Содержание

- 2. The Concept of the Business Entity Vagabond Travel Agency A business entity is separate from the

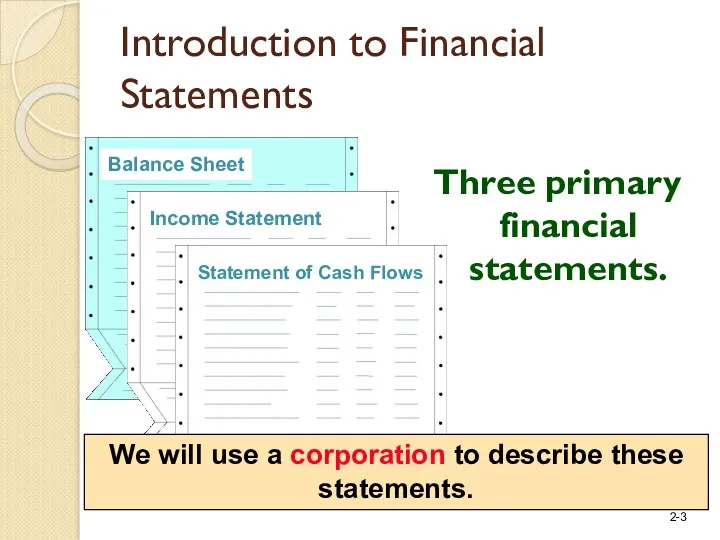

- 3. Introduction to Financial Statements Three primary financial statements. We will use a corporation to describe these

- 4. Introduction to Financial Statements

- 5. Introduction to Financial Statements

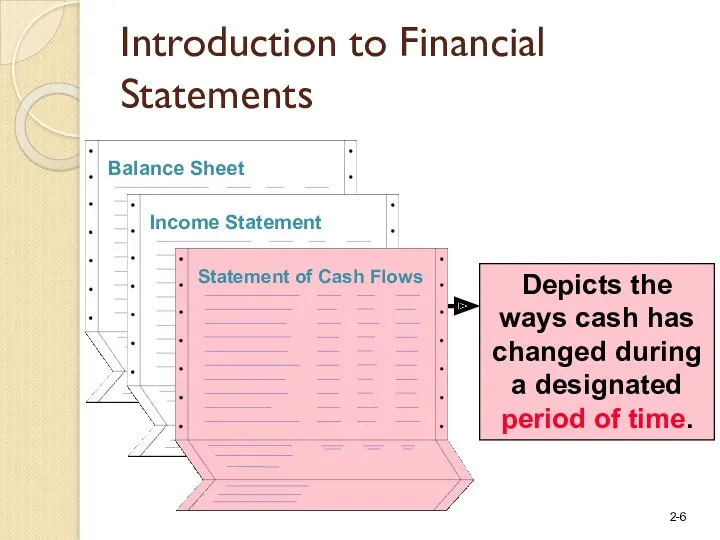

- 6. Introduction to Financial Statements

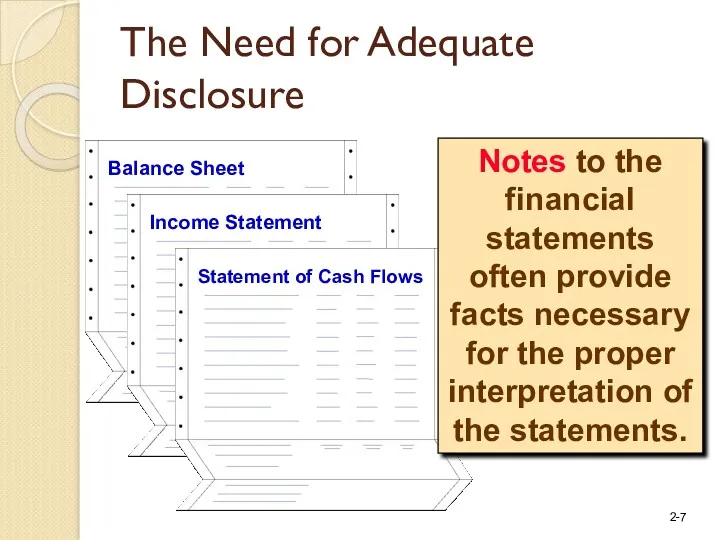

- 7. The Need for Adequate Disclosure Notes to the financial statements often provide facts necessary for the

