Содержание

- 2. Learning Objectives After studying this chapter, you should be able to… Describe basic accrual accounting concepts,

- 3. Learning Objective 1 Describe the basic accrual accounting concepts, including the matching concept

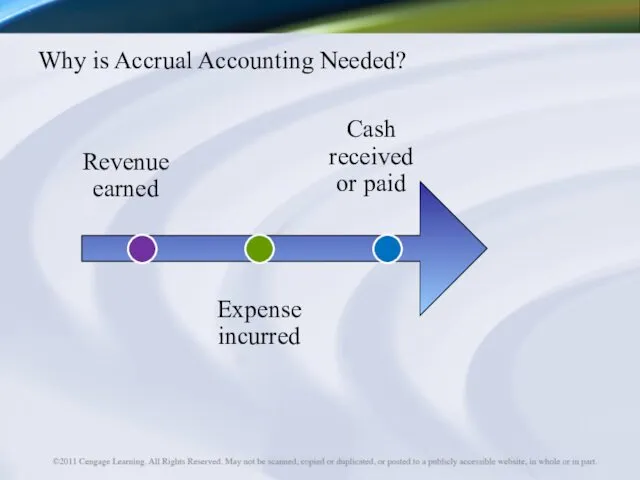

- 4. Why is Accrual Accounting Needed? Cash received or paid Revenue earned Expense incurred

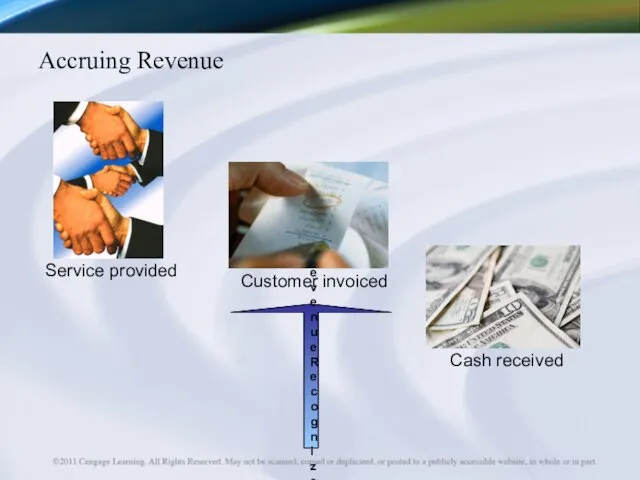

- 5. Accruing Revenue Revenue Recognized

- 6. Accruing Revenue Expense Recognized

- 7. Matching Principle

- 8. Learning Objective 2 Use accrual concepts of accounting to analyze, record, and summarize transactions

- 9. Accrual Concepts – Family Health Care Transactions Services are provided to patients Insurance is filed, payment

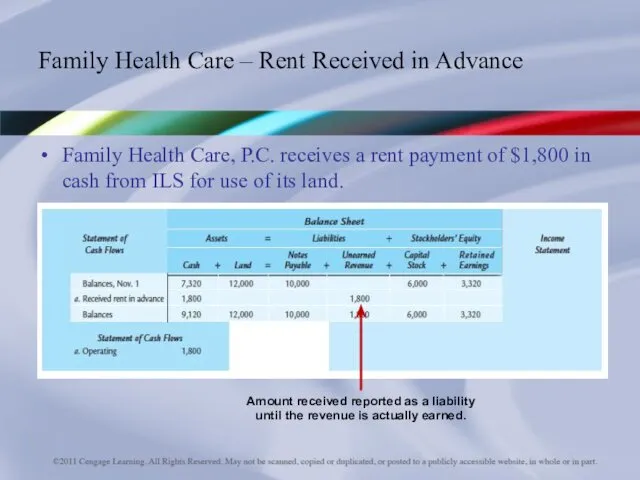

- 10. Family Health Care, P.C. receives a rent payment of $1,800 in cash from ILS for use

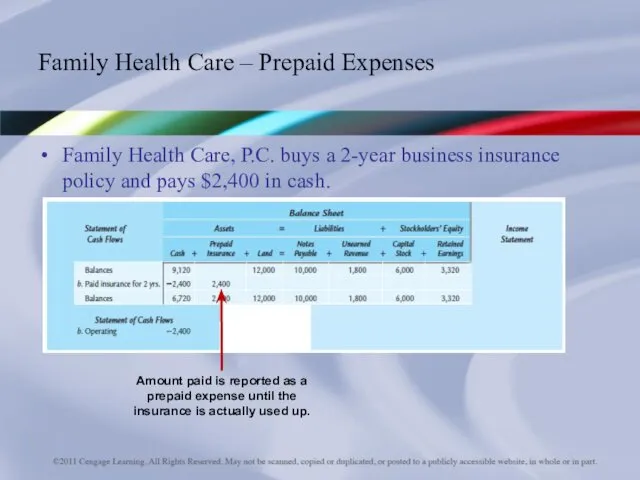

- 11. Family Health Care – Prepaid Expenses Family Health Care, P.C. buys a 2-year business insurance policy

