Содержание

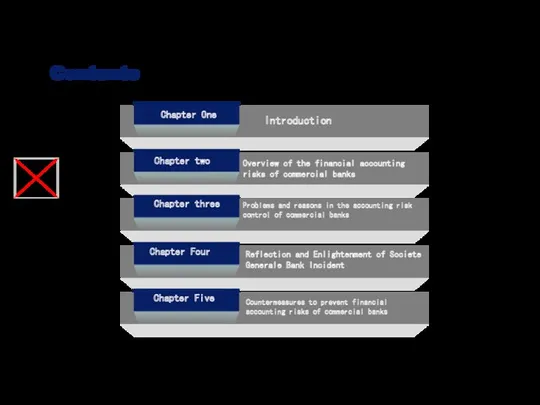

- 2. Contents Chapter One Chapter two Chapter three Chapter Four Introduction Overview of the financial accounting risks

- 3. Introduction Chapter One

- 4. 1 Background and significance of topic selection 1.1Background of topic selection As the backbone of chinese

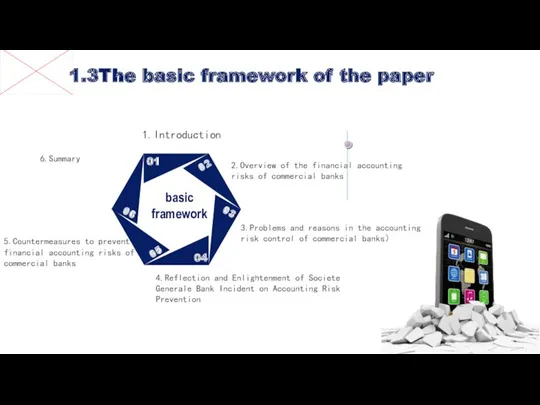

- 5. 1.Introduction 2.Overview of the financial accounting risks of commercial banks 3.Problems and reasons in the accounting

- 6. Overview of the financial accounting risks of commercial banks Chapter two 2.1 The meaning of financial

- 7. 2.1 2.2 2 Overview of the financial accounting risks of commercial banks

- 8. 2.3 2.4 2 Overview of the financial accounting risks of commercial banks

- 9. Problems and reasons in the accounting risk control of commercial banks Chapter three 3.1 Problems in

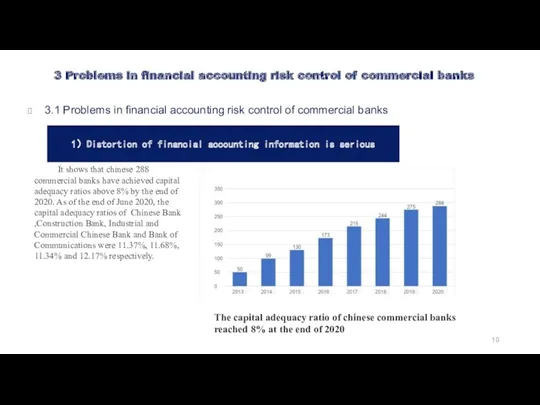

- 10. 3 Problems in financial accounting risk control of commercial banks 3.1 Problems in financial accounting risk

- 11. 3 Problems in financial accounting risk control of commercial banks 3.1 Problems in financial accounting risk

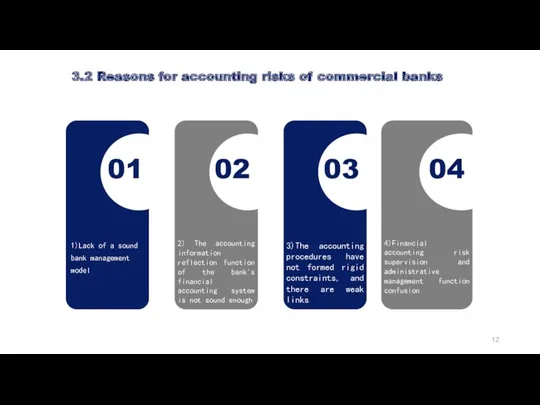

- 12. 3.2 Reasons for accounting risks of commercial banks 01 02 03 04 3)The accounting procedures have

- 13. Reflection and Enlightenment of Societe Generale Bank Incident on Accounting Risk Prevention Chapter four 4.1 Societe

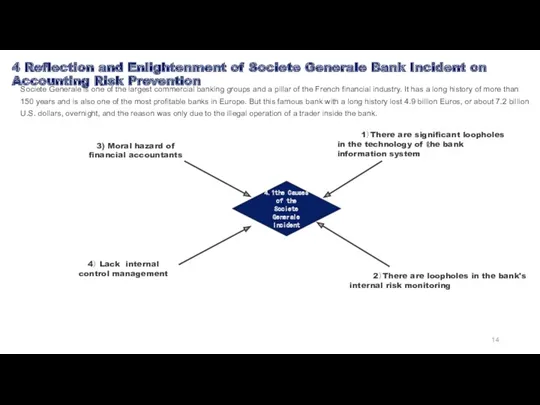

- 14. 4 Reflection and Enlightenment of Societe Generale Bank Incident on Accounting Risk Prevention 4.1the Causes of