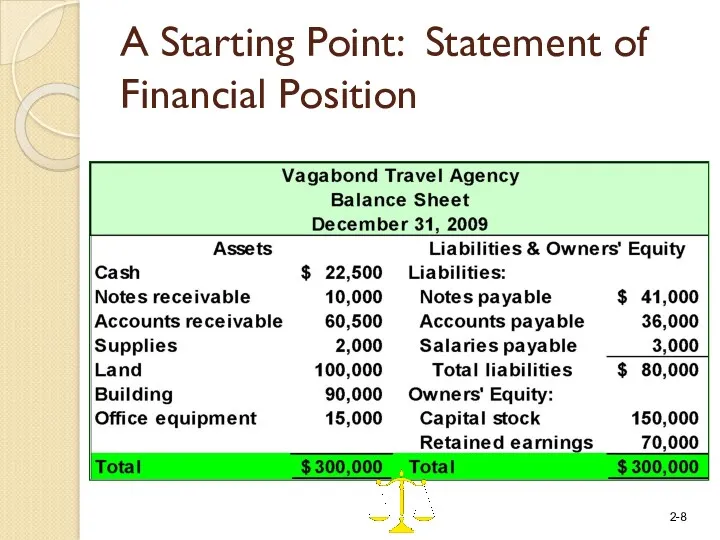

- 8. A Starting Point: Statement of Financial Position

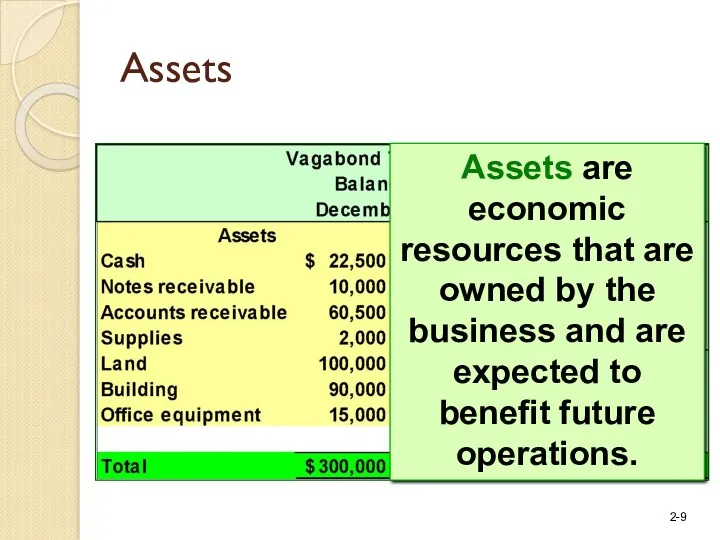

- 9. Assets Assets are economic resources that are owned by the business and are expected to benefit

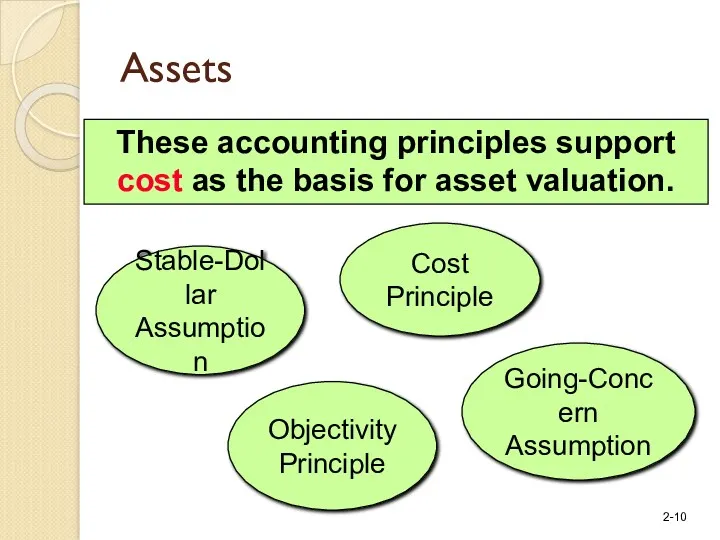

- 10. Assets Cost Principle Going-Concern Assumption Objectivity Principle Stable-Dollar Assumption These accounting principles support cost as the

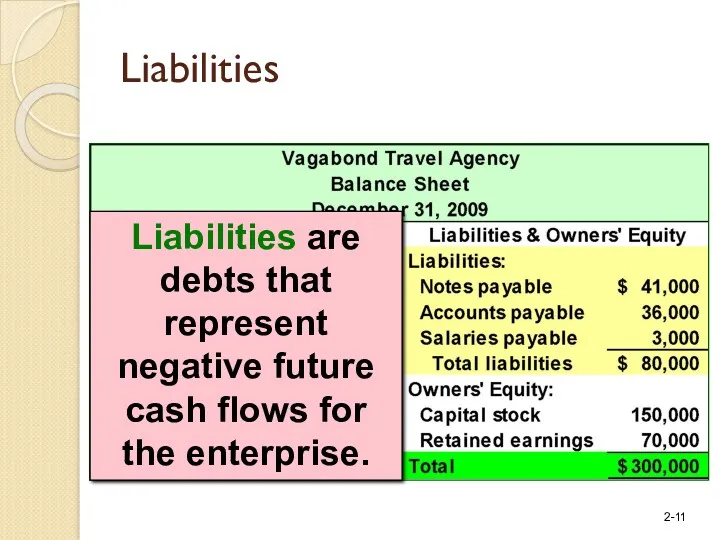

- 11. Liabilities Liabilities are debts that represent negative future cash flows for the enterprise.

- 12. Owners’ Equity Owners’ equity represents the owners’ claims on the assets of the business.

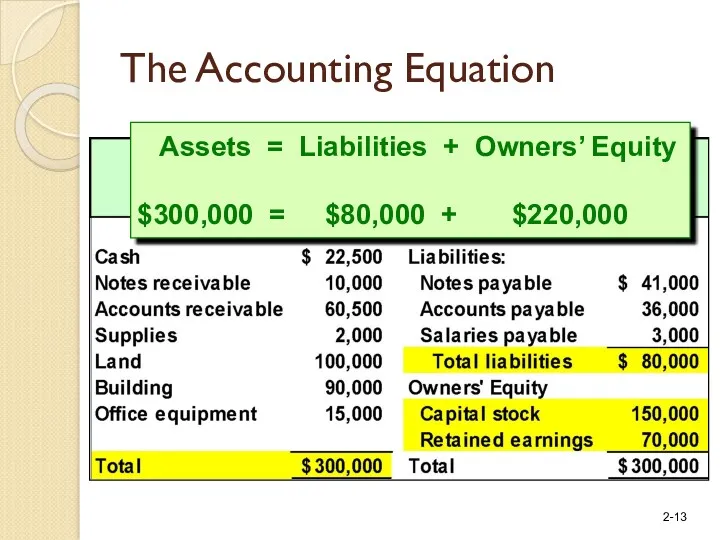

- 13. The Accounting Equation Assets = Liabilities + Owners’ Equity $300,000 = $80,000 + $220,000