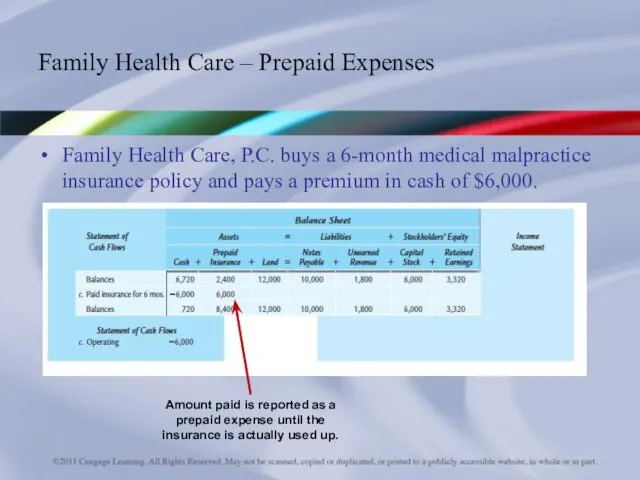

- 12. Family Health Care, P.C. buys a 6-month medical malpractice insurance policy and pays a premium in

- 13. Dr. Landry invests an additional $5,000 in the business and receives capital stock. Family Health Care

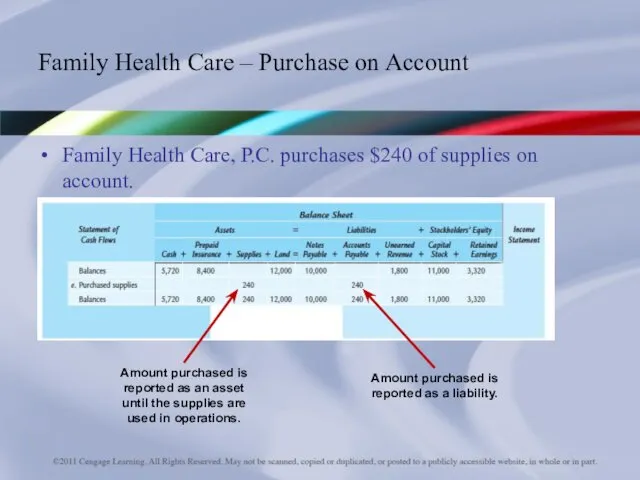

- 14. Family Health Care, P.C. purchases $240 of supplies on account. Family Health Care – Purchase on

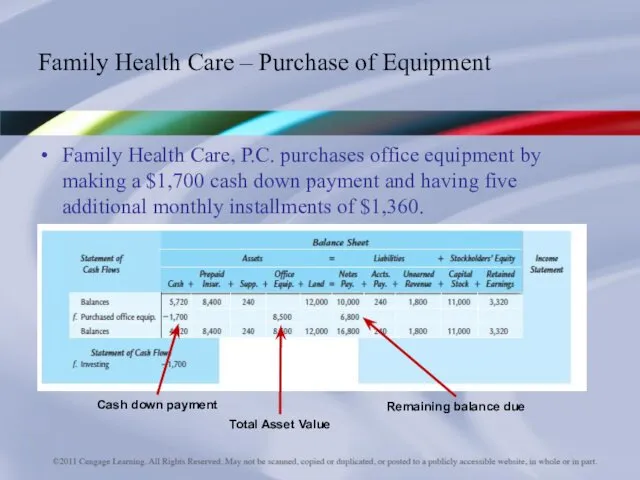

- 15. Family Health Care, P.C. purchases office equipment by making a $1,700 cash down payment and having

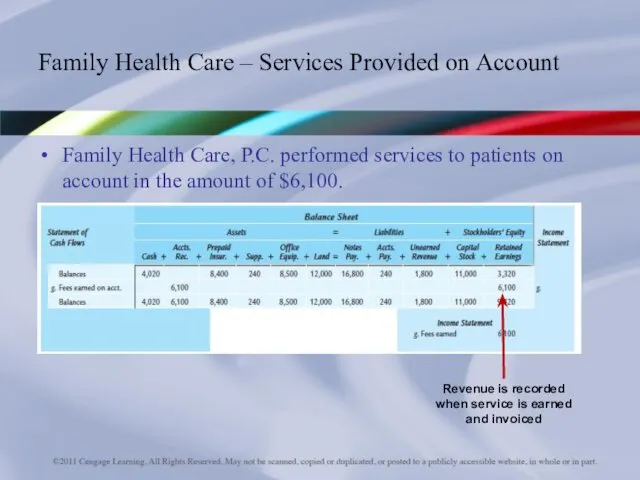

- 16. Family Health Care, P.C. performed services to patients on account in the amount of $6,100. Family

