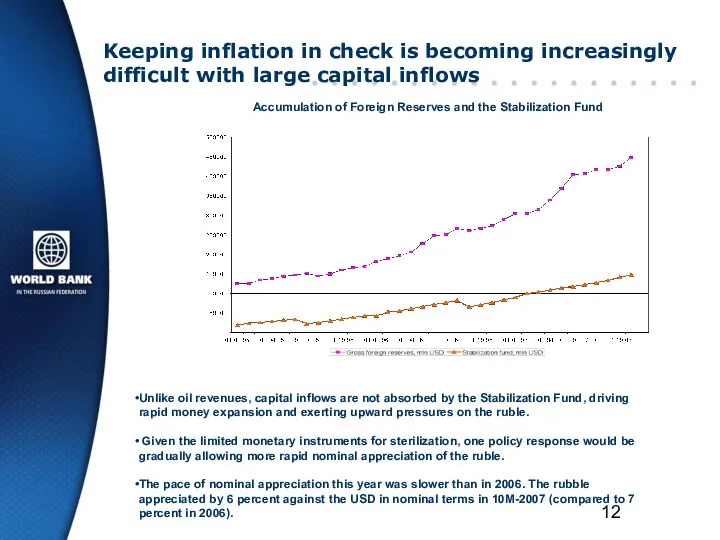

- 12. Keeping inflation in check is becoming increasingly difficult with large capital inflows Accumulation of Foreign Reserves

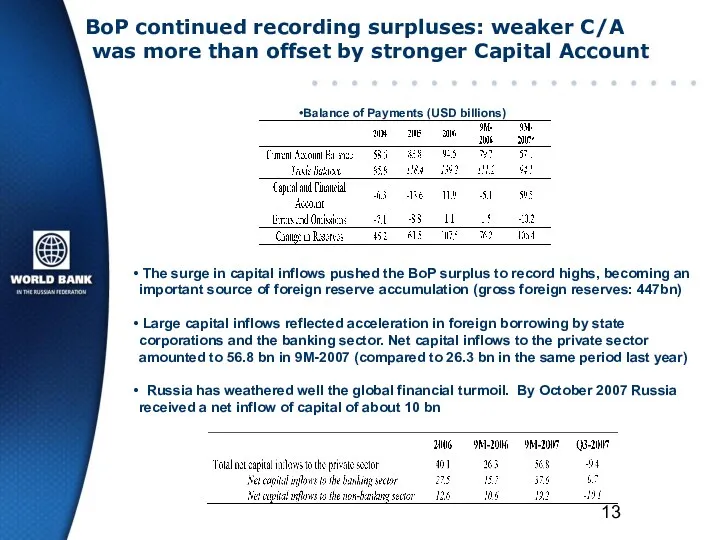

- 13. BoP continued recording surpluses: weaker C/A was more than offset by stronger Capital Account Balance of

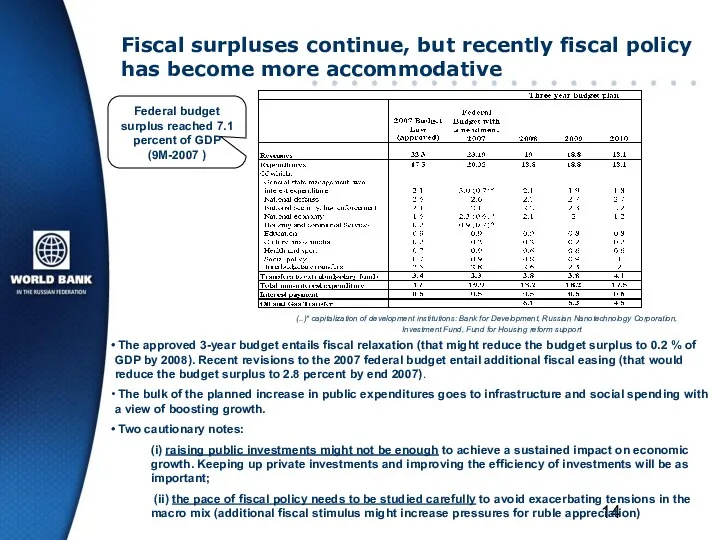

- 14. Fiscal surpluses continue, but recently fiscal policy has become more accommodative The approved 3-year budget entails