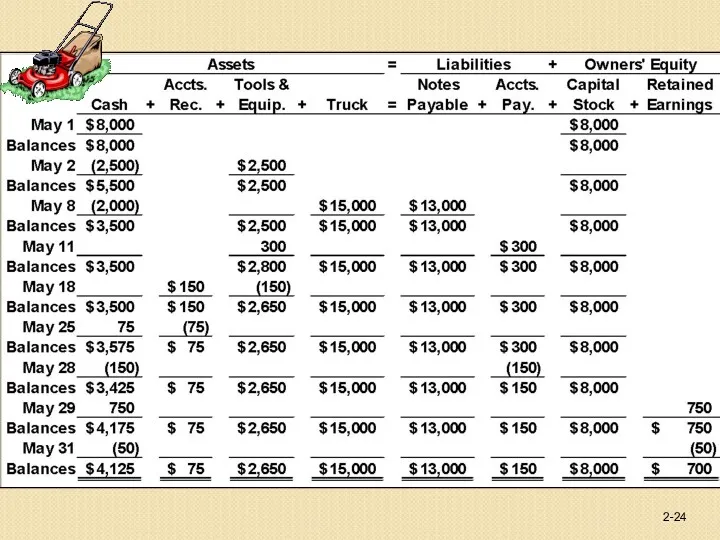

- 14. Let’s analyze transactions for JJ’s Lawn Care Service.

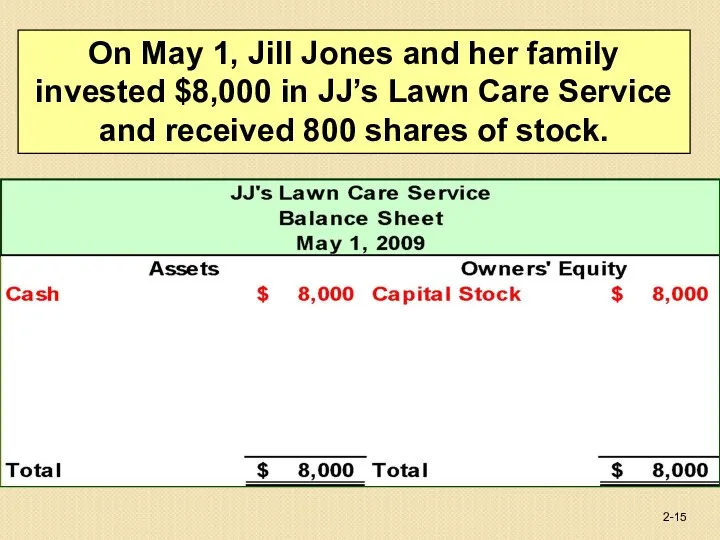

- 15. On May 1, Jill Jones and her family invested $8,000 in JJ’s Lawn Care Service and

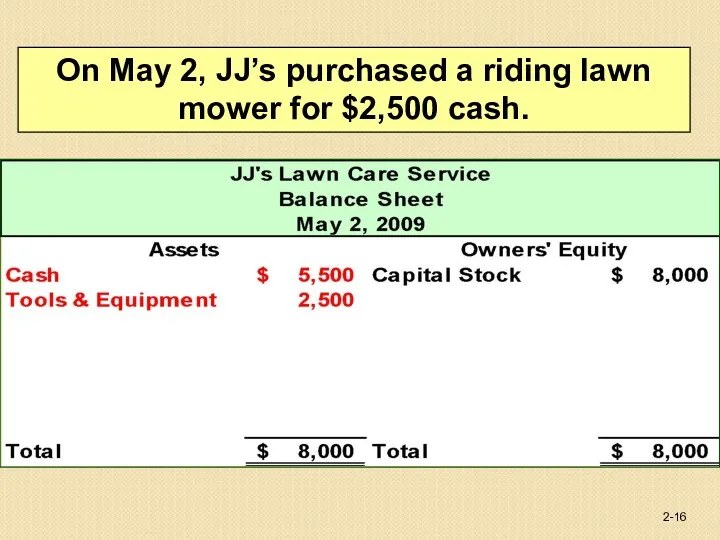

- 16. On May 2, JJ’s purchased a riding lawn mower for $2,500 cash.

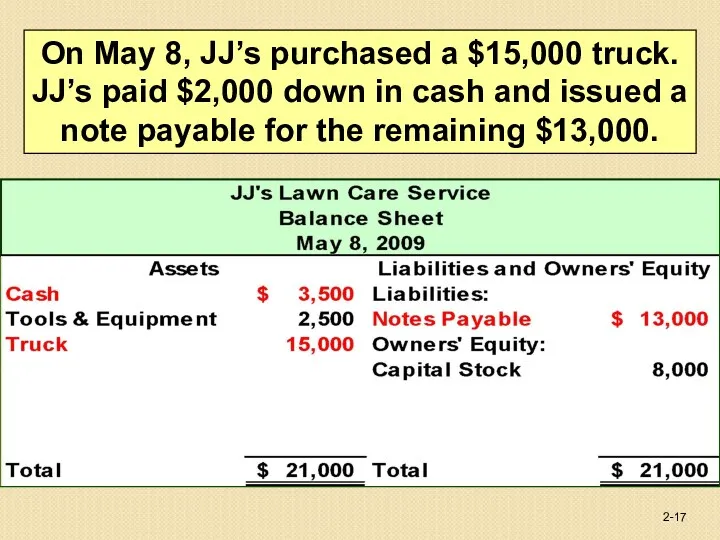

- 17. On May 8, JJ’s purchased a $15,000 truck. JJ’s paid $2,000 down in cash and issued