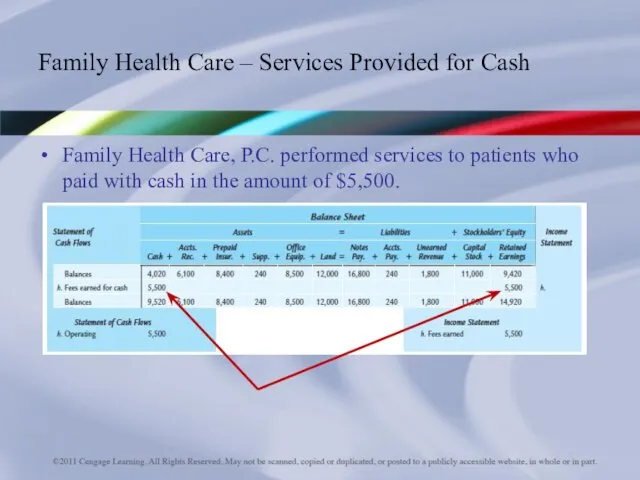

- 17. Family Health Care, P.C. performed services to patients who paid with cash in the amount of

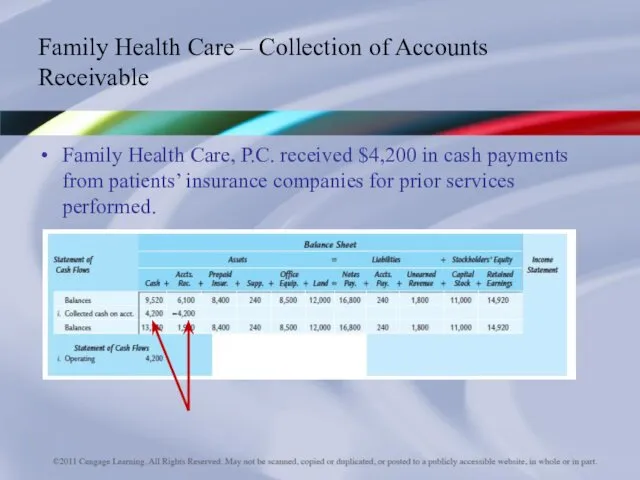

- 18. Family Health Care, P.C. received $4,200 in cash payments from patients’ insurance companies for prior services

- 19. Family Health Care, P.C. paid $100 for supplies previously purchased on account. Family Health Care –

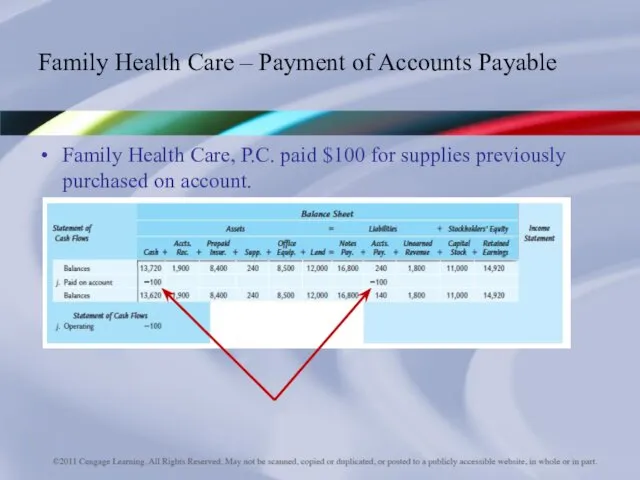

- 20. Family Health Care, P.C. incurred expenses for the month of November and paid cash for a

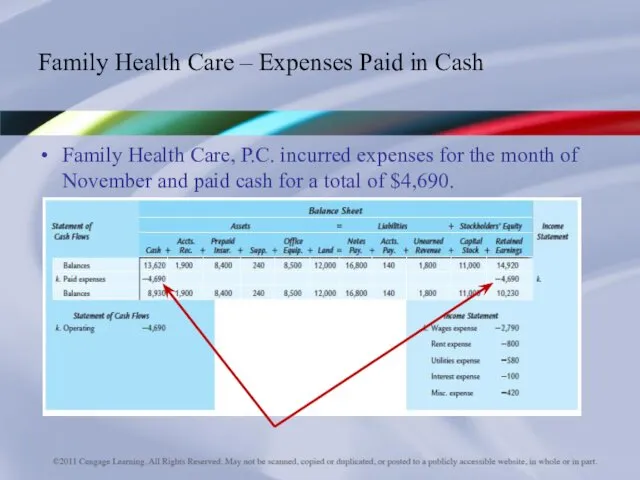

- 21. Family Health Care, P.C. paid dividends of $1,200. Family Health Care – Dividends Paid in Cash

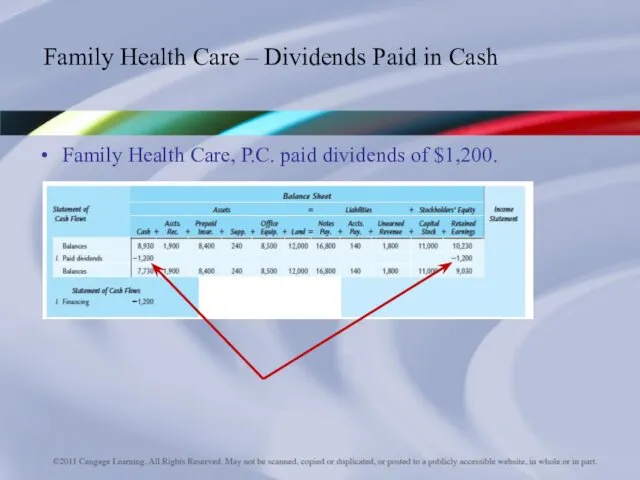

- 22. Learning Objective 3 Describe and illustrate the end-of-period adjustment process