- 15. Prospects Growth is likely to remain robust. With energy prices set to remain high, booming domestic

- 16. II. Productivity Growth in Russia

- 17. Russia has experienced a productivity surge, propelling economic growth Total factor productivity growth (5.8 percent) drove

- 18. What are the drivers of the productivity surge? Capacity utilization Sectoral shifts Firm dynamics

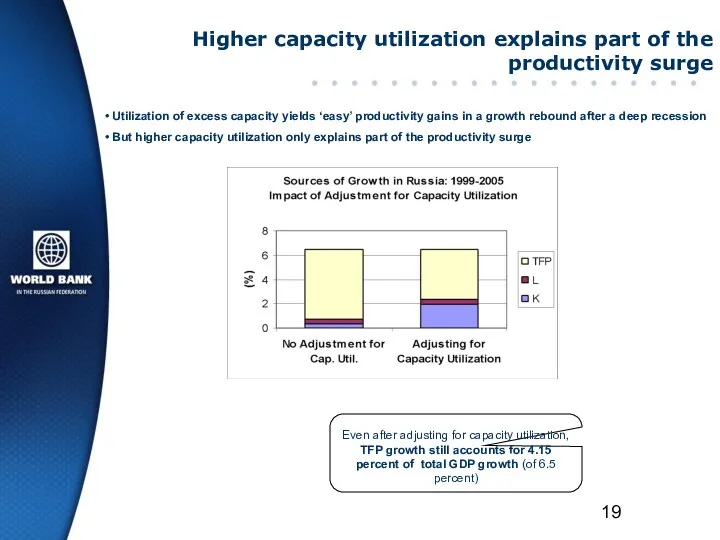

- 19. Higher capacity utilization explains part of the productivity surge Utilization of excess capacity yields ‘easy’ productivity

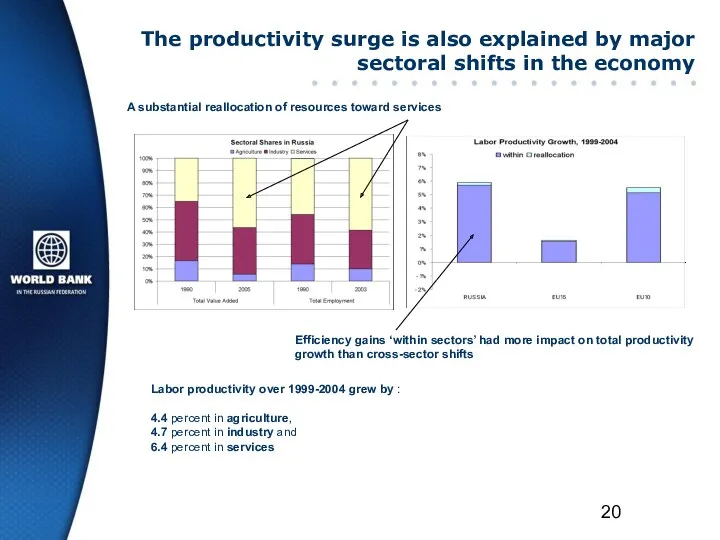

- 20. The productivity surge is also explained by major sectoral shifts in the economy A substantial reallocation

- 21. Firm dynamics Decomposing total productivity growth into three components: ‘within’: accounts for productivity growth within existing

- 22. Productivity growth came mostly from efficiency gains within firms -but reallocation & net entry also mattered

- 23. Firm turnover plays a smaller role than in other advanced economies Private entrants are less productive