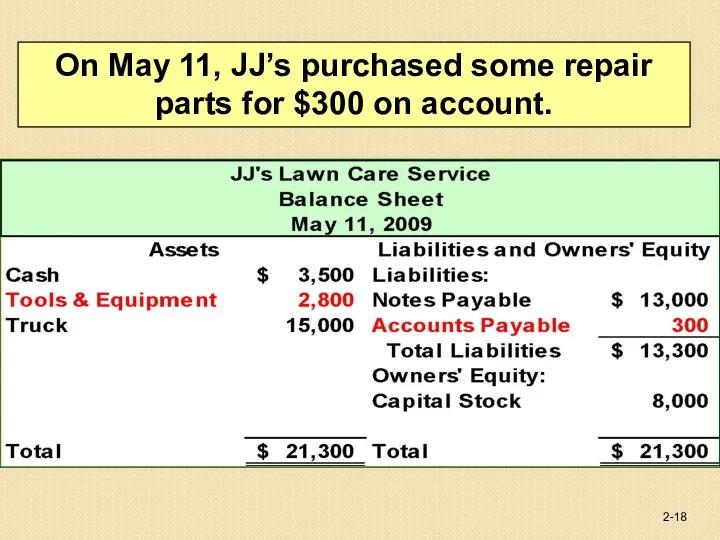

- 18. On May 11, JJ’s purchased some repair parts for $300 on account.

- 19. Jill realized she had purchased more repair parts than needed. On May 18, JJ’s was able

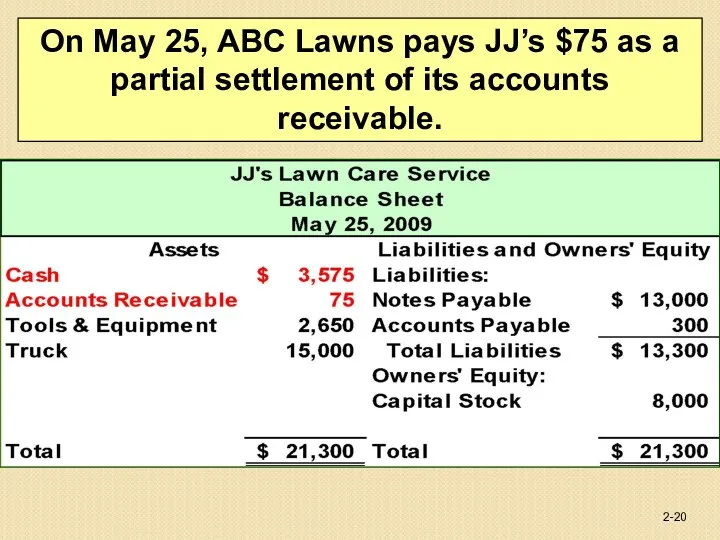

- 20. On May 25, ABC Lawns pays JJ’s $75 as a partial settlement of its accounts receivable.

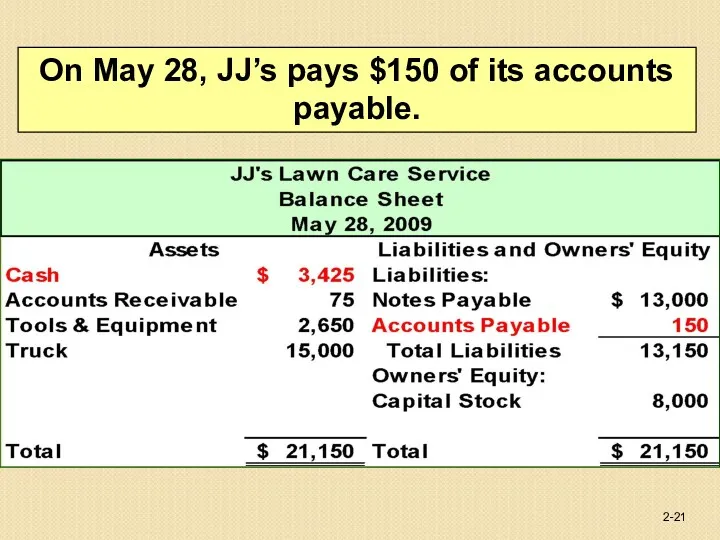

- 21. On May 28, JJ’s pays $150 of its accounts payable.

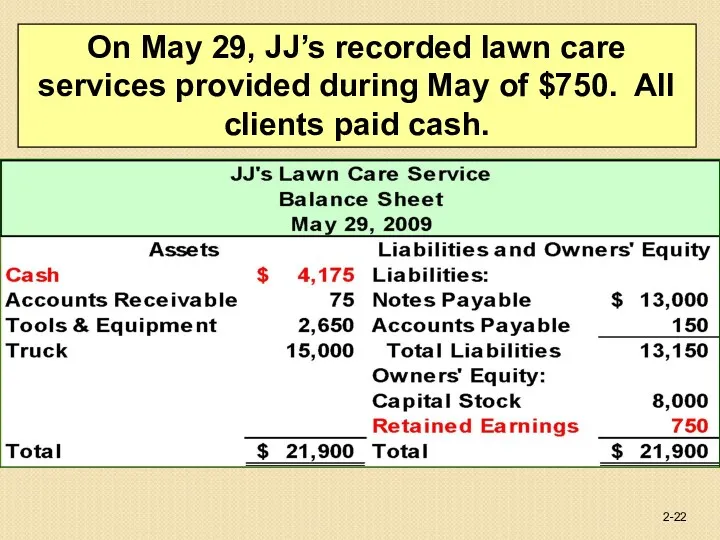

- 22. On May 29, JJ’s recorded lawn care services provided during May of $750. All clients paid