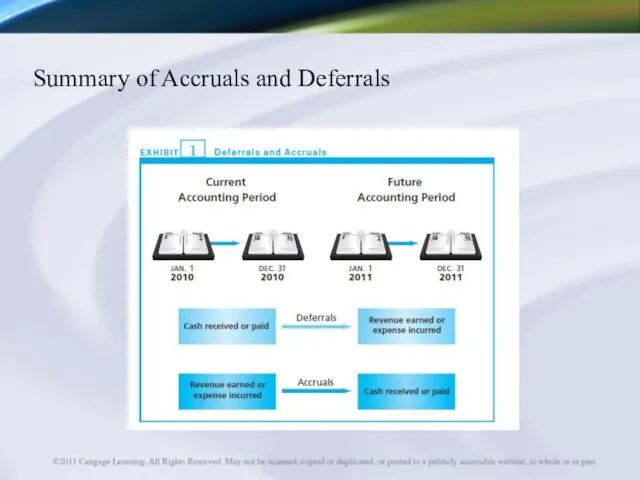

- 23. Summary of Accruals and Deferrals

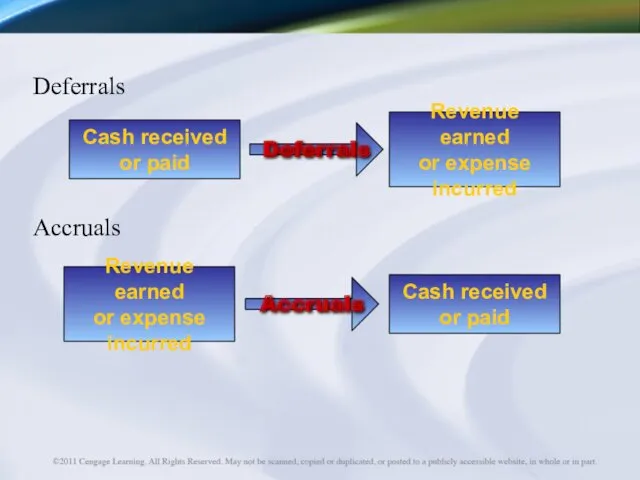

- 24. Deferrals Accruals

- 25. Deferred Expenses – Prepaid Insurance As prepaid insurance expires, the asset Prepaid Insurance decreases. Adjustments affect

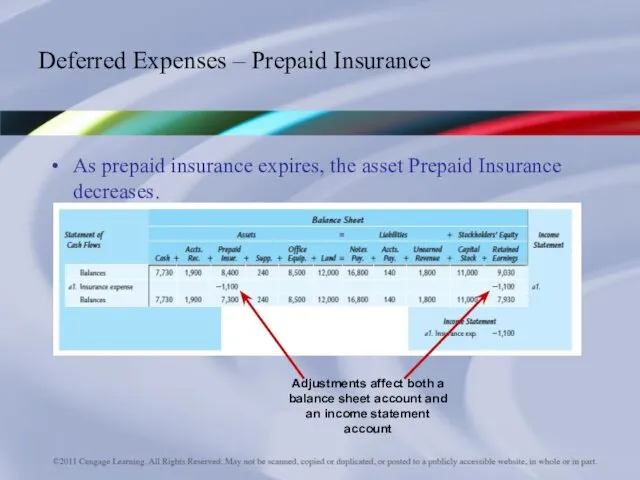

- 26. Deferred Expenses – Supplies During November, $150 of supplies was used in operations leaving a balance

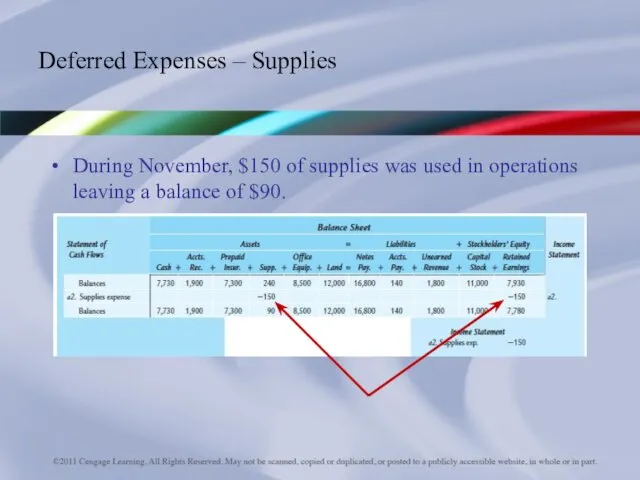

- 27. Fixed Assets and Depreciation

- 28. Deferred Expenses – Depreciation The depreciation on Office Equipment for Family Health Care is assumed to