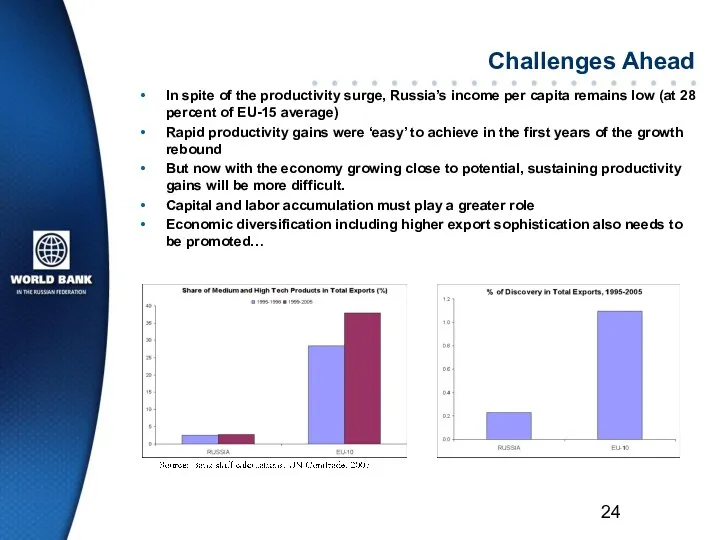

- 24. Challenges Ahead In spite of the productivity surge, Russia’s income per capita remains low (at 28

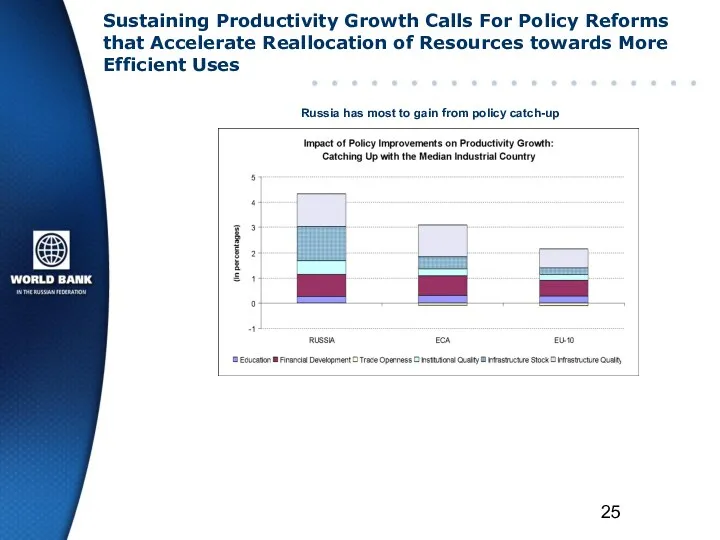

- 25. Sustaining Productivity Growth Calls For Policy Reforms that Accelerate Reallocation of Resources towards More Efficient Uses

- 26. III. From Red to Gray: The Third Transition of Aging Population in Russia

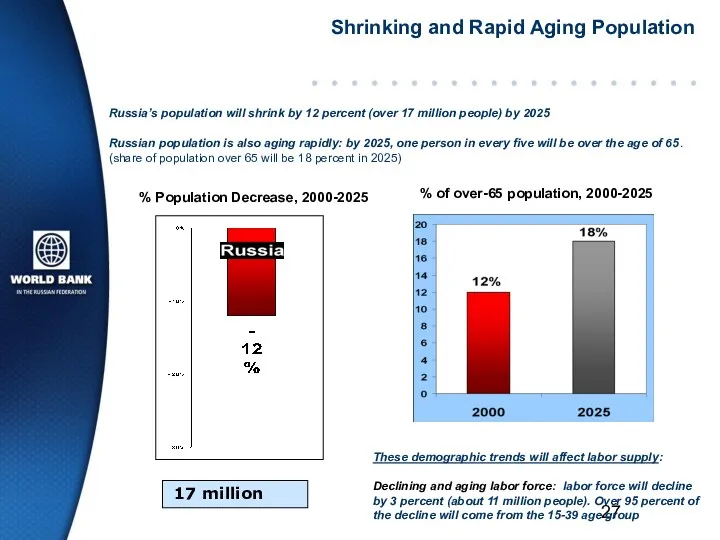

- 27. Shrinking and Rapid Aging Population % Population Decrease, 2000-2025 17 million % of over-65 population, 2000-2025