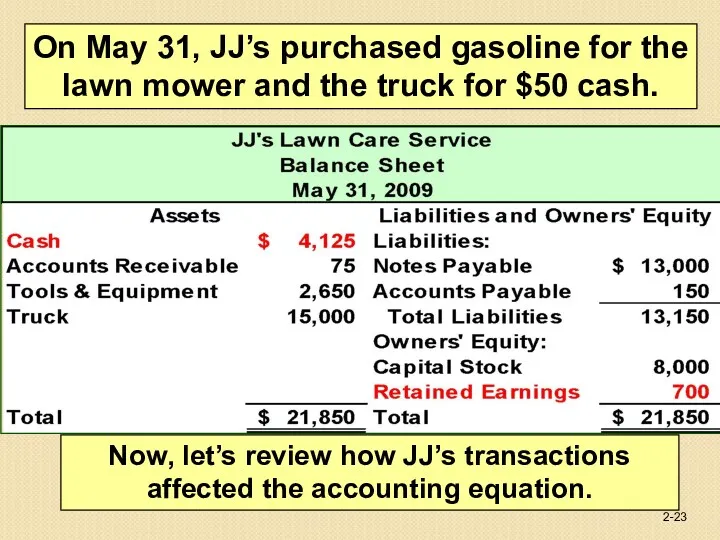

- 23. Now, let’s review how JJ’s transactions affected the accounting equation. On May 31, JJ’s purchased gasoline

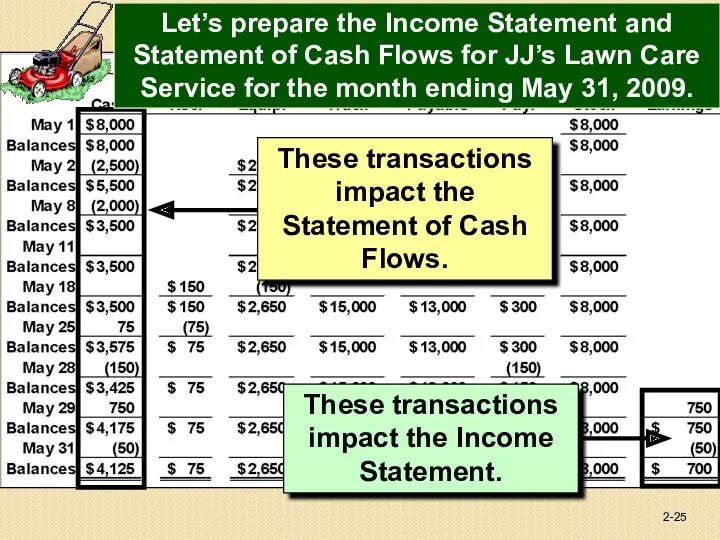

- 25. These transactions impact the Statement of Cash Flows. Let’s prepare the Income Statement and Statement of

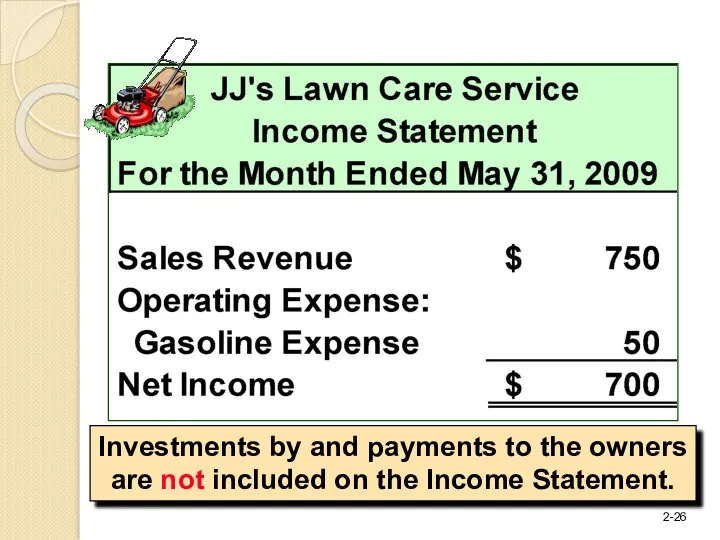

- 26. Investments by and payments to the owners are not included on the Income Statement.