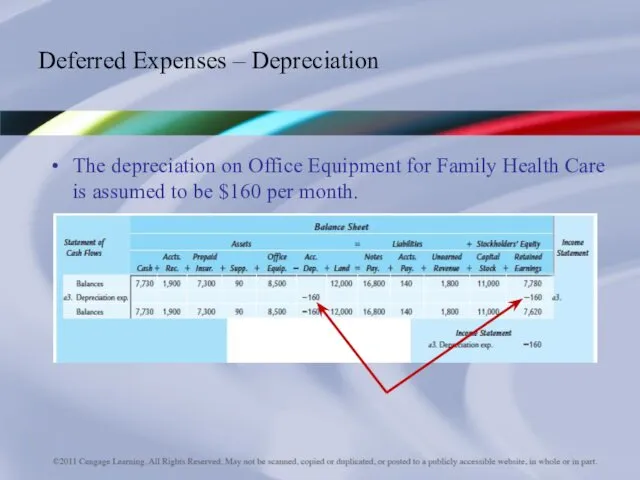

- 29. Deferred Revenue – Unearned Rent On November 1, Family Health Care received $1,800 from ILS for

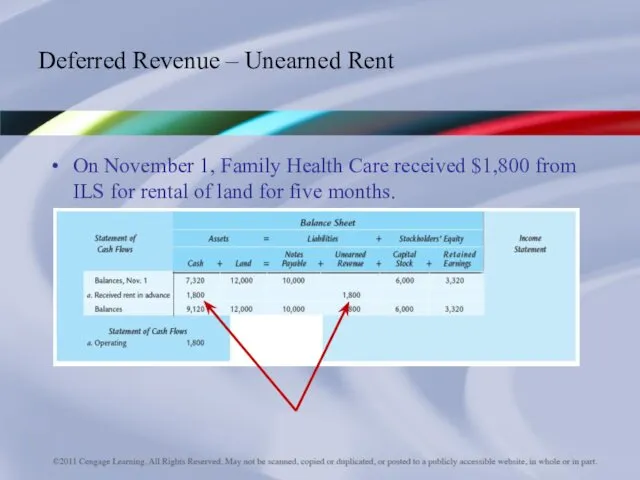

- 30. Accrued Expenses – Wages Owed

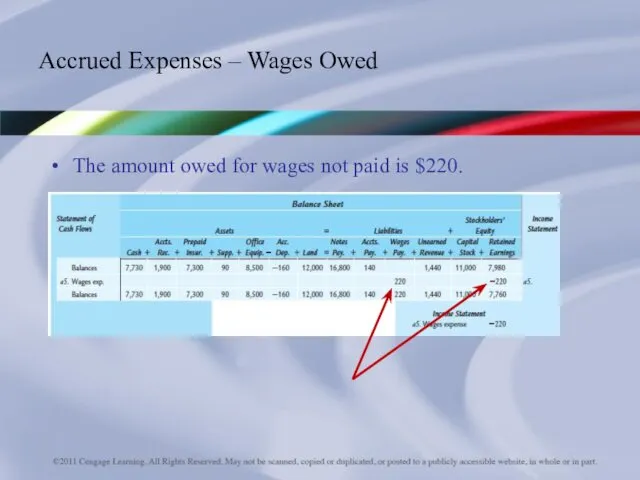

- 31. Accrued Expenses – Wages Owed The amount owed for wages not paid is $220.

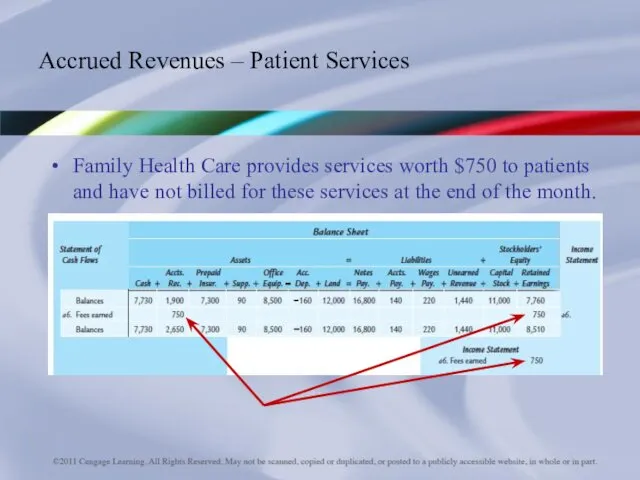

- 32. Accrued Revenues – Patient Services Family Health Care provides services worth $750 to patients and have

- 33. Learning Objective 4 Prepare financial statements using accrual concepts of accounting, including a classified balance sheet

- 34. Summary of Transactions for Family Health Care Family Health Care, P.C. prepares the four required financial