- 28. Aging is not a stop sign for growth: Message 1) Address labor shortage through reforms to

- 30. Скачать презентацию

Характеристики региональных интеграционных блоков с участием Франции

Характеристики региональных интеграционных блоков с участием Франции Договор о евразийском экономическом союзе. Астана, 29 мая 2014 года

Договор о евразийском экономическом союзе. Астана, 29 мая 2014 года Эффективность экономики.Экономический рост и НТП. Тема 24

Эффективность экономики.Экономический рост и НТП. Тема 24 Либерализм, или классическая школа в политической экономике. (Занятие 6)

Либерализм, или классическая школа в политической экономике. (Занятие 6) Казахстанская модель экономического развития

Казахстанская модель экономического развития Оборотні засоби підприємства. (Лекція 3)

Оборотні засоби підприємства. (Лекція 3) Основы предпринимательства и предпринимательской деятельности

Основы предпринимательства и предпринимательской деятельности Предпринимательство. Тренинг

Предпринимательство. Тренинг Казахстанская модель экономического развития

Казахстанская модель экономического развития Проблемные регионы

Проблемные регионы Экономическая теория, как наука, ее предмет, метод и функции. (Тема 1.1)

Экономическая теория, как наука, ее предмет, метод и функции. (Тема 1.1) Международная ликвидность. Спрос и предложение международной ликвидности

Международная ликвидность. Спрос и предложение международной ликвидности Совершенствование управления персоналом предприятия (на примере ОАО Речицкий метизный завод)

Совершенствование управления персоналом предприятия (на примере ОАО Речицкий метизный завод) Рынок труда. Безработица

Рынок труда. Безработица Конкуренция, понятие, функции, классификация. Базовые понятия. 3 часть

Конкуренция, понятие, функции, классификация. Базовые понятия. 3 часть Региональная экономика и региональная политика

Региональная экономика и региональная политика Р. Вернон. Жизненный цикл товара и международная торговля

Р. Вернон. Жизненный цикл товара и международная торговля Стратегия Казахстан 2030

Стратегия Казахстан 2030 Конкуренция, её виды, место и роль в современном хозяйственном механизме

Конкуренция, её виды, место и роль в современном хозяйственном механизме Экономика предприятия. Планирование хозяйственной деятельности предприятия. (Лекция 8)

Экономика предприятия. Планирование хозяйственной деятельности предприятия. (Лекция 8) Системный анализ в экономике. Моделирование систем. (Лекция 2)

Системный анализ в экономике. Моделирование систем. (Лекция 2) Організація і шляхи вдосконалення обліку, аудиту нерозподіленого прибутку, аналіз ефективності його використання

Організація і шляхи вдосконалення обліку, аудиту нерозподіленого прибутку, аналіз ефективності його використання Україна за роки незалежності

Україна за роки незалежності Основы бухгалтерского учета в схемах

Основы бухгалтерского учета в схемах Таможенно-тарифное регулирование внешнеэкономической деятельности. (Лекция 1)

Таможенно-тарифное регулирование внешнеэкономической деятельности. (Лекция 1) Анализ рынка СЭД в России

Анализ рынка СЭД в России Человек в экономике

Человек в экономике Основные тенденции развития российской экономики: от рецессии к стагнации

Основные тенденции развития российской экономики: от рецессии к стагнации