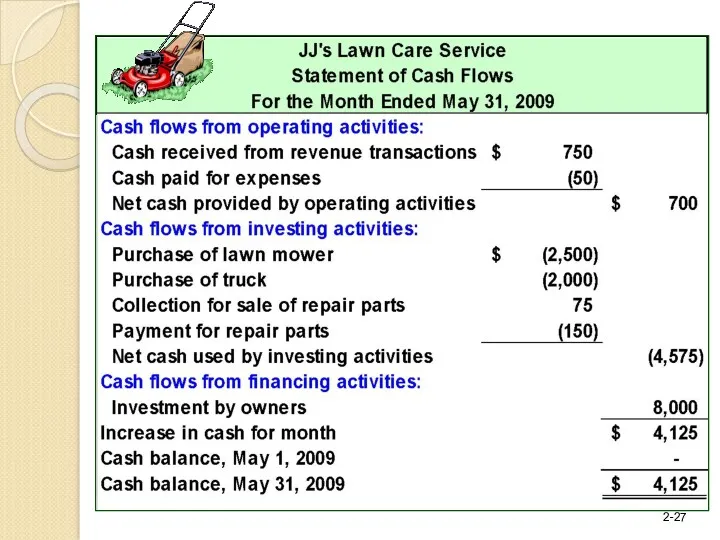

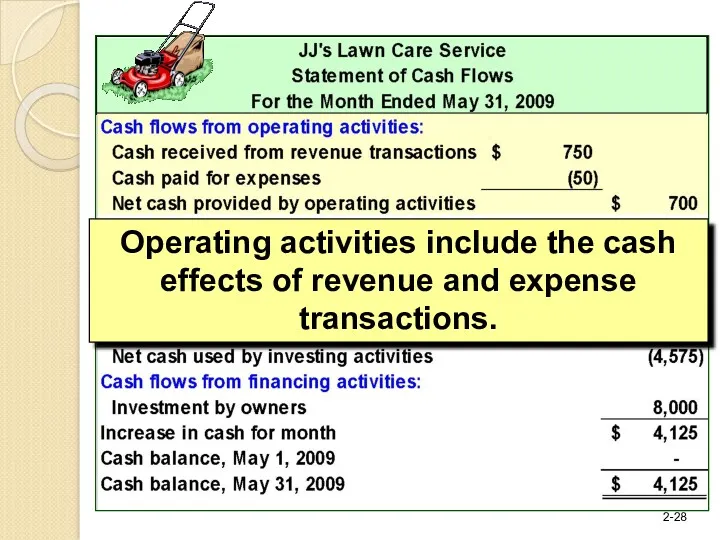

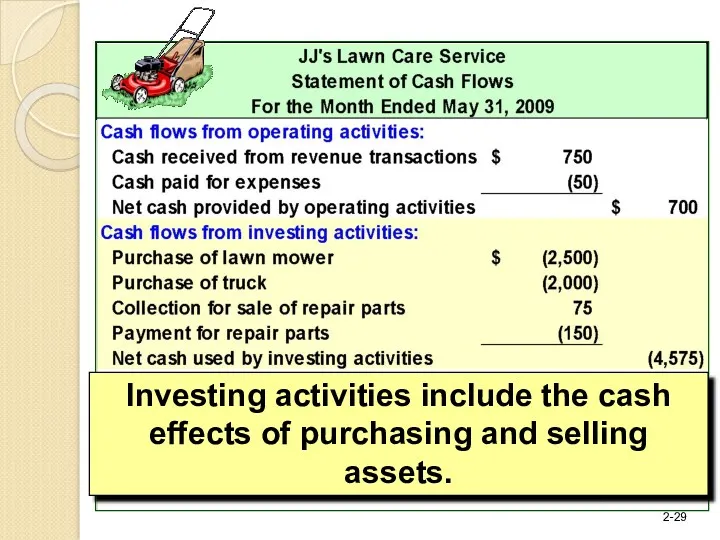

- 28. Operating activities include the cash effects of revenue and expense transactions.

- 29. Investing activities include the cash effects of purchasing and selling assets.

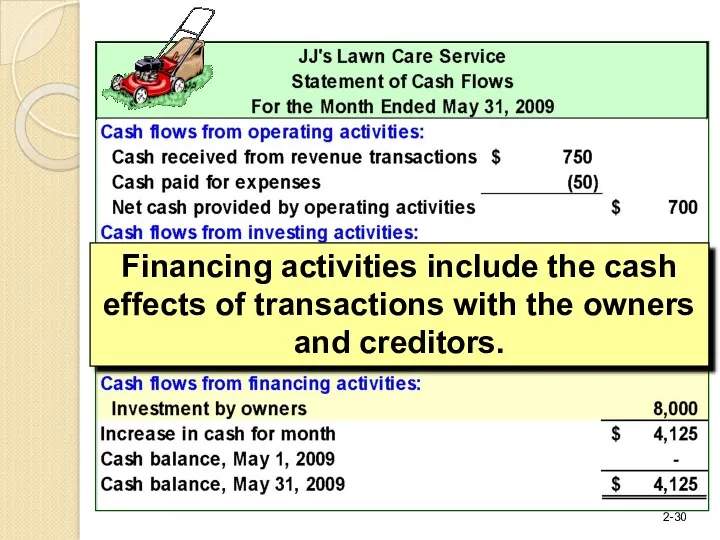

- 30. Financing activities include the cash effects of transactions with the owners and creditors.

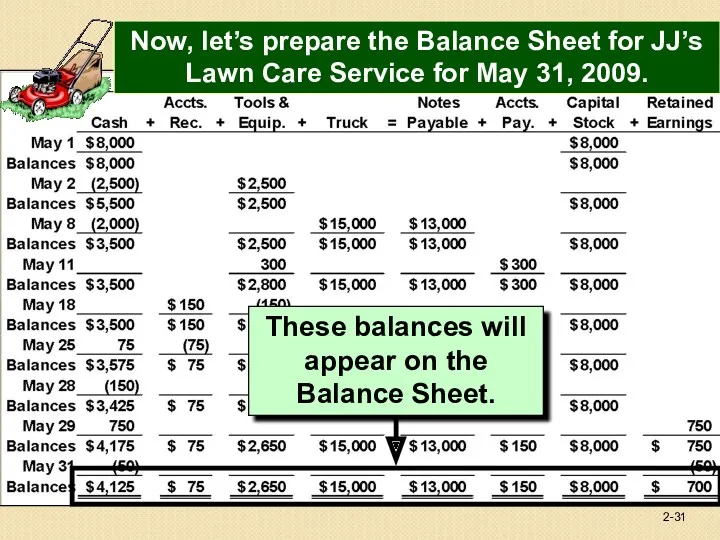

- 31. Now, let’s prepare the Balance Sheet for JJ’s Lawn Care Service for May 31, 2009. These