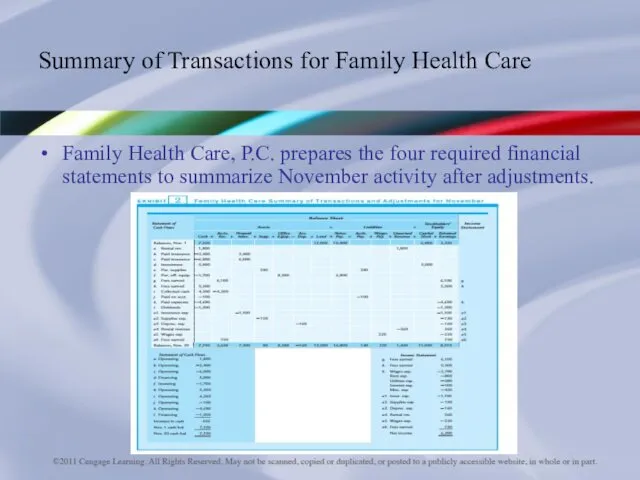

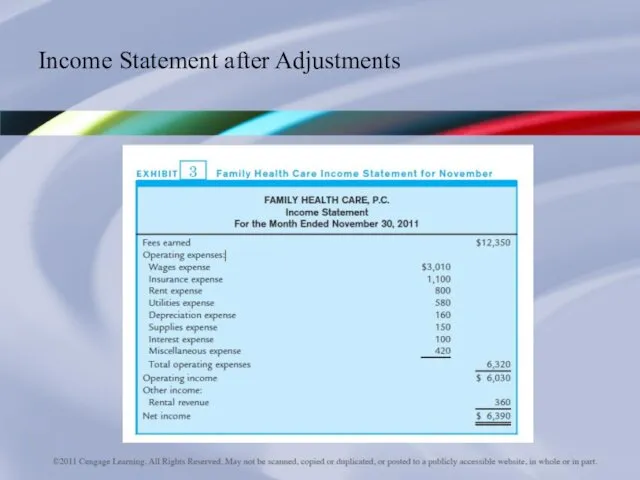

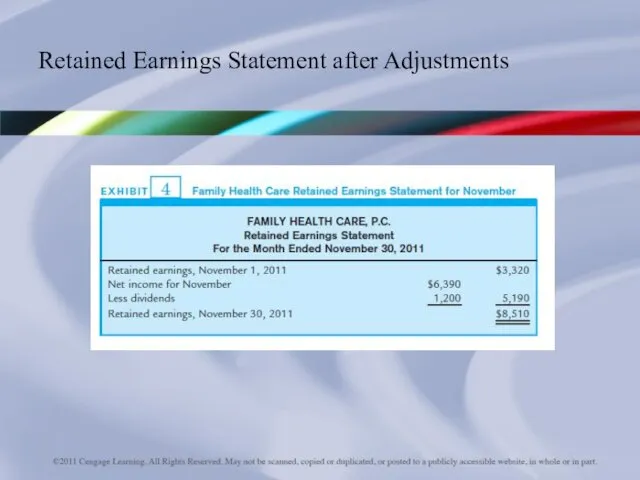

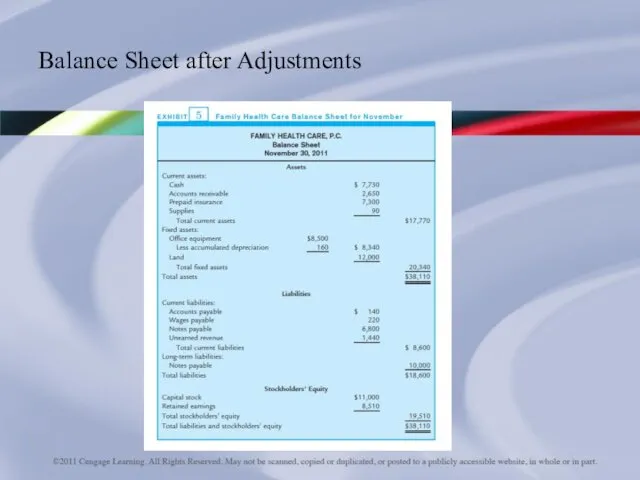

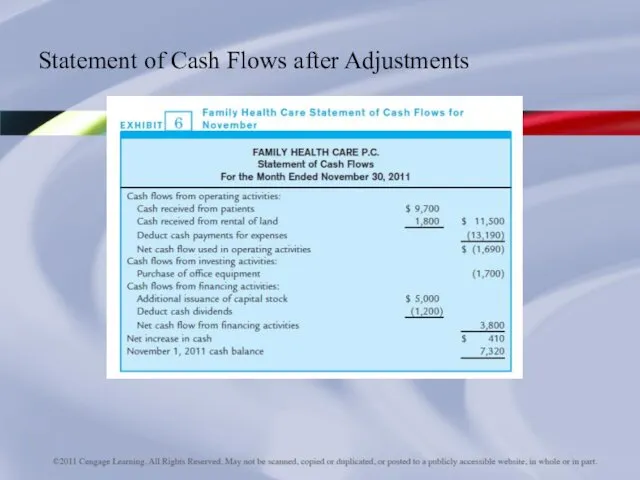

- 35. Income Statement after Adjustments

- 36. Retained Earnings Statement after Adjustments

- 37. Balance Sheet after Adjustments

- 38. Statement of Cash Flows after Adjustments

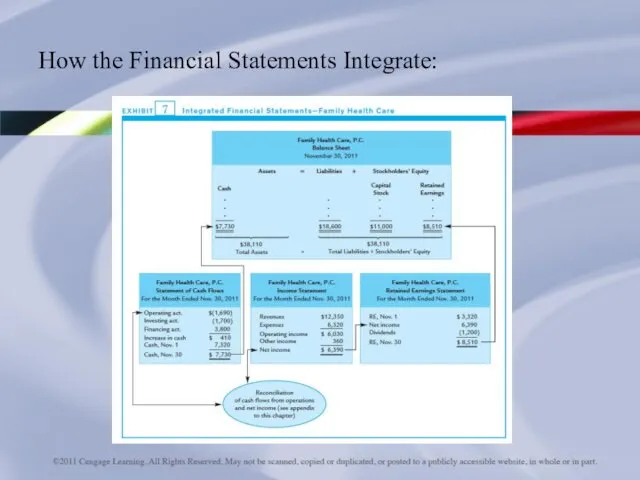

- 39. How the Financial Statements Integrate:

- 40. Learning Objective 5 Describe how the accrual basis of accounting enhances the interpretation of financial statements

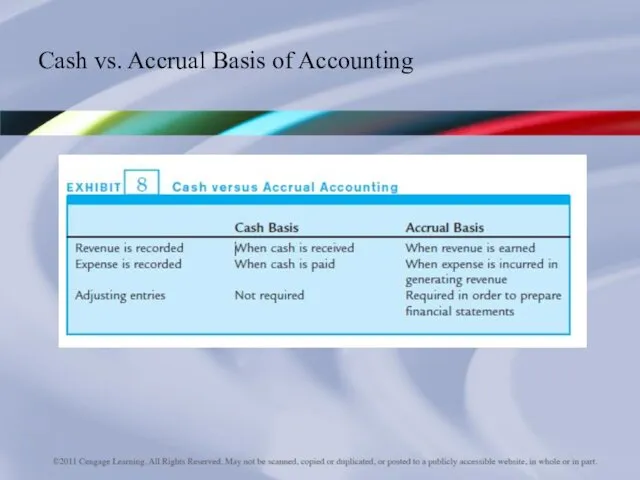

- 41. Cash vs. Accrual Basis of Accounting

- 42. Importance of Accrual Based Accounting Accrual based accounting provides a more accurate measure of company performance.

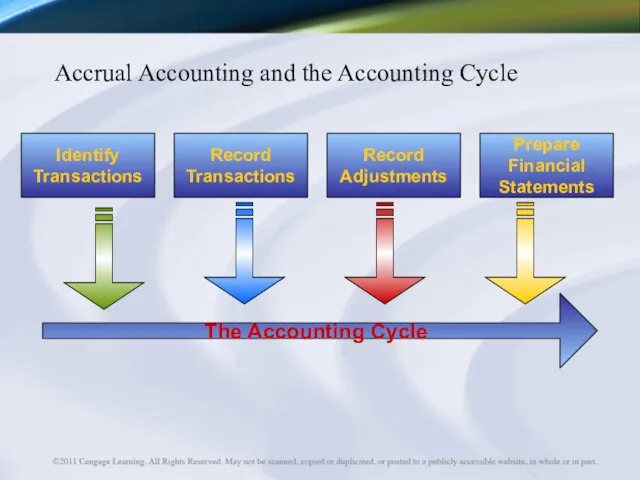

- 43. Accrual Accounting and the Accounting Cycle

- 45. Скачать презентацию

Управление рисками Интернет-торговли

Управление рисками Интернет-торговли Налоговая отчетность за 1 квартал 2020 года

Налоговая отчетность за 1 квартал 2020 года Активное и пассивное управление инвестиционным портфелем

Активное и пассивное управление инвестиционным портфелем Международная финансовая корпорация (МФК)

Международная финансовая корпорация (МФК) Национальный проект Демография

Национальный проект Демография Банковская система США

Банковская система США Кредитный риск

Кредитный риск Государственный бюджет

Государственный бюджет Операционный отчет

Операционный отчет Основы финансовой системы Великобритании

Основы финансовой системы Великобритании Учет оплаты труда и расчетов с персоналом предприятия. (Тема 9)

Учет оплаты труда и расчетов с персоналом предприятия. (Тема 9) Сақтандыруға түрткі болатын басты себеп

Сақтандыруға түрткі болатын басты себеп Виконання Інвестиційної програми за 2016 рік м.Вінниця

Виконання Інвестиційної програми за 2016 рік м.Вінниця Изменение мотивационной программы кредитных экспертов ПОС и специалистов по сопровождению продаж АВТО

Изменение мотивационной программы кредитных экспертов ПОС и специалистов по сопровождению продаж АВТО Поняття ризику. Основні характеристики ризику