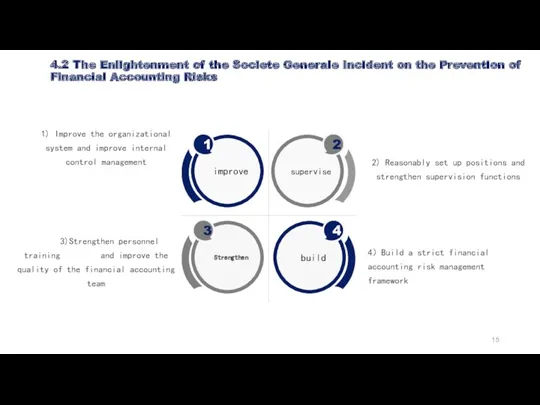

- 15. 4.2 The Enlightenment of the Societe Generale Incident on the Prevention of Financial Accounting Risks supervise

- 16. Countermeasures to prevent financial accounting risks of commercial banks Chapter five

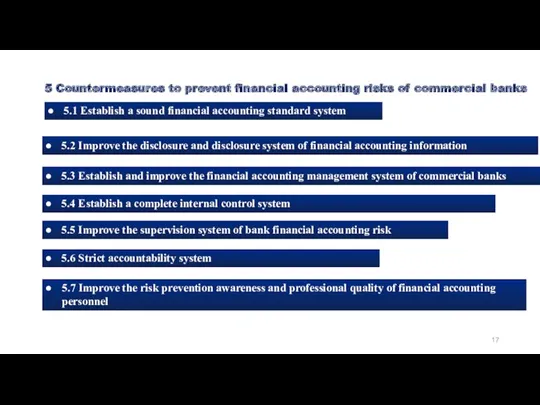

- 17. 5 Countermeasures to prevent financial accounting risks of commercial banks 5.1 Establish a sound financial accounting

- 19. Скачать презентацию

Нормативно-правовое регулирование бухгалтерского учета в Республике Казахстан

Нормативно-правовое регулирование бухгалтерского учета в Республике Казахстан Государственное пенсионное обеспечение. Размеры пенсий по ГПО

Государственное пенсионное обеспечение. Размеры пенсий по ГПО Приват банкинг в России

Приват банкинг в России Агентство регионального развития. Малый и средний бизнес и поддержка индивидуальной предпринимательской инициативы

Агентство регионального развития. Малый и средний бизнес и поддержка индивидуальной предпринимательской инициативы Сравнительный анализ программ автокредитования

Сравнительный анализ программ автокредитования Задачи к ГИА по дисциплине Аудит

Задачи к ГИА по дисциплине Аудит Счётная палата Российской Федерации

Счётная палата Российской Федерации Prezentatsia_ипотека

Prezentatsia_ипотека Администрация сельского поседения Сосновка. Об исполнении бюджета за 1 квартал 2023 г

Администрация сельского поседения Сосновка. Об исполнении бюджета за 1 квартал 2023 г Ответы на вопросы (сентябрь 2023)

Ответы на вопросы (сентябрь 2023) Гражданский бюджет

Гражданский бюджет Расчет отпускных. Начисление отпускных

Расчет отпускных. Начисление отпускных Результаты мониторинга электронной базы данных деклараций на товары, корректировок таможенной стоимости и таможенных платежей

Результаты мониторинга электронной базы данных деклараций на товары, корректировок таможенной стоимости и таможенных платежей Экспертные оценки рисков

Экспертные оценки рисков Правоохранительная деятельность и правовое регулирование бухгалтерского учета. (Тема 1)

Правоохранительная деятельность и правовое регулирование бухгалтерского учета. (Тема 1) Правовой статус и регулирование криптовалют

Правовой статус и регулирование криптовалют Нормативные и правовые основания законной налоговой оптимизации

Нормативные и правовые основания законной налоговой оптимизации Бюджетирование в системе управленческого учета организации: порядок разработки, внедрение, эффективность

Бюджетирование в системе управленческого учета организации: порядок разработки, внедрение, эффективность Зачем и как заниматься коммерциализацией результатов НИОКР в ВУЗе

Зачем и как заниматься коммерциализацией результатов НИОКР в ВУЗе Секьюритизация финансовых рынков и финансовых активов: за и против

Секьюритизация финансовых рынков и финансовых активов: за и против Международные валютно-кредитные отношения

Международные валютно-кредитные отношения Акцизы. Плательщики акциза

Акцизы. Плательщики акциза Корпоративні фінанси. Дивідендна політика корпоративних підприємств. (Тема 5)

Корпоративні фінанси. Дивідендна політика корпоративних підприємств. (Тема 5) Европейский банк реконструкции и развития

Европейский банк реконструкции и развития Перерасчет платы за услуги по содержанию и ремонту общего имущества многоквартирного жилого дома

Перерасчет платы за услуги по содержанию и ремонту общего имущества многоквартирного жилого дома Управление кредитным портфелем

Управление кредитным портфелем The potential impact of the implementation of ifrs for smes on banks' credit desicion, in the case of the republic of Кazakhstan

The potential impact of the implementation of ifrs for smes on banks' credit desicion, in the case of the republic of Кazakhstan Фонд развития промышленности Владимирской области

Фонд развития промышленности Владимирской области