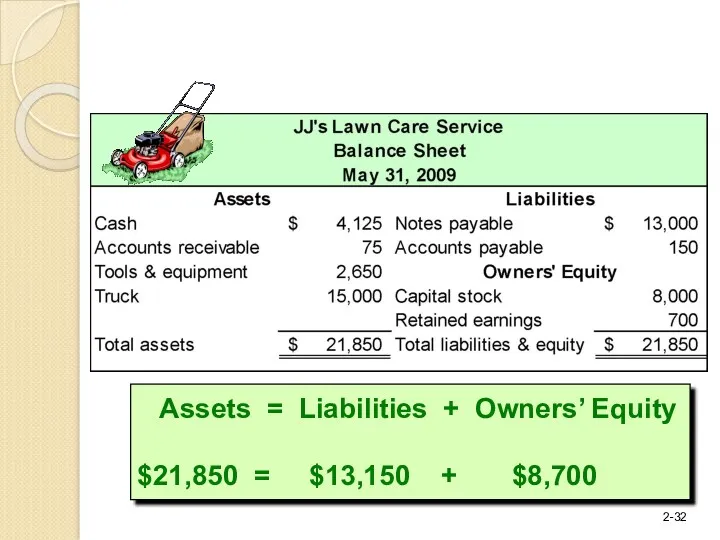

- 32. Assets = Liabilities + Owners’ Equity $21,850 = $13,150 + $8,700

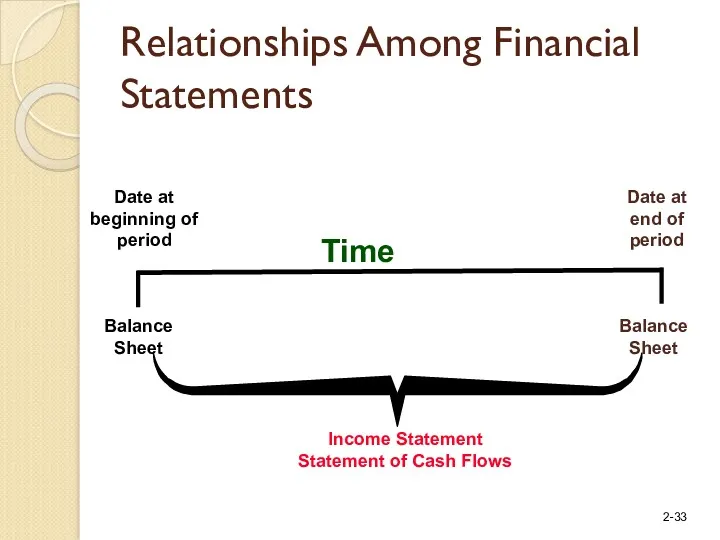

- 33. Relationships Among Financial Statements Date at beginning of period Date at end of period Balance Sheet

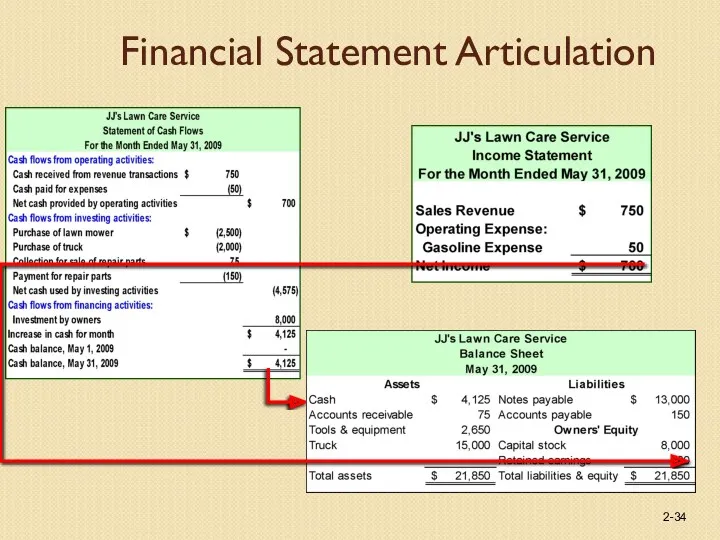

- 34. Financial Statement Articulation

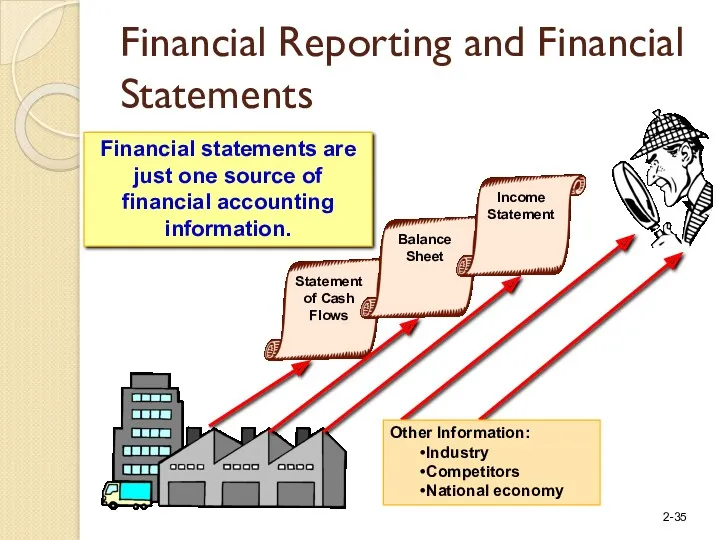

- 35. Financial Reporting and Financial Statements Financial statements are just one source of financial accounting information.

