Слайд 2

Introduction

SMEs are considered as the main source of modernization, innovation and

entrepreneurial spirit

July 2009 the IASB published the IFRS for SMEs

January 1, 2013 Kazakhstan has declared that from SMEs and state institutions were obliged to prepare its financial statemens according to IFRS for SMEs.

The main objective: to meet the SMEs financial statements users' needs

Слайд 3

Introduction(continuation)

The main users of the SMEs’ financial statements:

In our work

we are concentrated on banks as a main users.

Opaqueness is the first factor that might constrain financial institutions to start, financing SMEs

Слайд 4

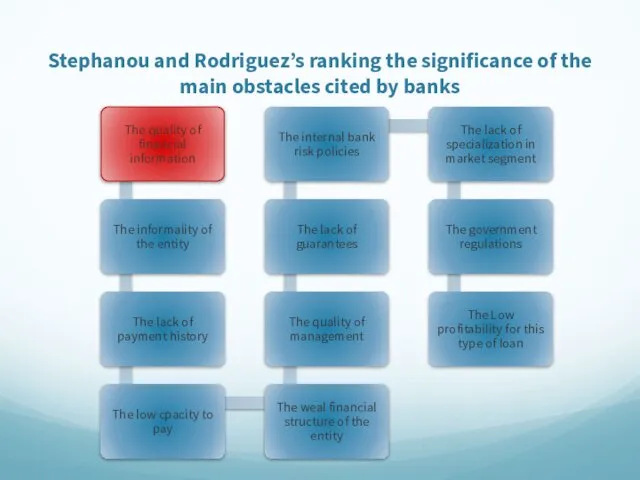

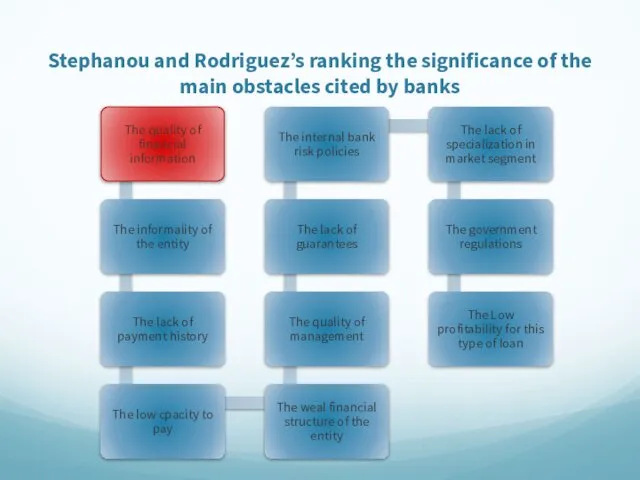

Stephanou and Rodriguez’s ranking the significance of the main obstacles cited

by banks

Слайд 5

Literature review

Many countries, such as Sweden, Czech Republic, Germany, Albania, Pakistan,

have a numerous research works directly and indirectly related to our work. The most significant ones:

Nermine Ahmed Mamdouh, “The Potential Effect of the Implementation of the IFRS For Smes on the Credit Decision for Small Entities”, International Business Research Conference in Dubai

Henning Zuelch and Stephan Burghardt, “The granting of loans by German banks to SMEs against the background of international financial reporting”

Слайд 6

Method

We used qualitative and quantitative method:

Firstly we created a questionnaire

Secondly

we used percentage analysis to quantify our results from the questionnaire

Our questionnaire is divided into 4 parts and totally consists 17 close ended questions.

We distributed our questionnaires to 34 second –tier banks that operate in Kazakhstan.

Слайд 7

Method

We have identified that 7 banks:

Trading and Industrial Bank of China

in Kazakhstan, Subsidiary Bank of China in Kazakhstan, Subsidiary Bank “Home Credit and Finance Bank”, Subsidiary Bank RBS Kazakhstan, “Al Hilal” Islamic Bank, Zaman bank, Citibank- do not issue loans for SMEs.

11 banks permitted to conduct a survey and officially answered to our questionnaire through the email address and by post.

Слайд 8

Findings

Our main findings are:

Banks have strong relationship with SMEs and, moreover,

have perspective strategic interest about them.

Banks have strong relationship with SMEs and, moreover, have perspective strategic interest about them.

Banks have strong relationship with SMEs and, moreover, have perspective strategic interest about them.

Banks agree with the statement that the quality of financial information is very significant for the banks’ decision making

Надзор и регулирование деятельности банков и страховых компаний

Надзор и регулирование деятельности банков и страховых компаний Анализ публичного бюджета Лысьвенского городского округа

Анализ публичного бюджета Лысьвенского городского округа Электронные платежные системы

Электронные платежные системы Учет, анализ и аудит дебиторской и кредиторской задолженности в организации (на примере ООО Профи Гласс

Учет, анализ и аудит дебиторской и кредиторской задолженности в организации (на примере ООО Профи Гласс Личное финансовое планирование

Личное финансовое планирование Банковские информационные системы

Банковские информационные системы Кому подходит новый режим?

Кому подходит новый режим? Финансовый отдел администрации Торопецкого района. Формирование бюджета города Торопца

Финансовый отдел администрации Торопецкого района. Формирование бюджета города Торопца Supply and demand

Supply and demand Операции на международном валютном рынке

Операции на международном валютном рынке Планирование производства. Тема 3

Планирование производства. Тема 3 Эволюция мировой валютной системы

Эволюция мировой валютной системы Корпорация қаржысының жайкүйін бағалау және қаржының тұрақтылығына қол жеткізу жолы

Корпорация қаржысының жайкүйін бағалау және қаржының тұрақтылығына қол жеткізу жолы Финансы и кредит

Финансы и кредит Тактическое финансовое планирование

Тактическое финансовое планирование Корпоративные финансы. Сущность и функции корпоративных финансов

Корпоративные финансы. Сущность и функции корпоративных финансов Гранты Президента Российской Федерации на развитие общества в 2018 году

Гранты Президента Российской Федерации на развитие общества в 2018 году Управление затратами. Понятие и классификация затрат. Методы управление затратами. Директ-костинг

Управление затратами. Понятие и классификация затрат. Методы управление затратами. Директ-костинг Финансовые риски и способы их минимизации презентация

Финансовые риски и способы их минимизации презентация Единый сельскохозяйственный налог

Единый сельскохозяйственный налог ОАО АСБ Беларусбанк

ОАО АСБ Беларусбанк Бюджет для граждан

Бюджет для граждан Состав таможенных платежей

Состав таможенных платежей Basic financial statements

Basic financial statements Управление финансовыми потоками на ОАО Хлебозавод № 5

Управление финансовыми потоками на ОАО Хлебозавод № 5 Проблемы наличного обращения

Проблемы наличного обращения Финансовые меры поддержки для СМСП по муниципальной программе Развитие и поддержка малого и среднего предпринимательства

Финансовые меры поддержки для СМСП по муниципальной программе Развитие и поддержка малого и среднего предпринимательства Порядок исполнения бюджета Свердловской области

Порядок исполнения бюджета Свердловской области