Поняття ризику. Основні характеристики ризику Программа добровольного индивидуального страхования Стоп.коронавирус

Программа добровольного индивидуального страхования Стоп.коронавирус Кредитование физических лиц в коммерческом банке

Кредитование физических лиц в коммерческом банке Недержавне пенсійне страхування: стан та перспективи розвитку

Недержавне пенсійне страхування: стан та перспективи розвитку О нарушениях прав потребителей финансовых услуг

О нарушениях прав потребителей финансовых услуг Рокетбанк. Инновационное IT решение для самозанятых предпринимателей Орифлэйм

Рокетбанк. Инновационное IT решение для самозанятых предпринимателей Орифлэйм Страхование физического лица

Страхование физического лица Специальные режимы налогообложения

Специальные режимы налогообложения Банковские карты

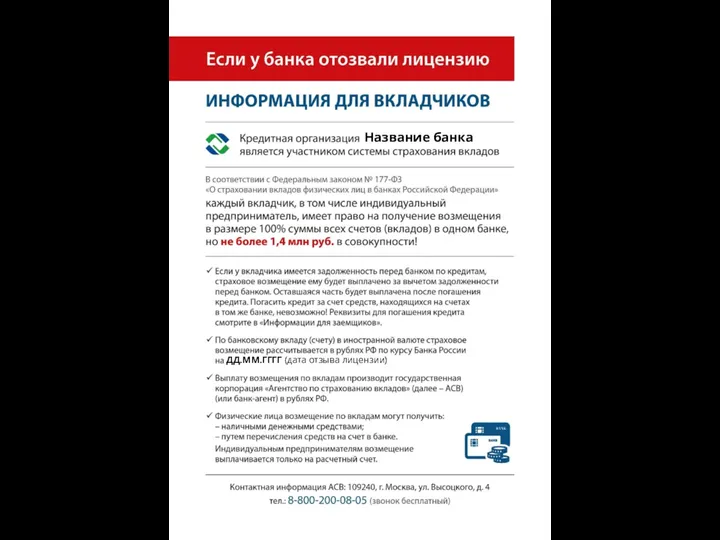

Банковские карты Если у банка отозвали лицензию. Информация для вкладчиков

Если у банка отозвали лицензию. Информация для вкладчиков Транспортный налог в Челябинской области на 2016 год

Транспортный налог в Челябинской области на 2016 год Начальная (максимальная) цена контракта (НМЦК)

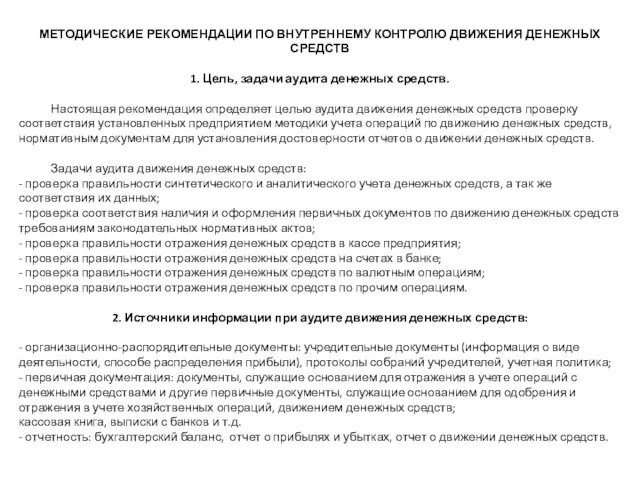

Начальная (максимальная) цена контракта (НМЦК) Методические рекомендации по внутреннему контролю движения денежных средств

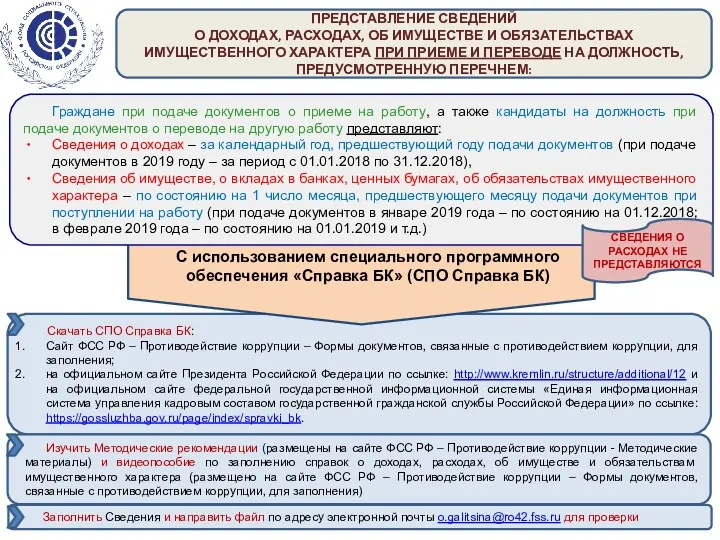

Методические рекомендации по внутреннему контролю движения денежных средств Заполнение справок о доходах

Заполнение справок о доходах