- 36. Forms of Business Organization Sole Proprietorships Partnerships Corporations

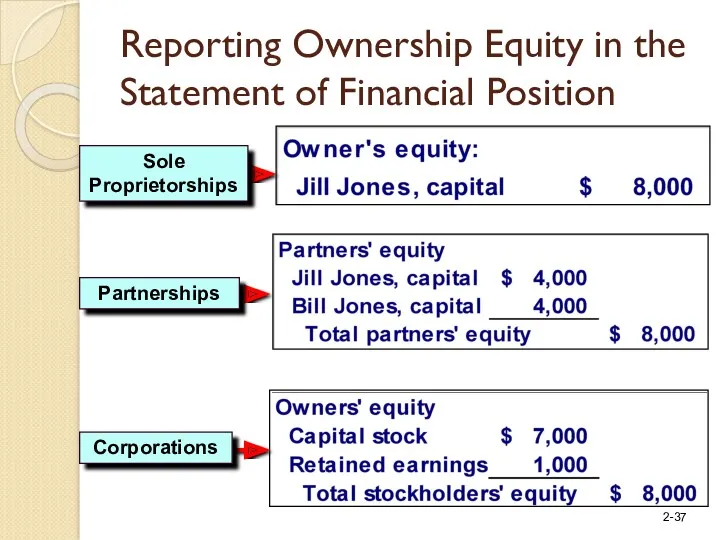

- 37. Reporting Ownership Equity in the Statement of Financial Position

- 38. The Use of Financial Statements by External Parties Creditors Investors Two concerns: Liquidity Profitability

- 39. Management’s Interest in Financial Statements Creditors are more likely to extend credit if financial statements show

- 41. Скачать презентацию

Управления финансовыми рисками на предприятии ООО Кытмановское

Управления финансовыми рисками на предприятии ООО Кытмановское Басня о том, как у зайчика товарный отчет не сходился

Басня о том, как у зайчика товарный отчет не сходился Nalogi

Nalogi Учет расчетных операций

Учет расчетных операций Проект по финансовой грамотности для взрослых и детей

Проект по финансовой грамотности для взрослых и детей Как сберечь и произвести накопления денежных средств

Как сберечь и произвести накопления денежных средств Кредиттер бойынша субсидиялар мен кепілдіктерді қалай алуға болады?

Кредиттер бойынша субсидиялар мен кепілдіктерді қалай алуға болады? Источники финансирования корпорации

Источники финансирования корпорации Пенсионная реформа 2010 г

Пенсионная реформа 2010 г Принципы разработки финансовой стратегии

Принципы разработки финансовой стратегии Инвестиционная безопасность коммерческой организации

Инвестиционная безопасность коммерческой организации Формы и методы проектного финансирования

Формы и методы проектного финансирования Введение в распределенные методы обработки информации. Технология Блокчейн

Введение в распределенные методы обработки информации. Технология Блокчейн История налогообложения. Понятие налога

История налогообложения. Понятие налога Финансовая основа местного самоуправления

Финансовая основа местного самоуправления Социальное и медицинское страхование

Социальное и медицинское страхование О бюджете Красновишерского муниципального района на 2018 год и плановый период 2019-2020 годов (второе чтение)

О бюджете Красновишерского муниципального района на 2018 год и плановый период 2019-2020 годов (второе чтение) Страхование жилого помещения

Страхование жилого помещения Что такое финансовая грамотность?

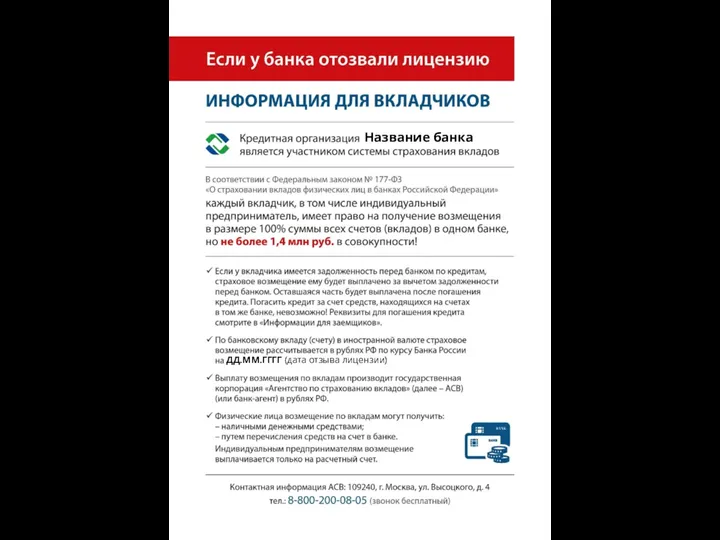

Что такое финансовая грамотность? Если у банка отозвали лицензию. Информация для вкладчиков

Если у банка отозвали лицензию. Информация для вкладчиков Анализ финансового состояния коммерческого банка (на примере ОАО КБ Пойдем)

Анализ финансового состояния коммерческого банка (на примере ОАО КБ Пойдем) Технический анализ финансовых рынков

Технический анализ финансовых рынков Налог на имущество физических лиц

Налог на имущество физических лиц Автоматизированная система прогнозирования финансовых временных рядов с применением многослойного персептрона

Автоматизированная система прогнозирования финансовых временных рядов с применением многослойного персептрона Бухгалтерская (финансовая) отчетность как завершающий этап учетного процесса

Бухгалтерская (финансовая) отчетность как завершающий этап учетного процесса The Banknotes of the UK

The Banknotes of the UK Предпринимательский договор

Предпринимательский договор Управление личным бюджетом

Управление личным бюджетом